Analyze and Invest with the Most Insightful Digital Alternative Data

Similarweb named the best alternative data provider

Trusted by hundreds of funds in over 30 countries

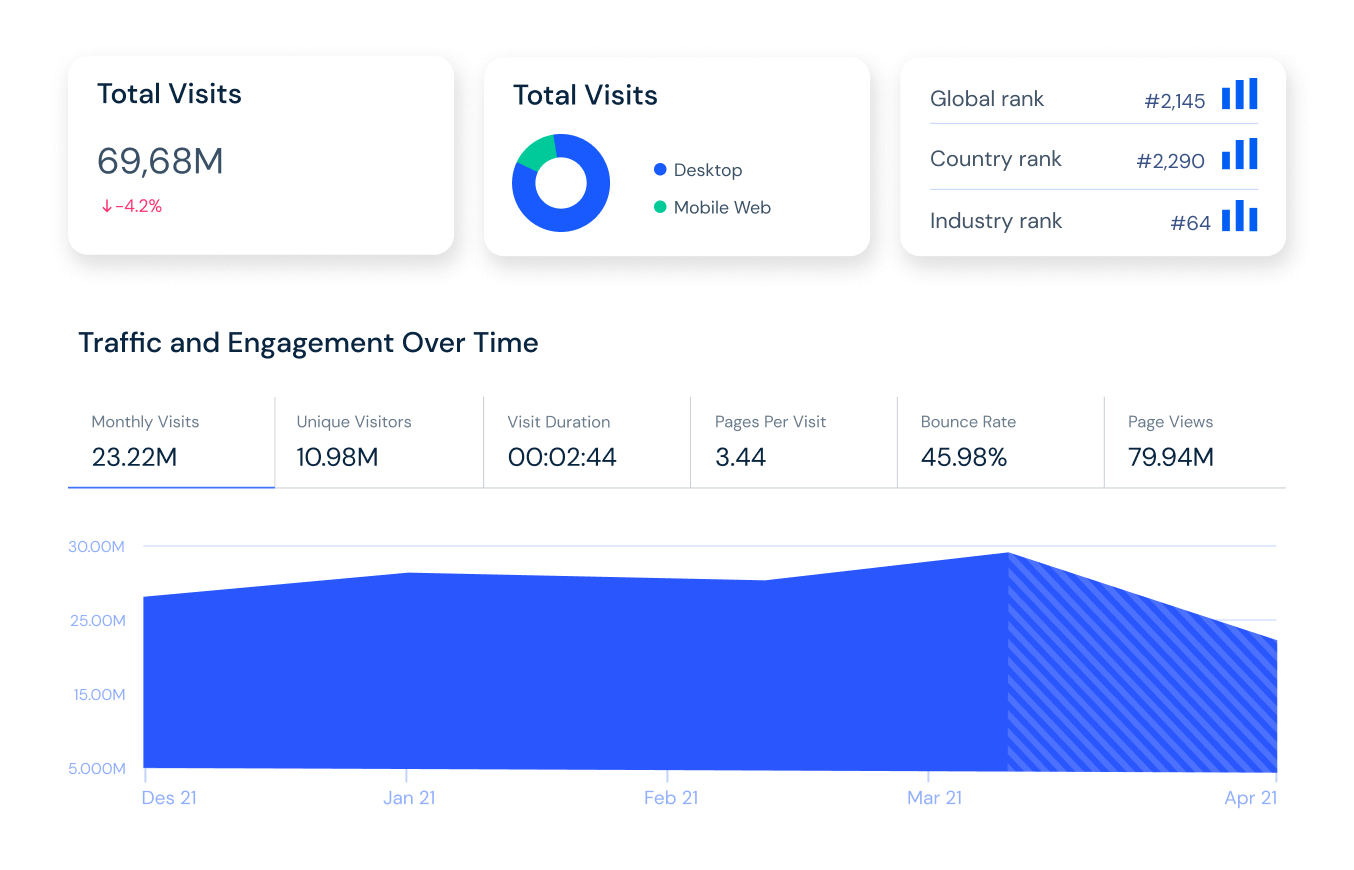

Discover investment ideas in real-time

- Forecast long term trends of company or sector performance.

