The Fastest-Growing US FinTech Apps of 2025 – and Why

Fintech has never moved slowly. But last year, it moved at a sprint. From reward credit cards to trading platforms and AI-powered finance tools, a new wave of fintech apps is here.

When an app goes through a period of rapid growth, it’s not often accidental. Behind every breakout fintech app are a set of deliberate choices: sharp positioning, smart acquisition strategies, seamless onboarding and a user experience that keeps users coming back.

Here, we’ll be taking a closer look at the fastest-growing fintech apps in 2025 spotlighted in our latest Digital 100 report.

But first, what’s D100?

Each year in our Digital 100 we rank the fastest-growing apps based on sustained growth in active usage, not just revenue or downloads. By focusing on actual user engagement across apps, the ranking highlights companies that are meaningfully growing.

And, with the help of our App Intelligence data, we’ll explore how these apps are attracting and retaining users and what their strategies can teach us about sustainable success in a very crowded market.

So, let’s jump in.

Atlas

Launched in 2022, Atlas is a rewards credit card with instant in-app approval and higher-than-average acceptance rates that targets users with limited credit histories who are often underserved by traditional banks.

What drove Atlas’ momentum in 2025?

Atlas’ story is a clear example of compounding growth, the kind that usually comes from more than just a one-off moment.

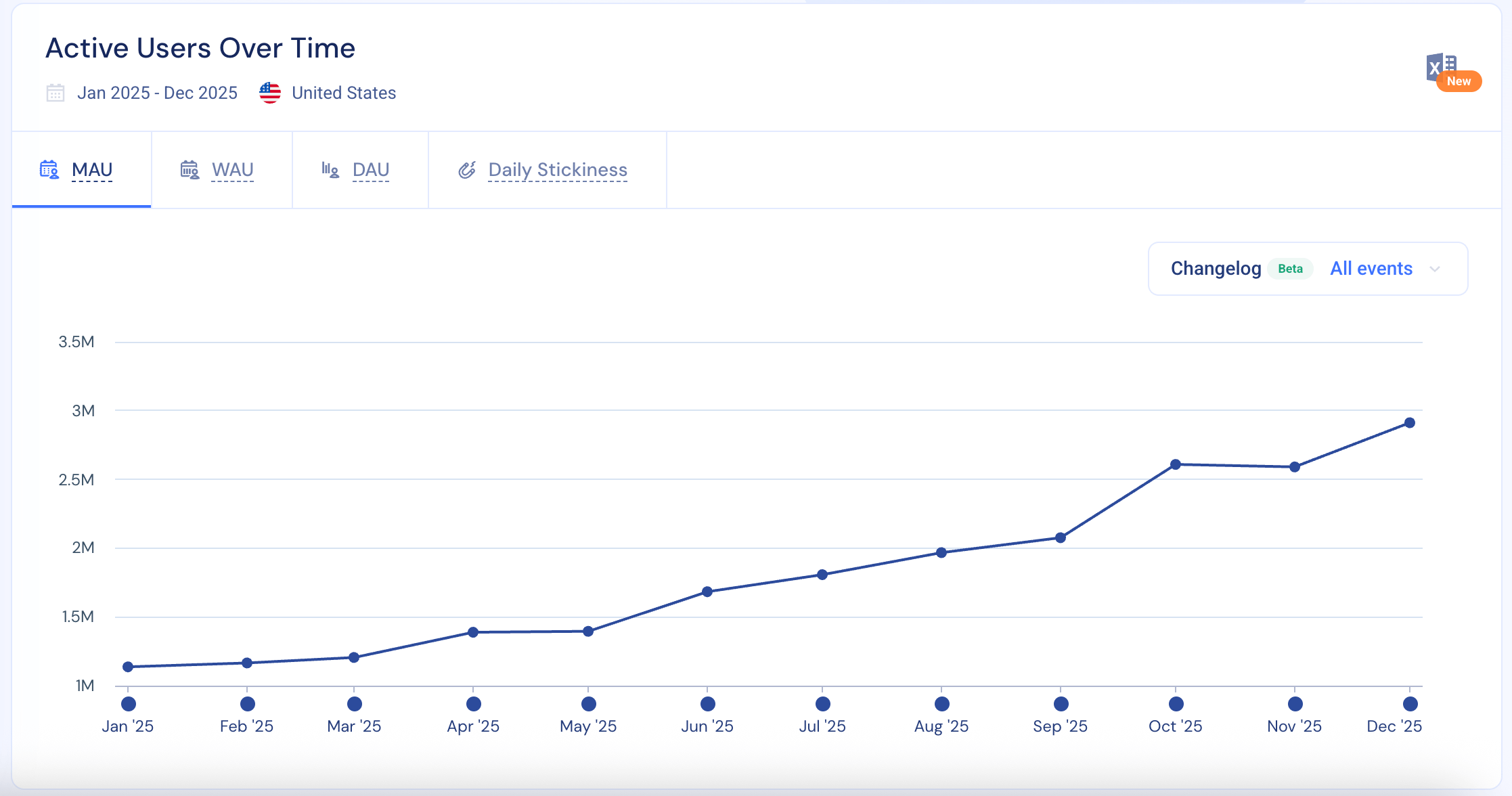

iOS Monthly Active Users (MAU) climbed from 1.14M in January to 2.91M in December.

Here’s some of Atlas’ strategies that line up perfectly with their strong acquisition trend:

