The Top 100 Most Visited Websites in the World (December 2025)

Every day, billions of people search, shop, stream, game, message, and manage their lives online. December is always a peak month for global web traffic, but December 2025 stood out even more than usual. Using Similarweb’s web traffic data, we analyzed the top 100 most visited websites in the world for December 2025, uncovering how holiday behavior, blockbuster entertainment, AI competition, and policy changes shaped digital demand at year’s end.

This month’s data reveals a web landscape defined by event-driven spikes: AI platform rivalry intensified, streaming finales “broke the internet,” annual marketing campaigns delivered predictable surges, and even government websites saw record traffic due to regulatory confusion colliding with holiday deadlines.

What is the #1 most-visited website in the world?

Google.com remained the most visited website globally in December 2025, with more than 84 billion visits.

Traffic to Google.com was broadly stable month-over-month, keeping Google well ahead of YouTube and Facebook. As in prior months, Google’s dominance reflects its dual role as both a traditional search engine and an increasingly AI-mediated interface. AI Overviews, Gemini integrations, and direct-answer experiences continue to satisfy more queries without requiring users to leave Google properties, reshaping how traffic flows across the wider web.

Top 100 most visited websites (December 2025)

Below is a table of the world’s most visited websites, ranked by total monthly traffic. The rankings include desktop and mobile web visits and are based on Similarweb data for December 2025.

