Stock Data Feeds: How They Work and How to Use Them to Generate Alpha

There are billions, even trillions, of data points investors can use when researching a sector or a specific ticker. So the question is, how do you harness all that data?

Let’s break it down: Individual data points are grouped into datasets and then organized into stock data feeds for easy access and analysis. The data feeds are fed into existing models or used to build backtested models for deep insights into a ticker’s daily, weekly, and monthly performance. This generates the alpha needed to support existing investment theses and create new investment opportunities.

We need to examine stock data feeds more closely to understand their impact.

What is a stock data feed?

A stock data feed is essentially a data feed that provides access to real-time or regularly updated datasets without manual extraction for automated analysis, reporting, and system integration.

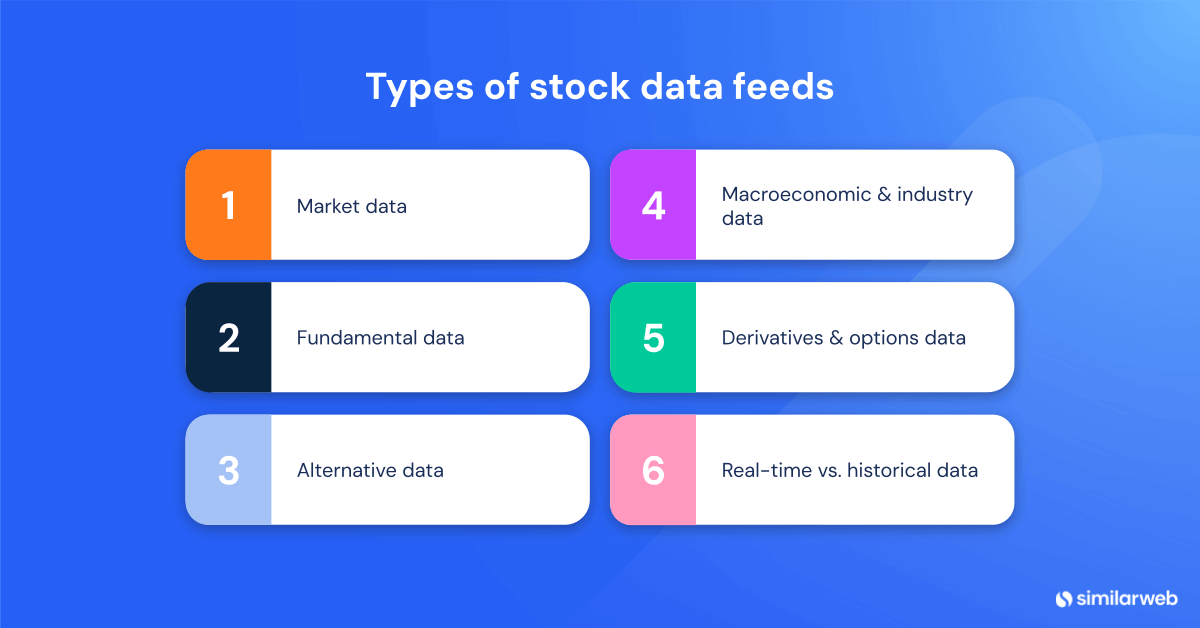

However, a stock data feed is constructed with stock-specific datasets investors need for in-depth ticker analysis, such as:

- Market data: price and trading information

- Fundamental data: financial statements and earnings reports

- Alternative data: web traffic and engagement data, credit card and consumer spending trends, and sentiment analysis

- Macroeconomic and industry data: interest rates, commodity prices, and sector trends

- Derivatives and options data: futures and swaps pricing, options chains, and volatility indices

- Real-time vs. historical data: ranges from intraday to decades of data

Why use stock data feeds?

Investors use stock data feeds to generate alpha based on real-time, historical, or alternative data, giving them the agility to make faster, more informed decisions and strengthen investment strategies.