Referral incentives to drive downloads

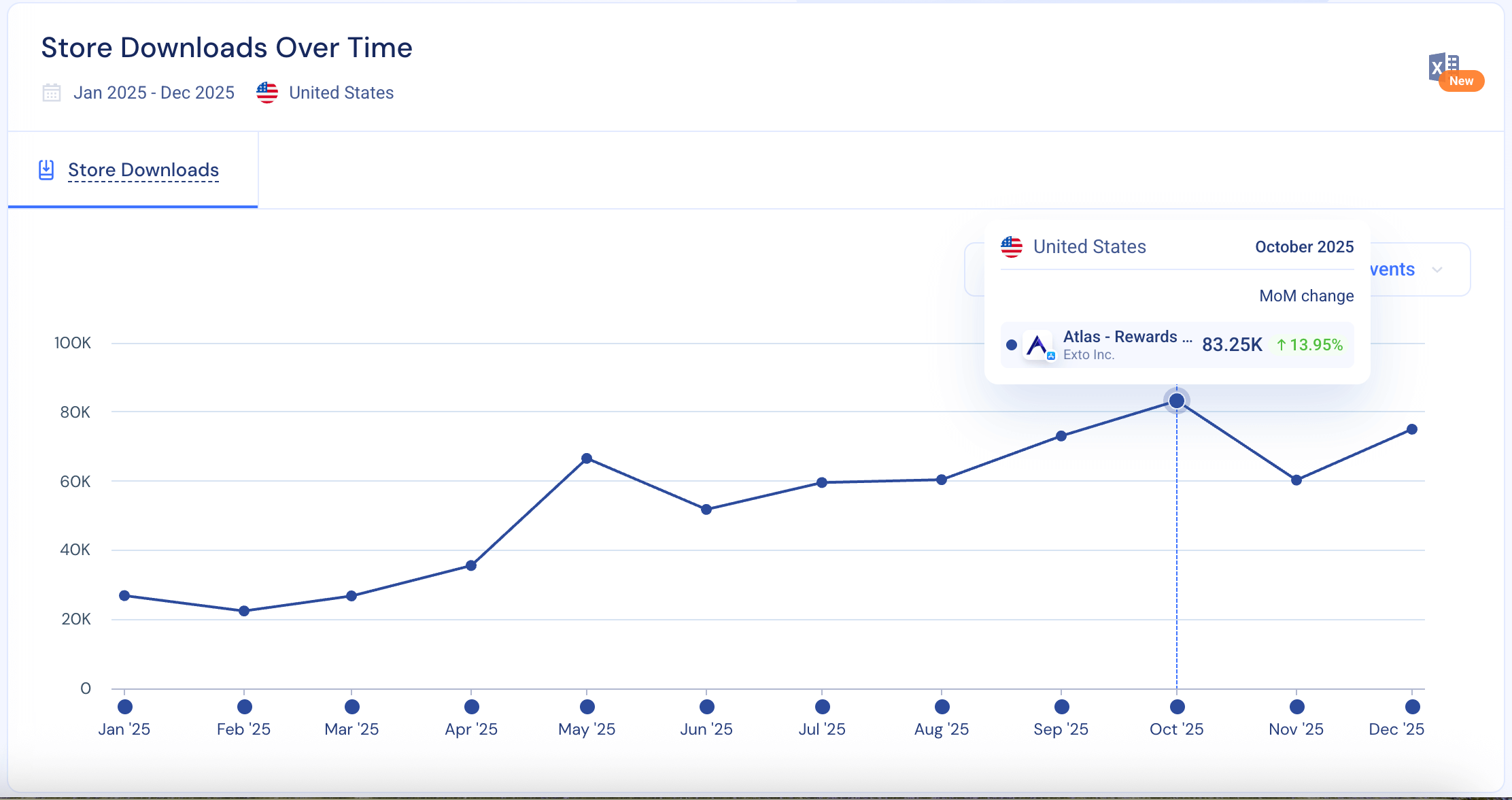

Atlas operates a referral program where users can earn rewards for inviting friends, including up to $100 in points. This is exactly the kind of strategy that can amplify paid acquisition and keep downloads going strong, as we can see in the data:

A rewards proposition made for conversion

Their marketing emphasizes cash back (including ‘Lucky Swipes’) and everyday rewards, the kind of strategy that works extremely well in paid social and Apple Search Ads because it’s easy to communicate and instantly motivates a trial.

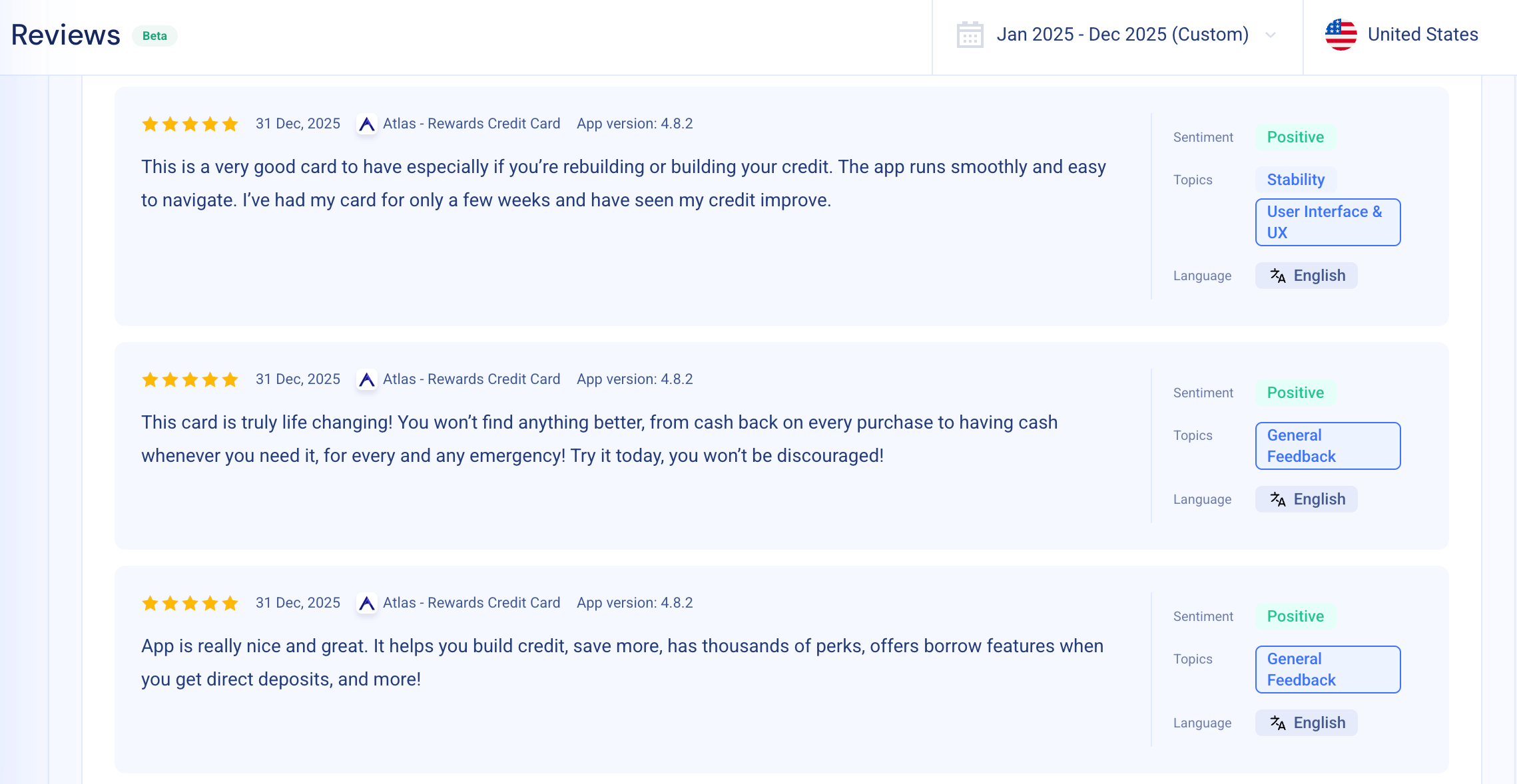

Searching by the keyword ‘cash back’ in our Review module, we can see the following positive feedback from users:

Lenme

Lenme mixes short-term lending with investment and borrowing services, facilitating fast access to cash and flexible credit solutions.

Over 2025, Lenme’s Monthly Active Users and revenue climbed steadily, showing that its value proposition clearly resonated with a growing audience of both borrowers and investors.

What drove Lenme’s momentum in 2025?

