Retail Media Demystified: Your Path to Ecommerce Success

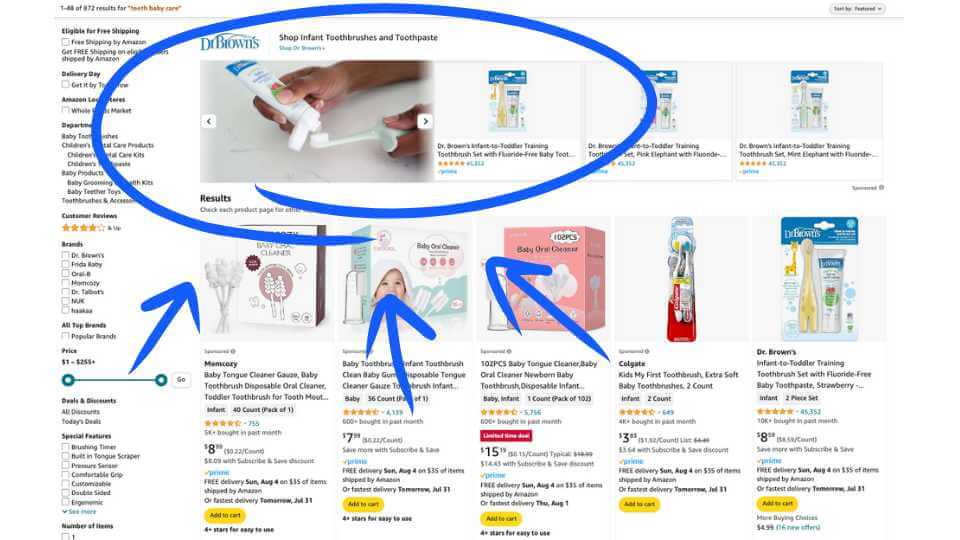

Imagine this: you’re browsing your favorite online store for something random like a new dinner set (you have friends coming over).

The next day, you return and see ‘sponsored’ kitchenware products have appeared like magic in your recommendations.

Ever wondered how this happens?

Get ready to step into the world of retail media.

