The Future Of Google’s Business Model: Will Search Stop Being Free?

As an SEO, i.e., someone whose industry has been fueling Google’s business model for years, I’ve been thinking a lot about Google’s future. I’ve spent more than 20 years watching search engines evolve. Google built its empire on the trust in free search results paid for by advertisers.

It’s true, advertising has always funded the “free” experience: Google’s paid‑search auction (what became AdWords and later Google Ads) allowed any business to bid on keywords and deliver ads alongside organic results.

That model worked because searchers with clear intent were willing to click on ads, and the vast reach kept ad prices relatively low.

The rise of mobile and the pandemic accelerated Google’s dominance, with annual advertising revenue swelling to ~$264.59 billion in 2024, more than double its 2018 total. But GenAI alternative engines, social platforms, and even Google’s own AIOs and AI Mode (no ads in AI yet) are starting to threaten that good ol’ revenue stream.

So, will Google just continue to expand and monetize its ad space into its AI features, or will it have to switch to a completely different business model to keep its income?

While I was starting to delve into this, imagining ways and tiers of possible monetization of search, and right before I started writing a movie script about “how one change to search accessibility resulted in humanity rioting about equal rights and access to information”, I remembered I work at Similarweb, and can actually pull out some data.

Let’s start from the beginning:

How Google made free search profitable

When Google launched in 1998, its promise was simple: deliver the most relevant information on the web for free.

Instead of charging users, Google monetized intent.

It introduced AdWords (later Google Ads), an auction-based system where advertisers bid to show text ads next to search results. This pay‑per‑click model became incredibly lucrative because it matched high‑intent queries (e.g., “buy running shoes”) with ads.

Over time, Google added display ads and shopping ads, and YouTube ads, but the core revenue still comes from search.

In 2023, Google generated $237.86 billion in advertising revenue, and over $264 billion in 2024. Even in 2025, Google’s advertising unit (search, YouTube, and network ads) posted 12.6% revenue growth to $74.18 billion, signalling that traditional search ads remain robust.

Google’s dominance stems from three pillars:

- Free organic results: keeping search free ensured user loyalty and volumes. Ads were clearly marked and separate from organic listings, maintaining trust.

- Massive user base and data: billions of daily searches give Google unrivalled insight into user intent. More searches mean more ad inventory and better targeting.

- Self‑service ad platform: AdWords lowered barriers for small businesses by letting anyone bid on keywords. Over time, Google layered automation and machine learning to maximise ad revenue.

Yes, Google’s free search is the engine behind its AdWords revenue. Google’s “bet” on search quality, intent matching, and user trust to keep the users coming back day after day paid off.

The users came for free, Google’s market share (and datasets) kept growing, and publishers paid millions of dollars so their ads would be seen (and clicked) by the right audience with the right intent.

The AI challenge and cannibalization risk

Large‑language‑model (LLM) based engines (i.e, ChatGPT, Perplexity, etc.) answer questions directly, often without sending traffic to publishers. Google responded with AI Overviews, its generative summaries at the top of search results. Then announced AI Mode, which allows users to converse with Gemini.

Experts warn that these summaries could cannibalize Google’s own revenue stream. John Wihbey of Northeastern University notes that AI Overviews keep users on Google’s page and push fewer visitors to other websites, potentially reducing web traffic by about 25%.

The feature’s launch has already caused publisher traffic declines: Seer Interactive has reported 20-40% fewer clicks when an AI Overview appears.

However, these AI features are extremely expensive to run.

The Guardian reported that Google is considering charging for AI‑enhanced search because the computational cost of generative responses is much higher than conventional search. Industry analysts estimate that more than 90% of AI compute spending now goes toward inferencing rather than training.

Reuters corroborated the story, noting that Google is exploring ways to incorporate generative AI into its paid subscription services while keeping the traditional search engine free with ads. Google told Reuters it is “not working on or considering an ad‑free search experience”.

In other words, free search with ads is not going away anytime soon, but premium AI features may sit behind a paywall.

