Pet Takeover? How CPG Pet Brands are Winning the Ecommerce Race

- Pet product ecommerce has grown at a faster rate than food and beverage, grocery, and health and personal care industries

- The most successful D2C pet brands sell niche, high-ASP (Average Selling Price) products

- Amazon’s largest pet brand, Blue Buffalo, generated $540M in 2024 and still grew at an impressive 38% YoY

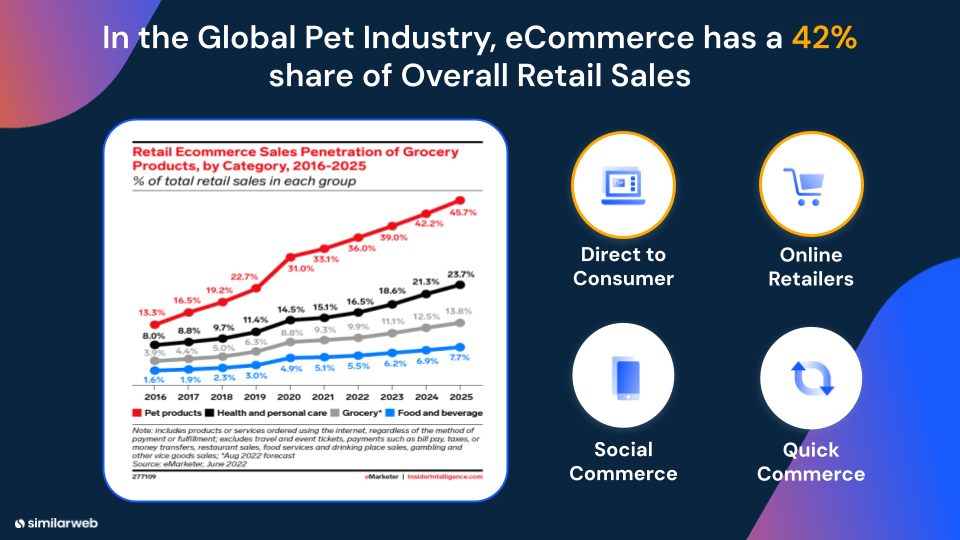

Quick stat alert: Ecommerce now accounts for 42% of all pet product sales globally, a significantly higher share than other industries.

Pet content has taken over the internet (and our hearts 🐶). So it’s no surprise that pet ecommerce is one of the fastest-growing online retail industries.

Nearly half of all global pet retail sales are now online. That means having a robust digital strategy is essential for pet brands looking to stay relevant.

Similarweb’s special report for the GlobalPETS forum 2025 picks apart the winning strategies pet brands are using to navigate direct-to-consumer (D2C) and Amazon marketplace.

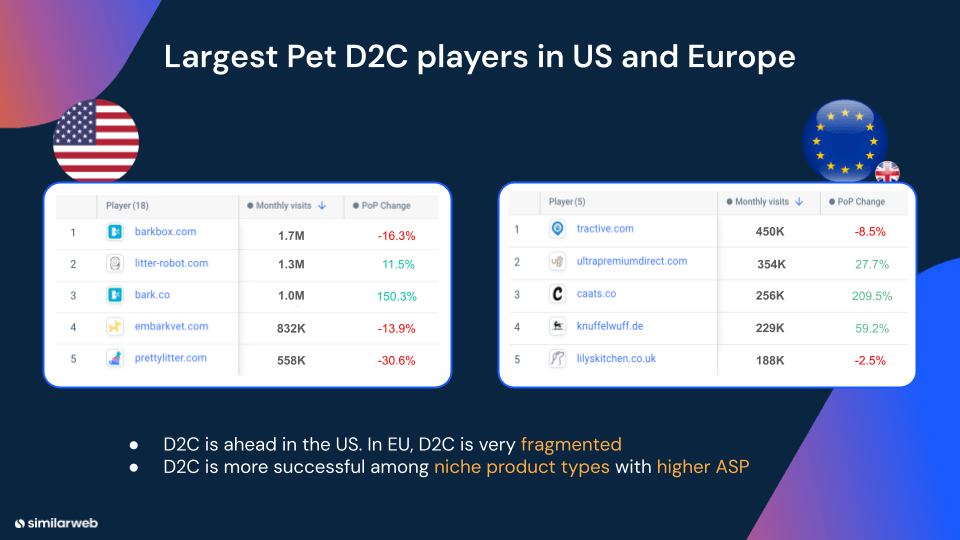

Pet brands winning the highest share of D2C traffic

Selling D2C comes with major advantages—stronger brand loyalty, higher margins, and full control over the customer experience.

