Untapped Markets: How to Discover Them and Take the Lead

Untapped markets are overlooked opportunities where real customer needs remain unmet. While most companies compete in saturated spaces, growth often comes from solving problems no one else is addressing. These markets can be hidden, hard to reach, or just emerging, but for those who spot them early, they offer a chance to grow with less competition and more impact.

What is an untapped market?

An untapped market is a group of potential customers whose needs are not being met by existing products or services. These customers may have no good alternatives today, or the available options fail to address their specific problems. The result is unmet market demand, a situation where people want a solution, but the market has not provided one yet.

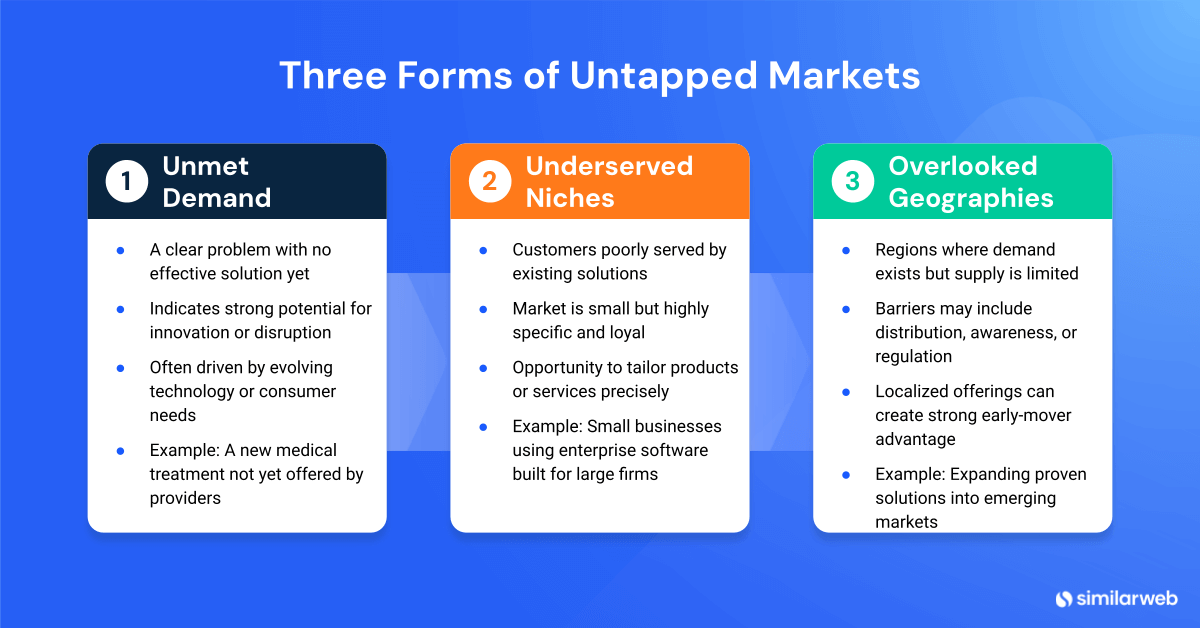

Untapped markets can take different forms:

- Unmet demand: A clear problem without a good solution, such as a new medical treatment that has yet to be offered by healthcare providers.

- Underserved niches: Customers who have limited or poorly fitting options, like small businesses that struggle with enterprise software designed for larger organizations.

- Overlooked geographies: Regions where existing solutions are not widely available, even though the need is similar to other markets.

It’s important to distinguish between untapped markets and niche markets. An untapped market is defined by unmet needs: it may be large or small, but remains unaddressed. A niche market, on the other hand, is a narrow, well-defined segment that may already have solutions, but tailored offerings are required to serve it well.

The strategic importance of targeting untapped markets

Untapped markets offer many advantages for companies looking to drive sustainable growth. Unlike saturated markets, where competition is intense, differentiation is hard, and customer acquisition costs are high, untapped markets give businesses room to build early traction with less friction.

These markets can act as growth engines when approached strategically:

- First-mover advantage: In an untapped market, being first gives companies a critical edge. Without entrenched competitors, they can define customer expectations, establish brand loyalty early, and shape the ecosystem. This often leads to stronger pricing power and higher margins in the early stages of market development.

- Resilience: Companies that operate across a mix of established and emerging markets tend to be more resilient. Untapped markets, while initially smaller or harder to access, can become reliable growth channels over time, especially when other segments stall or become oversaturated.

- Strategic leverage: Untapped markets are strategic opportunities that reveal hidden gems while driving growth and innovation. They can be used to extend product relevance, test new business models, or create footholds in emerging regions and verticals. By systematically identifying and addressing unmet needs, businesses can build competitive advantages that build up over time.

Key characteristics of untapped markets

Here are some of the key aspects of untapped markets.

