Holiday Season 2025: Trends & Tips for Success

Retailers know the holiday shopping season begins in the summer heat, not when the snow starts to fall.

Strategic planning in Q2-3 is essential for retailers aiming for a successful Q4.

Early insights into consumer behavior, market dynamics, and competitive strategies are literally worth sales.

The Similarweb Holiday Retail Planning 2025 report reveals crucial insights retailers must know. Here we grab a snapshot of the report to highlight the key trends and actionable strategies.

Download the full report for more comprehensive analysis and specific recommendations. Or open up Similarweb’s Web Intelligence or Shopper Intelligence platforms.

Consumer outlook – navigating the holiday mindset

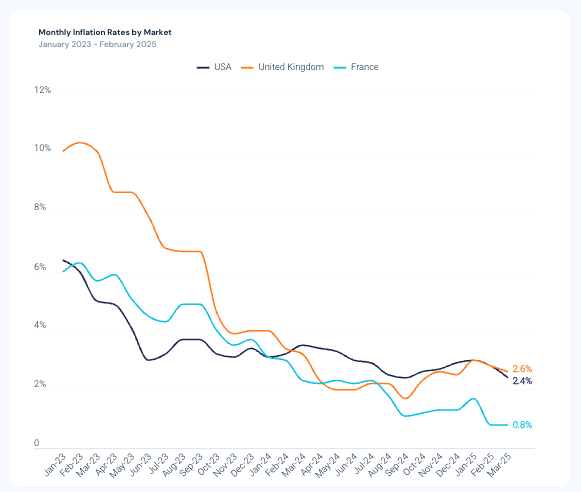

Despite easing inflation – down to around 2.4% in the US by early 2025 – retailers should remain cautious.

Similarweb consumer research from November 2024 shows 76% of US consumers plan to buy holiday gifts this year, a significant rise from 63% in the previous period.

But careful budgeting persists. 27% are expecting to spend less than last year, and only 10% are planning to spend more.

This indicates consumers are eager but remain cautious about their expenditures, particularly the older generations, who feel the squeeze more sharply.

The introduction of new tariffs adds another level of complexity. Tariff-related uncertainties create cautious consumer attitudes toward holiday spending. Retailers prepared for these scenarios, with strategies to mitigate pricing impacts, stand to maintain shopper trust and protect their margins effectively.

Timing is everything – Black Friday remains a key event

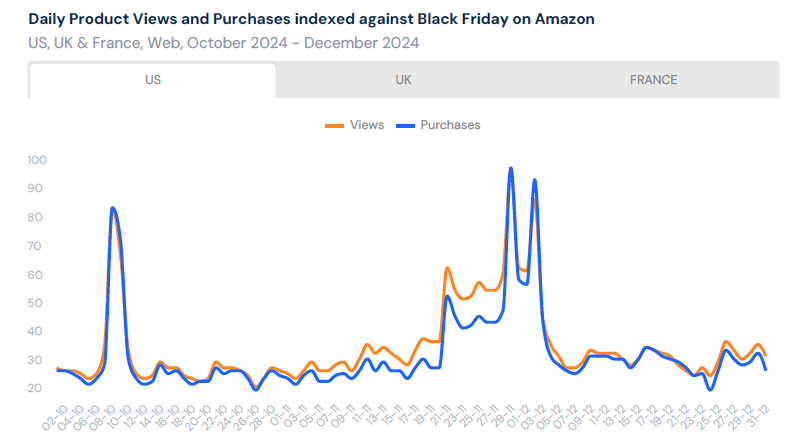

Black Friday’s importance continues to grow, with 36% of consumers in 2024 indicating they’ll definitely shop during this period, compared to 29% the previous year.

Shoppers strategically delay purchasing decisions until this high-value promotional period, underscoring its importance to retail strategies.

