Going Global on Amazon: Where the Growth Is in 2025

Amazon is no longer just a one-market game.

While growth in the US cools, sales in international Amazon marketplaces are accelerating, creating massive opportunities for brands that know where to look.

In our recent webinar, Go Global on Amazon: Rethinking Your Strategy with Real-Time Marketplace Data, our experts revealed how ecommerce behaviors and demand patterns are evolving across different international markets.

Here’s what you need to know if you’re thinking about scaling globally in 2025 and beyond.

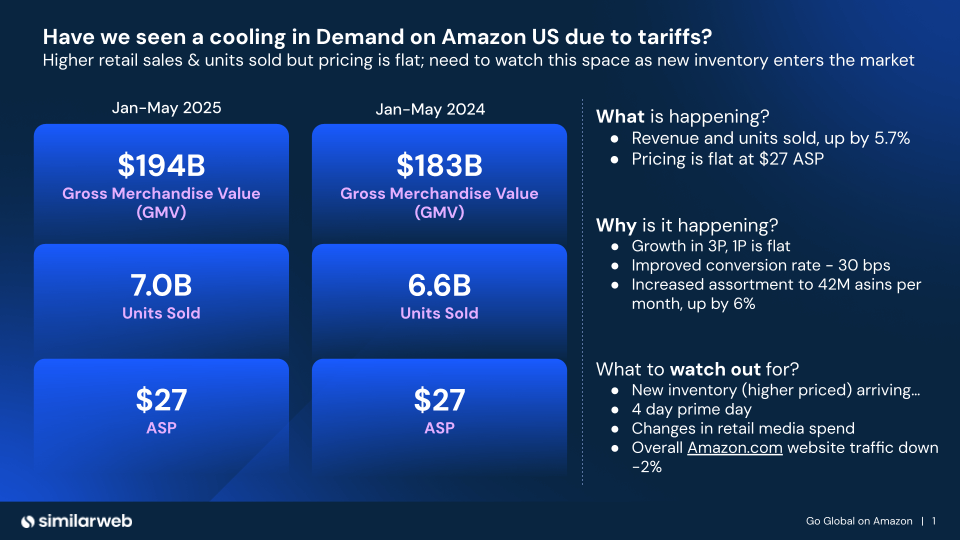

The US market isn’t what it used to be

Yes, Amazon US is still the biggest market by sales volume, but it’s no longer the fastest-growing. Between January and May 2025, Gross Merchandise Value (GMV) in the US grew by just 5.7%, with average selling prices (ASP) holding steady.

At the same time, consumer traffic dropped by 2%, and most of the growth came from third-party (3P) sellers, not Amazon’s own first-party (1P) retail business.

Here’s a breakdown of what’s happening and why:

What is happening?

- Revenue and units sold are both up by 5.7%

- Average Selling Price (ASP) is flat at $27

Why is it happening?

- Third-party (3P) seller growth is flat

- Conversion rates have improved by 0.3%

- Assortment has increased to 42M ASINs per month, up by 6%

What to watch out for?

- New, higher-priced inventory arriving

- Extended Prime Day and sales events

- Changes in retail media spend

- Overall amazon.com website traffic is down -2%.

So what’s going on? Demand on Amazon US is cooling. Even though retail sales and unit volumes are up, flat pricing is holding back revenue acceleration. This shift suggests brands should be watching the market closely, especially as new, higher-priced inventory enters the mix.