Unmet demand

An untapped market always starts with unmet needs. For example, before affordable video conferencing tools, small businesses had no easy way to run virtual meetings. Recognizing and solving these pain points defines the opportunity.

Growth potential

Untapped markets often grow quickly once solutions appear, because demand has been waiting. For instance, the rise of mobile payment apps in regions without strong banking systems led to rapid adoption. When barriers are removed, growth usually follows.

Diversification

Serving untapped markets spreads risk across different customer bases. A software company offering tools for large enterprises may add products for small businesses to balance revenue. Diversification makes the business less dependent on one segment’s performance.

Examples of untapped markets

Latent demand markets

Definition: Markets where a customer need clearly exists, but no effective or accessible solution is offered, either due to cost, awareness, or technical limitations.

Examples:

- Mental health for blue-collar workers: There’s growing awareness of psychological strain among laborers, yet few scalable, affordable mental health tools are tailored for them.

- Low-income urban mobility: Public transport deserts in megacities present a huge opportunity for affordable micromobility or shared transport.

Post-regulatory unlock markets

Definition: Markets that become viable following changes in law, policy, or standards.

Examples:

- Telehealth in post-pandemic developing markets: Regulatory frameworks now allow remote diagnostics and prescriptions in regions previously blocked.

- Cannabis tech infrastructure: As legalization spreads, there’s a tech infrastructure gap (e.g., banking, compliance, logistics) in cannabis supply chains.

Strategies to discover untapped and underserved markets

1. Using AI-driven market research tools

One of the most powerful ways to uncover untapped markets is by tracking real-time shifts in consumer behavior before your competitors notice. This is where Similarweb’s demand analysis tool and AI Trend Analyzer Agent stand out.

These tools allow you to go beyond assumptions and surface concrete, data-backed insights that highlight rising demand, hidden needs, and emerging market categories with real business potential.

Let’s look at a real example.

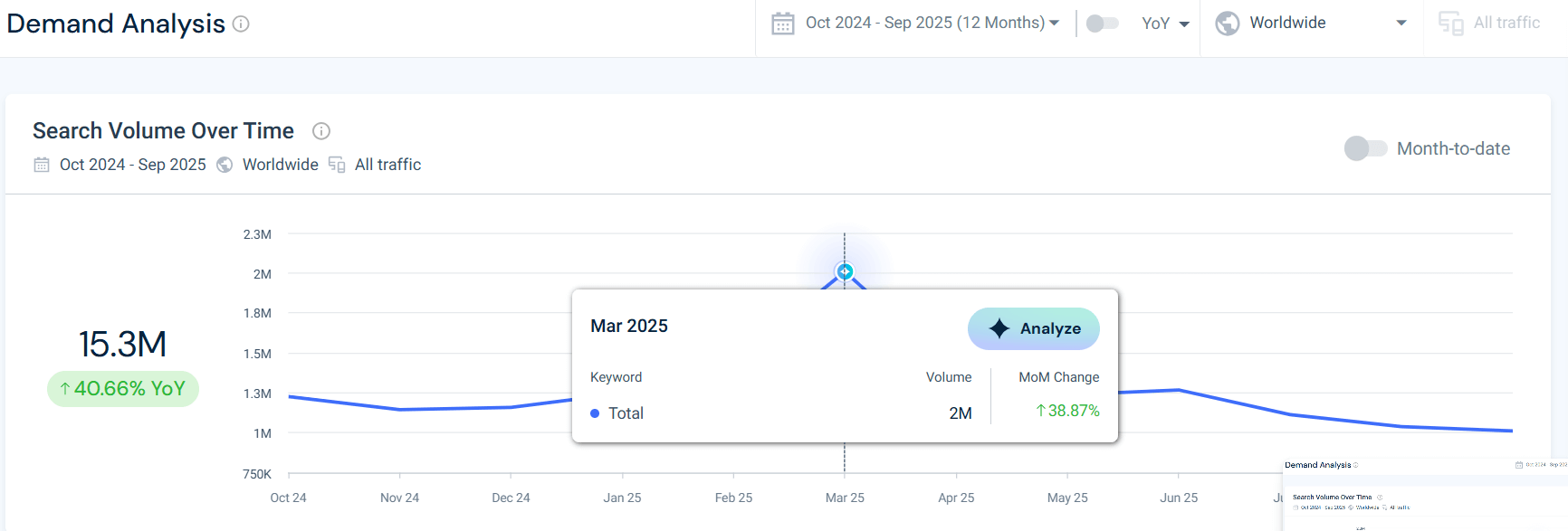

Using Similarweb’s Demand Analysis, we tracked worldwide search behavior around “AI productivity tools” over the last 12 months.

