4 Steps to Win Your Market in 2026 with Similarweb

2025 was… a lot.

Gen AI exploded. Consumer journeys got messier. Channels multiplied. And just when it felt like you understood what was working, things shifted again.

If you’re planning your 2026 marketing strategy, the real challenge is building a plan grounded in reality, one that accounts for:

- Your true market position

- Your new unknown competitors

- The channels that actually drive growth

That’s exactly what we explored in a recent Similarweb webinar, “4 Steps to Win Your Market in 2026“. In this post, I’ll distill that conversation into a practical, four-step framework you can use with your marketing, product, growth, and leadership teams to build a 2026 strategy rooted in real user data.

Interested in watching the full webinar? Here you go:

Now, let’s understand the current landscape.

The new reality. Change is faster, journeys are messier, data is noisier

A few big shifts are reshaping how you should think about your marketing strategy in 2026.

1. The pace of change is on a different level

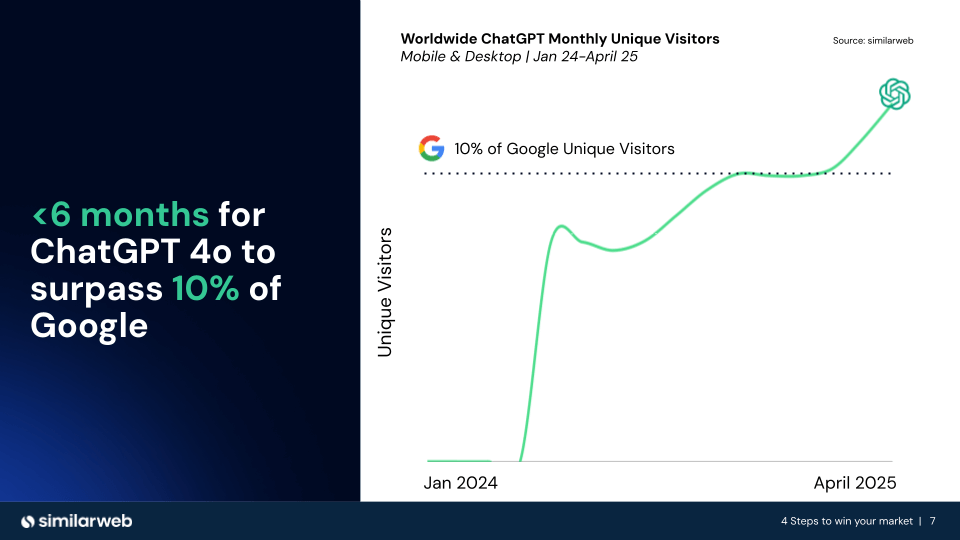

Although it took Amazon ~17 years to reach 10% of Walmart’s revenue…

…it took ChatGPT under 6 months to reach 10% of Google’s web traffic.

The gap between “early signal” and “major impact” is shrinking. If you’re only looking at last year’s performance, you’re already too late.

2. Gen AI is small in volume, big in influence

On paper, traffic referred from Gen AI platforms is still less than 1% of total traffic in many verticals, from retail to travel to forum sites like Reddit.

But when Similarweb’s Data Labs studied what happens after people ask ChatGPT questions like “Where should I buy a new phone?”, they found something surprising.

For every one click on a citation link inside ChatGPT, there were five additional visits to retailers via other routes, direct, search, and more, within the following hour. In other words, even when users didn’t click directly, what they saw in the AI answer still influenced their next steps.

The result? Your analytics might say “Gen AI is tiny,” but in reality, it’s already shaping awareness and demand much earlier in the journey.

When things are changing so rapidly, one thing is clear.

You can’t manage what you don’t measure

On the one hand, you might be growing 10% year over year and feeling good… while your key competitor is growing 40% and quietly taking share.

On the other hand, you might be losing traffic overall… but losing less than everyone else-meaning your share is actually increasing.

