How GenAI is Reshaping the Finance Industry in the UK

The internet is moving fast, and so are the consumers using it. What people search for, how they ask questions, and where they go for financial advice are shifting dramatically. At the heart of that shift is generative AI.

One of the clearest examples of this trend is what’s happening in the highly competitive UK market. GenAI tools like ChatGPT aren’t just gaining users – they’re starting to reshape the entire customer journey. In this post, we’ll explore what financial services companies need to know, based on real user behavior tracked by Similarweb.

ChatGPT is (far from) a fad

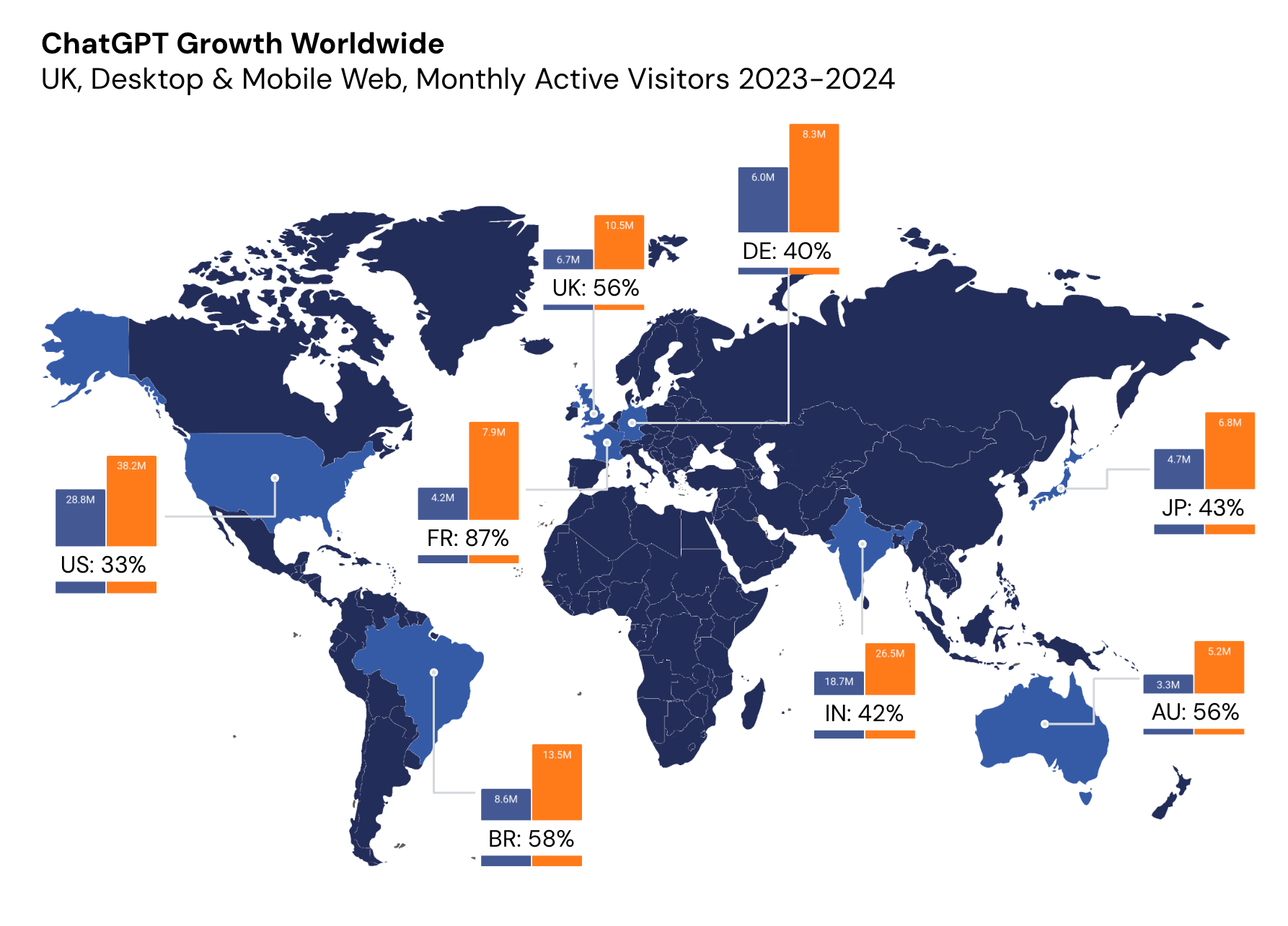

ChatGPT has gone from zero to over 10.5 million monthly users in the UK since its launch. In just the past year alone, usage jumped 56%. And the UK isn’t alone. France saw the highest growth among major markets, with an 87% increase in active users.

