How to Analyze Competitors’ AI Brand Visibility

When I started looking into AI brand visibility, I wasn’t trying to prove that AI search is “the future.” I was trying to answer a much more concrete question: why do some competitors consistently appear in AI-generated answers while others don’t?

Unlike traditional search, AI tools don’t give us rankings to analyze, generative engine optimization focuses on how brands appear in AI-generated answers. There’s no position one, no impressions report, and no obvious way to understand competition. Brands are either mentioned or they’re not, and that makes AI competitive analysis feel almost impossible.

That’s exactly why I decided to approach this from a competitive perspective. Instead of asking how visible my brand is, I asked how my competitors are winning visibility in AI answers, and what patterns explain that advantage.

Why competitive AI brand visibility analysis actually matters?

What became clear very quickly is that AI brand visibility isn’t random. Competitors don’t show up in AI answers by accident, and they don’t disappear without a reason. Each AI mention is the result of patterns AI tools rely on, specific prompts, trusted sources, and consistent brand associations.

By analyzing competitors’ AI visibility, I could see which brands AI tools consistently rely on, which topics they dominate, and where they’re vulnerable. More importantly, I could stop guessing. Instead of assuming which competitors matter, I could see who AI tools actually treat as authoritative. The value of this step is clarity: it shows which competitors are shaping AI-generated answers today, and in which contexts they are doing it.

This kind of analysis shifts the conversation from “How do we rank?” to “How do we become the brand AI trusts to mention?”, which is the core goal of answer engine optimization. Instead of reacting to AI answers after the fact, this approach shows where to focus first, and why those areas matter competitively.

So let’s start diving in.