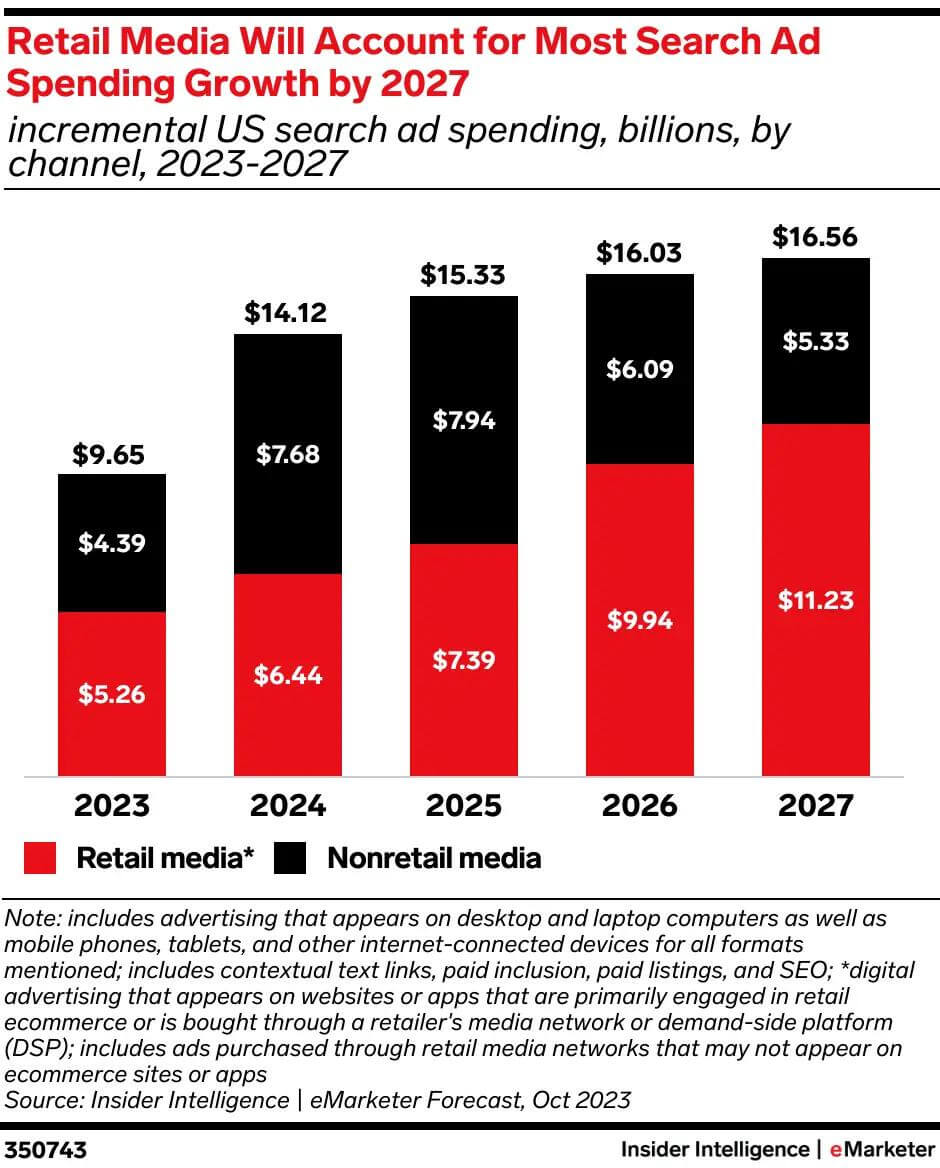

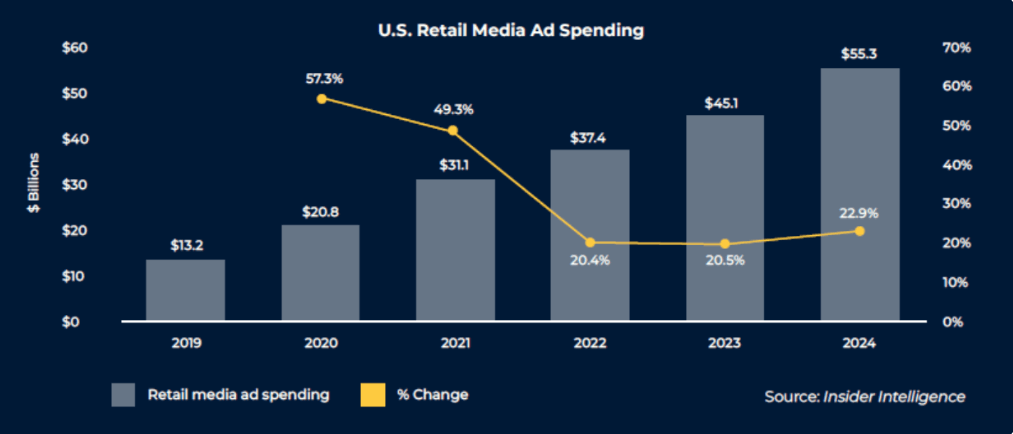

Described as the “third wave of digital marketing,” retail media is going through a major growth spurt, particularly in ecommerce. Analyst eMarketer forecasts retail media ad spending could hit $109.40 billion by 2027 – 20% growth year-over-year (YoY) from 2023.

We’ll demonstrate why retail media is making brands, retailers, and media buyers go weak at the knees with a vision of $$$s.

Including:

- Retail media networks: Top ecommerce retailers, their networks, and the advertisers using them

- How retail media got started: The seeds that were sown over 15 years ago

- Growing pains: Big retail media challenges for media buyers

Best of all?

You’ll get some easy-to-follow strategies to save you time and money when setting up your retail media campaign.

But first…

What is retail media?

Retail media describes how retailers – using their platforms, infrastructure, data, and traffic – enable advertisers to reach customers.

In other words:

Think of an ad for a popular drinks brand on a billboard at Manchester United. Or a similar sidebar ad on the nytimes.com website. Now, natively put these ads on an ecommerce site, app, or store.

There you have retail media in a nutshell. Or, at least, the scaled-down version.

What is not ‘scaled-down’ is the big money retailers can make turning their ecommerce sites into smart advertising platforms. So stores can further monetize their millions of visitors – even the ones that leave without buying.

And here’s the real kicker…

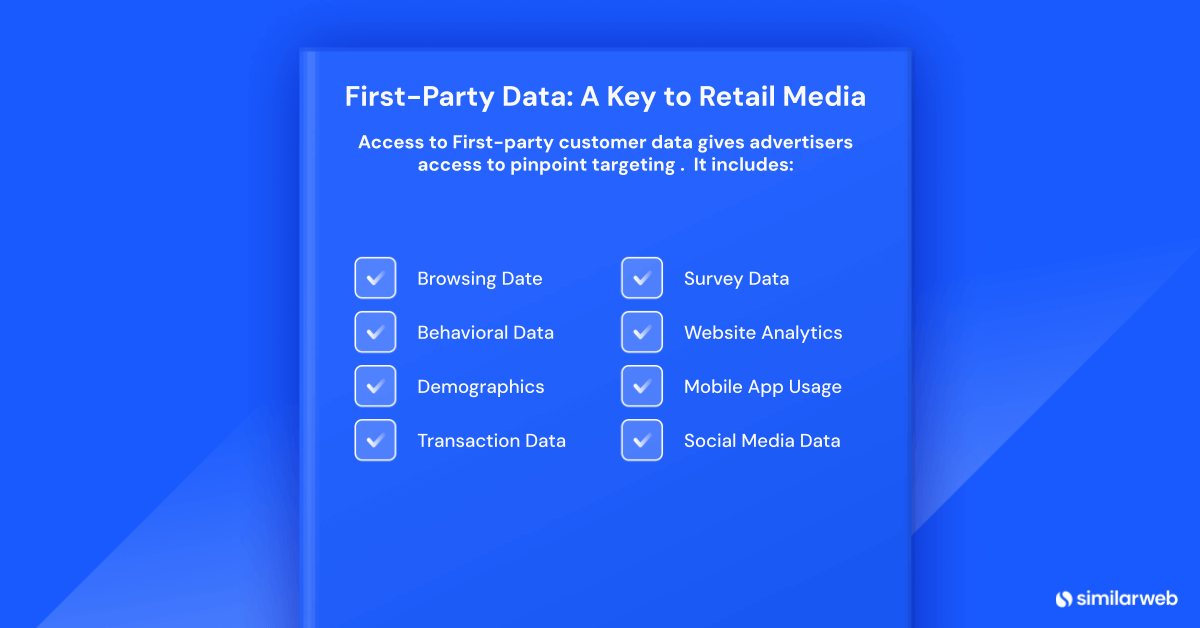

Advertisers can reach shoppers with precision targeting courtesy of first-party customer data.