Monitoring early season signals

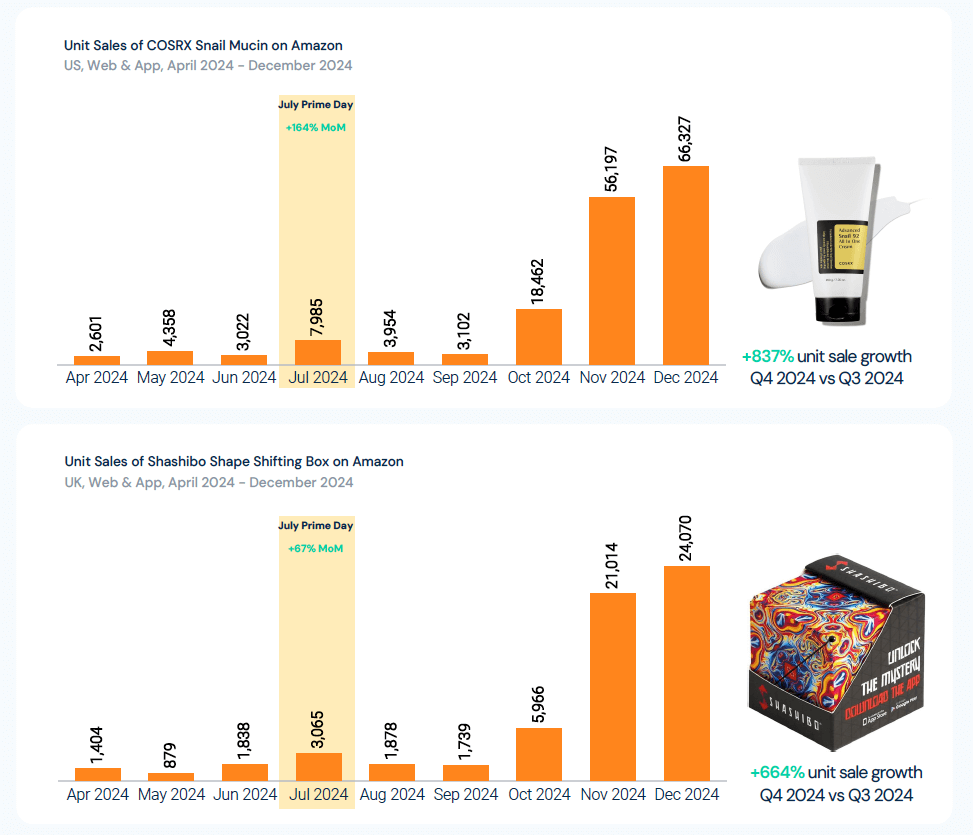

Earlier events, such as Amazon’s Prime Day, offer predictive insights for the holidays.

A prime example is COSRX Snail Mucin, which saw an impressive 837% increase in unit sales during the holiday season, following strong performance earlier in the year. This highlights the value of identifying and capitalizing on these early market indicators.

Strategic moves for winning holiday shoppers

Prioritize consumer demand

Winning holiday strategies focus sharply on consumer preferences rather than inventory clearance.

The Dyson Airwrap’s performance provides a compelling case: despite offering only a modest 2% discount, product views peaked around Black Friday, driving an 11% increase in revenue. This underscores the importance of aligning promotions closely with genuine consumer demand.

Optimize web and app channels

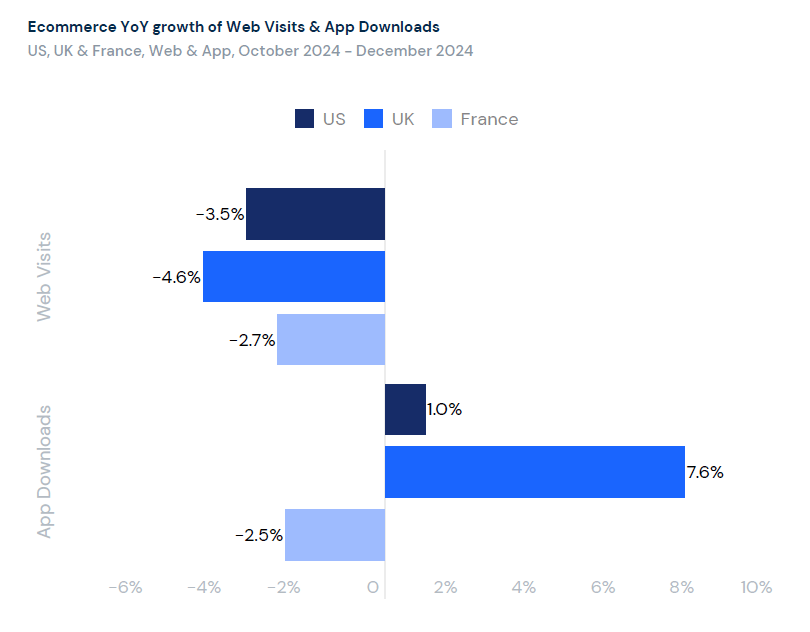

Channel strategy remains vital, with mobile app usage growing significantly, as seen in France with a 7.6% increase in downloads during the holiday season.

Even as web traffic slightly dips, apps offer personalized experiences critical for customer retention and loyalty. Retailers need to maintain broad web visibility while nurturing deeper app engagements.

Category spotlights – key trends to monitor

Consumer Electronics – late, but strong surge

Consumer electronics experience a notable surge close to Black Friday, driven by strategic consumer behaviors awaiting deep discounts.

Brands like Apple and Amazon topped the charts in 2024, boosted by new releases and strong consumer interest, particularly in items like Apple’s AirPods Pro 2.

Fashion – rapid purchase decisions

Fashion shoppers typically make rapid, style-driven decisions.

Key brands like Adidas and Calvin Klein benefited from this quick decision-making process, achieving strong holiday sales. Retailers must seize the moment by offering appealing promotions precisely when shoppers are ready to buy.

Beauty – longer consideration phase

Beauty sees extended consumer research phases, reflecting careful evaluation before purchase.

Brands like e.l.f., which achieved a 40% increase in year-over-year unit sales, effectively leveraged affordability, viral marketing, and consumer trust.

Toys & Games – extended shopping window

Toys & Games enjoy the longest shopping period, emphasizing careful, family-oriented decisions. LEGO notably stood out, achieving a 21% year-over-year increase in unit sales, particularly with products combining seasonal décor and play value.

Your 2025 Holiday retail roadmap

The holiday season may seem distant, but as any retailer knows, the time to prepare is now. Don’t let cautious consumer spending or new tariff complexities catch you off guard.

The Holiday Retail Planning 2025 report offers insights into these critical trends, plus actionable strategies to capitalize on Black Friday, optimize your web and app channels, and tailor your approach to consumer electronics, fashion, beauty, and toys & games.

Gain the data-driven advantage you need to outperform competitors and achieve optimal holiday success.

Wondering what Similarweb can do for your business?

Give it a try or talk to our insights team — don’t worry, it’s free!