How to Analyze AI Brand Visibility Across Your Competitors

1. Setting the competitive foundation: campaign and topic selection

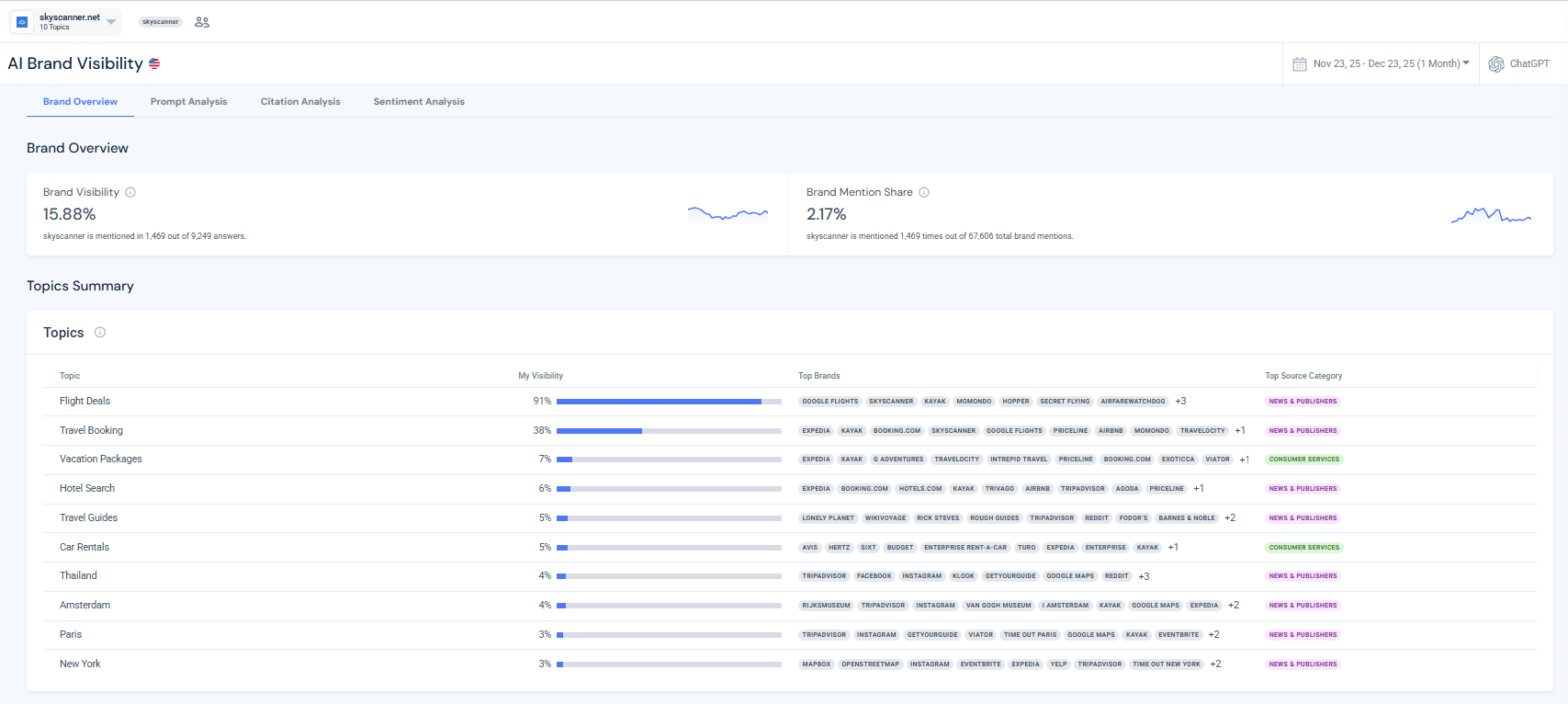

I started by creating a campaign in the Similarweb AI Brand Visibility tool for Skyscanner and selecting travel-related topics that reflect how users actually interact with AI tools.

Instead of thinking in keywords, I focused on topics that generate repeat AI answers, such as Flight Deals, Travel Booking, Hotel Search, and destination-based prompts.

In Flight Deals, Skyscanner showed very strong visibility, clearly competing at the top of the AI answer space. In contrast, topics like Hotel Search and Travel Guides showed noticeably lower coverage, even though those topics had high AI prompt visibility.

This imbalance suggested that competition wasn’t even. Skyscanner was strong where the product narrative was clear, and weaker where AI answers leaned more on reviews, editorial guidance, or experience-based content.

That early topic-level view already hinted at where competitors had an edge and where Skyscanner was underrepresented.

