Tariff Shockwaves Hit Automotive: How Demand and Turmoil Changed it Overnight

Early 2025 delivered a trade policy whirlwind with the US government announcing tariff increases country-by-country.

Automotive was particularly hit. +25% on vehicles from Canada and Mexico, and another 10% on imports from China. Steel, aluminum, auto parts, entire cars – nothing escaped unscathed.

And as we’ll show, consumers reacted instantly.

Here we’ll lift the hood on the auto market with Similarweb data, and show how these tariff shocks disrupted customer intent. Plus, we’ll highlight some key lessons about timing, trust, and pricing power in the sector.

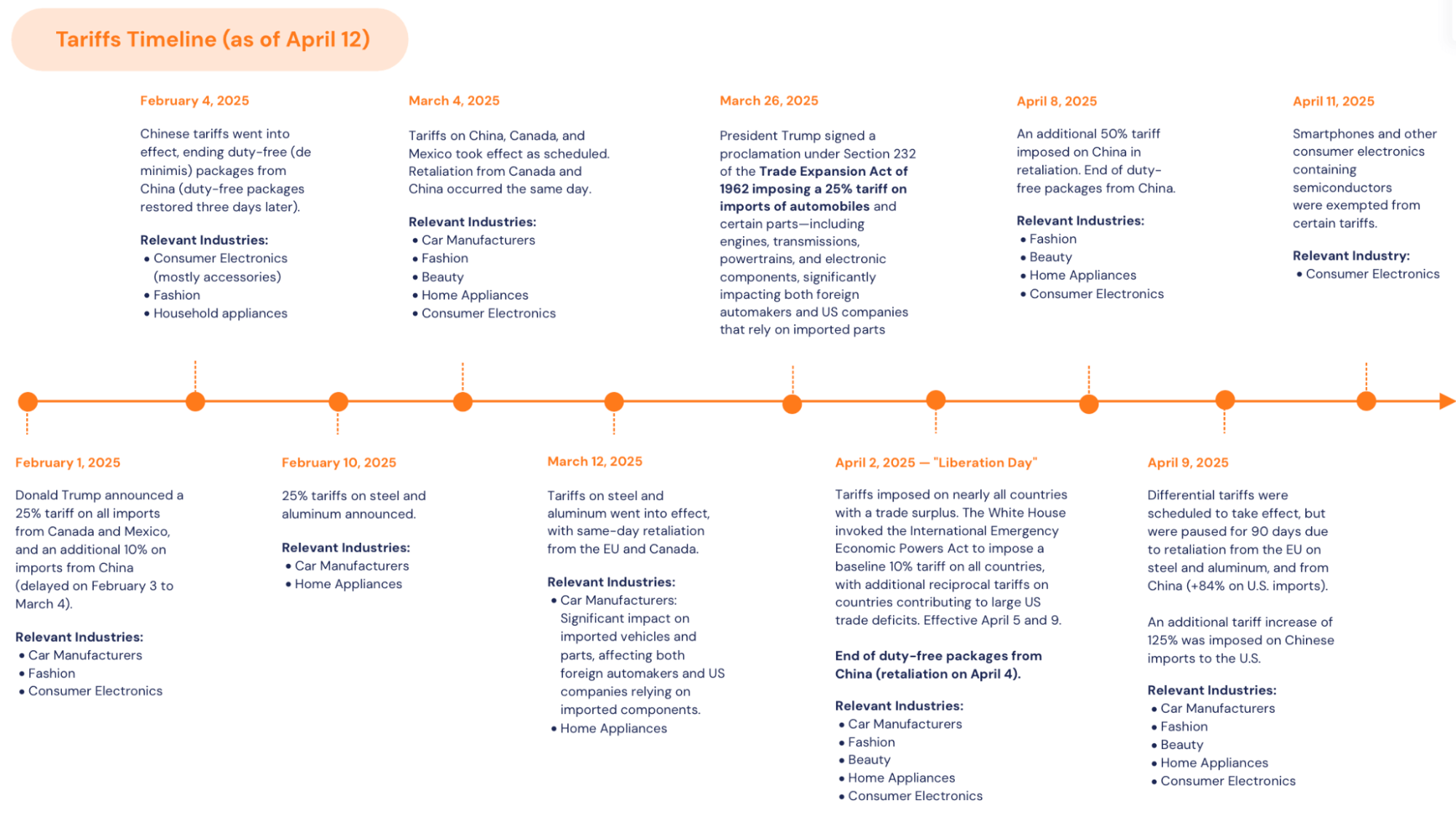

But first, let’s have a quick recap of the events around the tariff announcement…

Timeline: Trump’s tariffs and how the shock unfolded

The automotive industry’s turbulent ride began with a sequence of tariff announcements in early 2025. Each move intensified pressure on brands, suppliers, and consumers alike.