- Total search volume reached 15.3 million, up +40.66% YoY

- A sharp spike occurred in March 2025, with 2 million searches – a +38.87% month-over-month jump

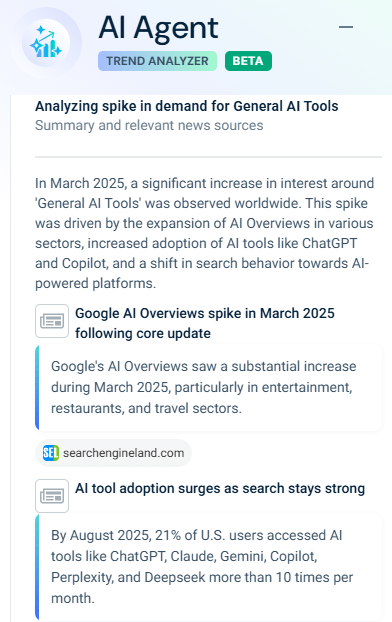

But why the sudden interest? That’s where the AI Trend Analyzer steps in.

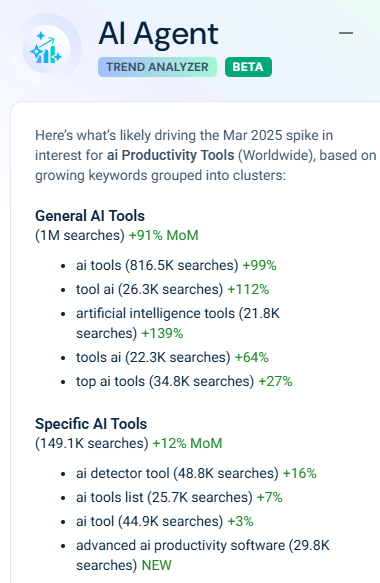

The AI Agent automatically analyzed the spike and surfaced two clusters of keywords fueling demand:

This signals a market where users aren’t just exploring AI, they’re actively looking for AI tools that improve daily work, focus, and creative output. Yet, despite the surge in interest, the landscape remains fragmented, with few dominant solutions built around productivity use cases.

2. Behavioral and keyword data

Sometimes the best way to uncover an untapped market is to listen closely to what people are already searching for, and not finding.

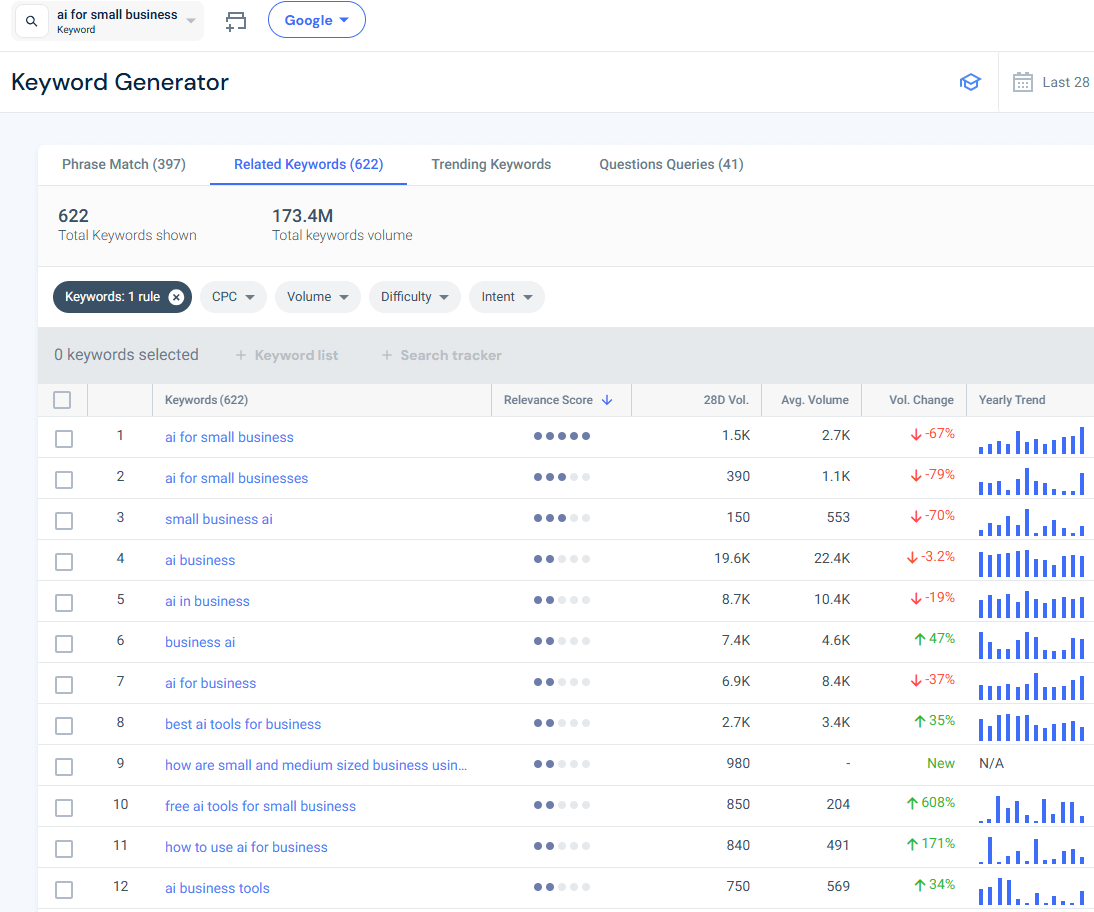

Using Similarweb’s keyword generator, we analyzed the keyword “AI for small business” to detect unmet digital demand in a rapidly evolving space.

