The UCP Era: Why Visibility Matters More Than Ever In Agentic Commerce

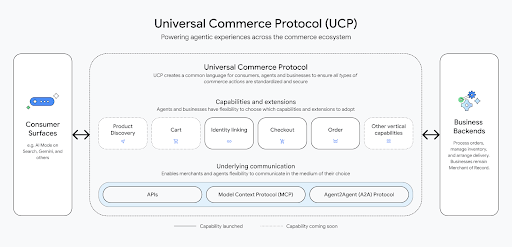

Last week, Google and Shopify announced the Universal Commerce Protocol (UCP), an open-source standard that fundamentally changes how commerce works in the age of AI.

UCP enables AI agents to not just recommend products, but complete entire transactions inside conversational interfaces like Google’s AI Mode, Gemini, and ChatGPT.

Gartner predicts that by 2026, 25% of search volume will move to AI assistants. With UCP, those conversations no longer end in clicks, they end in transactions, often without users ever visiting a website.

For brands, retailers, and marketplaces, this creates both unprecedented opportunity and a critical challenge.

What UCP actually does (and why it matters)

At its core, UCP standardizes the entire commerce workflow: product discovery, inventory checks, checkout, and post-purchase support, into a single protocol any AI agent can use with any merchant.

Instead of maintaining custom integrations for each platform, merchants integrate once and become accessible across all participating AI surfaces.

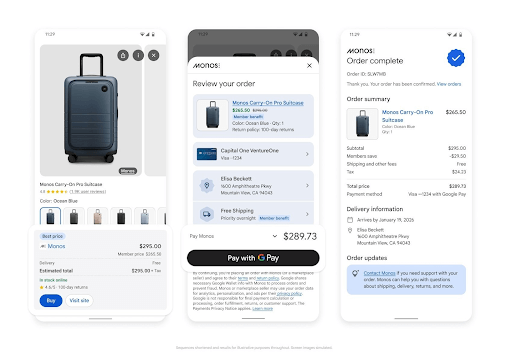

Google is rolling out three early capabilities powered by UCP:

- Direct Offers – Deals surfaced inside AI Mode when shoppers express purchase intent

- Business Agent – A branded AI representative that answers questions and completes transactions

- AI Mode Checkout – Embedded checkout using Google Pay or supported payment methods

The promise is clear: less friction, faster conversion, and fewer drop-offs. The cost is less obvious.

When decisions happen before brands can react

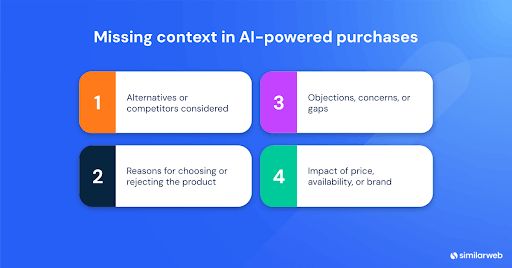

When purchases occur through AI agents, merchants receive fulfillment data but lose access to decision-making data.

What’s missing is the context that has traditionally powered growth and differentiation:

- Which alternatives or competitors were considered

- Why your product was chosen, or nearly rejected

- Objections, hesitations, or unmet needs expressed during the conversation

- How price, availability, or brand perception influenced the decision

You also lose visibility into how reviews and feedback are weighted. When an AI selects or rejects your product, was it sentiment, price, availability, or semantic fit?

Traditional analytics exposed this through clicks and A/B tests. In agentic commerce, those decisions collapse into an opaque AI evaluation layer brands can’t directly observe or test.

As BCG notes, “your most valuable customer might not be a human,” and as Visa’s Chief Product Officer Jack Forestell explains, “people will have AI agents browse, select, purchase and manage on their behalf”.

That shift turns brands and retailers from customer-facing businesses into agent-serving systems. This is the real risk. You don’t just lose a channel. You lose the feedback loop that tells you why your business is winning or losing.

Merchants aren’t losing all visibility

Merchants aren’t losing all visibility, but they are losing the most valuable layer: the context between intent and purchase.