The difference between those two stories only becomes clear with a relative view of your market. Without visibility into how you’re performing against competitors, across categories, and now within Gen AI–driven discovery, you’re left guessing. And when budgets are tight, guessing is expensive.

The 4-step framework to build your 2026 marketing strategy

Instead of reacting to every new channel, algorithm change, or AI headline, anchor your 2026 plan around four fundamental questions:

- Do we actually know how we’re performing relative to our competition?

- Do we know which channels truly drive valuable growth?

- Are we protecting our brand across every level of competition, including Gen AI?

- Can our teams easily access, share, and trust the same data?

Let’s break these down into four concrete steps you can use with your team to build a strategy rooted in reality.

Step 1: Stop guessing and measure your true market position

Before you plan another campaign, enter a new market, or launch a new product line, you need clear, quantified answers to two fundamentals.

1. Who’s really in your market now?

Your “mental list” of competitors is almost always out of date. New players emerge from adjacent categories, niche verticals, or entirely different business models, and in fast-moving spaces like AI, this shift can happen in weeks, not years.

2. How are we performing relative to them?

Looking at traffic or revenue in isolation can be misleading. What matters is whether you’re gaining or losing market share:

- Are there “rising threats” that are still small, but growing faster than the overall category?

- Are you over-fixating on familiar competitors while a newer player quietly climbs the rankings?

In practice, tools like Similarweb let you:

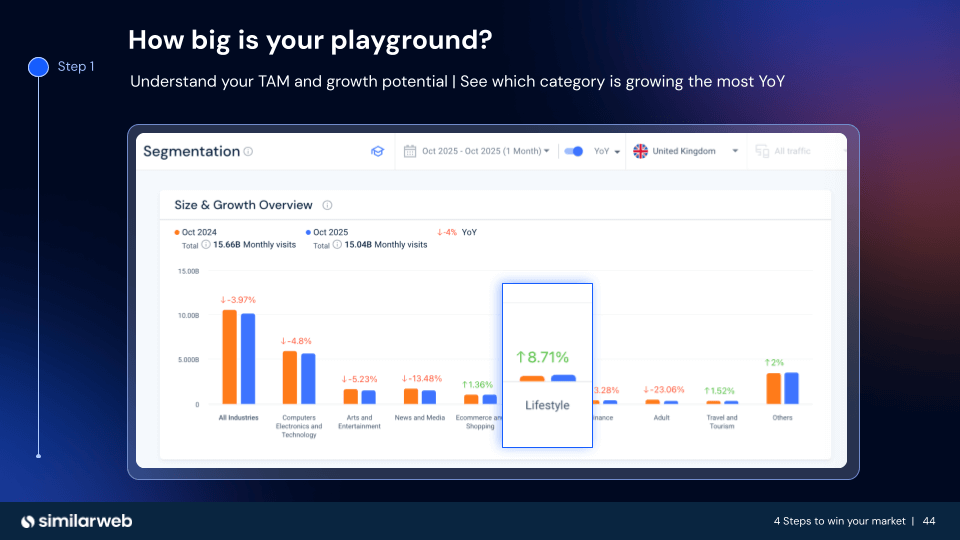

1. Size your total addressable market by category and geography

As the data shows, Lifestyle may be a smaller UK market, but it is outpacing every other industry in year-over-year growth, with a notable 8.7% increase in October alone.

