Fortified Gummies: The Sweet Spot of France’s Health Revolution

Key Takeaways:

- Building on the demand for health supplements, the Fortified Gummies market is rapidly growing, with a 36% YoY increase in searches.

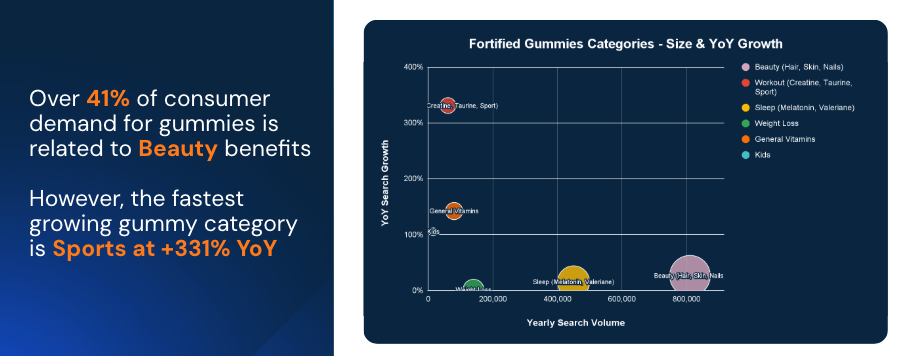

- While over 41% of consumer demand for gummies is driven by Beauty benefits, the fastest-growing gummy category is Sports nutrition and associated benefits at +331% YoY.

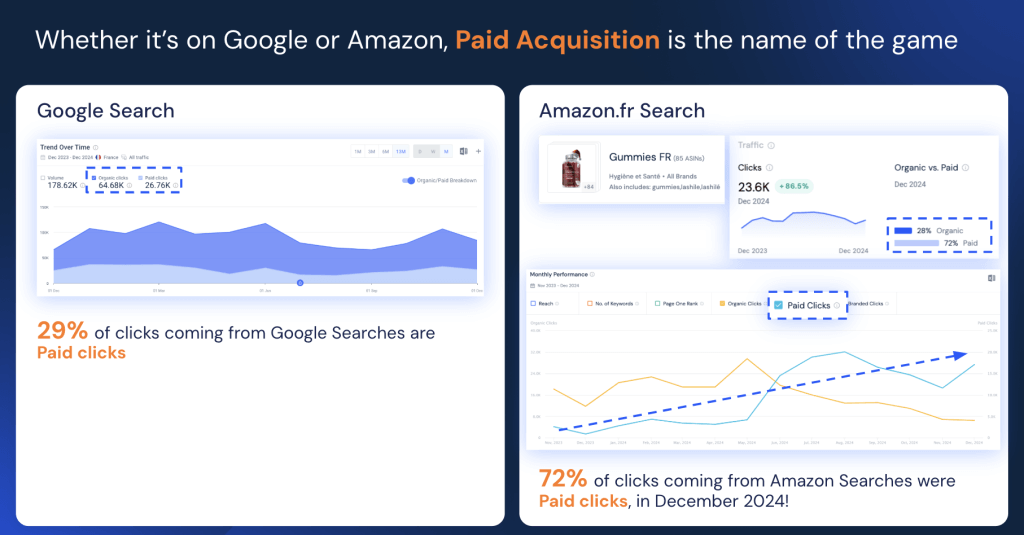

- Paid search now accounts for one-third of clicks in the Fortified Gummies category, highlighting the critical need for brands & retailers to invest in digital marketing strategies to maintain competitive visibility.

Fortified Gummies: growing strong doesn’t have to be a hard pill to swallow!

