AI Sentiment Analysis: A Step-by-Step Guide for Brands

Today, brands generate massive volumes of online conversations across social media, product reviews, news articles, forums, and beyond. All of these interactions reflect how people feel about a brand, whether their experiences are positive, negative, or somewhere in between. Understanding that emotional tone is essential for shaping brand perception, product positioning, and customer experience.

Traditionally, making sense of all these conversations has been time-consuming and difficult. That’s where AI sentiment analysis changes the game. And with Similarweb’s AI Brand Visibility tool, the process becomes faster, clearer, and far more actionable.

In this guide, I’ll walk you through step by step how to use Similarweb’s AI Sentiment Analysis tool, using PayPal as the example brand.

But first, let’s understand the basics.

What is AI Sentiment Analysis?

AI sentiment analysis is the process of understanding the tone and sentiment within AI-generated brand mentions and prompts. Instead of looking at raw online conversations, we analyze how AI reflects the way people talk, search, and ask about a brand: classifying these mentions as positive, negative, or neutral. This helps understand the emotional landscape surrounding a brand and identify the themes, concerns, and opportunities that shape public perception.

These insights also play a key role in Generative Engine Optimization (GEO), since AI systems increasingly mention brands based on how well they answer users’ questions and match their intent.

Similarweb analyzes thousands of AI brand mentions across a wide range of topics and categorizes each into sentiment buckets, giving us a real-time view of brand health.

How to Perform an AI Sentiment Analysis

To understand what people were saying about PayPal, I started at the very beginning: by looking at the big picture.

Starting from that high-level perspective made it much easier to see the story behind the data.

Let’s take a look.

Step 1: Starting With the Sentiment Overview

I began my analysis by selecting PayPal inside Similarweb’s AI Brand Visibility suite and opening the Sentiment Analysis tool. The first thing I saw was the overall sentiment breakdown: the number of positive, neutral, and negative mentions, along with their percentages.

From the screenshot, PayPal’s sentiment distribution was clear: a large majority of the 2,285 mentions were neutral, a meaningful portion were positive, and only a small share were negative.

I found this extremely helpful because, before going any deeper, I already understood the emotional balance of the brand’s online conversations. PayPal wasn’t dealing with a major negativity issue, but it also wasn’t sparking many strongly positive reactions.

Step 2: Diving Into Topic-Level Sentiment

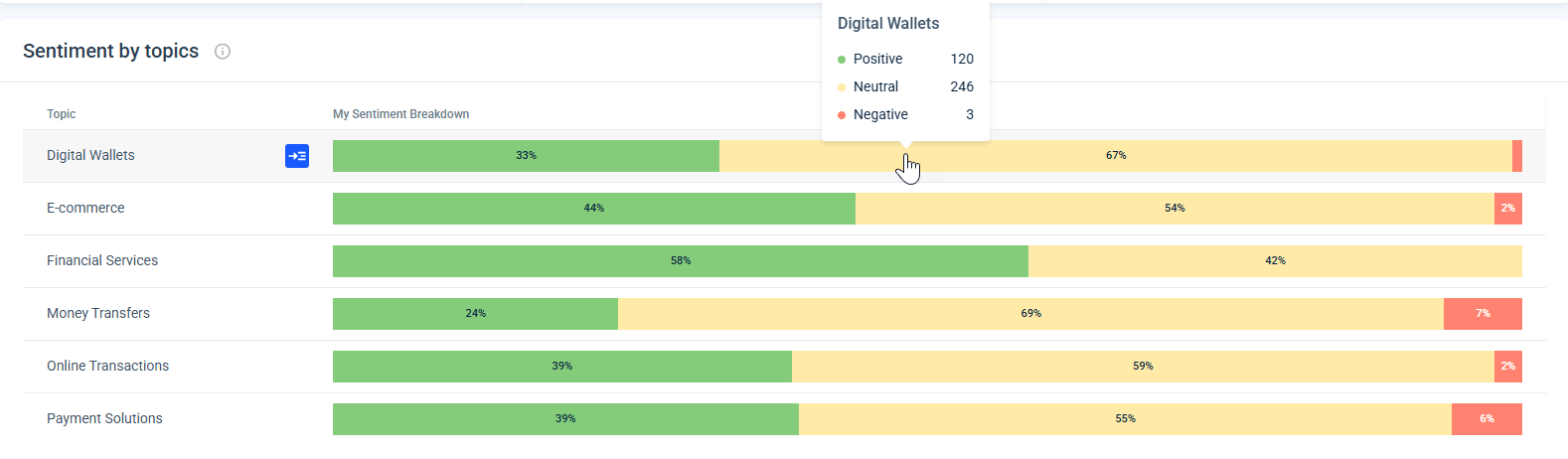

After understanding PayPal’s overall sentiment, I wanted to dig a little deeper and see what people were actually talking about. I moved down to the Sentiment by Topics section, where each topic, such as Digital Wallets, Ecommerce, or Money Transfers, is broken down into positive, neutral, and negative sentiment bars.