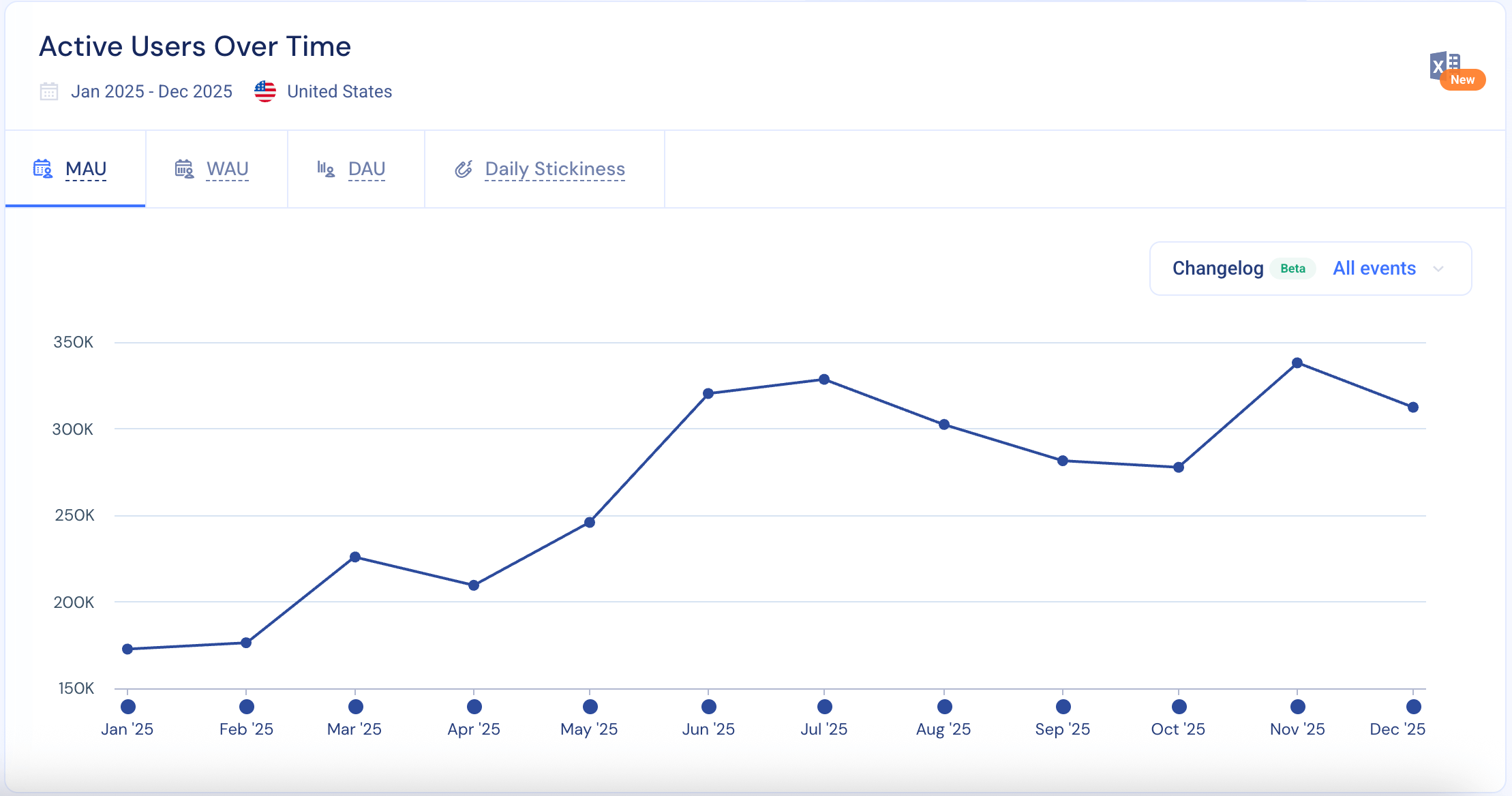

Lenme’s story is different from Atlas, with a less clear breakout spike, but instead more consistency over the year. We can see this with the steady increase of MAU:

Here’s some of Lenme’s strategies that line up with their growth:

Building trust with affiliate and referral programs

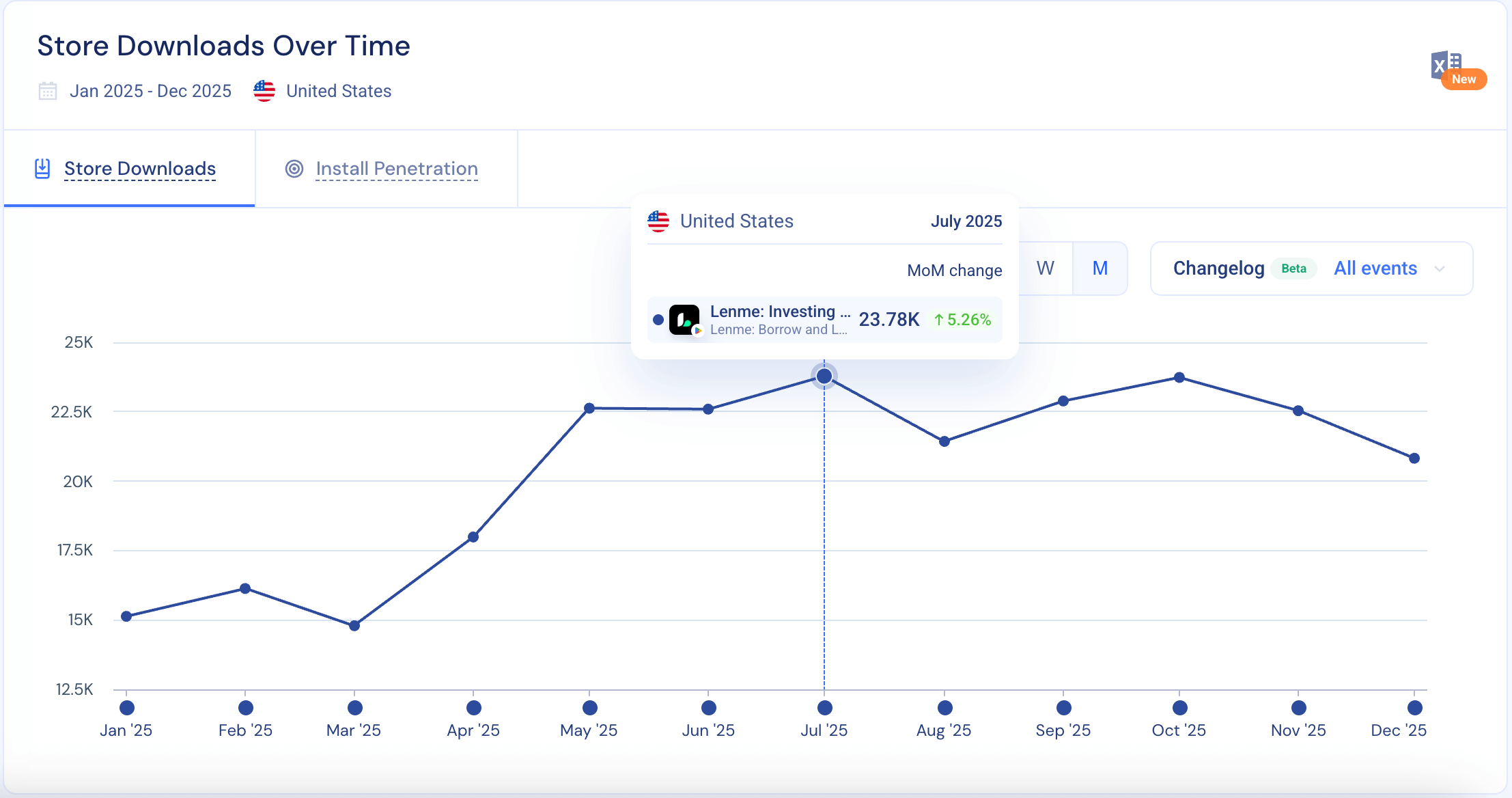

Lenme publicly promotes an affiliate program with ‘branded creatives’, large partner activity and a commission structure, as well as a dedicated referral program collection. These are strong acquisition strategies that can build up quickly over time and likely led to their steady downloads across the year:

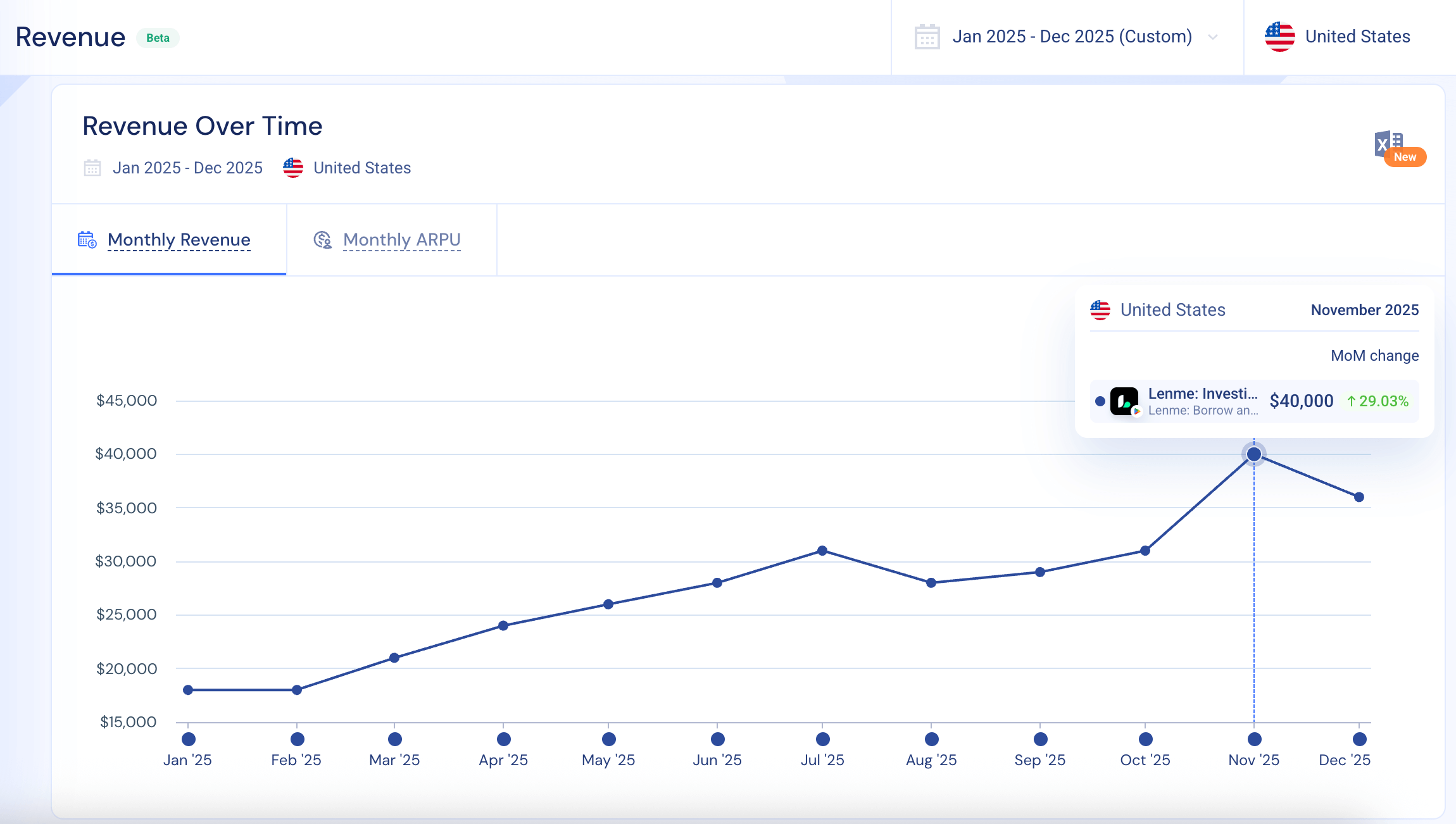

Lenme’s revenue increased by 122% on Android and 328% on iOS alongside both downloads and MAU, showing that new users weren’t just installing the app, they were actively using it and generating revenue – mostly through subscription fees and transaction charges:

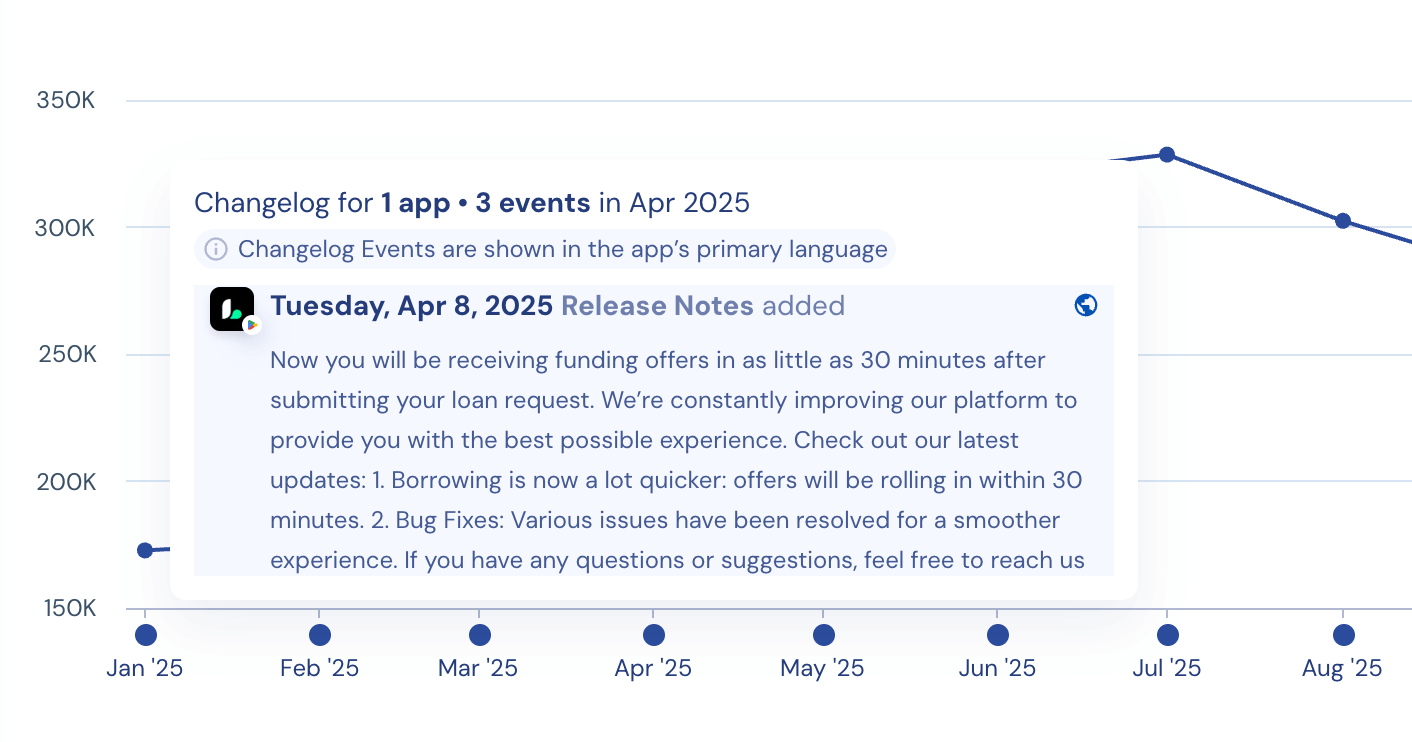

Service updates focused on improving the user experience

After a short dip in April, there is a clear uplift over the next few months. If we look at the ‘changelog’ of events during that time, this could be attributed to a service update that meant funding could now be received in 30 minutes or less after submitting a loan request, making borrowing significantly quicker. See the Release Note data here:

MoonPay

MoonPay is a global crypto app that acts as a bridge between traditional money and crypto, allowing users to easily buy crypto with dollars and cash out crypto back into their bank accounts.