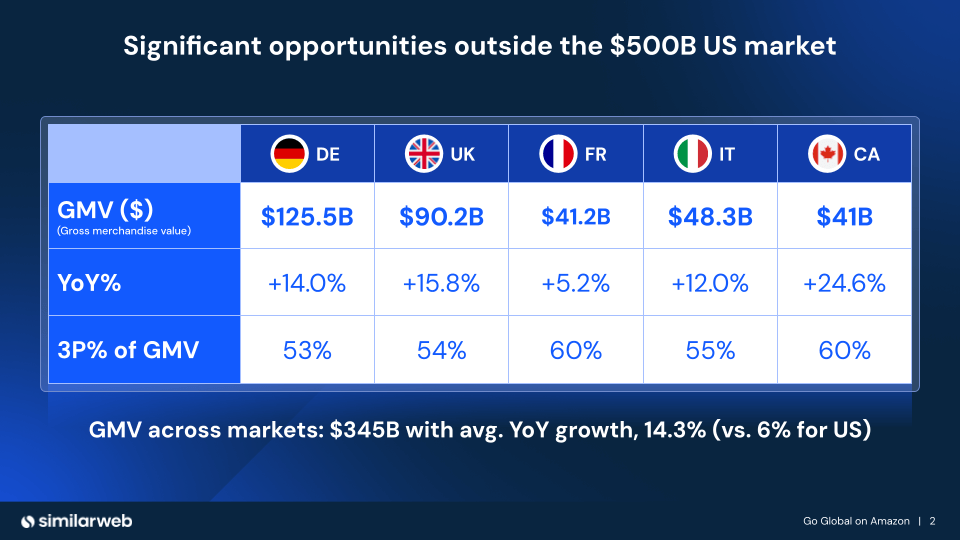

Opportunities to sell globally on Amazon

Amazon US is the largest market, boasting an annual gross merchandise value (GMV) of around $500 billion. However, with just 6% year-over-year (YoY) growth, it’s becoming increasingly difficult for new sellers to enter and scale quickly.

Compare that to some of the smaller, but rapidly expanding, international markets. In Canada, we’re seeing over 24% YoY growth.

The UK saw 15% growth, while Germany and Italy followed closely with 14% and 12%, respectively.

While the US remains a $500 billion giant, these trends highlight growing opportunities in international markets, driven in part by increased demand, expanding product availability, and competitive pricing.

According to Similarweb data, across international markets including Germany, the UK, France, Italy, and Canada, combined Gross Merchandise Value (GMV) stands at $345 billion, with an average year-over-year growth of 14.3%, more than double the 6% growth seen in the US.

Whether you’re already selling internationally or just exploring how to sell globally on Amazon, here are the key metrics to evaluate market potential:

- Gross Merchandise Value (GMV): This signals the total retail opportunity available in a given market

- YoY Growth: This indicates how quickly consumer demand is rising within the market

- 3P Share of GMV: A high third-party (3P) seller share, such as Canada’s 60%, suggests a more open and competitive landscape where new entrants can thrive

Amazon’s Global Selling program is making it easier than ever to enter these high-growth international markets and sell on Amazon globally.

Pro Tip: Want to see what’s trending? Use our free tool to explore top-selling products by country, including Canada, the UK, and Germany.

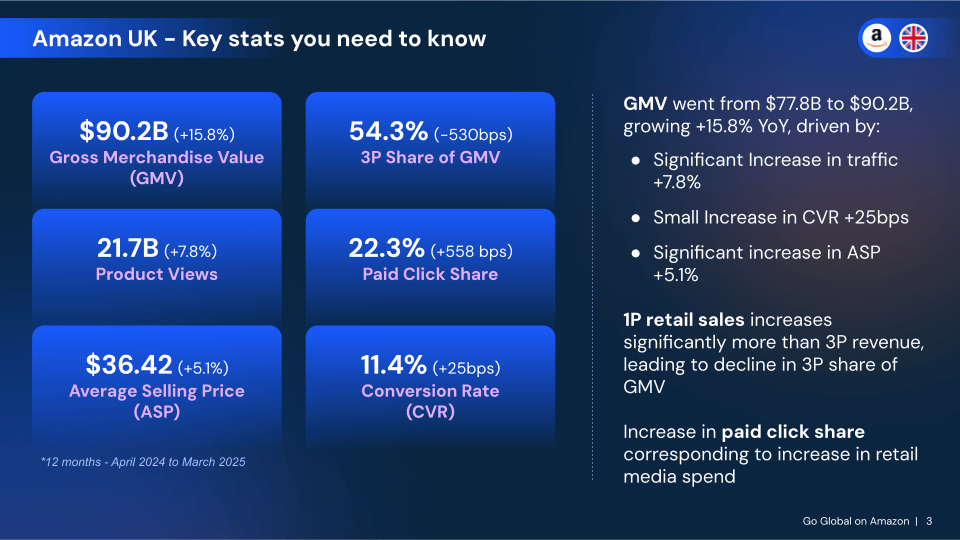

The UK and Germany are clear opportunities

If you’re looking for scale and momentum, Europe offers strong growth potential in ecommerce, especially in markets like the UK, Germany, and Italy, where demand and GMV are rising fast.