Here’s what we found:

- The base term “AI for small business” saw 2.7K avg. monthly searches, with several related terms like:

- “free AI tools for small business” (+608%)

- “how to use AI for business” (+171%)

- “AI business tools” (+34%)

- These modifiers indicate solution-seeking behavior as users want affordable, actionable, and easy-to-implement AI tools tailored to their business size and needs.

- Despite a decline in general volume for the core term, the growth in specific use-case searches shows demand is evolving, not fading. Users are moving from exploration (“What is AI?”) to implementation (“How do I use AI in my business today?”).

This kind of keyword behavior often reveals:

- A mismatch between demand and supply – users are searching, but not finding well-positioned solutions.

- An opportunity for product creators to build tools or services that speak directly to this underserved audience.

- A content opportunity for SEOs and marketing teams to build comparison pages, tutorials, and product reviews that rank for these emerging queries.

3. Niche identification

Not every opportunity lies in a blue ocean, and some are quietly forming in the corners of larger, crowded industries. Using Similarweb’s market research tool, you can move beyond assumptions and identify niche segments backed by real traffic behavior and competitive signals.

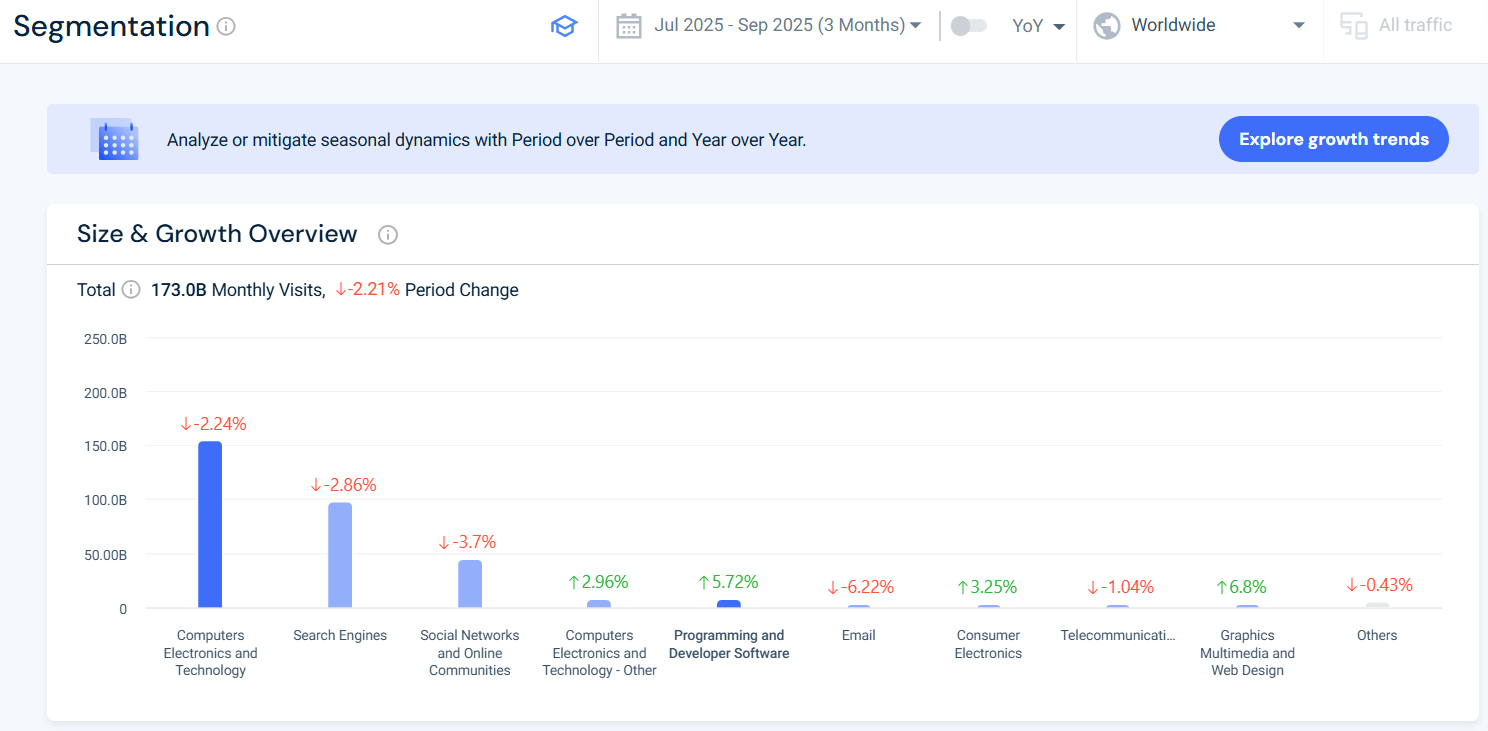

Here’s how to find your next niche opportunity, using Similarweb’s Programming and Developer Software category as an example:

1. Start with a growing submarket

Even when an entire category looks flat, micro-segments can show breakout potential. In the Segmentation view, we discovered that while Computers & Technology shrank overall, the Programming and Developer Software segment grew by +5.72%.

💡Pro tip: Look for small segments with positive period-over-period growth and rising engagement, especially if they contrast with their parent category.

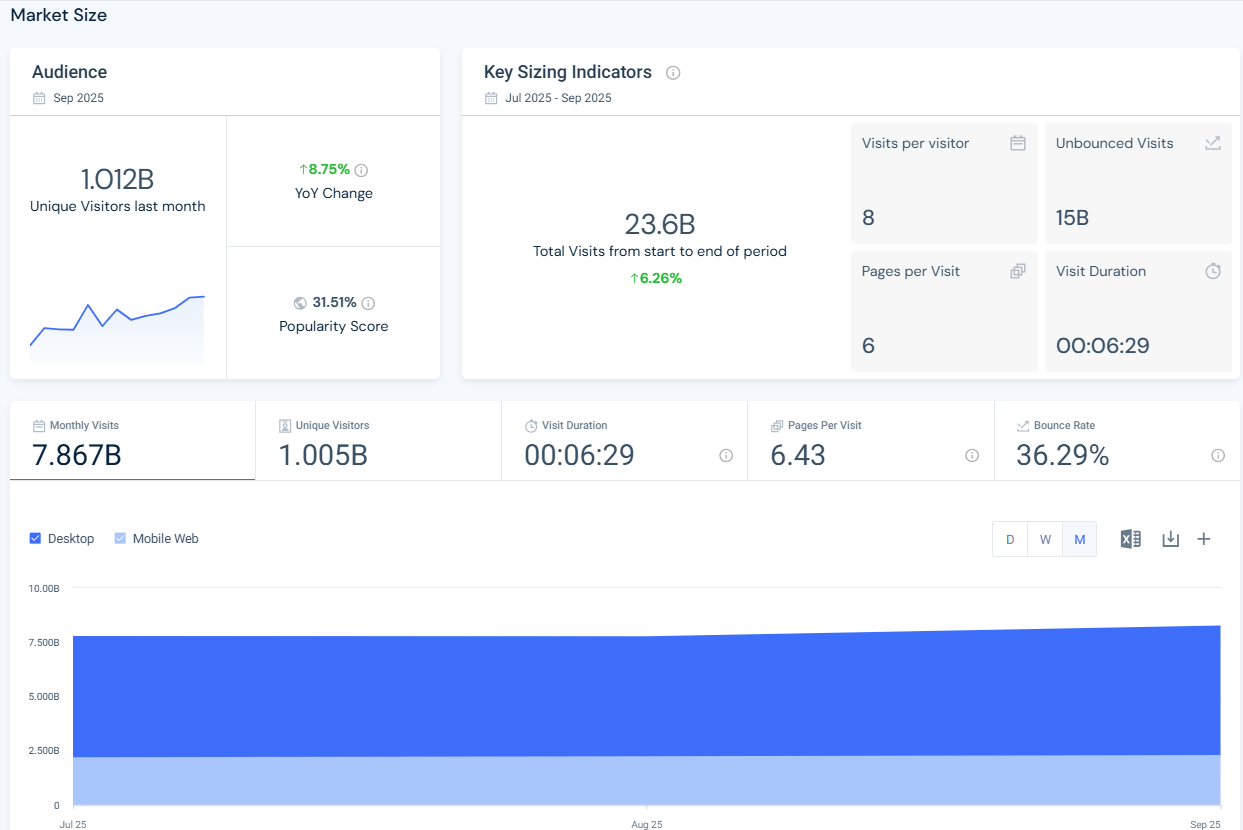

2. Validate engagement before jumping in

Next, we looked at audience behavior within the market:

- 1.01B unique visitors

- Visit duration: 6.5 minutes

- 8 visits per visitor on average

- 6.43 pages per visit

These numbers confirm that developer software users are curious and deeply engaged, suggesting a sticky, high-intent niche.