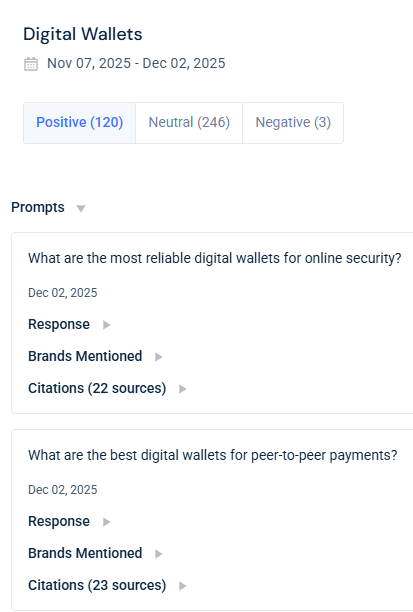

As I went through the list, I noticed a small blue arrow next to each topic. When I clicked it, I saw the full context behind these mentions. This is where things became much more revealing. I could see all the prompts associated with that topic, organized by sentiment: positive, neutral, and negative.

For example, under Digital Wallets, I found prompts like “What are the most reliable digital wallets for online security?” or “What are the best digital wallets for peer-to-peer payments?” Each prompt included the brands mentioned, the responses, and even citations from multiple sources.

Seeing the actual conversations behind the sentiment helped me understand not just how people felt, but why they felt that way.

What stood out to me most was how many of PayPal’s mentions came from people simply trying to figure things out: questions about security and reliability. It made sense that so much of the sentiment was neutral because people weren’t really sharing opinions, they were looking for answers.

I also noticed that PayPal showed up a lot in prompts related to safety and trust, which aligns with the more positive mentions.

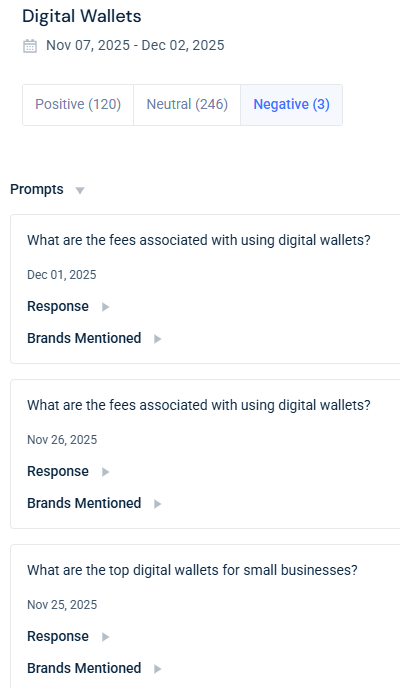

The negative prompts, however, point in a very different direction. When people do express concern, it’s usually about fees or costs associated with using digital wallets. Even though there are only a few of these mentions, they highlight a known pain point in the category, and one that competitors can use to their advantage.

From a strategic point of view, this gives PayPal a very clear opportunity. The brand is already associated with security and reliability, but it could shift more of that neutral sentiment into positive territory by addressing the topics people research most. That could mean being more transparent about fees, highlighting situations where PayPal is cost-effective, or explaining the advantages that justify the fees.

In other words, the data showed me that PayPal isn’t struggling with frustration, but competing with a lack of clarity. And if PayPal wants to strengthen its emotional connection with users, the biggest wins will come from answering that lack of clarity more clearly, before competitors do.

Step 3: Comparing Sentiment Against Competitors

Once I had a clear picture of PayPal’s internal sentiment, I needed to understand what those numbers actually meant in the real world. Were they strong? Average? Or falling behind the competition?