Brazil and the UK followed closely behind, both growing by 56%, while Japan (43%), India (42%), and Germany (40%) also saw strong momentum. Even in the mature U.S. market, usage grew by 33%.

That’s a clear sign that GenAI adoption isn’t a blip. It’s global, and it’s accelerating.

Consumers aren’t just trying it, they’re coming back

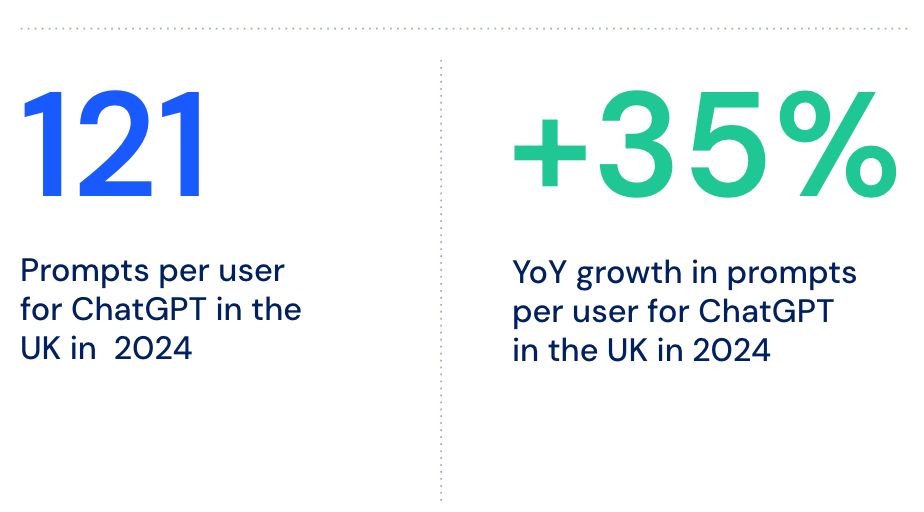

In the UK, ChatGPT users are averaging 121 prompts per person in 2024 – a 35% increase year-over-year (YoY). Visits per user have nearly doubled as well, rising from 6 to 11. This isn’t casual experimentation anymore. People are building GenAI into their routines.

That shift from occasional use to habitual behavior is especially significant in financial services.

According to Similarweb data, users aren’t just popping in to ask simple questions about ISAs or interest rates. They’re coming back repeatedly, using GenAI to explore more complex, personalized financial decisions.

