Nike Returns to Amazon: A Lesson For D2C Brands and Retailers?

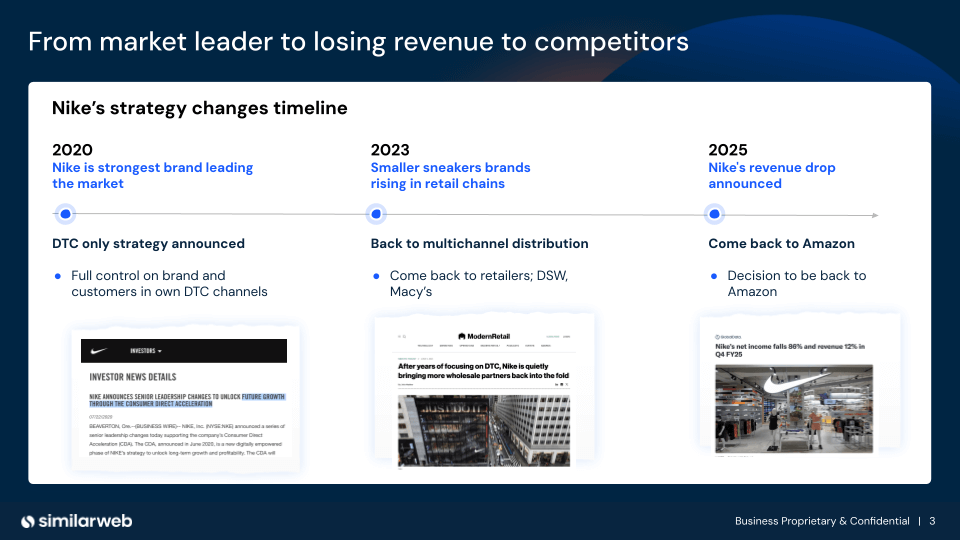

When Nike made its bold pivot in 2020 to focus on Direct-to-Consumer (D2C) through its Consumer Direct Acceleration strategy, it sent ripples through the retail world.

Many brands, inspired by Nike’s confidence, doubled down on D2C models, chasing higher margins and stronger customer relationships.

But the strategy revealed unintended consequences: the empty shelf space at retailers left by Nike was quickly filled by new, niche, and innovative brands. Instead of tracking how these competitors were winning discovery, Nike stayed focused on its existing D2C customer data.

Now, Nike’s return to Amazon signals its recognition that multichannel distribution is essential. This isn’t just about where Nike sells, but how it competes.

Let’s take a look at Nike’s journey over the past few years to see how this transformation took place.

The rise and fall of Nike’s D2C-only strategy

In 2020, Nike was the undisputed leader and launched its D2C-only strategy.

The goal was to gain full control over the brand and customer experience, and the benefits were certainly achieved (online sales accounting for 44% of Nike’s revenue by 2023, with no immediate impact on brand KPIs), but there was a side effect of this strategy.

New brands started to rise

Retailers needed full portfolios, so smaller, vertical brands specializing in running or athleisure quickly filled Nike’s absence.

By 2023, Nike quietly reappeared at retailers like DSW and Macy’s. Still, the official return to Amazon as a 1P seller was years away.

In early 2025, weak financial results forced Nike to announce major changes, including its return to Amazon, which it had exited in 2019.

