Retail’s New Reality: Adapt With the Data or Else

The UK ecommerce landscape is fragmented and evolving, and fast.

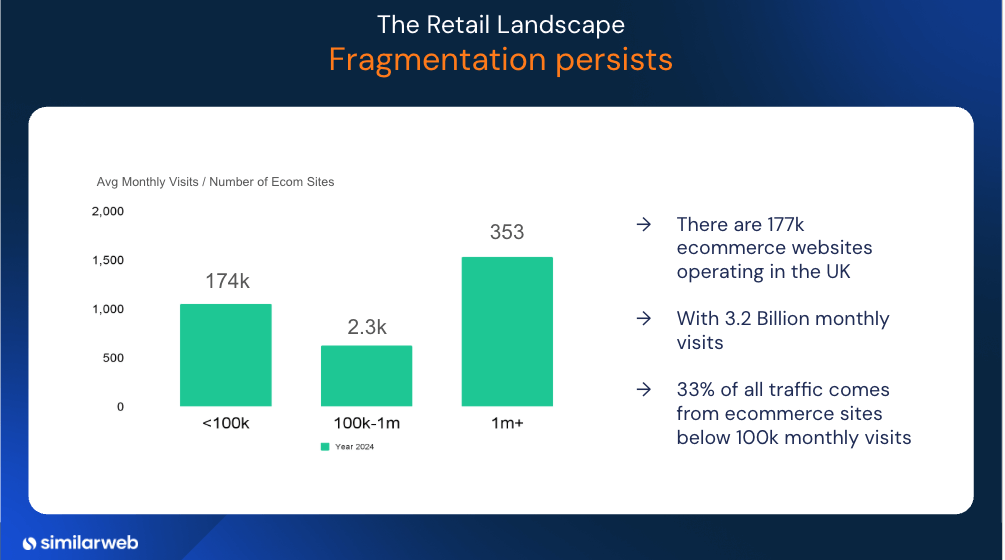

Right now the UK has 177,000 ecommerce websites, and 98% of them get under 100k monthly visits. Yet, 33% of overall traffic flows through these small players.

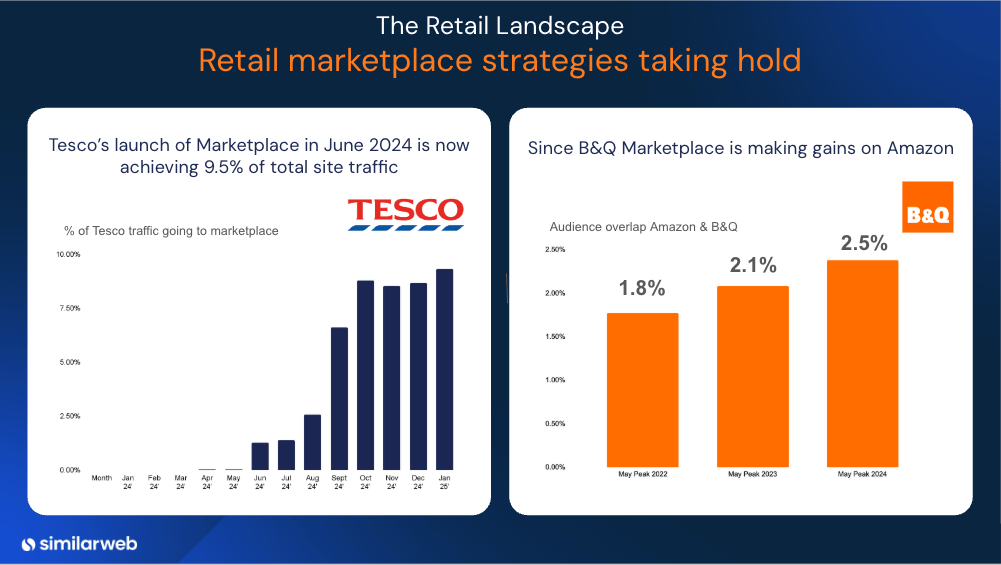

Then you add in Temu’s rise and Tesco’s marketplace pivot, and it’s clear: retail’s a moving target. You think you know the market, but there are probably entire aisles of apps, trends, and competitors out there you don’t even know about.

