The Top 100 Most Visited Websites in the USA (December 2025)

December is the most revealing month of the year for digital behavior. It compresses peak holiday shopping, last-minute logistics stress, major entertainment releases, and year-end reflection into just 31 days, and the web traffic data shows exactly where Americans turned when it mattered most.

Using Similarweb U.S. web traffic data, this report ranks the 100 most visited websites in the United States in December 2025 and highlights 10 sites that experienced especially meaningful month-over-month (MoM) movement. Unlike November, which is dominated by deal discovery, December is about execution: shipping, streaming, gifting, cooking, and getting things done fast.

What is the #1 most visited website in the USA?

Once again, Google.com ranked as the most visited website in the United States.

Similarweb data shows Google recorded 16.5 billion U.S. visits in December 2025, reinforcing its position as the web’s primary entry point even as month-over-month movement remained relatively modest at this scale.

Search remains the backbone of December activity: tracking packages, checking store hours, finding last-minute gifts, researching recipes, and navigating entertainment choices. While the largest platforms tend to show limited MoM volatility at this scale, Google’s dominance is reinforced in December by urgency-driven, task-oriented behavior across nearly every category represented in the Top 100.

Top 100 most visited websites in the USA (December 2025)

Below is the full list of the 100 most visited websites in the United States, ranked by total monthly visits. Rankings are based on desktop and mobile web traffic from Similarweb for December 2025.

| # | Domain | Monthly Visits | MoM traffic change |

| 1 | google.com | 16.5B | 3.32% |

| 2 | youtube.com | 5.8B | 6.67% |

| 3 | amazon.com | 2.7B | 8.14% |

| 4 | facebook.com | 2.5B | 6.31% |

| 5 | reddit.com | 2.1B | 5.59% |

| 6 | yahoo.com | 1.6B | 4.91% |

| 7 | bing.com | 1.4B | 3.83% |

| 8 | instagram.com | 1.1B | 4.28% |

| 9 | x.com | 1.0B | 1.21% |

| 10 | chatgpt.com | 964.0M | -4.15% |

| 11 | wikipedia.org | 708.2M | 0.75% |

| 12 | walmart.com | 603.2M | 3.40% |

| 13 | ebay.com | 548.5M | 9.67% |

| 14 | espn.com | 498.5M | -4.15% |

| 15 | linkedin.com | 493.0M | -3.46% |

| 16 | usps.com | 469.2M | 50.87% |

| 17 | tiktok.com | 455.9M | 4.65% |

| 18 | nytimes.com | 445.2M | 0.06% |

| 19 | office.com | 403.7M | -9.60% |

| 20 | weather.com | 401.1M | 19.54% |

| 21 | netflix.com | 386.3M | 13.90% |

| 22 | fandom.com | 369.8M | 13.69% |

| 23 | duckduckgo.com | 337.6M | 6.02% |

| 24 | temu.com | 324.6M | 5.93% |

| 25 | target.com | 297.8M | 13.82% |

| 26 | etsy.com | 294.2M | 18.52% |

| 27 | pinterest.com | 289.9M | 6.79% |

| 28 | live.com | 284.7M | 6.92% |

| 29 | zillow.com | 274.8M | 1.26% |

| 30 | instructure.com | 267.7M | -27.61% |

| 31 | cnn.com | 267.5M | -8.49% |

| 32 | paypal.com | 260.3M | 6.68% |

| 33 | microsoft.com | 254.0M | 6.38% |

| 34 | twitch.tv | 249.6M | 1.75% |

| 35 | xvideos.com | 245.4M | 7.37% |

| 36 | pornhub.com | 241.4M | 5.01% |

| 37 | xnxx.com | 234.3M | 6.66% |

| 38 | fedex.com | 224.2M | 52.12% |

| 39 | sharepoint.com | 217.3M | -10.52% |

| 40 | xhamster.com | 215.1M | 6.11% |

| 41 | roblox.com | 214.9M | 15.97% |

| 42 | gemini.google.com | 214.3M | 27.65% |

| 43 | chaturbate.com | 206.9M | 7.75% |

| 44 | foxnews.com | 205.9M | 1.84% |

| 45 | ups.com | 204.5M | 46.76% |

| 46 | aol.com | 200.4M | 7.57% |

| 47 | shop.app | 199.2M | 7.01% |

| 48 | chase.com | 195.3M | 13.32% |

| 49 | discord.com | 181.4M | 8.98% |

| 50 | homedepot.com | 173.5M | -9.31% |

| 51 | duosecurity.com | 169.1M | -17.86% |

| 52 | imdb.com | 166.8M | 10.04% |

| 53 | apple.com | 164.3M | 4.33% |

| 54 | office365.com | 161.8M | -5.61% |

| 55 | nextdoor.com | 161.6M | 7.55% |

| 56 | zoom.us | 160.5M | -12.00% |

| 57 | people.com | 151.9M | 13.58% |

| 58 | onlyfans.com | 149.6M | 12.83% |

| 59 | stripchat.com | 149.4M | 8.94% |

| 60 | msn.com | 148.7M | 8.30% |

| 61 | hbomax.com | 148.7M | 18.22% |

| 62 | indeed.com | 147.6M | 1.86% |

| 63 | bestbuy.com | 147.2M | -9.40% |

| 64 | spotify.com | 146.8M | 10.43% |

| 65 | narvar.com | 145.2M | 76.57% |

| 66 | quora.com | 143.6M | -3.58% |

| 67 | macys.com | 143.2M | 10.14% |

| 68 | canva.com | 142.7M | -2.53% |

| 69 | hulu.com | 139.3M | -3.53% |

| 70 | capitalone.com | 137.6M | 11.05% |

| 71 | citi.com | 136.2M | 7.75% |

| 72 | finance.yahoo.com | 133.2M | 4.28% |

| 73 | brave.com | 130.1M | 6.30% |

| 74 | peacocktv.com | 129.1M | 15.11% |

| 75 | usatoday.com | 125.6M | 3.24% |

| 76 | t-mobile.com | 122.1M | 7.02% |

| 77 | yelp.com | 117.3M | 7.86% |

| 78 | xfinity.com | 116.5M | 4.99% |

| 79 | lowes.com | 113.4M | -5.37% |

| 80 | att.com | 113.2M | 8.23% |

| 81 | accuweather.com | 110.6M | 22.74% |

| 82 | costco.com | 108.4M | 1.03% |

| 83 | bankofamerica.com | 107.1M | 11.87% |

| 84 | archiveofourown.org | 106.0M | 10.47% |

| 85 | bbc.com | 105.3M | 3.41% |

| 86 | craigslist.org | 105.2M | 4.66% |

| 87 | fidelity.com | 104.8M | 11.84% |

| 88 | okta.com | 103.2M | -2.30% |

| 89 | shopify.com | 102.1M | 26.33% |

| 90 | wellsfargo.com | 101.5M | 13.44% |

| 91 | kohls.com | 99.3M | -0.70% |

| 92 | allrecipes.com | 99.3M | -0.56% |

| 93 | clever.com | 95.4M | -8.93% |

| 94 | realtor.com | 94.6M | -4.27% |

| 95 | disneyplus.com | 93.7M | 9.64% |

| 96 | nypost.com | 93.5M | -2.10% |

| 97 | news.google.com | 93.0M | 3.65% |

| 98 | wayfair.com | 90.1M | -10.10% |

| 99 | cvs.com | 90.0M | 16.65% |

| 100 | doordash.com | 89.9M | 17.56% |

Highlights from the top U.S. websites (December 2025)

Below are 10 websites that stood out in December due to traffic scale, sharp MoM growth, or especially clear real-world drivers.