| # | Domain | Monthly Visits | MoM traffic change |

| 1 | google.com | 84.2B | 2.30% |

| 2 | youtube.com | 30.6B | 6.44% |

| 3 | facebook.com | 11.9B | 5.12% |

| 4 | instagram.com | 6.9B | 5.44% |

| 5 | chatgpt.com | 5.5B | -5.59% |

| 6 | x.com | 4.4B | 2.73% |

| 7 | reddit.com | 4.2B | 6.76% |

| 8 | whatsapp.com | 3.6B | -0.84% |

| 9 | wikipedia.org | 3.5B | 0.78% |

| 10 | bing.com | 3.4B | 1.44% |

| 11 | tiktok.com | 3.2B | 8.12% |

| 12 | amazon.com | 3.1B | 7.46% |

| 13 | yahoo.co.jp | 3.0B | 3.72% |

| 14 | yandex.ru | 2.9B | 3.48% |

| 15 | yahoo.com | 2.9B | 2.82% |

| 16 | bet.br | 2.0B | -0.38% |

| 17 | baidu.com | 2.0B | 2.60% |

| 18 | netflix.com | 1.8B | 16.06% |

| 19 | gemini.google.com | 1.7B | 28.38% |

| 20 | linkedin.com | 1.7B | -3.54% |

| 21 | naver.com | 1.6B | 3.45% |

| 22 | pornhub.com | 1.5B | 5.02% |

| 23 | pinterest.com | 1.5B | 5.01% |

| 24 | live.com | 1.4B | 2.34% |

| 25 | dzen.ru | 1.3B | 2.44% |

| 26 | temu.com | 1.3B | -4.05% |

| 27 | xhamster.com | 1.3B | 4.90% |

| 28 | bilibili.com | 1.3B | 2.82% |

| 29 | office.com | 1.2B | -11.59% |

| 30 | microsoft.com | 1.2B | 1.18% |

| 31 | xvideos.com | 1.2B | 6.42% |

| 32 | twitch.tv | 1.1B | 0.56% |

| 33 | vk.com | 914.7M | 5.20% |

| 34 | fandom.com | 896.7M | 13.56% |

| 35 | news.yahoo.co.jp | 888.7M | 3.25% |

| 36 | canva.com | 879.5M | -11.44% |

| 37 | weather.com | 877.5M | 9.15% |

| 38 | mail.ru | 837.5M | 4.23% |

| 39 | sharepoint.com | 814.9M | -12.30% |

| 40 | t.me | 791.9M | 5.61% |

| 41 | samsung.com | 761.6M | -5.75% |

| 42 | stripchat.com | 756.3M | 8.11% |

| 43 | globo.com | 739.1M | -3.76% |

| 44 | xnxx.com | 715.4M | 9.09% |

| 45 | duckduckgo.com | 713.5M | 4.86% |

| 46 | ebay.com | 678.8M | 9.19% |

| 47 | roblox.com | 669.2M | 15.38% |

| 48 | aliexpress.com | 634.6M | -17.38% |

| 49 | eporner.com | 627.1M | 14.12% |

| 50 | walmart.com | 626.9M | 3.03% |

| 51 | nytimes.com | 625.3M | 0.56% |

| 52 | discord.com | 621.4M | 11.09% |

| 53 | docomo.ne.jp | 605.2M | 10.09% |

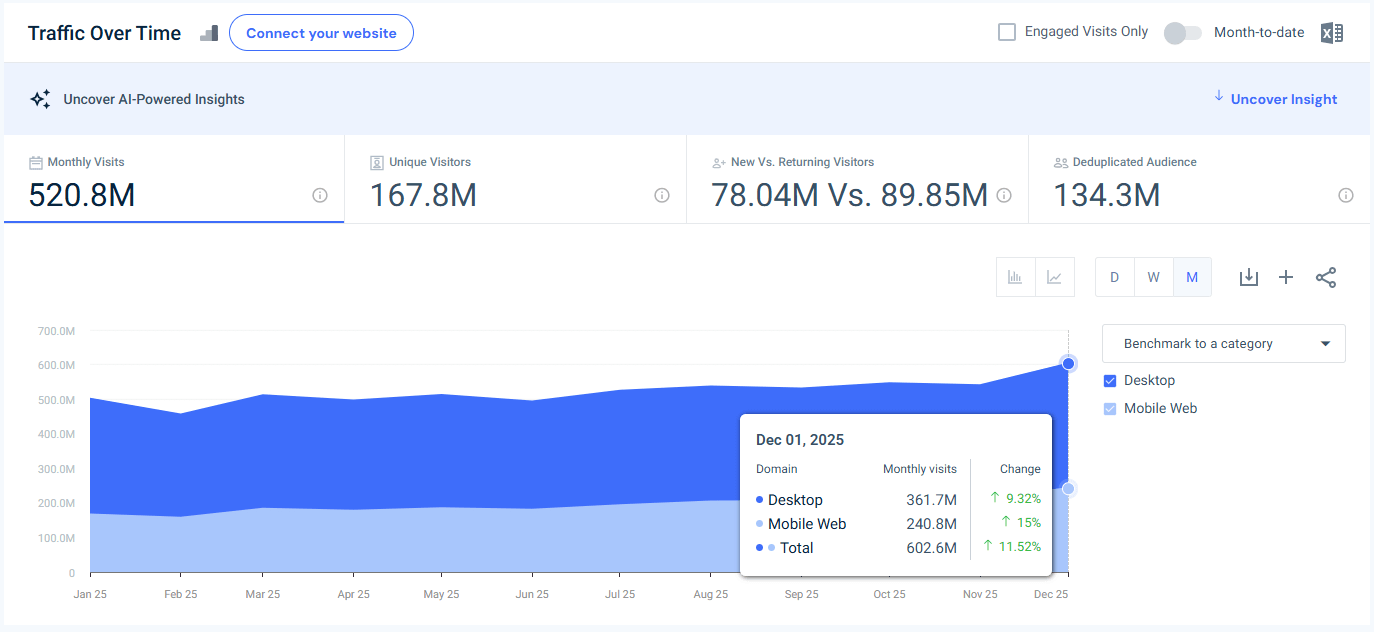

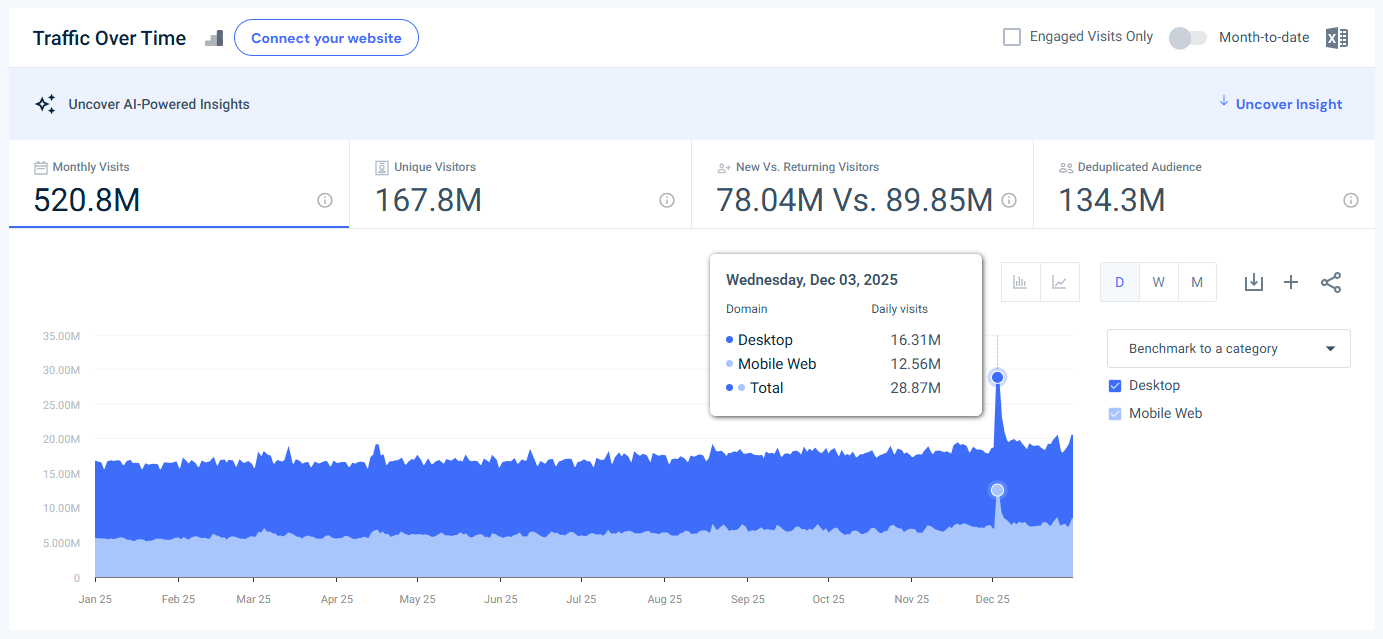

