AI Citation Gap Analysis: 7 Steps To Identifying & Closing Brand Visibility Gaps

When I first started optimizing for generative AI, it became clear that traditional SEO analyses and tactics no longer cover everything I need to know to achieve sustainable organic growth.

AI engines now answer questions directly and cite only a few sources. Zero‑click searches rose from 56% to 69% after Google rolled out AI Overviews, and fewer than 20% of searchers click an external link, dropping below 4% in AI mode.

Consumer behavior is changing too: the Capgemini Research Institute reports that nearly one in four consumers already shop with generative AI, and about 60% have replaced search engines with AI tools for product recommendations.

In short, generative AI engines are now a significant gateway to my brand, so I have to monitor and optimize for traffic and visibility within them.

AI citations can be fickle: Only 11% of domains overlap between ChatGPT and Perplexity, and half of all cited domains change monthly, but they’re not beyond SEO’s influence. Because of this volatility and opportunity, I created a guide for analyzing AI citations.

The next step is performing a citation gap analysis.

In this guide, I’ll use Similarweb’s AI brand visibility tools, with PayPal data as an example, to show how to compare a brand’s citation footprint with competitors, identify the topics and domains with the most influence, and discover where others are outperforming it.

What is an AI citation gap analysis?

AI citation gap analysis is the process of systematically measuring how often, where, and in what context your brand is cited in AI-generated answers compared with your competitors, across key topics, domains, and URLs.

Instead of just asking “Does my brand show up in AI results?”, I break visibility down into concrete layers:

- Which AI answers mention my brand (and which don’t)?

- Which topics am I strong or weak on?

- Which publishers and platforms are driving citations?

- Which specific pages are getting referenced?

By quantifying these patterns (brand vs. non-brand answers, share of citations, domain influence, and URL-level impact), I can see exactly where rivals are winning visibility that I’m not, identify missed opportunities with influential sites, and turn those gaps into a clear roadmap for outreach, content updates, and partnerships that improve my brand’s presence in generative AI engines.

Why AI citation gap analysis matters?

1. Generative AI engines are starting to shape user decisions.

In many queries, the AI answer encompasses the entire user experience, so visibility is measured by citations rather than ranking.

Similarweb’s researchers analyzed 24,000 conversations and 65,000 responses across ChatGPT, Perplexity, and Google and found that these systems foreground only selected sources, with news citations concentrated among a few outlets.

If a brand isn’t among those trusted sources, AI search won’t mention it.

2. Citations can be influenced.

Yext’s 2025 study shows that 86% of AI citations come from brand‑controlled sources: 44% from brand-owned web assets and 42% from listings, while forums like Reddit contribute just 2%.

Citation patterns vary with intent: objective questions lean on first‑party sites and local pages, whereas branded or subjective queries pull more from listings and reviews.

3. Benchmarking exposes gaps.

Comparing citations by domain, topic, and URL reveals hidden strengths and weaknesses. A PayPal competitor might dominate ‘digital wallets’ while it leads in ‘money transfers’.

Understanding those differences helps prioritize resources.

4. Insights drive action.

Once brands know which high‑influence domains cite their competitors, they can build relationships or produce content that fills those gaps, turning missed opportunities into visibility.

5. Now is the time to build leadership in new platforms.

More than half of U.S. consumers use AI engines weekly, yet 64% of marketing leaders are unsure how to measure success in AI search, and 72% expect AI search to affect acquisition more than traditional SEO within three years.

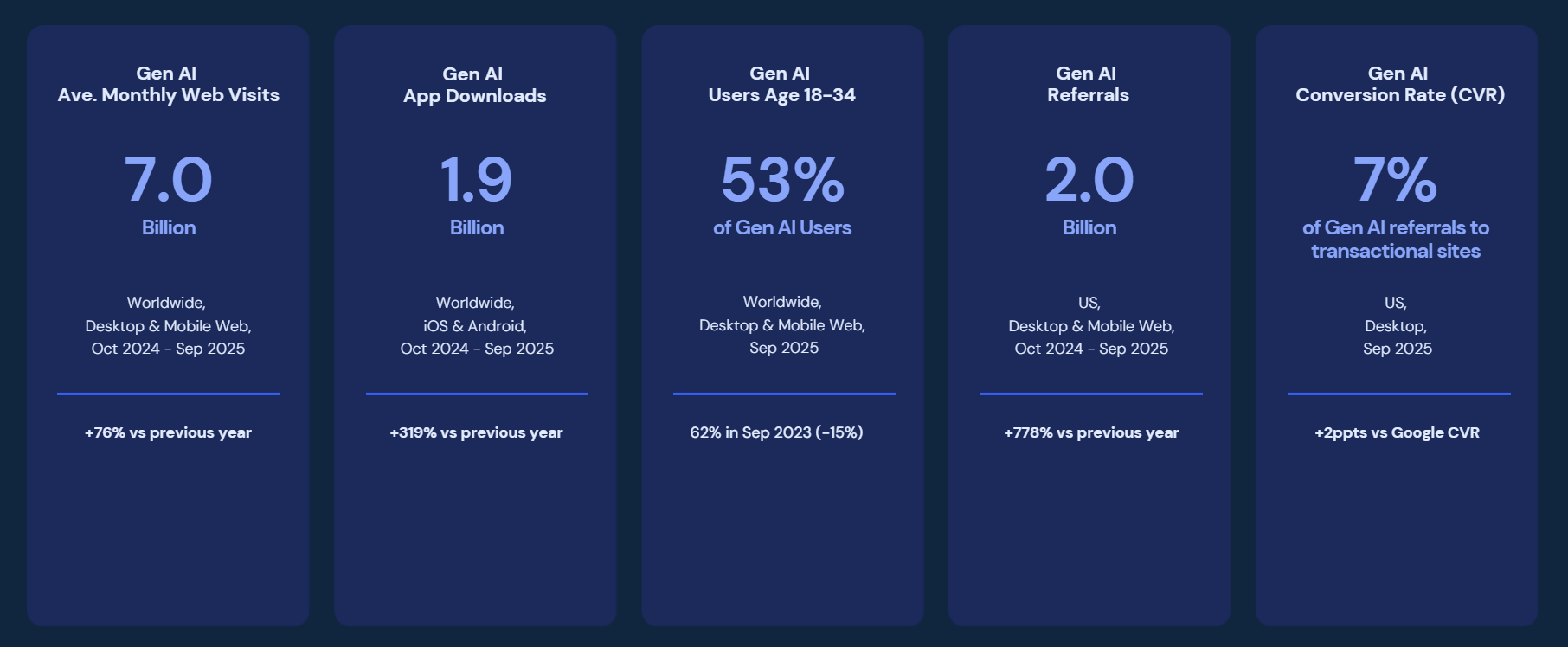

According to Similarweb’s 2025 Gen AI Landscape Report, monthly traffic to Gen AI websites grew by 76% Year over year to 7 billion visits. The same research also shows that Generative AI conversion rates are higher than Google’s, indicating that the traffic AI sends to websites is highly aligned with user intent and can be highly valuable.

Brands that start monitoring citations now will get ahead of the competition.

A Simple Framework for Citation Gap Analysis: D.E.E.P.

I like to break citation gap analysis into four phases using the D.E.E.P. framework:

1. Define: Goals and competitors

Clarify which topics and prompts are most relevant to my business, what success looks like (e.g., increased citations, higher domain influence scores), and who my key competitors are. Without a clear scope, the analysis becomes unfocused.

2. Explore: Analyze the citation landscape

Use Similarweb’s AI Brand Visibility features to view all citations across my topics, identify which domains are trusted, and categorize them. This exploratory phase helps benchmark my brand’s status.