- February 1: The US announces a 25% tariff on vehicle imports from Canada and Mexico, and an additional 10% tariff on imports from China (implementation delayed until March 4).

February 10: A separate 25% tariff on imported steel and aluminum is announced, crucial raw materials for automakers. - March 4: Tariffs on vehicles and parts from China, Canada, and Mexico officially go into effect. Canada and China respond immediately with retaliatory tariffs.

March 12, 2025: Tariffs on steel and aluminum imports take effect. Canada and the EU retaliate the same day, raising trade tensions further. - March 26, 2025: The US imposes an additional targeted 25% tariff specifically on imports of automobiles and essential components like engines, transmissions, and electronics, further disrupting supply chains.

- April 2, 2025 (“Liberation Day”): The White House broadens tariffs to nearly all countries with a trade surplus, establishing a baseline 10% tariff on imports, plus additional tariffs targeting countries with persistent trade deficits.

- April 9, 2025: Planned differential tariffs are temporarily paused for 90 days due to heavy retaliation from China (that placed an 84% tariff on US imports) and the EU. The US simultaneously announces a sharp 125% tariff increase on imports from China.

The immediate impact – spikes, then slumps

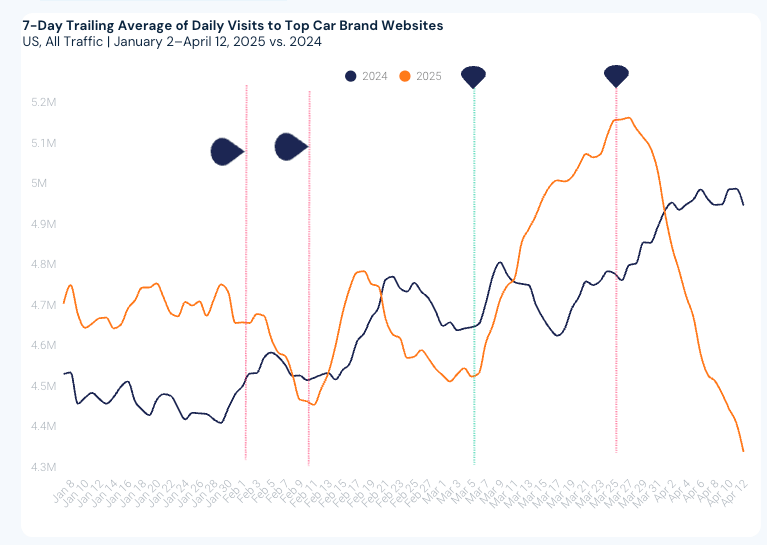

Consumer reaction to the tariffs was swift – and dramatic.

In late February and March, website traffic surged as consumers rushed to automotive brand sites. The goal was clear: buy before prices rose. However, this urgency-driven demand was short-lived.

By early April, after the imposition of the sweeping 25% tariff on all foreign auto imports, the surge turned into a sharp crash. Traffic didn’t just slow down – it plunged, quickly falling below January levels and deviating sharply from typical seasonal trends.

Similarweb data reveals a clear story:

A March spike was driven by consumers attempting to beat anticipated price increases.

An April collapse immediately following tariff implementation, breaking dramatically from past seasonal patterns.

Brands misinterpreting the March surge as sustained momentum overlooked a critical insight: This wasn’t excitement. It was panic buying, and panic is fleeting.

The takeaway? Urgency can drive rapid sales, but price shocks burn quickly and leave lasting scars on consumer intent. March 26 marked a critical turning point. The new 25% tariff on foreign automotive imports reshuffled consumer attention, setting the stage for structural shifts in brand preference.