| 54 | spotify.com | 602.7M | 11.52% |

| 55 | xhamster44.desi | 586.1M | 20.00% |

| 56 | chaturbate.com | 585.7M | 7.32% |

| 57 | espn.com | 569.7M | -4.22% |

| 58 | ozon.ru | 566.7M | 5.09% |

| 59 | amazon.co.jp | 554.9M | -1.46% |

| 60 | paypal.com | 551.9M | 5.31% |

| 61 | apple.com | 537.9M | 7.20% |

| 62 | booking.com | 530.5M | 5.93% |

| 63 | imdb.com | 525.5M | 13.26% |

| 64 | bbc.co.uk | 525.0M | -0.32% |

| 65 | etsy.com | 524.0M | 15.27% |

| 66 | amazon.in | 522.7M | 5.84% |

| 67 | github.com | 504.0M | 4.08% |

| 68 | msn.com | 496.9M | 7.04% |

| 69 | telegram.org | 491.4M | 10.27% |

| 70 | zoom.us | 490.6M | -15.34% |

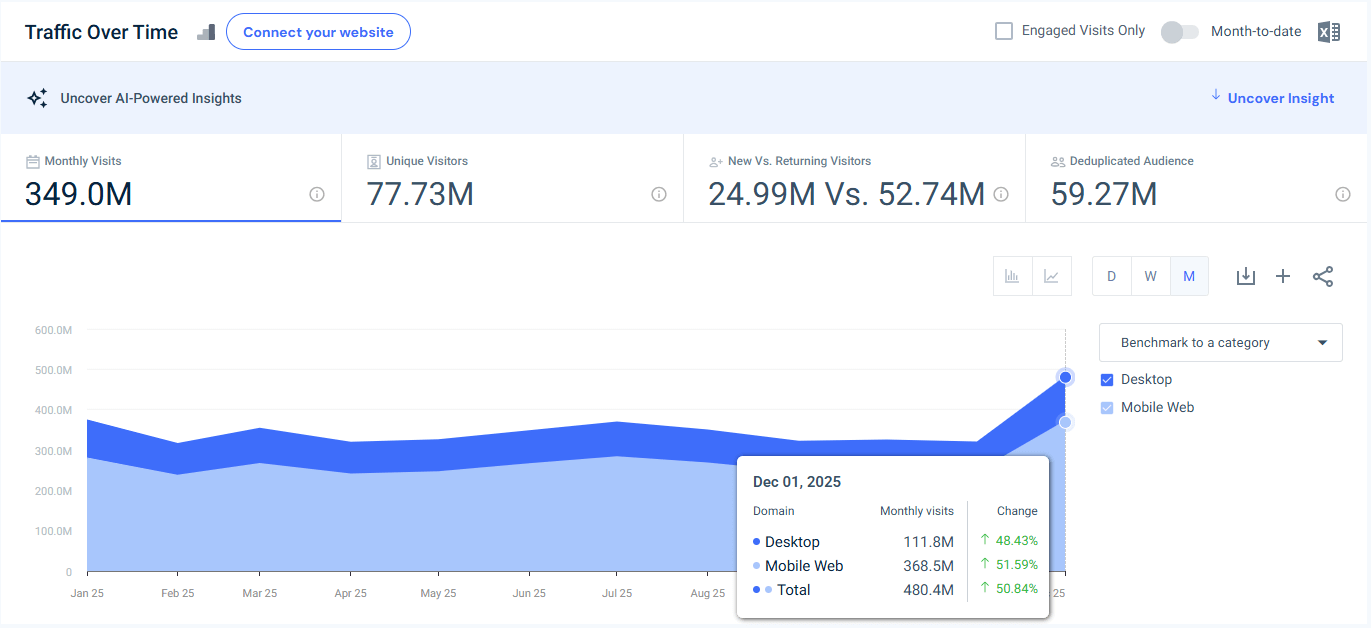

| 71 | usps.com | 480.4M | 50.84% |

| 72 | amazon.de | 469.2M | -1.20% |

| 73 | bbc.com | 463.8M | 1.88% |

| 74 | ya.ru | 463.0M | 2.41% |

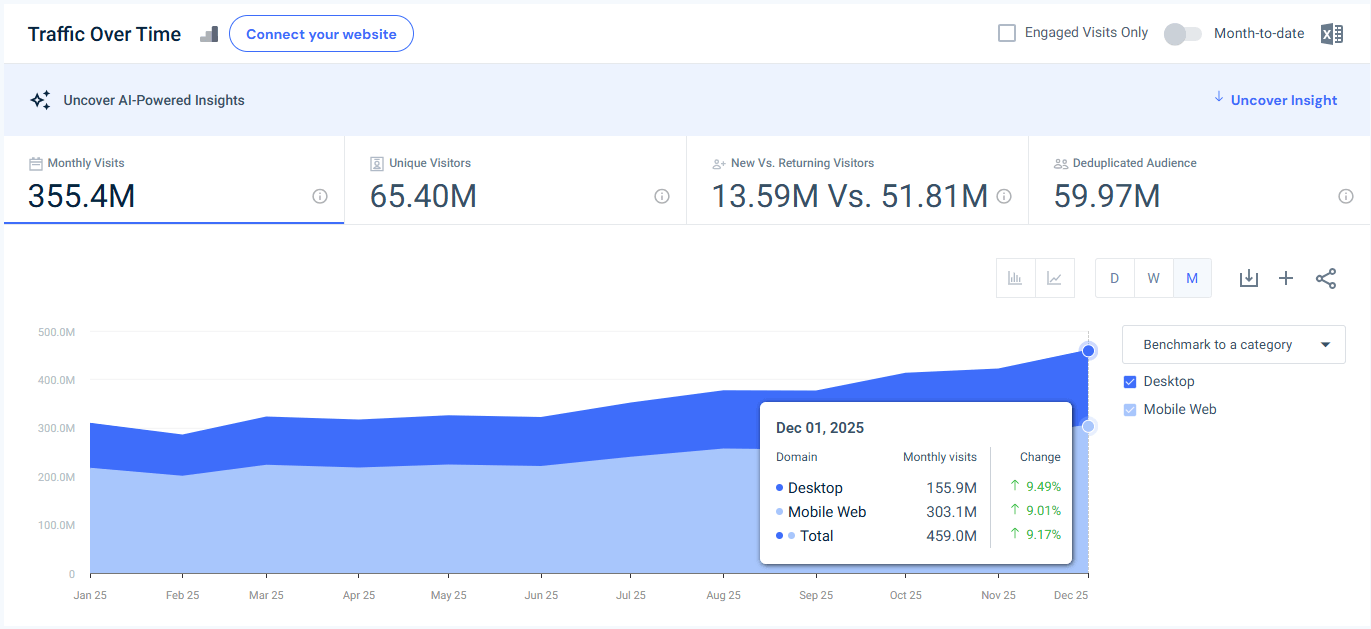

| 75 | brave.com | 459.1M | 9.17% |

| 76 | rakuten.co.jp | 450.6M | 6.78% |

| 77 | amazon.co.uk | 437.4M | 5.98% |

| 78 | cnn.com | 405.9M | -5.92% |

| 79 | ok.ru | 398.5M | 8.23% |

| 80 | wildberries.ru | 388.1M | 3.06% |

| 81 | qq.com | 372.9M | 5.69% |

| 82 | disneyplus.com | 372.5M | 7.93% |

| 83 | rutube.ru | 371.2M | 0.34% |

| 84 | music.youtube.com | 369.2M | 5.87% |

| 85 | hbomax.com | 368.9M | 15.01% |

| 86 | quora.com | 361.8M | -3.85% |

| 87 | office365.com | 345.5M | -9.28% |

| 88 | shein.com | 341.9M | -11.09% |

| 89 | namu.wiki | 341.9M | 6.43% |

| 90 | indeed.com | 335.7M | -3.57% |

| 91 | adobe.com | 331.2M | -0.48% |

| 92 | deepseek.com | 328.9M | -4.87% |

| 93 | cricbuzz.com | 328.0M | -5.46% |

| 94 | share.google | 325.3M | -20.10% |

| 95 | daum.net | 322.1M | -14.15% |

| 96 | instructure.com | 317.6M | -29.39% |

| 97 | douyin.com | 317.5M | 3.96% |

| 98 | erome.com | 313.1M | 14.92% |

| 99 | chat.deepseek.com | 312.7M | -5.50% |

| 100 | faphouse.com | 311.6M | 4.98% |

Highlights from the top websites

Below are 10 standout websites from the global top 100 that experienced notable growth or decline in December 2025, each tied to a clear real-world driver.

