US Beauty Market in 2025 – Leaders and Disruptors

The US beauty category is changing fast. New brands are stepping into the spotlight, and consumer habits are shifting along the way.

Here are just a few pointers:

- Amazon’s beauty category sales rose by 13.5%, even though overall website visits dipped slightly

- The skin care category has jumped ahead of hair care to claim the top spot, making up a quarter of all beauty sales on Amazon

- IlMakiage.com surged by 51% thanks largely to TikTok buzz

But these are just glimpses into what’s happening in beauty right now. Download our report What’s Driving the US Beauty Market in 2025 for more on the data.

We’re going to examine the sector in more detail to fully understand who’s leading and who’s shaking things up.

Who’s dominating beauty right now?

Amazon continues to lead the beauty market, even as visits to beauty-specific websites slow down.

Consumers might be browsing less, but they’re buying more intentionally. That’s helping Amazon’s beauty revenue climb steadily, up 13.5% in the past year alone.

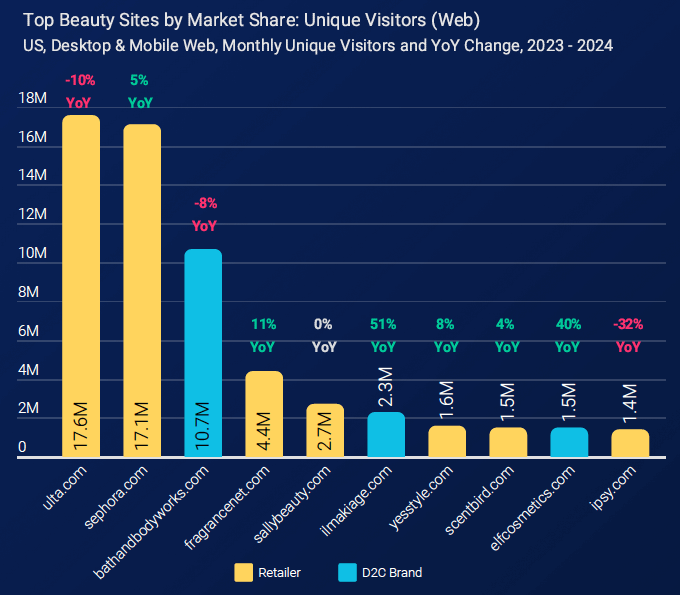

When it comes to specialized beauty retailers, Ulta.com and Sephora.com stand tall. Ulta attracted nearly 18 million unique visitors monthly, with Sephora right behind at just over 17 million. Both sites offer broad product ranges, which consumers clearly prefer over single-brand sites.

Here’s who’s leading right now:

- Top Beauty Retailers: Amazon, Ulta, Sephora

- Fastest-Growing Subcategory: Skin care (25% of Amazon’s beauty sales)

- Consumer Behavior: More deliberate purchases, less casual browsing

Skin care is more important than hair care

Skin care has become the hottest subcategory on Amazon, overtaking hair care.

Shoppers are increasingly focused on wellness, seeking products with proven benefits like hydration and anti-aging.

Seasonal trends reflect this: skin care sales spike twice, once in summer and again during the holidays, as consumers stock up on essentials.

Beauty disruptors who are shaking things up

While giants like Amazon and Ulta dominate, newer brands are shaking things up.

Two standout disruptors this year: IlMakiage.com and ElfCosmetics.com.

Il Makiage’s web traffic surged an impressive 51%, driven mainly by viral TikTok content. Elf Cosmetics saw a similar boost, jumping 40%, thanks to its strong social media presence.

Here’s a quick breakdown of the biggest:

- Il Makiage: +51% visitor growth (TikTok-driven)

- Elf Cosmetics: +40% visitor growth (strong social presence)

- Niacinamide searches: +109% (skincare wellness)

- Hair gloss searches: +181% (healthy hair care trend)

- Lip stain searches: +67% (natural makeup look)

Consumers are moving toward wellness-focused products, with natural ingredients topping their searches.

Interest in skincare ingredients like niacinamide more than doubled, rising by 109%.

Haircare is experiencing a similar trend, with searches for hair gloss treatments soaring 181%.

Makeup trends are shifting, too.

While traditional lipstick searches dropped slightly, interest in natural-looking alternatives like lip stains climbed sharply, up 67%.

Clearly, shoppers want products that enhance natural beauty rather than mask it.