What drove MoonPay’s momentum in 2025?

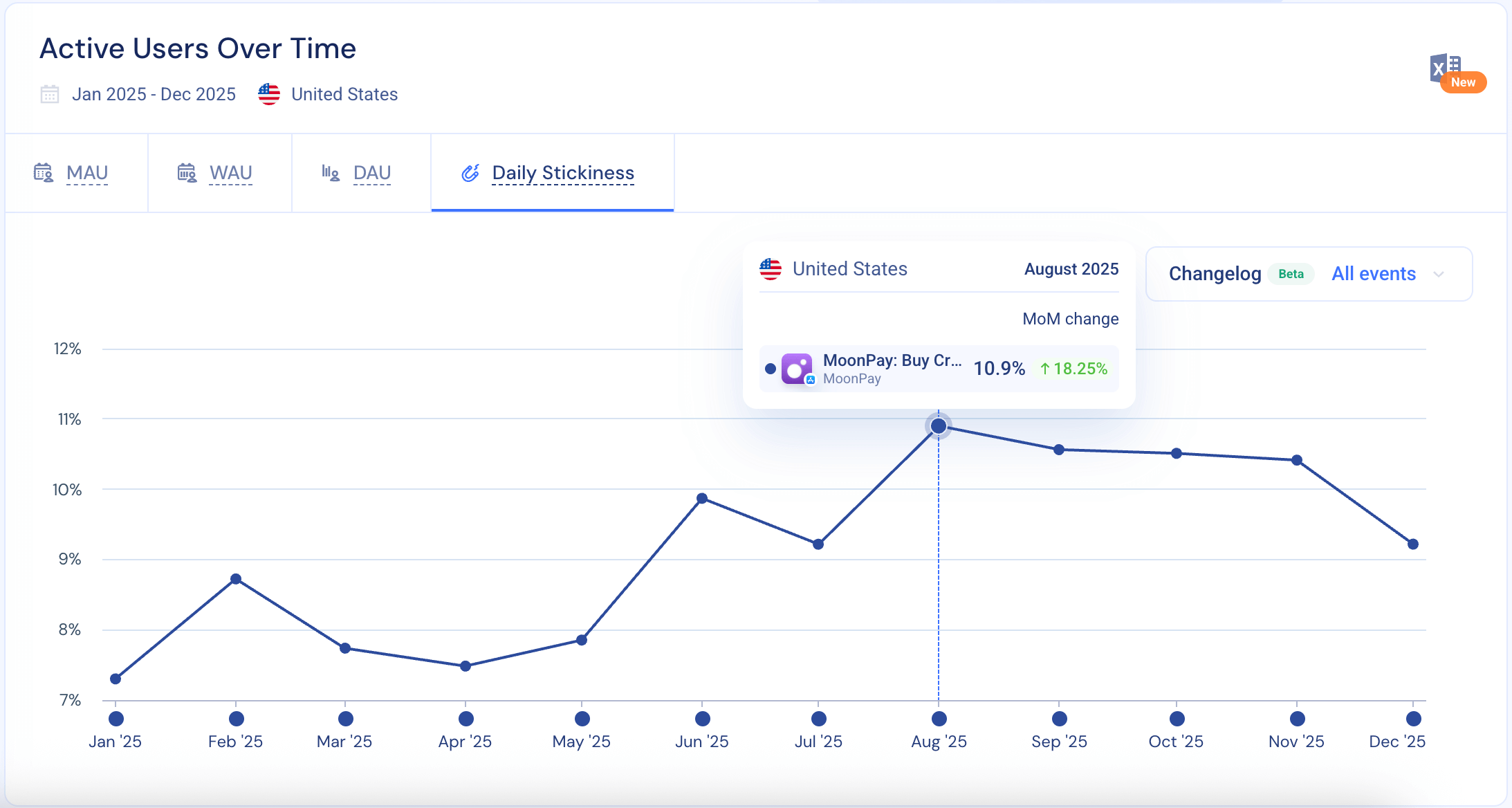

Across both iOS and Android, monthly active users peak sharply in August and stay relatively strong until the end of the year. Here’s what could explain why MoonPay captured more demand from August onwards:

August Bitcoin surge

Barron’s reported Bitcoin surging above $120k on August 11th, exactly the sort of thing that gets crypto on-ramps a lot more attention. Looking back at the MAU graphs, usage peaks precisely during this window, with ‘daily stickiness’ then confirming continued engagement rather than a sharp drop off:

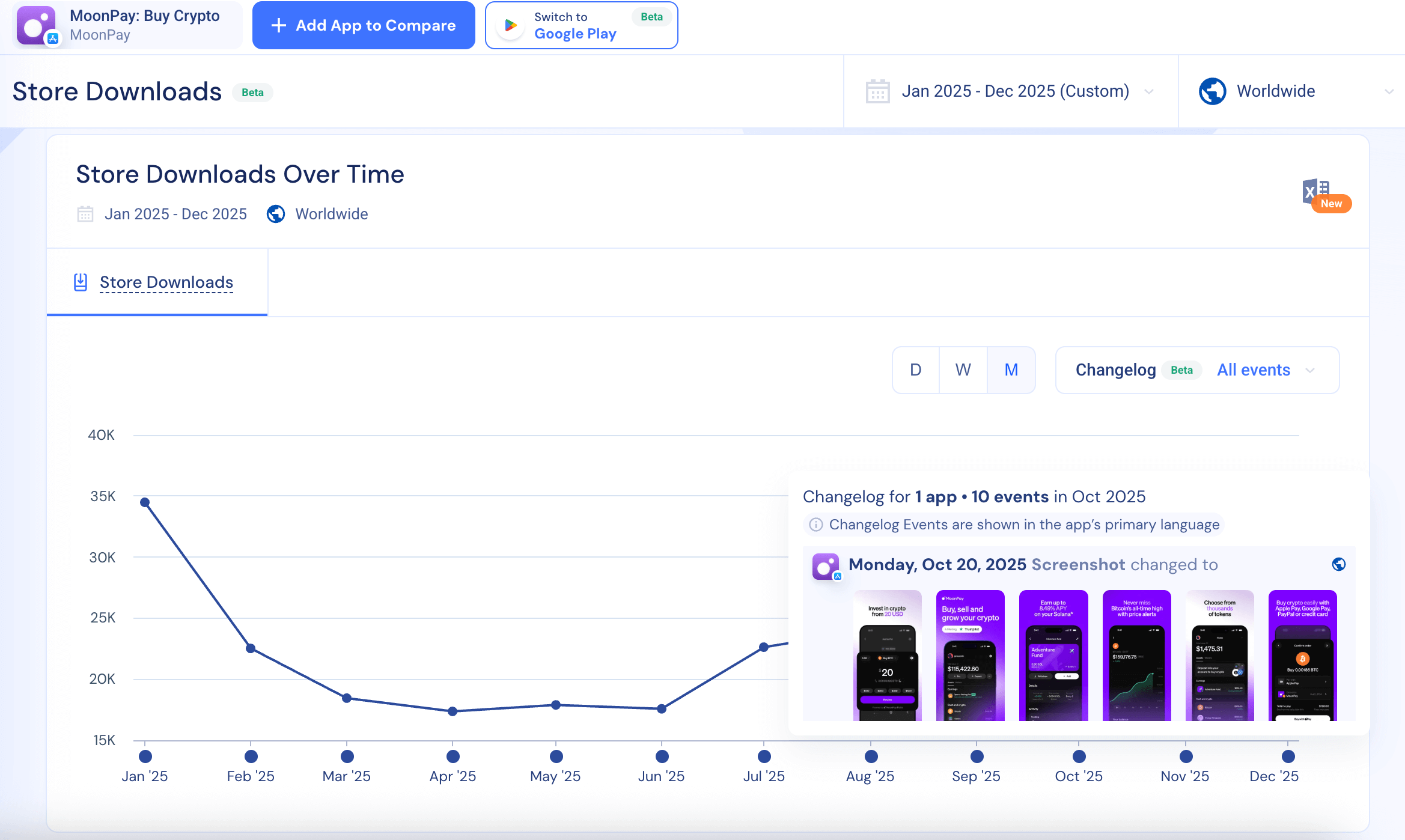

App store optimizations

In September and October, MoonPay made a series of updates within the app, from description changes to uploading new screenshots, which likely improved conversion on the App Store by better communicating its value proposition at exactly the right time (when Bitcoin interest was at its highest). We see clear evidence of this in our ‘changelog’ events:

Bread Financial

Bread Financial powers ‘buy now, pay later’ (BNPL) options and store credit cards seen at major retailers like IKEA or Wayfair. They act as the bridge between customers and their favorite brands, providing the flexible payment plans and credit tools used at checkout, while also offering high-yield online savings accounts for personal banking.

What drove Bread Financial’s momentum in 2025?

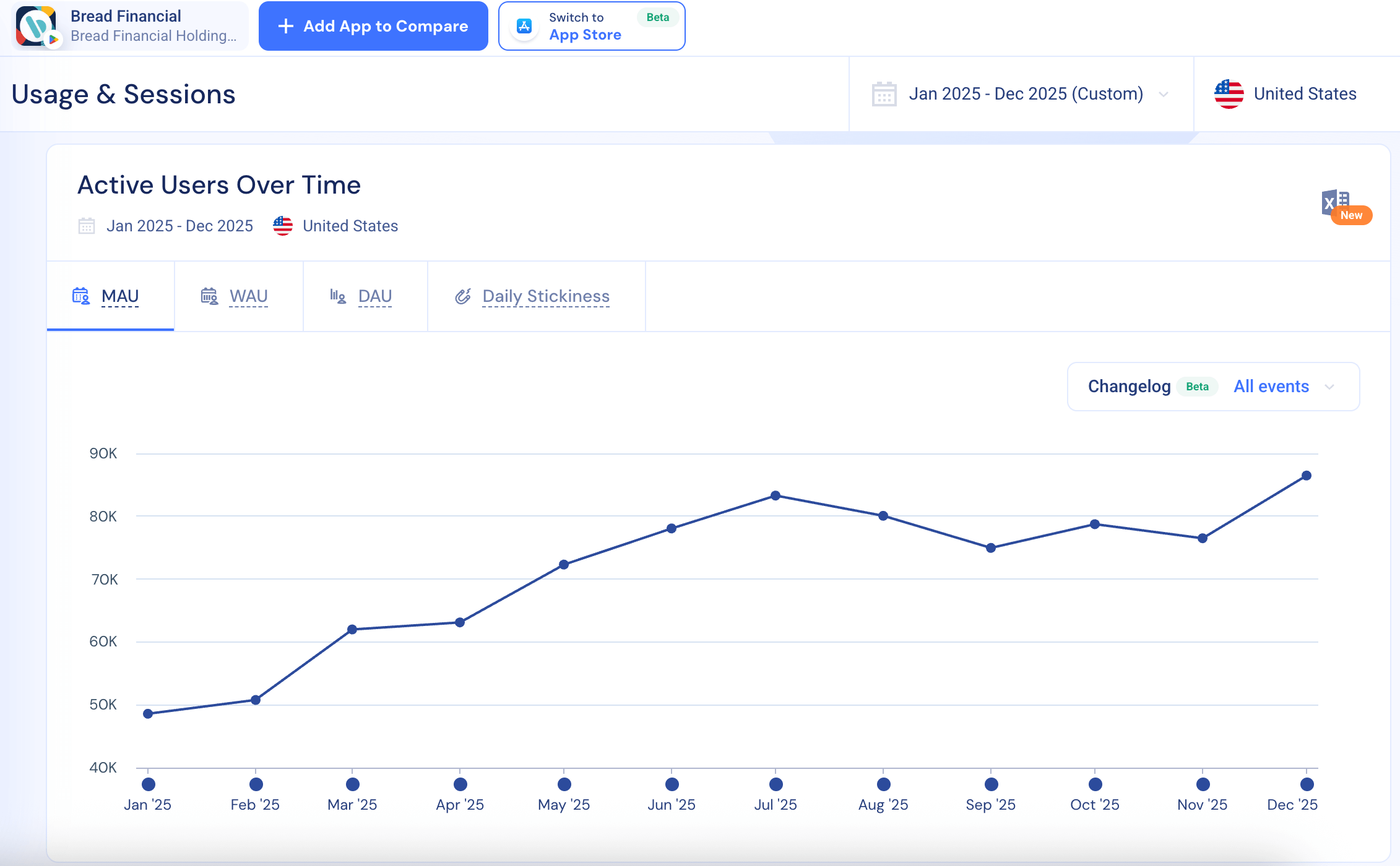

Bread’s growth in 2025 was steady rather than spike-driven, with a gradual increase over the year, which appears to be tied to its expanding card portfolio:

New premium credit card with Caesars in July

This is the kind of co-brand launch that can cause a surge of active users, which we see in the MAU data for July:

Popular partner card sites

Comenity (their subsidiary app) and many others, guide cardholders directly to the Bread Financial app to handle payments, track rewards and manage their accounts.