But without the built-in audience of marketplaces, brands need smart strategies to stand out and drive website traffic.

Here are the top D2C pet brands winning the most traffic:

The top two brands in the US are:

- BarkBox – A subscription-based toy and treat box for dogs that builds long-term customer loyalty through personalized plans and a strong, engaged community

- Litter-Robot – An automatic, self-cleaning cat litter box that has established itself as a category leader in premium pet solutions

The top two brands in Europe are:

- Tractive – A GPS tracking and activity monitoring device for pets that helps owners ensure their pets’ safety and well-being with real-time location tracking and health insights

- Ultra Premium Direct – A D2C premium pet food brand that delivers high-quality, natural nutrition for dogs and cats through a personalized subscription model

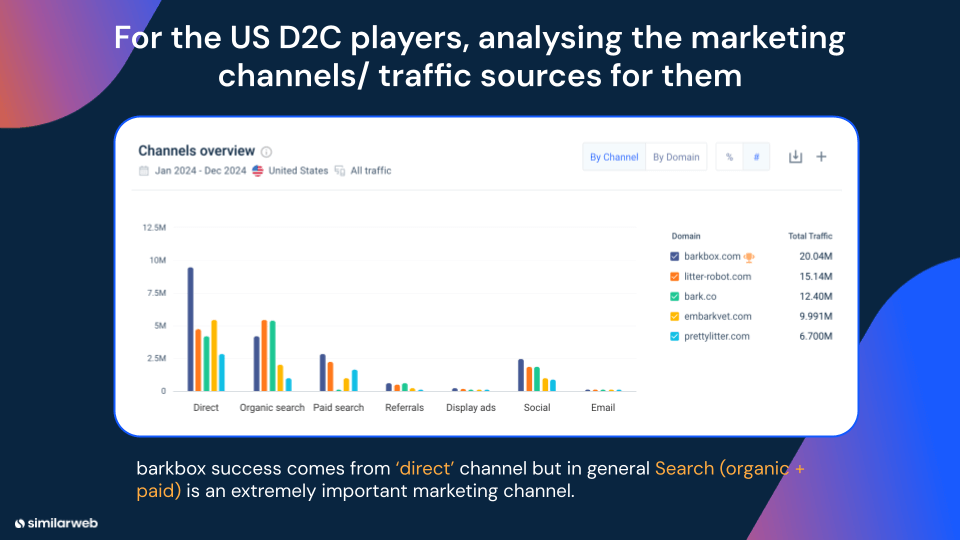

Key factors driving traffic to top pet brands in the US

For D2C pet brands, direct and organic search traffic plays a significant role in driving growth. Direct traffic comes from users who visit a website by typing the URL directly, while organic traffic comes from unpaid search engine results. Using Similarweb insights, we examined the traffic sources for the leading players in the market.

- BarkBox’s traffic data shows a strong trend of direct traffic, indicating high brand awareness and customer loyalty

- Litter-Robot is succeeding by capturing organic search traffic. The unique nature of their product allows them to stand out in their niche

Both brands demonstrate a combination of strong SEO presence, brand recognition, and customer loyalty.

Here’s how the US brands are coming out on top:

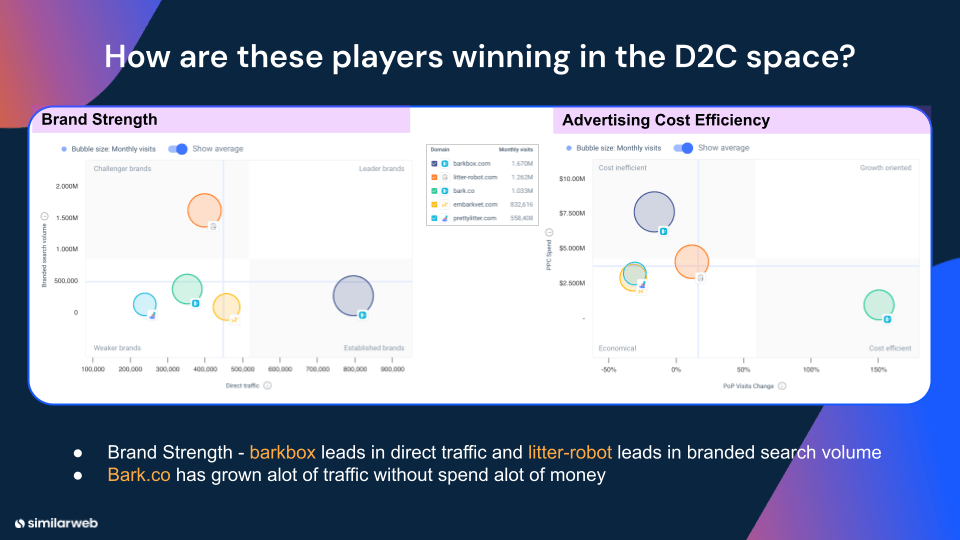

Using Similarweb data, we looked at online brand strength, which is measured through a brand’s direct traffic and branded search volume. For these D2C brands, three of them stand out.

- BarkBox is cost inefficient, but investing in building brand awareness and successfully driving growth through direct traffic

- Litter-Robot leads in branded searches thanks to its status as category leader for a niche product

- But, what really stands out here is Bark.co’s cost-effective traffic growth.

Let’s take a deeper look at how they did it:

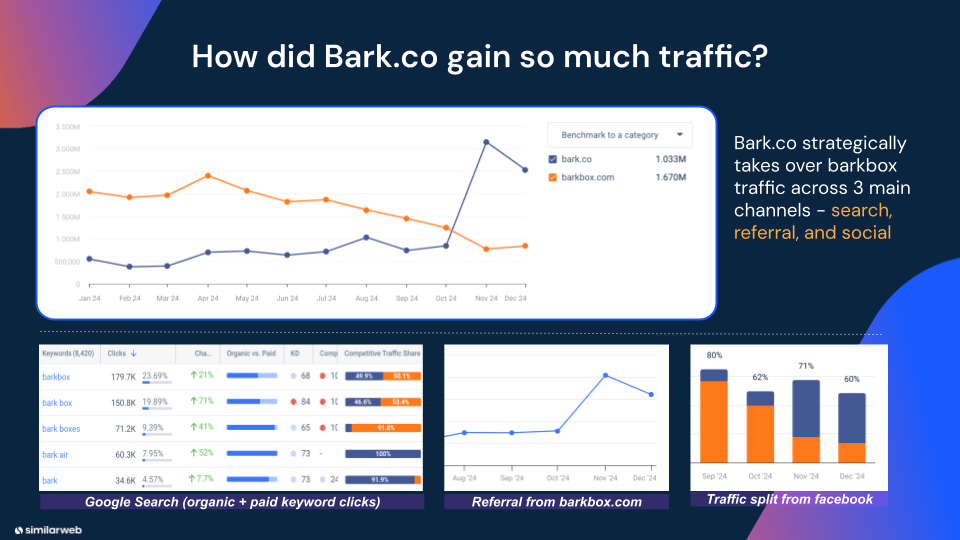

Bark.co’s winning D2C traffic strategy

Bark.co has emerged as a leader in D2C growth, increasing traffic without increasing ad spend.

So, what’s the secret?

As seen below, by strategically redirecting traffic from its well-known sister brand BarkBox through search, referrals, and social media, Bark.co funneled consumers to its site, expanding product exposure and strengthening brand loyalty.

Bark.co capitalized on the existing brand awareness and engaged the customer base of Barkbox to drive cost-effective growth. This approach allowed them to capture high-intent traffic while reinforcing their overall brand ecosystem.

You can see the change occur in Q4 as the traffic to bark.co and Barkbox switch in volume across search, referrals and social.

💡 Key Takeaway: Using a flagship product or brand recognition to drive traffic to a parent or sister brand helps CPG businesses scale efficiently without increasing acquisition costs. A winning strategy for sustainable D2C growth.

Selling pet products on Amazon

Amazon is every consumer’s trusted best friend. Customers know the platform well, can easily compare products and prices, and rely on reviews to make confident purchasing decisions.

But convenience isn’t the only factor driving pet owners to Amazon.

