Heatmaps: Summer Travel Cooling, Ecommerce Recovering

Every two weeks, the Similarweb Investor Solution team produces a series of global and regional web traffic heatmap reports – snapshots of the digital economy’s gains and losses.

Key takeaways

- The strongest positive trends at the moment are in markets including cloud infrastructure, personal finance, retail trading, retail investing, and luxury retail. The personal finance traffic might be interpreted as a sign of people getting more budget conscious. On the other hand, might retail trading and retail investing growth be a sign of investors thinking the markets have hit bottom and are ready to bounce back?

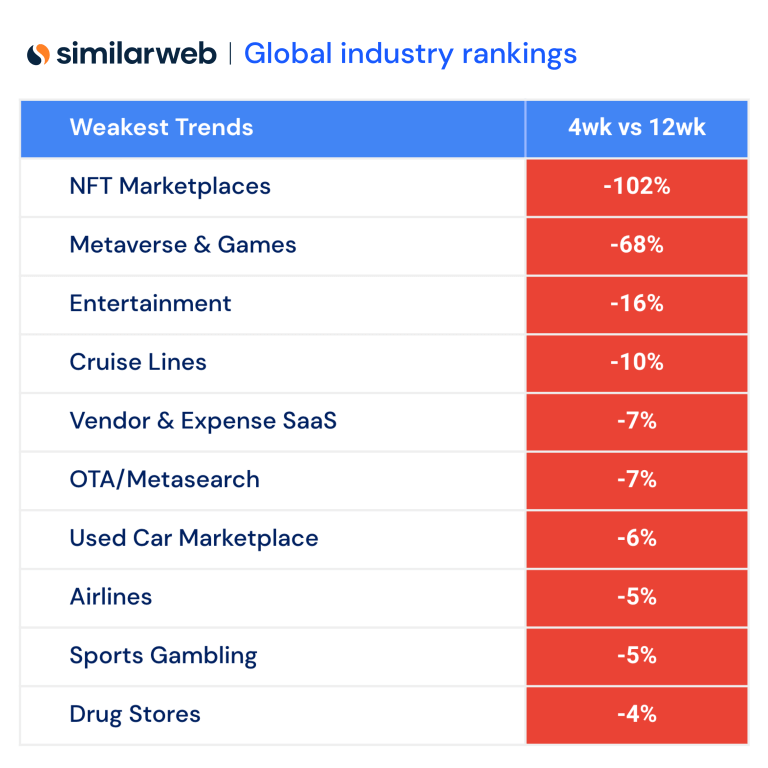

- The markets with the worst trends include NFT Marketplaces, Metaverse & Games, Entertainment, Cruise Lines, and other travel categories. Apparently, the digital audience is not as eager for a getaway, whether that’s an escape into imagination or another part of the world. Travel specifically may be feeling the impact of staffing shortages on the quality of the travel experience.

- The post-pandemic recovery of the travel industry has been a story all year, but that trend is becoming weaker as the year goes on. For example, traffic to cruise line websites was up 71% year-over-year within the past 12 weeks but if we look at the past four weeks the increase was 60% – a drop of 11%. In other words, the trend is moving in the wrong direction even though traffic is still up. Over the same period, airline traffic growth has fallen from 25% to 19% and online travel agency/travel search growth has dropped from 21% to 17%.

- The retail and ecommerce sector looks like it could be emerging from the doldrums. While its traffic was down 6% in the most recent two-week period, the numbers have been inching up.

- Other industries, while still down, show potential signs of life. For example, cryptocurrency exchange traffic was down 21% over a 12-week period. Over the last four weeks, traffic was still down but not as much, 17%. In other words, we categorize that traffic as “Rising,” meaning it looks like Crypto Exchanges may not be underwater forever. But while Exchanges netted a 4% improvement, another segment of the crypto market, NFT Marketplaces, is suffering through a 102% decline according to our web traffic heatmap metrics.

Here is a sampling of the industries covered:

How to read this: Each 2-week snapshot of industry traffic is color-coded green or red for year-over-year increases and decreases. Rising and falling trends are determined by comparing data from the most recent four weeks with the most recent 12 weeks.

The big picture

Our web traffic heatmap reports look at trends across the digital economy. Investor clients, including some prominent names such as Morgan Stanley, use these statistics as signals of positive or negative momentum. The chart below shows two-week snapshots of each industry’s year-over-year comparison with the traffic it attracted last year. The strongest positive numbers are the darkest green, while the biggest declines are the darkest red, and everything else falls somewhere in between.

Travel is an example of an industry shown as green or growing in each two-week snapshot but nevertheless flagged as “Falling” because that growth has slowed over the past four weeks. On the other hand, Travel’s gain for the last two weeks (23%) was stronger than for the previous two weeks. In the text to accompany the full report, our analysts talk about Travel potentially “stabilizing.”

The overall Crypto market, on the other hand, has been negative most of the year and is still falling. Even though the decline in traffic to Crypto Exchanges is slowing, it was still down 24% in the most recent two weeks. The overall market including NFT Marketplaces and blockchain-based Metaverse & Games was down 28%, year over year.

The best and the worst

Within each sector, we’ve also identified the most positive trends…

…and the most negative.

More red than green

So far in 2022, we’re seeing more red than green – traffic falling, rather than rising – across the digital economy. Even some bright spots like travel that have been growing are seeing their growth decelerate. On the other hand, note that EdTech, which has been in the red for the entire period covered by this report, shows signs of rebounding.

These are just a few highlights from the full Similarweb Heatmaps report, available as a free download..

The Similarweb Insights & Communications team is available to pull additional or updated data on request for the news media (journalists are invited to write to press@similarweb.com). When citing our data, please reference Similarweb as the source and link back to the most relevant blog post or similarweb.com/blog/insights/.

Disclaimer: All data, reports and other materials provided or made available by Similarweb are based on data obtained from third parties, including estimations and extrapolations based on such data. Similarweb shall not be responsible for the accuracy of the materials and shall have no liability for any decision by any third party based in whole or in part on the materials.

Wondering what Similarweb can do for your business?

Give it a try or talk to our insights team — don’t worry, it’s free!