3. Evaluate: Analyze gaps at multiple levels

Drill down into topics, domains, and URLs to quantify where competitors are outperforming me. Compare my site to competitors, analyze the influence scores of cited domains and URLs, and note which website categories (news, reviews, etc.) dominate.

4. Plan: Make data-driven decisions to act

Develop an action plan to close gaps. Decide where to create or optimize content, build partnerships or PR, add structured data, and monitor progress. Closing citation gaps is a continuous process, not a one‑off task.

Throughout this guide, I’ll refer back to these phases to show how the framework translates into concrete steps.

Step 1: Define visibility benchmarks

Before analyzing gaps, I’ll define what success looks like. For PayPal, my key questions are:

- Visibility vs competitors:

- How visible is PayPal compared with Apple Pay, Google Pay, and Stripe across all topics?

- Which brand is mentioned most often in AI answers?

- Topic‑level visibility share: Across topics such as digital wallets, ecommerce, etc., how does PayPal’s visibility compare with competitors?

- Citation distribution:

- How many domains cite PayPal vs its competitors?

- What is the average influence score of those domains?

- URL analysis:

- Which individual URLs contribute to citations?

- Are high‑influence sites linking to PayPal or its competitors more often?

I’ll use Similarweb’s AI Brand Visibility tool to answer each question.

Step 2: Evaluate overall brand visibility gaps

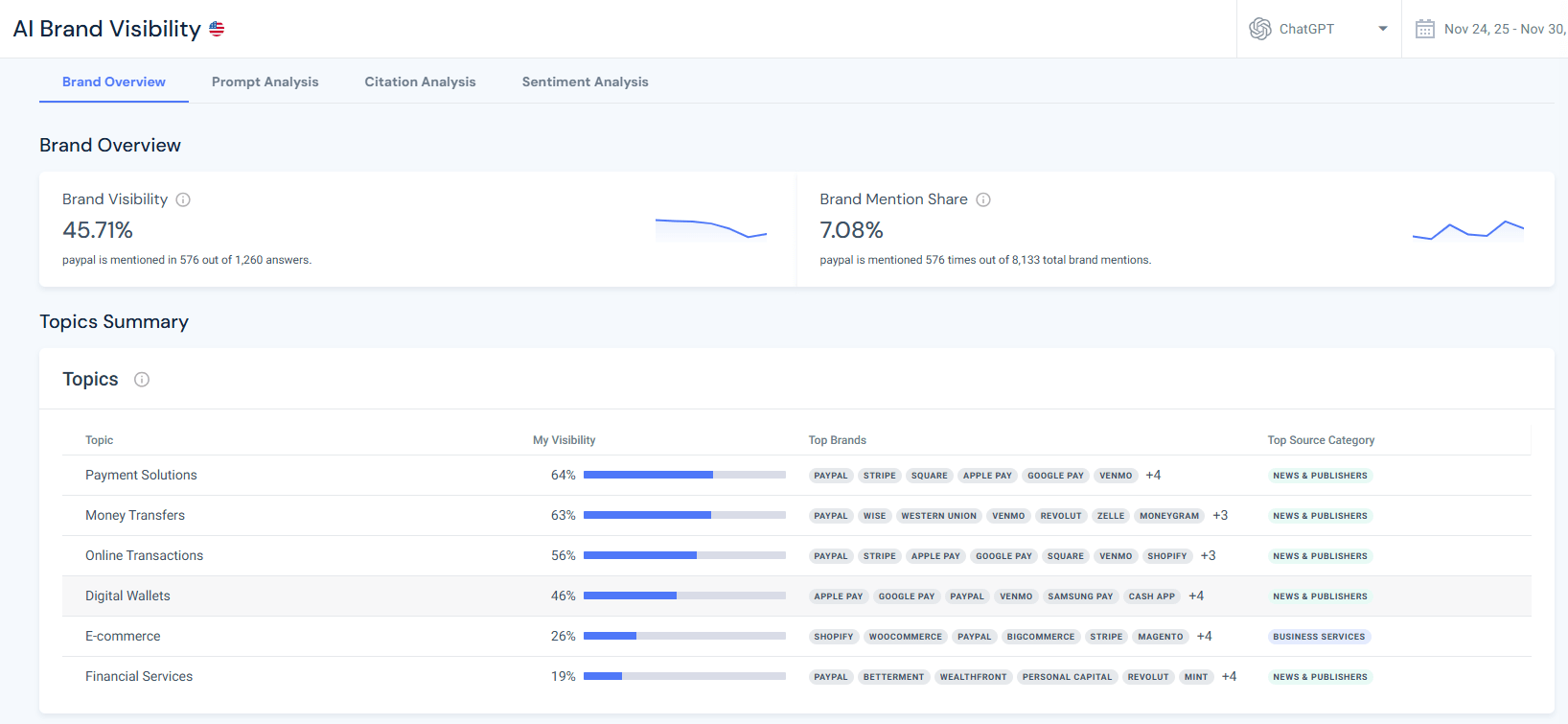

In the Brand Overview tab, I see the top‑level metrics: Brand Visibility and Brand Mention Share. These metrics answer my first question about overall visibility vs competitors.

Check brand visibility.

Brand visibility measures the percentage of answers that mention my brand in AI search among all answers across tracked topics.

In my example, PayPal’s brand visibility is 45.71%, meaning it is mentioned in 576 of 1,260 answers over the last seven days.

Brand visibility is a primary benchmark because it reflects how frequently AI models bring my brand into the conversation.

Check brand mention share.

Brand mention share measures the percentage of my brand’s mentions out of all brand mentions. PayPal’s share is 7.08%, representing 576 mentions out of 8,133 total brand mentions.

This metric reflects relative exposure: a high visibility but low share may indicate a crowded space with many other brands.

Compare to competitors (all topics)

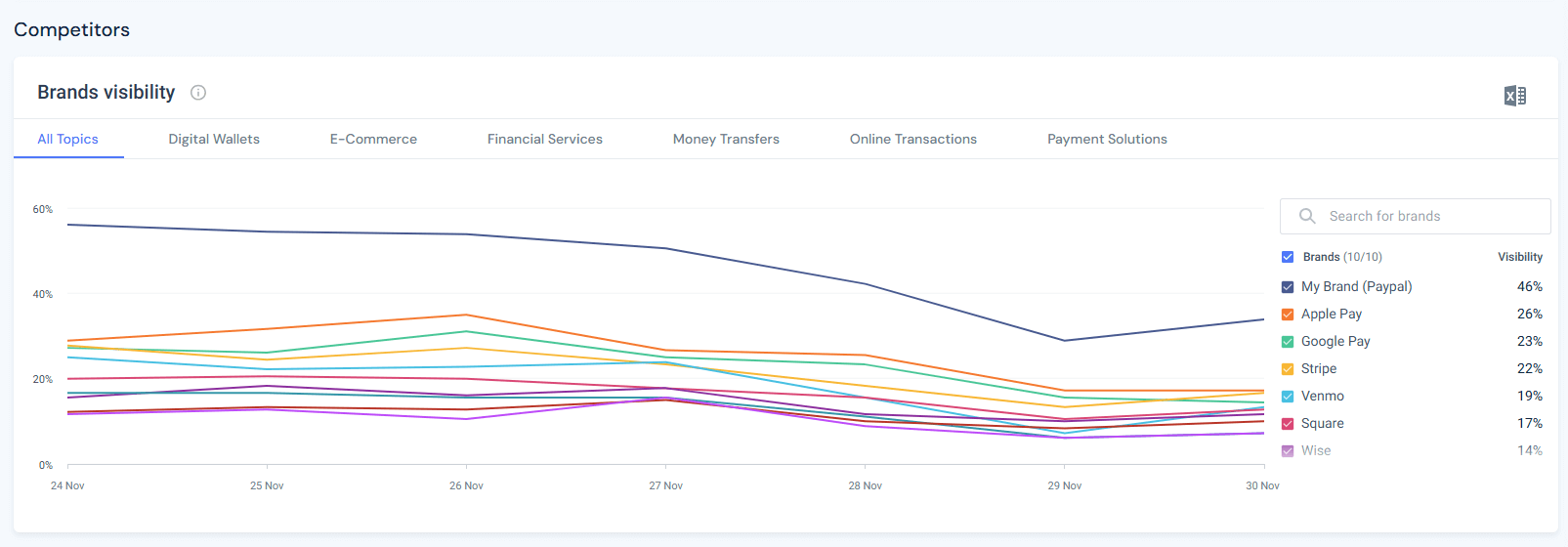

Scroll down to the Competitors section and observe the Brands’ visibility chart. It shows visibility percentages for PayPal and competitors across All Topics.