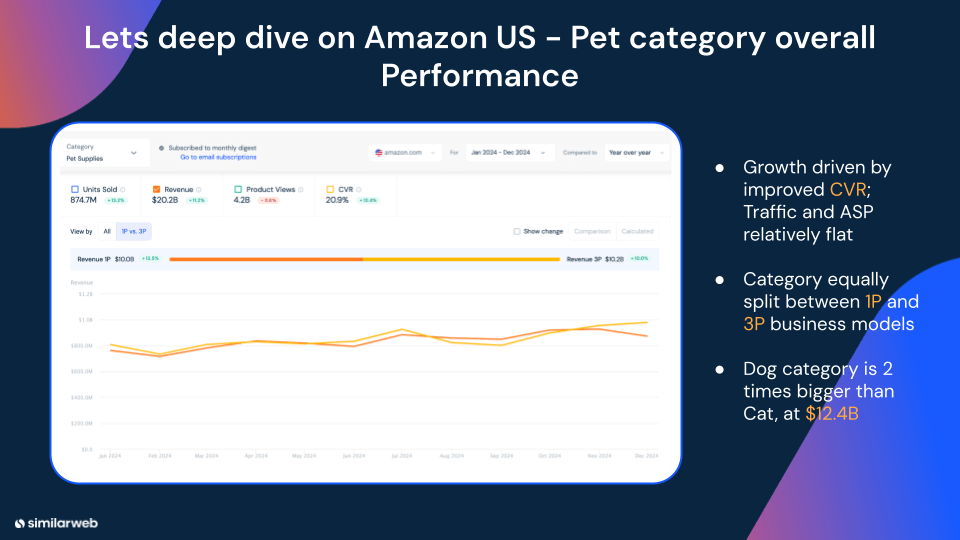

Over $20.2 billion was spent on pet supplies on the platform in the past year alone, up by 10% YoY.

This makes Amazon the #1 online marketplace for pet brands to reach high-intent shoppers. The category is equally split between 1P vendors and 3P sellers, representing significant competition from smaller niche 3P sellers and brands.

With traffic and ASP remaining flat, brands face intense competition to drive traffic to their product pages.

To win, they must implement smart strategies that maximize visibility and conversions.

