From Prompts to Purchases: How ChatGPT and Rufus are Changing How We Shop

Gen AI has officially crossed the line from a ‘pretty cool tool’ to a measurable force in ecommerce.

In our latest webinar, From Search to Shop, we went deep into the world of ChatGPT, Amazon Rufus and AI-native discovery and how it’s changing the consumer journey at a speed never before seen.

The takeaway is clear:

AI is no longer happening around ecommerce, it’s happening inside it. AI has now moved past helping shoppers search for products, and is now redefining how they shop, too. And a lot of the impact is not currently obvious to retail brands.

Below, we break down the most important insights and actionable takeaways from the discussion:

1. AI is the new starting point on the customer journey

The biggest shift isn’t technological, it’s behavioral.

Consumers are no longer going straight to retailers, search engines or marketplaces. Their starting point is an AI assistant.

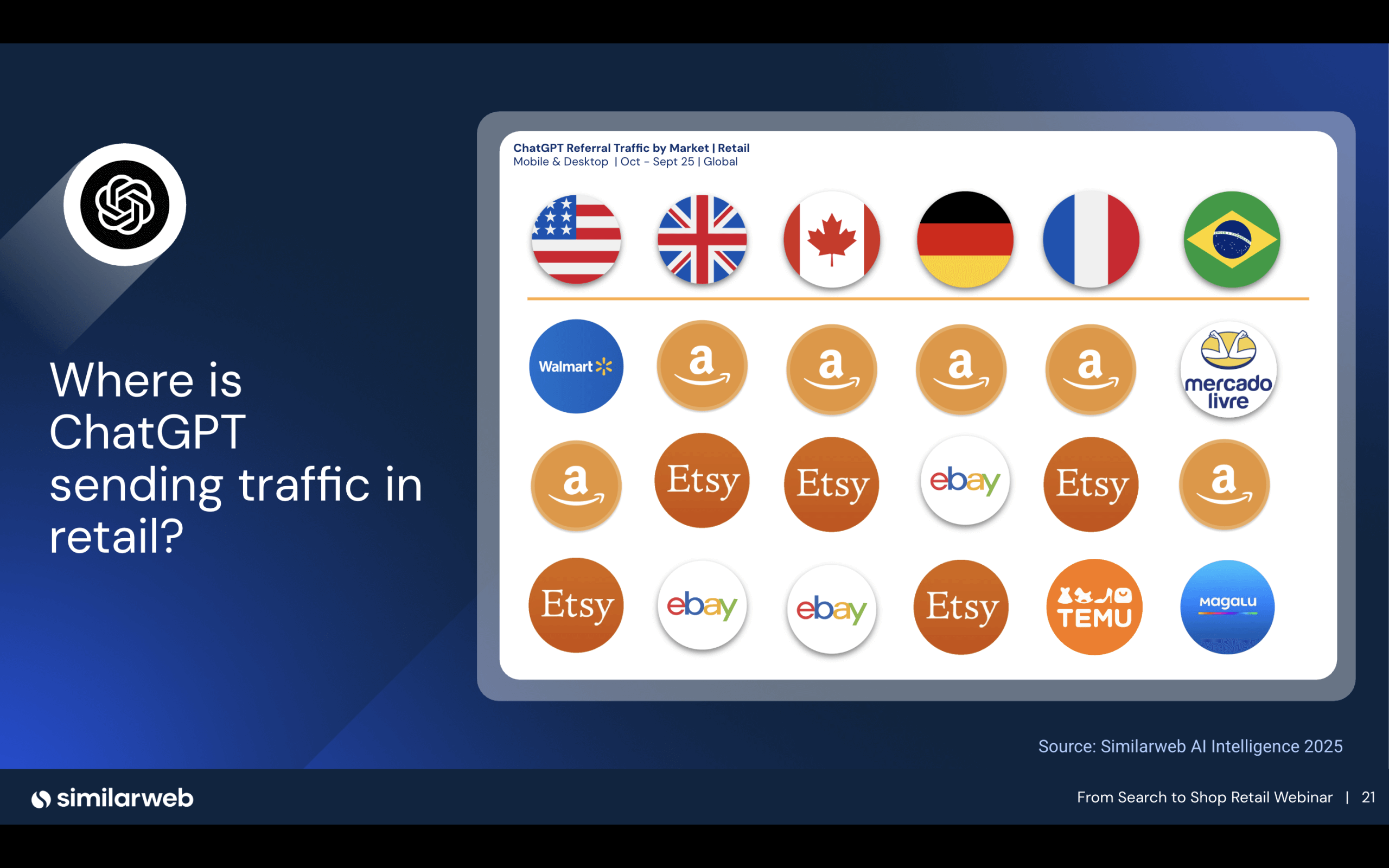

Take ChatGPT. Shoppers have been using it to ask questions, compare products and get recommendations for a while. But now, more and more, they are clicking the product links that are recommended in the thread.

So, we’re looking at 2 billion monthly visits and 800% growth in outbound referrals for ChatGPT. And this new behavior is growing extremely fast.

This matters because: AI changes when and how demand forms.

For example, in the electronics buying funnel, we’ve seen that:

- 38% of AI prompts occur in the interest stage

- 24% in consideration

- Only 11% make it to evaluation

Meaning: 89% of AI-driven influence happens before retailers see a single site visit.

2. ChatGPT is driving 5x more shopping behavior than you think

If you only track referral traffic from ChatGPT, you’re looking at the tip of the iceberg.

People don’t only click referral links from ChatGPT. They’re more likely to xtake the recommendation, open a browser and then buy. If you only measure the click, you miss out on a big part of the consumer journey.

Most users treat ChatGPT like a trusted advisor and then take things into their own hands. It may look something like this:

Get recommendations from ChatGPT, open Google → Walmart → Amazon directly.

So, their behavior is shaped by ChatGPT, but attributed elsewhere.

And brands that rely on last-click attribution simply won’t get the full picture.