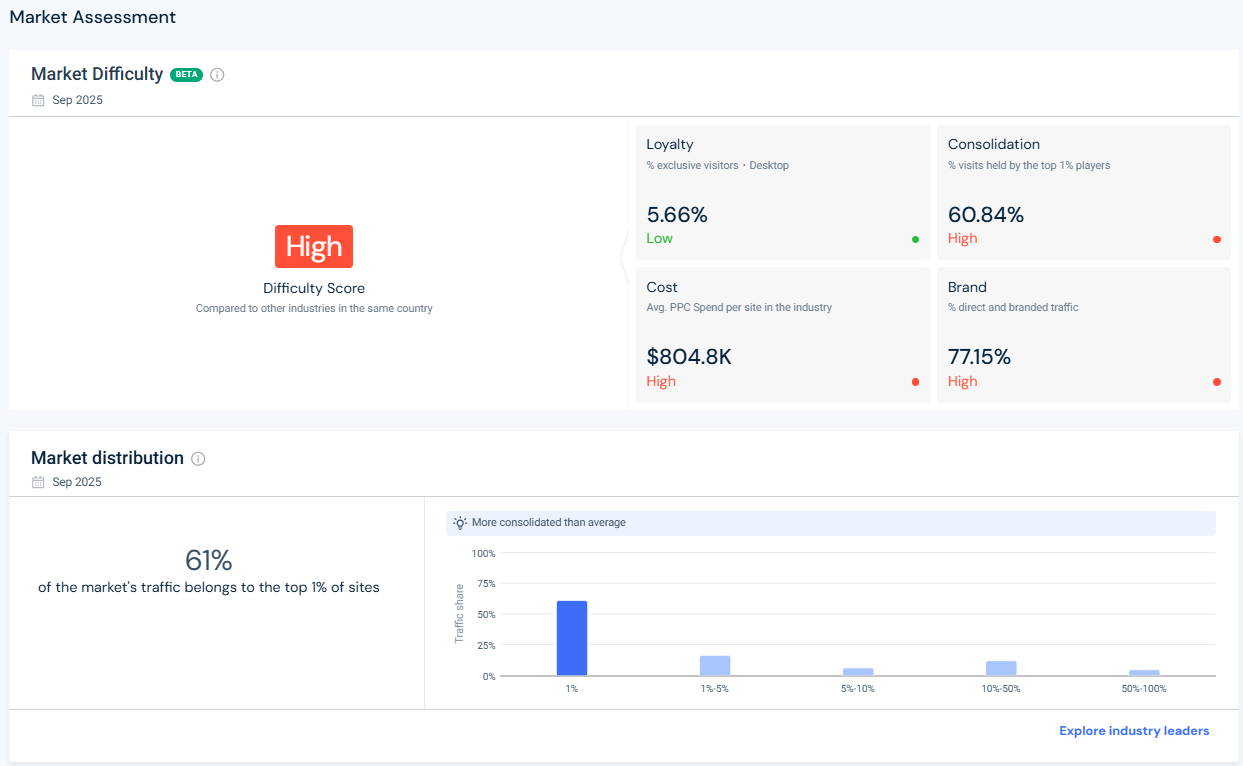

3. Measure the barriers: Market Difficulty

Before going deeper, it’s essential to assess how hard it is to enter or compete in the segment.

The market shows High Difficulty, driven by:

- High brand strength (77% direct/branded traffic)

- High consolidation (Top 1% of sites own 61% of traffic)

- High PPC costs ($804K average per site)

💡 But note: Loyalty is low (5.66%), meaning users aren’t locked into a single provider, a green flag for niche players offering something different.