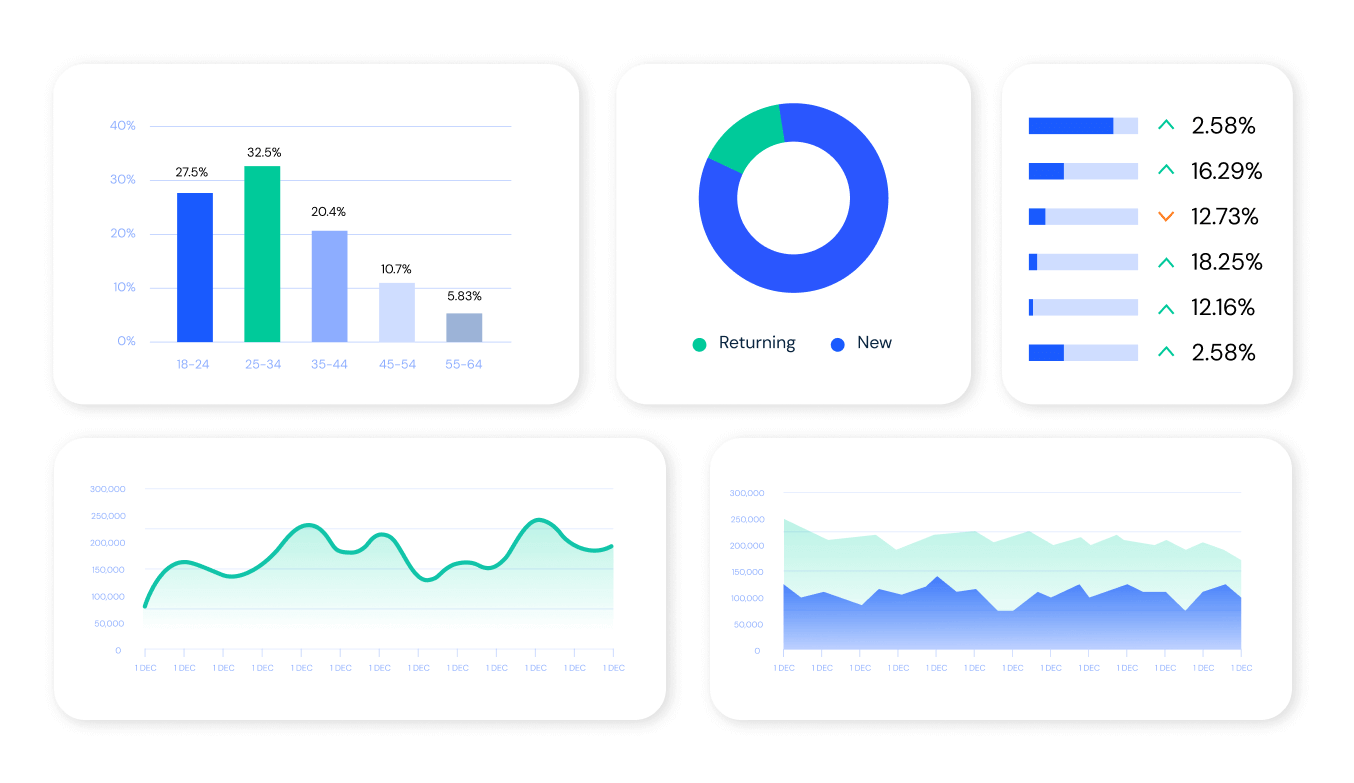

- Understand consumer behavior trends.

- Monitor any company’s digital footprint with web and app traffic.

