Top AI Tools by Web and App Usage (August 2025 Data)

New month – New data!

Generative AI tools continue to grow and change the way people search, learn, and create. As an SEO, it’s important to try to look beyond hype and measure real‑world adoption in order to understand where our audience is going to get answers and adjust our SEO/GEO strategies.

Following up from last month, I checked Similarweb’s Web and App Intelligence data for August 2025 to compare the leading AI tools by their website traffic, mobile app adoption, and engagement metrics. I also looked at regional trends and new product developments in order to provide context and understanding of the overall trends and show where user behavior is shifting. Spotting changes in user behavior early can help me adapt to them before my competitors do, and win traffic and market share while they are still struggling to adjust.

TL;DR:

- ChatGPT is unshaken as the leader in both web and app usage globally.

- Claude.ai had an impressive 18.7% MoM growth in website traffic in August.

- Google’s Gemini app is more downloaded than the ChatGPT app, but has a much lower MAU.

- DeepSeek continues to crash, losing over 50% of its monthly visits since May 2025.

- Several recent product releases have heated the AI tools market with new abilities and features from all leaders.

Summarize with ChatGPT | Google AI | Perplexity | Grok

Methodology and Data Sources

For this research, I analyzed data from August 2025 using Similarweb’s Web Intelligence and App Intelligence platforms. Where available, I detailed the month‑over‑month change. The metrics include:

| Metric | Description |

| Website visits | Total visits (all devices) per month. |

| Monthly active users (MAUs) | Unique users of an app within a month. |

| Downloads & Ratings | App store installations and average user ratings. |

| Daily stickiness | Daily active users ÷ monthly active users (a proxy for engagement). |

| Traffic share by country | Percentage of total site visits from each country. |

| Traffic channels | Distribution of visits by acquisition channel (direct, organic search, paid, referrals, social, etc.). |

What data did I cover in my analysis?

- Global usage metrics: Total visits, app downloads, and monthly active users (MAUs).

- Regional breakdown: How AI tools perform in the United States, Europe, and Asian markets, using traffic‑share data where available.

- Engagement indicators: Monthly and daily stickiness, as well as device distribution, to analyze how deeply users engage with each platform.

- Product releases: Recent product development and trends that affect user behavior and adoption rates.

Note: All metrics are for August 2025 and global unless otherwise stated.

Global Summary of Top AI Tools

| Tool | Website Visits | MAUs (App) | Downloads | Rating | Daily Stickiness |

| ChatGPT.com | 5.846B visits (+2.2% MoM) | 388.02M | 55.3M | 4.65★ | 43.87% |

| Google Gemini | 723.3M visits (+3.39% MoM) | 47.56M | 72.21M | 4.61★ | 5.59% |

| DeepSeek | 319.2M visits (–8.91% MoM) | 49.49M | 2.58M | 4.22★ | 20.10% |

| Perplexity | 148.2M visits (+5.42% MoM) | 26.24M | 10.43M | 4.49★ | 20.10% |

| Claude | 148.4M visits (+18.64% MoM) | n/a (no public app) | n/a | n/a | n/a |

| AI Studio (Google) | 99.13M visits (+12.53% MoM) | n/a | n/a | n/a | n/a |

| NotebookLM | 63.81M visits (+7.98% MoM) | n/a | n/a | n/a | n/a |

| Meta AI | 10.90M visits (–3.78% MoM) | n/a | n/a | n/a | n/a |

| Quark | 87.14M visits (–1.19% MoM) | n/a | n/a | n/a | n/a |

| Doubao | 74.29M visits (+8.96% MoM) | n/a | n/a | n/a | n/a |

| Replit | 12.58M visits (–3.09% MoM) | n/a | n/a | n/a | n/a |

ChatGPT reached 5.846 billion website visits and 388M MAU in August 2025, leaving its competitors in the dust. Not only does it have the most visits and users, but it also has the highest stickiness and app-store ratings among competitors. It’s a true omnichannel, multi-audience tool.

Gemini, the runner-up, passed 700 million visits, and also leads in download numbers, which continue to be higher than ChatGPT’s. Its daily stickiness, however, is the lowest of all apps. As Gemini is a Google product, I suspect all signs point to Google pushing installs of this app via their Android OS, resulting in many installs and no uses.

While MAU is still very much on ChatGPT’s side, I advise SEOs to continue watching the Gemini download trend.

Google, as a competitor, might motivate more users to download the app, getting it installed on more devices than ChatGPT eventually. If that happens, there’s a chance Google will manage to shift the user base to its favor, and that’s also something we need to be aware of. However, as said, remember to also watch stickiness and MAU before making any quick decisions.

Claude.ai and Google’s (them again) AI Studio show impressive growth MoM of 18.6% and 12.5% respectively. Both are still very far in terms of numbers from ChatGPT, but if their growth continues, they might be able to close the gap in the future.