While finance searches are dropping, GenAI prompts are rising

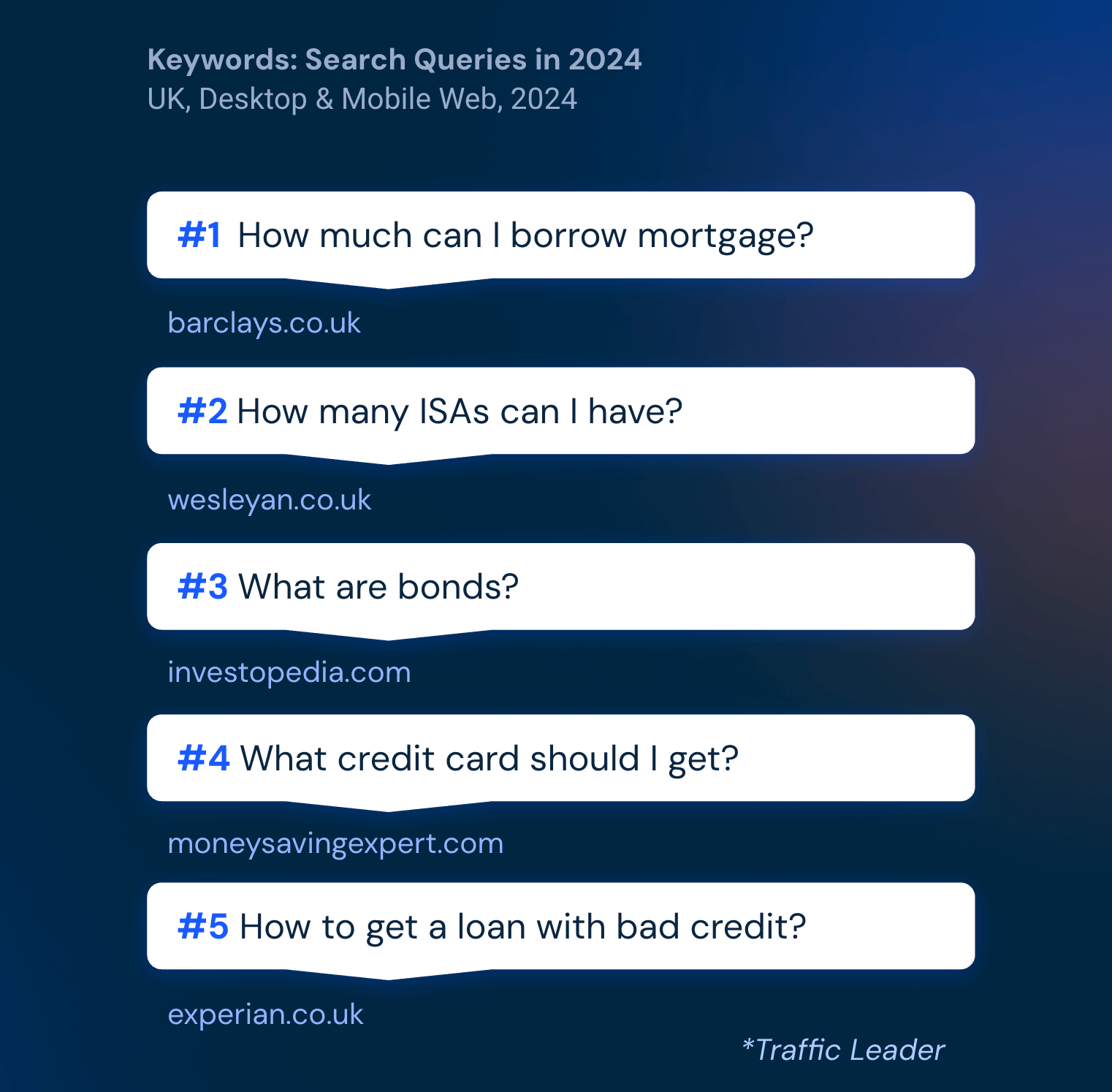

Using Similarweb’s Keyword Research tool, we can find keywords that actually drive traffic – seeing what people search, where they search, and how. For example, when we look at search volume for terms like “mortgage” on Google over the past year (and also more recently, over the last 28 days), there’s a clear downward trend.

But when we check how often the same term appears in GenAI prompts, it’s on the rise – sometimes even showing seasonal spikes.

This signals a bigger shift: consumers are moving away from broad search engines and toward tools that give them more personalized, context-aware answers.

What people ask has changed, and it’s now much more personal

In the past, financial searches were often short and generic. People would ask Google things like “How much can I borrow for a mortgage?” or “What credit card should I get?” These queries were simple and aimed at learning the basics.

But GenAI tools invite more complex, personal questions. One real example we captured through Similarweb shows just how far this has gone:

“For someone like me, a Spaniard living in the UK, who has a personal main Lloyds account for GBP, a joint account with my wife in GBP, a personal Santander Spain account in EUR and a Revolut account, and who’s thinking of entering a mortgage for buying a house in the UK, what’s the best option if I aimed at having a single bank that allows me to operate in both countries smoothly and without paying a lot of fees?” – Real banking Gemini search query captured by Similarweb

That’s not something anyone would’ve typed into Google. But it’s exactly the kind of question consumers are now turning to GenAI to answer.

And for financial services, this opens a new window into what people really need.