In my 7-day sample, the numbers were as follows:

| Brand | Visibility (%) |

| PayPal | 46 |

| Apple Pay | 26 |

| Google Pay | 23 |

| Stripe | 22 |

| Venmo | 19 |

| Square | 17 |

| Wise | 14 |

| Cash App | 11 |

These percentages are shown in the brand visibility chart. The chart also shows visibility trends over the past week, revealing peaks and declines for each brand.

A key observation is that PayPal’s visibility is roughly double that of Apple Pay and Google Pay across all topics. Another observation is that all brands in this chart experienced a decline in visibility over the past 7 days. These baseline benchmarks provide context for deeper analysis.

Step 3: Explore topic‑level visibility gaps

The overall view isn’t granular enough to highlight variations across topics. However, I can drill down by clicking the topic tabs in the competitor chart. I recommend analyzing at least five topics relevant to my industry.

For the PayPal citation gap analysis, I’ll start with Digital Wallets, Ecommerce, Financial Services, Money Transfers, and Online Transactions.

For each topic, I’ll check visibility percentages for PayPal and the topic’s top competitors. Then I’ll check their visibility per topic vs their main competitors.

This process will reveal PayPal’s strengths and weaknesses in terms of visibility, as well as its competitors’ weaknesses, which can later be used for my GEO (Generative Engine Optimization) strategy and prioritization.

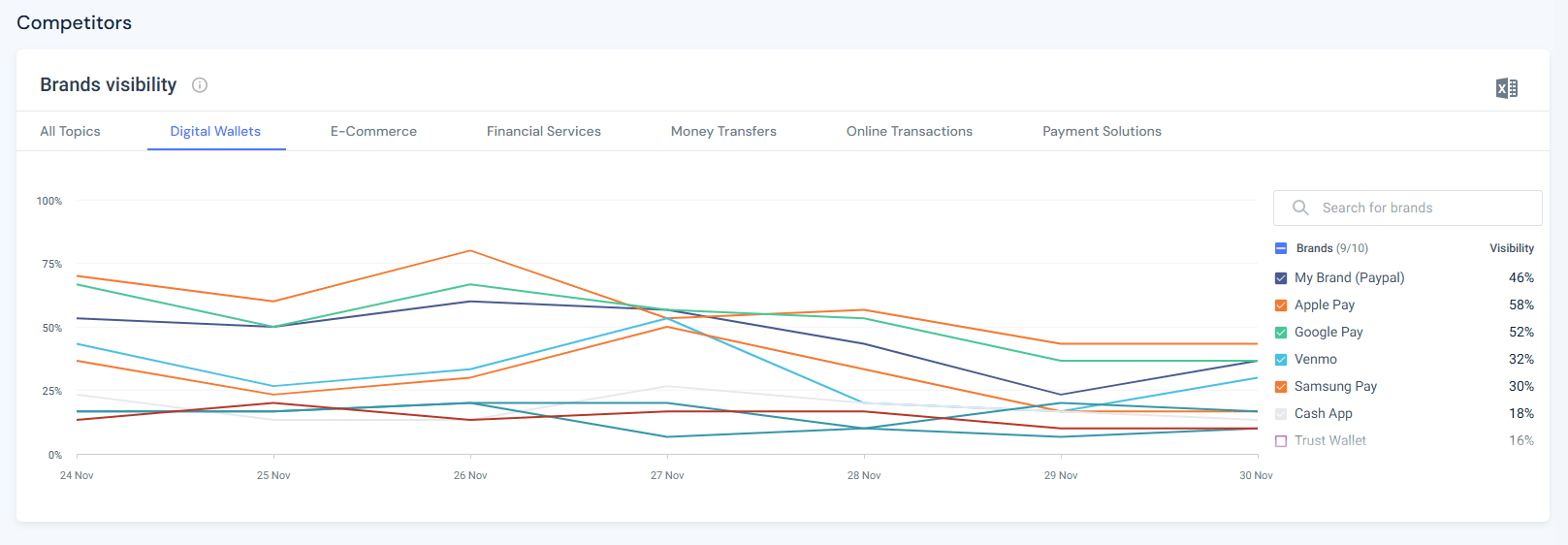

PayPal’s visibility in the “Digital Wallets” topic

When switching to the “Digital Wallets” topic, the chart shows that Apple Pay leads with 58% visibility, followed closely by Google Pay at 52%, while PayPal’s visibility declines to 46%. Competitors like Venmo and Samsung Pay also appear, but with lower shares.

The chart below shows the data over time:

What can I learn from this?

PayPal’s leadership in overall visibility does not translate to the Digital Wallets topic. Apple Pay and Google Pay dominate, highlighting a gap.

How can I close this gap?

To close it out, I’d invest in creating content on PayPal’s digital‑wallet features, improve partnerships, and ensure high‑authority domains discuss PayPal in this context.

High authority domains get cited more by LLMs, which means they carry a double value:

- Increased mentions when LLMs cite those high-authority websites

- Increased authority for PayPal (thanks to links from said high-authority domains), leading to increased citing of the PayPal brand itself.

This will create a cycle of constant seeding of LLMs with information that serves PayPal.