Social networks vs. Google Ads: an outgoing traffic reality check

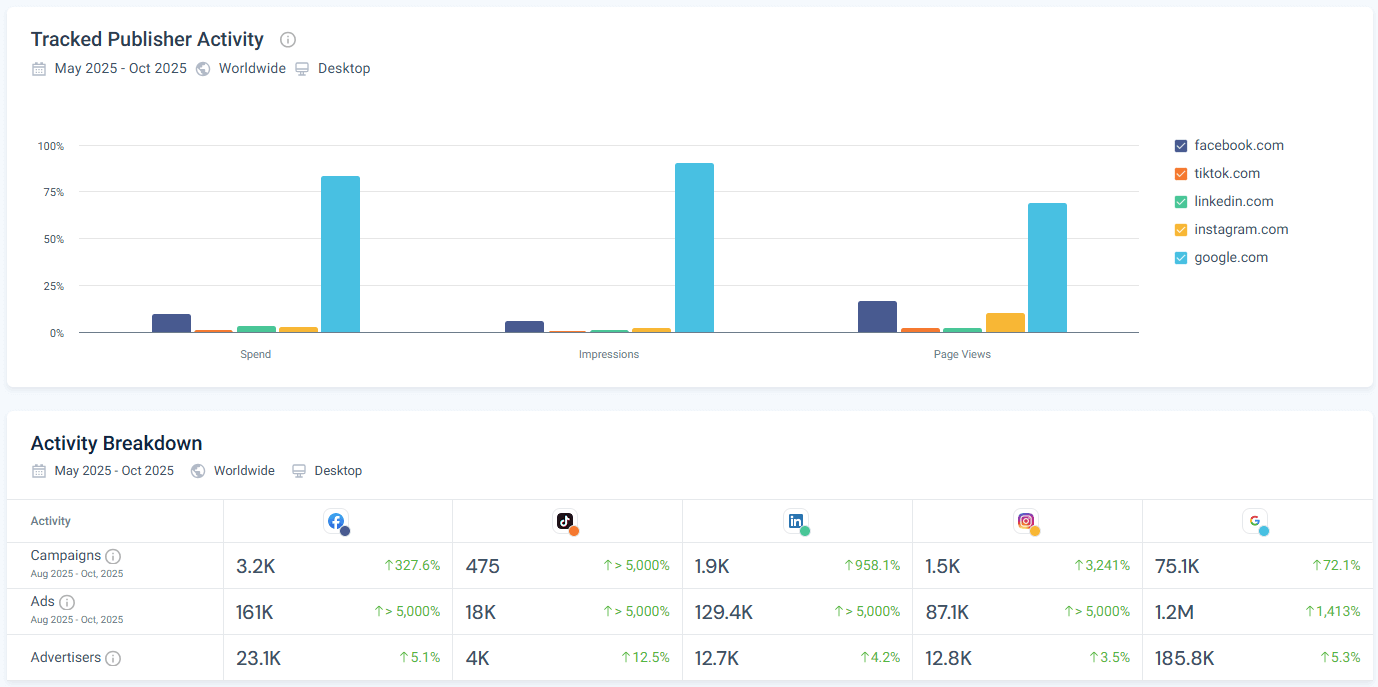

To see how these industry trends translate into actual traffic, I used Similarweb’s Ad Intelligence and Publisher Analysis modules and compared outgoing traffic from Google ads with that from the main social networks in the past 6 months (May-Oct 2025).

Two observations stood out:

- Advertisers allocate far more campaigns and spend on Google: In Publisher Analysis (under Ad Intelligence) for the

Last 6 months, Google.com hosted 75.1K campaigns and 1.2M ads, versus Facebook.com’s 3.2K campaigns and 161K ads.In fact, even if I were to combine all the top social networks together, they would still account for only 10% of the campaigns hosted by Google and 30% of their total ad numbers.In the last 28 days (ending 10 Nov 2025), Google.com hosted 3.9K campaigns and 192.8K ads, versus Facebook.com’s 542 campaigns and 22.9K ads. About 24,100 advertisers ran display campaigns on Google, compared with 1,700 on Facebook. That’s still a huge gap.

Even top advertisers such as instructure.com and sharepoint.com spent over 90% of their display budgets on Google. This suggests that, at least for display advertising, advertisers see Google’s network as a more reliable source of volume and intent than social networks.

- Google still dominates display ad traffic: In the Display Advertising “Ad Networks” module, the Google Display Network sent about 88.7% of visits to advertisers vs. only 11.3% from Facebook.

These findings align with industry forecasts: while social ad budgets are growing faster, Google still drives more paid traffic for many advertisers.

For search campaigns specifically, Google remains indispensable because no social platform can replicate keyword‑level intent. However, the growth of retail media and social commerce shows that conversion‑oriented budgets can shift quickly when platforms offer better targeting or more purchase‑ready audiences.

