The Digital Trends Redefining the Pet Industry in 2025

The pet care industry is moving fast, and so is consumer behavior across search, the digital shelf, and retail channels within the category.

To stay competitive, ecommerce professionals need to spot the right trends and opportunities. Using Similarweb data, we’ve analyzed the latest shifts in pet food, supplements, and retail media.

If you’re looking to optimize product discovery, win traffic, and invest smarter in retail media, this guide is for you.

Summarize with ChatGPT | Google AI | Perplexity | Grok

The pet industry is growing, but not where you think

🎯 Ecommerce implication: Audit your channel mix, because traffic isn’t where it used to be.

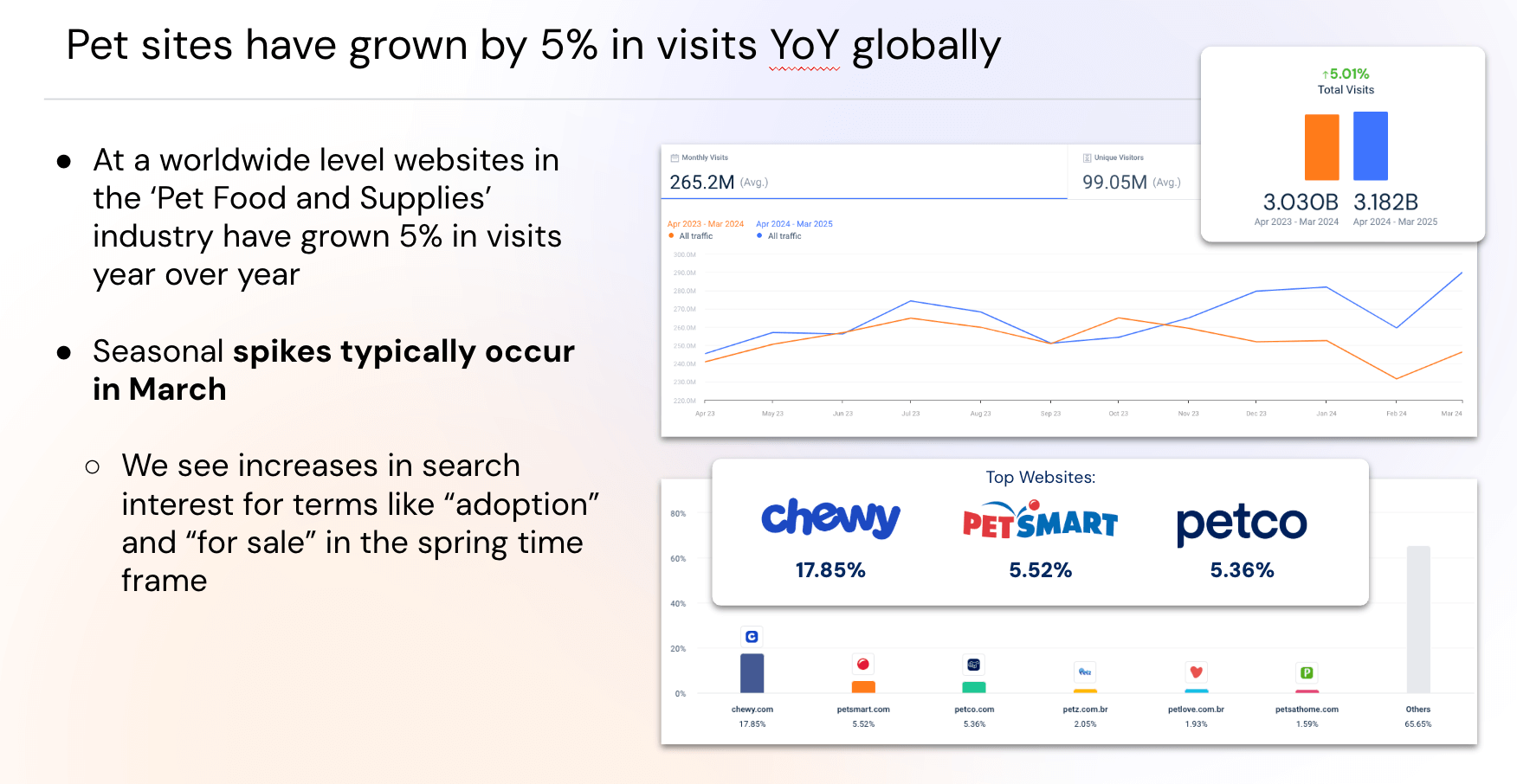

Pet-related websites saw a 5% YoY increase in global visits, driven by seasonal interest spikes in March and ongoing demand in key verticals.