ChatGPT.com

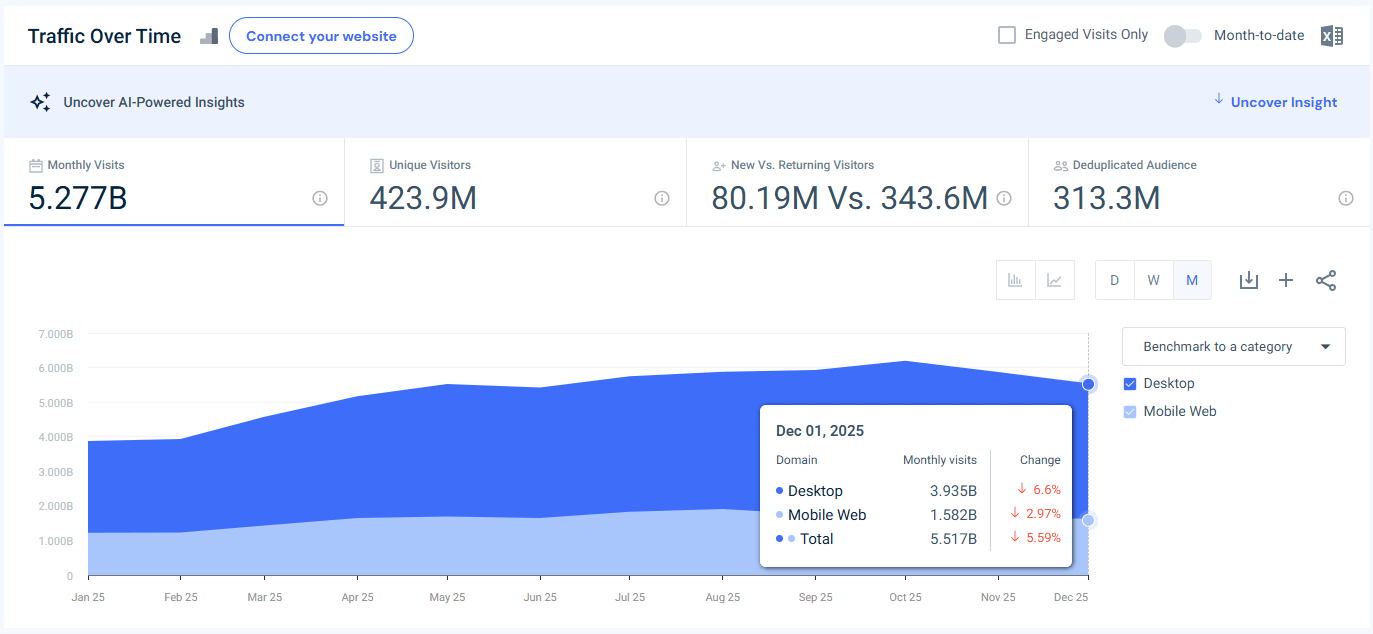

#5 Worldwide

🤖 ~5.5B visits | ▼ ~5.6% MoM

ChatGPT’s web traffic declined for a second consecutive month, marking a clear post-hype normalization phase. The timing is notable: the decline coincides directly with Google’s rollout of Gemini 3, which accelerated competitive pressure on standalone AI assistants.

While ChatGPT still dominates AI web traffic in absolute terms, December’s data highlights a shift:

- Users are increasingly splitting usage across multiple AI tools

- Some engagement is migrating away from the web interface toward apps, APIs, and enterprise integrations

- Google’s ability to surface Gemini directly inside Search creates structural distribution advantages

TikTok.com

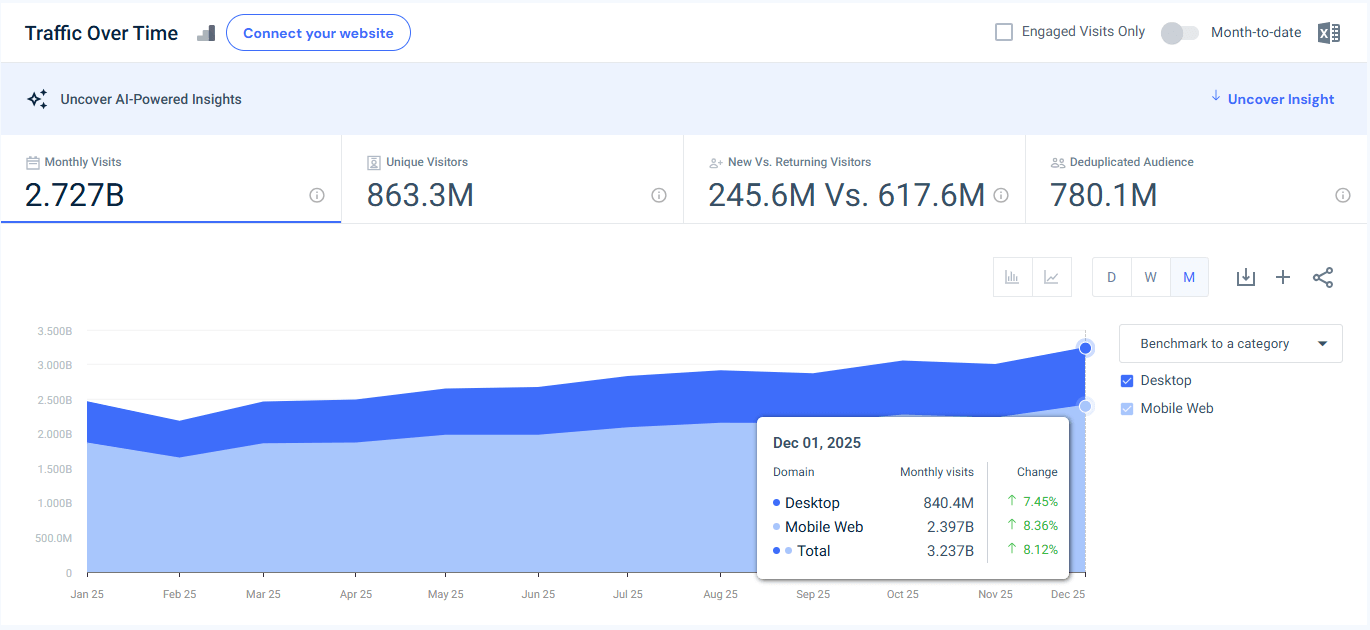

#11 Worldwide

🎵 ~3.24B visits | ▲ ~8.1% MoM

TikTok delivered one of December’s strongest gains, driven primarily by TikTok Shop’s explosive growth during the holiday season.

Mobile traffic accounted for nearly three-quarters of visits, underscoring TikTok’s role as a mobile-first discovery and commerce engine. According to Emarketer, TikTok Shop now represents ~18% of US social commerce in 2025, with growth accelerating through the holidays as creators blended entertainment, gifting, and impulse buying.

December reinforces TikTok’s evolution from “just” a video platform into a full-funnel commerce ecosystem, one where browsing, recommendation, and checkout increasingly happen in the same session.