So what do you do?

The only thing you can. You monitor, track, and adapt. And tools like Similarweb will help you do it.

The problem: survival means adapting

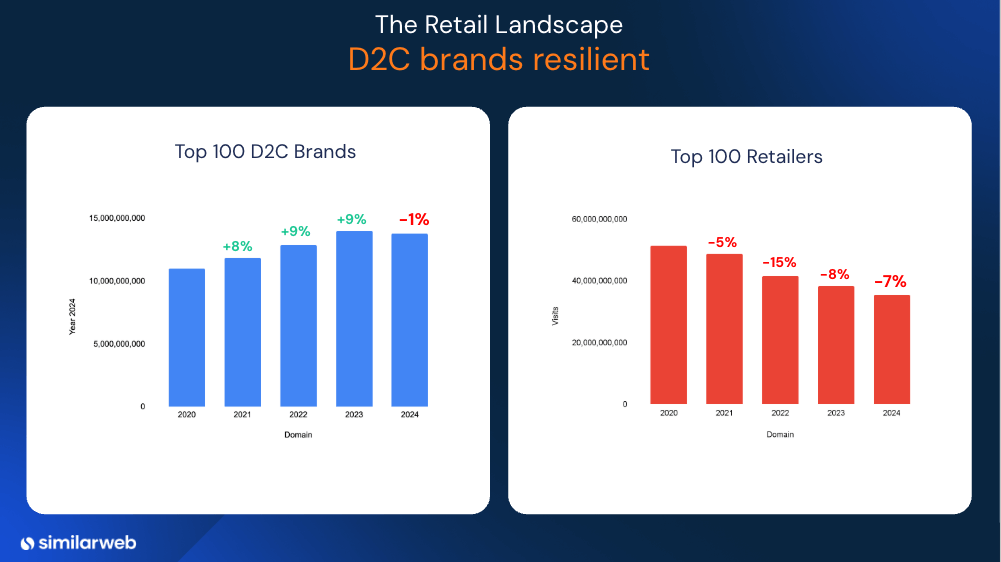

Top 100 UK retailers have been bleeding traffic since the covid years — down 5%, 15%, 8% in the last six years. While D2C brands just posted 10% growth.