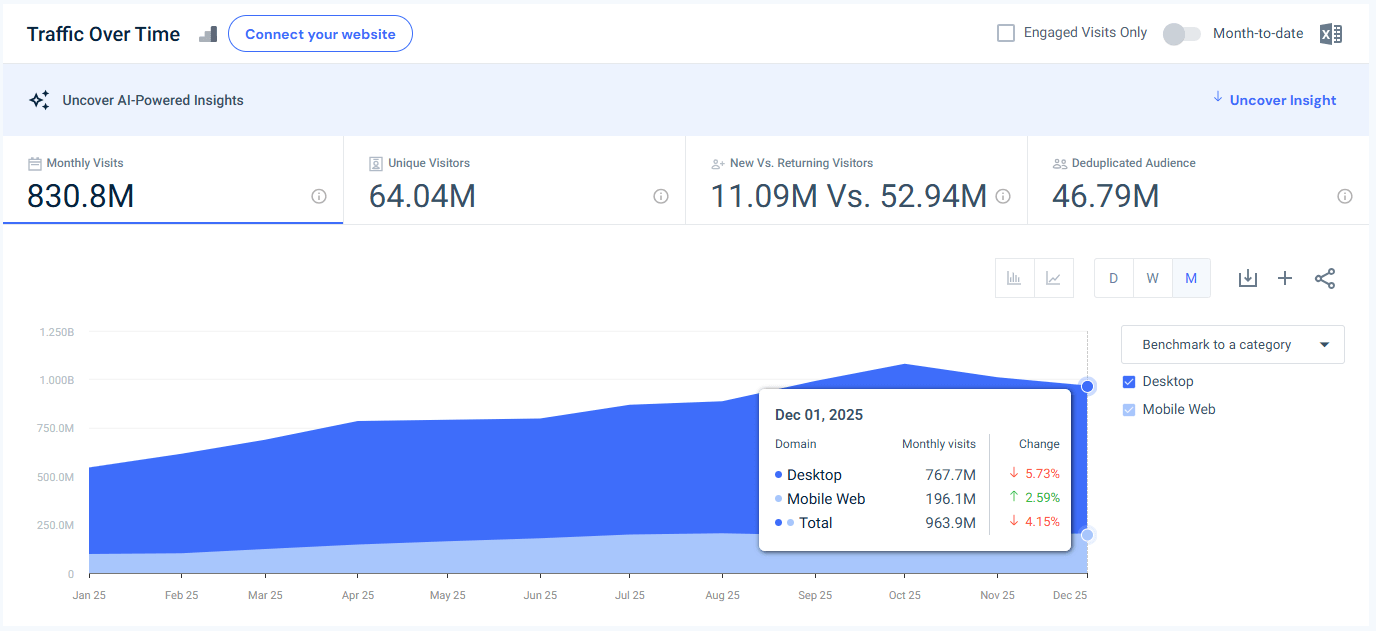

1. ChatGPT.com

#10 in the USA

🤖 963.9M visits | −4.15% MoM

- Desktop: 767.7M (−5.73%)

- Mobile web: 196.1M (+2.59%)

Insight: ChatGPT cooled slightly in December after heavy autumn usage but remained a near-billion-visit platform in the U.S.

Why it matters: December’s dip reflects seasonality, not loss of relevance. OpenAI rolled out GPT-5.2 mid-month, emphasizing professional workflows like spreadsheets, presentations, coding, and agents. Benefits felt most during work-heavy periods, not holiday downtime. Notably, mobile usage continued to grow, signaling lighter, habitual interactions during travel and time off. Coverage of the release highlighted the escalating competitive pressure between OpenAI and Google’s Gemini ecosystem, reinforcing ChatGPT’s role as core AI infrastructure even as usage normalizes.