Netflix.com

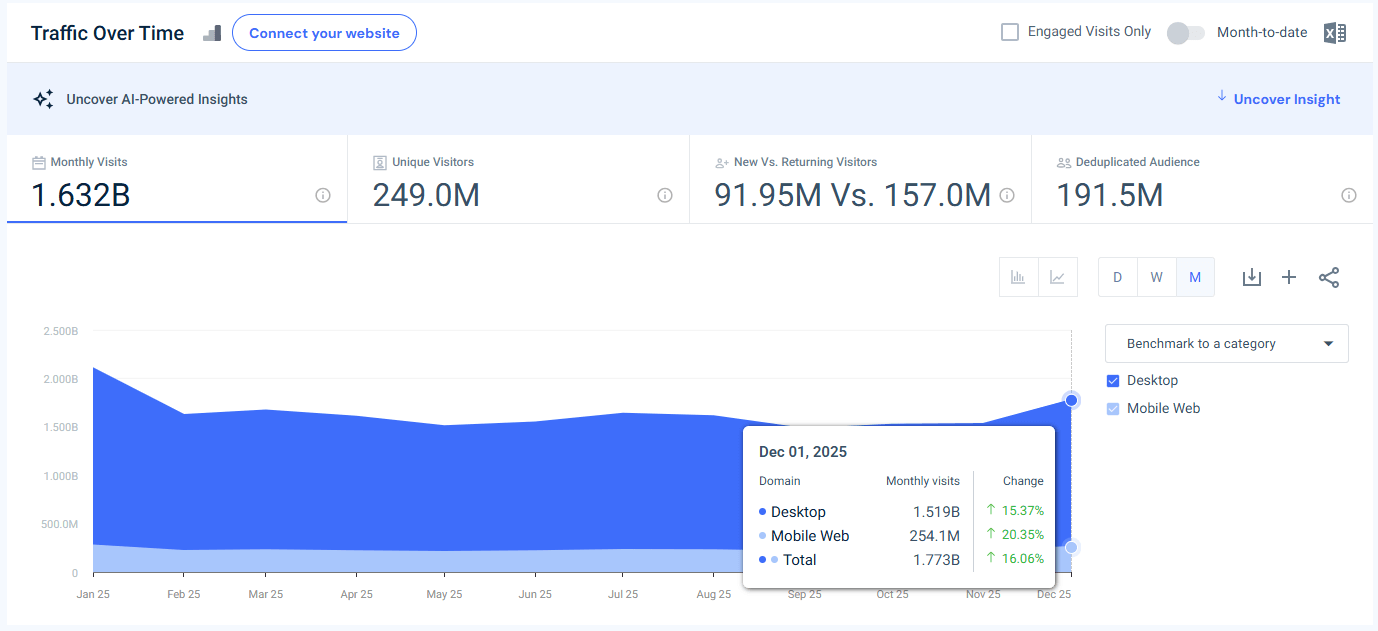

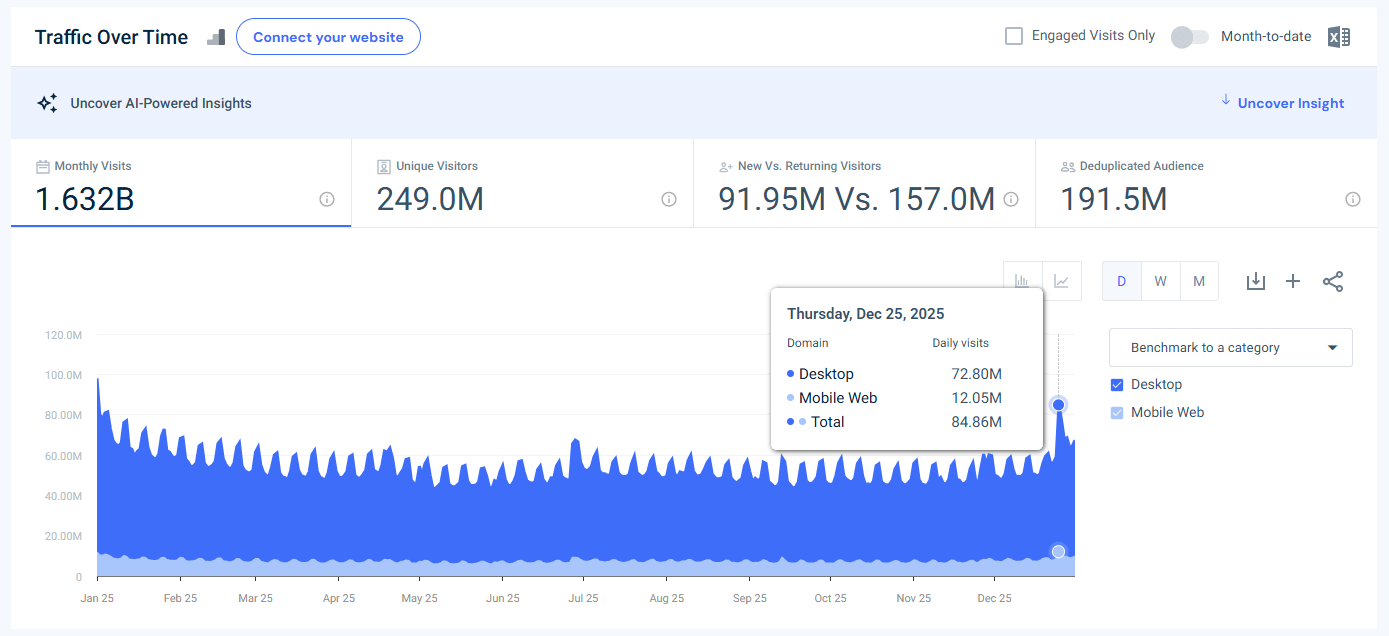

#20 Worldwide

🎬 ~1.77B visits | ▲ ~16.1% MoM

Netflix’s December growth was decisively event-driven. Daily traffic data shows two sharp spikes:

- December 25

- December 31

Both align precisely with the release of Stranger Things Season 5, Volume 2 and the series finale.

This was the biggest streaming event of 2025, engineered for maximum cultural impact:

- Christmas Day and New Year’s Eve releases

- Massive spoiler-avoidance urgency

- Cross-platform social amplification

Netflix’s performance shows that appointment viewing still exists in an on-demand world, when the IP is big enough.

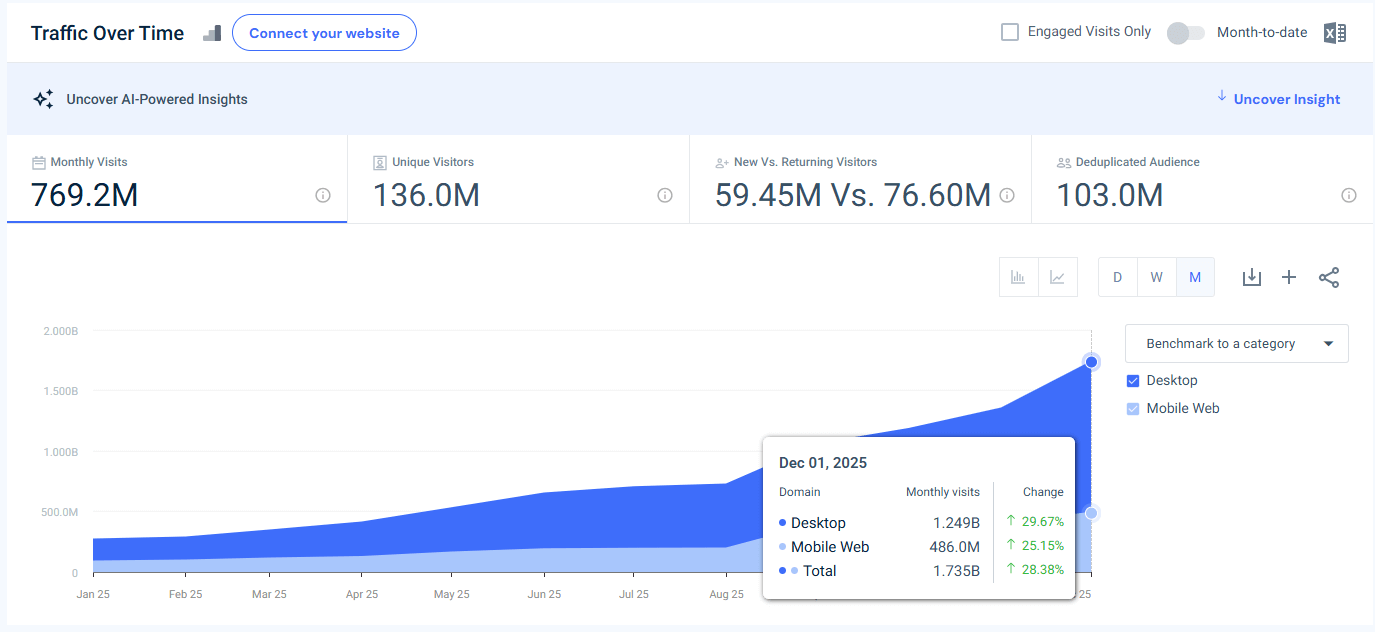

Gemini.google.com

#26 Worldwide

💫 ~1.74B visits | ▲ ~28.4% MoM

Gemini was one of the fastest-growing sites in the entire top 100, and for the first time, it entered the top 20 most-visited websites in the world. December’s surge followed the launch and expansion of Gemini 3, alongside deeper integration across Google Search, Workspace, Chrome, and developer tools.