The traditional referral model is starting to break

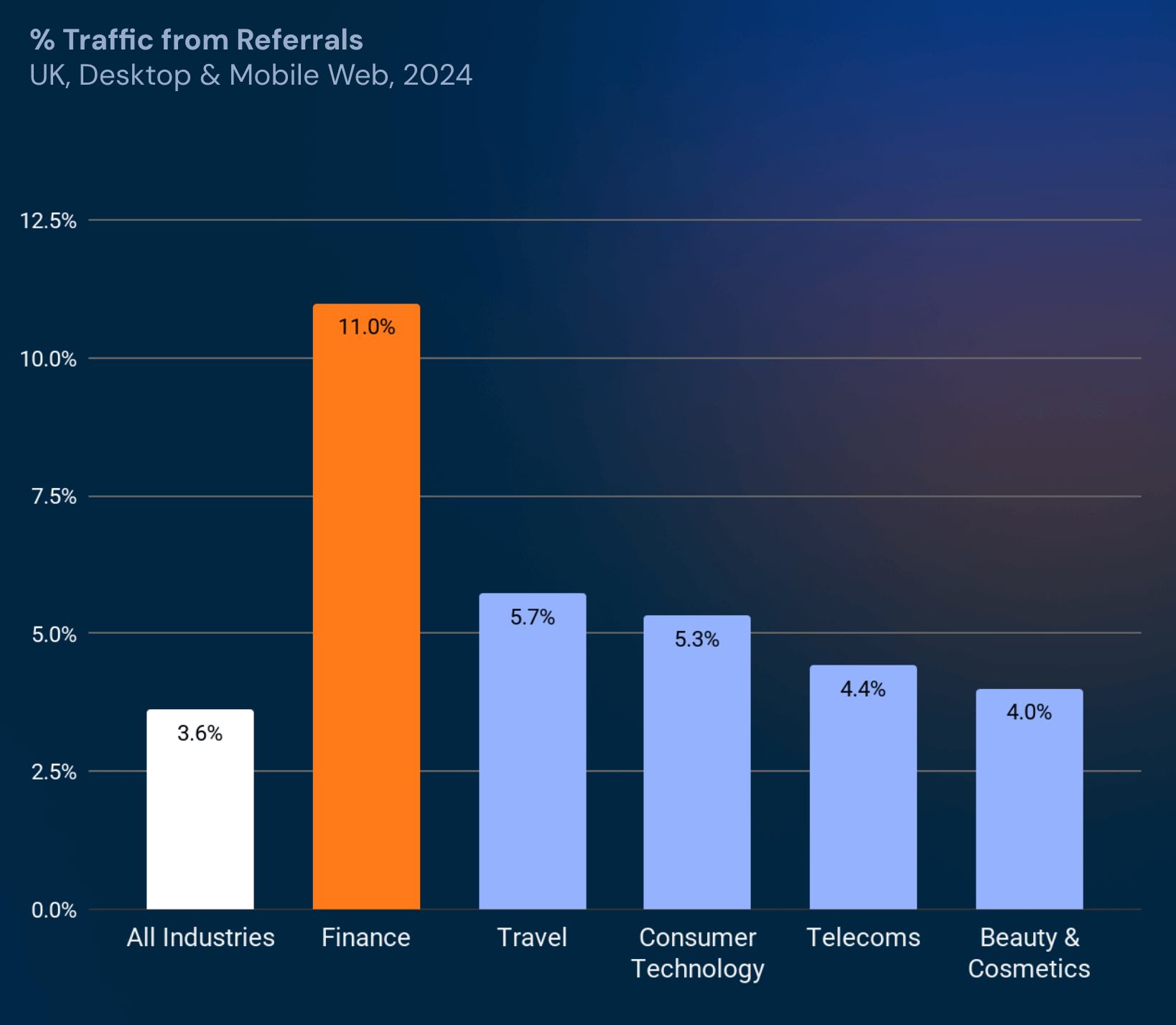

Referrals have always been a key traffic driver for the Finance industry (11% on average), nearly three times more than the average across All Industries (3.4%).

But that model seems to be shifting.