Better still, ecommerce is not bound by editorial rules news and media sites might face around native ad formats. While the trackable KPI for a retail media ad is a sale, not just referring someone to a product page.

Retail media is starting to put pressure on certain other platforms (yes, we’re talking about you, Google, and Facebook 😉).

What is a retail media network?

In-store point-of-sale advertising existed long before the World Wide Web. But ecommerce has driven a new revolution.

A retail media campaign can range from purchasing a sponsored product slot on a specific keyword to running a 6-month multi-touch programmatic marketing campaign on autopilot.

And the retail media network is what holds all of this together.

So what is a retail media network and how it is different from retail media?

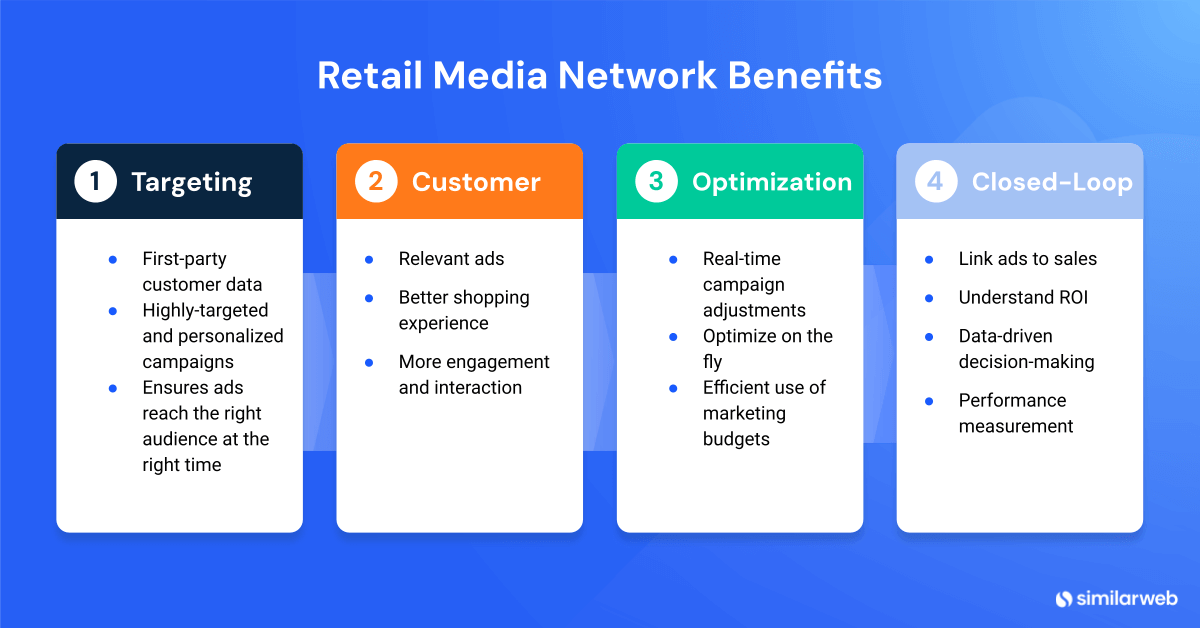

A retail media network (or RMN) acts as an interface to buy and sell ads on a retailer’s properties, set up campaigns, handle analytics, and KPIs.

Retail media network are present in all of the following areas.

Data and how it fits in with retail media

The data collected by retail media networks is crucial for understanding consumer behavior preferences and targeted digital marketing strategies.

It includes:

🗣️ Granular first-party data: Retailers collect detailed data, including audience demographics, purchase behaviors, and loyalty information. All allowing advertisers to create highly targeted campaigns.

🎁 Loyalty programs: Retailers gather data through loyalty programs, capturing information on purchase frequencies, product preferences, and customer profiles.

☁️ Third-party data integration: Retail media networks often supplement their own data with third-party data sources and feeds, enhancing their market and consumer insights.

Retail media effective measurement

Effective measurement is essential for understanding a retail media campaign’s impact and efficiency. It helps with data-driven decision-making and optimizing future campaigns.

Key elements include:

- Closed-loop reporting: Many programmatic advertising platforms offer closed-loop reporting. This provides real-time performance insights that link everything from the initial touchpoint to a sale. It allows for immediate campaign adjustments.

- Attribution models: Different attribution models, such as last-touch and multi-touch, are used to determine the effectiveness of advertising efforts. Time frames may vary.

- Data integration: It’s crucial to integrate data from different sources, such as first-party retailer data and third-party data providers. This integration enhances insights and enables a more comprehensive understanding of campaign performance.

Cross-retailer measurement: A significant challenge is the lack of a unified measurement solution that captures consumer behavior across multiple retailers.

How retail media compares with other platforms (source: BCG)

Advertising inventory

The availability and management of advertising inventory are critical for retail media networks.

Here’s what you need to consider:

- 📦 On-site and off-site inventory: Retail media networks offer both on-site (directly on retailer platforms) and off-site (across the web) advertising options, expanding the reach of campaigns.

- 🤝 Partnerships with DSPs: Retailers can partner with external demand-side platforms (DSPs) – like The Trade Desk, Amazon DSP, or Stack Adapt – to control their inventory and make it easier to access ads.