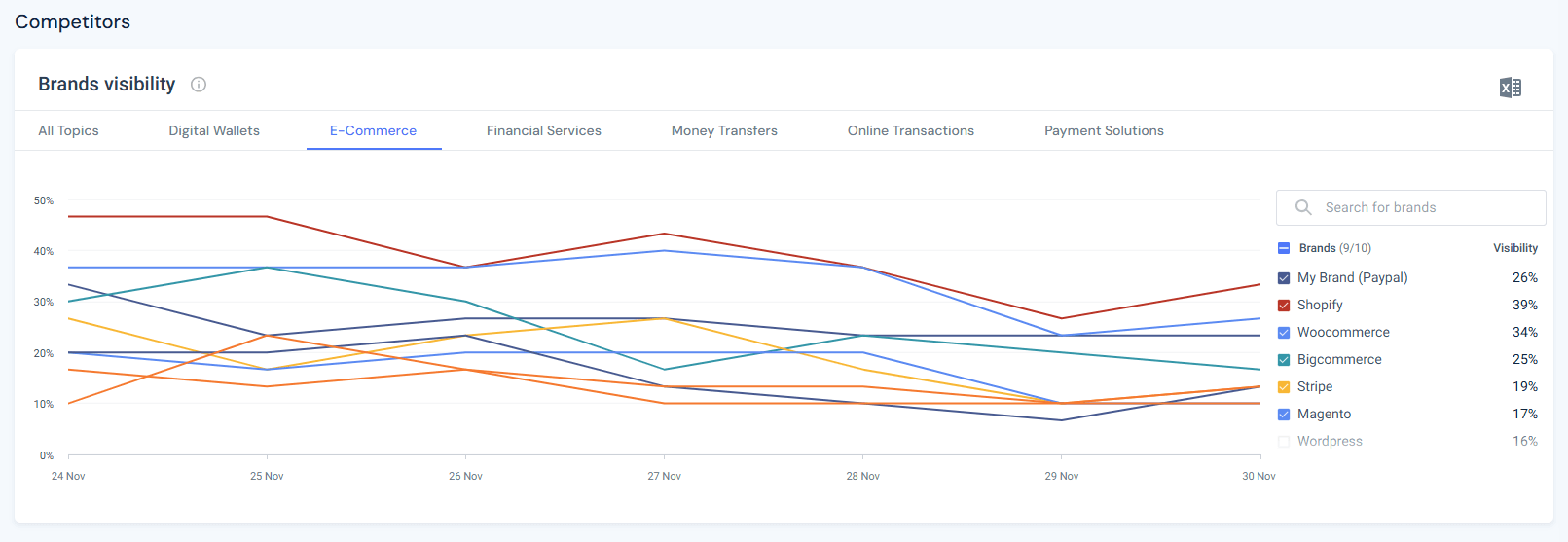

PayPal’s visibility in the “Ecommerce” topic

In the “Ecommerce” topic, the competitive set changes. Platforms like Shopify and WooCommerce, which are not direct payment services but act as an ecommerce infrastructure, appear. PayPal’s visibility is 26%, while Shopify leads with 39% and WooCommerce with 34%. Stripe appears at 19%.

See the past 7 days’ trend below:

What can I learn from this?

- PayPal’s visibility in ecommerce is lower than that of platforms built into online stores.

- PayPal’s core competitors have very low visibility shares and are not even in the top 10.

How can I close this gap?

To improve, I’d recommend that PayPal integrate more closely with ecommerce ecosystems and encourage merchants to highlight PayPal’s benefits in documentation or support content that AI models might cite.

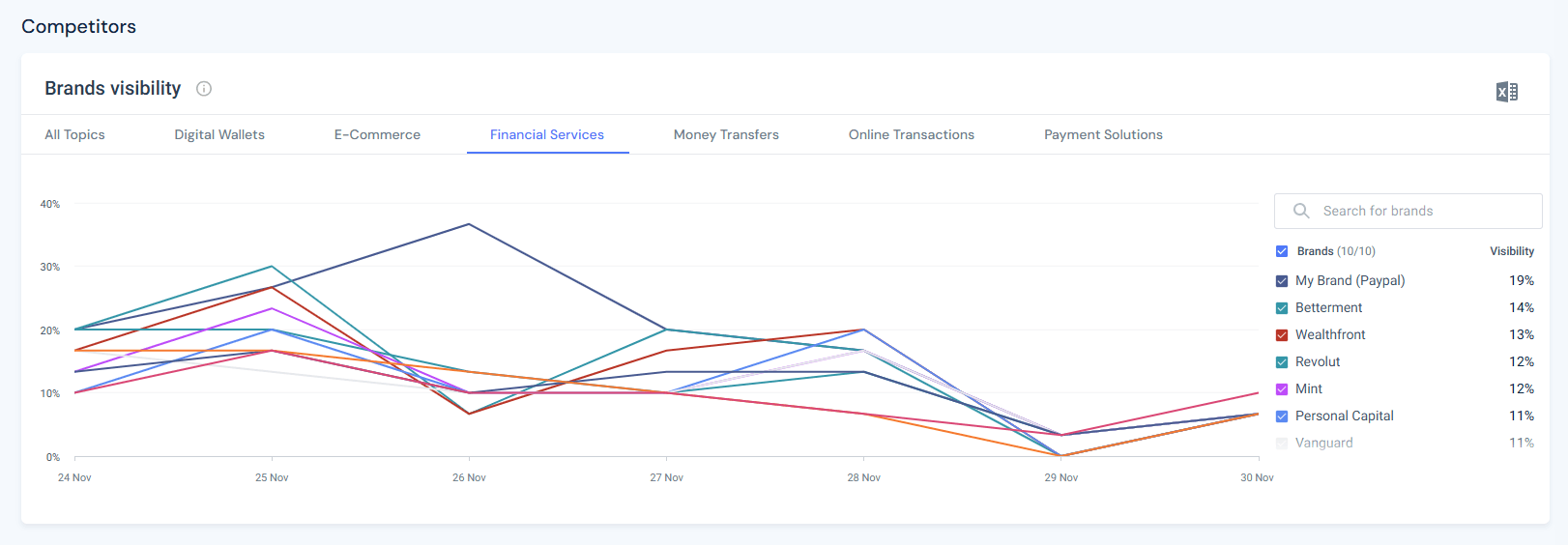

PayPal’s visibility in the “Financial Services” topic

In the “Financial Services” topic, the field widens to include investment platforms. PayPal’s visibility is 19%, while Betterment, Wealthfront, and Revolut each range around 14%.

PayPal’s competitors from previous topics are nowhere to be found:

What can I learn from this?

- The competitive set has changed completely again:

- Core competitors from other topics have very little visibility in “Financial Services”.

- New competitors mean new partnership opportunities with publishers that my core competitors might not have access to.

- PayPal maintains leadership here, but the margin is narrow.

How can I create a lead in this topic?

To maintain and grow visibility for this topic, I’d recommend continued investment in financial services content, thought leadership, and partnerships with relevant industry publishers to increase PayPal’s authority in these areas, thereby increasing its potential for citation.

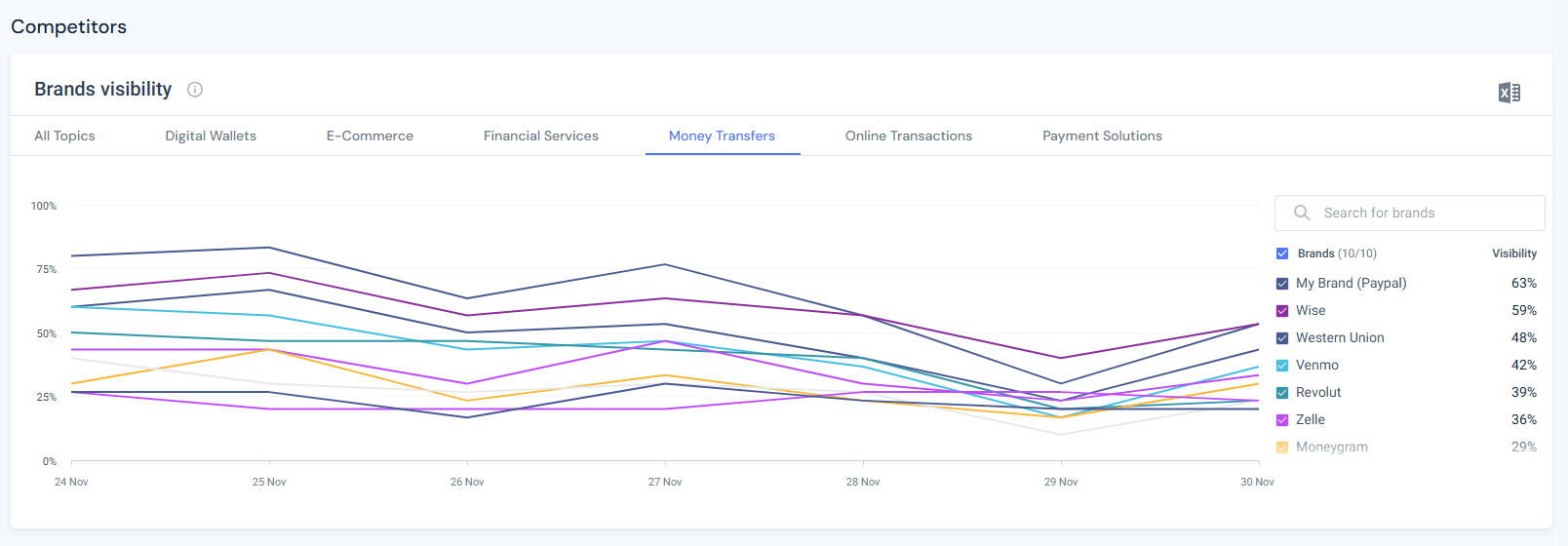

PayPal’s visibility in the “Money Transfers” topic

Money transfers are PayPal’s historic core. Unsurprisingly, PayPal has 63% visibility, slightly ahead of Wise at 59% and Western Union at 48%.