In the UK, the largest market outside of the US:

- GMV jumped +15.8% YoY to reach $90.2B

- Average Selling Price (ASP) increased +5.1%

- Retail media investment increased, with paid clicks gaining a significant share of traffic

The GMV in the UK grew from $77.8B to $90.2B (Similarweb data), an increase of 15.8% YoY. This growth was driven by a significant increase in traffic (+7.8%), a small increase in Conversion Rate (CVR) of +25bps, and a significant increase in ASP of +5.1%.

Notably, 1P retail sales increased significantly more than 3P revenue, leading to a decline in the 3P share of GMV. The increase in paid click share also corresponds to an increase in retail media spend.

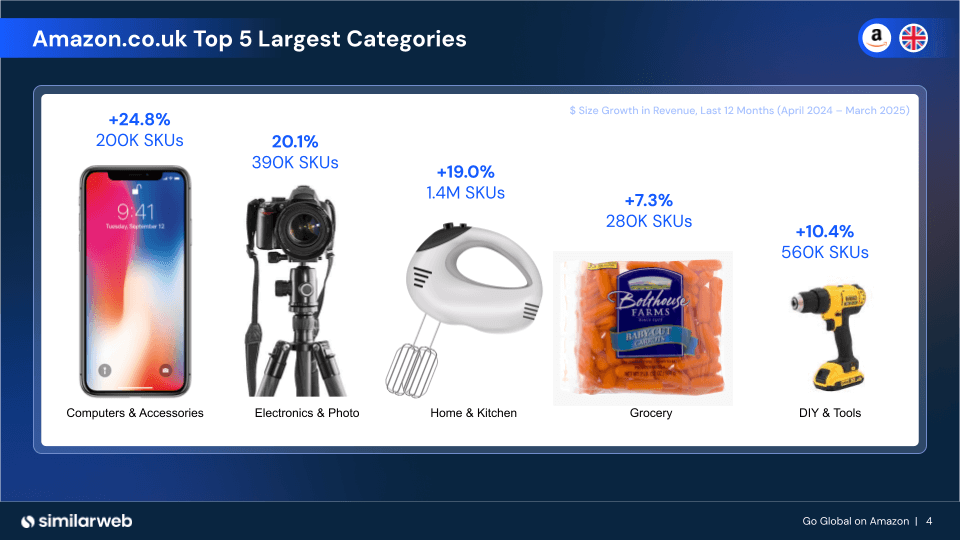

Looking at Amazon.co.uk’s top categories, we can see clear opportunities to prioritize:

- Computers & Accessories saw a +24.8% increase with 200K SKUs

- Electronics & Photo experienced a 20.1% increase with 390K SKUs

- Home & Kitchen grew by +19.0% with 1.4M SKUs

- Grocery had a +7.3% increase with 280K SKUs

- DIY & Tools showed a +10.4% increase with 560K SKUs

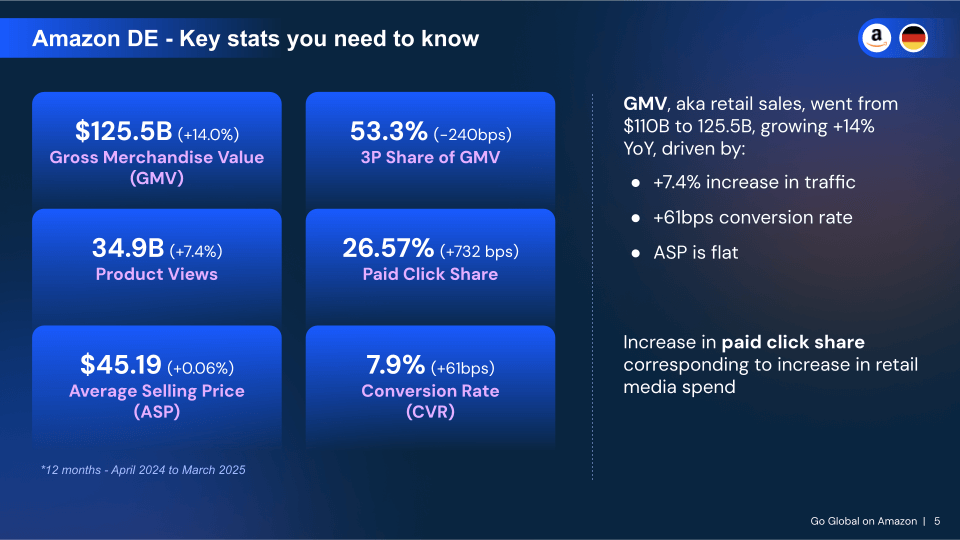

In Germany, the second largest market outside of the US:

- GMV hit $125.5B, a +14% YoY increase

- 1P retail grew by nearly 20%, significantly shifting the market dynamic

- An increase in paid clicks corresponds to an increase in retail media spend

Germany’s GMV, which represents retail sales, increased from $110B to $125.5B, growing +14% YoY. This was driven by a +7.4% increase in traffic and a +61bps conversion rate, while the ASP only increased by 0.06%.

Additionally, 1P retail sales increased by 19.3%, leading to a decrease in 3P share of GMV. The increase in paid click share also corresponds to an increase in retail media spend.

Challenger brands are winning with local insight

Some of the most exciting success stories in international Amazon markets are coming from nimble challenger brands, which can move fast and localize effectively.