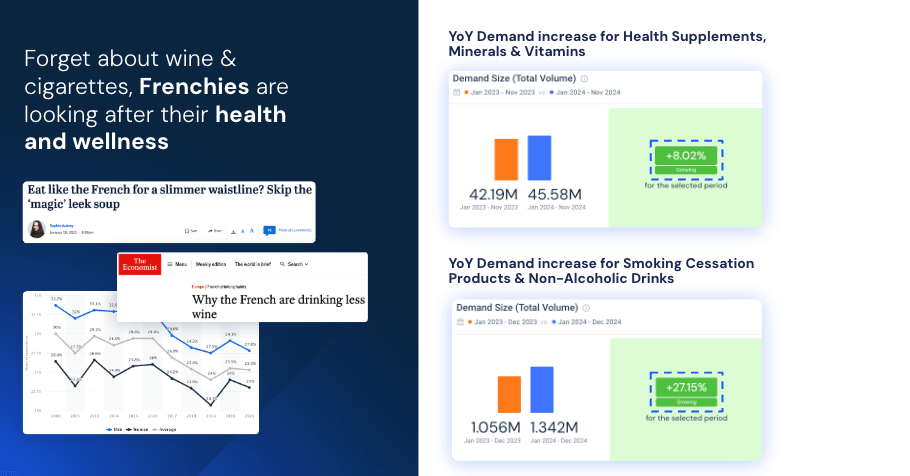

As health-conscious habits sweep across France, the demand for products supporting healthier lifestyles is surging. French consumers are increasingly seeking supplements, smoking cessation aids, and non-alcoholic beverages as part of their wellness-focused routines.

With an impressive +8% YoY growth in demand for health supplements and a remarkable +27% YoY increase for smoking cessation products and non-alcoholic beverages, this isn’t just a fleeting New Year’s resolution fad—it’s a lasting trend.

Yet, amid this health-conscious boom, one category stands out as the most promising opportunity for growth: fortified gummies.

With an impressive 36% YoY growth in demand, fortified gummies are emerging as a key player in the health and wellness market. These nutrient-packed treats offer a convenient, enjoyable, and effective way to supplement daily diets, making them particularly appealing to a broad range of consumers, from busy professionals to families with children.

This trend represents a golden opportunity for brands to capitalize on – so much so that leading global retailers such as Amazon & Sephora have entered the market and launched their own private-label offerings.

That said, this expanding market is far from saturation, as the majority of product clicks come from non-branded keyword searches, highlighting a significant opportunity.

Gum-meet Your Match: How Brands Are Sweetening Daily Routines

Successful brands know how to seamlessly integrate into their consumers’ daily routines, offering tailored support at every step.

- In the morning, beauty and vitality nutrients provide an energizing start to the day.

- At lunchtime, diet-focused gummies with fat-burning and weight-loss nutrients help consumers stay on track with their goals.

- After work, workout supplements power up fitness enthusiasts for optimal performance.

- Finally, bedtime gummies with ingredients like melatonin and valerian ensure a restful night’s sleep.

By addressing diverse wellness needs throughout the day, these brands are becoming indispensable partners in healthy living, resulting in 25% of consumers returning to their websites within the next 3 months.

Rising popularity of Fortified Gummies across categories

Which categories represent a strategic opportunity? Which ones are growing the fastest?

As brands strive to engage consumers at every touchpoint, certain categories stand out as essential.

Over 41% of consumer demand focused on beauty benefits, making it the largest category. However, the fastest-growing segment is sports gummies (made of ingredients such as creatine & taurine – promoting energy), which have surged an impressive 331% YoY, driven by active lifestyles and fitness trends.

General vitamins and kids’ vitamins are also experiencing remarkable growth, each more than doubling in demand annually, highlighting the widespread appeal of gummies across all age groups and health needs.

With all these nutrients, fortified gummies are raising the bar—and our vitamin levels!

But which ingredients should you consider launching or selling next?

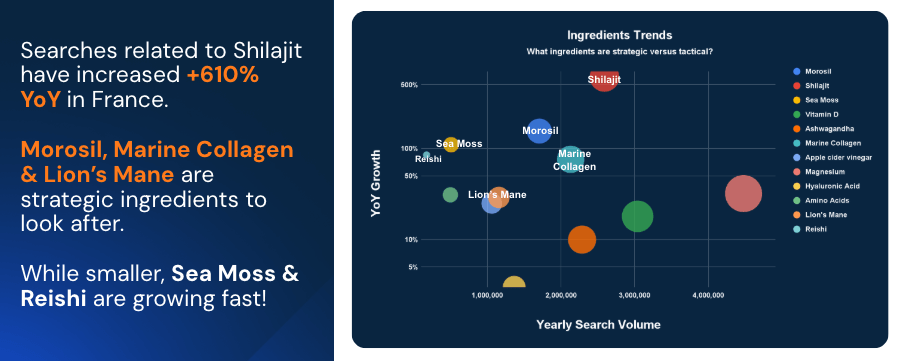

Searches for Shilajit have skyrocketed by 610% year over year, positioning it as a prime opportunity for product development and marketing strategies.

Meanwhile, other ingredients like Morosil, Marine Collagen, and Lion’s Mane also present significant potential, averaging a +86% YoY growth in searches.