Interestingly, in the 7-day visibility trend, PayPal led until November 28th, and on November 29th, Wise took over.

What can I learn from this?

- PayPal is slightly ahead, but is declining.

- Wise is gaining and might pass them soon.

- Smaller competitors did not experience the same decrease trend as bigger brands.

How can I regain visibility?

The money transfers topic is dominated by news websites & publishers. This means that proactively increasing citations from news or consumer‑finance domains about PayPal’s low fees, global reach, or consumer protections could defend this leadership.

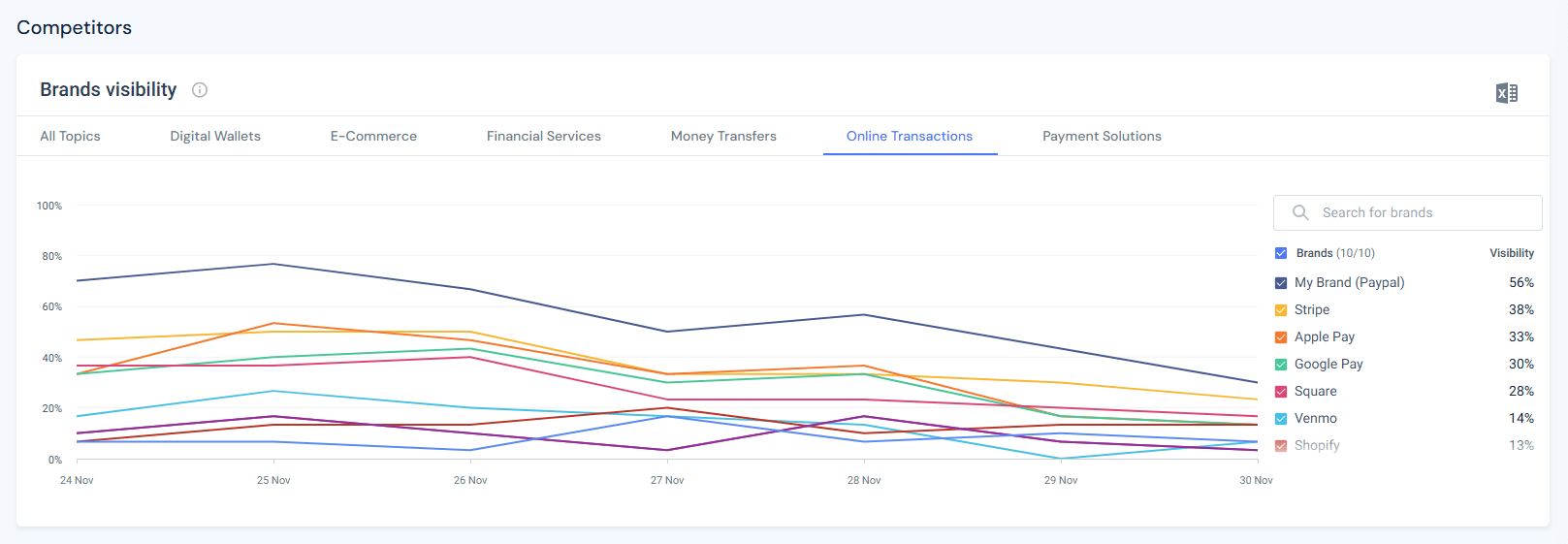

PayPal’s visibility on Online Transactions topics

The “Online Transactions” topic blends payments and checkout flows. Here, PayPal leads with 56% visibility. Stripe follows at 38%, with Apple Pay and Google Pay at 33% and 30%, respectively.

What can I learn from this?

- PayPal’s strength in online transactions stems from being integrated into the checkout flows of many merchants.

- While my visibility has declined over the past 7 days, my competitors’ has dropped as well.

How can I increase PayPal’s lead in this topic?

I’d focus on maintaining the highest share of visibility while also keeping an eye out for emerging players gaining visibility, developing partnerships with highly cited websites, and emphasizing security features in content to keep this advantage.

PayPal visibility vs competitors: side-by-side comparison

Now I’ll summarize all of PayPal’s visibility scores side-by-side vs its main competitors across topics:

| Topic | PayPal (%) | Apple Pay (%) | Google Pay (%) | Stripe (%) |

| All Topics | 46 | 26 | 23 | 22 |

| Digital Wallets | 46 | 58 | 52 | 6 |

| Ecommerce | 26 | 14 | 11 | 19 |

| Financial Services | 19 | 7 | 5 | 8 |

| Money Transfers | 63 | 18 | 18 | 6 |

| Online Transactions | 56 | 33 | 30 | 38 |

This table lets me quickly identify topics where PayPal lags behind competitors and where it leads.

What can I learn from this?

- Among its core competitors, PayPal has the highest share of visibility across topics. While they are not the winner on every topic, they have higher visibility than their competitors on most of them.

- Most core competitors invest primarily in “digital wallets” and “online transactions” topics. That leaves us with three topics where PayPal can increase its visibility more easily, with less interference from its main competitors.

Which topics should I focus on to increase visibility in AI?

In PayPal’s case, digital wallets and ecommerce stand out as areas to improve.

- Both areas are most relevant to PayPal.

- Competitors’ visibility in “Ecommerce” is very low, leaving a more open field for PayPal to grow.

- This is true for “Financial services” as well, but the topic itself is a bit further from PayPal’s core, so that it might be a less valuable investment of resources.

- PayPal is 3rd in “Digital wallets”, which is their core topic. Investing in visibility and topical authority around it is a must for PayPal.

Now that I understand the top-level view of my brand visibility vs. my competitors, I can dive into analyzing my citation status relative to them and plan how to influence the topics I have just chosen.

Step 4: Analyze citation distribution (DEEP: “Evaluate” continued)

So far, I’ve focused on visibility metrics. Next, I need to understand where citations come from. It’s time to start the main event and switch to the Citation Analysis tab. Here I can find metrics that show how often my domain is cited, from which domains, and with what influence.

Benchmark key citation metrics

At the top of the Citation Analysis tool, there are three key metrics:

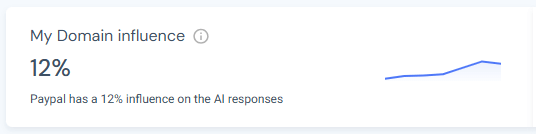

1. My Domain Influence:

The percentage of AI answers influenced by the citations from my domain. For PayPal, this value is 12%, meaning that 12% of ChatGPT’s answers in the last week referenced PayPal’s own website.

I can also see that my influence has increased over the past week, with a slight decline 2 days ago, meaning that my website was cited more times than last week.

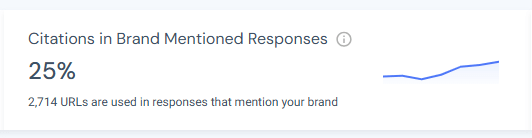

2. Citations in Brand Mentioned Responses:

The number and percentage of URLs cited in answers that mention my brand. PayPal has 2,714 cited URLs, accounting for 25% of all citations in responses that mention PayPal.