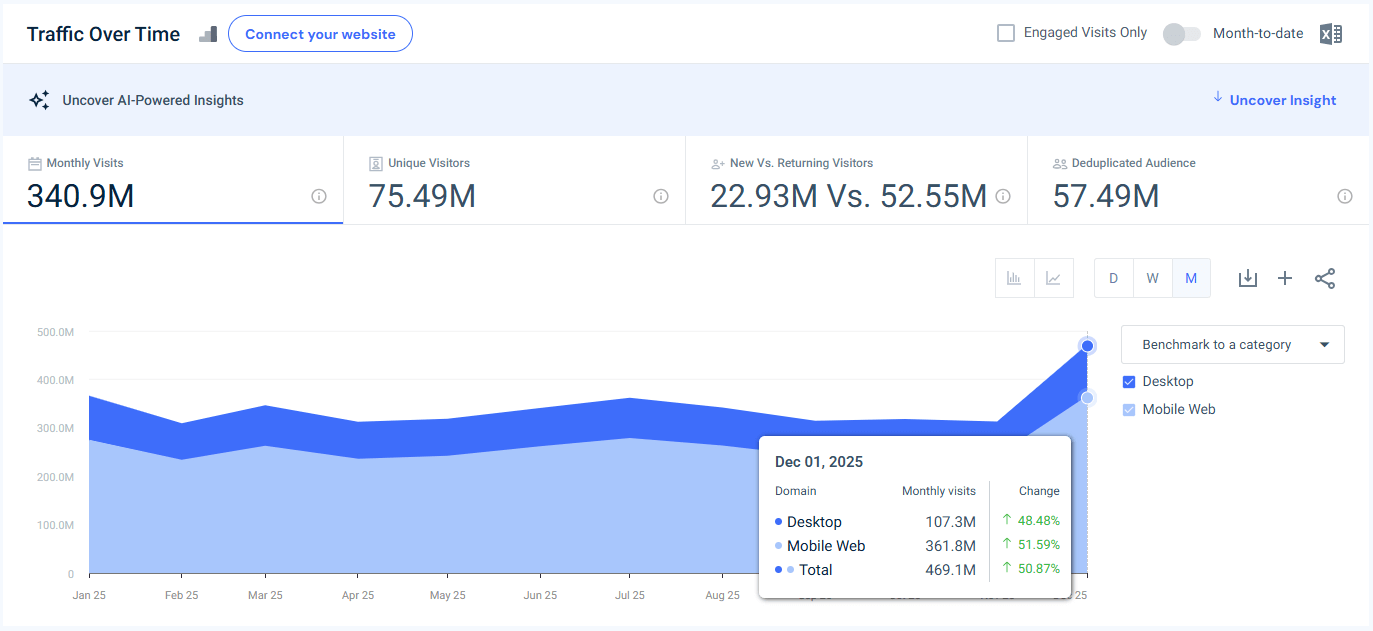

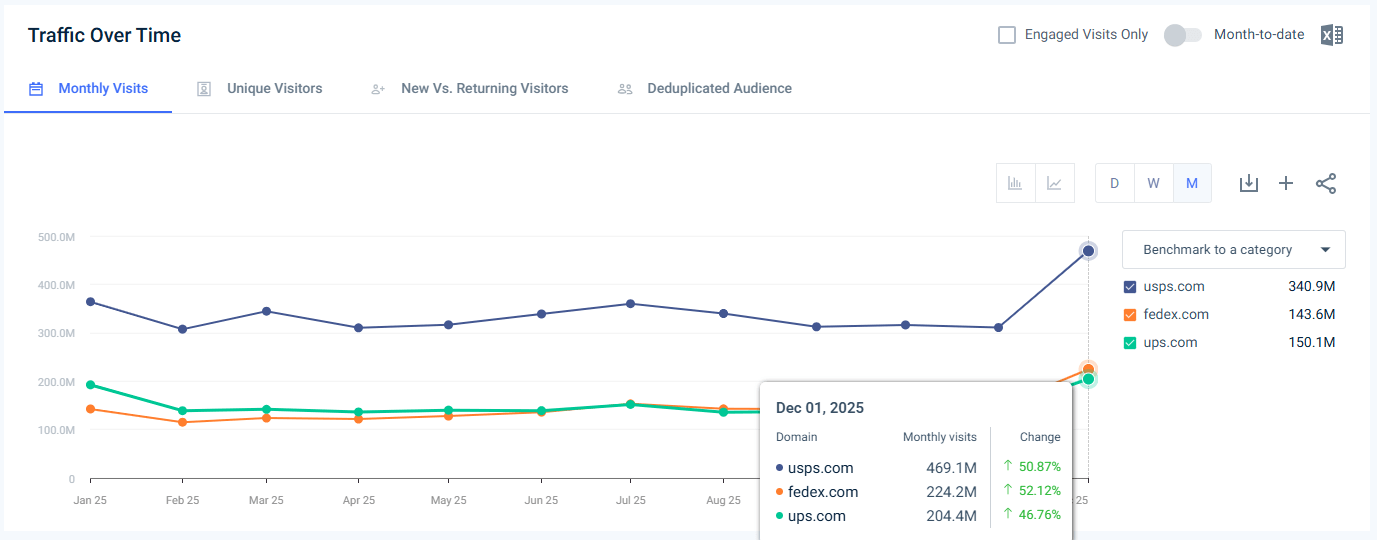

2. USPS.com

#16 in the USA

📦 469.1M visits | +50.87% MoM

- Desktop: 107.3M (+48.48%)

- Mobile web: 361.8M (+51.59%)

Insight: USPS posted one of the largest seasonal traffic surges anywhere in the Top 100.

Why it matters: December is USPS’s digital Super Bowl. Final shipping deadlines, package tracking, and service checks drove massive mobile-led traffic. USPS publicly warned that the week of Dec. 15 would be the busiest of 2025, reinforcing predictable mid-month spikes. The data shows how physical logistics bottlenecks translate directly into digital demand.

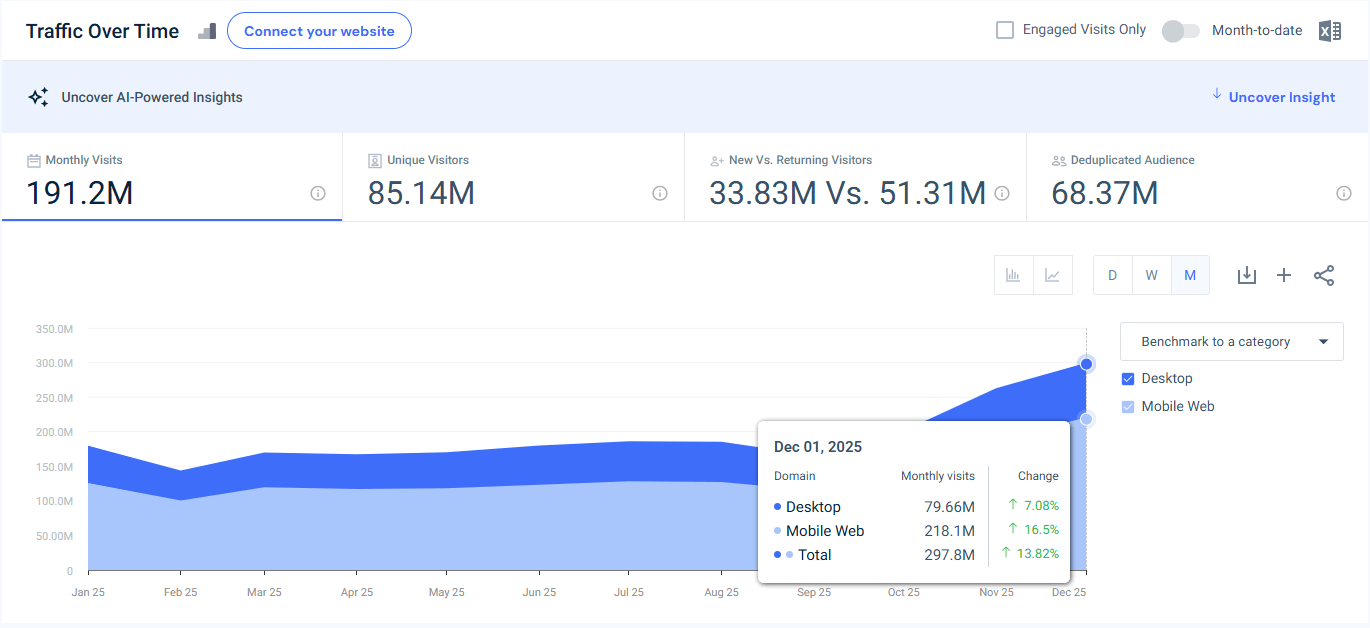

3. Target.com

#25 in the USA

🎯 297.8M visits | +13.82% MoM

- Desktop: 79.66M (+7.08%)

- Mobile web: 218.1M (+16.5%)

Insight: Target sustained November momentum deep into December instead of tapering off.

Why it matters: Target’s “Step Into the Holidays” campaign, extended Black Friday deals, and heavy omnichannel advertising drove repeat visits. According to YouGov BrandIndex, Target saw one of the strongest Ad Awareness lifts in December, reflecting how consistent messaging and weekly deal cadence keep traffic elevated even after peak promo windows.