- 🎯 Competitive edge and cost: As competition for prime inventory increases, so do the associated costs. Advertisers must carefully consider the value and potential return on investment when selecting inventory options.

Historical timelines and key milestones

Retail media has come a long way, evolving from simple affiliate programs and in-store media to the sophisticated advertising ecosystems we know today.

Early developments

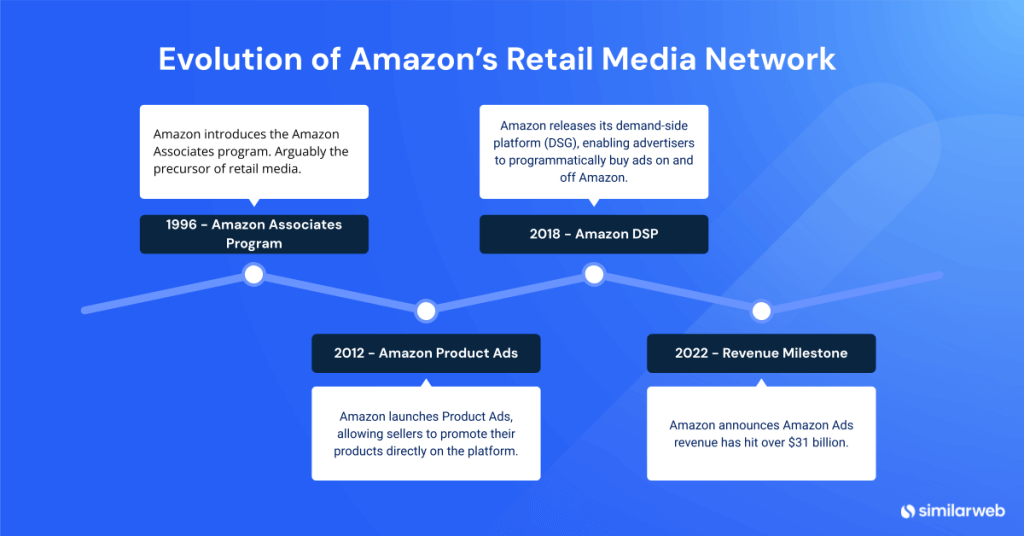

Despite the use of retail media in brick-and-mortar stores, the growth of ecommerce retail media networks owes a lot to Amazon’s early initiatives.

The Amazon Associates Program, launched in 1996, set the wheels in motion for retail media networks. It leveraged third-party websites to drive traffic to Amazon without relying on traditional display ads or organic search for traffic.

By 2012, Amazon had launched Amazon Product Ads, which allowed sellers to promote their products directly on Amazon’s platform. This was soon followed by Walmart’s entry into the retail media space with the launch of Walmart Media Group (now Walmart Connect).

Growth from 2012-20

From 2012 to 2020, retail media networks have grown and matured significantly.

In 2018, Amazon introduced its Demand-Side Platform (DSP) service, Amazon DSP, allowing advertisers to programmatically buy display and video ads both on and off the Amazon platform.

Kroger entered retail media in 2018 with the launch of Kroger Precision Marketing. By 2019, the retail media landscape had expanded further. Major retailers like Best Buy, CVS, and Home Depot all launched their own retail media networks.

Impact of COVID-19

The pandemic accelerated retail media network growth as brick-and-mortar stores shut and consumers shifted their shopping online.

In the US in 2020, ecommerce sales grew 43%, rising from $571.2 billion in 2019 to $815.4 billion. Retail media spending simultaneously surged by 57%, triggering a period of exponential growth that is still running.

Recent advances

Since 2020, retail media has continued to hold its upward trajectory. In 2022, Amazon’s ad revenue topped $31 billion.

Walmart also upgraded its capabilities by launching Walmart DSP in 2023. In the same year, it generated $3.4 billion in revenue, a 28% increase from the previous year.

Third-party cookies

The ‘will they; won’t they’ drama with Google deprecating third-party cookies looks like it’s over. For the moment, at least.

However, if they do go, advertisers will lose a lot of visibility over campaign performance. While first-party data will provide retail media networks with an edge over other types of digital ad technology.