As purchases move into AI interfaces, meaningful signals still exist, especially in search. Google Search Console continues to surface impressions and position data, including keywords with zero clicks but real visibility. In simple terms, you can still see where your brand shows up, even when users never visit your site.

Google has confirmed that AI features like AI Overviews and AI Mode are included in Search Console performance reports, just like traditional results.

This reframes the challenge. Visibility still exists, but it’s fragmented, indirect, and increasingly upstream of conversion.

Because Google doesn’t yet offer a way to separate AI-driven visibility from classic organic clicks, merchants can see that they’re appearing, but not whether that visibility lives inside an AI interface or a standard result.

That’s why embedding visibility and actionability directly into ecommerce platforms matters more than ever. Done right, it helps close the insight gap by showing:

- When and where products and brands appear

- What content resonates across the full funnel

- Which competitors surface in AI Mode for high-intent prompts

Where brands and retailers see things differently

UCP doesn’t affect everyone equally. It creates two distinct competitive battlegrounds, each with its own rules.

For brands: The semantic relevance game

In the UCP era, brands don’t compete for rankings. They compete to become trusted inputs to AI systems.

AI agents evaluate products based on semantic relevance, review sentiment, and execution signals, often before a shopper sees any options. Reviews are no longer just social proof; they are decision data. AI systems synthesize them to understand real-world performance, common issues, and whether a product delivers on its claims.

Brands with inconsistent sentiment, unresolved quality issues, or unclear positioning are filtered out early, without explanation.

As a result, brand competitiveness increasingly depends on:

- How AI agents describe your products and claims

- Whether your brand appears credible and authoritative in AI responses

- Consistency of messaging across AI platforms

- Visibility in on-site search across retail partners

- Competitive pricing and in-stock availability at evaluation time

The channel optimization challenge

Winning the AI recommendation is only half the battle. The second decision – where the purchase happens – often determines margin, data access, and long-term advantage.

AI agents choose channels based on price, availability, shipping speed, convenience, and past performance. Brands therefore have to optimize beyond DTC conversion alone:

- Keep DTC competitive on price, shipping, and inventory

- Avoid stockouts and pricing gaps across retail partners

- Understand which channels AI agents favor by category or context

- Balance DTC margins against the signals of marketplaces

A brand that wins relevance but loses channel selection still loses the sale, and may train AI agents to favor competitors with stronger multi-channel execution.

For retailers and marketplaces: The execution excellence game

Retailers compete on execution and economics. AI agents will increasingly prioritize merchants that reliably convert intent into successful outcomes. The signals that matter most include:

- Price competitiveness and promotions

- Assortment breadth and relevance to shopper needs

- Inventory availability and out-of-stock frequency

- Shipping speed and fulfillment reliability

- Breadth and freshness of in-demand brands

- Returns experience and customer satisfaction metrics

In an agentic world, execution failures don’t hurt performance – they erase relevance.

Retailers that are overpriced or out of stock will quietly disappear from AI recommendations, opening the door for smaller, more agile players to compete with giants on pricing, availability, and assortment.

The multi-channel dilemma: When your brand competes against itself

Here’s a question that keeps brand leaders up at night: When an AI agent recommends your product, which version gets selected? Your DTC site? Amazon? Walmart? A specialty retailer?

This isn’t a theoretical problem. It’s happening right now, and it fundamentally changes the economics of brand strategy.

The AI agent’s decision tree

When a shopper asks an AI agent for a product recommendation, and your brand wins that recommendation, the agent must then decide where to send the purchase. The factors influencing this decision include:

- Price and promotions – Is your DTC site offering a better deal than Amazon, or vice versa?

- Shipping speed and cost – Does Amazon Prime beat your standard shipping?

- Inventory availability – Is the product actually in stock across all channels?

- Assortment breadth – Which retailer offers the best selection of sizes, colors, or related products?

- Trust and convenience – Does the shopper already have an account? Payment saved?

- Return policies – Which channel offers the easiest returns?

- Historical performance – Has the shopper successfully purchased from this retailer before?

The strategic tension

This creates a profound tension for brands. You’ve invested in building your DTC channel for higher margins and customer data. But AI agents might consistently favor Amazon because of faster shipping and embedded checkout.