Learning from The Inkey List success story

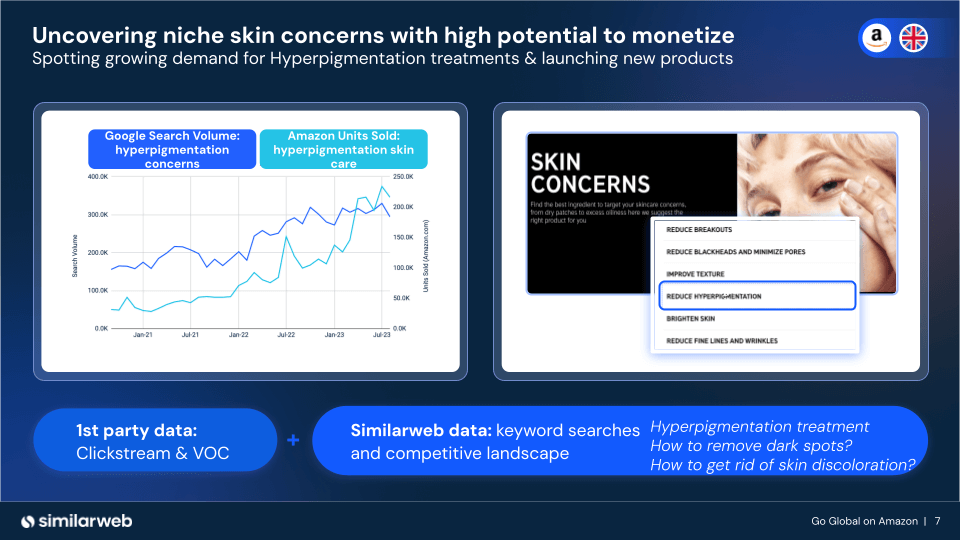

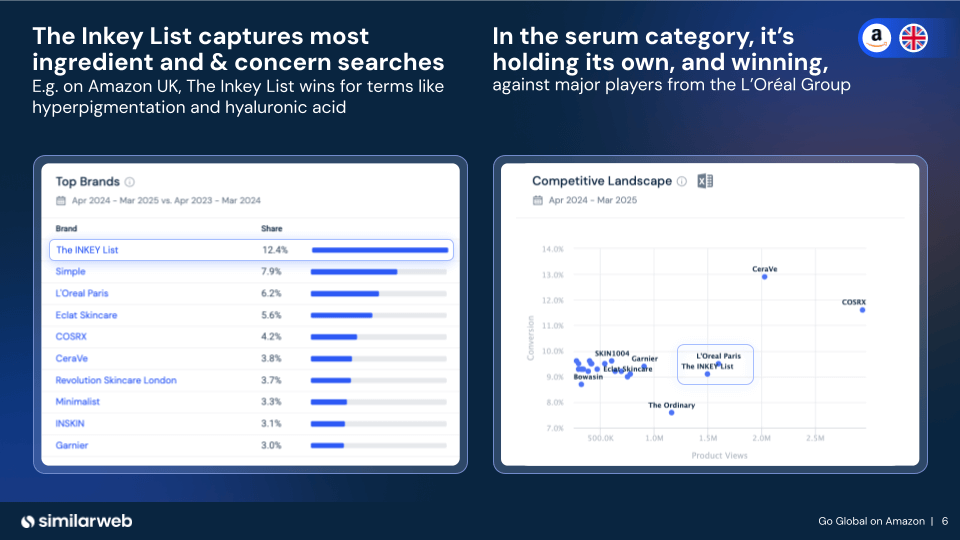

Consider The Inkey List, a UK-based skincare brand known for its affordable, ingredient-led products. In the UK, they’ve become a standout success story in the beauty category.

Rather than trying to compete head-to-head with established beauty brands on broad keywords or brand equity, they strategically focused on what shoppers were actively searching for: concern-based terms like “hyperpigmentation”.

The Inkey List successfully captured the majority of ingredient and skin concern searches on Amazon UK, winning for terms like hyperpigmentation and hyaluronic acid.

In the serum category, they are holding their own and even winning against major players from the L’Oréal Group.

By launching products specifically aligned with those niche concerns and supporting them with targeted retail media, The Inkey List managed to grow their UK sales by +9% YoY. They achieved this by focusing on niche keywords, including searches like “how to remove dark spots?” and “how to get rid of skin discoloration?”.

The Inkey List’s winning formula is simple yet effective: identify emerging shopper interest, match it with relevant products, and ensure visibility where it matters most.