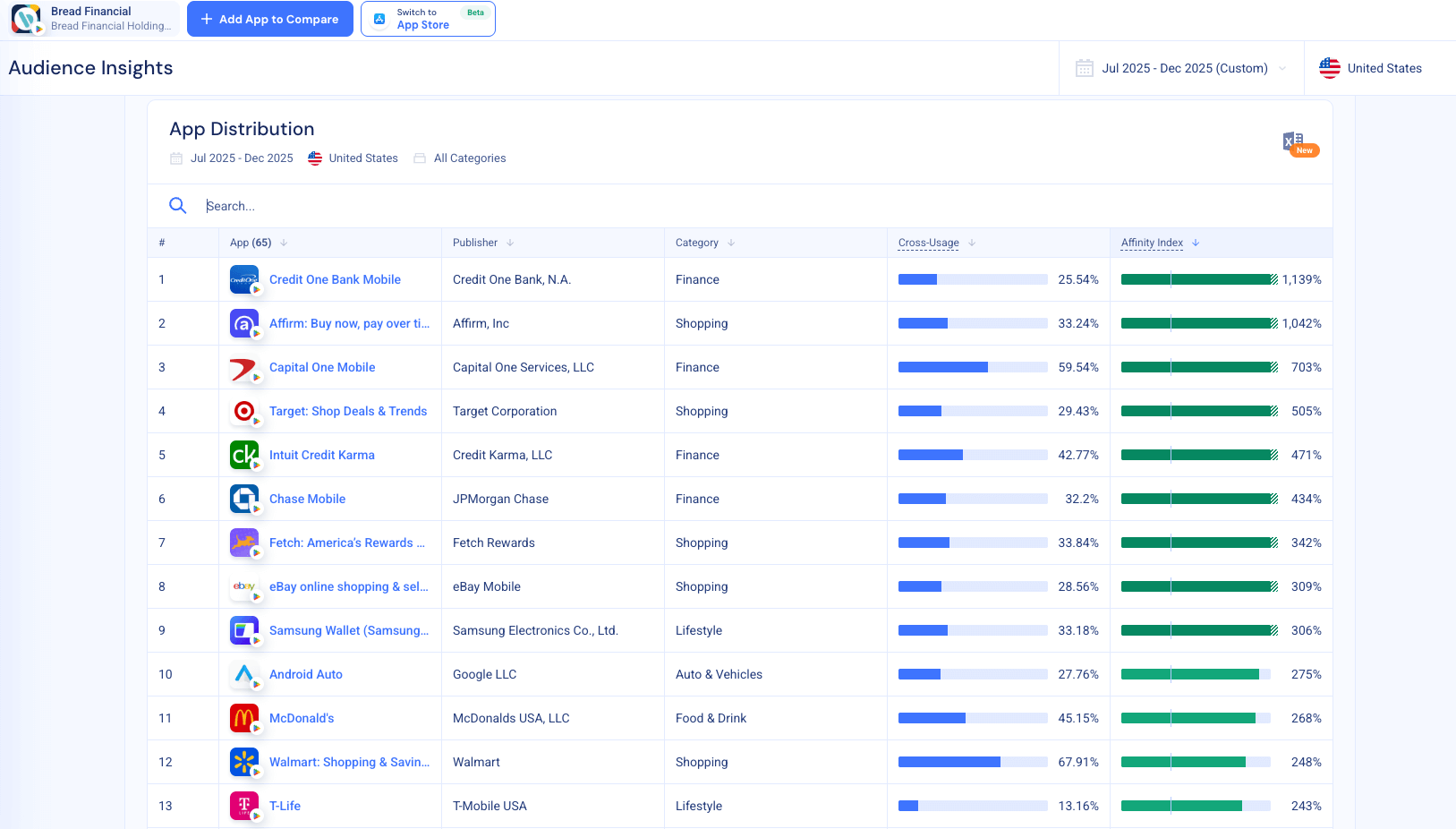

We can see this in Similarweb’s Audience Insights, which highlights which apps Bread users overlap with the most:

Here, there’s a very high cross-usage with other financial apps, but also with brands and retailers that use BNPL services, like Affirm (1,042% affinity), Target, eBay and Walmart.

It’s clear that Bread users are not just there for banking, they’re deal conscious, rewards-driven, engaged shoppers, showing that Bread is strongly embedded in the everyday retail world.

Común

The Común app offers checking accounts, debit cards and financial services specifically for Spanish-speaking immigrants navigating the new US banking system, meeting a clear, underserved need in the immigrant community.

What drove Común’s momentum in 2025?

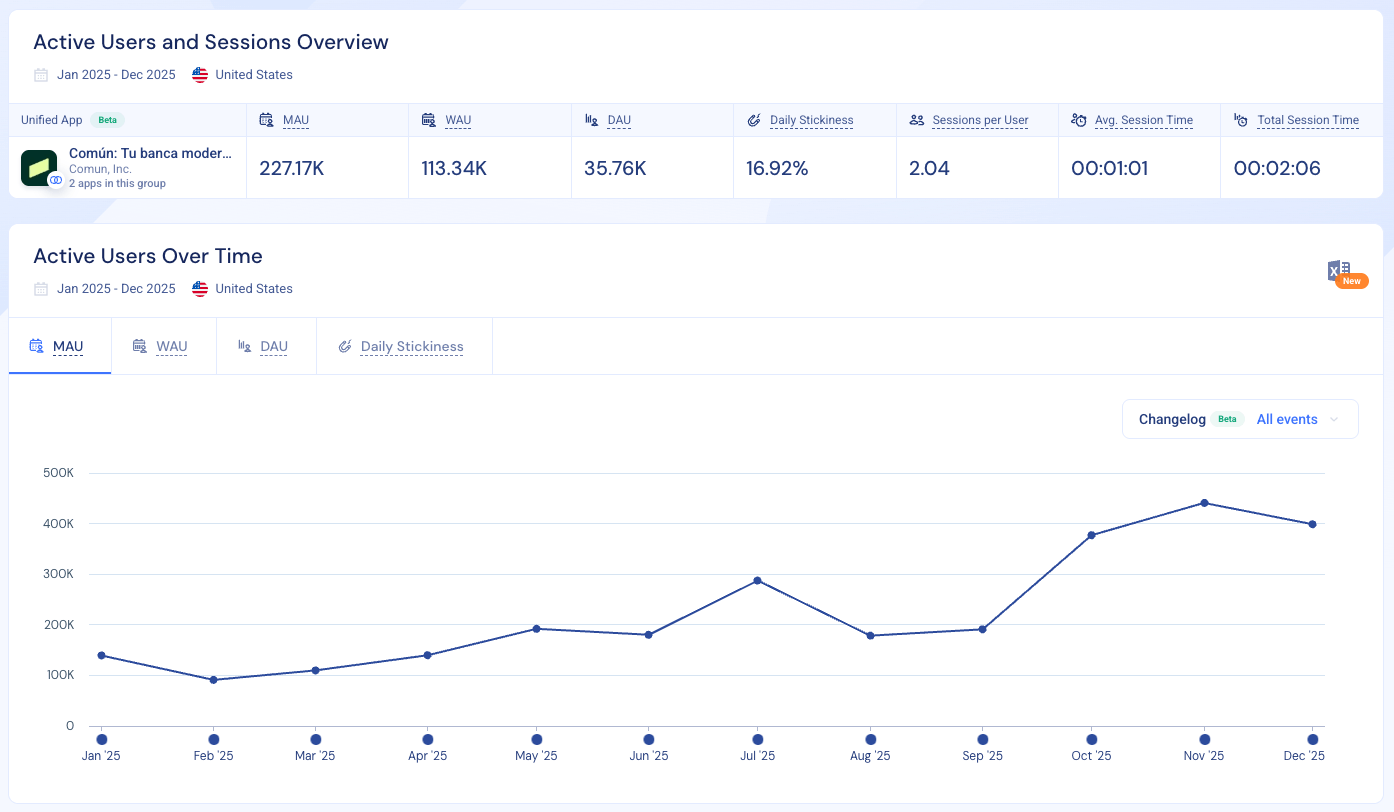

In 2025, Común’s growth stands out with one of the strongest late-year growth spurts across the apps we’ve analyzed, with its biggest lift in usage from October to December:

Here’s what could have contributed to their later growth spurt:

Spanish-first, immigrant-focused positioning

It’s framed as a Spanish-first banking hub for immigrants, with its bilingual nature, easy onboarding and transparent fees making it an instant hit with newcomers.