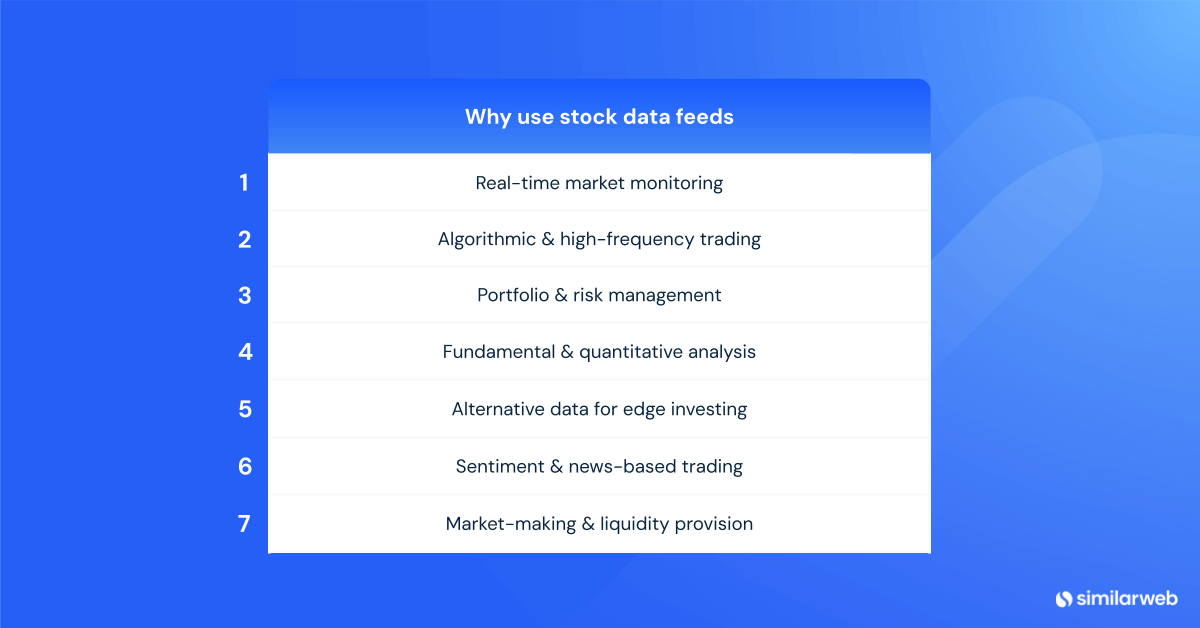

These stock data feeds are used for:

- Real-time market monitoring: Track price movements and execute trades accordingly

- Algorithmic & high-frequency trading: Automate trades based on ultra-low latency data

- Portfolio & risk management: Assess portfolio performance and hedge against risk

- Fundamental & quantitative analysis: Analyze historical trends, earnings reports, and market patterns

- Alternative data for edge investing: Gain deeper insights into portfolio companies and potential investment opportunities

- Sentiment & news-based trading: Monitor sentiment shifts from news, social media, or earnings reports

- Market-making & liquidity provision: Maintain tight bid-ask spreads and adjust orders in real time

What are Stock Intelligence Stock Feeds?