However, major players like Chewy, PetSmart, and Petco are seeing declines in site visits. This suggests consumer attention is increasingly directed toward D2C, niche retailers, and content-first discovery platforms.

Key Takeaway: Brands must diversify their presence and reconsider where digital marketing efforts are being allocated. Being dominant on a single retailer is no longer enough.

Dog food searches are in decline, except for freeze-dried

🎯 Ecommerce implication: Shift toward high-converting recipes like freeze-dried, and optimize PDPs for quality-conscious queries.

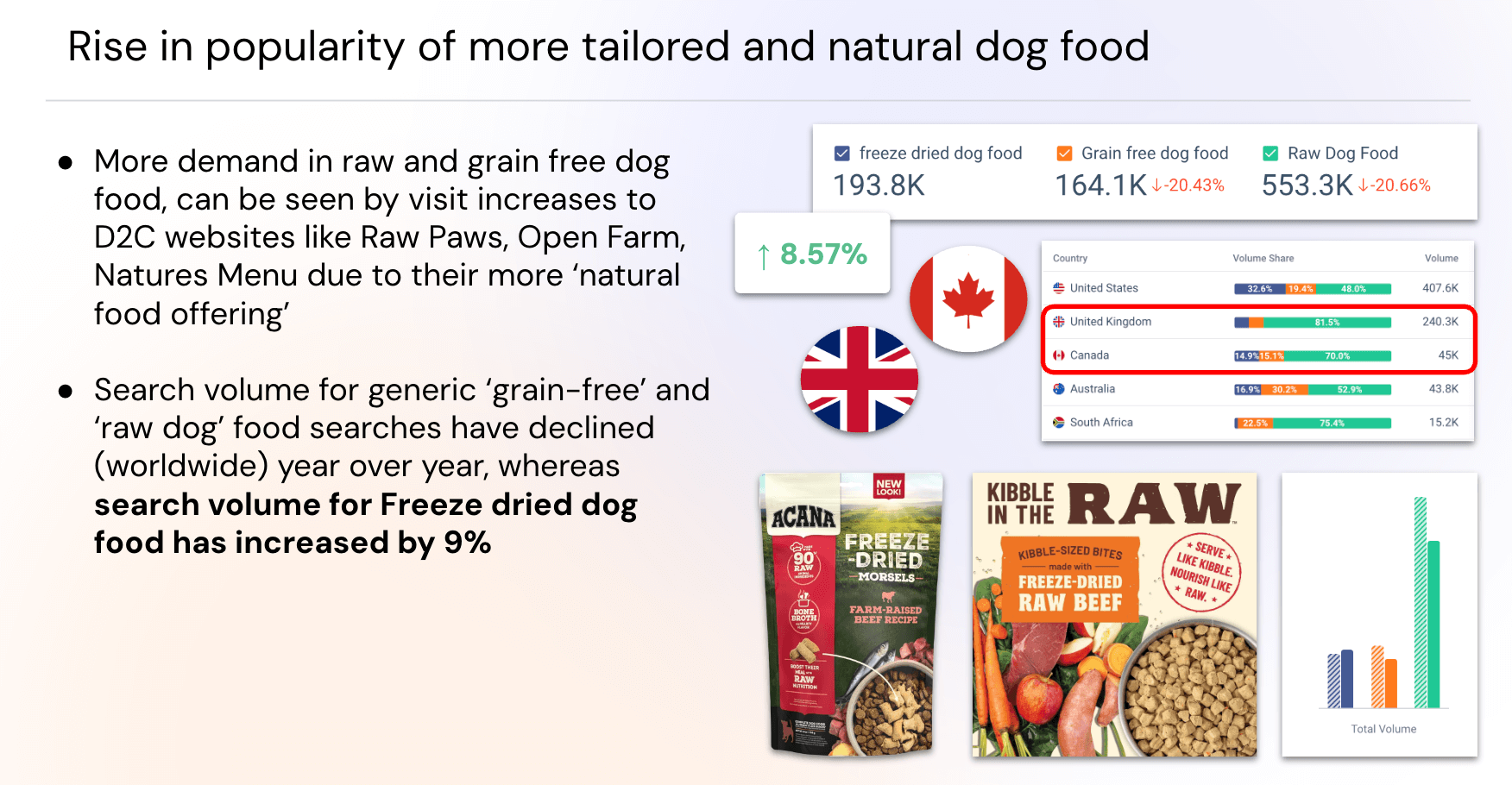

Dog food-related search volume is down 14% YoY, but the composition of demand is shifting:

- Searches for freeze-dried dog food are up 9% globally, with standout YoY growth of 77% in the UK

- D2C brands like Nature’s Menu and Open Farm are capitalizing on this trend, with the former seeing 600%+ click growth MoM.

On Amazon, dry food still leads in volume, but freeze-dried is rapidly gaining revenue share.

Key Takeaway: Brands need to reevaluate product mix and SEO strategies to align with rising interest in premium, health-focused brands.