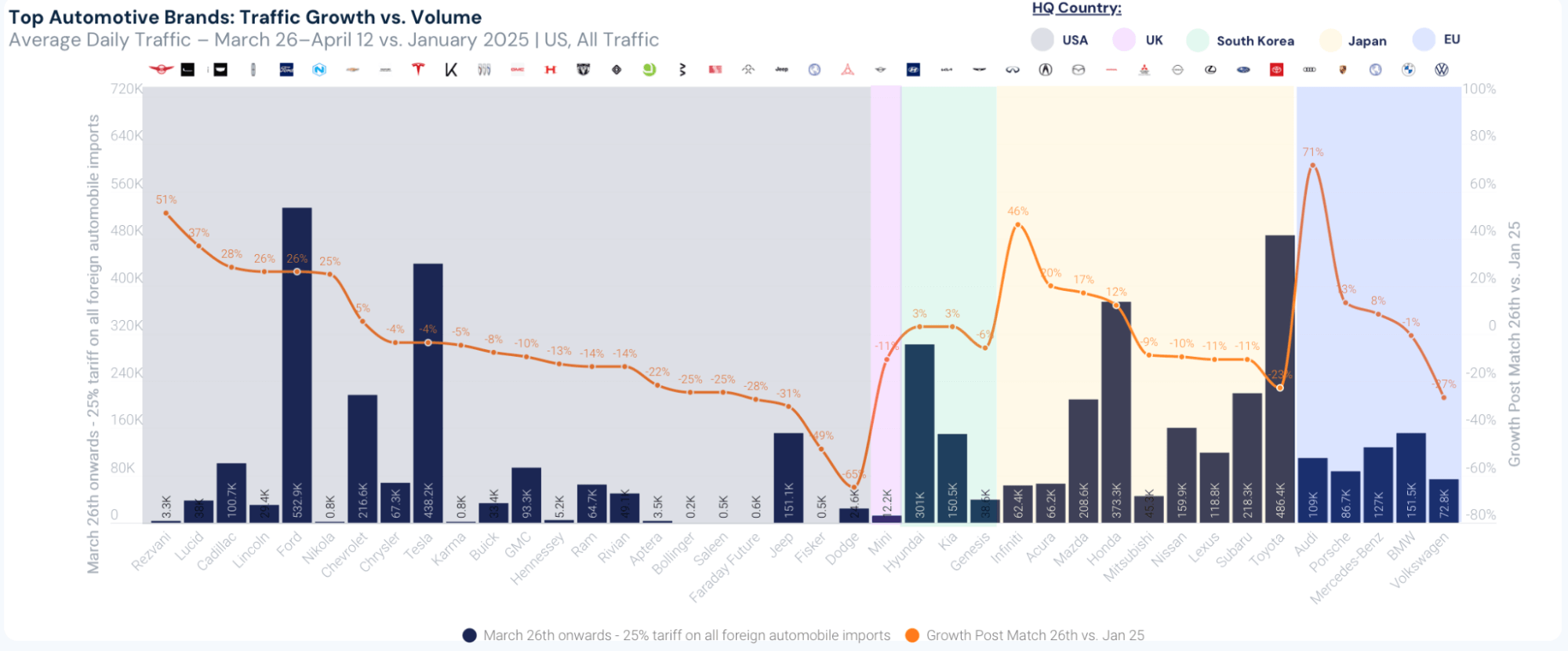

Winners and losers – the brands that held the line and those who lost

Not all brands felt the shocks equally. Some automakers briefly thrived on urgency-driven demand, while others faltered despite strong reputations. Here’s who seized the moment, who stumbled, and why timing, trust, and perceived value matter more than brand origin alone.

How U.S. brands captured the moment:

- Cadillac: +68% post-announcement

- Chevrolet: +5%

- Jeep: peaked at +154% YoY in mid-March, but then dropped sharply but to -22%.

Their gains came from timing. These brands benefited from a narrow window where U.S.-based production and patriotic sentiment aligned with urgency buying. But the lift wasn’t consistent.

Others faltered despite home-field advantage:

- Dodge: –41%

- Chrysler: –12%

- Lincoln: –14%

Their declines suggest that being a U.S. brand wasn’t enough. Consumers differentiated between legacy loyalty and actual value under price pressure.

Foreign brands – especially German and British – were hit hardest:

- BMW: –27%

- Volkswagen: –31%

- Mercedes-Benz: –32%

- Mini: –25%

The severe impact on European brands (BMW, Volkswagen, Mercedes-Benz, Mini) is directly tied to their dependence on imported vehicles and components. The tariff impact was direct and steep, compounding existing price sensitivity in the mid- and premium segments.

Japanese and Korean brands were the outliers:

- Subaru: +107%

- Mazda: +24%

- Honda: +6%

They gained share as “value-stable” options – trusted, reliable, and less exposed to volatility in both price and perception. There was a method to their relative success: consistent quality, clear pricing, perceived reliability, and lesser reliance on affected supply chains.

Insight: Tariffs acted as a forced stress test. Consumers gravitated to brands with pricing power, consistent quality, and clear domestic supply chains. National origin mattered less than perceived resilience and affordability.

The winners weren’t the cheapest or the flashiest. But often they were the most predictable.