You win the semantic relevance battle: AI chose your brand over competitors – you lose the economics battle when the sale happens at a marketplace with higher fees and zero customer data.

What this means in practice

- A premium brand might find that AI agents default to Amazon even when their DTC site offers exclusive colorways or bundles

- A brand offering a discount on its own site might still lose to a retailer with faster fulfillment

- Brands optimizing for DTC conversion may discover that AI agents never send shoppers there at all

The visibility challenge deepens here. Not only do you need to know if your brand is being recommended, but where those recommendations are directing purchases, and why.

How Similarweb helps you see what’s actually happening

Agentic commerce doesn’t eliminate the need for competitive intelligence – it makes it essential. While UCP may limit what data flows after a transaction, the real battle for visibility happens before the AI agent makes its recommendation.

At Similarweb, we provide a unified view across the entire digital commerce ecosystem, from traditional web traffic to AI platforms to retail execution.

For brands: Maximize AI, search, and retail visibility

Gen AI Intelligence

Gen AI Intelligence shows you how your brand actually appears across AI platforms like ChatGPT, Gemini, Perplexity, and others, based on real user prompts and real AI responses.

You can:

- Monitor AI brand visibility across topics and competitors on a daily basis

- Identify which domains, pages, and sources influence AI recommendations

- See the exact prompts where your brand appears or is missing

- Understand sentiment and context around AI-driven brand mentions

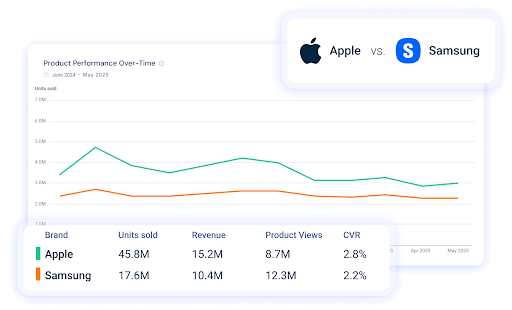

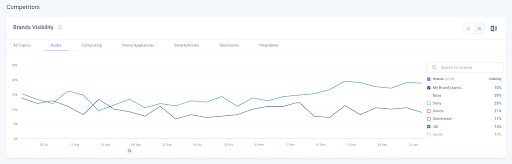

For example, using Gen AI Intelligence with a brand like JBL, we can see its visibility score for audio equipment is steadily increasing with a strong presence in high-intent comparison prompts, while Samsung’s visibility is gradually declining. This signals a shift in AI-driven consideration well before it shows up in sales data.

Cross-channel visibility: Understanding where AI agents send your customers

When AI agents recommend your brand, where do purchases actually happen? This is no longer a passive question, it’s a strategic imperative.

Cross-Retail IQ (our cross-retail analytics platform), combined with our web traffic data, gives you a unified view of performance across every sales channel. You can quickly see where AI-driven demand is being captured and where it’s leaking.

With this view, brands can:

- Compare traffic and conversion performance across DTC and retail partners

- Identify which channels win by product category or customer segment

- Spot pricing or availability gaps that push AI agents toward specific retailers

- Monitor competitive positioning across every channel where you’re sold

- Detect shifts in channel preference before they impact revenue

The goal isn’t just to win the AI recommendation, it’s to win it on your preferred channel, with clear insight into what’s driving AI agents’ channel decisions.