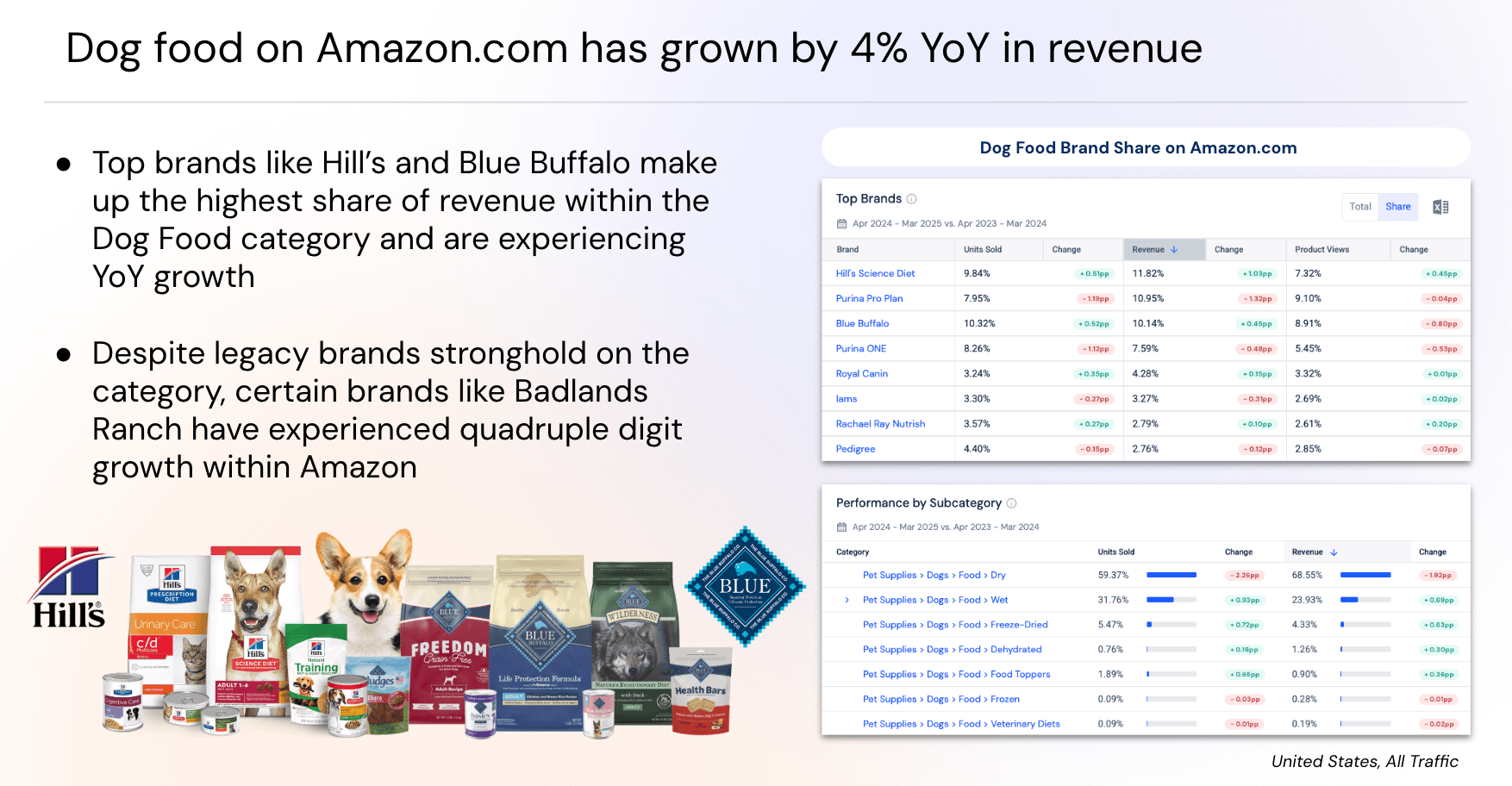

Despite a decline in searches, dog food on Amazon has grown by 4% YoY in revenue

🎯 Ecommerce implication: Monitor fast-growing brands and SKU performance before they claim your share of the digital shelf.

Legacy leaders like Hill’s and Blue Buffalo hold the lion’s share of Amazon’s dog food revenue. However, new entrants like Badlands Ranch (a celebrity-owned D2C brand) are seeing quadruple-digit YoY growth.

Key Takeaway: Use market intelligence to identify disruptor brands early. Monitor category-level unit and revenue growth to spot gaps or rising threats in real time.

