Ready to Conquer the Digital Shelf? Shopper Intelligence 2.0 Is Here

Hi, I’m Daniel, a Product Marketing Manager here at Similarweb, and I have a really exciting announcement for ecommerce brands and retailers.

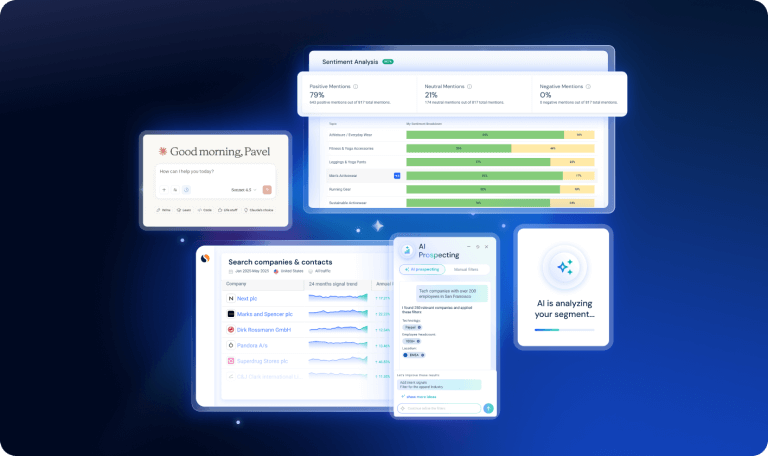

Every week, we sit down with ecommerce leaders who share the same frustrations: “Shopper behavior is unpredictable,” “Market trends shift overnight,” and “Retail media costs are spiraling.” Lately, it’s gotten worse with tariffs and other layers of complexity no one has seen coming. Sound familiar? That’s why we’re launching Shopper Intelligence 2.0.

So if you and your team are thinking: “We need sharper data, faster signals, and more granular insights to react in real-time.”

Well, that’s exactly what we’ve built.

The next generation of ecommerce insights

Ecommerce competition fiercer than ever, retail media spend rising, and shopper journeys more fragmented. So we’ve reimagined Shopper Intelligence to give you:

✅ Unmatched visibility into Amazon performance

✅ Cross-retailer analytics to scale your omnichannel strategy

✅ Full-funnel insight into what shoppers search (on or off Amazon), click, and buy

The new and improved dataset in Shopper Intelligence 2.0 is your single source of truth for ecommerce growth, combining the best of digital shelf analytics, retail traffic intel, and granular product, category, and consumer behavior data.

Here’s what we’ve introduced:

1. Weekly granularity and best-in-class data quality

No more waiting weeks to spot a trend. With weekly data updates, you can stay in sync with the market and react quickly to competitive shifts, category spikes, or campaign momentum.

🔍 Why this matters:

- Act on key moments as they unfold

- Optimize campaign timing, pricing, and inventory

- Make real-time decisions with confidence

Whether you’re launching a Prime Day campaign or responding to a competitor promo, this level of freshness gives you a competitive edge.

2. Child ASIN-level product insights

Not all products perform the same, and now, you don’t have to guess why. Go beyond category-level views and dive into detailed metrics at the child ASIN level.

📦 What you can do:

- Understand revenue, traffic, and conversion rate per product

- Identify which color, size, or variant is winning

- Compare similar items within your own catalog or against competitors

This is the kind of granularity that turns guesswork into strategy.