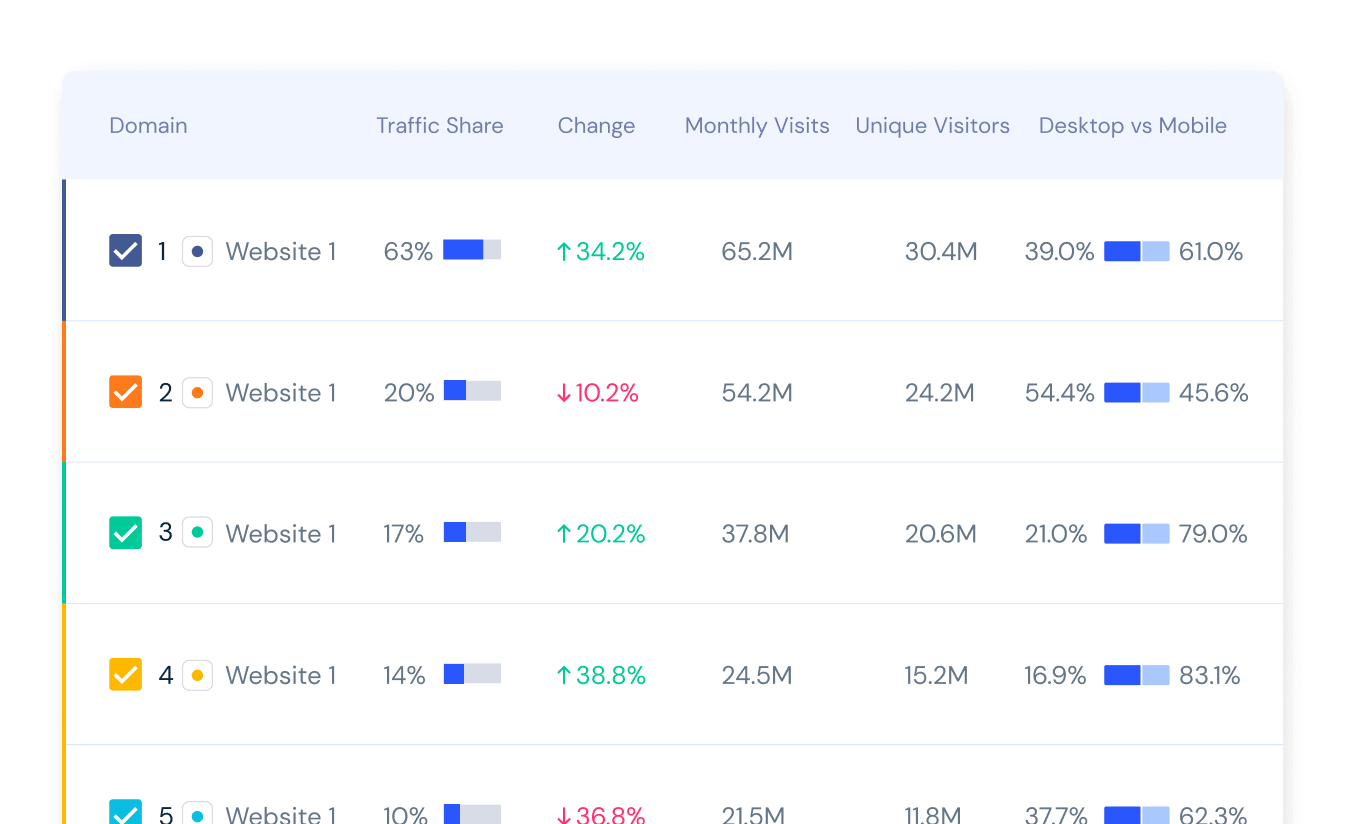

Explore the full digital landscape of any company

- Track key signals of earnings performance.

- Generate alpha with hundreds of unique data points.

- Find new opportunities with real-time signals.

- Validate an investment hypothesis.

- Benchmark performance against competitors.

Empower your predictive models with digital data

- Gain systematic coverage of millions of private and public companies.

- Access billions of data points daily across multiple metrics that correlate to a company’s KPIs.

Only Similarweb gives you the scale and granularity of alternative data that you need

-

Proprietary web and app traffic datasets are unsurpassed in the breadth and depth of digital intelligence

-

Industry-leading quantitative data supplemented by unique qualitative traffic & engagement metrics

-

Comprehensive, highly-curated datasets focused on company-specific KPIs, affording deep insights and surfacing signals.

-

Worldwide and local coverage, insights for +190 countries

-

Daily, weekly and monthly granularity of data affords bespoke analysis.

Analyze the digital performance of companies using Similarweb data

All digital activity

- Website, app and industry traffic data

- Transactions and SKU level data

- Marketing channels and keyword data

- Audience behavioral data

Every website and app

- Comprehensive 360° coverage

- Unlimited access to 100m websites and 4.7m apps

- Tracking 210+ industries across 190+ countries

Real-time

- Processing billions of digital signals daily

- Surfacing insights on a 48-72 hour lag

- Daily, weekly and monthly granularity

Subscribe to our weekly Investors Newsflash to receive digital insights straight to your inbox. We cover everything from upcoming IPOs to earnings previews.

Back your strategy with unbeatable data

5/10

World's Top Hedge Funds / Asset Mgrs.

10/10

World's Top Investment Banks

9/10

World's Top Private Equity Firms

7/10

Largest Venture Capital Firms

- Be the first to identify digital inflections to generate investment ideas

- With granular data on 1B+ websites and 4.7M+ apps, there are endless data points to provide greater conviction to your investment strategy

- Uncover alpha opportunities through hundreds of digital metrics

- Enrich your diligence with web and app traffic data

- Source new opportunities and monitor performance over time, gain insight into both private and public digital company performance and benchmark across the competitive landscape

- Go beyond financials and track changes in online consumer behavior to contextualize a company's performance and to foresee future market changes

- Use web and app traffic data to get a 360° view of company and sector health, with data on 1B+ sites, 4.7M+ apps and 210+ industries, all at your fingertips

- Utilize digital behavior data to enrich and find signals in any company that you are tracking

- Leverage Similarweb like our corporate customers do to improve a portfolio company's marketing strategy, drive traffic to its website and grow its business

- With data on 1B+ websites and traffic from 190+ countries, Similarweb has coverage on any public company and all of its digital assets

- Dozens of traffic & engagement metrics for the online activity of every website to surface millions of signals

- Extract and integrate Similarweb data via API, S3 or Snowflake delivery to automate repeatable analyses and integrate data points into internal systems

Don't Take Our Word for It

FAQs

-

This depends on the company being analyzed, the types of products/services it offers, its channel approach, and the structure of its digital presence.

-

Similarweb data includes the percentage of visitors to a website or landing page that complete the desired action. In most cases, this will be a sign-up or a purchase, but it could also be any other activity you define as conversion. For further information on Conversion Analysis see here.

-

Segment Analysis lets you gain visibility into the performance of a particular line of business, category, topic, or brand on any website in a way that is easy to understand and benchmark. For further information see here.

-

Yes, Excel downloads are available on the platform.