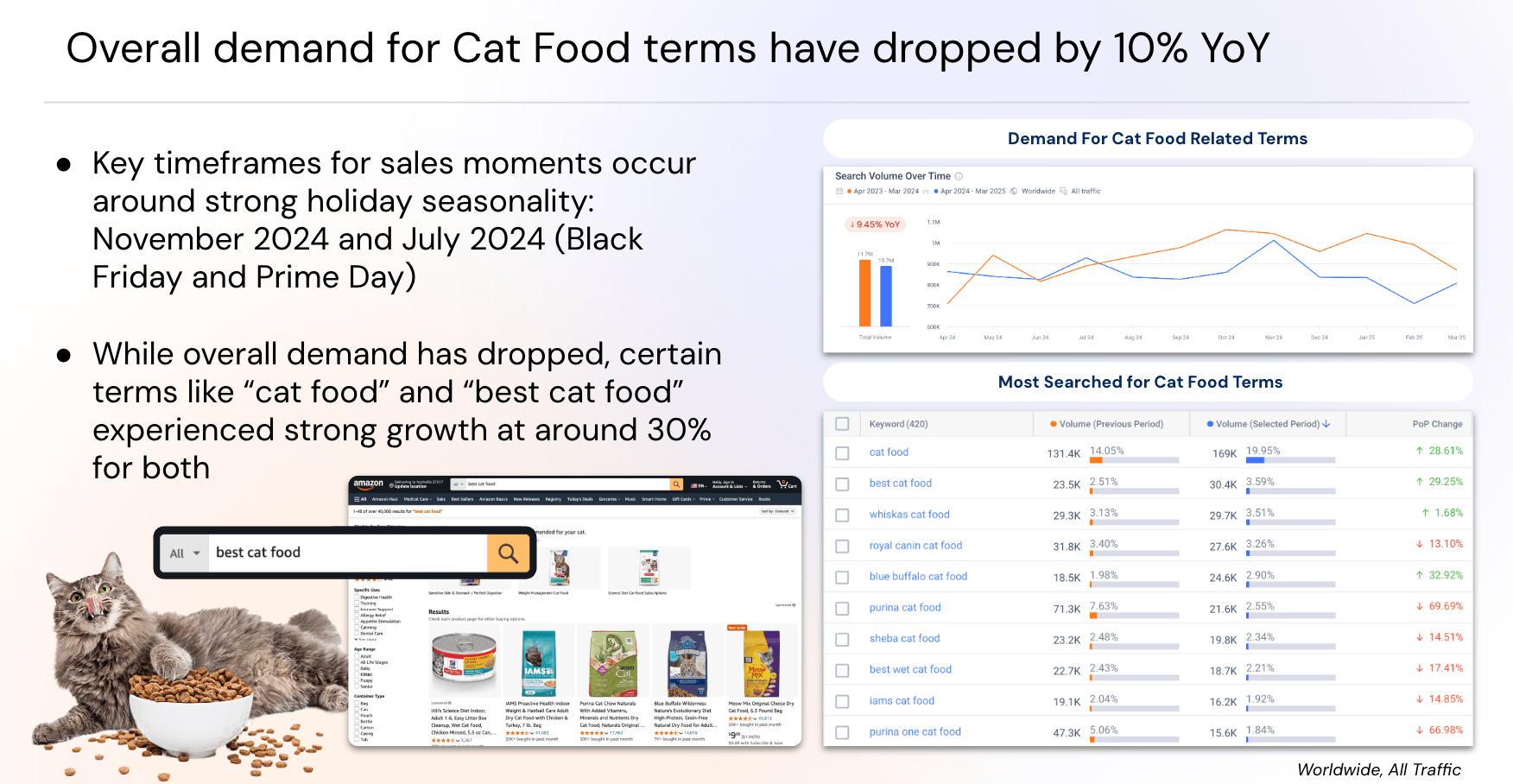

Cat food shoppers are becoming less brand loyal

🎯 Ecommerce implication: Tailor messaging for value-seeking consumers and invest in educational content.

Overall search demand for cat food is down 10% YoY. But interest in non-branded terms like “best cat food” is growing by ~30%. This points to a drop in brand loyalty and a rise in price or value-first shopping behavior.

Additionally, YouTube is showing the highest growth in cat food-related traffic, revealing an extended research phase in the consumer journey.

Key Takeaway: Focus on search-driven category visibility and top-of-funnel content that answers consumer questions and builds trust.

Pet supplement demand is flat, but natural formats are driving conversion

🎯 Ecommerce implication: Optimize for ingredient-level search and retail readiness.

Pet supplement searches remain flat. But within the category, herbal supplements grew 36% YoY in Amazon revenue. Dog multivitamins still dominate at 31% category share, indicating that pet owners prefer all-in-one formats.