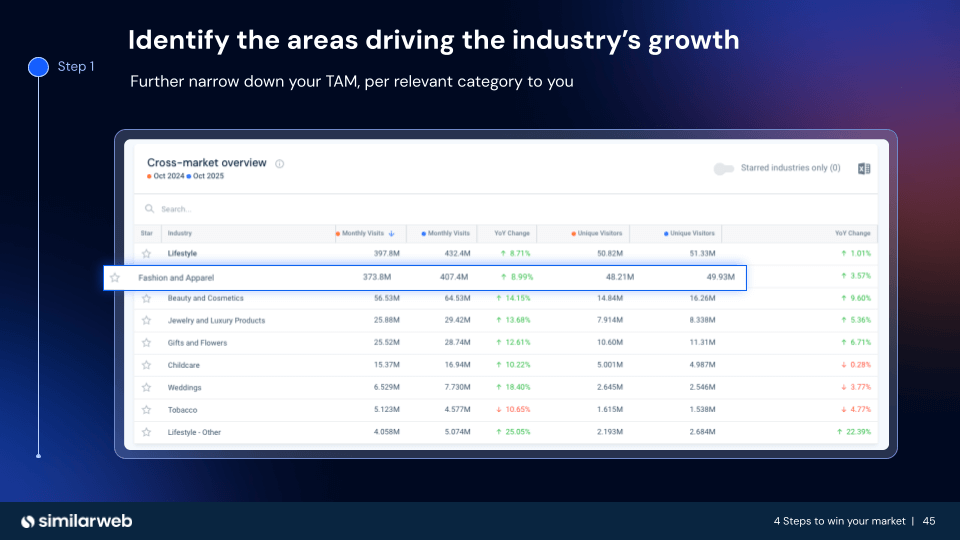

2. Identify which categories are growing fastest year-over-year

Once you’ve identified the industry you want to focus on, you can narrow your analysis to understand what’s happening within its subcategories. For example, within the UK Lifestyle category, Fashion and Apparel is the largest subcategory, despite showing the slowest growth.

Weddings, which is a smaller subcategory is seeing a substantial 18.4% YoY growth.

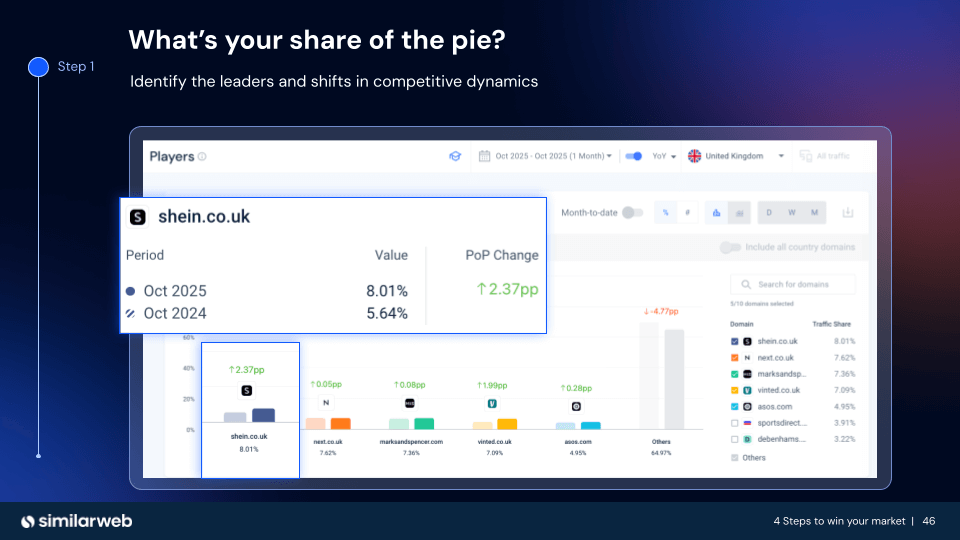

3. Map your competitive landscape to find both leaders and fast-growing challengers

Now that you’ve sized the market, you can assess your position relative to competitors. For example, Shein is not only the largest player, but also the fastest-growing, contributing significantly to the overall growth of the category substantially outpacing Next.

How to apply this in your 2026 planning

During your strategy offsite or Q1 planning, start here:

1. Define the market you care about

For example, “lifestyle ecommerce in the UK,” “digital banking in the US,” “B2B marketing tools globally”).

2. Use external data (like Similarweb) to:

- Identify all major players, both direct and indirect.

- Rank them by traffic, visits, or category share.

- Flag the top rising players and the ones losing momentum.

3. Benchmark yourself:

- What’s your share of total visits?

- How is your share trending vs. last quarter / last year?

- Who are you really competing with in each category or line of business?