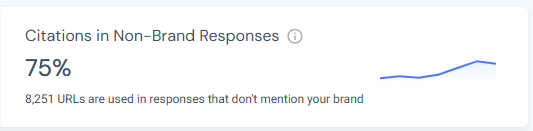

3. Citations in Non‑Brand Responses:

The number and percentage of URLs cited in answers that do not mention my brand. PayPal has 8,251 URLs (or 75%) cited in responses where the brand is absent.

Non‑brand citations present opportunities:

- My brand website can attract relevant web traffic and users through prompts with broader topics and more complex prompt intent. Optimizing for these prompts can help increase overall visibility.

- If domains that cite competitors also discuss topics relevant to my brand, building relationships with them could convert non‑brand citations into brand citations.

Analyze top domains and influence scores.

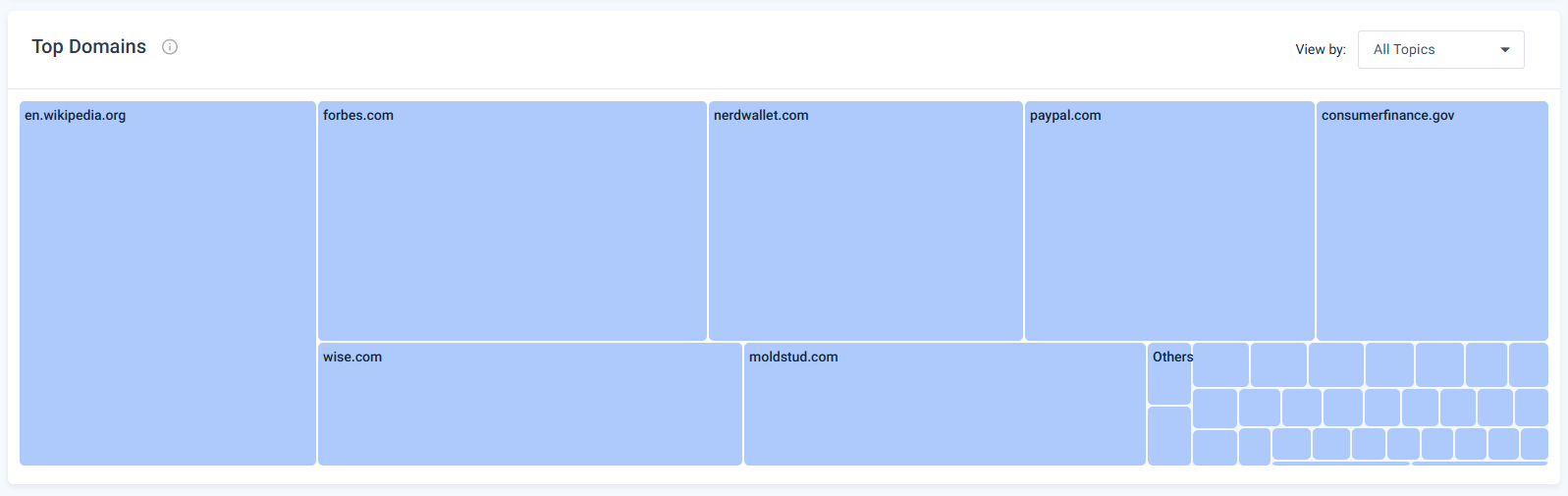

Below these metrics, Similarweb displays a treemap of Top Domains. Each rectangle represents a domain, sized by the number of citations and colored by its influence score.

For PayPal, the largest domains being cited include en.wikipedia.org, nerdwallet.com, paypal.com, consumerfinance.gov, forbes.com, wise.com, and moldstud.com.

- Wikipedia is the only Review & UGC website in the chart, but it leads it. This means Wikipedia has high authority on many topics relevant to PayPal, not just 1 or 2.

- PayPal is the 4th most cited domain for its own target topics. This is a good status for any brand.

- Forbes and NerdWallet are high-authority publishers relevant to all finance-related topics. It makes complete sense that they both have high influence scores and citation volumes.

- The influence score is a proprietary metric that measures how strongly a domain contributes to AI-generated answers.

- A high influence score means citations from that site frequently appear in answers.

- Wise is the only other brand domain cited in the top 10, making it PayPal’s most dangerous competitor.

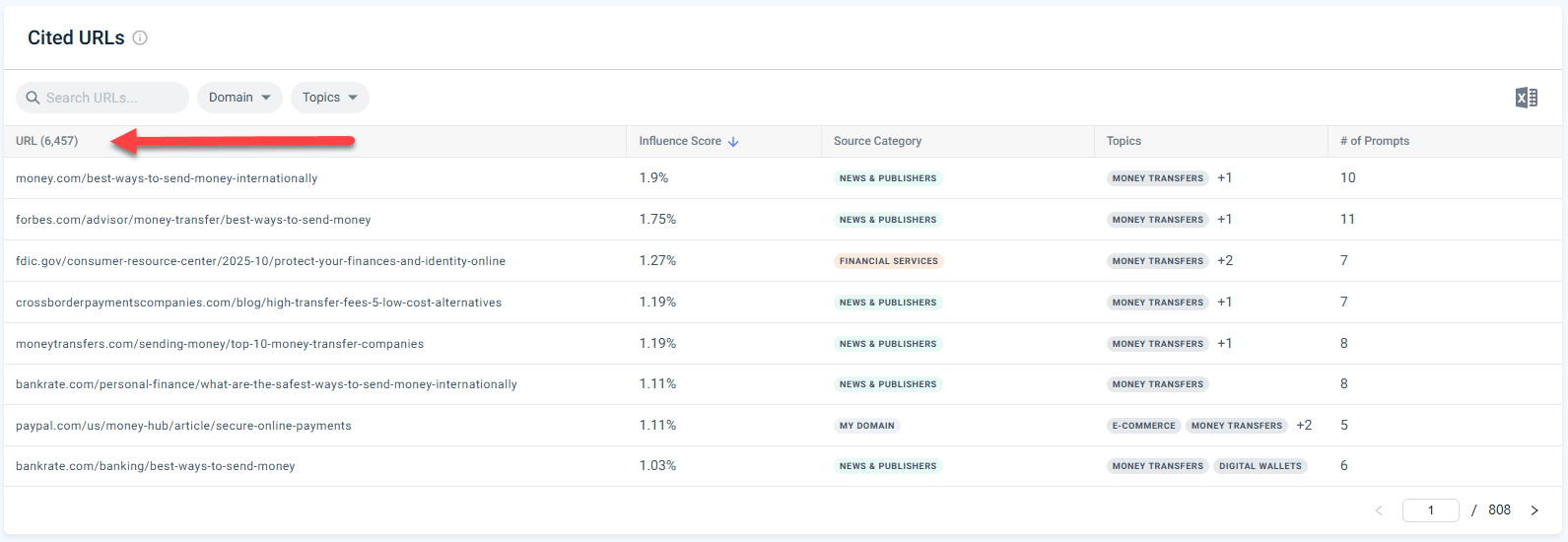

Analyze the cited URLs table.

Scrolling further reveals a detailed table listing each cited URL, its domain, topics, influence score, source category, and the number of prompts in which it appears.

For example, the chart below shows me that almost 6.5K URLs are being cited in answers to prompt topics relevant to PayPal.

This is where I can benchmark the # of cited URLs, their influence scores, and the number of prompts they’re pulled into. This will allow me a more granular citation gap analysis when I compare my data to my competitors in the next step.

As promised, in the following steps, I will show how to use the tool’s filters to narrow down to specific topics, source categories, and source domains.