2. Finding the competitors that AI tools mention across topics

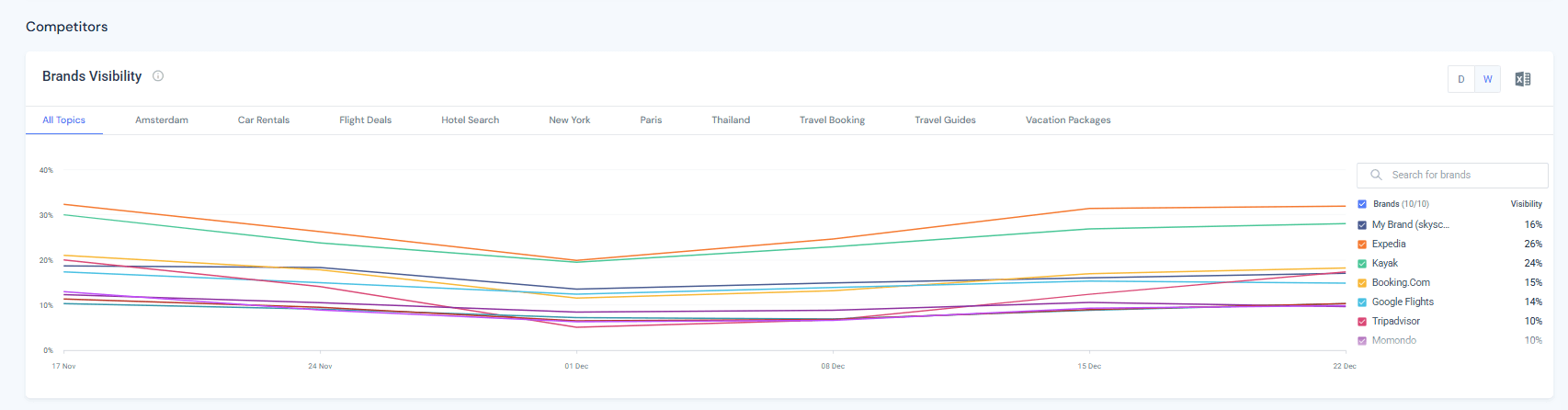

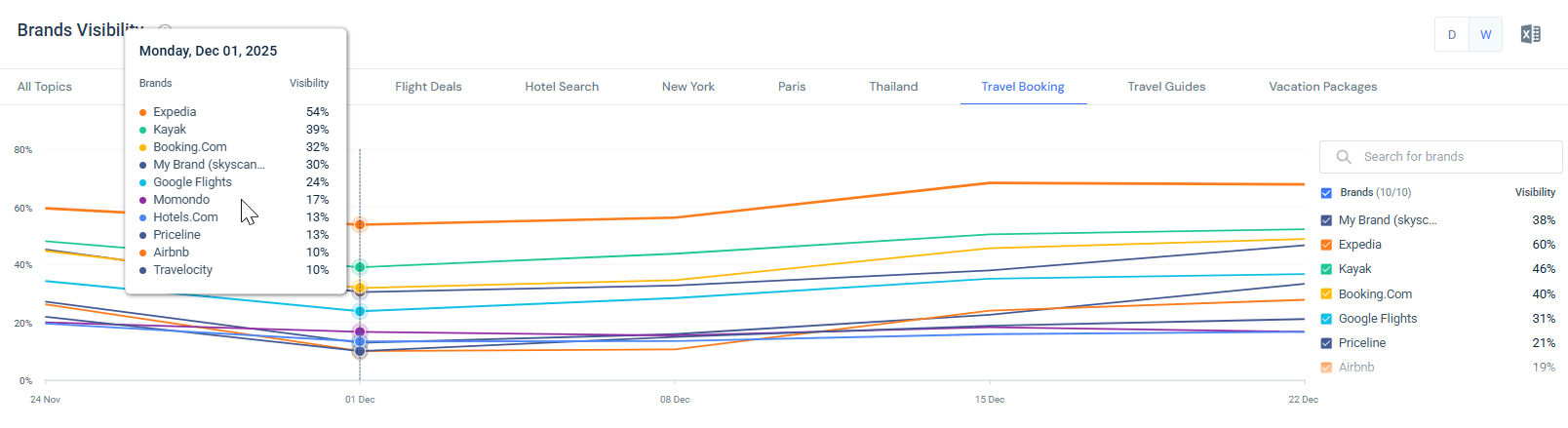

Next, I looked at the competitors’ view across all topics to understand who Skyscanner is really competing with in AI-generated answers.

What stood out most was the dynamic nature of visibility over time. Around early December, visibility dipped across most brands, followed by a steady recovery. This volatility showed that brands gain and lose exposure as AI systems adapt to sources and prompt patterns.

When I broke this down by topic, the competitive picture changed dramatically.