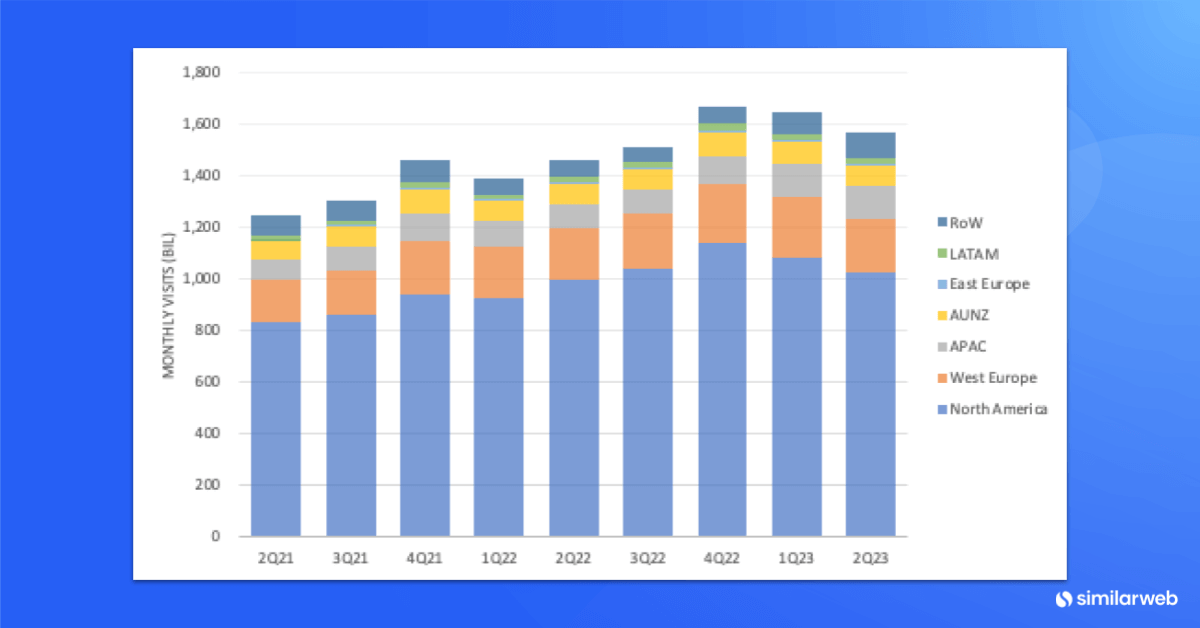

Now, let’s narrow the focus and look at alternative data—more specifically, web intelligence data. Metrics like traffic and engagement, marketing channels, mobile apps, page-level data, and website structure are proxies for company KPIs and can track top-line performance and revenue growth. Combine those metrics into a single data feed for a single ticker, and investors gain granular insights into portfolio companies and potential investment opportunities.

Stock Intelligence’s Stock Feeds help investors build backtested models and discover high-quality signals designed to optimize research and analysis.

More specifically, investors can:

- Monitor new client wins

- Track technology adoption

- Assess cohort performance

- Measure net & gross retention

With that information, investors can generate the alpha they need to support investment portfolios, strategies, and decisions.

How Stock Feeds can drive your research

Think of a Stock Intelligence Stock Feed, a stock profile that delivers high-quality signals for company KPIs to expand research and refine analysis.

Here’s how the data works:

Traffic & engagement data

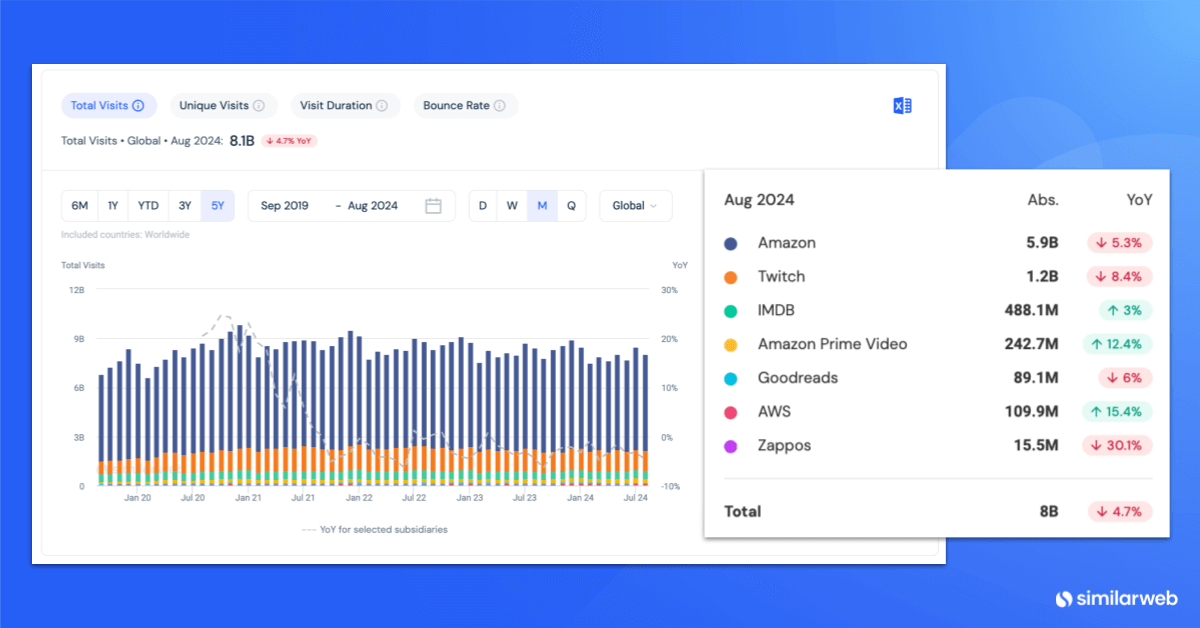

With a holistic view of company performance with website traffic and engagement data, you can answer questions like: How much traffic to Amazon subsidiaries is trending YoY?

Conversion data (segments)

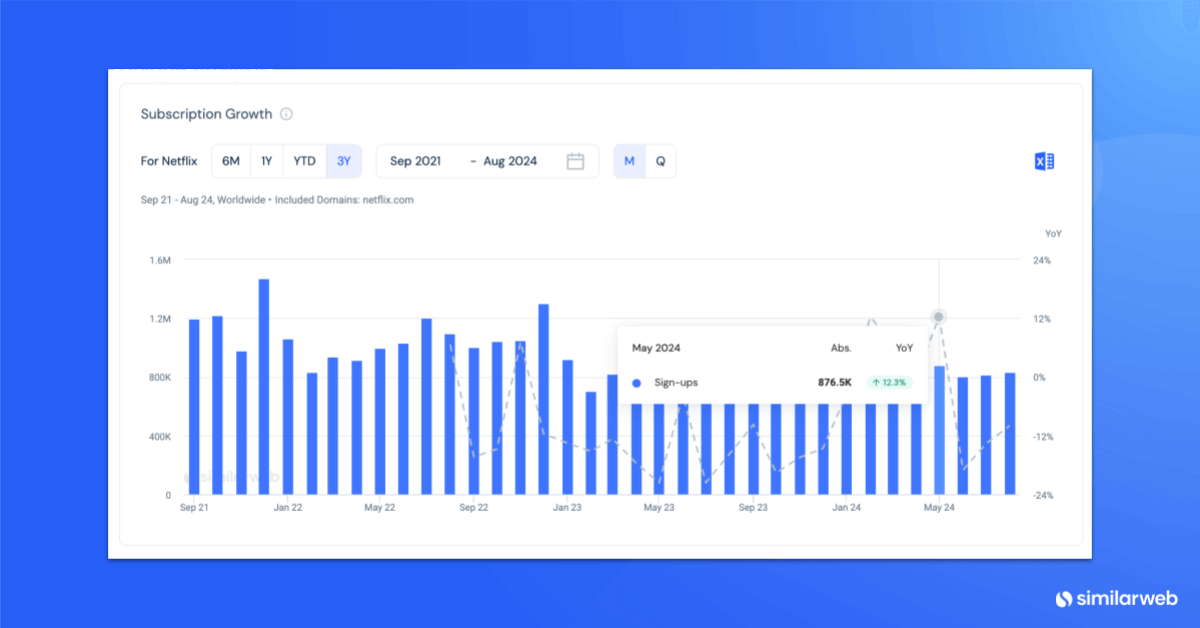

Conversion data can be used to monitor customer growth by tracking traffic to the checkout page through URL segmentation and answering questions like, “What types of clients are signing up to Netflix?”

Referral data

Understand the ecosystem with referral data by tracking traffic sources to reveal strategic relationships and market influence, which provides answers to questions like: How many monthly visits are directed to Shopify by country?

Subdomains & folders data

Leverage distinct URLs, such as subdomains (similarweb.zoom.com) and folders (zoom.com/similarweb/), to track client growth. Count-level activity reports can include a month-by-month analysis of which enterprise customers are leveraging a company’s platform, which companies are new, and how these customers are retained over time.