The negative impact was felt across the entire marketing funnel

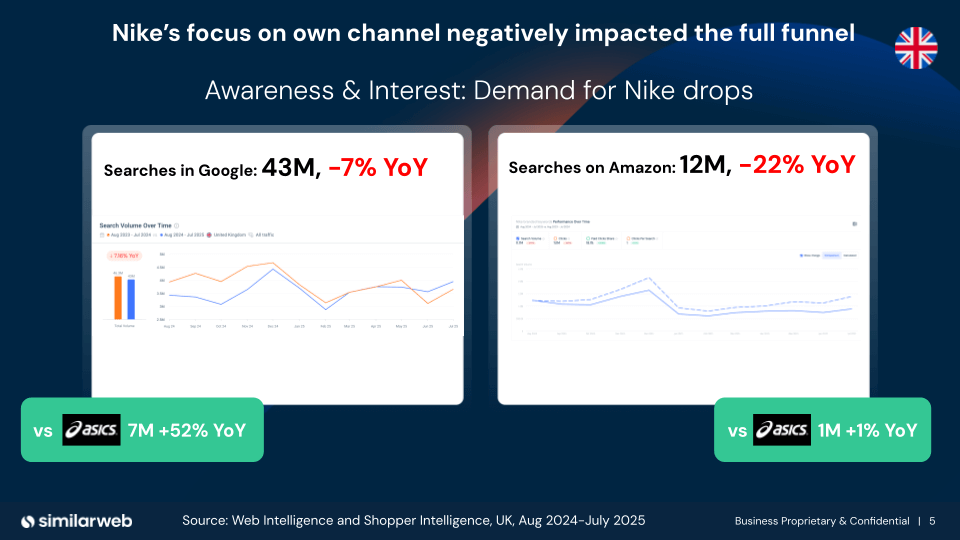

In the UK, Nike’s largest market outside the US, overall brand demand plummeted.

This was most evident in search data: Google searches for the brand fell by 7% and Amazon searches dropped a staggering 22%. This significant decline in top-of-funnel interest was a clear sign that the D2C strategy had damaged the brand.

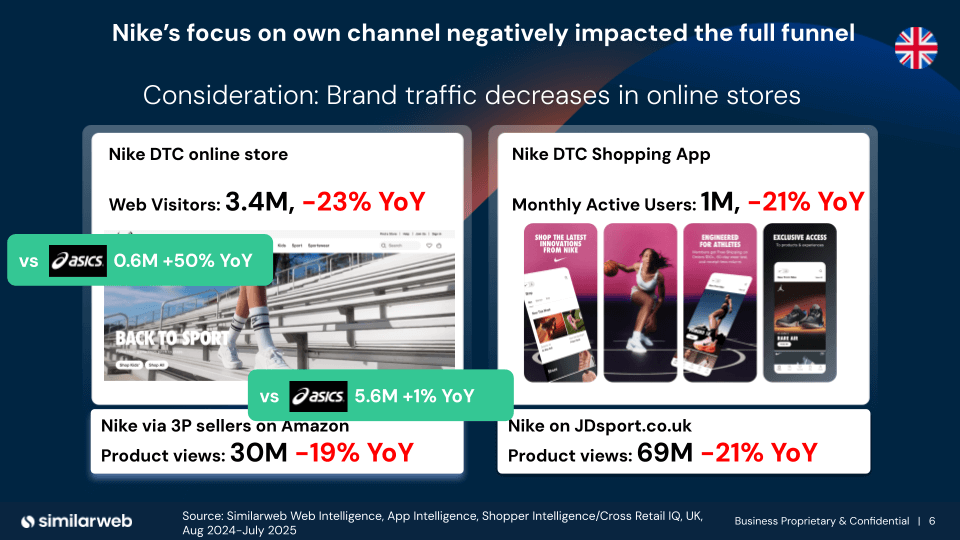

Nike’s D2C channels started declining

Further down the funnel, Nike’s D2C channels (website and app) showed significant weakness. Traffic to Nike.com decreased by 23% year-over-year (YoY), while average Monthly Active Users (MAUs) on its shopping app declined by 21% across both iOS and Android.

It could be argued that this decline is a natural consequence of a strategic shift back to multichannel distribution, which would intentionally deprioritize D2C. However, the data suggests otherwise.

During the same period, Nike product views on JDsports.co.uk, a major retail partner, also fell by 21%. Furthermore, views for Nike products sold by third-party (3P) sellers on Amazon dropped by 19% YoY.