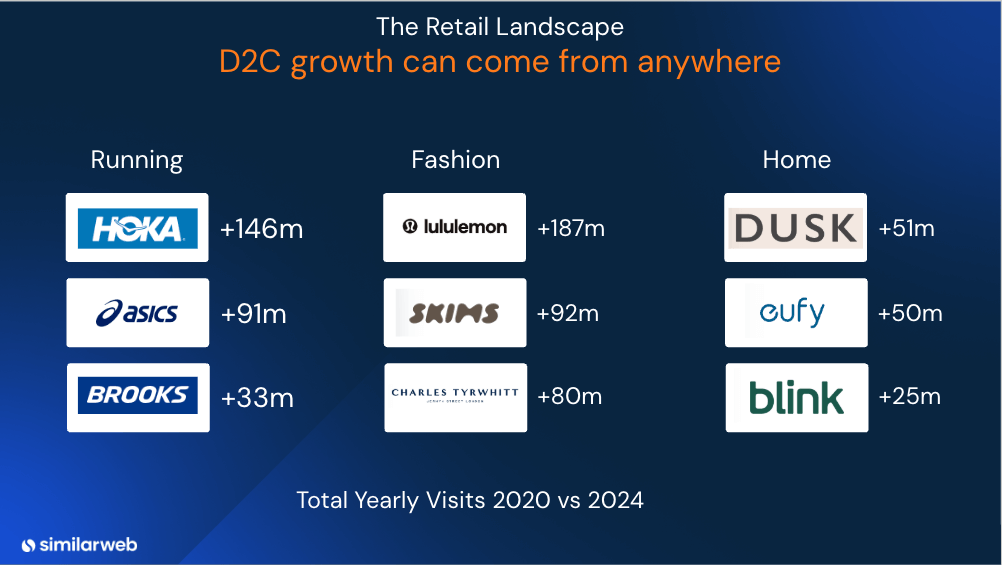

New entrants like litfad.com’s web traffic exploded into the Home and Garden space too, reaching 2.5 million visits fast. App usage soars, with fashion and grocery leading.

Ignore these new entrants, and you’re toast.

Data is the differentiator

Data and its use will separate the winners from losers in UK retail. Old ways fail.

The problem for all retailers is you miss the full market picture. Lack of data means many will only be tracking the big 3 or 4 competitors, and using delayed and incomplete solutions.

You need speed. That high-level market summary that just landed in your inbox? It probably took six months to produce, and it’s already out of date.

Similarweb changes that.

It spotted the meteoric rise of Tesco Marketplace from the day it launched.

It showed both Litfads growth and the channel strategies it took to scale fast.

It’s about seeing the changes in real time, and understanding in-depth what is driving it.

Real-world wins: proof it works

Data pays off in UK retail.

B&Q’s Marketplace started three years back and now pulls in massive sales.

Charles Tyrwhitt, a shirt maker, went from 90k to over 500k monthly visits in five years. It leaned on ecommerce hard. Hoka and Skims show it, too—millions more visits yearly.

It’s data that finds these wins. It tracks what works—marketplaces, search, or focus. Retailers see proof. Results don’t lie. Data works.

Action plan: how to go beyond survival with data

1: Know your market

The market’s huge. Remember, there are 177,000 ecommerce websites. You must see it all. Spot new entrants early. Don’t succumb to death by a thousand cuts, track the full market, not just the giants.

2: Understand your competition

Old data hides the truth. Find real rivals—big and small. It benchmarks winners like that D2C brand on your patch that’s up 10%. Good retailers learn how top players drive web traffic. They spot gaps and outsmart competitors with data, not guesses.

3: Optimize product and pricing

Data shapes smart choices. Use a product like Similarweb’s Shopper Intelligence platform to check ranges against demand. Pricing matters, too. Compare it live— go where demand is high and keep pricing sharp. Stock what sells.

4: Maximize ad spend

Leaders spend smart. For example, Similarweb tracks search and other marketing channels. Optimize keywords and be seen where it counts. Use data to direct the cash into the right campaign.

5: Build the right experience

Apps are great. But it’s not just about having an app; it’s about making it good. Fashion and grocery lead here. Retailers benchmark usage with Similarweb. They spot features that hook users, like easy checkout or loyalty perks. Then they build those into their own platforms. Top brands build loyalty this way.

6: Adopt live market intelligence

Retailers need to watch the market constantly, not just once a year. Similarweb maps a million keywords for search share. Retailers see every threat weekly. Small moves beat big fixes. Stop focusing only on big names and start learning from fast risers like Litfad or D2C brands.

It’s not about one huge insight. There are no silver bullets. Just constant tweaks.

Your data will decide your sales tomorrow

UK retail won’t stand still and change bites the slow.

Big retailers shrink — down 15%. D2C brands rise 10%. New players like Litfad hit 2.5M visits fast. Data decides who leads.

At Similarweb we believe we have this covered. Live market intelligence is the way forward. Weekly, real-time data shifts culture and speeds decision-making. Making small wins stack up.

Let’s reiterate – because it’s worth saying this again – there is no one big fix. It’s about steady moves and marginal gains.

Retailers who invest, shape tomorrow. Others will fade. In this fragmented fight, we believe Similarweb is the edge.

The future’s already here. And data is driving it forward.

Wondering what Similarweb can do for your business?

Give it a try or talk to our insights team — don’t worry, it’s free!