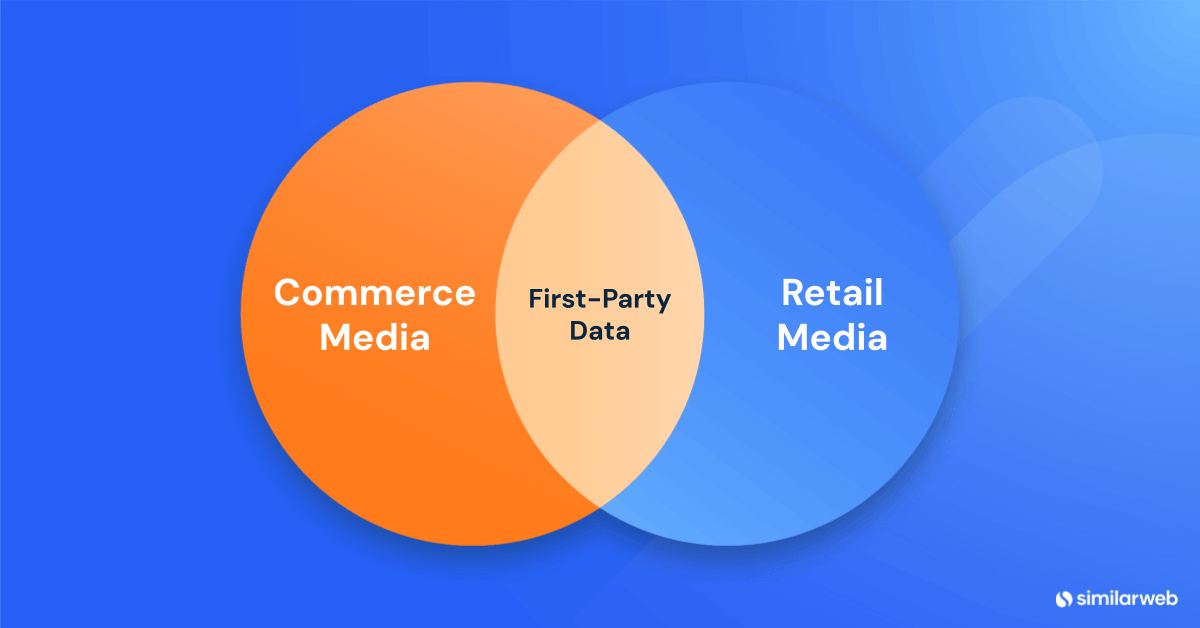

Retail media vs. commerce media

Retail media and commerce media are often confused with each other. In reality, commerce media is an umbrella term that encompasses retail media.

Commerce media, like retail media, describes the integration of programmatic advertising and first-party consumer data. But it also delivers targeted, shoppable ads across multiple channels (including third-party websites and social media platforms).

It includes selling products directly through everything from mobile ads to live video.

Differences and commonalities between retail and commerce media

There are three main aspects where retail media and commerce media differ or overlap:

- Scope: Retail media is confined to the retailer’s properties, while commerce media spans multiple channels

- Control: Retail media is typically managed by the retailer. Commerce media may be handled by third parties

- Data use: Both use first-party data and are thus insulated from a reliance on third-party cookies

Commerce media examples outside of retail

Non-retail sectors are leveraging a commerce media-like approach.

Travel provides a good example: Airlines use customer data to offer additional products or services during booking or in-flight. Similarly, hotels can sell local attractions and services to guests through their booking sites, enhancing their experience and generating additional revenue.

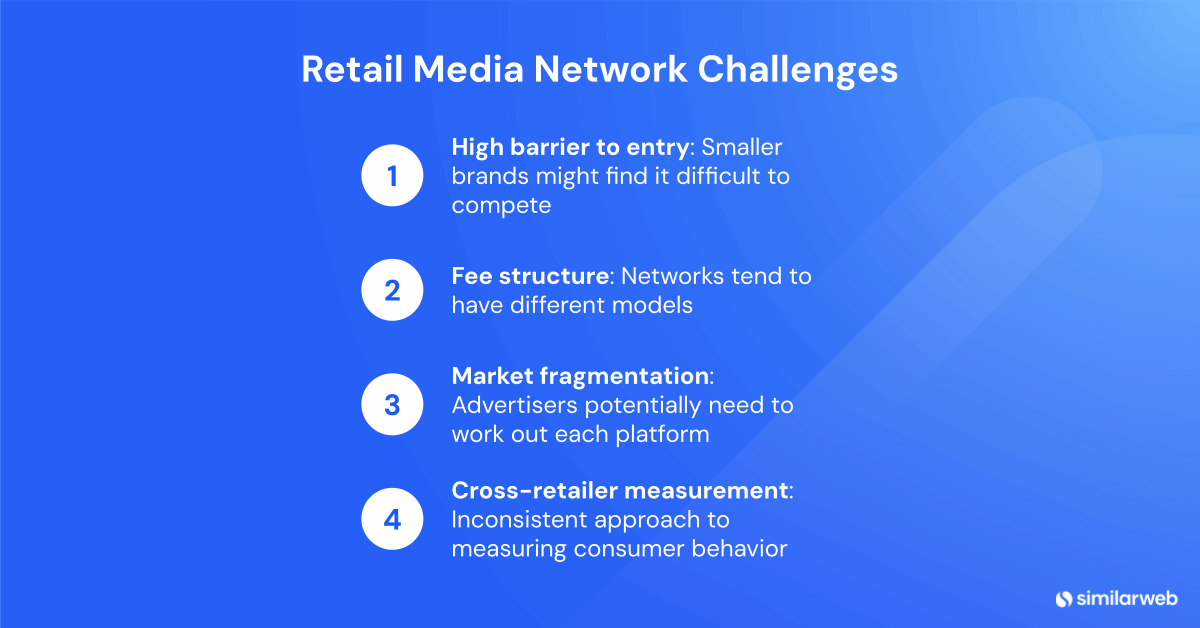

Retail media network challenges

Retail media networks offer numerous advantages – especially for large retailers with high traffic and robust first-party data.

However, the rapid growth has not been without growing pains. Here are some of the challenges:

- High barrier to entry: Smaller brands might find it difficult to compete due to the high start-up costs and the need for specialized platform knowledge.

- Fee structure: Understanding and managing different fee structures across various networks can be complex. Networks tend to use their own pricing model. It could be CPC, CPM (per thousand impressions), or something completely different.

- Market fragmentation: Differing network interfaces and requirements mean advertisers need to work out each platform individually. This fragmentation requires additional resources, both in terms of time and money. According to a 2023 IAB study, 70% of media buyers said “complexity in the buying process” was their biggest issue with retail media networks.