This widespread decline indicates that the problem isn’t a simple channel shift; rather, it’s a broader issue of weakening brand demand that is impacting both Nike’s D2C channels and its key retail partners.

ASICS multi-channel strategy

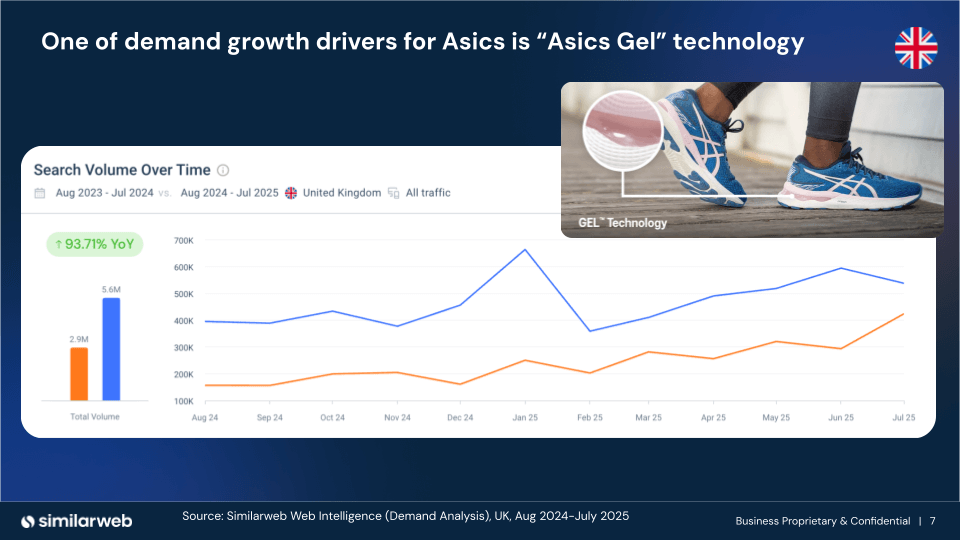

Nike’s declining demand becomes even more pronounced when contrasted with the success of its rival, ASICS.

While Nike focused on narrowing its funnel to an existing customer base, ASICS was actively expanding its own. It did this by competing directly on shelves and offering unique product innovations that customers were seeking.

The result of this strategy is evident in the data. Searches for ASICS’s “GEL” technology surged by an impressive 94% YoY, a clear sign of how effective product-led messaging can be in driving demand across multiple channels.

The secret to retail success

The truth is, when you are focused on your own data and your own channel, you’re not under competitive pressure all the time. You have a lot to improve and optimize on your own, with a large customer base.

Being on the digital shelf of Amazon, with the depth of data available from this marketplace (both 1P and from market intelligence companies) and a headcount focused on optimizing it, would clearly show you where your weak points and white space growth opportunities are.