Make this your starting slide for 2026 planning. Everything else should tie back to how you shift that relative position.

Step 2: Move from constant pivots to focused growth opportunities

Once you know where you stand, the next step is understanding why the market leaders are winning.

Many teams treat channels as a checklist: “We do SEO, PPC, display, social, email…”, but the real advantage comes from knowing which marketing channels are moving the needle for your competitors so that you know what to focus on.

1. See which channels move the needle for sites in your industry

Above we see that although all the brands analyzed saw a decrease in organic and direct traffic, paid traffic is seeing significant growth.

2. Analyze competitor SEO and PPC search strategies

Here, we can see which keywords are performing well, along with a breakdown of the strongest-performing keyword clusters. Among them, the mortgage keyword cluster showed the highest growth in PPC.

3. Allocate budget without hurting growth

Above, we can see competitors’ display advertising spend alongside their tactical focus. Santander prioritized native ads, while Lloyds Bank concentrated on video.

How to apply this in your 2026 planning

Start by building a channel performance map that compares you directly with your top competitors. Instead of asking, “Are we investing in this channel?” ask, “How important is this channel relative to everyone else in the market?”

1. Map channel traffic and trends

Look at how much traffic each channel contributes today and, just as importantly, how it’s changing year over year.

You’ll often uncover patterns like paid search or display growing in importance for category leaders, while other channels quietly decline but still drive meaningful volume. Those nuances are where smarter budget decisions live.

2. Search strategy and keyword clusters

Next, go deeper into search behavior itself. Rather than treating keywords as an endless list, group them into clusters that reflect real user intent, including things like “best credit card for travel,” “mortgage calculator,” or “fleece-lined leggings.”

For each cluster, evaluate who owns the majority of clicks, whether that dominance comes from SEO, paid search, or both, and which clusters are growing fastest in demand. This is how you spot opportunity before it becomes obvious.

3. Use data to make deliberate decisions

Finally, use these insights to make deliberate budget decisions. Instead of cutting 10% across the board, decide where to double down because the data supports it and where to pull back because competitors are clearly outperforming you.

This might mean investing in new ad formats competitors are already scaling, expanding into emerging keyword areas, or testing entirely new channel plays with a clear hypothesis behind them.

When done well, this step replaces the familiar feeling of “we’re constantly pivoting” with something far more powerful. A focused channel mix tied directly to competitive reality and proven growth drivers.

Step 3: Go deeper. Protect your brand at every level (especially in Gen AI)

Because your business and your competitors are complex entities, a single line on a market share chart is not enough.

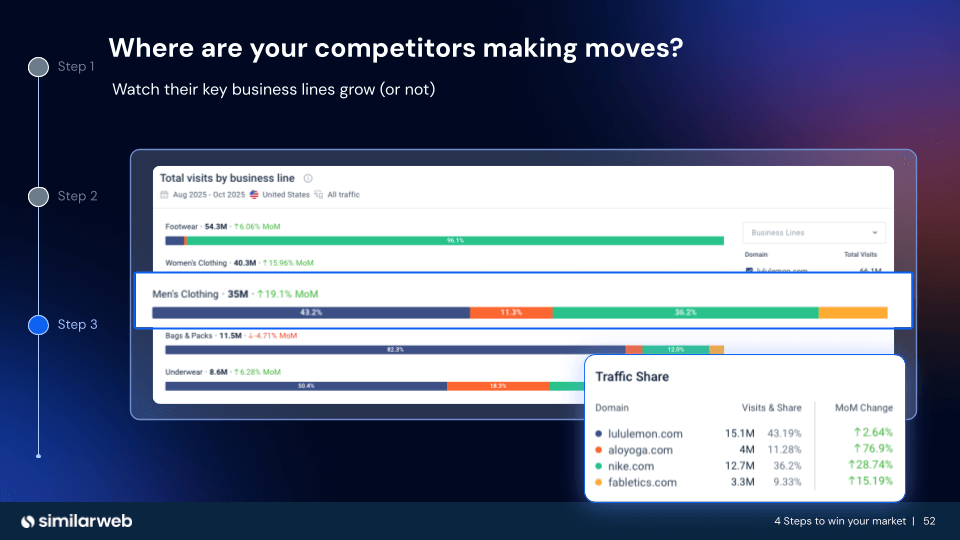

1. See which business lines, product categories, or pages are driving growth

Focusing on sports apparel brands, we see that while Footwear is the largest business line, Men’s Clothing is growing the fastest, at 19.1% month over month.