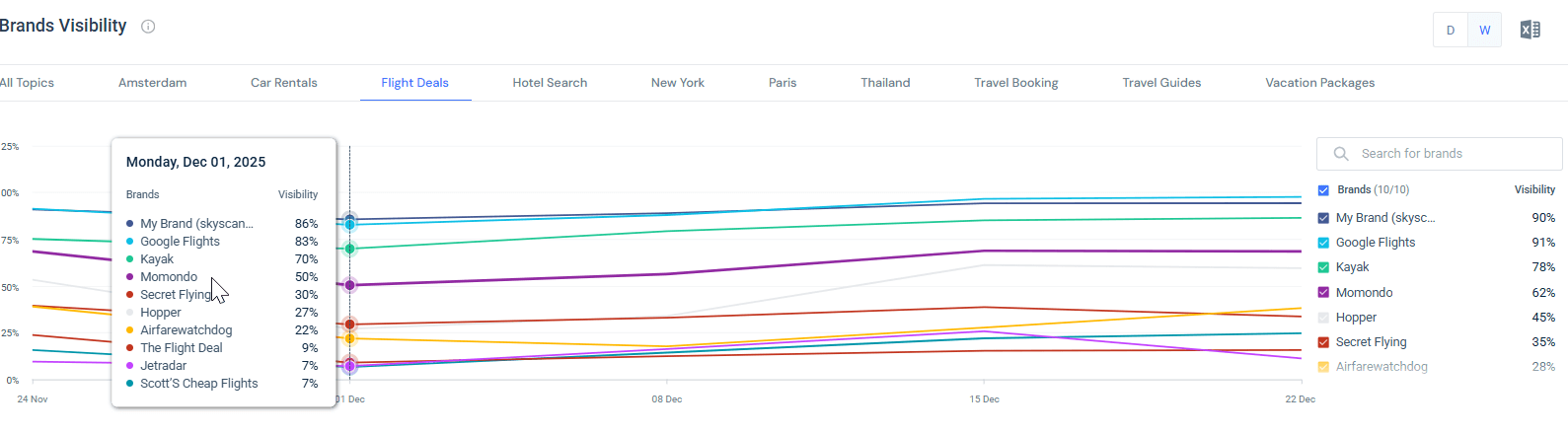

In flight-related prompts, Skyscanner clearly stood out as one of the strongest brands in AI-generated answers. In the Flight Deals topic, Skyscanner reached around 90% AI visibility, competing directly at the top of the category.

This confirmed that Skyscanner’s AI strength is highly concentrated in flight-centric queries, where AI tools consistently associate the brand with price comparison and deal discovery.

The picture shifted again when I looked at travel booking-related prompts.

In the Travel Booking topic, Expedia clearly led the competitive set, reaching around 60% AI visibility and Skyscanner appeared in the middle of the pack with about 38% visibility.

This distribution showed a different kind of competitive pressure. Unlike flight-related prompts, where Skyscanner competes at the very top, travel booking prompts are more crowded and harder to stand out in.

AI tools leaned more heavily toward brands that offer end-to-end booking experiences, showing why Expedia and Booking.com lead booking-related prompts.

Together with the flight-related analysis, this made the pattern clear: Skyscanner’s AI visibility is strongest where flight comparison is central, while competitors gain the upper hand as prompts shift toward broader booking decisions.

3. Discovering where competitors win and you’re missing entirely

This was the clearest turning point in the analysis.