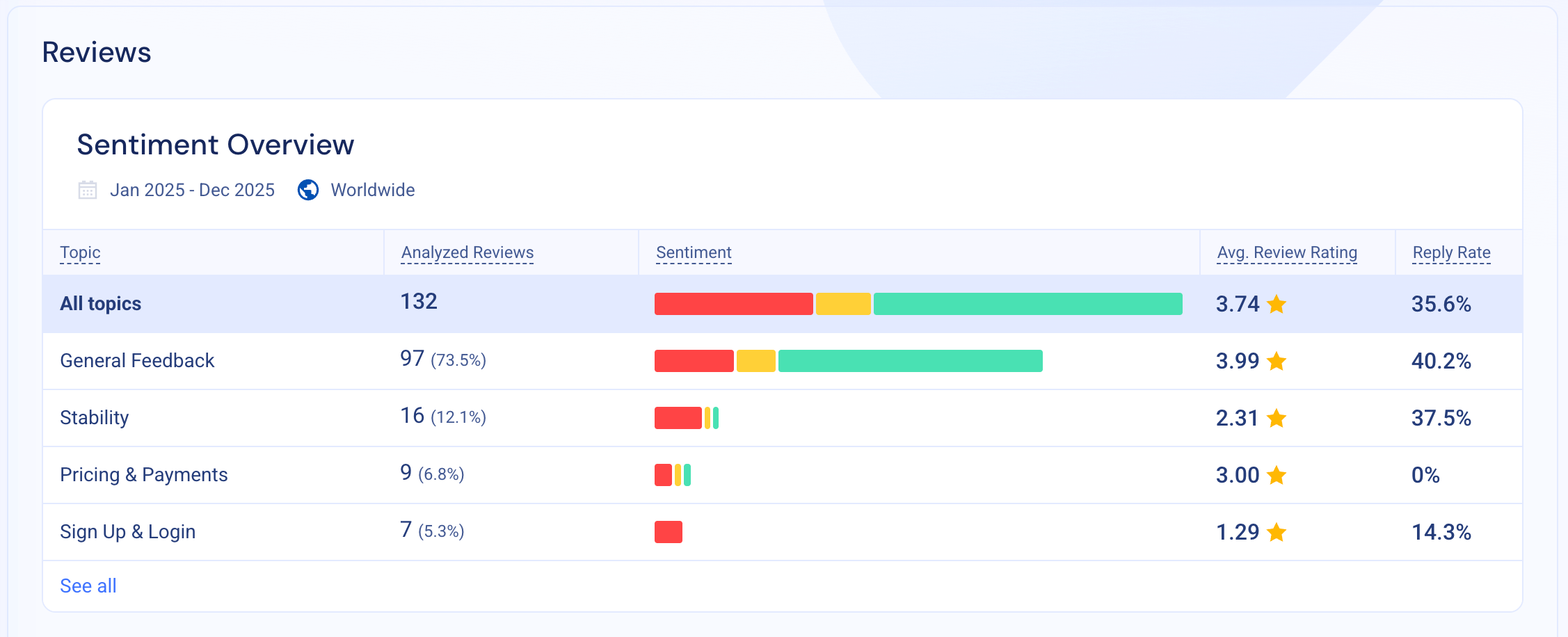

The app’s easy all-in-one approach is reflected in its 3.74 average App Store rating, with 60% of reviews carrying positive sentiment:

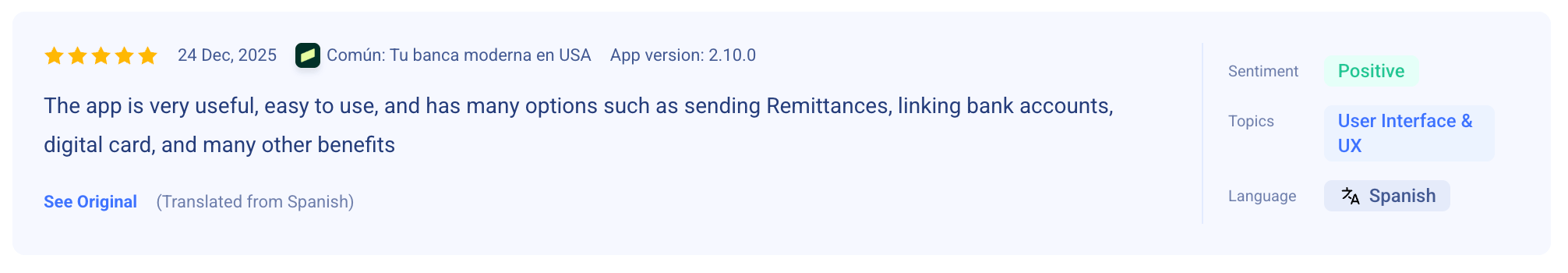

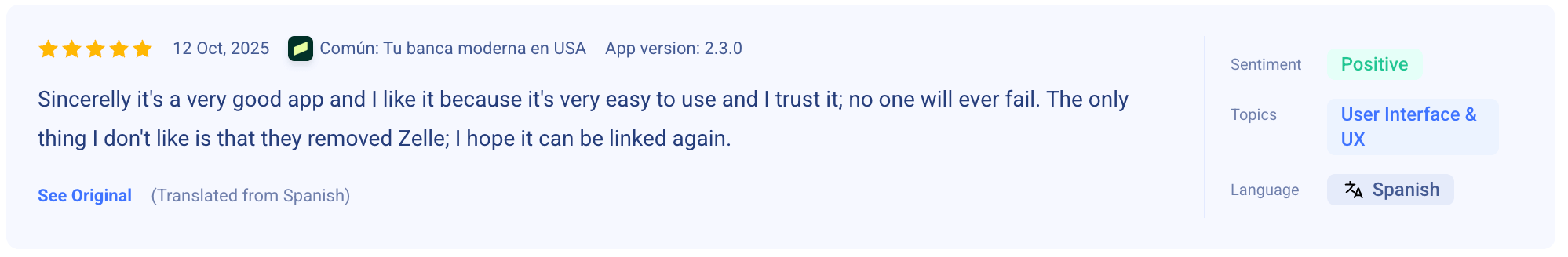

Here’s a quick snapshot directly from the reviews themselves to show what users enjoyed (or didn’t) about the app. The reviews mention that users particularly liked the app’s easy user interface and smooth UX:

What do they all have in common?

1) Clear positioning

Each of these apps knows exactly who it’s for. For example, Atlas focuses on accessible credit and rewards, MoonPay makes buying and selling crypto simple and Común supports Spanish-speaking immigrants navigating US banking. That clarity makes it easier for the right users to find them, and want to stick around.

2) Intentional growth strategies

None of their growth was random. Atlas and Lenme used referrals, reward and affiliate partner programs, while Bread grew through new card launches and partner sites guiding users into the app. Each app had its own reliable way to bring users in.

3) Growth that lasted

Some apps built steady momentum month after month, while others captured a big moment and held onto users afterward. The common thread is that when the product solves a real problem and reaches the right audience, growth tends to follow. And, for many of the apps (particularly Lenme and Común) that growth is closely tied to the user experience and how easily users can access and complete transactions in the app.

Wondering what Similarweb can do for your business?

Give it a try or talk to our insights team — don’t worry, it’s free!