Now, I’ll check these base metrics for PayPal’s competitors

Step 5: Compare citation metrics vs competitors

Now that I know PayPal’s citation metrics, I need to benchmark them against Apple Pay, Google Pay, and Stripe.

Similarweb allows me to switch to another brand within the same campaign via the dropdown at the top. For each competitor, I recorded the same metrics: My Domain Influence, Citations in Brand Mentioned Responses, and Citations in Non‑Brand Responses.

The results are compiled into the table below, giving me an overview across all metrics:

| Brand | Influence (%) | URLs in Brand Responses | % of Cited URLs (Brand) | URLs in Non‑Brand Responses | % of Cited URLs (Non‑Brand) | Total Domains Citing | Average URL Influence Score |

| PayPal | 12% | 2,714 | 25% | 8,251 | 75% | 3,391 | 0.13% |

| Apple Pay | 26% | 8,184 | 81% | 1,948 | 19% | 1,535 | 0.15% |

| Google Pay | 7% | 1,587 | 15% | 9,008 | 85% | 3,045 | 0.14% |

| Stripe | 9% | 1,054 | 10% | 9,548 | 90% | 3,835 | 0.13% |

How to analyze the metrics in the table

- Domain Influence:

If my competitors have higher domain influence scores, their own websites are more often cited, indicating stronger content authority. I may need to improve on‑site content, documentation, and thought leadership. - Cited URLs in Brand vs Non‑Brand Responses:

A high percentage of non‑brand citations signals that many answers come from domains that don’t mention my brand. Identifying these domains reveals outreach targets. - Total Domains Citing & Average Influence:

The number of unique domains citing each brand and the average influence of those domains highlight breadth versus depth. A brand may have many low‑influence citations or a few high‑influence ones. I use this metric to decide whether to broaden outreach or deepen relationships with high‑influence publishers.

Step 6: Drill down by topic and domain.

After benchmarking high‑level metrics, I can drill down to pinpoint where to act. This involves two sub‑analyses: topic‑specific citation gaps and domain/URL gaps.

Analyze topic‑specific citation gaps.

Within the Citation Analysis tab, I use the Topic filter to select a relevant topic (e.g., Digital Wallets). Record the number of citations and average influence for each competitor.

In my PayPal example, I found that URL influence scores are more important than the domain influence scores for AI visibility.

Apple Pay has the highest visibility score in this group. It has the most citations in the “digital wallets” topic and the highest average influence scores for cited URLs. Google gets mentioned by the highest-scoring domains, but judging from the final visibility result, not by enough highly influential URLs.

See the full chart:

| Topic: Digital Wallets | PayPal | Apple Pay | Google Pay | Stripe |

| Citations | 69 | 101 | 82 | 67 |

| Avg. Domain Influence | 0.21 | 0.26 | 0.27 | 0.22 |

| Avg. URL influence | 0.16 | 0.17 | 0.15 | 0.15 |

This shows that Apple Pay not only has more citations in digital‑wallet content, but also that those citations come from high-influence sites with the highest-influence URLs on my top target topic.

How to close this topical citation gap?

To increase my visibility and citation share, I suggest targeting URLs based on influence score, using the domain influence score only as a secondary decision metric. High-authority domains still matter, but when prioritizing resources and time, I like to focus on actions that can have the most impact.

The action plan would be to produce high‑quality digital‑wallet content and promote it on authoritative finance and tech domains.

- Finance domains have high authority scores, and PayPal already enjoys visibility in finance-related topics while Apple Pay doesn’t.

- Targeting finance websites can yield wins on two topics at once, making them even more lucrative for me.

Analyze domain and URL gaps.

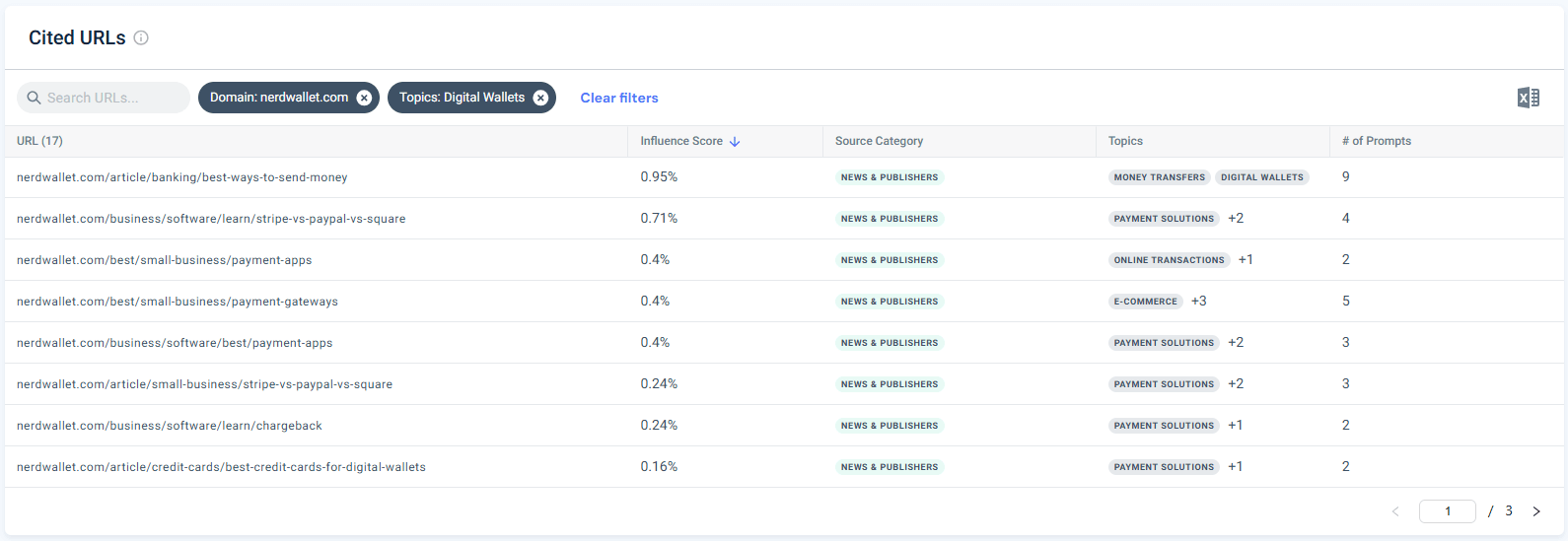

Next, I click on the Top Domains treemap to view individual domains, or scroll down to the URLs section and use the filters. I chose NerdWallet.

Below are NerdWallet’s citations across the “digital wallets” topic:

17 NerdWallet URLs were cited in 41 answers to prompts in the past 7 days, but PayPal was mentioned in only 30 of them. This accounts for 75% of mentions, which is pretty nice, but real perspective comes from examining what my competitors mention rates there as well.

Comparing this data to Apple Pay’s and Google Pay’s mentions in NerdWallet for this topic shows that Apple Pay got mentioned in 35 of the AI answers that cited NerdWallet, and Google Pay was mentioned 28 times.

Now I know that:

- While PayPal is mentioned in 75% of answers, Apple Pay is mentioned more. This is a gap I want to close. Increasing the number of mentions from this highly-cited publisher will most likely increase my visibility as well.

- Google Pay has fewer mentions on NerdWallet, but ranks 2nd in visibility for this topic. This means other high-authority sources mention it more often.

Step 7: Plan actions to close the citation gap

After collecting insights, it’s time to act. I put the data and insights I gathered so far to use and start building my plan:

Defining clear targets and priorities

- Aggregating my findings

- Prioritizing topics by business needs and impact

- Prioritizing my target domains by influence score and # of citations

- Prioritizing the target URLs from each domain for outreach

- Defining clear targets for each topic and source type

Evaluating timelines and needed resources

- Estimating the time required per target URL until it’s being outreached.