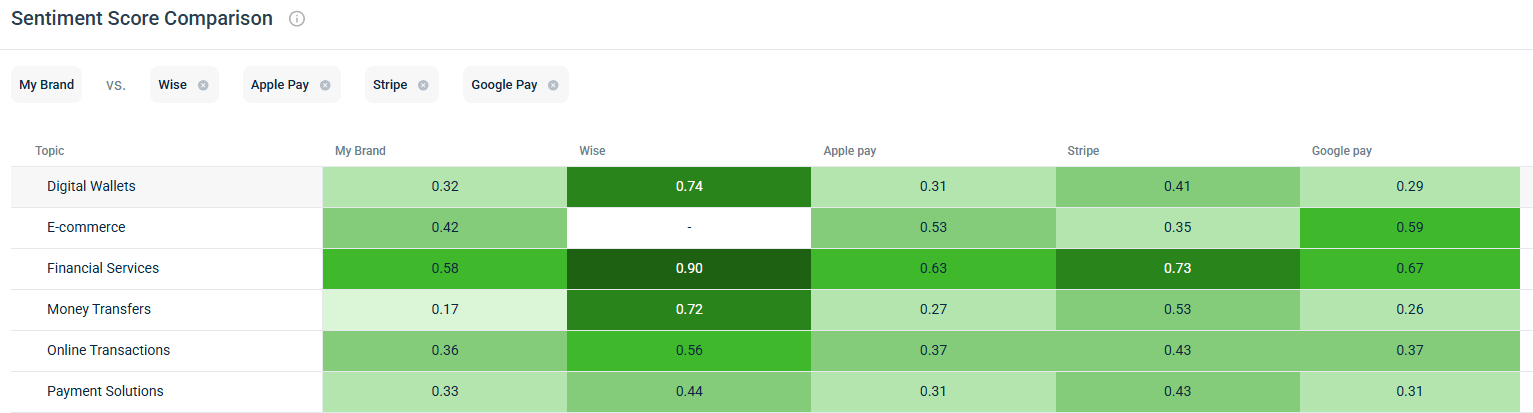

To answer that, I moved to the Sentiment Score Comparison heatmap. I added PayPal’s competitors: Wise, Apple Pay, Stripe, and Google Pay. The heatmap immediately showed me how each brand’s sentiment score ranged from -1 to 1 across the same set of topics.

What really stood out as I moved through each row was how consistently PayPal sat in the middle of the table. The brand wasn’t struggling. Its scores were positive across the board, but competitors often scored higher, suggesting concrete opportunities.

In Financial Services, Wise’s score of 0.90 was dramatically higher than PayPal’s 0.58. That kind of gap usually reflects a clear user preference, often tied to transparency and trust around managing money.

Stripe wasn’t far behind either, with 0.73, which again signaled that other brands are generating stronger positive sentiment in conversations about financial products. For PayPal, this suggested a need to focus on improving the emotional side of how people talk about using the platform for financial tasks, not just the functional side.

In Money Transfers, the gap was even more noticeable. PayPal’s score of 0.17 was far below Wise’s 0.72 and Stripe’s 0.53. This told me something important: whenever people talk about money transfers, PayPal rarely inspires strong positive reactions.

When users compare services for sending money, brands like Wise seem to generate far more optimism and satisfaction. That ties back to what we saw earlier with the negative prompts: concerns about fees show up in this topic, and that may be holding PayPal back from scoring higher.

Even in E-commerce, where PayPal has a long history and strong brand familiarity, competitors like Apple Pay and Google Pay pulled ahead in sentiment. Apple Pay, for example, scored 0.53 in E-commerce compared to PayPal’s 0.42, which might reflect its smooth checkout experience or strong mobile reputation.

But this wasn’t all bad news, it was incredibly useful. Together, these patterns told me that PayPal’s sentiment challenges aren’t rooted in distrust or negativity. The scores were all positive. Instead, PayPal is being out-loved, not disliked.

Users simply talk about competitors with more enthusiasm, especially in areas tied to simplicity, speed, or cost efficiency. This kind of sentiment gap is also something you can explore further using a Citation Gap Analysis, which helps reveal where competitors are mentioned more often and why.

PayPal could benefit from communicating more proactively about improvements in fees, transfer speeds, or user experience. These are the topics where competitors generate the strongest sentiment lift. Highlighting simplicity, transparency, or value could help shift the conversation.

The heatmap didn’t just compare numbers, it showed me exactly where PayPal has room to create deeper, more positive emotional connections with users, and where a few strategic shifts could make a meaningful impact.