2. Understand what consumers are searching for

Looking at consumer demand for the Leggings category in the US, we see strong interest in Yoga Pants. While overall demand for Leggings remains higher, it is declining year over year, whereas demand for Yoga Pants is growing.

Consumers are also searching for more specific product types, including “fleece-lined leggings,” “flare leggings,” and “cotton leggings.”

3. Monitor your AI brand visibility

With tools like prompt analysis and citation analysis, you can see:

- Which user prompts your brand appears in or is missing from entirely

- Which domains and URLs LLMs rely on as sources for answers in the categories that matter to you

- Where partnerships or content optimization could significantly increase your brand’s visibility in AI-generated responses

How to apply this in your 2026 planning

Start by breaking your strategy down to the same level your business actually operates at, not just “the brand,” but the structure beneath it. That means looking at performance across lines of business, categories, and individual products or pages, all the way down to the URL level.

1. Break your strategy down to the same level your business operates in

At each layer, map three core signals:

- How much traffic you’re getting and how fast it’s growing

- How your share compares to competitors

- How underlying demand is changing over time

This is where hidden risks and opportunities tend to surface. A category might look stable overall, while a specific product line is either accelerating ahead of the market or quietly falling behind.

2. Use demand signals to shape your content and how it’s positioned

Rising micro-trends like niche product attributes or emerging use cases often appear in search behavior well before they show up in revenue reports. When you spot these early, you can respond with dedicated landing pages, targeted campaigns, or stronger merchandising before competitors catch on.

Just as important, this view helps you identify declining terms where you may still be over-investing simply because “that’s how it’s always been done.”

3. Add Gen AI to your brand-health dashboard

Finally, expand your definition of brand health to include Gen AI visibility. AI-generated answers are becoming a new layer of competition, shaping perception even when they don’t drive direct clicks.

Track whether your brand is mentioned in AI chatbots when people ask about your core categories and use cases, whether competitors are being recommended instead of your brand, and whether those answers are accurate and on-brand, or incomplete and misleading.

From there, you can make informed decisions about where to act. That might mean prioritizing certain prompts or topics in your SEO and content roadmap, strengthening your presence on the source domains LLMs rely on, or investing in partnerships and PR that increase your authority in AI-driven responses.

This is how you move from “acting blind” to actually protecting and growing your brand across every channel and level of competition.

Step 4: Replace data chaos with simple, shared access

Even teams with strong insights often hit the same wall. Different functions rely on different tools, dashboards, and spreadsheets. Marketing, product, strategy, and leadership each operate from their own version of reality, and before long, meetings become debates about whose numbers are “right” instead of discussions about what to do next.

The final step of the framework is about scaling with data. Not collecting more of it, but turning insights into a shared operating system for the entire business. One that everyone can access, trust, and act on.

In practice, this means meeting teams where they already work, while ensuring the underlying data stays consistent.

Some ways teams do this:

1. Simplify your data analysis with AI Studio

Ask questions in natural language and get answers backed by Similarweb data, along with ready-to-use dashboards and reports

2. Connect Similarweb’s data to your workflows with MCP

Enable AI assistants like Claude to directly access web analytics, traffic data, and competitive intelligence metrics without requiring custom implementation.