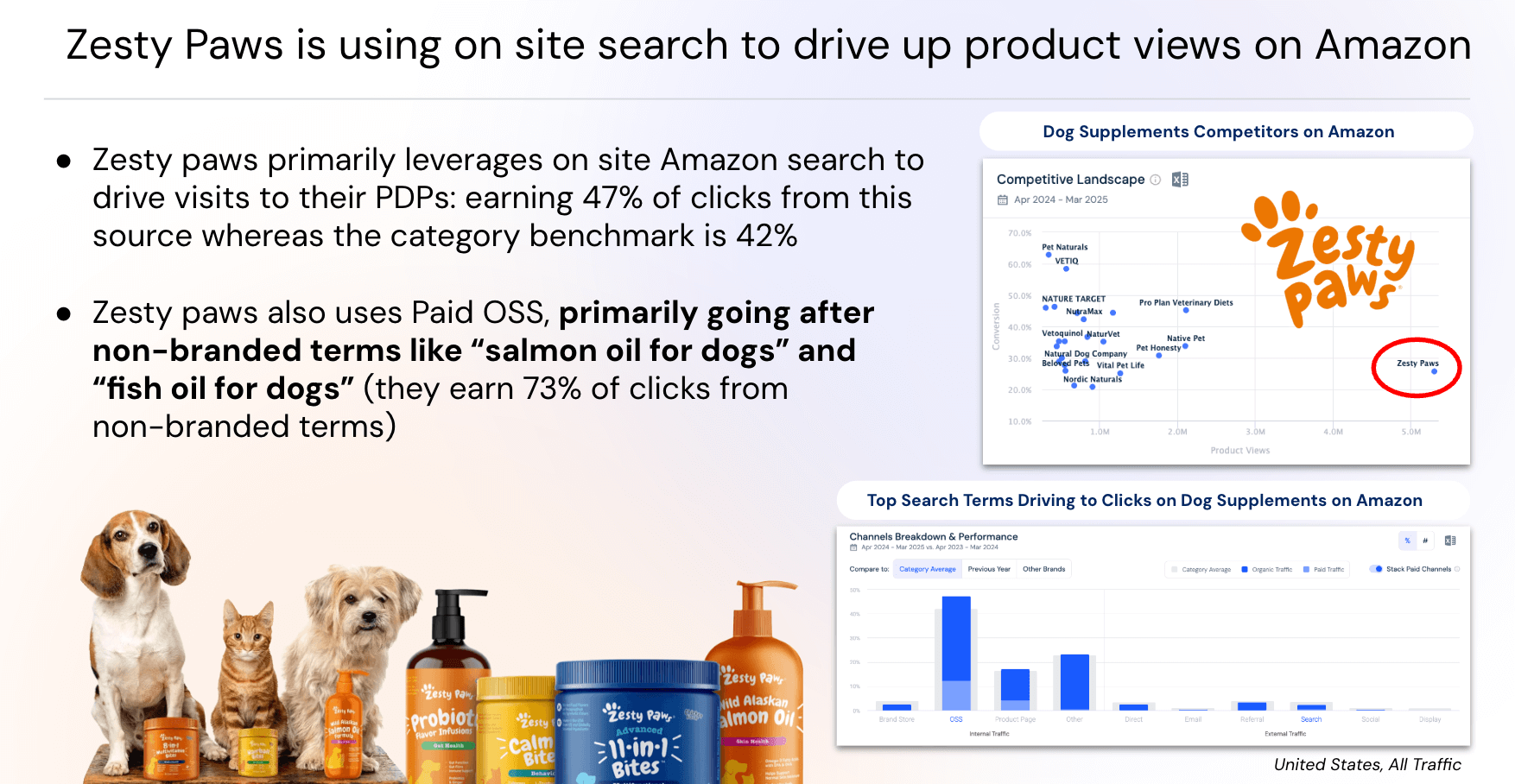

Brands like Zesty Paws are leveraging non-branded OSS terms (e.g. “salmon oil for dogs”) and outperforming the category benchmark for internal search traffic, earning 47% of traffic via Amazon OSS vs. 42% average.

Key Takeaway: Target mid-funnel search intent with specific, benefit-driven keywords. Ensure top-performing SKUs are backed by paid search and highly optimized PDPs.

Start-of-life products: Search demand for puppies and kittens has dropped

🎯 Ecommerce implication: Match content and merchandising to Spring spikes and high-question volume queries.