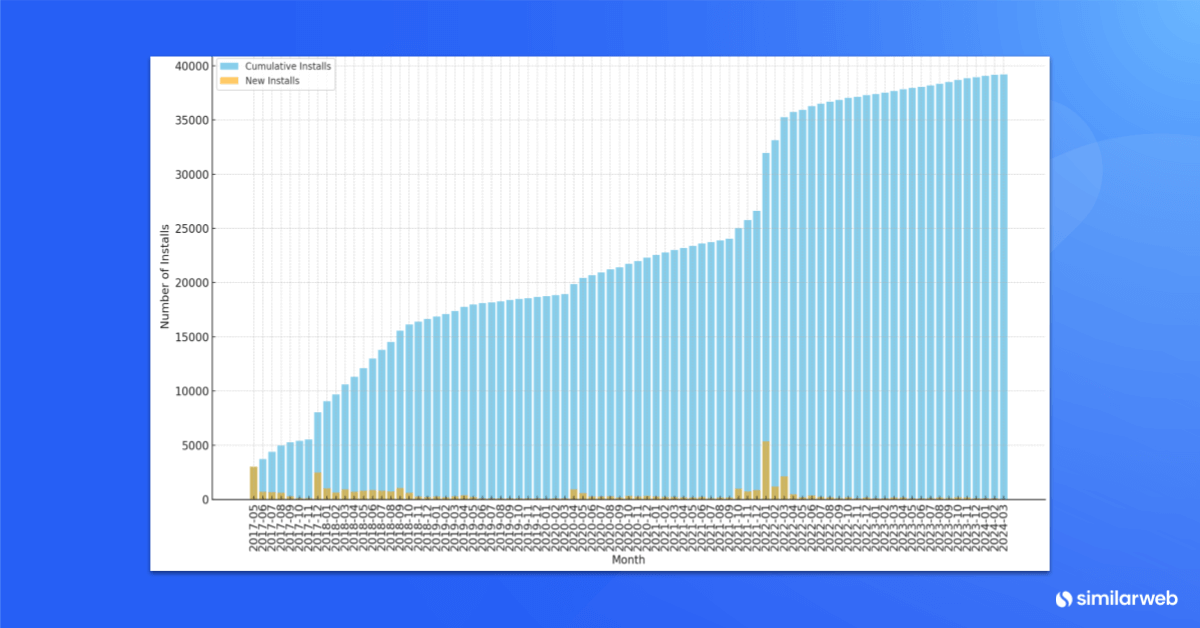

Technographics data

Analyze millions of websites and their technologies or millions of technologies and their customers. For example, how many companies have DHL technology installed on their websites?

Technographics paired with engagement data show whether that technology is being used or sitting dormant, which can shed light on growth vs. potential churn.

Build your models with data that generates alpha

Stock data feeds provide investors with the critical signals needed to refine investment strategies, validate theses, and uncover hidden opportunities. Stock Feeds integrate a layer of web intelligence into your research process. Whether you’re tracking customer acquisition, analyzing retention trends, or identifying market shifts, alternative data from Similarweb Stock Intelligence can give you the edge you need to stay ahead of the market.

FAQs

How are stock data feeds different from traditional market data feeds?

Stock data feeds combine multiple datasets—including fundamental, market, and alternative data—while traditional market data feeds focus mostly on price and volume. Alternative data feeds, like Similarweb Stock Intelligence Stock Feeds, offer additional insights into customer behavior, web traffic, and company KPIs that can signal performance shifts before earnings reports are released.

Can I integrate Similarweb Stock Intelligence Stock Feeds into my existing models?

Yes. Similarweb Stock Intelligence Stock Feeds are designed for seamless integration into quantitative models, research workflows, and proprietary systems. Whether you need real-time updates or historical data for backtesting, the feeds can be structured to fit your investment approach.

Are Similarweb Stock Intelligence Stock Feeds useful for all types of investors?

Yes, but they are especially valuable for:

- Hedge funds & institutional investors looking for early signals on company performance.

- Quantitative researchers building backtested models with alternative data.

- Portfolio managers track existing investments and identify potential risks or opportunities.

Invest using the most insightful asset research

Leverage data used by 5,000+ companies to improve your strategy