How top pet brands are winning traffic on Amazon

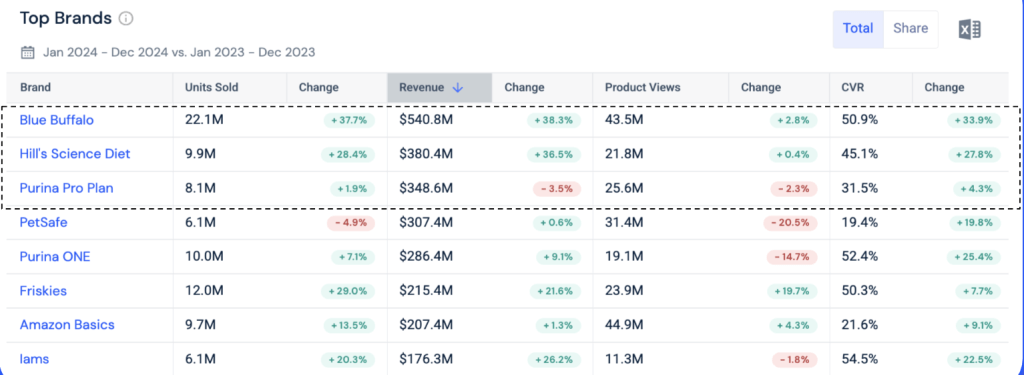

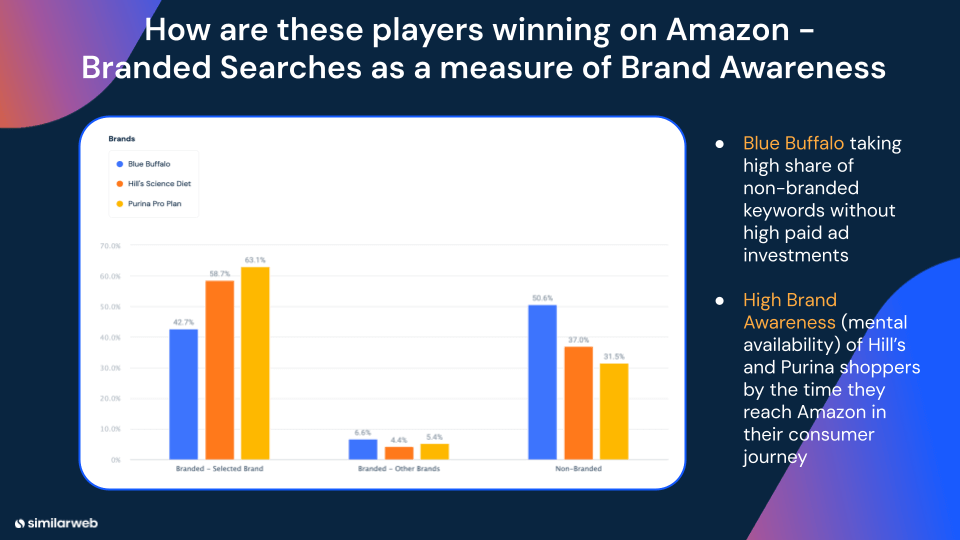

The top three pet brands generating the most revenue on Amazon are Blue Buffalo, Hill’s, and Purina, all operating predominantly as 1P sellers.

In a category that grew 10% YoY, existing category leader Blue Buffalo succeeded in growing revenue by 38.3% YoY. Here are the key strategies behind their success:

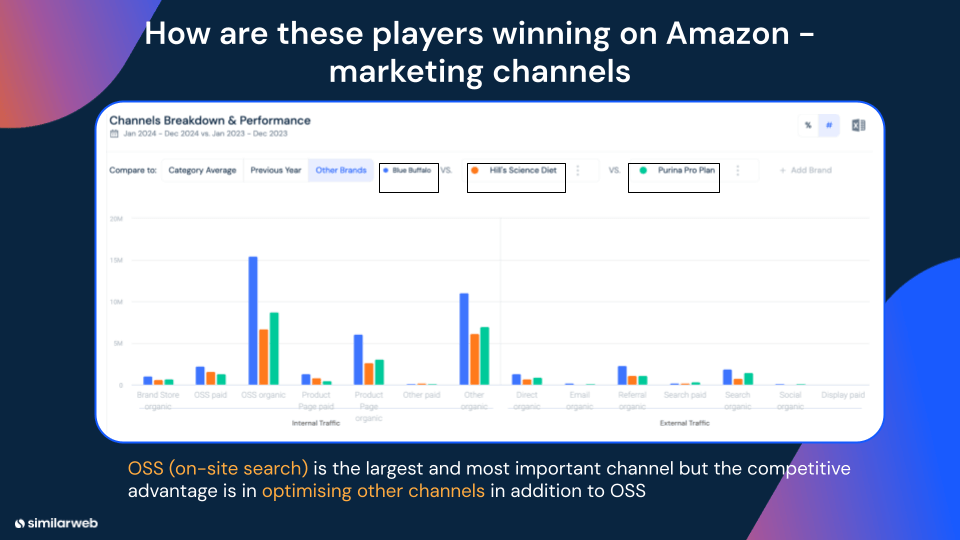

1. Mastering on-site search (OSS)

Most sales on Amazon start with a search. Brands that optimize product listings, keywords, and ads gain the most visibility.

Blue Buffalo received the highest traffic from Amazon on-site search, but their success goes beyond that. They executed a holistic Amazon strategy, leading in both internal traffic sources (Amazon search, ads, and product pages) and external channels driving traffic to Amazon.

2. Capturing non-branded traffic

While Blue Buffalo had the lowest branded searches (indicating a low brand awareness) compared to Hill’s and Purina, they excelled at capturing a significantly larger share of non-branded Amazon search traffic.

With fully optimized product pages, they successfully attracted organic traffic without relying on paid ads for non-branded searches. This gave them a cost-efficient competitive edge.