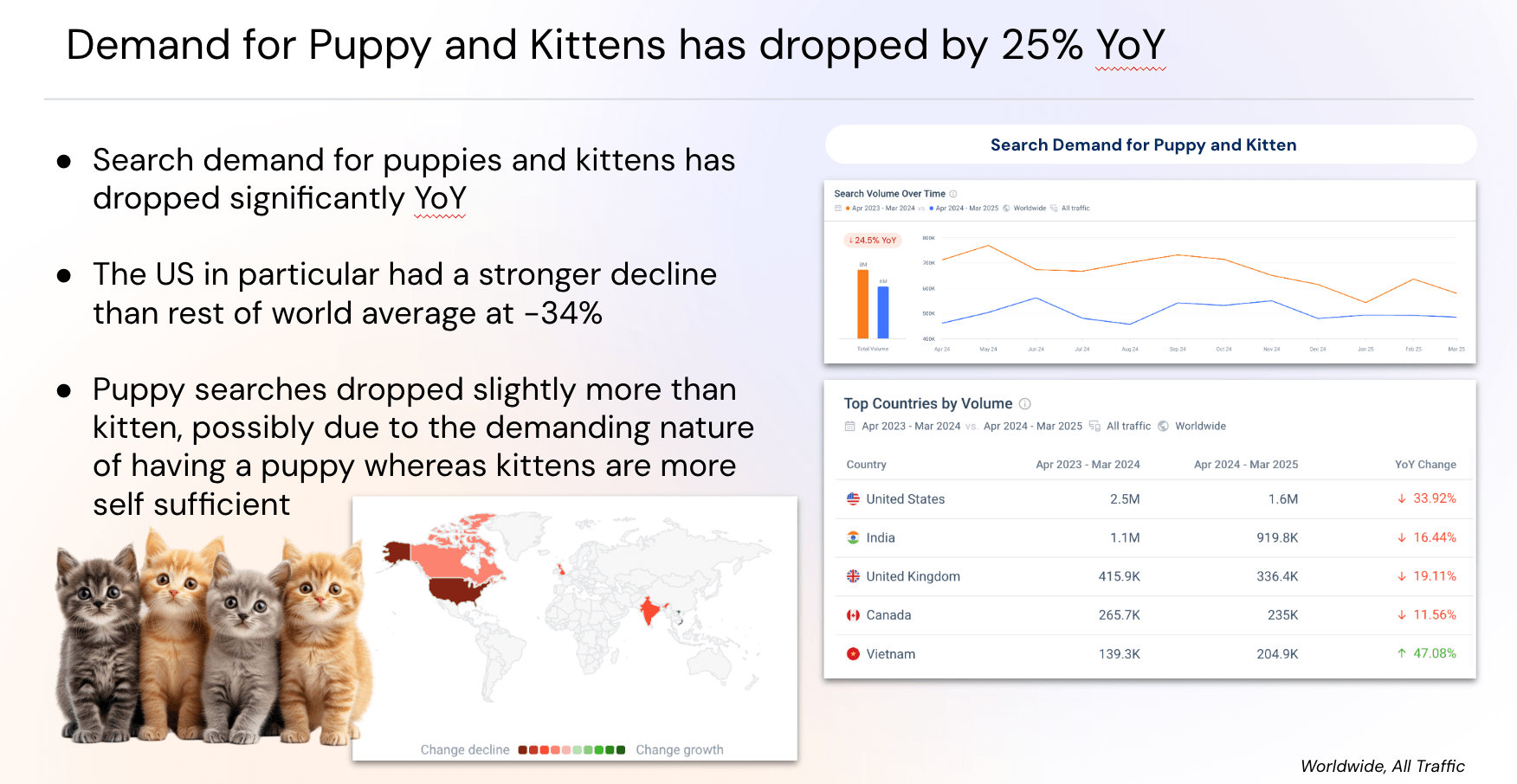

Search demand for “puppy” and “kitten” has dropped 25% YoY, with a stronger decline in the U.S. post-COVID. However, Spring (March–August) remains a seasonal high-intent window.

Google data shows spikes in queries like:

- “How much to feed a 25 lb puppy”

- “When to switch puppy to adult food”

Purina is capturing that traffic by investing in educational SEO content.

Key Takeaway: There is still a clear conversion opportunity if your PDPs and blog/FAQ content address consumers’ product-related questions in real time.

Retail media trends: On-site search and PDP ads are the new battleground

🎯 Ecommerce implication: Maximize ROI by focusing investment on high-yield retail media placements.