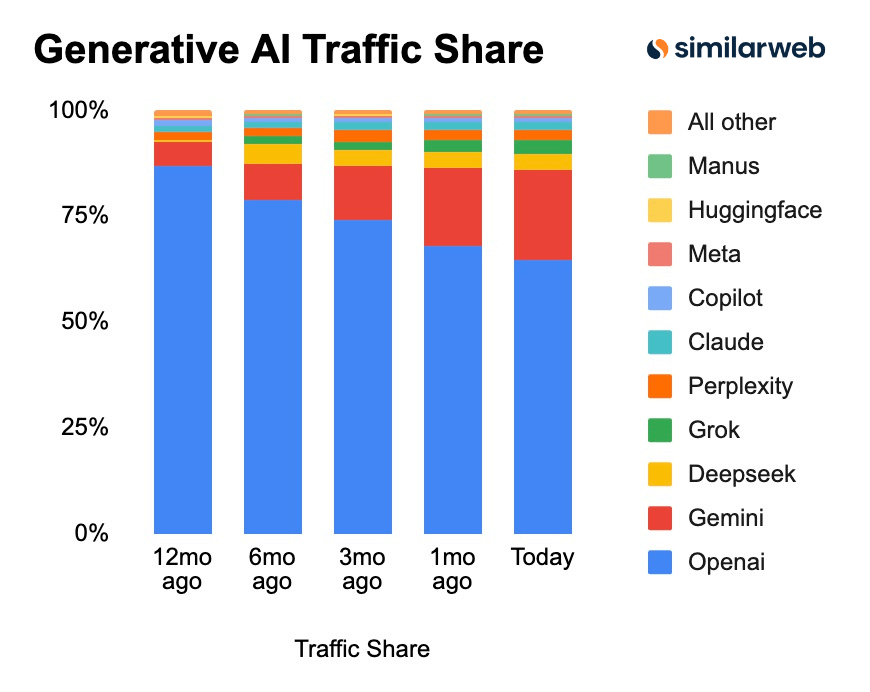

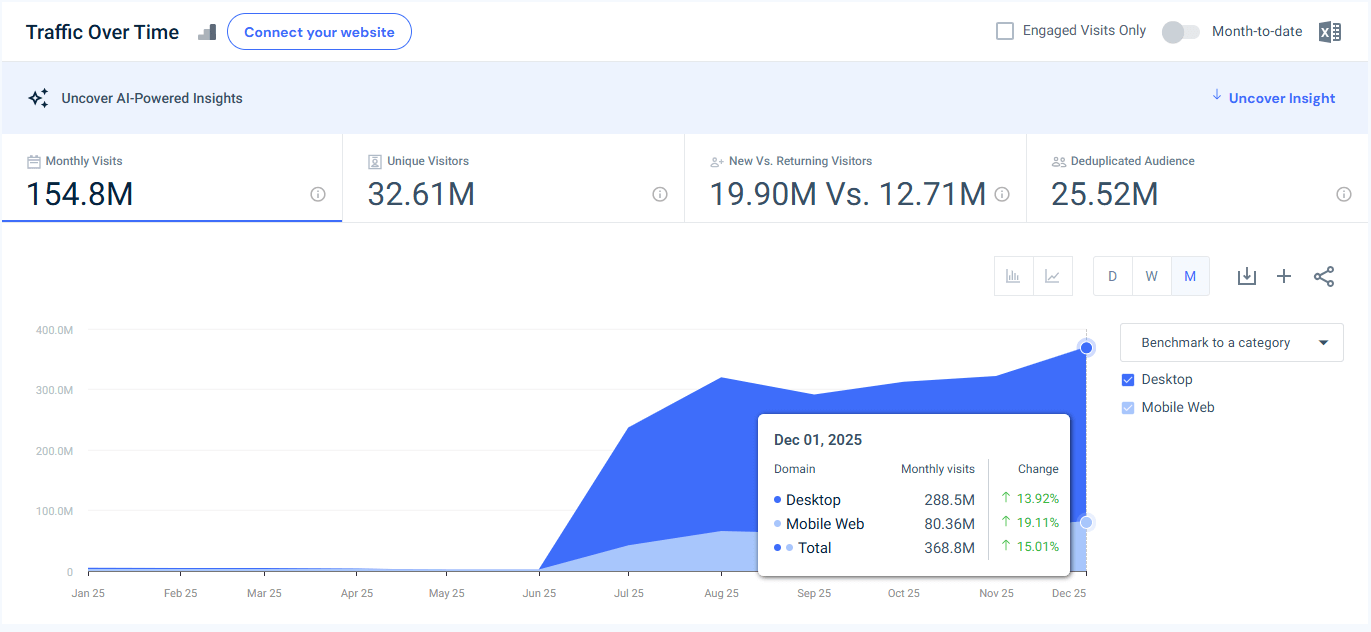

Similarweb’s Generative AI traffic share data shows that Gemini isn’t just growing-it’s actively capturing share. Over the past month, Gemini accounted for a rising portion of AI web visits, while ChatGPT’s share declined modestly.

This marks December as an inflection point in the AI race: competition is shifting from novelty to ecosystem leverage.