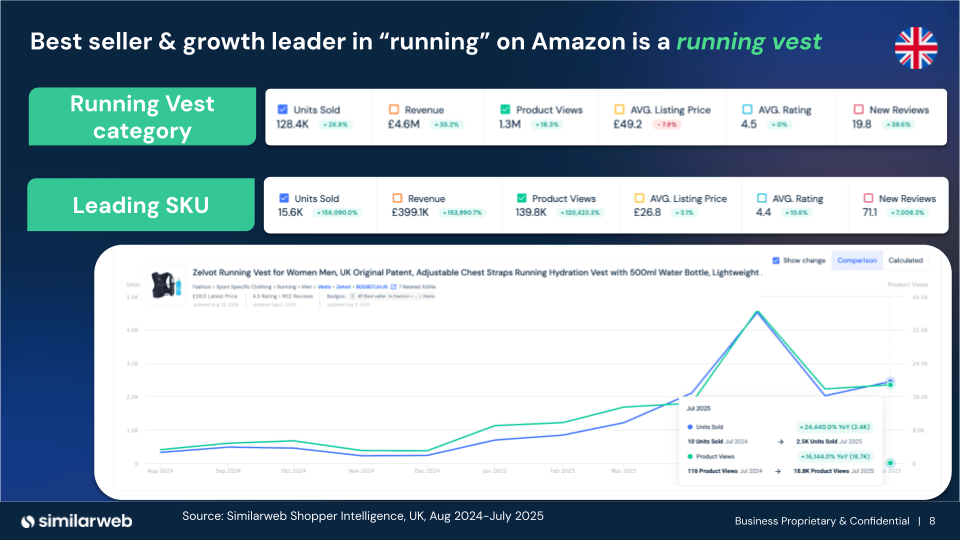

It took us just 5 minutes to discover in Similarweb Shopper Intelligence that the top-growing product category in Running on Amazon UK is a running vest (+35% Revenue YoY). The best seller is a low-cost brand Zelvot (over 10% of all Units Sold!), but Salomon is also capturing this trend with a price range similar to Nike.

Nike, despite having a running vest product, is nowhere in the top charts.

A strategic pivot back to Amazon

In May 2025, Nike reversed course and officially returned to Amazon, a move designed to expand reach, boost sales, and combat counterfeiting.

The results were immediate. From July onward, Nike’s Amazon sales began climbing, with strong performance during key seasonal moments: Prime Day in July and the Back-to-School season in August. Unit sales surged YoY across multiple key markets:

- United States: +20%

- United Kingdom: +7%

- Germany: +12%

- France: +15%

- Italy: +82%

Even though this growth included both 1P (first-party) and 3P (third-party) sales, the trend line is clear: Nike’s marketplace presence is strengthening fast.

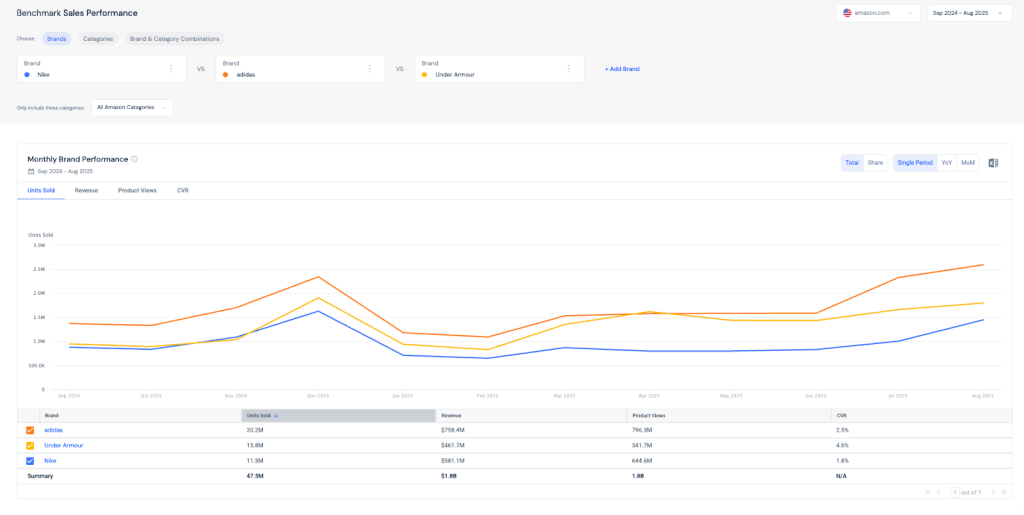

Diving deeper into the US, we see the exact 1P vs. 3P split for Nike compared with competitors. By reclaiming control of its marketplace presence, Nike is positioned for massive growth.

Data from Similarweb’s Shopper Intelligence shows that Nike could unlock more than $500M in annual 1P sales in the US if it follows the trajectory of category leaders like Adidas and Under Armour, both of which already see over 60% of their product sales coming from 1P.