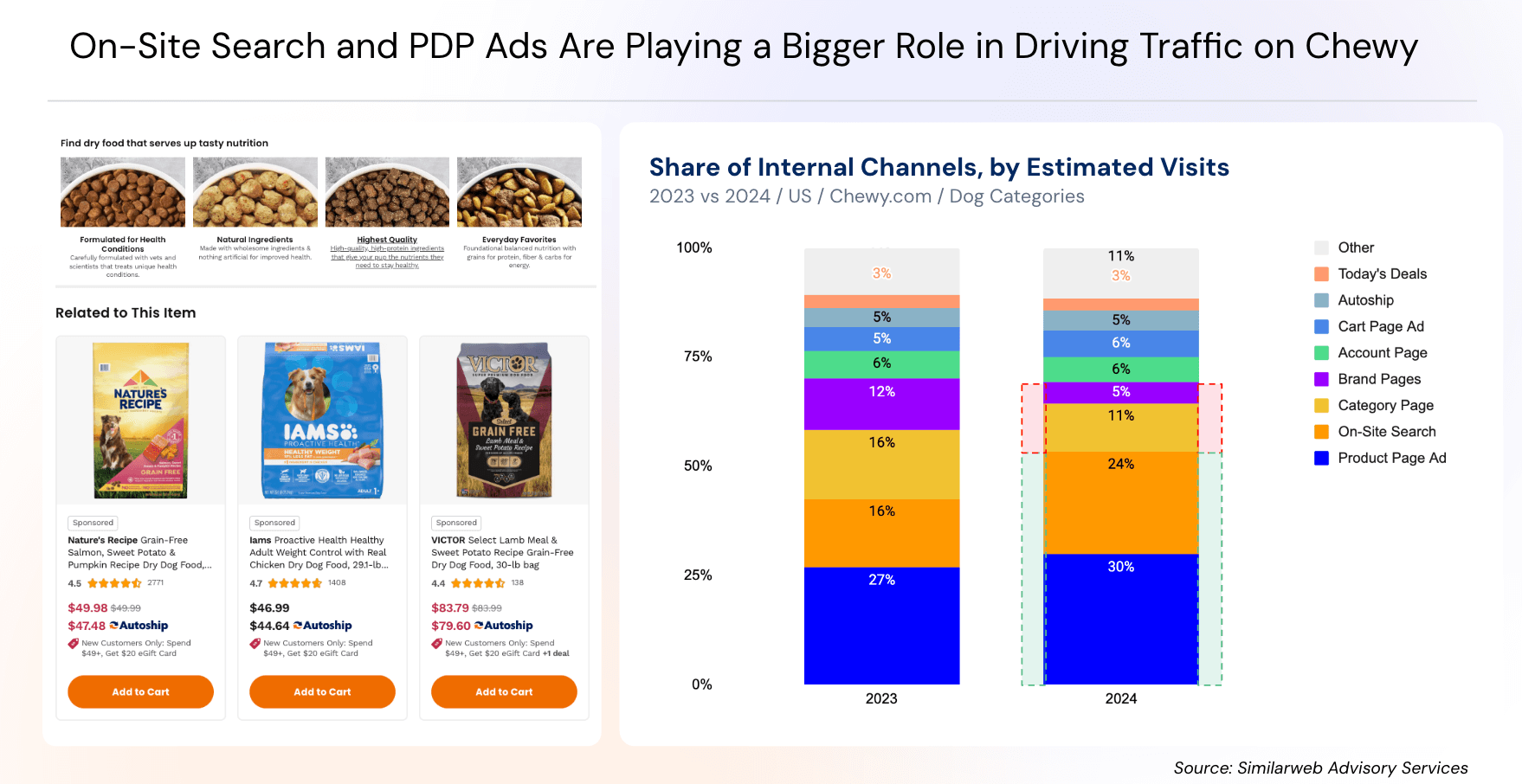

On Chewy, 74% of users begin their journey on-site, not via external search. That makes internal visibility critical. The most effective internal marketing channels in 2024:

- Product Page Ads (PDPs)

- On-Site Search (OSS)

Ingredient- and condition-specific searches dominate:

- “Grain-free dog food” (+243% YoY) → Nature’s Recipe

- “Kidney care dog food” (+1658% YoY) → Hill’s

- “Probiotics for dogs” (+5998% YoY) → Purina

Key Takeaway: Prioritize investment in OSS and PDPs. Optimize product titles, meta descriptions, and keywords for focused discovery.

Winning pet ecommerce requires cross-channel intelligence

What ecommerce leaders should do next:

- Align media, SEO, and retail teams around real-time consumer intent

- Monitor new entrants disrupting category share

- Prioritize performance-based placements over branded display

- Invest in educational content that matches emerging queries

Ecommerce leaders who monitor trends and adapt their ecommerce strategy in real time will capture the next wave of growth.

Use Similarweb to identify demand signals, optimize shelf presence, and stay ahead of competitors with data that moves at your speed.

The ultimate edge in retail insight

Put the full picture at your fingertips to drive product views and sales