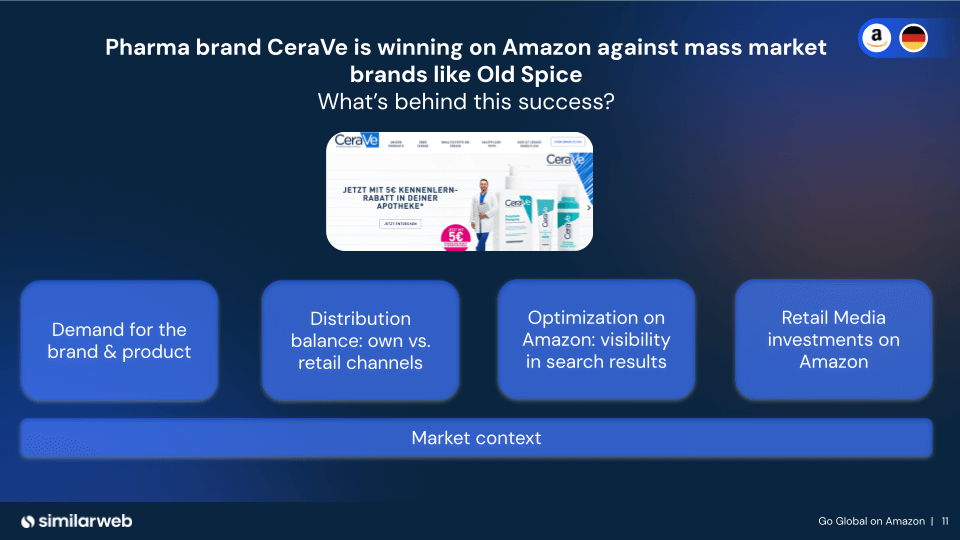

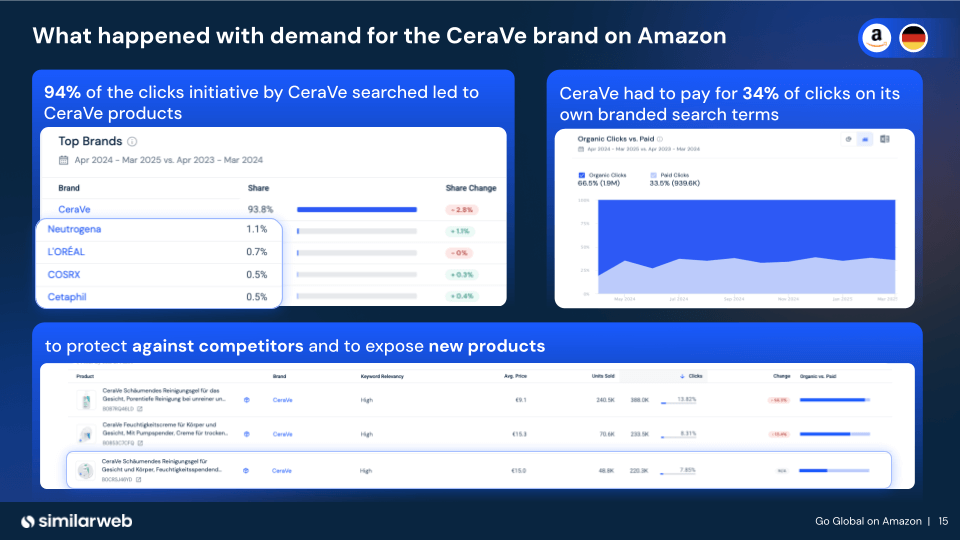

What happened with the demand for CeraVe on Amazon Germany

CeraVe, the skincare brand with pharmaceutical roots, has been making the most of its strong brand recognition to boost its presence on both Amazon and its direct-to-consumer (DTC) site. And it’s paying off. CeraVe is currently the top-selling product across all subcategories in the Cosmetics category on Amazon Germany.

And more importantly, CeraVe has built a powerful blueprint for how to expand successfully on Amazon’s global marketplaces.

Not your typical beauty brand

What makes its success stand out even more is the fact that CeraVe is a dermatology-first brand. It focuses on simple, clinically-backed formulations rather than lifestyle-driven marketing or traditional beauty positioning.

That’s why it’s surprising to see CeraVe outperforming well-known names like Old Spice or local favorites like Nivea to become the leading brand in the category.

Dominating the best-sellers list

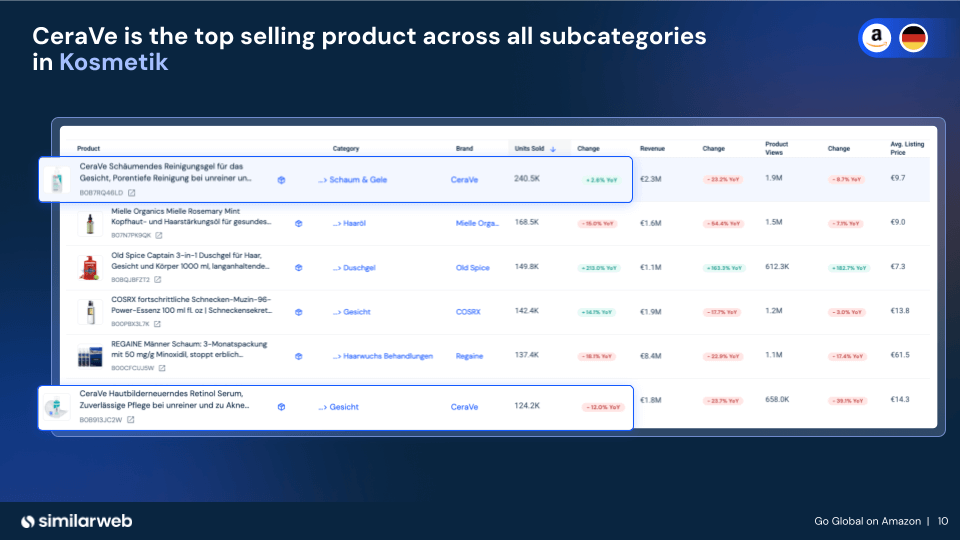

In fact, CeraVe, which is owned by L’Oréal, had two products in the top 10 on Amazon Germany in May 2025:

- Foaming Cleanser took the #1 spot, selling over 240,000 units with a solid +2.6% year-over-year growth

- Retinol Serum came in at number six, reinforcing CeraVe’s strong positioning and smart portfolio strategy

Understanding the demand for CeraVe on Google Search

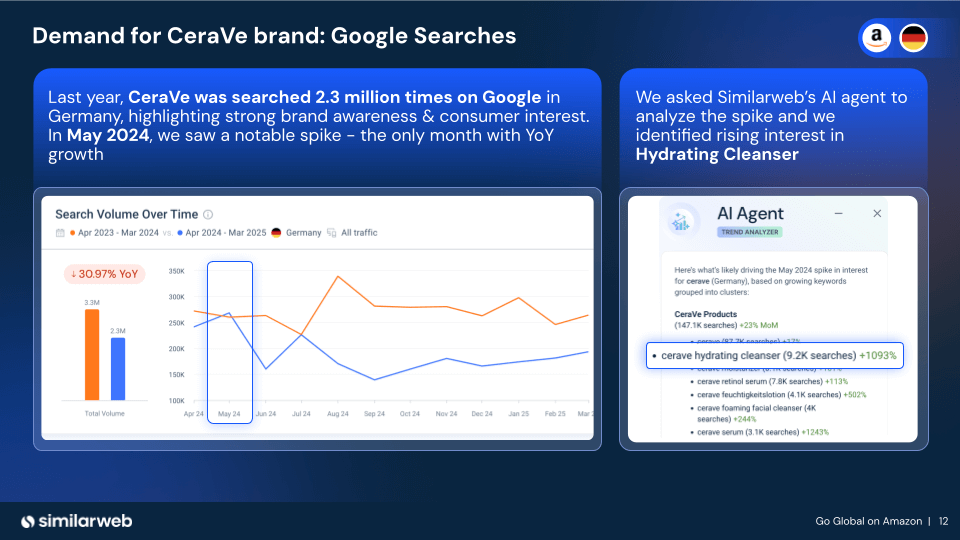

Last year, CeraVe was searched 2.3 million times on Google in Germany, a strong indicator of brand awareness and consumer interest.

While overall search volume was down compared to the previous year, May stood out as the only month that saw year-over-year growth for the brand.

To understand the reason behind this spike, we used Similarweb’s AI trend analyzer agent, which identified a surge in interest around the term “Hydrating Cleanser” up by over 1000%.

This sharp rise in a niche skincare category appears to have been captured almost entirely by CeraVe.

Inside the shopper journey

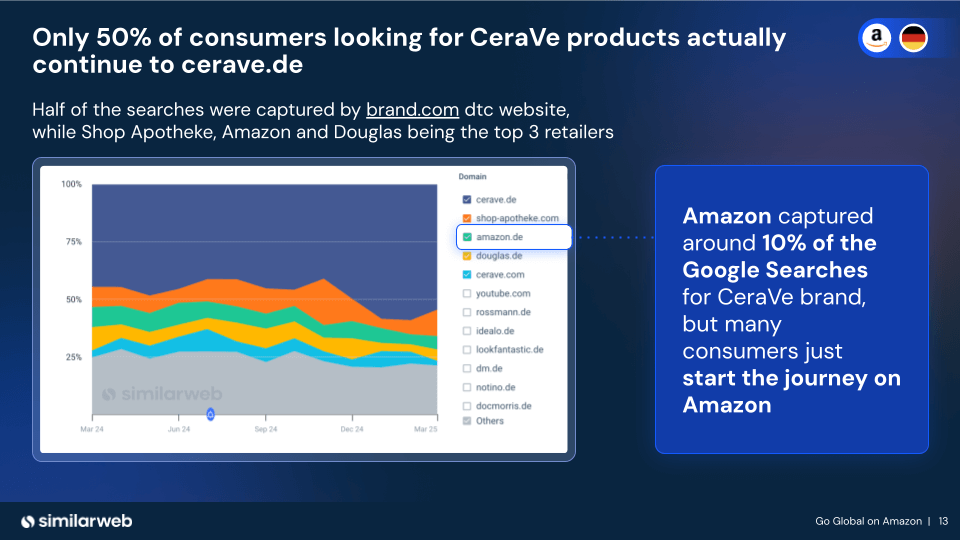

Organic search sends users in multiple directions. After searching for CeraVe on Google, only 50% landed on the brand’s own DTC site. The rest were split across major German retailers like Shop Apotheke, Amazon, and Douglas, with some heading to YouTube.