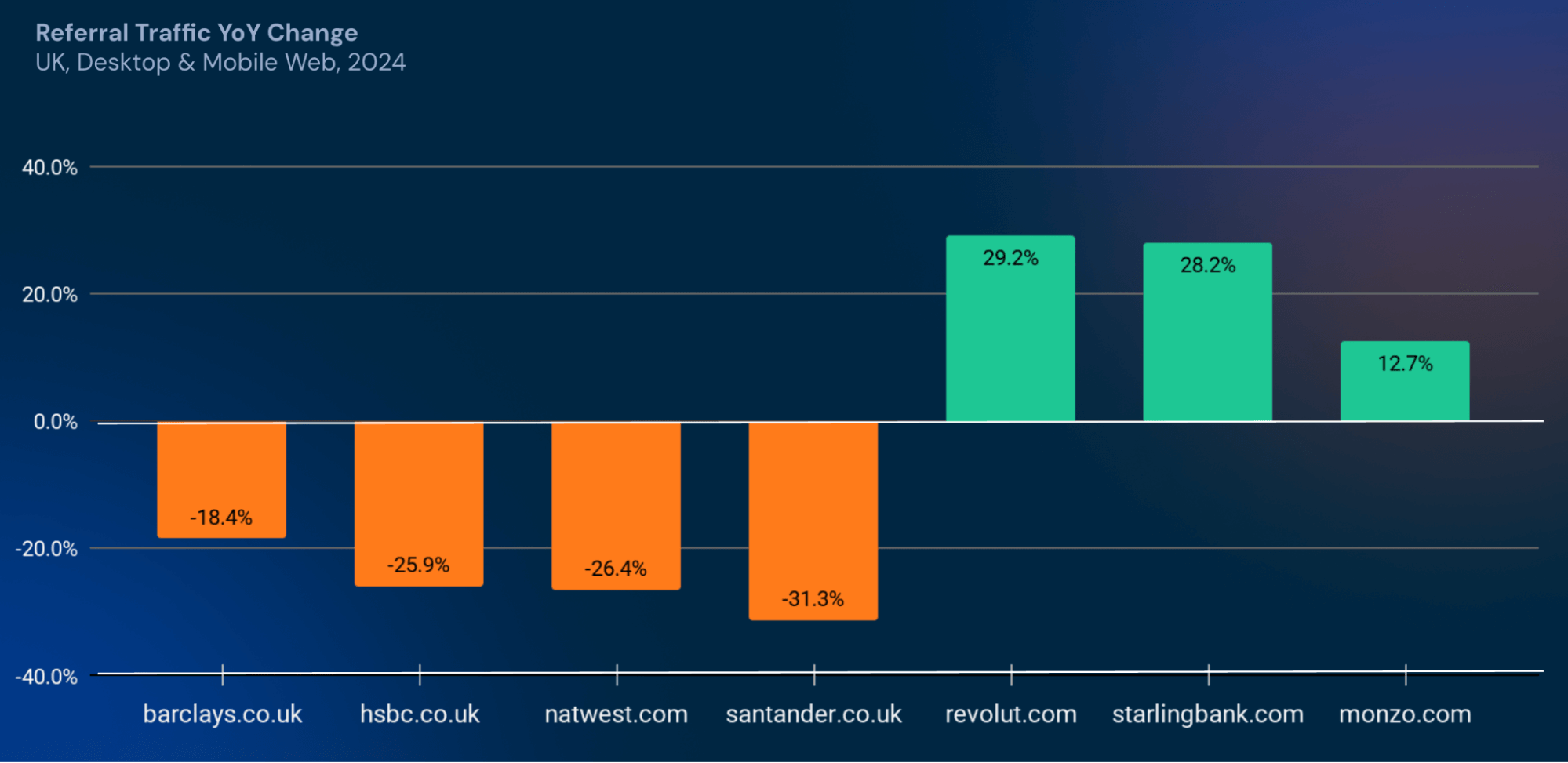

Traffic from referrals is falling sharply for UK’s traditional high street banks. Over the past year, NatWest is down more than 26%, Barclays dropped 18.4%, and Santander saw a 31.3% drop. In contrast, challenger banks are seeing significant gains. Revolut is up 29.2%, Starling Bank is up 28.2%, and Monzo has grown 12.7% YoY.