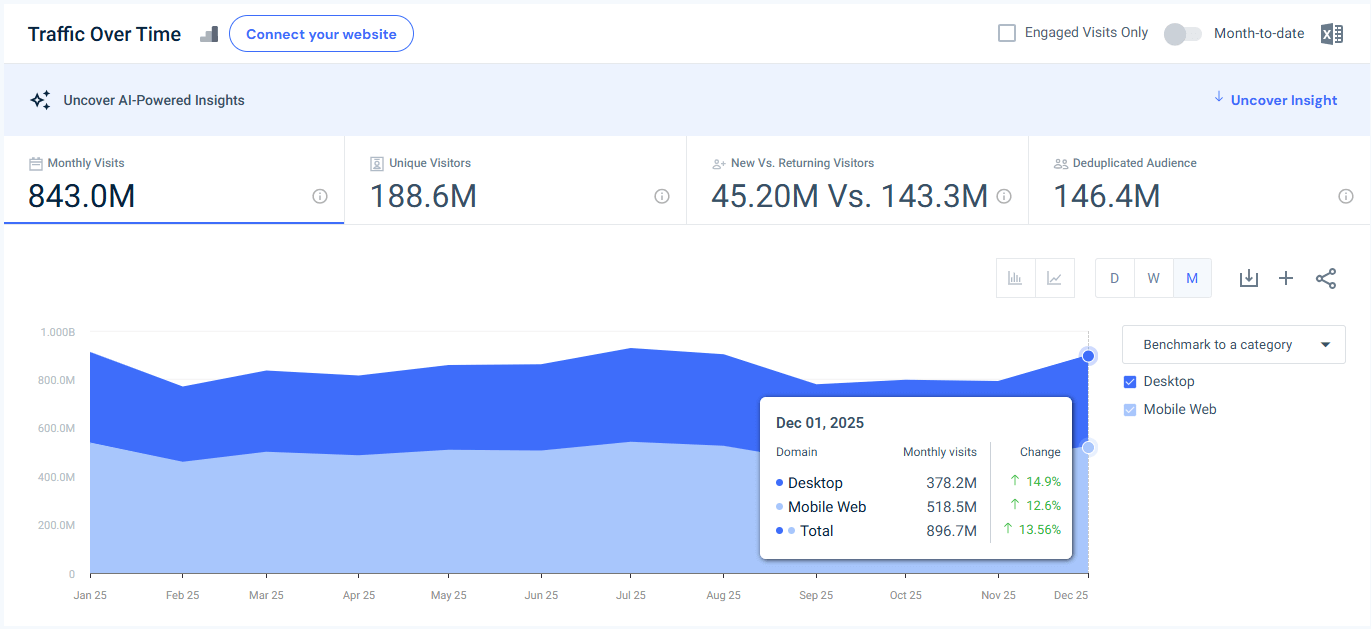

Fandom.com

#32 Worldwide

📚 ~897M visits | ▲ ~13.6% MoM

Fandom benefited from a perfect storm of IP-driven demand:

- Avatar: Fire and Ash (Avatar 3) drove moviegoers to lore pages, while a simultaneous Avatar: Frontiers of Pandora DLC release sent gamers searching for guides.

- Fallout Season 2 reignited interest in timelines, canon explanations, and franchise history.

These dual audiences-film and gaming-converged on Fandom, reinforcing the role of wikis as companion platforms to modern entertainment.

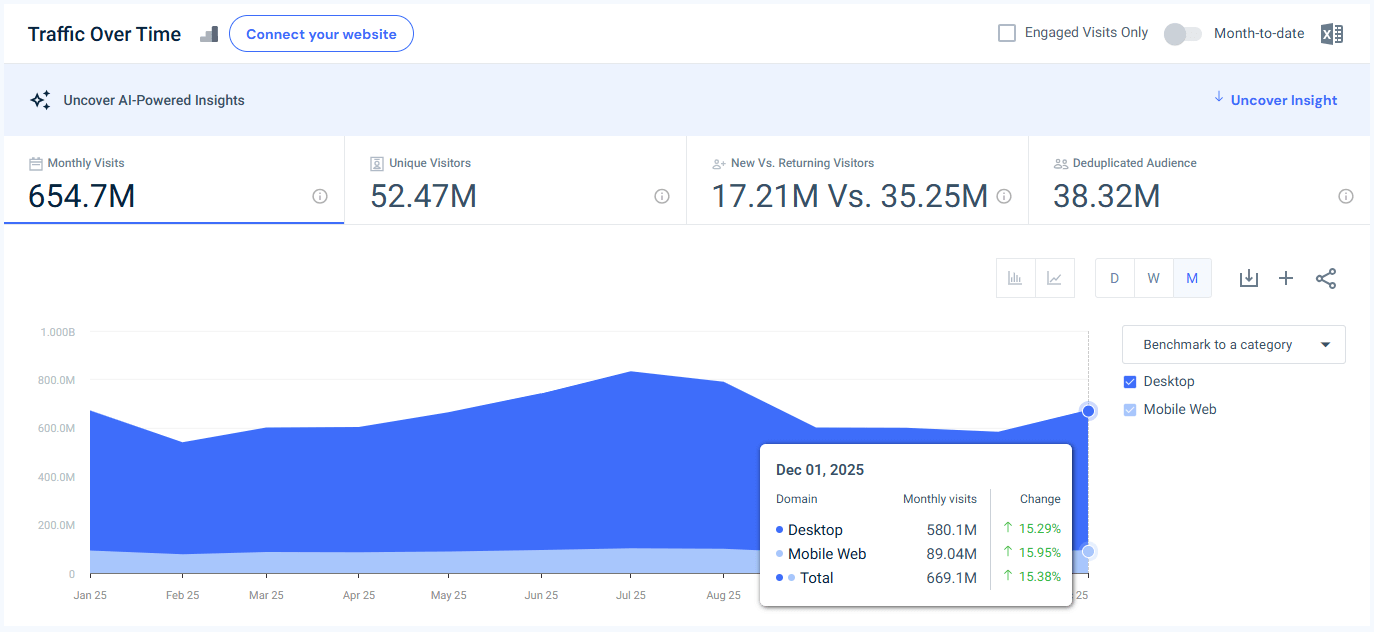

Roblox.com

#39 Worldwide

🎮 ~669M visits | ▲ ~15.4% MoM

Roblox’s December growth followed a familiar but powerful pattern:

- Traffic peaks around December 25 and December 31

- Players log in to redeem gift cards and Robux

- Seasonal events and limited-time items drive re-engagement

Roblox highlights how digital gifting fuels platform economies, not just ecommerce or streaming.

Spotify.com

#47 Worldwide

🎧 ~603M visits | ▲ ~11.5% MoM

Spotify Wrapped once again proved its effectiveness. Daily traffic spiked sharply on December 3, the day Wrapped 2025 launched.

According to Music Business Worldwide:

- Wrapped reached 200M engaged users in 24 hours

- Engagement was 19% higher YoY

- Shares increased by 41%

Wrapped has become a cultural ritual-an annual campaign that reliably cuts through algorithmic noise and drives measurable traffic impact.

USPS.com

#63 Worldwide

📦 ~480M visits | ▲ ~50.8% MoM

USPS posted one of the largest MoM increases in the top 100, driven by two forces:

- A new “Postmark Rule” effective December 24, which caused confusion over whether last-minute mail would be considered legally “on time.”

- Peak holiday shipping volume, especially during the USPS-designated busiest week (USPS notified their employees that Dec 15-21 will be the busiest week). As expected, all the shopping that happened during November and especially Black Friday is now driving interest in shipment tracking.

Brave.com

#62 Worldwide

🛡️ ~459M visits | ▲ ~9.2% MoM

Brave’s December growth followed the launch of agentic AI browsing in its Nightly build. The feature allows the browser to perform multi-step tasks autonomously while maintaining strict privacy controls.