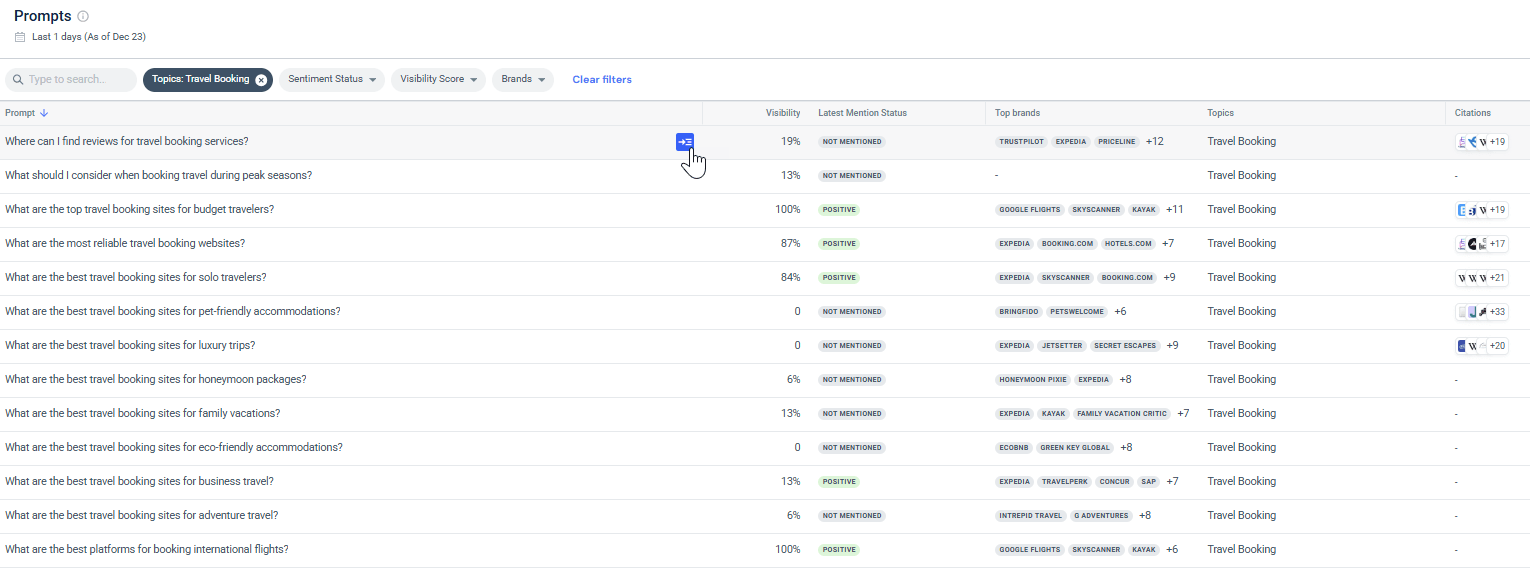

I checked the AI Prompt Analysis tool and reviewed the high-visibility prompts that did not mention Skyscanner, focusing on the Travel Booking topic. These weren’t rare cases, but high-intent prompts with visibility scores between 13% and 19%.

Across these prompts, competitors like Expedia, Booking.com, Priceline, and Trustpilot-linked platforms appeared consistently.

This revealed a clear competitive pattern. Skyscanner was absent not because AI tools didn’t understand the brand, but because these prompts leaned heavily toward trust, reviews, and experiential guidance, areas where competitors had stronger AI associations.

In other words, competitors weren’t just winning on price or scale. They were winning on contextual relevance within AI answers.

4. Understanding the sources behind competitor visibility

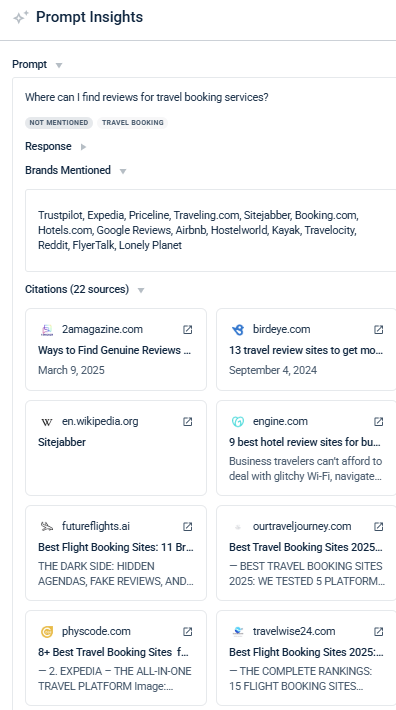

To understand why those competitors kept appearing, I drilled into the Prompt Insights for one of the high-visibility prompts where Skyscanner was not mentioned: “Where can I find reviews for travel booking services?”

This view made the pattern immediately clear. In the Brands Mentioned list, AI tools consistently mention platforms like Trustpilot, Expedia, Priceline, Booking.com, Hotels.com, Kayak, Airbnb, and even editorial brands such as Lonely Planet. Skyscanner was absent from this list, and the citations behind the answer explained why.

This set of sources included:

- Editorial articles like “Best Travel Booking Sites” and comparison-style rankings

- Review-focused platforms and content discussing trust and user feedback

- Travel publishers and community-driven sources such as Wikipedia and long-form travel blogs

AI tools weren’t favoring these competitors at random. They had stronger citation signals because they repeatedly appeared in the exact content formats AI relied on to answer this question.

Skyscanner’s absence wasn’t about brand recognition, it was about not being present in the sources powering the answer.