- Evaluating the timeframe from the outreach phase to the receipt of a positive (or negative) answer from the source.

- Planning needed resources:

- Adding a mention to existing content may require me to reach out with the copy I wish to add or change on the page. This may require additional content resources beyond SEO.

- Outreach takes time as well (getting the contact, crafting a personalized email, etc.). I evaluate the time it takes my team to perform outreach, then assess how many sources they can cover per week.

Creating a roadmap to close the citation gap

Now I put everything I have on a calendar:

- Setting a start date for the project.

- Aligning with my estimated timelines and available resources.

- Defining the actions and checkpoints I need to execute to follow this roadmap

- Defining the KPI’s and measurement routines.

- Making sure I measure output as well as performance

- Measuring performance by topic, not just overall

- Measuring each source’s impact on my performance. This will help me better understand each source’s value to my goals and identify shifts in the source’s influence on AI.

Measuring, iterating, and expanding.

Measuring impact is critical to ensure ongoing growth.

- Making sure I refer to the metrics I benchmarked and the data I gathered.

- Tracking my key performance metrics to ensure I’m going in the right direction and increasing my visibility efficiently in the right places.

Iterating on my actions and their impact on performance.

- Improving my citation gap analysis process,

- Improving my outreach velocity and efficiency.

- Finding ways to scale without losing quality.

- Trying different outreach styles.

Expanding my source pool on an ongoing basis.

- Performing a periodical citation gap analysis to

- Identifying high-level changes and new sources to add to my pool.

- Spotting new competitors or existing competitors gaining visibility on specific topics and sources.

.

- Setting a daily/weekly schedule (or an automated feed) to:

- Surfacing changes per source: Identify new cited URLs, changes in influence score, etc.

- Finding emerging sources I can act on quickly: Fresh, small sources can be outreached with a high chance of a positive reply. I can use that to secure mentions and citations in sources my competitors may not yet know about.

How can I help PayPal close its citation gaps?

PayPal has many ways to close its citation gaps and increase its visibility in AI engines. If I were their SEO, I’d prioritize the following steps:

- Optimizing for “digital‑wallet” related prompts:

- Developing comprehensive guides on how PayPal operates as a digital wallet, emphasizing security, speed, and convenience.

- Creating supporting content that addresses pain points for digital wallet users and helps them answer questions or resolve issues.

- Optimizing all related product pages, adding relevant details, and addressing insecurities.

- Creating content comparing PayPal to its competitors, reviewing strengths vs weaknesses. Comparative content is often cited in AI, which means PayPal itself can be cited in more AI answers on this topic.

- Creating collaborations with high‑influence domains:

- Reaching out to domains like techradar.com, pcmag.com, bankrate.com, and nerdwallet.com (if they cite competitors more often) to offer reviews, case studies, or sponsored research that include PayPal.

- Offering long-term partnerships to high authority websites.

- Offering a periodical research or case study

- Offering affiliation benefits and plans

- Sponsoring a section on the publisher’s website dedicated to a related topic, and using it to mention and link to PayPal.

- Improve ecommerce partnerships:

- Improving work with ecommerce platforms, highlight PayPal as a payment method in their documentation.

- Encouraging merchants to share stories of improved conversions with PayPal, which AI models can learn from.

- Monitor progress regularly:

- Setting a quarterly cadence to repeat the citation analysis, using a rolling 7‑day or 30‑day window depending on my research needs.

- Using Similarweb (or setting up a tracking dashboard) to make sure I’m on top of all my GEO KPI’s on a daily basis.

- Adjusting my GEO strategies based on improvements or new gaps.

My AI citation gap analysis template

If you’d like to use my template to structure your research, feel free to do so. Just copy the template and modify the data to suit your industry and competitor landscape. I added a dedicated tab in the template for each analysis step to make it easier to follow.

Here’s a preview:

Takeaways & next steps

AI citation gap analysis is essential for brands seeking to remain visible in an increasingly AI-driven world. By systematically benchmarking your brand against competitors, drilling down by topic and domain, and planning targeted actions, you can identify patterns, close gaps, and increase your authority.

In my PayPal example, I discovered strong performance in money transfers and online transactions, but a weaker presence in digital wallets and ecommerce.

Now it’s your turn: using this guide, you can do the same for your brand and core topics.

With the DEEP framework and downloadable template, you now have a repeatable method to uncover insights, optimize your content strategy, and ensure your brand is cited by AI engines across the topics that matter most.

FAQ

What is AI citation gap analysis?

AI citation gap analysis is the process of measuring how often your brand is cited in AI‑generated answers compared with competitors and identifying where you fall short. A citation gap analysis benchmarks your brand’s share of AI citations across topics, domains, and URLs, showing you where to focus content and outreach to increase citations.

Why does AI citation gap analysis matter?

Generative AI engines rely on retrieval‑augmented generation to search the web and prioritize relevant, trusted sources for their answers. If your brand isn’t among those trusted sources, AI search won’t mention it. By understanding your citation gaps, you can proactively optimize content, build partnerships with high‑authority domains, and ensure your brand appears in AI answers.

How do I benchmark my brand’s AI visibility against competitors?

Use Similarweb’s AI Brand Visibility tool. Start in the Brand Overview tab and record metrics such as brand visibility and brand‑mention share. Next, compare your visibility across topics to identify where competitors lead. Finally, switch to each competitor’s profile to benchmark metrics such as domain influence and citation distribution between brand‑mentioned and non‑brand responses. Structured tables summarizing these metrics help expose gaps.

How often should I perform citation gap analysis?

Because AI models update regularly, a quarterly or monthly cadence is recommended. Regular monitoring helps you detect shifts in competitor visibility, new high‑influence domains, and emerging topics. It also ensures your outreach and content efforts remain aligned with changing AI behavior.

What is domain influence, and how is it measured?

Domain influence measures the percentage of AI answers that include citations from your own website. A higher domain influence indicates that your site is a trusted source. Competitors with higher domain‑influence scores are cited more often, suggesting stronger on‑site content or authority. Tracking this metric over time helps assess the impact of content improvements and outreach.

Can I improve my domain influence?

Yes. Publish high‑quality, authoritative content on your domain, especially in the form of definitive guides, FAQs, and research reports. AI models are more likely to cite sources that provide comprehensive answers. Ensure technical SEO best practices (structured data, clear headings, and more) are implemented.

How do I identify topics where my brand is weak in AI citations?

Drill down into topic‑level visibility. In the competitor visibility chart, select each topic. Record the visibility percentage for your brand and competitors. Topics where your brand’s visibility is lower than competitors’ highlight citation gaps. Within those topics, use the citation analysis tab to see which high‑influence domains and URLs cite competitors but not you: these become priority outreach targets.

Why focus on high‑authority domains and URLs?

AI engines prioritize relevance, freshness, and trust. Content from high‑authority domains and URLs with strong E‑E‑A‑T (Experience, Expertise, Authoritativeness, and Trustworthiness) signals is more likely to be cited by AI engines. Targeting high‑influence domains ensures your content appears in the limited citations AI engines display.

How can I expand my citation footprint across new domains?

Identify high‑authority domains with high influence scores that frequently cite competitors but not your brand. Reach out to these domains with relevant content such as case studies, research, or guest posts. Focus on topics where your brand has expertise and where competitor visibility is low. Building relationships with publishers increases the likelihood of citations, thereby improving AI visibility. Regularly performing citation gap analysis helps you spot new domains and emerging topics to target.

Wondering what Similarweb can do for your business?

Give it a try or talk to our insights team — don’t worry, it’s free!