The average pet consumer’s complex online journey

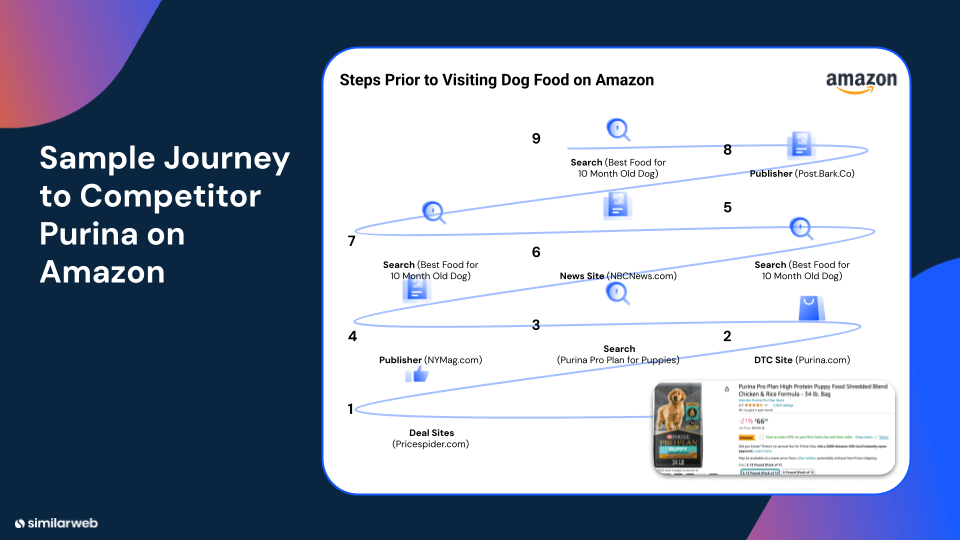

The pet consumer journey often starts with a search, either on Amazon, Google, or Social Media.

With multiple key stages in the decision-making process, the typical user journey is complex, and pet brands must be smart and strategic in ensuring they appear at every touchpoint of the user journey.

Below is an example of one complex journey, starting from search, reading blogs, and ending up on Amazon:

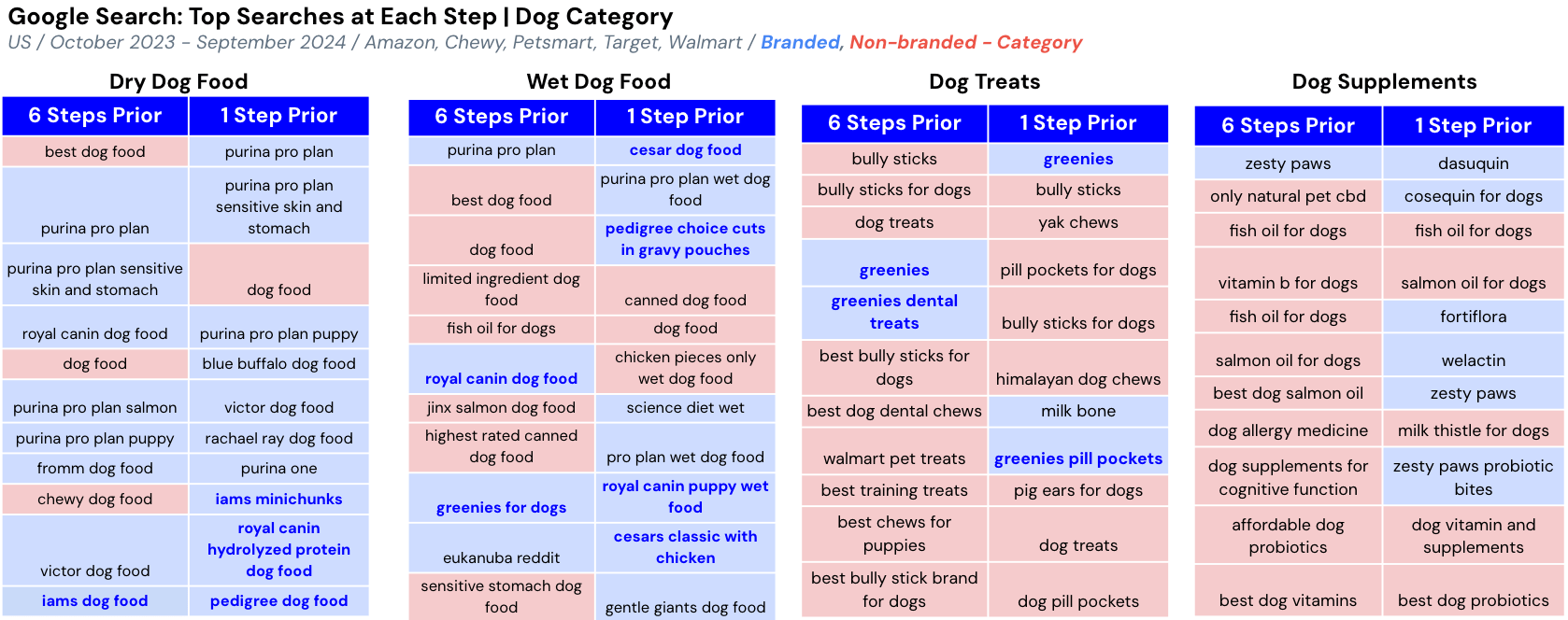

How do search trends vary by pet product?

The way consumers search depends on the type of pet product:

Above you can see four different examples of how search behavior changes depending on the product.

- Dog food searches are typically branded (e.g., “Purina Pro Plan”), allowing established brands to dominate

- Smaller brands may struggle to compete unless they bring something new and unique to the market

- Treats and supplements are category-first searches (e.g., “natural dog treats”), making SEO and search ads crucial for product discovery

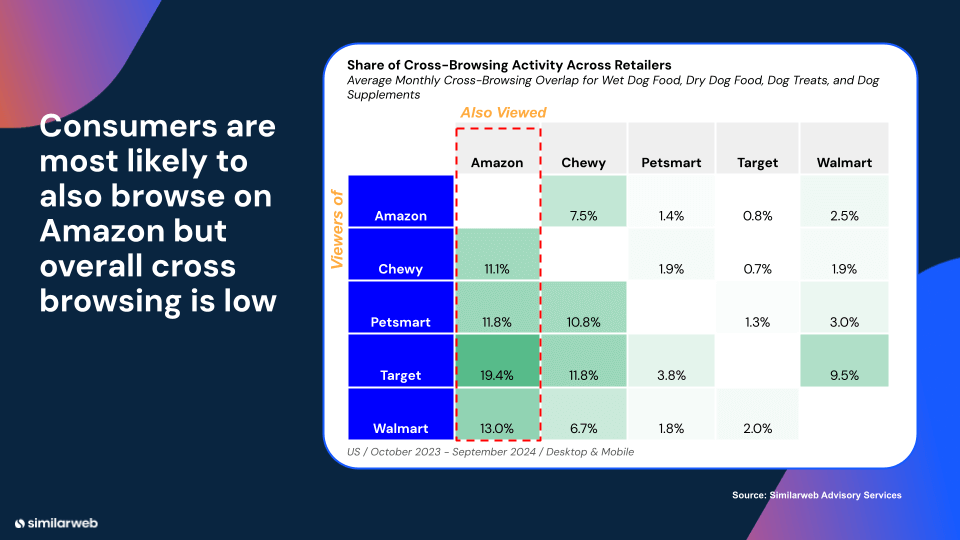

Which retailers are consumers browsing?

Consumers are most likely to browse on Amazon, but cross-browsing across multiple retailers is relatively low.

Understanding cross-browsing behavior is crucial for brands deciding which platforms to sell on to reach new audiences. A brand selling on Amazon, for example, might find that Chewy and PetSmart have the least overlap in shoppers (with 11.1% and 11.8%, respectively), meaning these platforms offer a greater opportunity to reach new customers.