But here’s the catch: Google doesn’t tell the full story.

While Shop Apotheke appears prominent in post-search traffic, many consumers bypass Google entirely and start their journey directly on Amazon. So even though Amazon only captures around 10% of the traffic that follows a Google search, it’s actually driving a much larger share of total demand.

Amazon’s real share of the journey

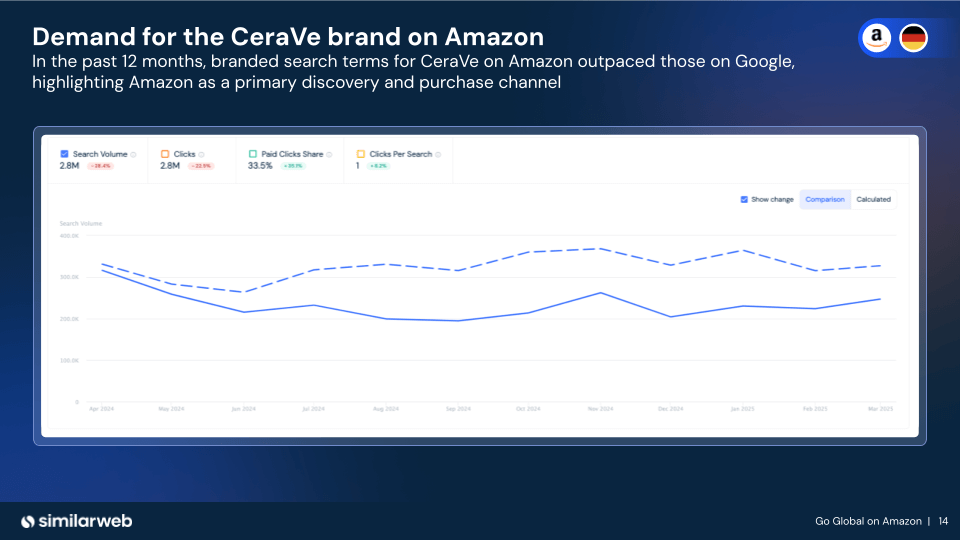

Amazon-branded search volume for CeraVe actually surpassed Google over the past year. They had 2.8 million branded searches on Amazon, compared to Google’s 2.3 million.

That makes Amazon CeraVe’s #1 product discovery channel.

CeraVe’s investment in paid search

Once shoppers land on Amazon and search for CeraVe, most of them follow through. A huge 94% of branded search clicks went directly to CeraVe products, meaning there’s very little funnel leakage.

Even the small share (just under 6%) that went to competitors often still landed within L’Oréal’s portfolio.

Still, CeraVe isn’t taking any chances. The brand paid for 34% of its own branded search clicks. That investment does two things: it protects against competitors trying to capture branded search intent (especially lower-cost disruptors when demand spikes), and it helps promote new product launches by using the momentum of its existing popular listings.

A good example is the new version of the Foaming Cleanser, now ranked #3, with over 60% of its traffic coming from paid ads, a clear signal it’s being strategically pushed.

CeraVe’s dominance in Germany shows a repeatable model for scaling succesfully on Amazon globally. The brand’s ability to align product strategy with market demand, invest smartly in retail media, and balance direct and marketplace distribution shows how data-backed decisions lead to category leadership.

Go global with unmatched market and consumer data

Winning market share globally isn’t guesswork. It takes data, speed, and a hyper-local strategy.

Every market behaves differently: what’s trending in the US may be over in Europe. From retail media costs to keyword competition and product saturation, regional dynamics matter.

That’s why brands need real-time, localized insights to expand. With Similarweb’s Shopper Intelligence, you get instant access to category benchmarks, click-share trends, and more, tailored to each market.

Wondering what Similarweb can do for your business?

Give it a try or talk to our insights team — don’t worry, it’s free!