Though more niche, interest in Sea Moss and Reishi has doubled over the past year, indicating growing curiosity about these ingredients.

How can brands and retailers chews to successfully win over consumers?

With 29% of clicks related to gummies originating from paid Google searches and 72% of product clicks on Amazon driven by paid ads in December 2024, it’s clear that paid acquisition plays a crucial role in driving consumer engagement.

As competition intensifies, brands and retailers must prioritize investment in paid strategies to ensure visibility and capture potential customers, especially in non-branded keyword searches where competition is fierce and brand loyalty is still forming.

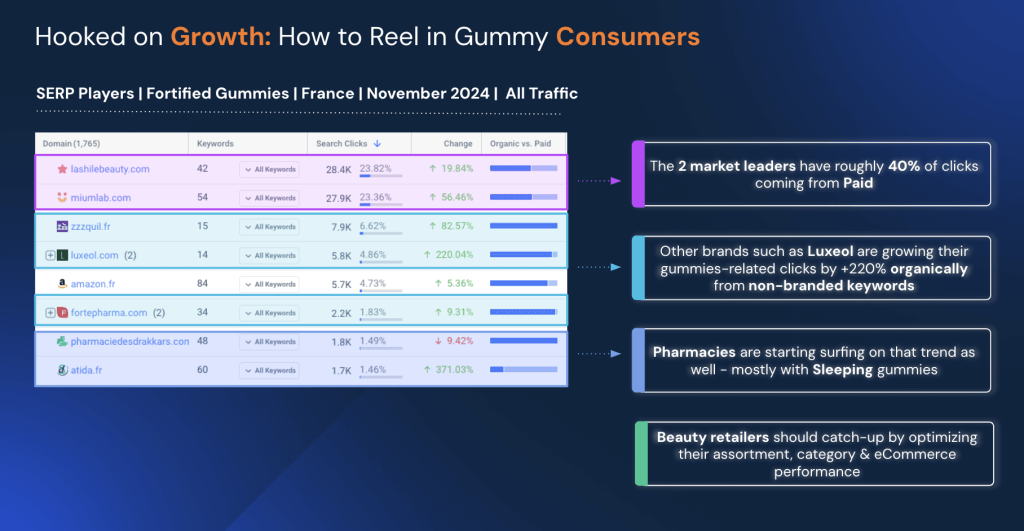

Hooked on Growth: How to reel in Gummy Consumers

The two market leaders dominate with around 40% of their clicks driven by paid strategies, while emerging brands like Luxeol are making impressive gains, growing their gummy-related clicks by 220% organically through non-branded keywords.

Pharmacies are joining the trend, primarily focusing on sleeping gummies, signaling the category’s broad appeal.

Beauty retailers, however, need to catch up by optimizing their assortments, refining category strategies, and enhancing ecommerce performance to capitalize on this growing market.

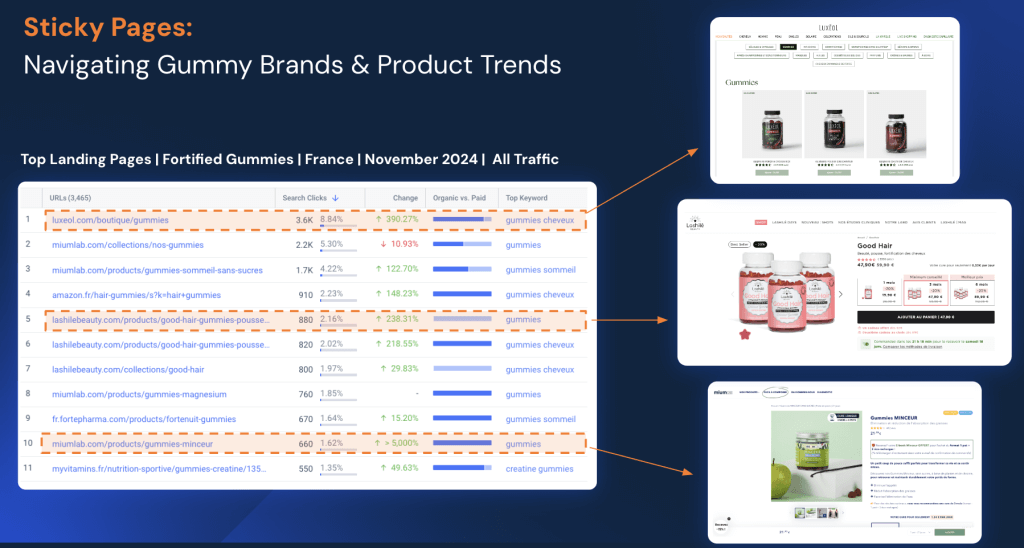

Sticky pages – Navigating Gummy Brands & Product Trends

To master customer acquisition, it’s crucial to understand which brands, products, and content are gaining traction online. Our landing page analysis reveals that, in November 2024, Hair gummies were especially popular, with Luxeol seeing an impressive +390% MoM increase in clicks.