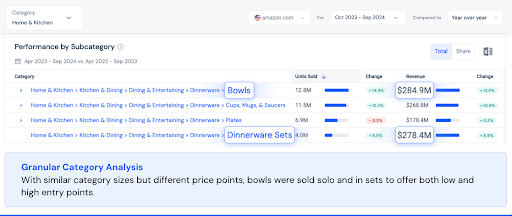

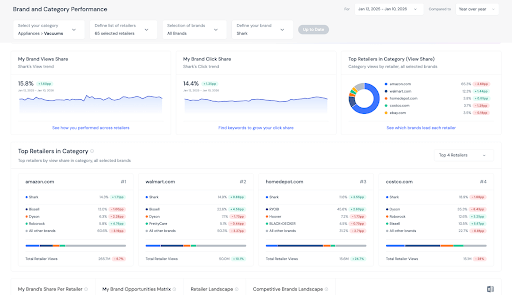

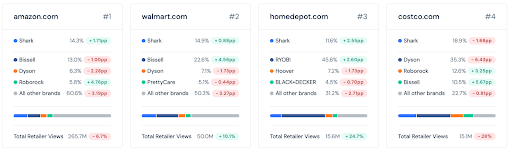

Using Cross-Retail IQ, brands can benchmark growth against competitors and pinpoint which retailers are driving results. For example, in the US vacuum category, Shark’s growth is led by Walmart (+1%) and The Home Depot (+1.4% and +0.8% YoY), while underperforming partners can be quickly deprioritized.

We also see Shark maintaining a stable brand views share (15.8%) and brand clicks share (14.4%) over a 52-week period – signaling strong, consistent positioning across retailers.

On-site search inside retailers and assortment visibility

As AI agents increasingly rely on retailer signals, visibility within retailer search, shelf presence, and assortment depth are becoming direct inputs into recommendations.

Cross-Retail IQ extends AI visibility into the retail layer, with coverage across 680+ retailers. Brands can see not just where shoppers click, but how shelf share and attention, including the impact of retail media, act as proxy signals for relevance and availability.

These signals increasingly determine which brands AI agents treat as default options, and where search visibility aligns or breaks across channels.

For example, analyzing LEGO’s top competitors’ top 10 keywords across the 20+ retailers it sells through in the UK reveals where whitespace exists for both PDP content optimization and retail media efficiency. This includes identifying paid opportunities around the terms competitors are seeing the strongest growth in.

Brand health and trust signals

Similarweb’s Brand Health Tracking rounds out the picture by monitoring the trust signals that influence AI recommendations, including review sentiment, brand mentions, content quality, and competitive positioning across the web.

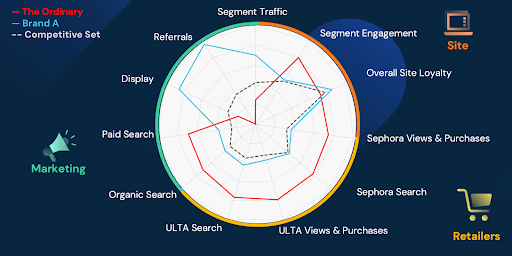

As seen below, Brand A – the top competitor to The Ordinary – outperforms the competitive set in brand awareness within the US skincare category, particularly across onsite loyalty, display, and referral KPIs. However, The Ordinary is winning on retailers and Google Search.

This bird’s-eye view highlights where each brand is strong and where it needs to improve, making it a critical success factor for shaping both AI visibility and brand strategy.

For retailers and marketplaces: Win on execution, price, and availability

Competitive execution at scale

For retailers, Cross-Retail IQ delivers a unified view of competitor performance across other retailers, such as Amazon, Walmart, Target, and eBay. Teams can track:

- Category growth and demand shifts

- The fastest-growing brands and SKUs

- Price positioning vs. competitors

- Assortment gaps that limit AI recommendations

Assortment benchmarking: What consumers are actually finding

AI agents don’t just check if you have a product – they evaluate your entire assortment against competitors.

Cross-Retail IQ enables retailers to:

- Benchmark assortment coverage against competitors by category and subcategory

- Identify gaps where competitors offer brands or variants you’re missing

- Track which assortments Gen AI platforms favor in recommendations

- Monitor assortment velocity to spot which retailers are expanding fastest in key categories

For example, if AI agents consistently recommend Target over your store for home goods, Cross-Retail IQ can reveal whether it’s because Target carries 40% more SKUs in that category, stocks brands that are trending in AI conversations, or has better availability across popular items.

Shopper Intelligence: Where demand actually converts

Shopper Intelligence enables deeper, retailer-specific analysis with weekly product-level data, traffic channel insights, and conversion metrics.