Are publishers beginning to diversify away from Google?

Similarweb also shows subtle but noteworthy shifts in how publishers allocate their display inventory. When I compared the six‑month period (May-Oct 2025) with the most recent 28‑day snapshot (as of 10 Nov 2025), two trends emerged:

- Slight erosion in Google’s network share: Over the six‑month window, the Google Display Network commanded 88.7% of visits versus 11.3% for Facebook. In the last 28 days, that share has dipped to 84.4%, meaning roughly four percentage points of traffic migrated to competing platforms.

Likewise, the line.me network shifted from 59.6% of visits going to Google to 55.7%, with Facebook’s share rising correspondingly. Though still minor, such changes hint that publishers are testing alternative channels.

- On the spending side, the trend mirrors the visit data: line.me competitive spend share moved from roughly 53.7% in Google’s favour to 47.4%, giving Facebook more than 38% of spend. What’s even more interesting is that when I dive into the data and look at the pages that line.me is advertising, it seems they stopped promoting store.lime on Google, and shifted those budgets to social networks.

While Google remains the dominant partner for most publishers, the fact that any of these bars are narrowing signals a gradual diversification. Marketers should watch these metrics closely because incremental shifts today could foreshadow larger reallocations tomorrow.

Possible future business models for Google Search

1. Insert ads inside AI Overviews (status quo plus)

Google’s most straightforward path is to integrate ads into AI Overviews and AI Mode. The company has already said it will connect ads to AI Overviews, and prototypes show sponsored links or product recommendations embedded inside generated answers.

This approach lets Google keep search free while creating new ad inventory. Ads could be contextually aligned with the generative response, making them feel less intrusive. For example, a question like “best running shoes for marathon training” might trigger an AI answer followed by a sponsored carousel of shoes.

Publishers and brands would need to supply structured data or content snippets that Google’s models can ingest. As an SEO, I suspect a new field of “AI model SEO” will emerge, where websites optimize data feeds and markup to influence generative answers.

However, this model risks user trust if ads blur with organic AI content, and regulators could scrutinize the blending of paid and organic results.

2. Subscription‑based AI search (freemium)

Given the high cost of running LLMs, my bet is on Google adopting a freemium model.

Google already offers subscriptions such as Google One and Gemini Advanced. A bundled plan could include expanded AI search, higher query limits, and deep‑research capabilities similar to ChatGPT Plus or Perplexity Pro. Subscribers might also get ad‑free Gmail, additional storage, and priority support.

Google can take it one step further and show more ads to non-paying users than the paying ones, which might be good for the users, but not so good for B2B advertisers, if we agree that most businesses will have some sort of paid account.

A paid tier could stabilize revenue as advertisers reallocate budgets.

The downside is adoption: will users pay for something they’ve had free for 25 years (riots, in)? And will high‑spending advertisers still reach enough audiences in free search results (roi, out)?

3. Publisher partnerships and revenue sharing

AI Overviews rely on ingesting content from news outlets, blogs, forums, and Q&A sites. OpenAI and Microsoft have already signed deals with major publishers, paying to license content for training and direct answers. Wihbey suggests Google may end up paying “every imaginable publisher” to feed its generative models.

Google could create a revenue‑share program where publishers opt in to have their content summarised and, in return, receive compensation or traffic credits. This model would align incentives: Google gets high‑quality training data, and publishers get paid when their information powers an AI answer. It also reduces copyright risks.

From an SEO perspective, publishers should experiment with structured data and track how often their articles surface in AI Overviews, negotiating deals where possible.

4. Search‑as‑a‑Service and vertical licensing

Another path is to license Google’s search engine technology to other companies (e.g., powering SaaS products, corporate intranets, or IoT devices). Alphabet already licenses Android and Google Maps. Search could become a service accessible via API with per‑query pricing.

Enterprises could pay for branded search widgets, with generative AI tailored to their domain and ads turned off. Google’s leadership in LLMs and cloud infrastructure gives it an advantage here.

However, margins might be lower than advertising, and strong competitors (OpenAI partnered with Microsoft, Anthropic with Amazon, etc.) are crowding the market.

5. Ecosystem monetization (hardware & cloud)

Finally, Google may lean on hardware (Pixel phones, wearables), cloud services, and enterprise AI.