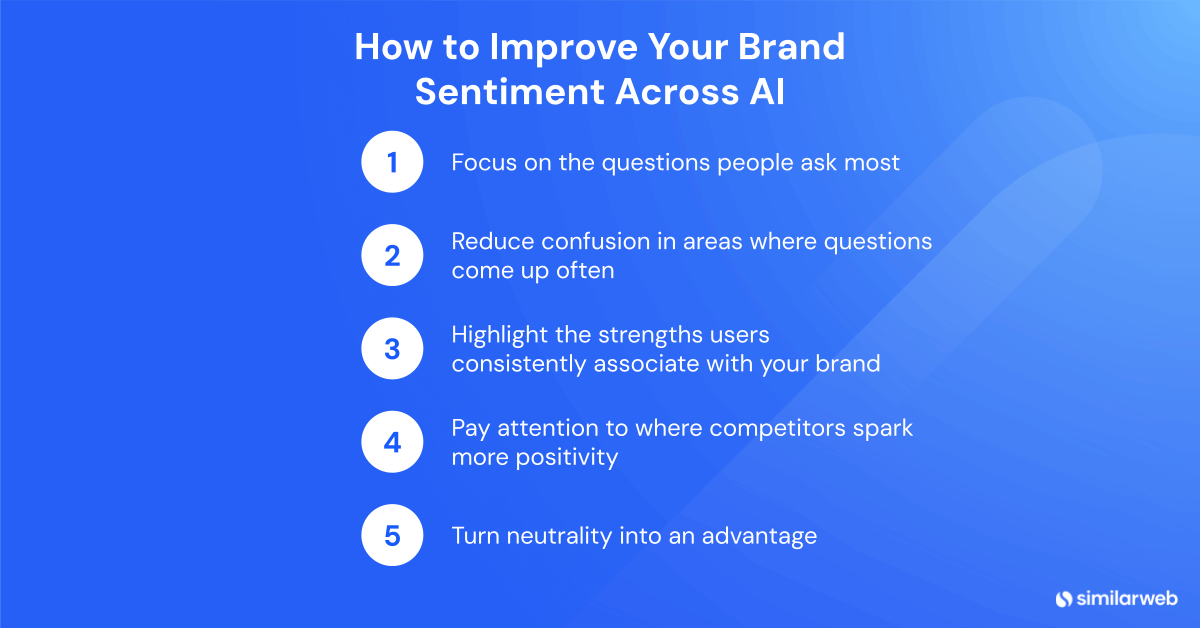

How to Improve Your Brand Sentiment Across AI

1. Focus on the questions people ask most

When users often search for the same types of information, like the security and reliability questions I saw for PayPal, they’re showing you exactly what matters to them. These common topics point to areas where users want clarity or a deeper understanding.

By explaining these important topics more clearly in your messaging, product content, or help resources, you can meet users’ needs and improve how your brand is seen in those areas.

2. Reduce confusion in areas where questions come up often

In the negative prompts, I saw that many of the concerns were about fees. Even though the number of negative mentions is small, when the same topic appears again and again, it usually means users aren’t fully sure about it.

Clearing up these common questions early can help prevent confusion from turning into negative sentiment.

3. Highlight the strengths users consistently associate with your brand

For PayPal, safety and trust showed up often in the positive and neutral prompts.

When a brand already owns certain emotional territories, highlighting those strengths, through product experience, messaging, or UX, can push sentiment upward and help you differentiate more clearly.

4. Pay attention to where competitors spark more positivity

In the heatmap comparison, some competitors generated significantly stronger sentiment in areas like money transfers and e-commerce. When that happens, it’s a sign that users value something, speed, simplicity, pricing, convenience, and that another brand is delivering more effectively.

Identifying those advantage points can help guide your own improvements.

5. Turn neutrality into an advantage

A high volume of neutral sentiment isn’t a problem, it’s an opportunity. Neutral mentions usually come from users who are still exploring or comparing options, just as I saw many PayPal prompts for general use cases.

Brands that answer those questions more directly can shift sentiment from neutral to positive simply by removing friction or confusion.

Turning Sentiment Into Strategy With Similarweb

By the end of this analysis, I wasn’t just looking at sentiment scores. I had a real understanding of how people talk about PayPal and what shapes those conversations. Similarweb’s AI Sentiment tool made it easy to move from raw mentions to meaningful insights, showing not only the mood around the brand but the reasons behind it.

That’s the real advantage of our tool: it turns random online questions, prompts, and comparisons into clear guidance brands can act on.

With visibility into what people care about most, where sentiment shifts, and why, brands can make smarter decisions and strengthen how they show up in the market, today and moving forward.

FAQs

What is AI Sentiment Analysis?

AI sentiment analysis uses machine learning to classify online conversations as positive, neutral, or negative, helping brands understand public perception at scale.

Which sources are included in the sentiment data?

AI Brand Visibility pulls from digital mentions across news, forums, blogs, app reviews, social media, and other public online channels.

Can I see sentiment by product or feature category?

Yes. The sentiment-by-topic breakdown categorizes mentions into tracked themes such as Digital Wallets, E-commerce, or Payment Solutions.

What does a sentiment score mean?

The sentiment score ranges from -1 to 1: 1 = all mentions positive, 0 = neutral, and -1 = all negative.

How does sentiment help my brand strategy?

Sentiment analysis identifies user pain points, competitive gaps, and opportunities for marketing, product, and PR improvement.

Can I compare my sentiment to competitors?

Yes, Similarweb provides a full competitor sentiment heatmap so you can benchmark performance in each category.

How often should I run AI sentiment analysis on my brand?

It depends on your industry, but most brands benefit from checking sentiment regularly, weekly or monthly. If you’re launching a campaign, releasing a new feature, or dealing with a PR moment, more frequent monitoring can help you identify shifts in real time.

Wondering what Similarweb can do for your business?

Give it a try or talk to our insights team — don’t worry, it’s free!