It’s a clear divergence. As user behavior shifts, so too does the flow of qualified traffic, and we can see that challenger banks are gaining ground fast.

GenAI is already sending serious traffic to finance brands

It may still be early days, but GenAI tools are already making their mark – driving a meaningful share of traffic to financial services websites. In fact, they’re sending around 30–40% as much traffic as top broker sites. That’s a real shift in how users are discovering financial information.

While GenAI hasn’t overtaken credit brokers yet in terms of referrals, it’s gaining ground fast.

Just two years into its mainstream rollout, ChatGPT is already holding its own.

In 2023, top GenAI tools like ChatGPT, Gemini, Copilot, and Perplexity saw collectively total traffic of 55.3 million visits. By 2024, that number more than doubled to 115.3 million. Monthly unique visitors also climbed from 6.9 million to 10.9 million – a 61% YoY increase.

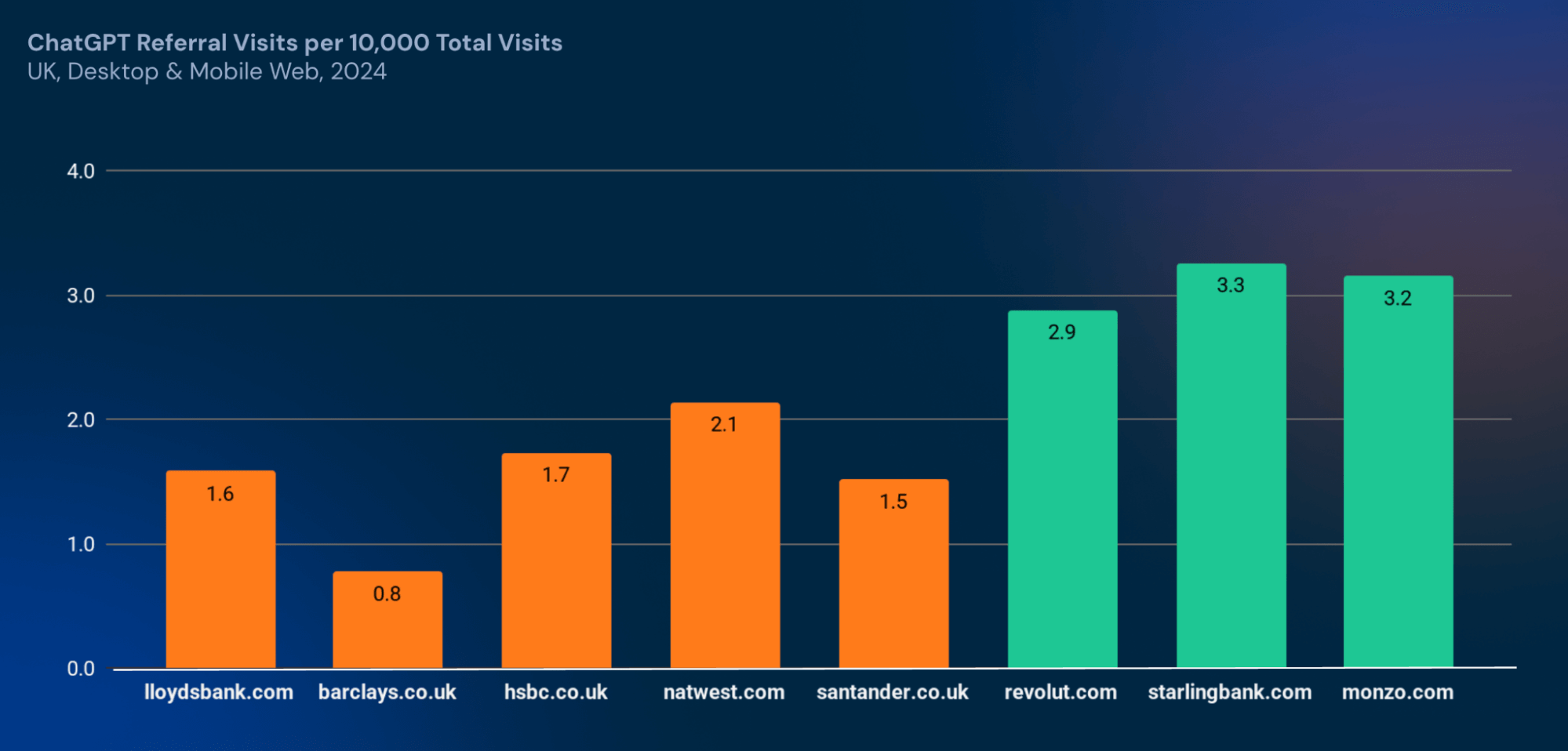

What’s especially interesting is where that traffic is going. Challenger banks are getting a larger share relative to their size. For example, Revolut, Starling Bank, and Monzo receive more than 3 ChatGPT referrals per 10,000 site visits – far higher than any of the high street incumbents.

This suggests GenAI isn’t just popular, it’s already influencing how consumers discover and evaluate financial services providers. And it means that the customer journey is starting much earlier, in a much more personalized way.

Instead of landing on your homepage via a search ad or broker site, potential customers might be introduced to your brand through a GenAI-generated answer, one that surfaces your offerings based on relevance, clarity, and trustworthiness.

In this new model, your website content, FAQs, and educational resources don’t just support SEO – they become the raw material GenAI tools rely on to generate responses to queries. If your brand isn’t present in those moments, you may not even be in the consideration set.

📌 PRO TIP: Similarweb’s Web Intelligence allows you to do just that. With our insights, you can understand what content drives engagement, what keywords fuel discovery across channels (including GenAI), and how your competitors are showing up in these new digital touchpoints – so you can optimize your presence and stay in the conversation.