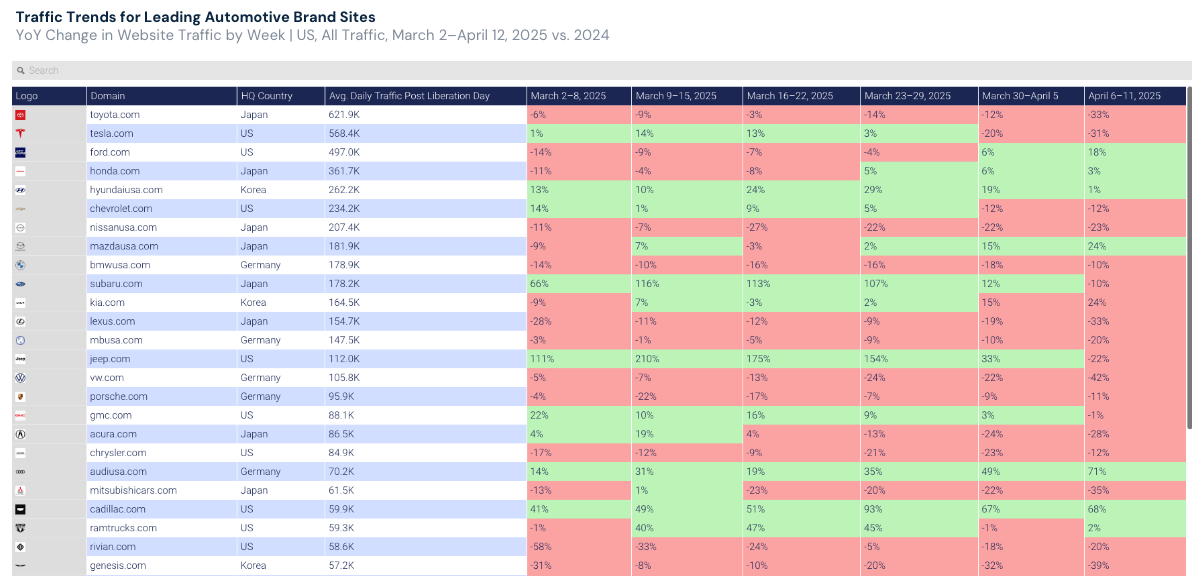

Structural shifts in consumer preference

Consumer behavior in the automotive sector during early 2025 wasn’t shaped by gradual trends – it was jolted by rapid reactions to tariff announcements. Yet beneath these short-term spikes lie deeper shifts with potentially lasting consequences.

Following the March 26 announcement of a 25% tariff on all foreign auto imports, European and premium U.S. brands saw sustained declines in web traffic.

Crucially, these brands did not recover quickly, indicating more than a fleeting reaction.

Consumers seem to have fundamentally changed their evaluation criteria, increasingly wary of brands heavily exposed to external cost pressures.

In contrast, Japanese and Korean automakers either maintained or grew their share of consumer interest. Buyers are clearly associating these brands with price stability and operational reliability – qualities that have become paramount amid trade volatility.

The key takeaway: Consumers are adapting to uncertainty by favoring brands that offer consistent pricing, reliable availability, and clear operational advantages. Even if tariffs are eased, this preference toward predictable, value-oriented brands may remain firmly entrenched.

What should brands and manufacturers do?

The tariff environment of 2025 injected new structural risks into the automotive market. Navigating these disruptions demands more than reactive tactics – it requires proactive, scenario-based planning:

- Diversify supply chains strategically.

Overreliance on specific regions – especially for steel, aluminum, and critical vehicle components – increases cost exposure and operational vulnerability. Embrace regional manufacturing or “China+1” strategies proactively. - Adapt pricing based on segment elasticity.

Closely monitor how price sensitivity varies between entry-level and premium automotive segments. Protect affordability for price-conscious buyers, and clearly justify premium pricing through tangible performance or value benefits. - Invest in loyalty and customer experience.

Automotive purchases hinge on long-term trust. Strengthen loyalty programs, after-sales service, and customer engagement strategies to retain buyers in a volatile pricing environment. - Anticipate and prepare for continued volatility.

As tariff scenarios evolve rapidly, model multiple outcomes – potential hikes, rollbacks, exemptions – and build flexibility into your sourcing, pricing, and go-to-market plans. Treat tariffs not as external disruptions but as integral elements of strategic planning.

Want the full picture on how this affects other verticals?

Tariffs were disruptive in the extreme. They reshaped consumer behavior, rewrote competitive dynamics, and redefined what it takes to succeed in the automotive market.

It illustrated why brands need to strategically anticipate future shifts and integrate flexibility into their core operations.

Want deeper insights?

This blog provided just a snapshot. The complete report, The State of Digital Consumers: Tariffs Edition, goes beyond automotive, delivering comprehensive analysis across key industries, including fashion, electronics, beauty, and home appliances.

To explore the full findings, including beauty, fashion, electronics, and more, download the full report.

Wondering what Similarweb can do for your business?

Give it a try or talk to our insights team — don’t worry, it’s free!