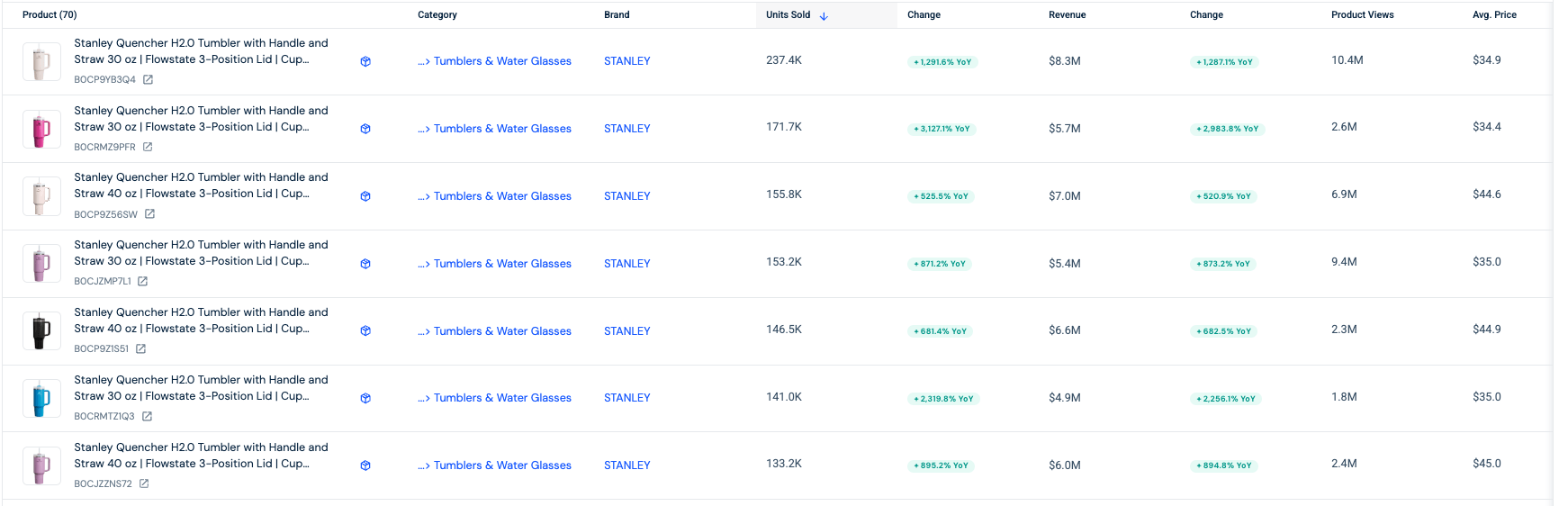

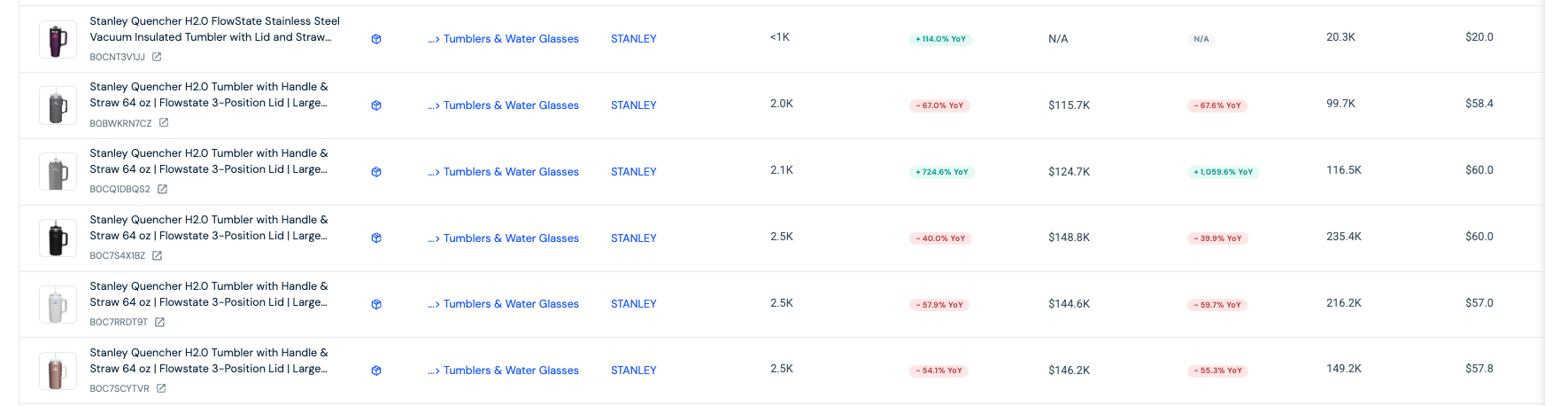

Take the viral Stanley Cup, for example.

There are (at least) 70 variations of this popular product. If you’re deciding what to stock, seeing overall Stanley Cup sales isn’t enough — you need to know which specific sizes and colors are actually driving revenue.

The 30- and 40-ounce Stanley Cups in Rose and Pink are the clear winners, selling over 236,000 and 171,000 units, respectively, and each generating millions in revenue. Almond Rose and Passion Pink are right behind, also pulling in millions.

Meanwhile, the 64-ounce and 20-ounce variations are struggling, selling fewer than a few thousand units monthly and barely generating revenue.

If you only examined at total sales without ASIN-level detail, you could easily miss the real winners. And the revenue gap could be millions.

When you can see what’s trending, down to the exact model and color, you can optimize inventory, pricing, and promotions precisely.