Niche sites are becoming GenAI authorities

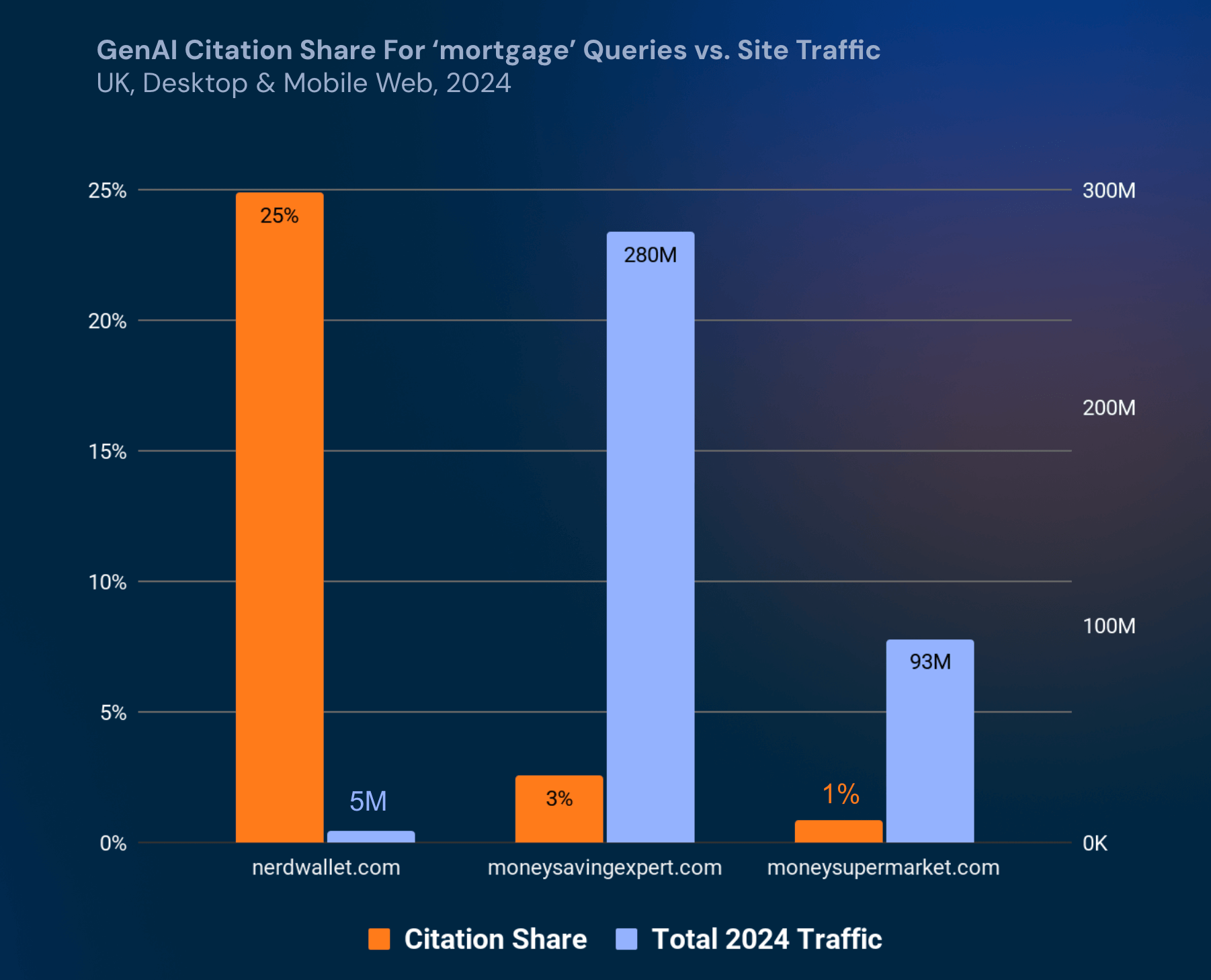

Another major shift? The sources GenAI tools pull from.

Take mortgage-related queries, for example. Nerdwallet, a leading American personal finance company with relatively modest traffic, shows up in 25% of citations in ChatGPT responses. That’s significantly higher than more prominent UK financial sites like MoneySavingExpert (+3%) or MoneySuperMarket (+1%).

This further highlights that some brands are punching above their weight, and GenAI is rewarding them. Instead of defaulting to the most visited sites, these tools are prioritizing content that’s clear, specific, and directly relevant to the user’s intent.

For your brand, it means you don’t need the biggest audience to become an authority. What matters is whether your content answers the right questions, in the right way. If it does, GenAI will find it—and so will your next customer.

Your GenAI user is the audience of the future

If you’re wondering who GenAI users really are, the data paints a clear picture: they’re younger, more digitally savvy, and closely aligned with the customer base of challenger banks.

In the UK, over half of GenAI users are under the age of 35 – that’s 24% higher than the general population. But it’s not just about age. It’s about behavior. These are the consumers turning to AI, not just Google or brokers, for financial guidance.

For traditional banks whose customer bases tend to skew older, this is both a challenge and an opportunity. Younger audiences are forming new digital habits that will become the norm in the near future.