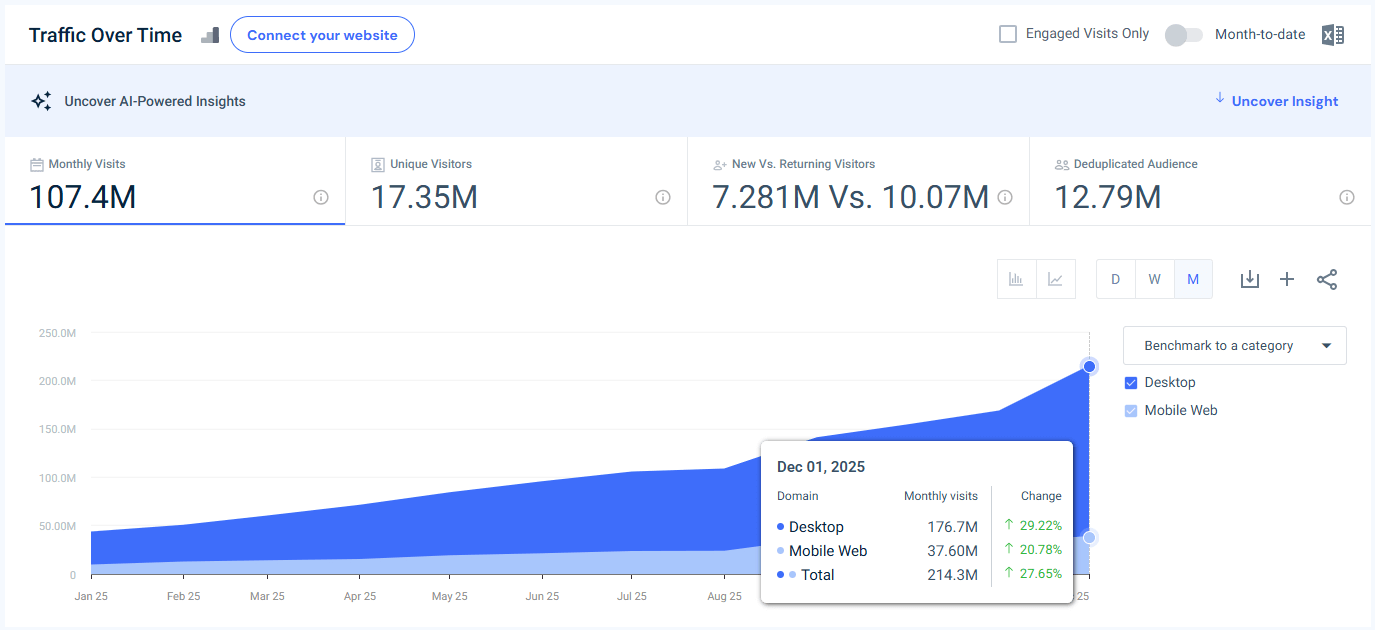

4. Gemini.google.com

#42 in the USA

✨ 214.3M visits | +27.65% MoM

- Desktop: 176.7M (+29.22%)

- Mobile web: 37.6M (+20.78%)

Insight: Gemini recorded one of the strongest AI platform surges of the month.

Why it matters: Google’s launch of Gemini 3 in late November, and its immediate rollout across Search, the Gemini app, and developer tools, fueled sustained December adoption. Desktop-heavy growth reflects work, building, and planning use cases rather than casual browsing. Google positioned Gemini 3 as its most capable reasoning and agentic model to date, raising the competitive stakes in AI search and productivity.

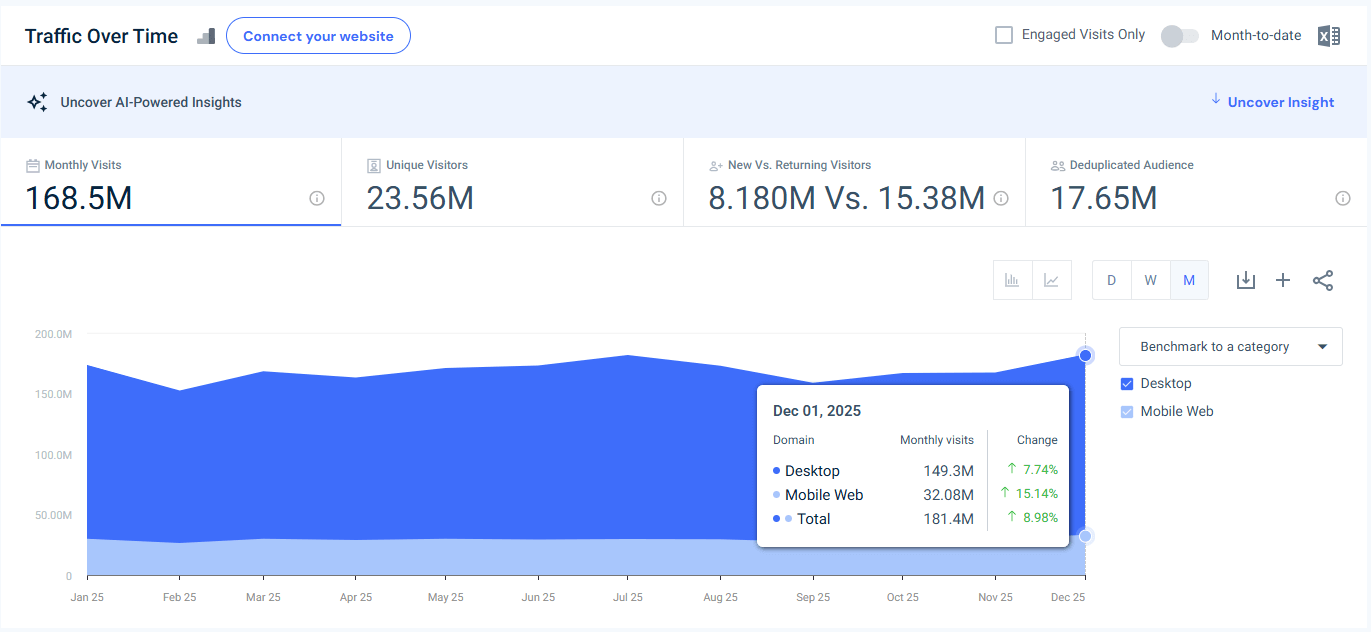

5. Discord.com

#49 in the USA

🎮 181.4M visits | +8.98% MoM

- Desktop: 149.3M (+7.74%)

- Mobile web: 32.08M (+15.14%)

Insight: Discord benefited from year-end reflection and community re-engagement.

Why it matters: Discord launched Checkpoint 2025, its first Spotify-Wrapped-style annual recap, celebrating the platform’s 10th anniversary. These personalized summaries drive curiosity, sharing, and revisits, especially on desktop, where the feature was most stable at launch. Wrapped-style mechanics once again proved effective at reactivating users during a traditionally slower period.