5. Comparing sentiment: how AI positions competitors

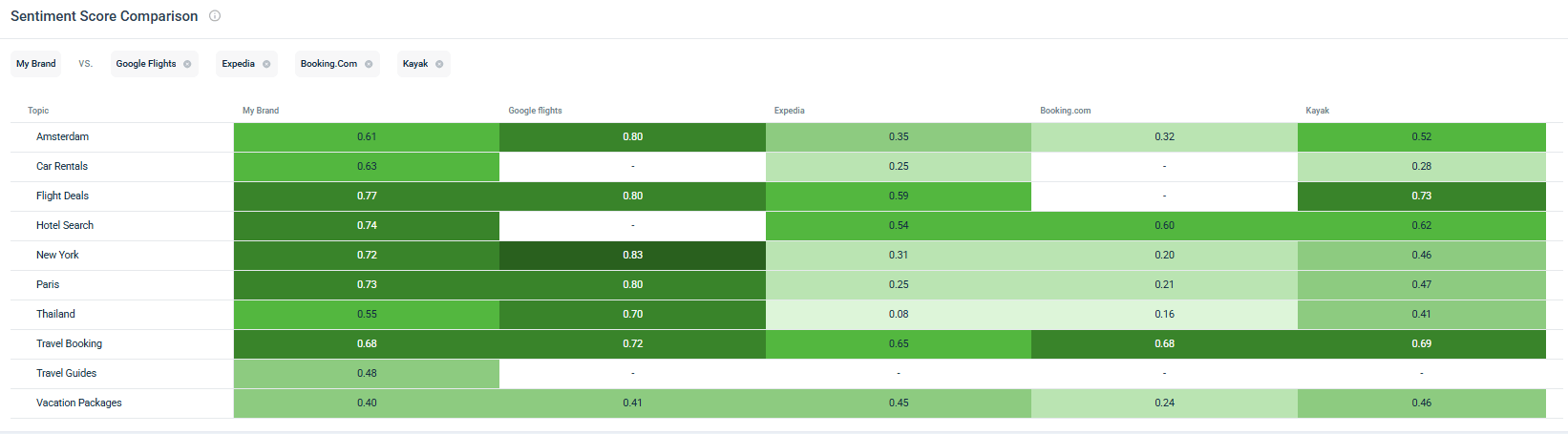

The final layer of my analysis was sentiment, and this is where the picture became more complex.

When reviewing the AI Sentiment Analysis tool, I found that Skyscanner’s sentiment scores were consistently strong:

- Flight Deals: 0.77

- Hotel Search: 0.74

- Travel Booking: 0.68

In contrast, competitors like Expedia and Booking.com, while more visible overall, showed lower or more mixed sentiment in several topics. Google Flights performed strongly in destination-based prompts but didn’t dominate transactional sentiment.

This revealed an important insight: Skyscanner’s challenge isn’t trust, it’s coverage. When Skyscanner appears, AI tools frame it positively. The opportunity lies in expanding presence into prompts where sentiment strength can already work in its favor.

What does this competitive analysis reveal to me?

Looking across visibility, prompts, citations, and sentiment together, several insights became clear.

AI visibility is not shared evenly, even among well-known brands. AI tools don’t try to balance exposure. They repeatedly return to the same brands for the same types of questions.

Once a brand is associated with a specific prompt type, like flight deals, reviews, or booking decisions, it tends to be mentioned again and again. This creates a loop where competitors who appear early gain more visibility over time, while others struggle to break in.

Citations play a key role in this loop. Brands that show up in the sources AI relies on become the “safe choice” for future answers. At that point, visibility is no longer about who is best, but about who already fits the answer AI is trying to give.

Sentiment helps explain where this loop can be broken. Some competitors appear often, but with weaker or neutral framing. That suggests opportunities to compete by showing up with clearer value and stronger positioning, rather than trying to out-mention competitors.

Turning AI Brand Visibility Insights into Action

This analysis proved to me that AI brand visibility is measurable. Once you understand how competitors earn their mentions, through prompt coverage, trusted sources, and positive framing, you can move from observation to action.

Based on this analysis, the competitive opportunities are clear:

1. Prioritize high-visibility prompts where Skyscanner is not mentioned

Focus on prompts related to reviews, trust, and use-case-driven travel planning.

2. Reverse-engineer competitor citations

Identify the editorial and review sources that repeatedly mention competitors and work toward presence in those same content ecosystems.

3. Expand topic coverage where sentiment is already strong

Use Skyscanner’s high sentiment in flight and booking topics as leverage to enter related prompts.

4. Track competitors by intent, not as a single group

Separate flight, booking, destination, and review-driven competitors to avoid misleading comparisons.

5. Monitor visibility trends over time

Because AI exposure is unstable, changes in competitor visibility can signal emerging threats or opportunities early.