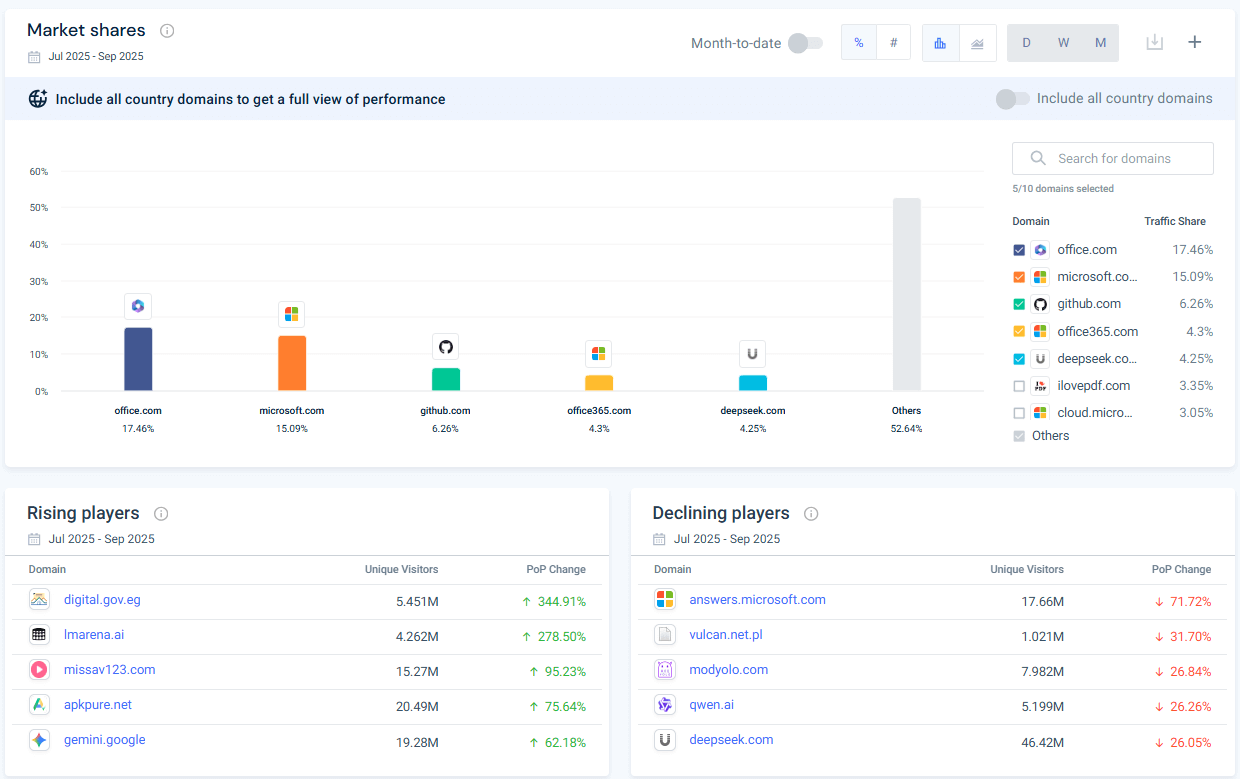

4. Find the entry point: rising players

One of the fastest ways to spot emerging niches is by watching who’s rising fast.

💡 Rising players often hint at what’s next. Analyzing their traffic and value prop can point you to underserved use cases.