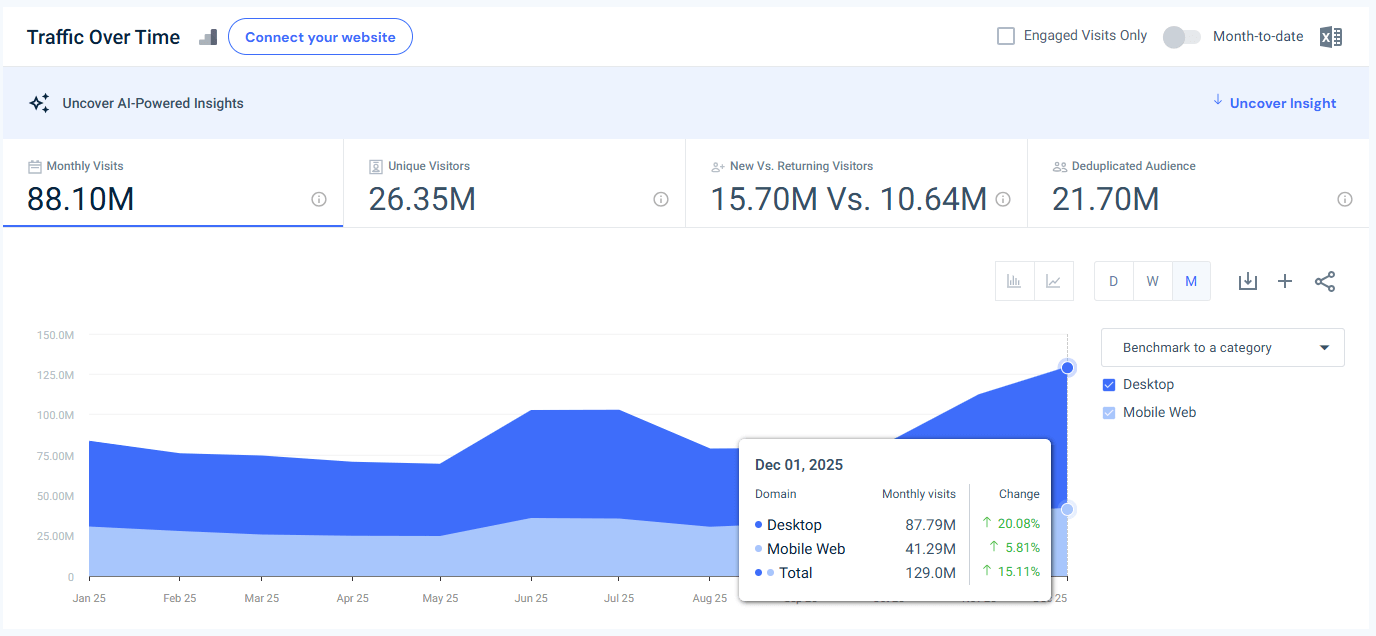

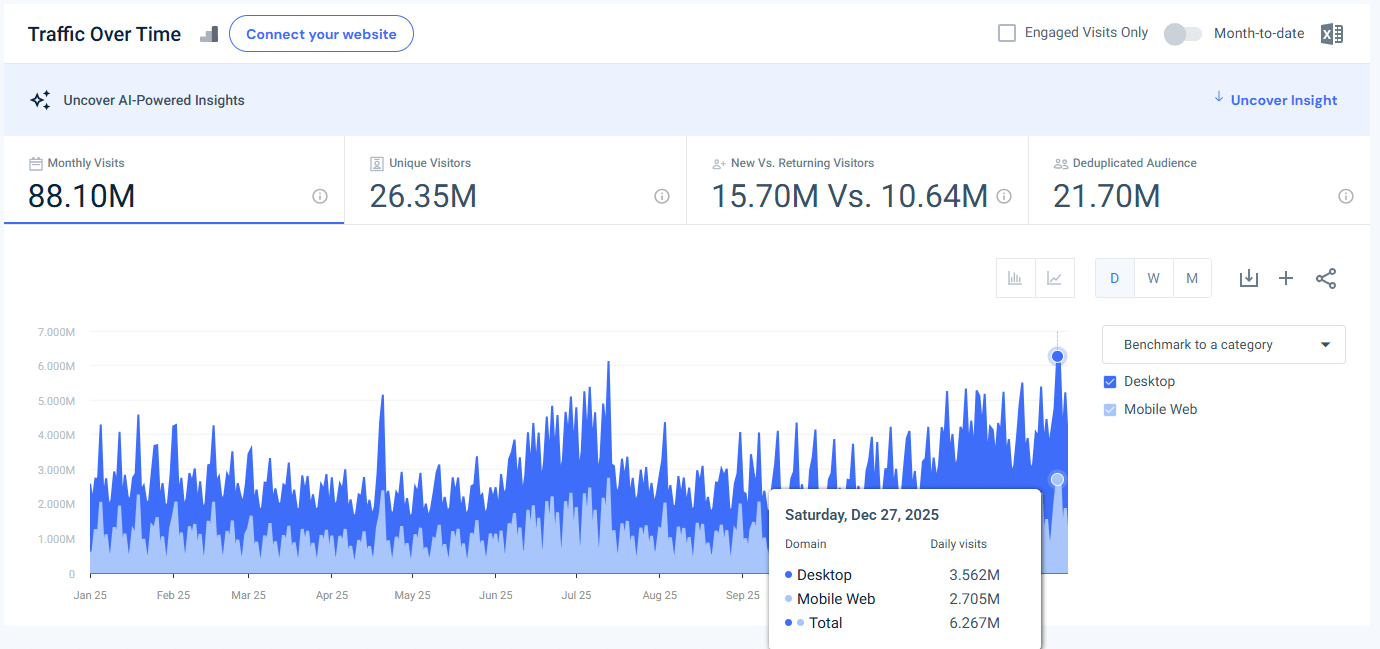

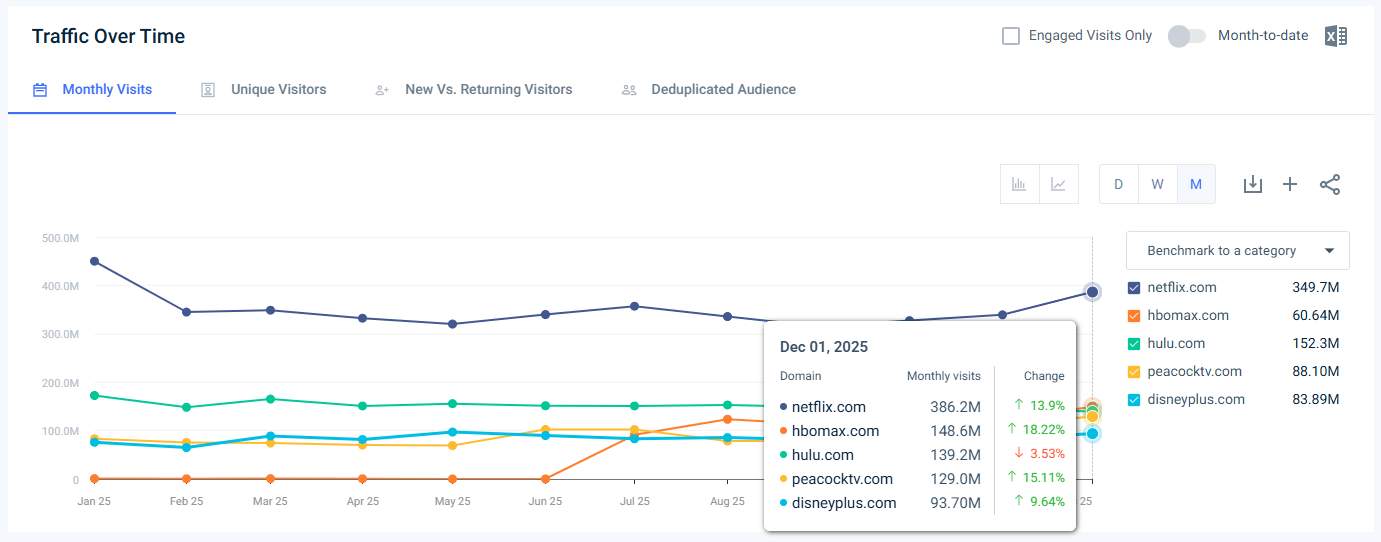

6. PeacockTV.com

#74 in the USA

🏈 129.0M visits | +15.11% MoM

- Desktop: 87.79M (+20.08%)

- Mobile web: 41.29M (+5.81%)

Insight: Peacock’s December growth was driven by appointment viewing, not background streaming.

Why it matters: Peacock held exclusive national streaming rights to a Week 17 NFL game on Saturday, Dec. 27, producing a clear single-day traffic spike.

Exclusive NFL broadcasts have repeatedly delivered record engagement, reinforcing Peacock’s strategy of using live sports to drive subscriptions and usage.