This positioned Brave at the forefront of a new phase in the AI race: browser-native, agent-based AI, rather than standalone assistants. Interest came primarily from developers, security researchers, and early adopters.

HBOMax.com

#85 Worldwide

📺 ~369M visits | ▲ ~15.0% MoM

HBO Max benefited from a three-pronged content strategy:

- The blockbuster event: It: Welcome to Derry delivered record-setting finale viewership.

- The viral surprise: Heated Rivalry exploded on TikTok and X, proving HBO can win with romance-driven fandoms.

- The legacy revival: Mad Men joined the catalog in 4K, triggering rewatches and Gen Z discovery.

Together, these shows compounded engagement across prestige, virality, and nostalgia.

Trends in December 2025’s global traffic

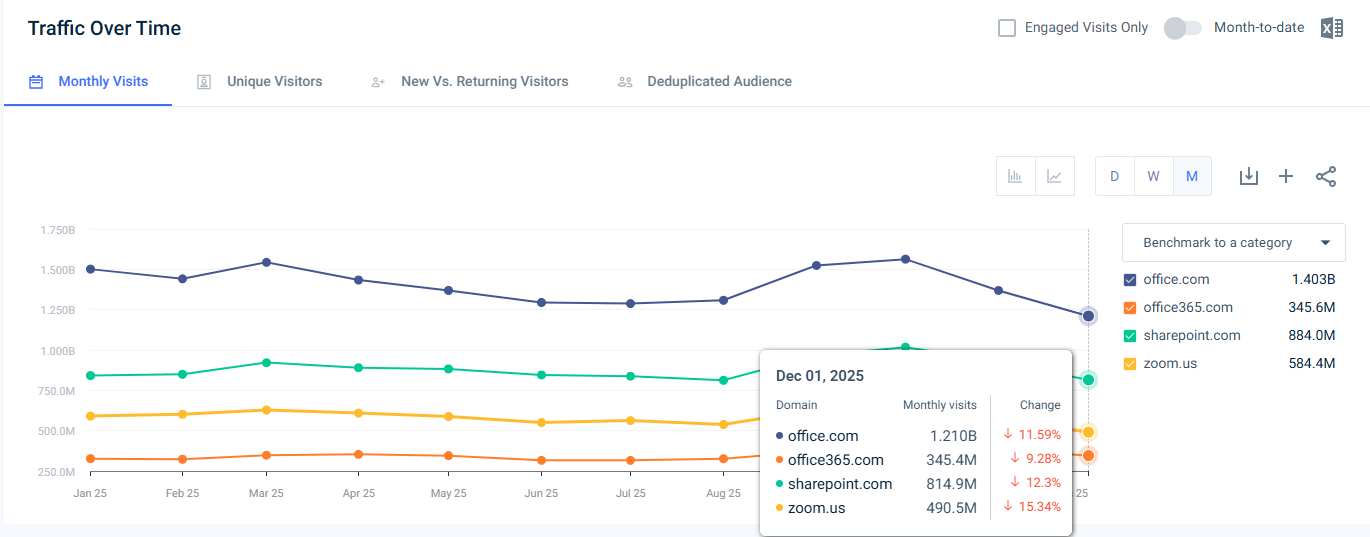

Work and productivity sites dipped across the board

One of the clearest seasonal patterns in the December top 100 is that work-related domains declined month over month. This includes Microsoft’s productivity ecosystem (office.com, office365.com, sharepoint.com) and work communication tools like zoom.us.

The driver is straightforward: fewer working days, more PTO, fewer meetings, and less document collaboration. December traffic does not disappear, but it shifts away from weekday, work-tethered usage and toward consumer behavior.

Holiday commerce shifted from buying to tracking, shipping, and returns

After November’s deal-heavy surge, December activity tends to move down-funnel. Shoppers have already bought, and now they need shipping confirmation, delivery certainty, and return workflows.

That creates a tailwind for logistics and fulfillment destinations, which is why USPS was one of the biggest growers in the entire top 100. December 2025 amplified this effect further with postmark-rule confusion near year-end deadlines, turning USPS.com into both a shipping utility and a compliance destination.

Entertainment was driven by tentpoles, not steady demand

December’s biggest consumer traffic gains were concentrated around cultural moments:

- Netflix benefited from Stranger Things, which created clear spikes on Dec 25 and Dec 31.

- HBO Max gained from a three-lane strategy: a prestige anchor (It: Welcome to Derry), a viral surprise (Heated Rivalry), and a catalog revival (Mad Men in 4K).

- Fandom rose alongside blockbuster IP and game and TV tie-ins, showing that explanation platforms (wikis, lore hubs, guides) still grow when audiences need context.

- Roblox and Spotify reinforced the same idea in different forms: holiday events and gifting (Roblox) and a predictable annual campaign moment (Spotify Wrapped).

The takeaway is that streaming and entertainment traffic is increasingly event-shaped, with platforms competing to create appointment moments in an on-demand world.

AI assistants entered the share-capture phase

AI was still one of the most strategically important categories in December, but the dynamic is changing.

- ChatGPT declined on the web month over month.

- Gemini surged, and Similarweb’s generative AI traffic share view shows Gemini taking a larger slice of assistant web traffic.

- DeepSeek emerged as a meaningful secondary beneficiary, growing from a smaller base but signaling rising demand for alternative, research-oriented AI tools outside the US Big Tech ecosystem.

- Brave’s growth points to the next battleground: agentic AI embedded in the browser, where distribution and defaults matter as much as model quality.

In other words, December reinforced that AI growth is no longer just adoption, it is competitive reallocation.

Social platforms blended entertainment with commerce

TikTok’s December growth highlights how social platforms are increasingly monetized through shopping behavior, not just attention. As TikTok Shop scales, web traffic reflects that shift, with more users moving from discovery to purchase within the same ecosystem.

Overall, December 2025 looked like a web of sharp seasonal rotation: work traffic softened, entertainment and fandom surged on big moments, and commerce shifted from promotions to fulfillment and shipping reassurance.

Key takeaways

- AI web traffic is consolidating, with Gemini gaining share and ChatGPT normalizing after early surges.

- Blockbuster content and finales still “break the internet,” even in an on-demand era.

- Annual campaigns like Spotify Wrapped remain among the most effective growth levers online.

- Infrastructure and government sites can see explosive growth when policy changes collide with seasonal behavior.

- December traffic is increasingly shaped by events, not steady baseline growth.

To explore global digital trends by industry, category, and country, try a free trial of Similarweb’s Web Intelligence Platform.

FAQs

What is the most visited website in the world?

Google.com, with more than 84 billion visits in December 2025.

Which categories grew the most?

AI platforms, streaming services, ecommerce-adjacent platforms, and logistics/infrastructure sites.

Where can I explore traffic by country or category?

Visit Similarweb’s Top Websites Tool to explore live rankings by region, industry, and device distribution, and to drill down into competitors’ traffic sources, engagement metrics, and growth trends.

Track your digital metrics and grow market share

Contact us to set up a call with a market research specialist