3. Automate your workflows with AI agnets

Examples of AI agents that can be embedded into your workflows include:

- AI trend analyzer: Spot unusual demand spikes and help you act before competitors

- AI SEO strategy agent: Turn real user search behavior into a topic-level SEO roadmap

- AI Sales meeting prep agent: Build a 1-page brief for sales reps so they walk into every meeting informed about the account’s digital behavior

How to apply this in your 2026 planning

To make this final step stick, the goal is to weave shared data into your operating rhythm, not treat it as a one-time setup project.

1. Choose a single “source of truth” for market & competitive data

Start by committing at a leadership level to a single source of truth for market and competitive data. This doesn’t mean replacing every tool overnight, but it does mean aligning on which numbers you use when discussing market share, category growth, and competitive performance.

Once that decision is made, make the data easy to access. Insights hidden in spreadsheets or owned by one team don’t scale.

2. Define a small set of shared KPIs

Next, narrow your focus to a small, shared set of GEO KPIs that everyone understands and trusts. Rather than tracking everything, agree on a few signals that reflect brand health and demand across the business.

That might include market share by category or line of business, channel-level traffic and growth, and a concise view of Gen AI impact, such as brand visibility, sentiment, and a handful of “north star” metrics that indicate whether awareness and demand are moving in the right direction.

3. Automate reporting where possible

From there, look for opportunities to automate wherever possible. Replace manual slide-building with recurring dashboards that update weekly or monthly.

Use AI and agents to summarize what’s changed, flag anomalies worth attention, and suggest where teams should dig deeper. This shifts your team’s energy from reporting on the past to acting on what’s happening now.

4. Make data part of how you work, not a quarterly event

Finally, make this shared data view part of how the business actually runs. Bring it into weekly marketing reviews, quarterly business reviews, and product or market expansion discussions. The more frequently decisions are grounded in the same trusted dataset, the faster alignment happens and the easier it becomes to move as one team.

Putting it all together for 2026

Taken together, these four steps form a simple, repeatable narrative for building your 2026 marketing strategy, one that replaces reaction with clarity.

Ready: Analyze your market

Stop guessing who you’re competing with. Measure your true position against both established players and fast-rising challengers, so every decision starts from reality.

Set: Find growth opportunities

Understand which channels and tactics actually drive results for you and for others in your category. Use that insight to shift budget and focus toward sustainable, evidence-based growth.

Go: Protect your brand

Look beyond the topline. Drill down by line of business, category, and URL, and track demand shifts and Gen AI visibility to ensure your brand shows up where customers discover, evaluate, and decide.

Fly: Access trusted data your way

Replace spreadsheet chaos with shared dashboards, AI agents, and connected data. Give every team from marketing to leadership a consistent, reliable view of performance.

Build your 2026 strategy around these four steps, and you’re no longer reacting to Gen AI, new channels, or the next surprise trend. You’re creating a repeatable way to win your market, no matter how fast the landscape changes.

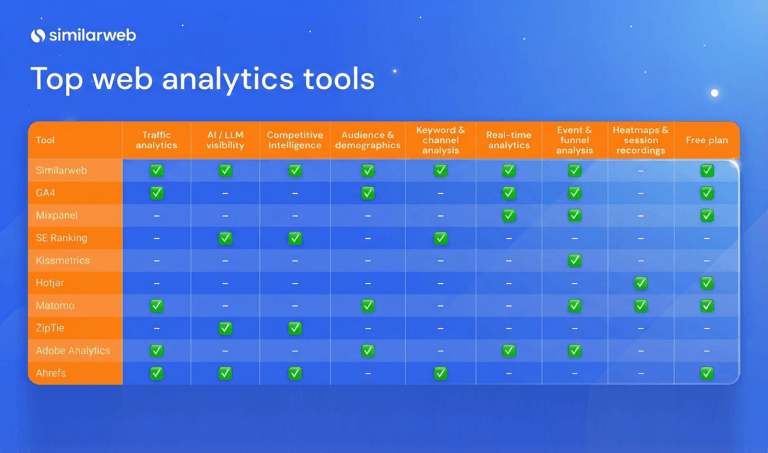

Your full marketing toolkit for a winning strategy

The ultimate solution to help you build the best digital strategy