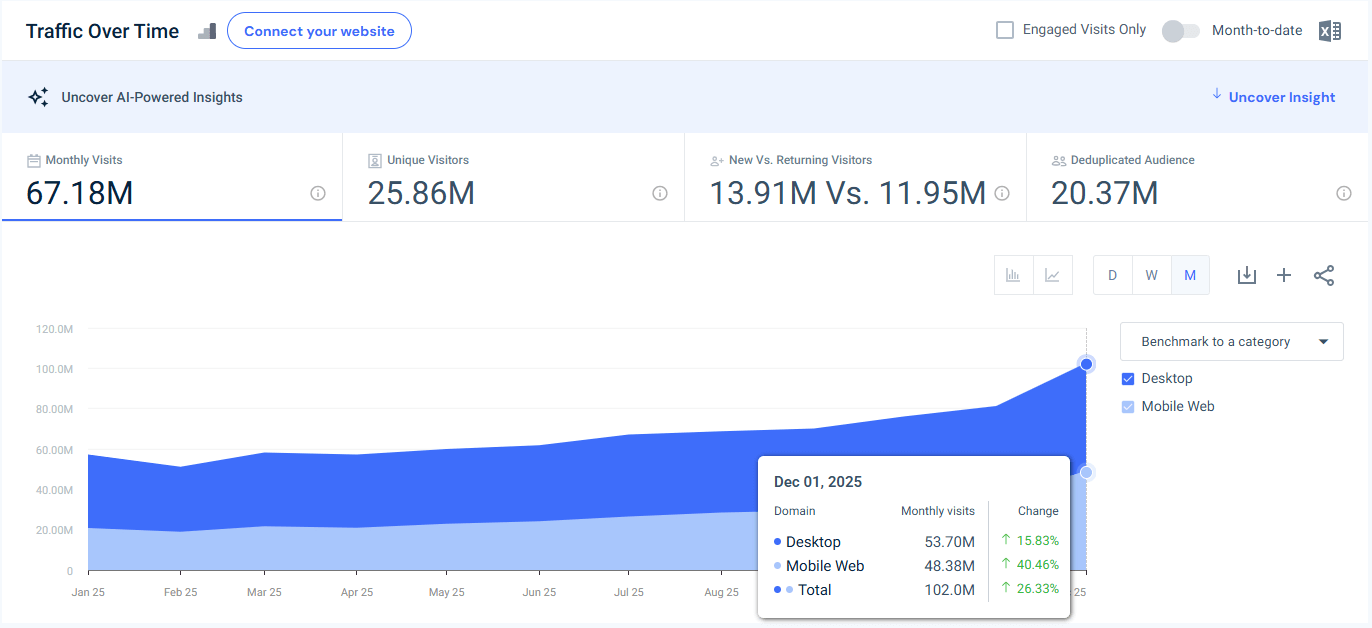

7. Shopify.com

#89 in the USA

🛍️ 102.0M visits | +26.33% MoM

- Desktop: 53.7M (+15.83%)

- Mobile web: 48.38M (+40.46%)

Insight: Shopify’s December traffic reflects both commerce scale and platform evolution.

Why it matters: Shopify merchants generated $14.6B in Black Friday–Cyber Monday sales, and that momentum carried into December as last-minute shopping windows shifted later. At the same time, Shopify launched Agentic Storefronts, enabling products to surface directly inside AI platforms like ChatGPT, Perplexity, and Copilot. Shopify reported a sevenfold increase in AI-driven traffic in 2025, peaking during the holidays.