Social strategy and GenAI – the key to growth

Social media is essential for brands chasing growth.

Here is where Il Makiage has utilized social influencers effectively. It is doubling traffic from social channels alone. Its “get ready with me” videos on TikTok drove awareness and engagement, turning views into website visits.

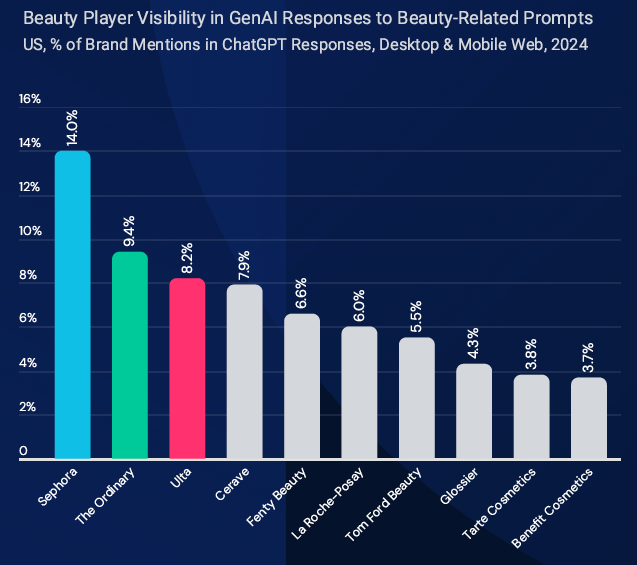

GenAI visibility is another key driver shaking up beauty marketing.

Here, Sephora and Ulta lead in GenAI mentions with significant referrals directly from platforms like ChatGPT. The Ordinary stood out as the only brand site frequently cited in GenAI, showing how targeted digital conversations boost brand recognition.

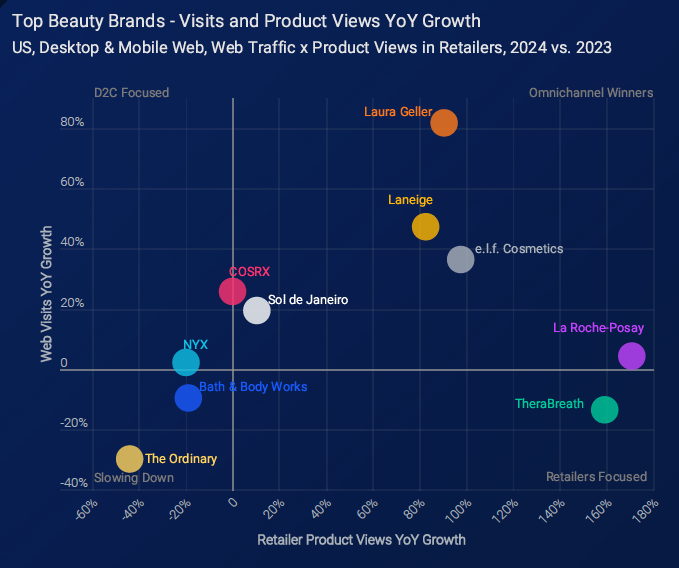

Smart brands blend direct-to-consumer (D2C) and retail strategies. Laura Geller nearly doubled product views at retailers while also growing its D2C visits by over 80%. La Roche-Posay saw explosive retail growth (+172%) alongside steady D2C traffic.

Brands winning right now:

- Social-driven: Il Makiage

- GenAI-savvy: Sephora, Ulta, The Ordinary

- Balanced D2C + Retail: Laura Geller, La Roche-Posay

Staying ahead in the new beauty sector

The future of beauty belongs to brands mastering social media, harnessing GenAI, and responding quickly to shifting consumer interests.

Success stories like Il Makiage and Elf Cosmetics prove how powerful a strong social presence can be.

At the same time, Amazon’s steady growth shows that even giants need to adapt to keep their lead.

Wellness is now at the heart of consumer choices, reshaping searches and buying habits. Brands that tune into these changing preferences – offering products people trust and genuinely want – are set to lead the next wave.

Knowing who’s rising and who’s reshaping the beauty landscape helps you stay ahead. But we’ve only touched the surface here. For a complete picture of the latest trends, rising brands, and detailed insights into consumer behavior, there’s much more to discover.

Download the full report now for more detailed insights.

Wondering what Similarweb can do for your business?

Give it a try or talk to our insights team — don’t worry, it’s free!