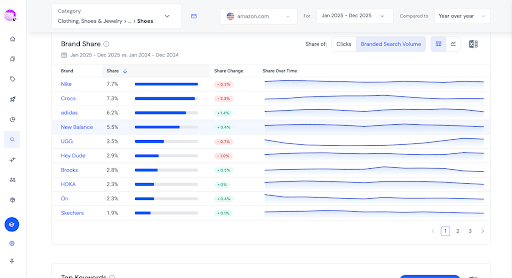

For example, using Shopper Intelligence, we can see that in the men’s shoes category on Amazon.com, brands like adidas, Brooks, and New Balance are experiencing growth in Branded Share, clear indicators of rising demand and the types of brands AI agents are increasingly likely to recommend.

Pricing and availability: Table stakes for agentic commerce

When purchases are made by AI on behalf of shoppers, price and availability stop being “nice to have” optimizations. They’re the basic requirements for being considered at all.

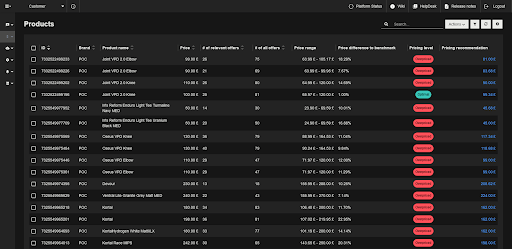

Similarweb’s digital shelf and pricing intelligence capabilities (powered by XPLN) allow teams to:

- Monitor real-time product availability and detect out-of-stock risks early on

- Track pricing, promotions, and map compliance across retailers

- Identify revenue risk from availability-vs-demand mismatches

- Ensure high-intent products are actually eligible for AI recommendations

For example, a product may appear frequently in AI shopping prompts but never surface in recommendations because it’s often out of stock or priced higher than close alternatives.

When comparisons happen instantly, these issues don’t show up as gradual performance declines – they result in immediate exclusion, often without brands realizing what went wrong.

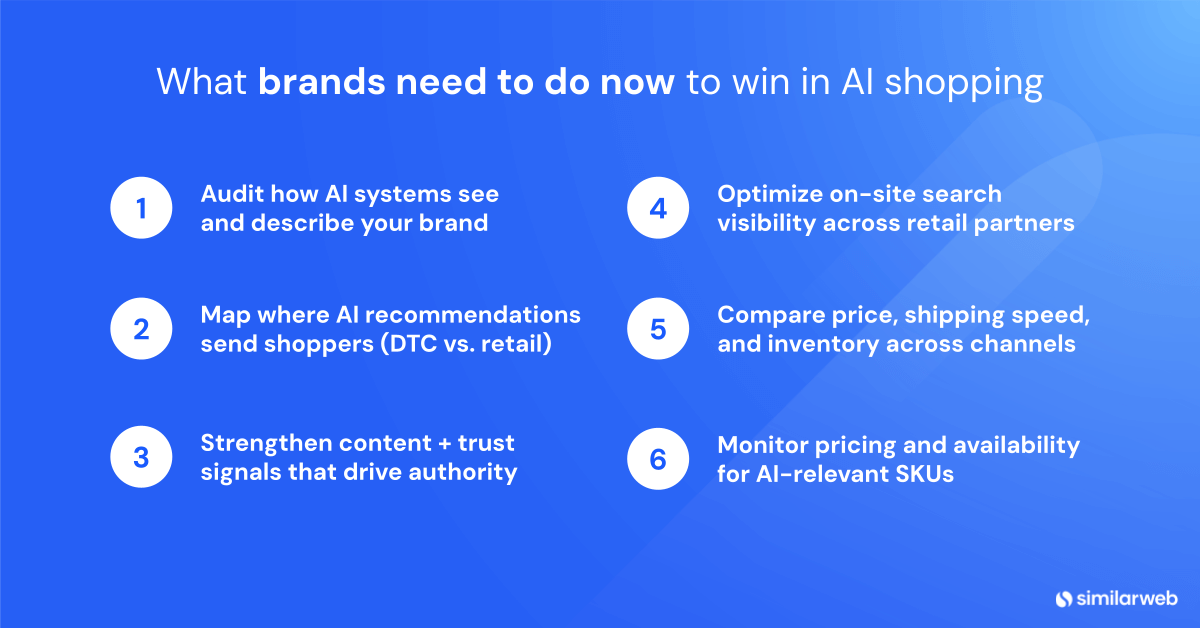

What you should do right now

Whether you’re a brand, retailer, or marketplace, the priorities are becoming clear.