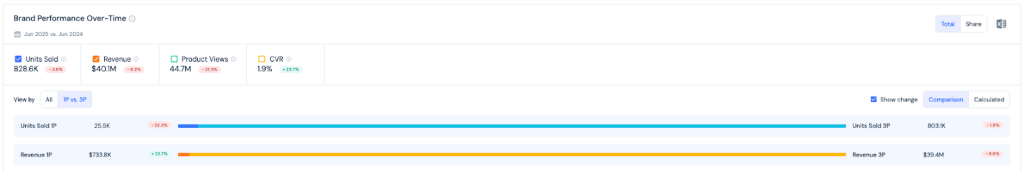

Already, the shift is paying off. Nike had been missing out on $39.4M in revenue per month previously captured by third-party sellers.

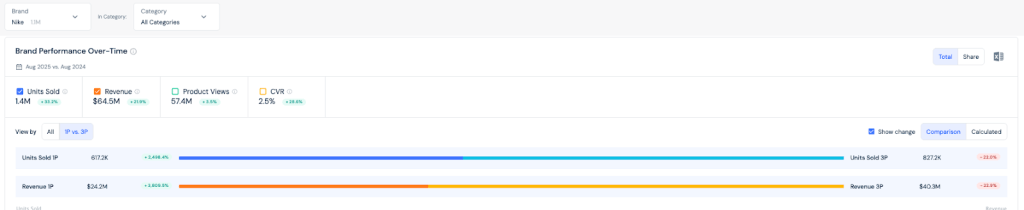

In August – the first month of its return – Nike’s 1P sales jumped 3,800%, reaching $24M with 617K units sold directly.

Looking at Nike’s full list of subcategories, we can see that conversion rates (CVR) have risen across the board. This is an additional sign that consumer trust and the introduction of 1P sales are driving stronger overall performance.

And consumers are catching on quickly.

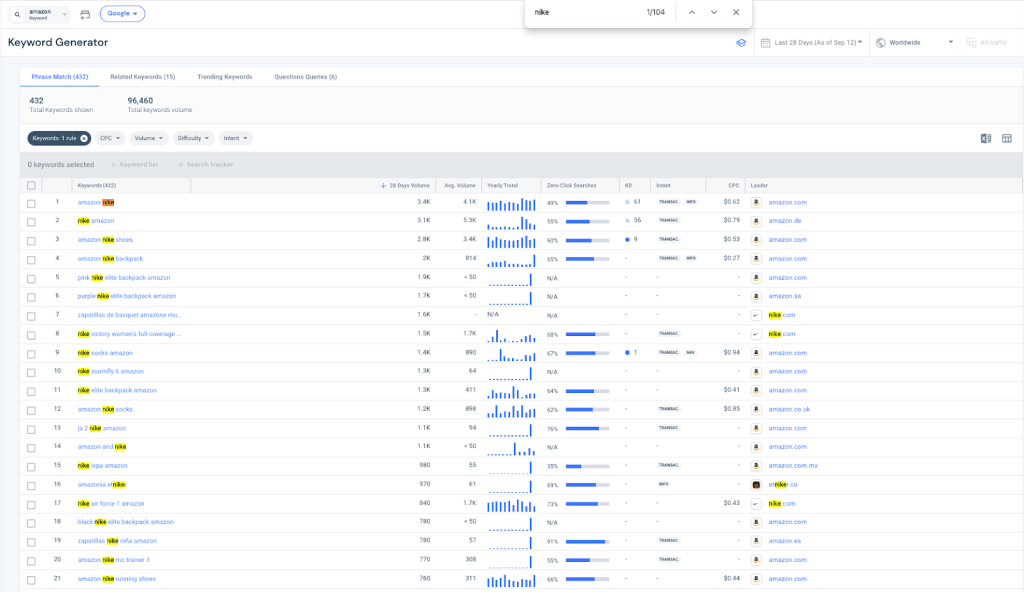

People are no longer just searching for Nike. They’re searching for Nike + Amazon to buy their favorite products where they shop most. In the past 28 days alone:

- “amazon nike shoes” → 2.8K searches

- “amazon nike backpack” → 2K searches

The growing list of ‘Nike [Product] + Amazon’ searches makes this one of the hottest Amazon-related trends right now, proving the move is as much a win for Amazon as it is for Nike.