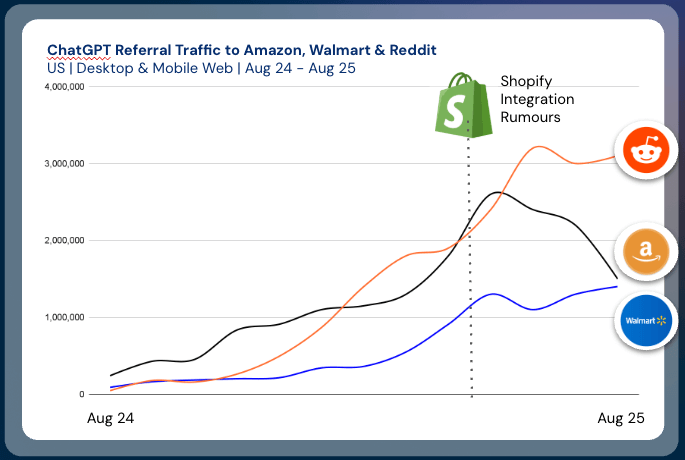

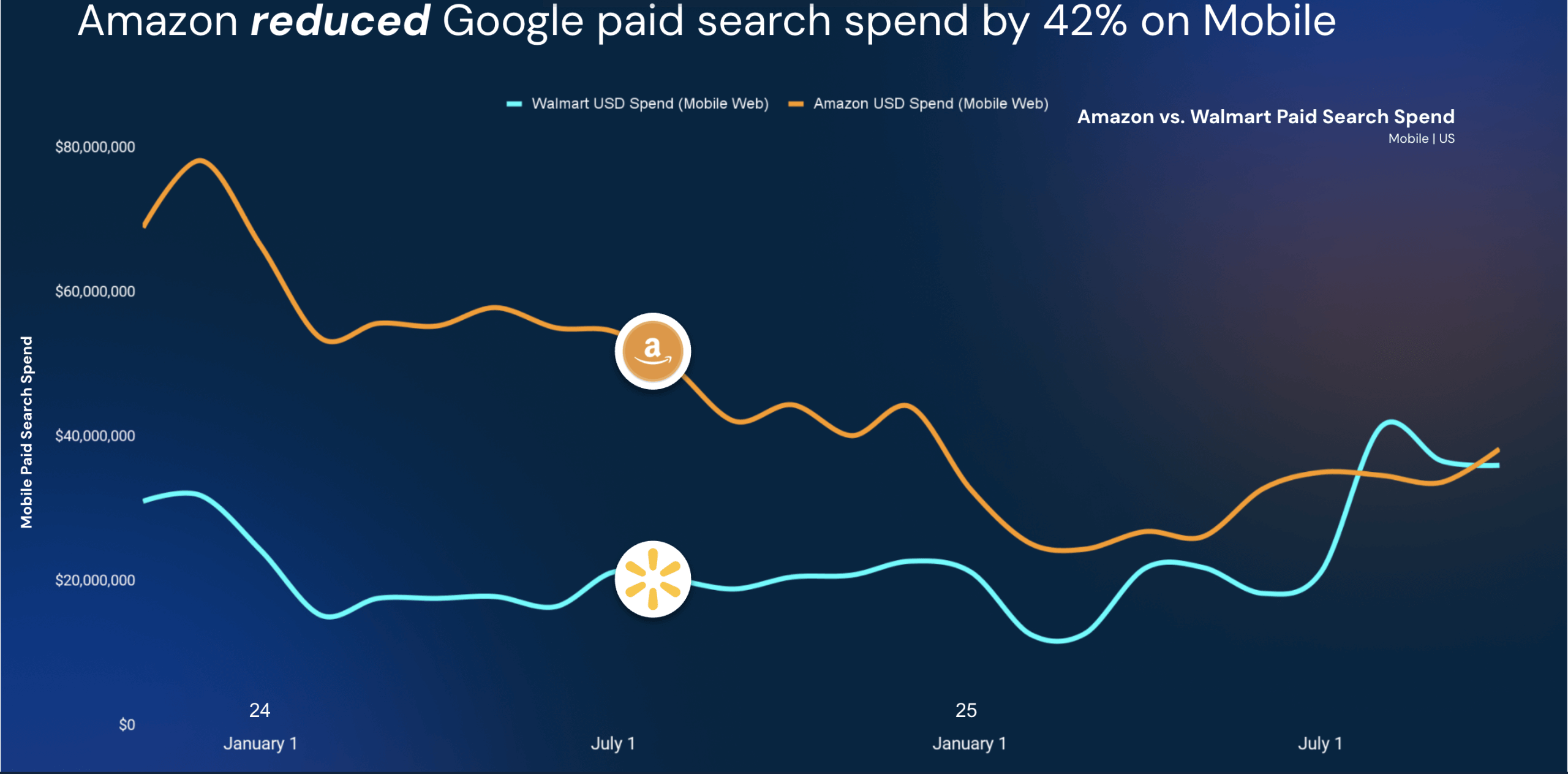

3. Walmart is gaining more traffic with Paid Search and GenAI

One of the biggest trends highlighted in the discussion was Walmart’s recent digital surge.

Why Walmart is gaining shares:

- Amazon strategically cut Google paid search spend

- Walmart increased its spend 64% year-over-year (YoY) in August to September

- ChatGPT referrals rose to 18.5% of all Walmart referral traffic in October

- Telcos entered the chat with locked/unlocked iPhone 17 listings

- Smartphone and laptop pageviews also spiked

The relationship between having a successful paid search strategy and GenAI recommendation is showing measurable growth in Walmart’s traffic share.

Walmart benefited from Amazon’s paid search pullback as well as from where GenAI is sending shoppers next, because GenAI is redistributing clicks as well as competitive advantage.

Walmart didn’t just benefit from Amazon’s paid search pullback, they benefited from where GenAI is sending shoppers next – because GenAI isn’t just redistributing clicks, but competitive advantage, too.

4. Amazon’s Rufus actually converts

A huge misconception is that Rufus competes with ChatGPT for the research part of the new customer journey.

It doesn’t. Rufus is turning out to be more of a conversional tool that helps shoppers validate decisions, compare attributes and justify that final purchase.