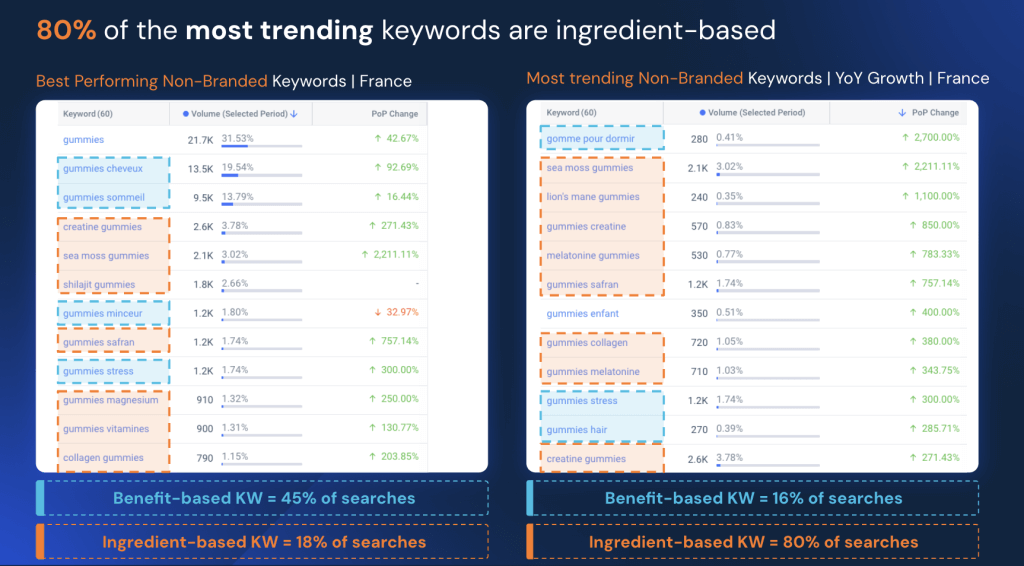

80% of the most trending non-branded keywords are ingredient-based

Among the 10 most performing & non-branded keywords, 45% are benefit-related, while only 18% are ingredient-related, highlighting a stronger focus on desired outcomes.

However, when looking at the Top 10 most trending keywords, a striking 80% are ingredient-related. This shift indicates that gummy consumers are increasingly searching for products based on specific ingredients, reflecting a growing interest in targeted nutrition and informed decision-making.

So, how can Similarweb help you?

Whether you’re a brand, a retailer, or an e-pharmacy, Similarweb has got you covered and can help you in many different ways.

- First, we can help you spot trends before they’re yesterday’s news, and highlight which ones are fads, and which ones are here to stay

- We’ll help you boost your shelf-esteem with better category and ecommerce strategies.

- Thanks to our robust, fresh & granular data, you’ll be able to search for success by nailing your SEO & Paid campaigns

- Finally, by keeping a close pulse on consumer demand and online shopping behavior, you can stay ahead of the curve and make a mark in your market!

The Similarweb Insights & Communications team is available to pull additional or updated data on request for the news media (journalists are invited to write to press@similarweb.com). When citing our data, please reference Similarweb as the source and link back to the most relevant blog post or similarweb.com/blog/insights/.

Contact: For more information, please write to press@similarweb.com.

Disclaimer: All names, brands, trademarks, and registered trademarks are the property of their respective owners. The data, reports, and other materials provided or made available by Similarweb consist of or include estimated metrics and digital insights generated by Similarweb using its proprietary algorithms, based on information collected by Similarweb from multiple sources using its advanced data methodologies. Similarweb shall not be responsible for the accuracy of such data, reports, and materials and shall have no liability for any decision by any third party based in whole or in part on such data, reports, and materials.

Wondering what Similarweb can do for your business?

Give it a try or talk to our insights team — don’t worry, it’s free!