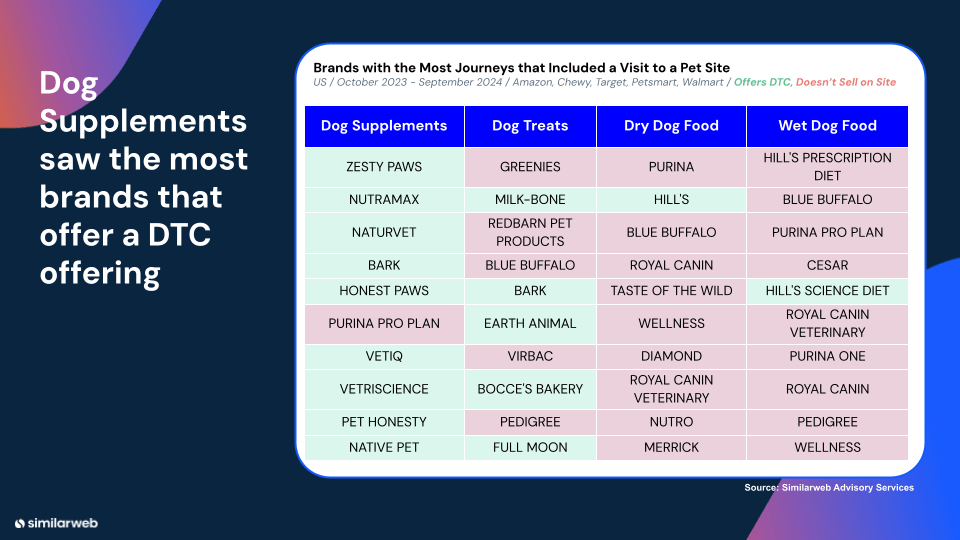

D2C or marketplace: where to sell by product

The trend here aligns with what we see in branded vs. non-branded search. When branded search volume is higher, brands tend to prefer selling on Amazon and other marketplaces. Branded searches typically indicate larger brands that are comfortable relying on external retailers for distribution.

- Dog food is primarily sold on Amazon, with many brands choosing not to operate their own D2C sites

- Pet supplements have a much higher number of D2C retailers

While marketplaces offer scale for everyday essentials like pet food, D2C provides a stronger opportunity for high-margin, specialized products like supplements.

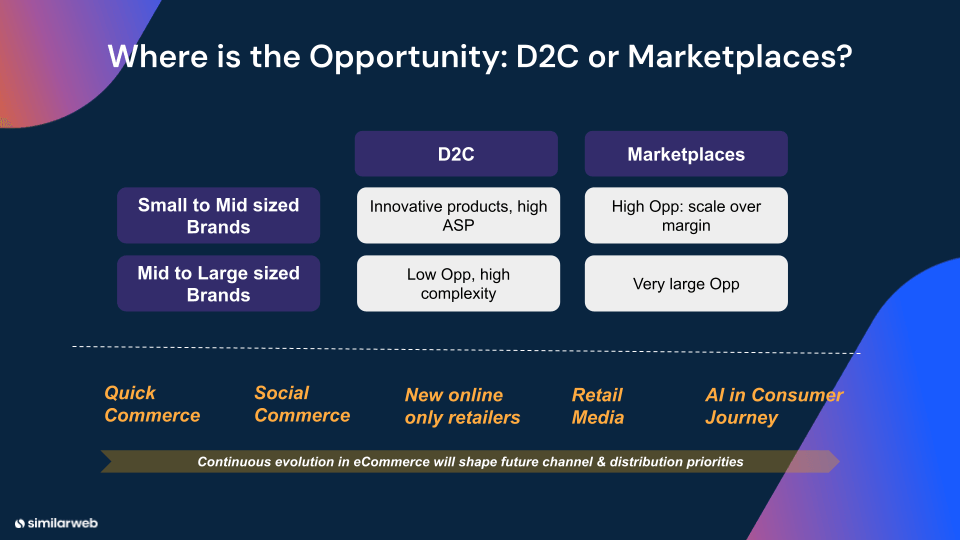

So, where should pet brands focus?

Where a pet brand should focus depends on its size, uniqueness, and ability to attract customers.

- D2C works best for niche or innovative brands that can draw in consumers with a unique value proposition, high engagement, and strong direct traffic. These brands often have higher ASPs to account for customer acquisition and third party fulfillment costs

- Larger, less differentiated brands perform better on marketplaces like Amazon and Chewy. They prioritize scale over margin, utilizing high traffic on marketplaces, branded searches, existing buyer relationships, and competitive pricing to stand out

💡 Key Takeaway: Choosing the right marketing channel depends on whether a brand can generate demand on its own or needs to compete where shoppers are already looking.

Looking ahead: what’s next for pet ecommerce

CPG pet brands must stay ahead in key areas to drive growth and remain competitive. Quick commerce enhances convenience, social commerce serves as a critical consumer touchpoint, and AI personalizes the user journey.

Brands that adopt a holistic strategy, integrating D2C, marketplaces, social media, and retail media will drive more traffic and sales. Reaching consumers across the right online channels and engaging them at every stage of the buyer’s journey is key to capturing a larger share of pet shoppers.

Wondering what Similarweb can do for your business?

Give it a try or talk to our insights team — don’t worry, it’s free!