- Cross-retailer measurement: The lack of a consistent approach to measuring consumer behavior was cited in this study by BCG. This makes it difficult to analyze a campaign across multiple retail and third-party channels.

- Privacy concerns: Given the high level of customer targeting, data protection can be a sticky area, even with first-party data.

Top retail media networks

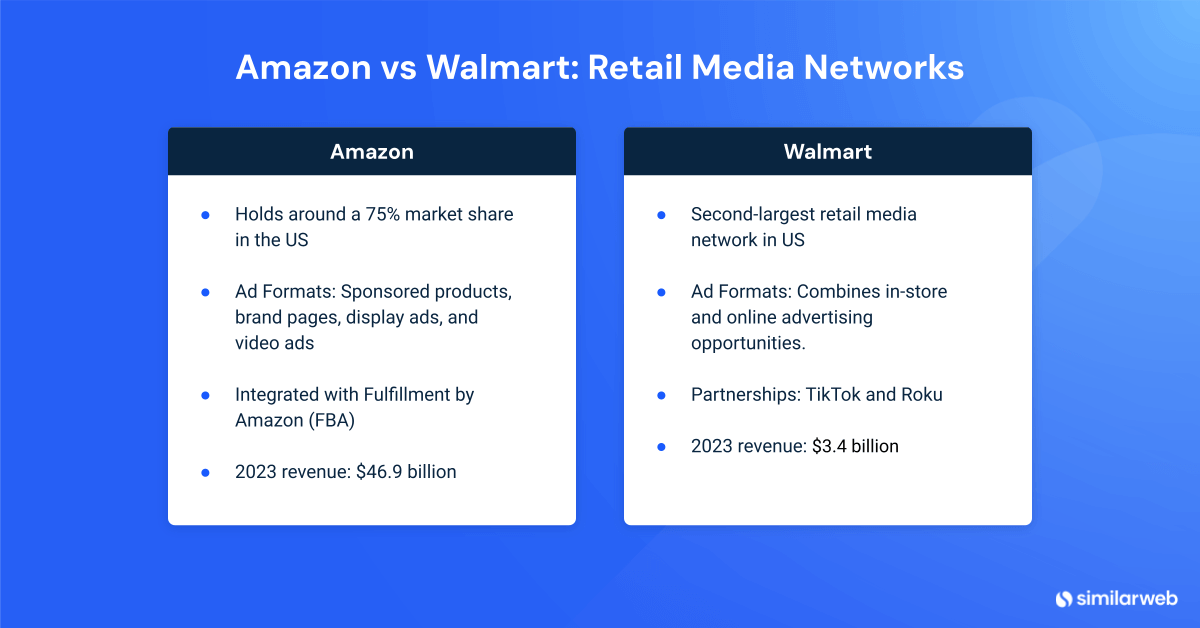

Unsurprisingly, Amazon dominates as the top retail media network. To put it into perspective, it already ranks as the third largest ad network behind Google and Facebook.

But that doesn’t mean there are no alternatives out there.

Walmart (Walmart Connect) and Target (Target Roundel), in particular, also have their own networks. And offer many of the same benefits as Amazon. This includes:

- ✔️Large reach (into the billions)

- ✔️Closed-loop reporting

- ✔️Utilization of first-party data for targeting

- ✔️Ad products: sponsored products, display ads, and video ads

- ✔️Advertising on third-party sites

Other big retail networks are Best Buy Ads, Kroger Precision Marketing, and Instacart Ads. Indeed, most of the big retail chains worldwide, like Tesco and Carrefour, have built out their own networks.

Shape retail media strategy in line with consumer trends

Now we move on to the fun part – how to plan a retail media strategy.

Before you do anything you need to understand consumer trends.

Why is this important?

Let’s say you’ve joined an audio company. They want to take on Apple with a new set of noise-canceling earbuds.

Your new boss has said they expect you to immediately position the product next to market leaders like Apple and “take sales off of them.” Oh, and make sure you keep down your cost per acquisition.

Of course, you smile. Why the confidence?

- First, you know a retail media campaign will do the job.

- You have access to Similarweb’s Web Intelligence and Shopper products.

Lets build a picture of what is happening in the market around earbud sales.

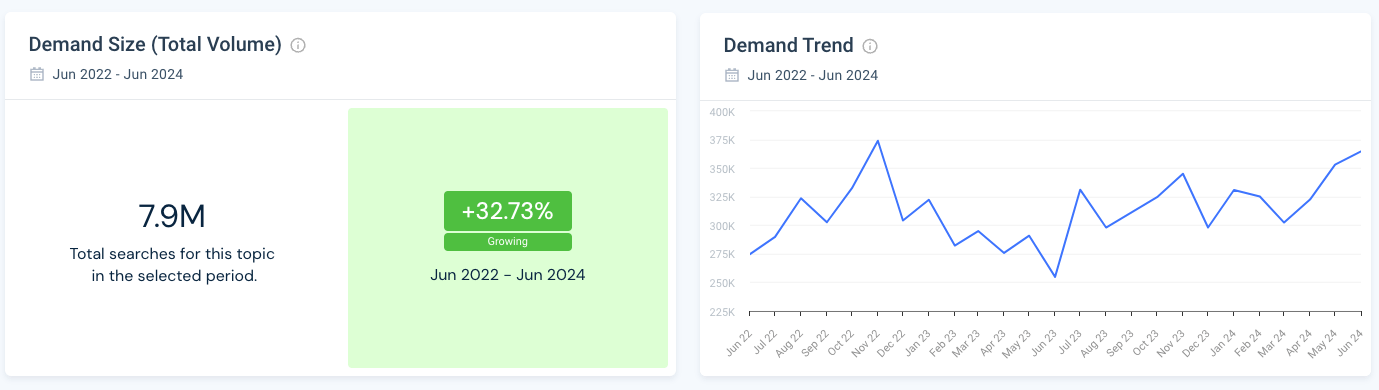

Establish a demand trend for earbud headphones

Trends make a great starting point. We need to understand the demand for noise-canceling headphones and how it fluctuates over time.