How will Nike’s return to Amazon impact the D2C channel?

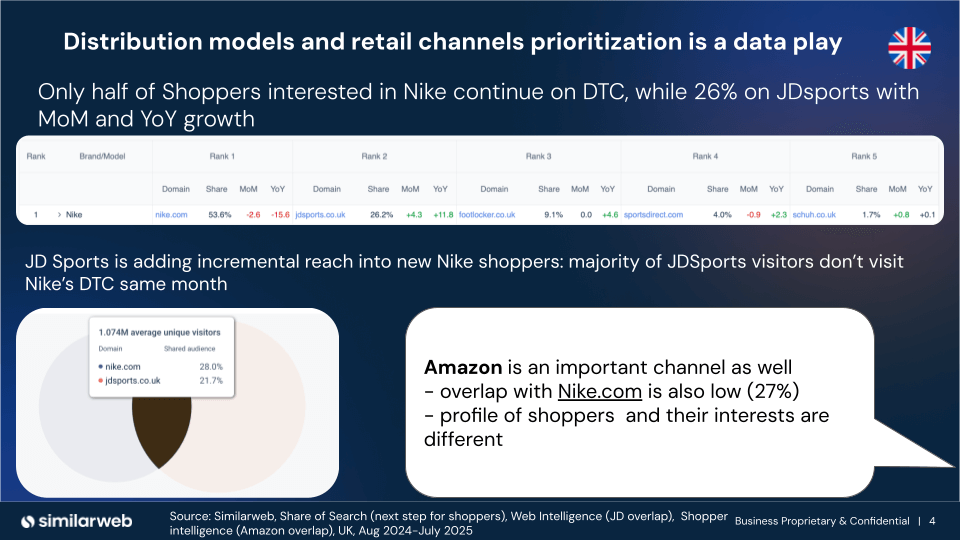

When we look today at the audience searching for Nike brand or its products on Google (UK, last month), we can see that 54% of them will follow on Nike.com.

More or less, half of customers that are loyal to Nike’s brand don’t necessarily need to be loyal to Nike’s D2C channel. You can have a strong brand, but shoppers might have a preference to shop in specific channels. And these channels offer something else: an opportunity to reach new customers who wouldn’t have purchase intent for Nike products yet.

Reaching new audiences on Amazon

Looking at the past 12 months, Similarweb data shows that in the UK, Amazon is an opportunity to reach an incremental audience. If we look at the web overlap between Amazon.co.uk and Nike.com, it is massive, as nearly everyone visits Amazon for some reason.

That’s why for marketplaces, we always need to analyze data at a category or even brand level.

We looked at shoppers who were viewing (considering) any Nike products on Amazon. Only 27% of them were looking at the D2C channel Nike.com, which means over 70% of potential incremental Nike shoppers that Amazon can bring!

Interestingly, this will be a different figure depending on category, whether it’s women’s or men’s shoes, running, or other categories.

These insights can be a perfect signal of how my audience profile on the D2C channel (the most loyal customer base) differs from the marketplace audience, as well as vertical store audiences (e.g. JD Sports). By the way, JD Sports has a 22% audience overlap on a monthly basis with Nike.com, offering also high incrementality in the sneakers category.

Having a deep understanding of both overlaps and profiles is essential to strategize on assortment available and promoted in different channels.

What’s next?

Nike came back to Amazon and embraced a multichannel strategy.