📌 PRO TIP: With Similarweb’s Demand Analysis, you can analyze any segment and break down audiences by age, interests, behavior, and browsing patterns. Spot emerging trends, benchmark against digital-first competitors, and tailor your strategy to engage the next generation of customers, before they’ve formed lasting brand loyalties.

GenAI prompts are a goldmine of consumer insight

Beyond referrals and traffic, there’s something even more valuable hidden in GenAI prompts: unfiltered consumer intent.

When we analyzed ChatGPT prompts that included the word “mortgage,” certain terms popped up over and over, like “deposit,” “interest rate,” “fixed,” and “terms.” These themes reflect what’s really on people’s minds when considering big financial decisions.

This kind of insight is incredibly powerful. It’s like an always-on, unstructured consumer survey. And it could directly inform how financial institutions shape content, messaging, and product offerings moving forward.

Don’t shy away from disruption – learn from it

GenAI is already reshaping the way consumers search, engage, and make decisions—and the UK is at the forefront of this shift. From driving new referral traffic to spotlighting niche voices and uncovering highly personalized needs, the message is clear: financial services brands need to act now.

Want to understand how these changes are impacting your business, or how to turn them into opportunities?

Book a meeting with our team of digital experts to discover how Similarweb’s GenAI data, capabilities, and insights can help your brand stay ahead and thrive in an increasingly competitive landscape.

Wondering what Similarweb can do for your business?

Give it a try or talk to our insights team — don’t worry, it’s free!