Let’s fire up the Demand Analysis tool and grab the top 160+ transactional keywords linked to ‘noise-canceling earbuds by volume over the last 25 months.

These results can be used to create a segment in the Demand Analysis tool. We’ll then understand how searches for these keywords have fluctuated over the last two years.

Good news.

Here we can see segment interest is on the rise. It’s clearly a good time to run a campaign.

But there are so many retail media networks out there. We don’t want to waste time testing each one.

Maybe we can narrow the list down.

What retail networks should you go for?

Let’s go back to our list of the top 160 keywords and look at how much website traffic they send to transactional sites.

The best, by far, are Best Buy and Amazon. Plus, both of these sites have retail networks (Amazon Ads & Best Buy Ads).

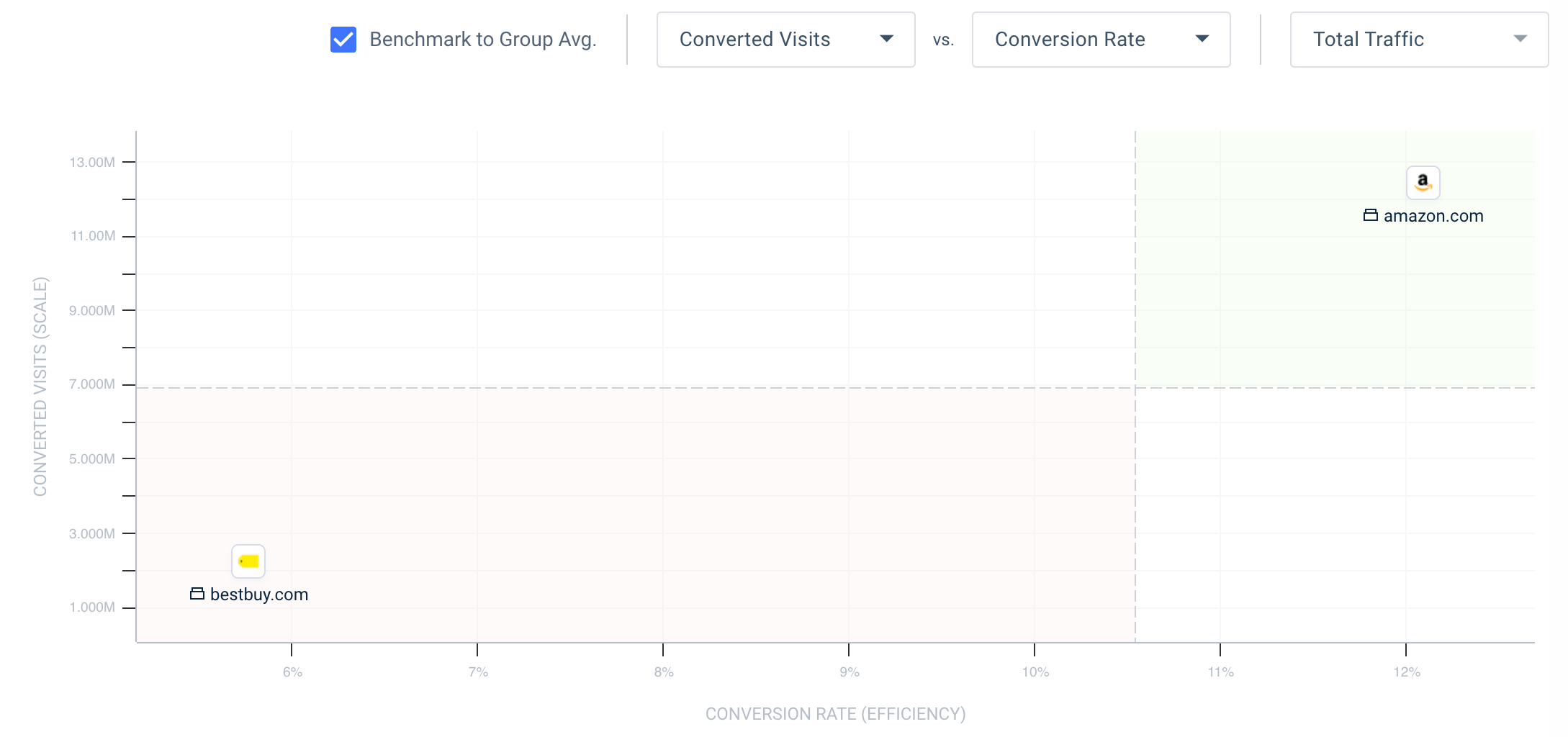

Clearly, Amazon is bringing in the most website traffic. But is it more effective in terms of sealing the deal and getting customers to the checkout?

To determine this, we can use the Conversion Analysis tool to obtain the conversion rate for both stores’ audio categories.

Let’s look at it over the last 18 months.