The Reuters report on Alphabet’s Q3 2025 results shows that cloud revenue grew 34%, becoming a significant driver. Selling devices with embedded Gemini AI could shift value away from search altogether. The Visual Capitalist shows that Google ads still provide 57% of Alphabet’s revenue. That’s a big incentive to keep both searchers and advertisers happy.

In this scenario, search remains free but is becoming less central to Google’s business as products are added in. Cloud customers pay for AI infrastructure, and consumer devices become subscription conduits (e.g., Pixel Pass bundling hardware, YouTube Premium, and AI features).

This diversification reduces reliance on search advertising and helps Google compete with competitors’ services ecosystem.

Implications for marketers and publishers

- Budget diversification:

- Similarweb data shows that paid search contributes only a fraction of publisher traffic. This means marketers should not rely solely on Google Ads.

- Social and referral channels often drive more visits and conversions. Investing in compelling social content, influencer marketing, and brand communities can yield better returns.

- Structured data and AI optimization:

- To appear in AI Overviews, websites need clean markup, authoritative content, and up‑to‑date information.

- Brands should adopt schema.org, product feeds, and high‑quality descriptive copy. We’re entering the era of Generative Engine Optimization (GEO) and Large Language Model Optimization (LLMO), which means they should optimize for conversational responses rather than blue links.

- Monitor subscription models:

- If Google launches a paid search tier, marketers must decide how to allocate their budgets according to where they expect their audience to be.

- B2B brands will have new challenges reaching their audience, who will be on the paid tiers most likely, and may get fewer ads for that.There’s also a chance that Google will monetize its ad platform, forcing marketers to decide whether to subscribe to enhanced insights or stick with the free tier. Premium features may offer deeper audience data or better ad placement.

- Advocate for fair revenue share:

- Publishers should push for licensing agreements that compensate them when their content is used to train models or answer questions. Without fair payment, AI Overviews could erode business models.

Conclusion

Google built the most successful advertising engine in history by keeping search free and monetizing intent. That model is under pressure from AI chatbots, rising compute costs, and shifting user behavior.

Credible reports suggest that Google is exploring a freemium approach, keeping traditional search free with ads while offering paid AI‑enhanced search. The company may also insert ads into AI Overviews and may license content and search technology (let’s face it, it’s Google, they can insert ads into ads).

Meanwhile, social networks already deliver far more traffic to publishers than paid search, implying that advertisers will increasingly diversify budgets.

As an SEO who’s seen a core update or two, my advice is to prepare for a multi‑channel world: optimize for AI and traditional search, build resilient brands on social platforms, and monitor how Google’s pricing evolves. Search won’t stop being free anytime soon, but the free experience could feel very different in the age of AI.

FAQ

Will Google start charging for ordinary search?

No. Google has publicly stated that it is not working on or considering an ad‑free search experience. Reports suggest it may offer premium AI features to paying subscribers while keeping the classic search results (with ads) free.

What are AI Overviews?

AI Overviews are generative summaries that appear at the top of Google results. They synthesize information from multiple sources to answer a query directly. According to Northeastern University, these features may reduce website traffic by about 25% because users no longer need to click links.

How will ads be displayed in AI search?

Google has said it will eventually connect ads to AI Overviews. Early tests show sponsored product listings or contextual ads integrated within the AI summary, maintaining a free‑with‑ads model.

Why are social networks delivering more traffic than paid search?

Data from Similarweb shows that major publishers like the New York Times and CNN receive hundreds of millions of visits from social networks but only millions or tens of thousands of visits from paid search. Social platforms offer targeted advertising and viral distribution, whereas paid search ads often appear when users already know what they want, resulting in fewer clicks.

What should publishers do to remain visible in AI‑driven search?

Publishers should invest in structured data, high‑quality content, and answer‑friendly formatting. They should monitor how often their content appears in AI Overviews and negotiate fair licensing deals. Diversifying traffic sources (email, social, direct subscriptions) will also reduce reliance on any single platform.

Track Gen-AI And Organic KPI's On The #1 SEO Platform

Give it a try or talk to our marketing team - it’s free!

Even top advertisers such as instructure.com and sharepoint.com spent over 90% of their display budgets on Google. This suggests that, at least for display advertising, advertisers see Google’s network as a more reliable source of volume and intent than social networks.

Even top advertisers such as instructure.com and sharepoint.com spent over 90% of their display budgets on Google. This suggests that, at least for display advertising, advertisers see Google’s network as a more reliable source of volume and intent than social networks.