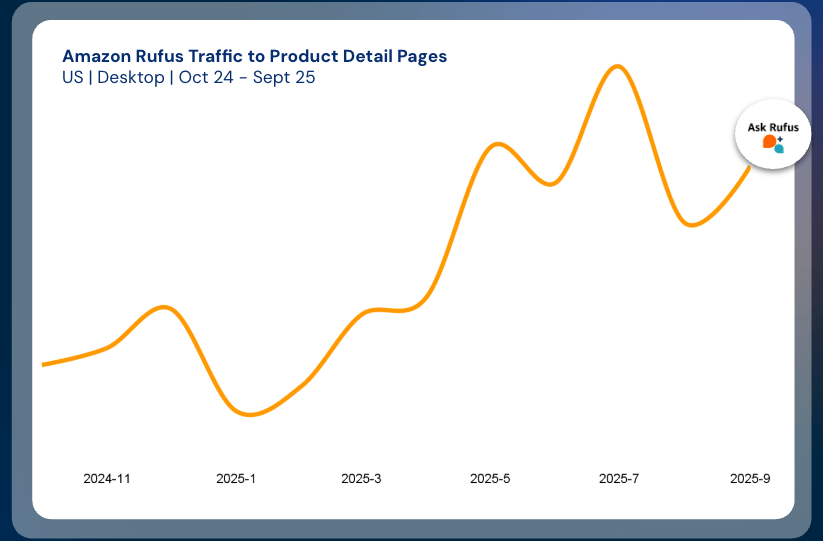

Similarweb’s data supports this:

- Rufus to PDP traffic is picking up speed

- Total volume is still small but influential

- Conversion rates on Amazon went up 1 percentage point since Rufus launched

- High-intent periods like Prime Day cause spikes in Rufus usage

- Categories most reliant on decisive journeys, like tools and electronics, over-index in Rufus usage

Basically, ChatGPT gets you to the airport, but Rufus helps you land the plane.

It’s the first clear separation of discovery AI vs. decision AI in retail.

5. Search isn’t dying, its role is just ‘under construction’

Don’t worry, on-site search is still growing pretty dramatically.

For top retailers, it’s:

- Walmart: +41%

- Target: +25%

- Amazon: +9%

This may seem counterintuitive in an AI-first world, until you understand the new flow:

AI → Retailer Search → Product Page → AI Assistant → Purchase

Consumers use ChatGPT to scope the product out, then search a retailer to actually purchase it.

AI doesn’t replace search fully, it just changes which searches matter. And this reinforces that retailers and brands must treat on-site search as a primary strategic channel, not an operational one.

What every brand’s strategy should look like in 2026

We’ve created a quick strategic playbook, built directly from the webinar’s key insights:

1. Treat AI visibility like SEO, but more urgently

Every brand needs a GenAI visibility strategy:

- Improve AI citation analysis

- Strengthen brand authority (Wikipedia, press, trusted sources)

- Fix entity accuracy

- Influence the topics you want ChatGPT to associate you with

- Use content to “train” LLMs about your products

ChatGPT is already shaping demand.

So brands must start shaping ChatGPT. Start by checking out your AI brand visibility.

2. Reinforce your position in on-site search

Search remains the #1 entry point on Amazon and Walmart. But the starting point for search is now influenced upstream by AI. Learn more about AI brand mentions to understand how to make yourself more visible to AI.

Also, if ChatGPT users ask about ‘best laptops for students,’ that keyword spike will show up on retailers days or weeks later.

Brands must:

- Know their top keywords

- Protect their click share

- Update weekly

- Track competitor’s AI performance

3. Reevaluate retail media investment with AI in mind

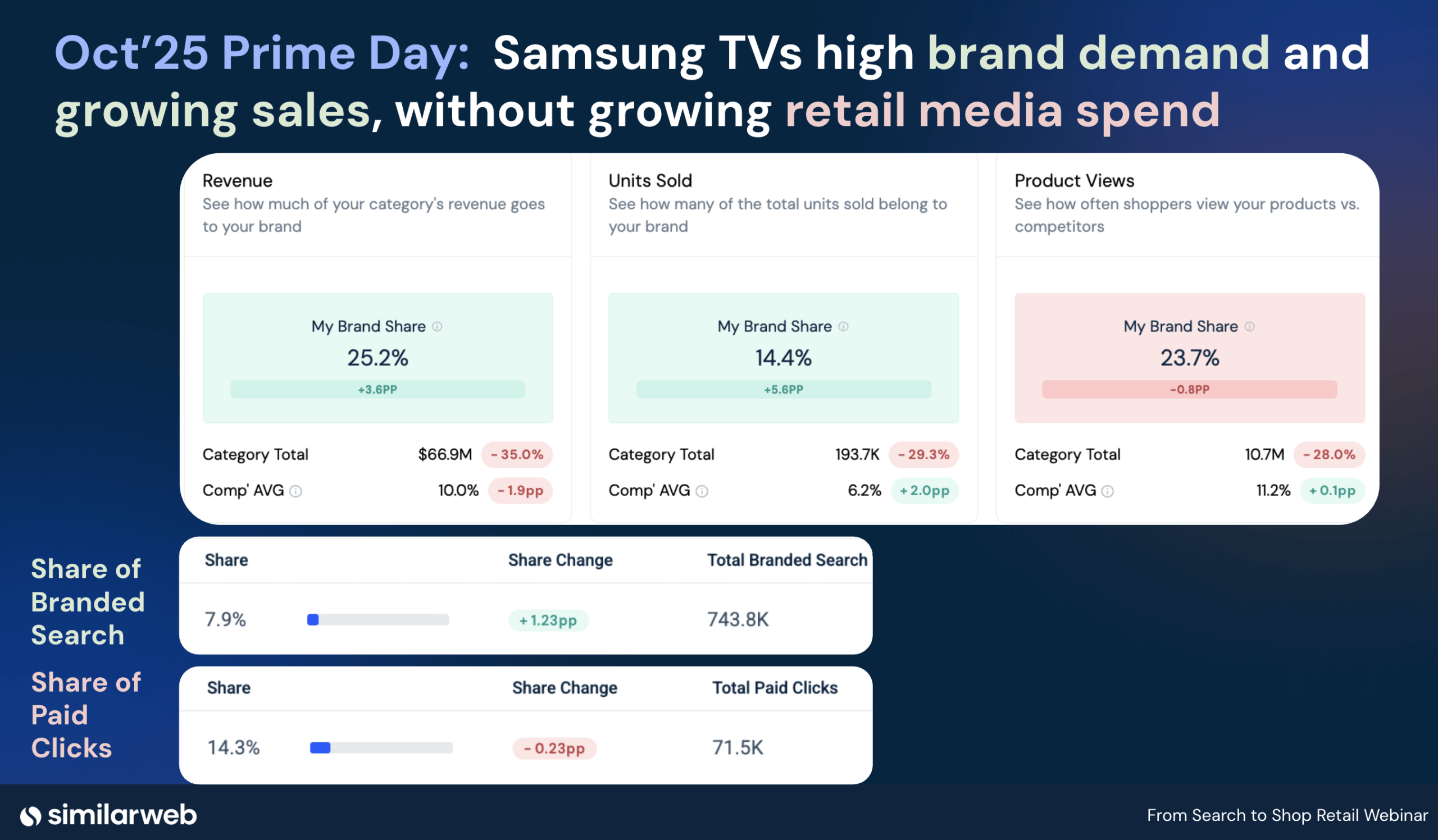

As you can see below, Samsung’s Prime Day case study in the webinar showed that strong AI visibility, organic brand demand and optimized PDPs can lift sales without increasing retail media spend:

This is the first signal of AI de-prioritizing paid search when done right.

4. Create conversationally-rich PDPs

One of the most practical insights from the webinar is that AI systems don’t rank products the same way traditional search engines do. They don’t care about keyword stuffing, rigid formatting or short bullet points.

AI now rewards context. Rufus, ChatGPT and other LLM-driven tools are built to understand things like nuances, scenarios, problems, personal needs and comparisons.

This means the content that performs best in AI-driven shopping isn’t very SEO-like at all. It’s more about real language that’s rooted in human experience, and the more detailed the better!

The example from Skechers proved it. They’re the #1 brand in traffic from Rufus within Clothing, Shoes and Jewelry. And their content is rich in:

- Context

- Use cases

- Conditions

- Customer stories

This is the content that wins with AI modules like Rufus.

A final word…

AI is quickly rewriting the entire shopping journey, as well as changing the boundaries of search and slowly redefining what ‘visibility’ means for brands.

The market is changing fast, so you need the most comprehensive digital intelligence to keep up. Similarweb is positioned at the center of this transformation, with the data, the behavioral signals, and the analytics to help brands not just keep pace, but lead in this new AI era.

Wondering what Similarweb can do for your business?

Give it a try or talk to our insights team — don’t worry, it’s free!