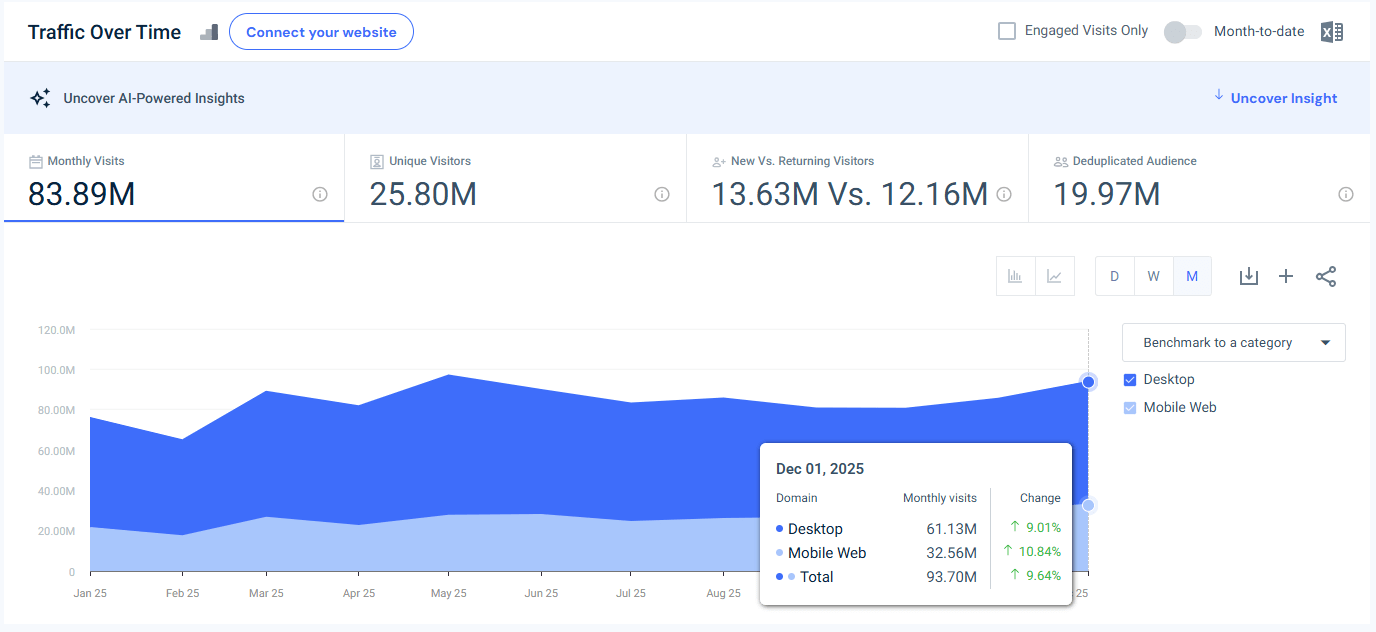

8. DisneyPlus.com

#95 in the USA

🎬 93.7M visits | +9.64% MoM

- Desktop: 61.13M (+9.01%)

- Mobile web: 32.56M (+10.84%)

Insight: Disney+ stacked December with culture, fandom, and franchise power.

Why it matters: The end of the Eras Tour drove global attention with Taylor Swift | The Eras Tour | The Final Show and the six-part documentary The End of an Era, while Percy Jackson and the Olympians Season 2 delivered recurring engagement throughout the month. Combined with holiday classics, Disney turned December into a sustained traffic engine rather than a single-week spike.

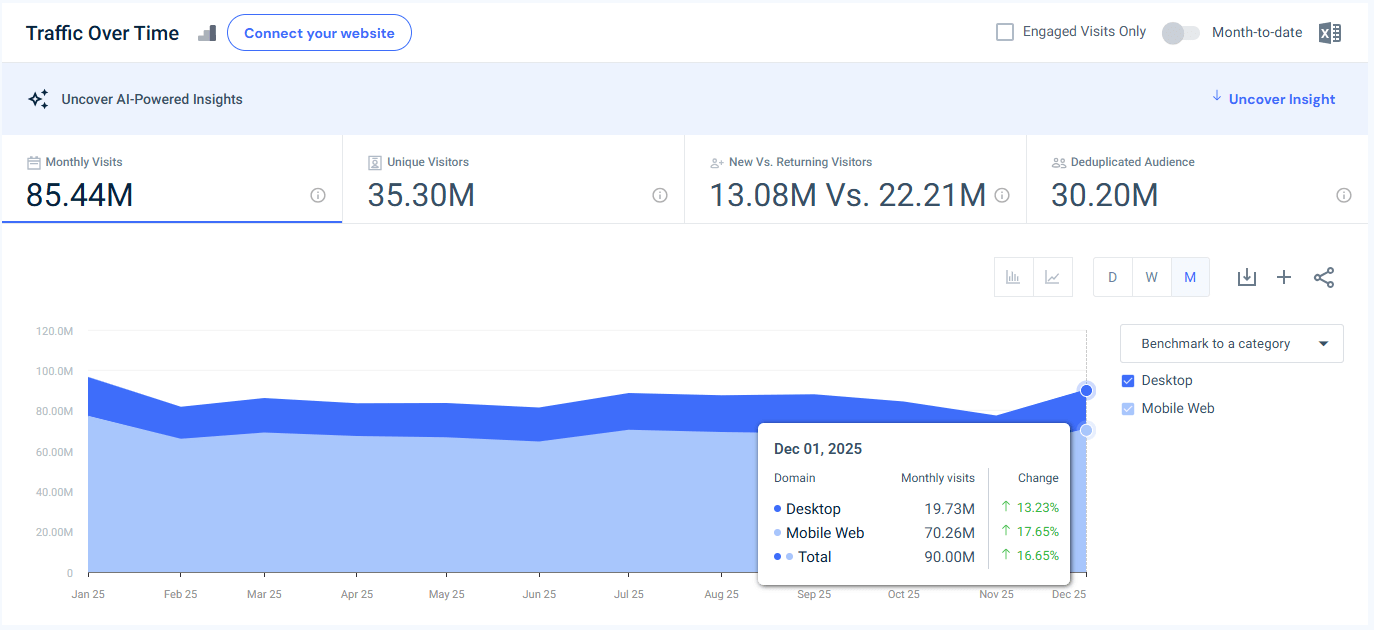

9. CVS.com

#99 in the USA

💊 90.0M visits | +16.65% MoM

- Desktop: 19.73M (+13.23%)

- Mobile web: 70.26M (+17.65%)

Insight: CVS traffic surged due to strategy, not seasonality.

Why it matters: CVS’s Dec. 9 Investor Day drove interest after the company raised 2025 revenue guidance to at least $400B and unveiled a new AI-native consumer engagement platform designed to unify Aetna, Caremark, and pharmacy experiences. Healthcare traffic responded directly to corporate and technology announcements.