Get product-level insights3. Full-funnel marketplace intelligence

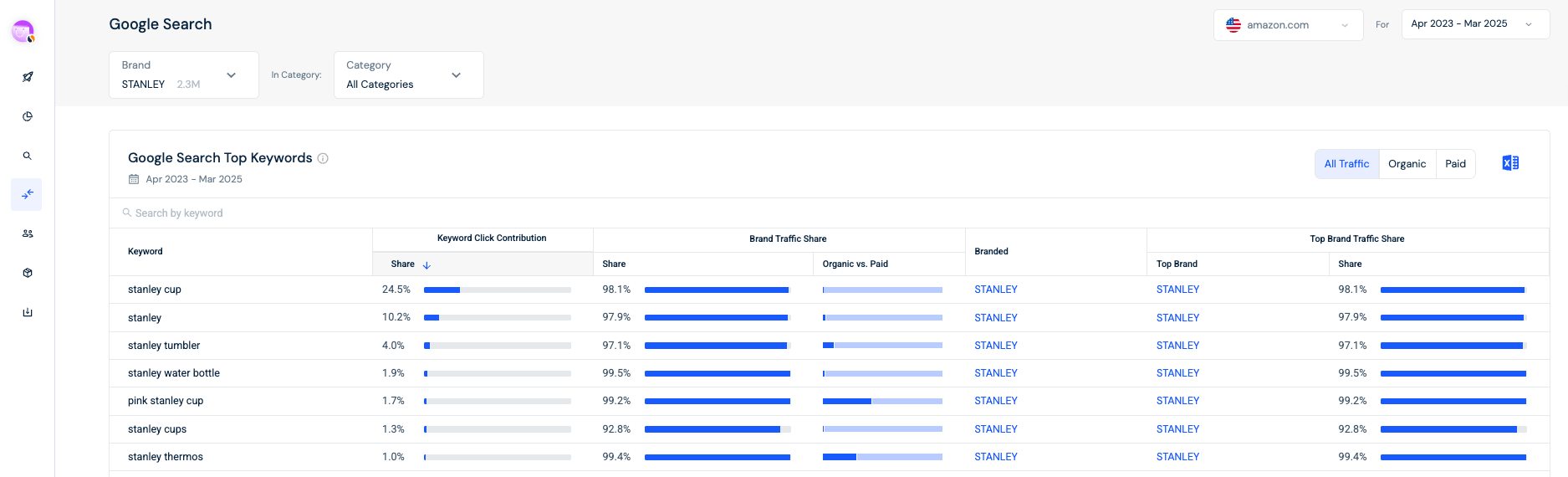

Not all searches start on Amazon. Most of them start on Google. Shopper Intelligence 2.0 provides insights into which Google keywords bring traffic to your pages, giving you deeper insights into your complete shopper journey.

🔁 You’ll be able to:

- Track how shoppers search, what they click, and what they ultimately buy

- Identify which products capture attention (and why)

- Analyze internal and external traffic sources, including competitor campaigns

For example, looking at the top Google searches leading to Amazon for Stanley right now, it’s no surprise to see “pink stanley cup” ranking in the top five.

This tells you exactly what shoppers are searching for, including keywords they use to describe it.

If you’re stocking Stanley Cups, insights like this tell you what colors and styles to promote in search and retail media campaigns, where demand is starting, and how to capture it before competitors do.

With full-funnel visibility, you’re not just reacting to marketplace trends – you’re anticipating them.

See the full funnelNow with expanded global coverage

We’re excited to share that Shopper Intelligence 2.0 includes improved Amazon data for the UK, Germany, France, and Italy.

Whether you’re comparing regional trends or actively selling in these markets, you’ll gain a deeper understanding of local shopper behavior, how consumers discover your products, and what your competitors are doing to stand out.

Use it to analyze your pricing vs. competitors, tailor your marketing campaigns, and fine-tune your ecommerce strategy per market.

4. Cross-Retail IQ: go beyond Amazon

Amazon is huge, but it’s not the whole picture. With Cross-Retail IQ, currently available for English-speaking countries, you can now benchmark performance across 150+ retail domains (including major players like Walmart, Etsy, Target, and much more).

🌐 What this unlocks:

- Unified product taxonomy across retailers

- AI-powered product tagging and filtering

- Product-level metrics like page views, pricing, and search performance

- Custom dashboards, API access, and flexible data feeds

This is a game-changer for any brand that wants to win across digital retailers, not just on Amazon.

Compete smarter with the best shopper insights

To recap, Shopper Intelligence helps you:

🎯 Drive more traffic to your Amazon product pages

Get a full breakdown of traffic sources and discover new ways to draw traffic to your products.

💡 Run smarter campaigns

Understand your customers’ path to purchase – including which competitor products they considered – and use that to sharpen your creative and targeting.

🌐 Track marketplace performance in one view

Unique to Similarweb, our unified approach lets you track your marketplace strategy across digital retailers for true omnichannel planning.

Let’s grow your ecommerce strategy together

We rebuilt Shopper Intelligence for ecommerce businesses who want to act faster, see deeper, and grow smarter. From full-funnel insights to cross-retailer benchmarking and granular analytics, this is your new command center for marketplace success.

Ready to see it in action?

Book a one-on-one demo to see how it fits into your strategy or check out the updated data in the platform for yourself.

Wondering what Similarweb can do for you?

Here are two ways you can get started with Similarweb today!