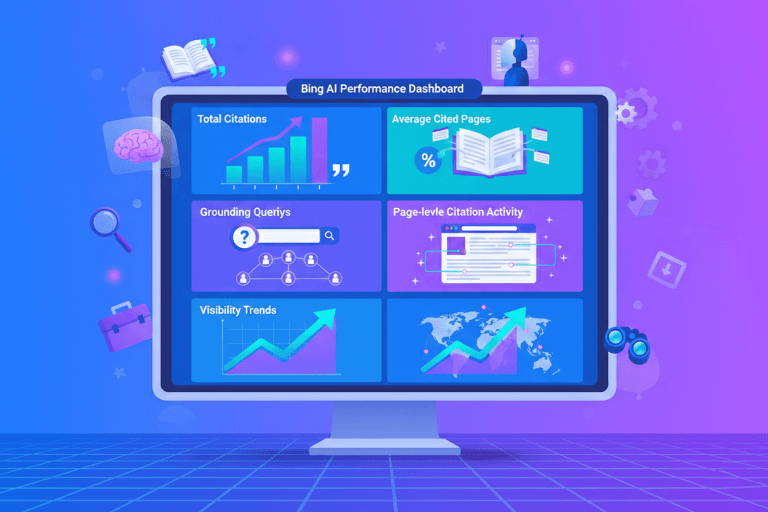

Competing in AI Answers Using Similarweb Data

This analysis makes it clear that AI brand visibility is already shaping how competitors appear in high-intent travel conversations. By analyzing Skyscanner alongside Expedia, Kayak, Booking.com, and Google Flights, clear patterns emerge around prompts, citations, and sentiment. AI prompt analysis shows where competitors dominate AI answers, AI citation analysis explains why they appear, and AI sentiment analysis reveals how they are positioned.

With Similarweb’s AI Brand Visibility tools, these insights are easy to access and compare across brands, topics, and time. This makes it possible to move beyond observation and actively manage how your brand competes in AI-generated answers.

FAQs

What is AI brand visibility competitive analysis?

AI brand visibility competitive analysis looks at how often and where competitors’ brands are mentioned in AI-generated answers, and how those mentions compare to your own. Instead of rankings, it focuses on prompts, citations, and sentiment to understand which brands AI tools prefer to mention.

How is AI competition different from traditional search competition?

In traditional search, competition is about rankings and keywords. In AI search, competition happens at the prompt level. Brands don’t “rank”, they appear, or don’t, based on how AI systems build answers and which sources they trust.

Why do some competitors appear in AI answers more often than others?

From what I observed, competitors appear more often when AI tools can confidently associate them with trusted sources, review platforms, or editorial content. Visibility is driven by credibility signals, not just brand size.

Can a competitor have high AI visibility but weak positioning?

Yes. High visibility doesn’t always mean strong positioning. Sentiment analysis shows that some competitors are mentioned frequently but described in a neutral or less favorable way, which can indicate an opportunity rather than a threat.

What are “high-visibility prompts,” and why do they matter?

High-visibility prompts are questions that AI tools answer frequently and consistently. If competitors dominate these prompts and your brand isn’t mentioned, those gaps represent some of the clearest competitive opportunities in AI search.

Why is citation analysis important for competitive insights?

Citations reveal where AI tools get their information. When competitors repeatedly appear in the same trusted sources, it explains their visibility advantage. This helps you understand why competitors win, not just that they win.

Do AI competitors always match SEO competitors?

Not necessarily. AI tools often mention brands that don’t dominate traditional search results. Competitive analysis in AI can discover new competitors you might not actively track in SEO.

How often should you analyze competitors’ AI brand visibility?

AI answers evolve quickly as sources and prompts change. Competitive analysis should be ongoing, especially in fast-moving industries where brand perception can shift rapidly.

What’s the biggest mistake brands make when thinking about AI competition?

The biggest mistake is assuming AI visibility will happen automatically. Without understanding how competitors earn their mentions, brands risk being invisible in AI-generated answers, even if they perform well elsewhere.

Wondering what Similarweb can do for your business?

Give it a try or talk to our insights team — don’t worry, it’s free!

![GEO Framework For Growth Leaders [+Free Template]](https://www.similarweb.com/blog/wp-content/uploads/2026/02/attachment-growth-leader-geo-decision-framework-768x429.png)