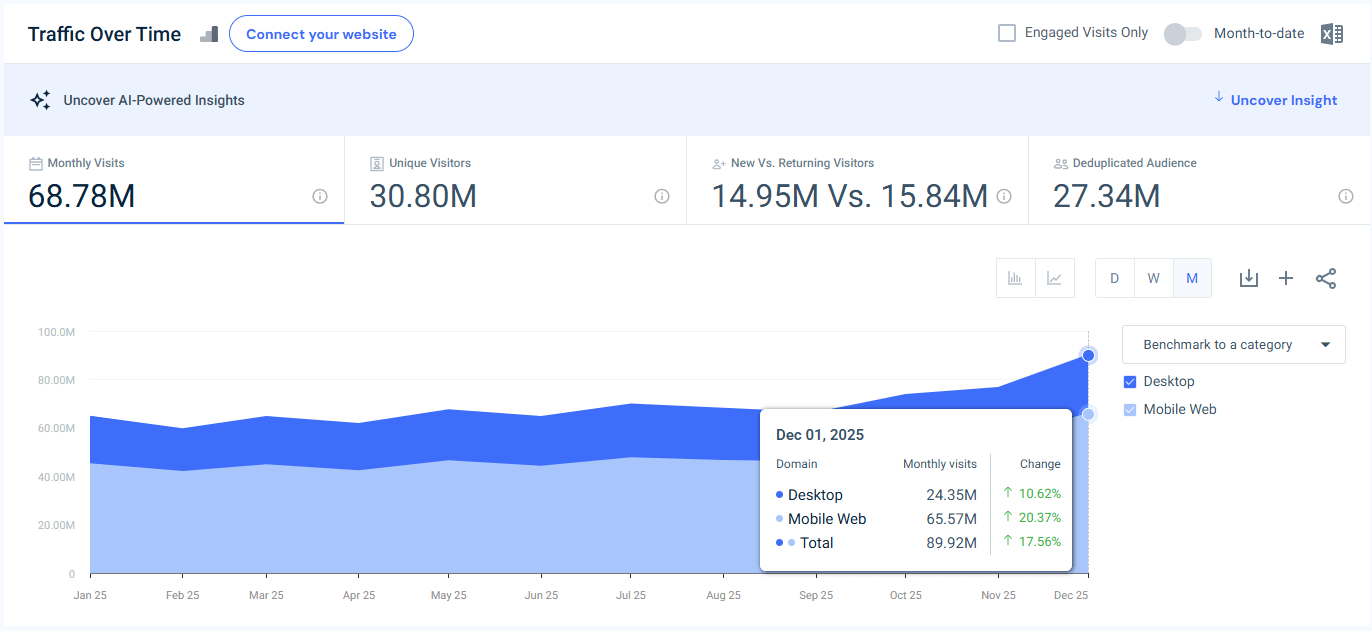

10. DoorDash.com

#100 in the USA

🛵 89.92M visits | +17.56% MoM

- Desktop: 24.35M (+10.62%)

- Mobile web: 65.57M (+20.37%)

Insight: DoorDash won December by solving holiday problems in real time.

Why it matters: DoorDash launched its “Last Minute Rescue” campaign to target shoppers hit by shipping delays, using a social-led sweepstakes to drive urgent web traffic. Days later, DoorDash introduced a grocery shopping app inside ChatGPT, turning AI-generated recipes into instant orders and capturing top-of-funnel holiday meal planning traffic.

Trends in December 2025’s U.S. web traffic

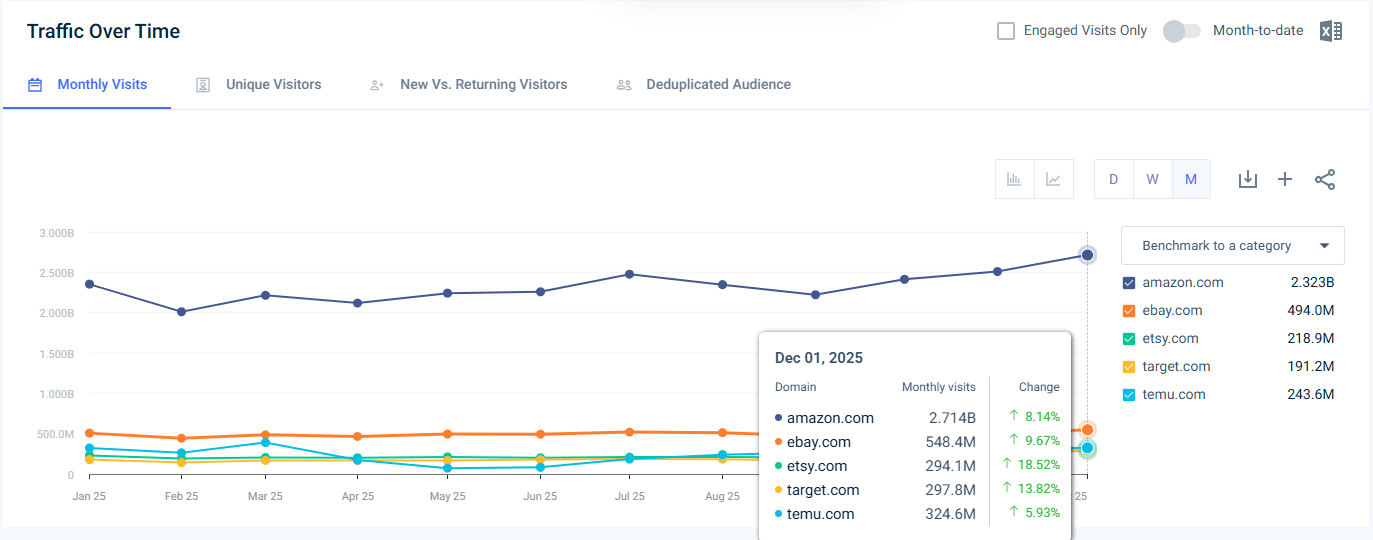

Ecommerce momentum carried straight from November into December

Holiday demand did not reset after Cyber Week, it extended. Ecommerce and marketplace sites across the Top 100 continued to post MoM growth as consumers shifted from deal-hunting to fulfillment and last‑minute purchasing.

Amazon, Target, Shopify-powered stores, and secondary marketplaces all benefited from shoppers returning repeatedly to complete purchases, manage orders, and replace delayed gifts. December traffic confirms that ecommerce seasonality now spans multiple months, not a single promotional window.

Shipping and logistics sites surged as delivery anxiety peaked

December produced some of the sharpest MoM increases anywhere in the Top 100 for logistics domains.

USPS, FedEx, and UPS all spiked as consumers tracked packages, checked cutoff dates, and searched for contingency options. USPS’s +50% MoM growth highlights how physical delivery constraints reliably translate into digital traffic surges, especially on mobile, during the final two weeks before Christmas.

TV and movie streaming traffic climbed as audiences spent more time at home

Entertainment streaming platforms broadly benefited from December viewing behavior.

Netflix, Peacock, Disney+, and HBO Max all posted MoM gains as holidays increased at-home screen time and exclusive releases created appointment viewing moments. Unlike November’s browsing-heavy usage, December streaming traffic reflects longer sessions and repeat visits driven by live sports, franchise premieres, and culturally dominant releases, reinforcing streaming’s role as a core holiday activity.

What December Reveals About Digital Demand

December closes the year by revealing what digital demand looks like under pressure. When time matters, attention concentrates around platforms that help users finish tasks, track packages, replace missing gifts, stream live events, manage essentials, and solve last‑minute problems. The month’s traffic patterns highlight how seasonality, logistics, and cultural moments still outweigh experimentation, even as AI and new interfaces continue to reshape how people discover and act online.

For marketers and analysts, December serves as a stress test: the sites that scale during this period are not just popular, they are operationally critical. As we move into the new year, these signals offer a clear baseline for understanding which platforms users rely on when expectations are highest and patience is lowest.

To explore deeper insights across industries, countries, and competitors, visit Similarweb’s Web Intelligence platform or use our free Top Websites ranking tool.

FAQs

What made December different from November in web traffic patterns?

November is research and deal-driven; December is execution-driven. Tracking, delivery, and streaming spikes dominate.

Which industries benefited most in December 2025?

Logistics, streaming, healthcare, and ecommerce infrastructure platforms saw the strongest gains.

Did AI platforms continue to grow in December?

Growth was mixed, but AI remained deeply embedded across planning, shopping, and productivity workflows.

Why do shipping and delivery sites spike so sharply in December?

Final deadlines, tracking anxiety, and delivery exceptions all compress demand into a narrow window.

Is December volatility higher than in other months?

Yes, especially for sites ranked outside the Top 10, where seasonality and events drive large MoM swings.

Track your digital metrics and grow market share

Contact us to set up a call with a market research specialist