For brands:

- Audit how AI systems see and describe you today

- Map where AI recommendations send shoppers across your DTC and retail channels

- Strengthen the content and trust signals that influence authority

- Optimize on-site search visibility across retail partners

- Compare pricing, shipping speed, and inventory availability between your DTC site and retail partners

- Monitor pricing and availability for AI-relevant SKUs

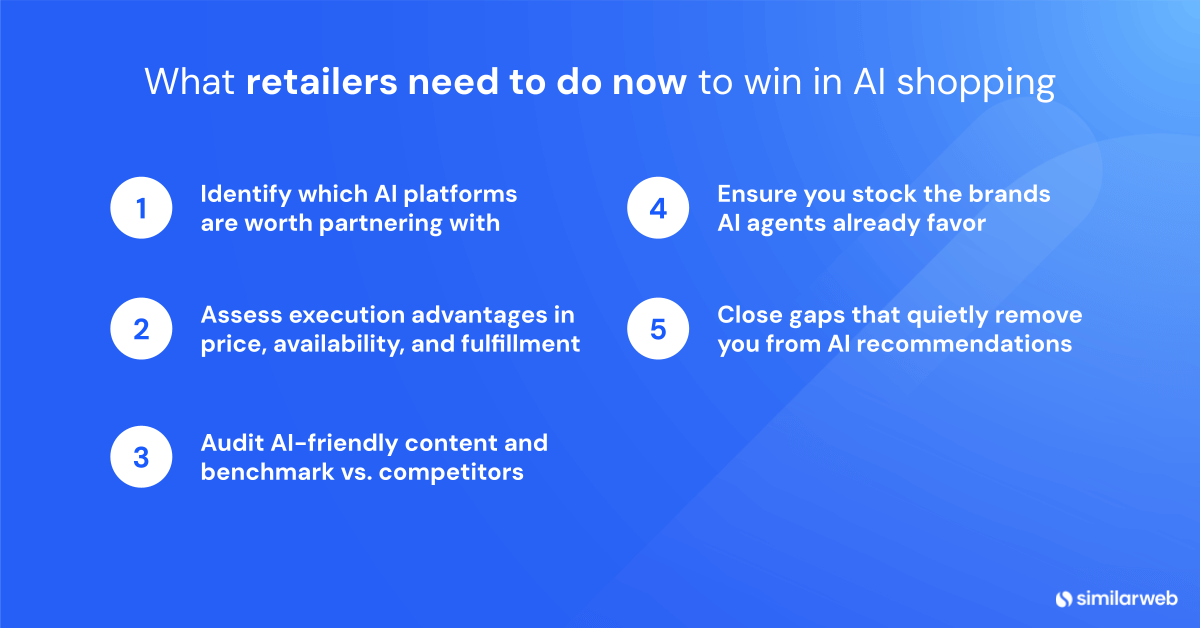

For retailers:

- Identify which AI platforms are worth partnering with

- Assess execution advantages in price, availability, and fulfillment

- Audit your content (gen ai friendly) and benchmark visibility against competitors

- Ensure you stock the brands AI agents are already favoring

- Close gaps that silently remove you from AI recommendations

Bottom line: Growing visibility is the real competitive advantage

UCP represents a disruptive change in how commerce works. It delivers convenience for consumers and reach for merchants, but it also risks turning digital commerce into a black box.

The winners in agentic commerce won’t be the companies that simply integrate with UCP first. They’ll be the ones that maintain deep visibility into competitive dynamics, execution signals, and the factors shaping AI-driven decisions.

The tools to navigate this transition already exist. The real question is whether you’ll invest in visibility while others are still trying to understand what questions to ask.

Ready to future-proof your commerce strategy? Discover how Similarweb’s industry-leading data for websites, apps, and the retail ecosystem is helping leading brands and retailers win in the age of agentic commerce.

The ultimate edge in marketplace intelligence

Put the full picture at your fingertips to drive product views and sales