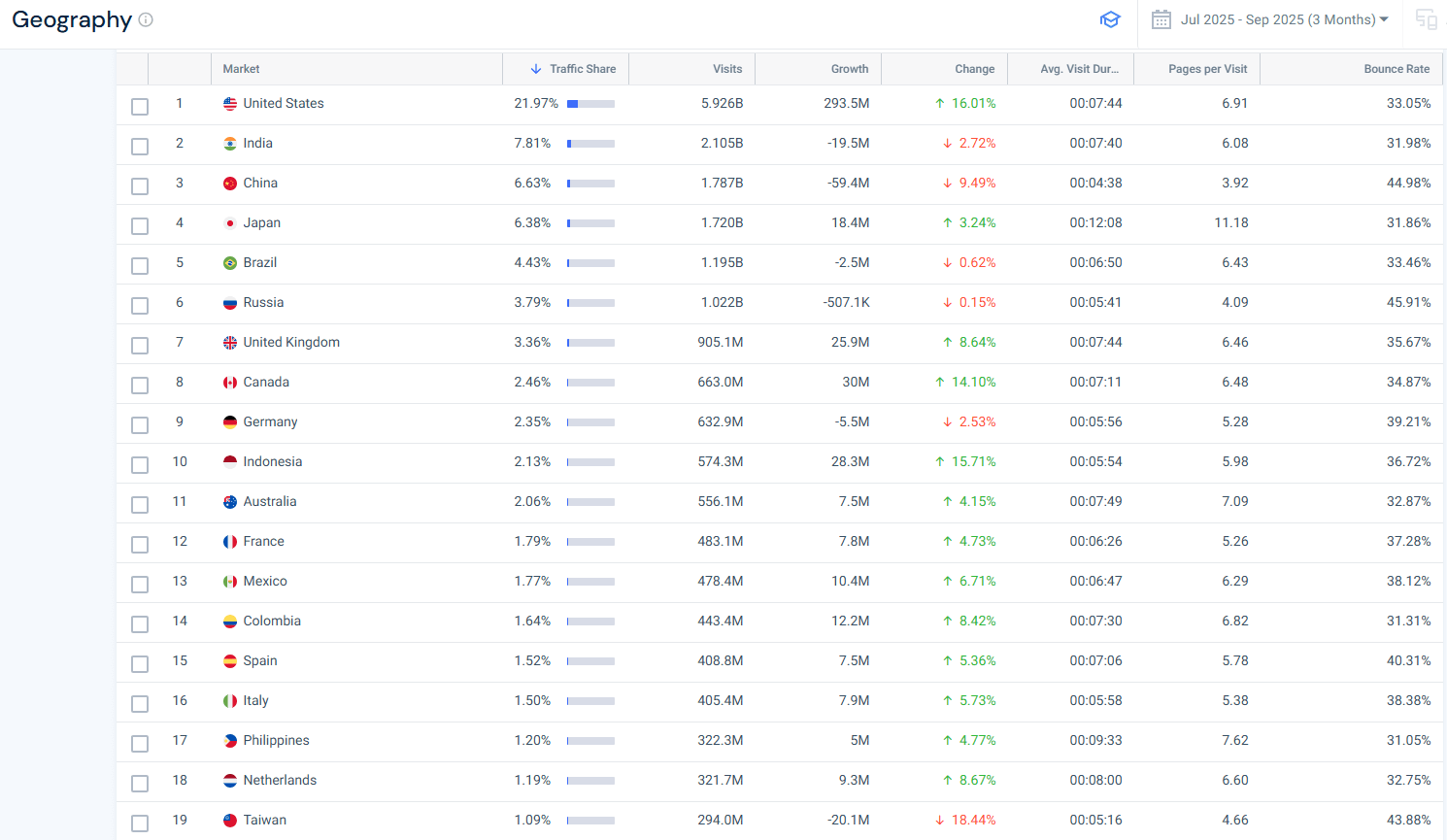

5. Drill into Geography for Localized Niches

Finally, niche opportunities often live outside the US and EU.

- Indonesia (+15.7%), the Philippines (+4.8%), and Colombia (+8.4%) are showing double-digit growth in visits

- Yet these regions are often underserved by localized dev platforms

💡 Consider tailoring products or content to specific languages, pricing models, or regional developer needs.

A niche is an overlooked pocket of high engagement, unmet need, and fast change within a small market.

Best practices for sustained growth in untapped markets

Use market selection frameworks

Choosing the right untapped market requires discipline, not guesswork:

- The Blue Ocean Strategy is a commonly used framework that helps companies assess whether a space truly lacks competition or is just underserved.

- Structured approaches, such as scoring markets by size, accessibility, growth rate, and fit with company strengths, create a repeatable way to prioritize opportunities. This helps focus on markets where unmet demand aligns with long-term viability.

Leverage internal strengths and assets

Expanding into an untapped market is most effective when it builds on existing advantages. Companies should assess which capabilities, such as technology, distribution networks, or brand equity, can be adapted to new contexts. This lowers entry costs and accelerates adoption.

For example, a logistics company with strong delivery infrastructure might extend into rural markets where ecommerce is growing but last-mile coverage is weak.

Localize and foster inclusive engagement

Untapped markets often require tailored approaches rather than one-size-fits-all solutions. Localizing products, through language, pricing, design, or cultural fit, makes adoption more likely.

Engaging communities directly, whether through partnerships with local businesses or involving users in product feedback, helps companies avoid missteps. Inclusive design ensures solutions serve diverse populations, which is especially critical in demographic and geographic gaps.

Measure and iterate with KPIs

Early entry into untapped markets involves uncertainty. Clear KPIs, such as adoption rates, retention, and cost to serve, are essential to track traction and validate assumptions.

Instead of committing heavy resources upfront, companies should adopt an iterative approach: test, measure, refine, and scale what works. This disciplined cycle reduces risk and ensures growth strategies stay aligned with real demand signals.

Discovering untapped markets with Similarweb

Identifying and serving untapped markets is both a growth tactic and a mindset. It requires companies to move beyond surface-level metrics and listen closely to what people need but aren’t getting.

Whether it’s a new demographic, an overlooked region, or a shift in user behavior, Similarweb Web Intelligence can help you identify markets that reward those who can move early, adapt fast, and scale boldly. For businesses willing to explore the gaps others ignore, the payoff can be more than just revenue: It can be relevance, resilience, and long-term market leadership.

FAQs

What is an untapped market?

An untapped market is a group of customers whose needs are not being met by current products or services. These markets show unmet demand, underserved demographics, or overlooked regions with growth potential once solutions are introduced.

How are untapped markets different from niche markets?

Untapped markets are defined by unmet needs and may be large or small, but currently lack solutions. Niche markets are specialized segments that are already served, but require more tailored offerings.

Why are untapped markets strategically important?

They offer lower competition, reduced customer acquisition costs, and the potential for first-mover advantage. These markets also allow companies to diversify, test new models, and build long-term growth channels.

What are some key characteristics of untapped markets?

They typically have unmet demand, rapid growth potential once solutions emerge, and offer diversification opportunities across customer segments, geographies, or industries.

What strategies support growth in untapped markets?

- Use market selection frameworks like Blue Ocean Strategy

- Leverage existing assets such as tech or distribution

- Localize products and engage communities directly

- Track performance using clear KPIs and iterate based on real data

Track your digital metrics and grow market share

Contact us to set up a call with a market research specialist