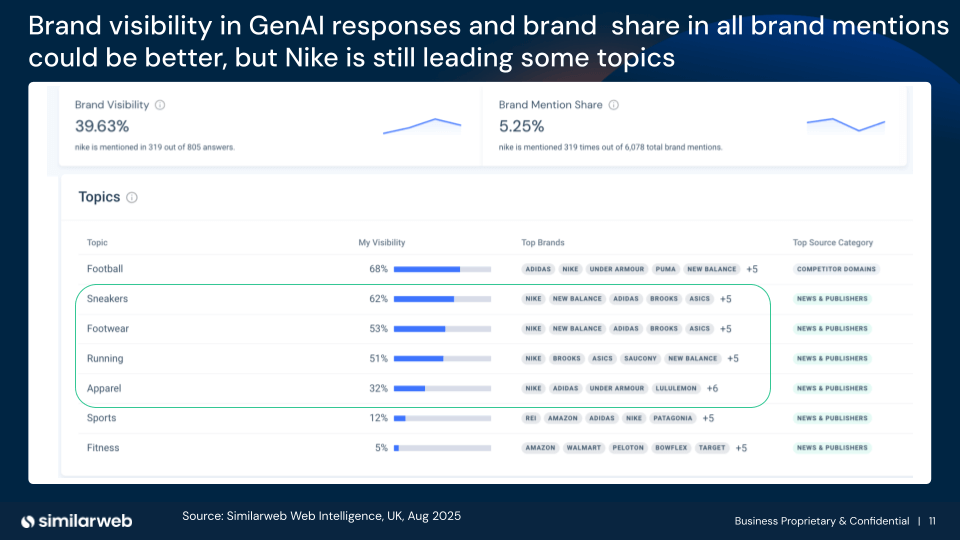

All D2C-first brands should learn a lot from this move. But there are new challenges ahead. Customer discovery is changing with Gen AI. There are new rising factors that impact where shoppers will go. The role of a strong customer base, loyalty, and community will be very important, and Nike will benefit from it, having high scores in GenAI brand visibility and brand mentions.

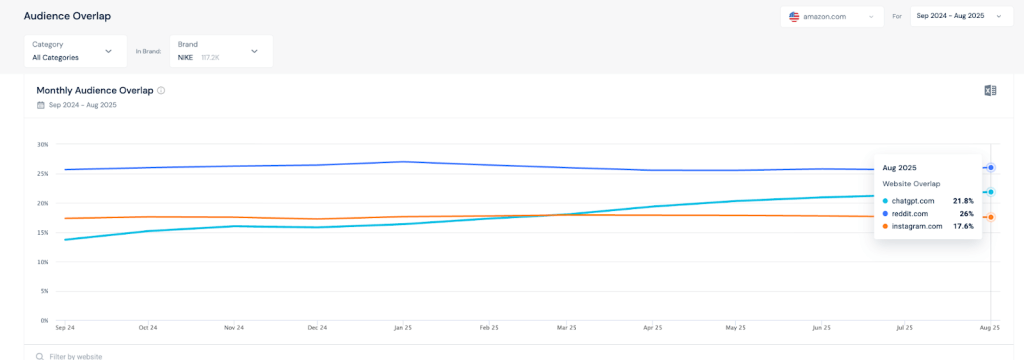

As we observe the rise of new touchpoints, shoppers are increasingly looking into ChatGPT on the same day as shopping on Amazon for Nike products. In the UK, it grew 10 percentage points over the last 12 months, reaching 24%, while in the US, it increased by 12 percentage points, reaching 26%.

As discovery becomes increasingly fragmented across search, marketplaces, retail, apps, and AI, the winners won’t be those locked in channel wars.

Success will come to the brands and retailers that show up consistently across every touchpoint, offering a wide product range optimized for the shopper profile, a unified brand presence, and stories compelling enough to capture attention wherever consumers choose to shop.

Balancing loyalty and customer base growth, optimizing own channels, and watching the market outside your silo in real time will be key.

The ultimate edge in retail insight

Put the full picture at your fingertips to drive product views and sales