Here we can see Amazon is above average in terms of the conversion rate and converted visits for audio goods. It also has over x3 the conversion rate efficiency of Best Buy.

OK, we are going to target Amazon.

But there’s more we can do before we go to Amazon Ads.

Boost your retail media strategy with Shopper Intelligence

Whatever you’re selling, Amazon will always be a top performer. In our case, there are thousands of headphone products and brands.

How do we know what to focus on?

We need some sort of marketplace intelligence tool.

Here is where Similarweb Shopper Intelligence comes in. It’ll reduce time spent testing ads by mapping out all those hidden Amazon trends and patterns.

Establish the popular headphone brands

Similarweb Shopper Intelligence allows us to dissect the top brands on Amazon in just about every category. So’ noise-canceling earbuds’ is no problem.

There are no surprises here.

Apple is on top in terms of views and units sold, and targeting them may be expensive. However, there may be opportunities to target smaller brands.

For example, compared to Apple (19%), JBL and Beats have the third and fourth-highest share of views, at 5.9% and 5.8%, respectively, but are failing to convert. Maybe people are less than impressed with what they find in the search results. If so, it might be worth targeting branded search for these two brands with some sponsored product ads.

Grabbing the top-performing branded keywords on Amazon

We can complete the picture by doing an analysis of the top keywords in the earbuds category over the last two years. Here we can filter out non-branded keywords and unit sales of under $100.

Why is this important?

Well, we’re not just interested in search volume, are we? We’re using a retail media network, so it’s ultimately about clicks and sales. So we’ll look at that, as well as what keywords our competitors are optimizing.

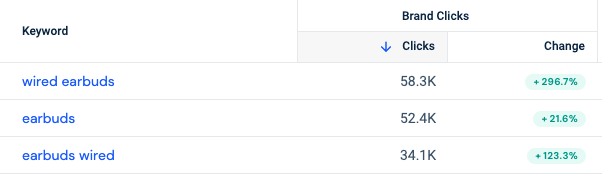

Looking at Skull Candy in the Brand On-Site Search Overview, we can see it has received a 296% boost in traffic for the keyword ‘wired earbuds’. Looks like a good keyword to bid on.

How the subcategory is performing

Let’s look at the subcategories to see how earbuds perform against other headphone categories.

To get this, we go to Category Sales Performance. Here we can see earbuds have performed well within the overall category over the last 12 months. They’ve also smashed it in terms of revenue.

Just to be sure, we can also examine how searches for our top keyword, ‘noise-canceling earbuds,’ have performed over the last year.

Search volume has gone down, but the share of paid clicks has substantially increased. This could indicate that this is a competitive category, and we may need to spend money to compete.

The alternative is to find another search term that has a lot of traffic. But is less competitive in terms of paid clicks like that Skullcandy term we found earlier.

We have only scraped the surface of what Similarweb Shopper Intelligence can do when preparing for a retail media campaign.

However, we can see there is plenty of opportunity.

Demand is steady and trending up. But we may need to buy Amazon’s ads if we are to compete with the big guns.

Retail media – where do we go from here?

Retail media networks have clearly made themselves part of mainstream media. It’s easy to see why they are being described as the third wave of digital marketing.

In the past, referring traffic to an ecommerce site would have been a successful outcome for Google, Facebook, or any content site.

And then, it’s up to the brand and the ecommerce store to convert.

Retail media networks remove some of this uncertainty. Here, advertisers already have a customer on the site who is closer to buying. They can also track and optimize for actual sales rather than clicks.

This is critical.

But it is still early days. Media buyers are struggling with fragmentation in terms of acquisition and measurement.

There are many networks to choose from, and competition can be high for some keywords.

Similarweb can help provide visibility across them all, whether it’s examining retailers across the board or focusing on the world’s number one online marketplace.

Try it yourself. Get a free trial of Similarweb’s web intelligence and shopper intelligence suites – unlock the insights you need to outperform the competition.

FAQs

What should brands consider when choosing a retail media network?

Brands should consider where their target customers are shopping and the specific capabilities of different networks. Research and strategic planning are crucial to avoid overspending and to choose the network that offers the best reach for their product category.

What is a retail media network?

A retail media network (RMN) is a platform created by a retailer that allows brands to buy advertising space within the retailer’s ecosystem. This includes the retailer’s website, app, and other digital properties, enabling brands to target consumers based on their shopping behaviors and preferences.

How many retail media networks are there?

There are numerous retail media networks globally, as many major retailers have developed their own RMNs. Examples include Amazon, eBay, Walmart, AliExpress (Alimama), Instacart, and Tesco. The number continues to grow as more retailers create their own advertising platforms.

Why is retail media booming?

Retail media is booming due to several factors: RMNs use first-party data to offer precise targeting based on consumer behavior. Various ad formats, such as sponsored products, display ads, and video ads, attract brands—the ability to adjust campaigns in real time and measure their effectiveness. The significant rise in ecommerce, accelerated by the COVID-19 pandemic, has increased the demand for retail media.

What types of retail media are there?

Retail media encompasses various types, including sponsored products, which are ads that appear alongside relevant product listings. Display ads are banner ads on retailer websites and apps. Video ads promote products within the retailer’s ecosystem. Native ads blend seamlessly with the content, providing a non-disruptive user experience. Programmatic ads are automated ads that target consumers based on real-time data and algorithms.

The ultimate edge in marketplace intelligence

Put the full picture at your fingertips to drive product views and sales