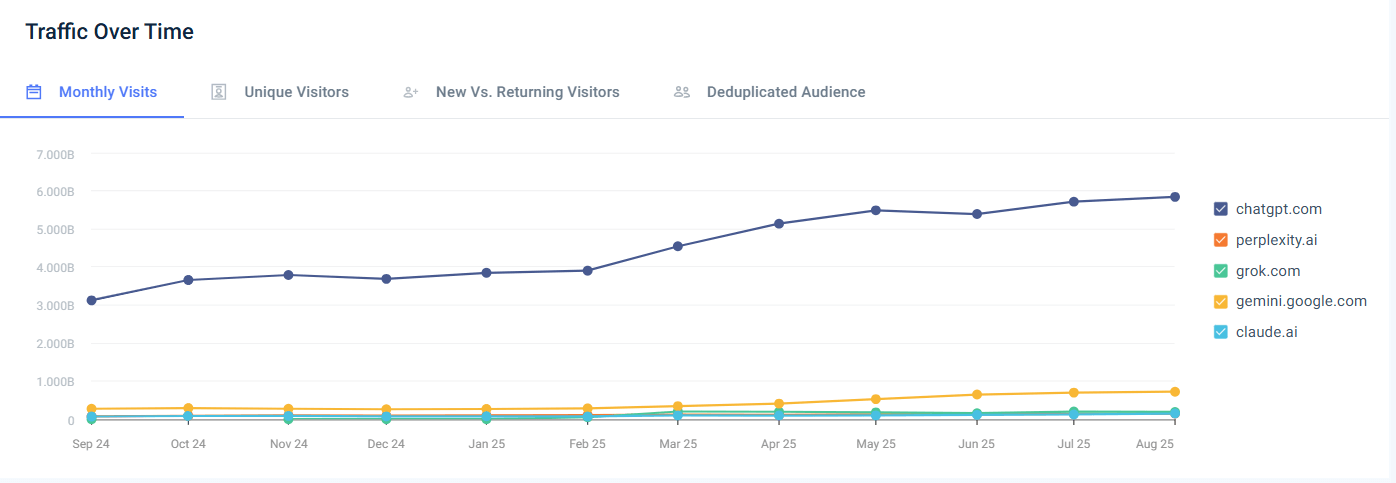

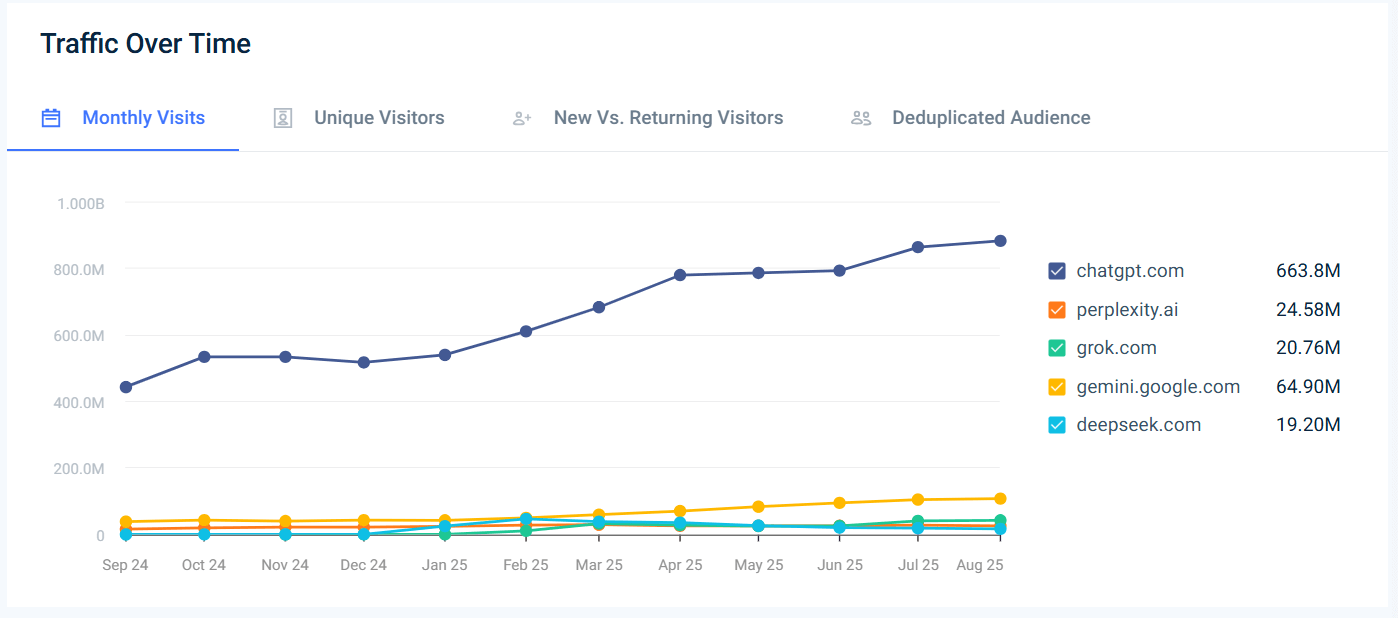

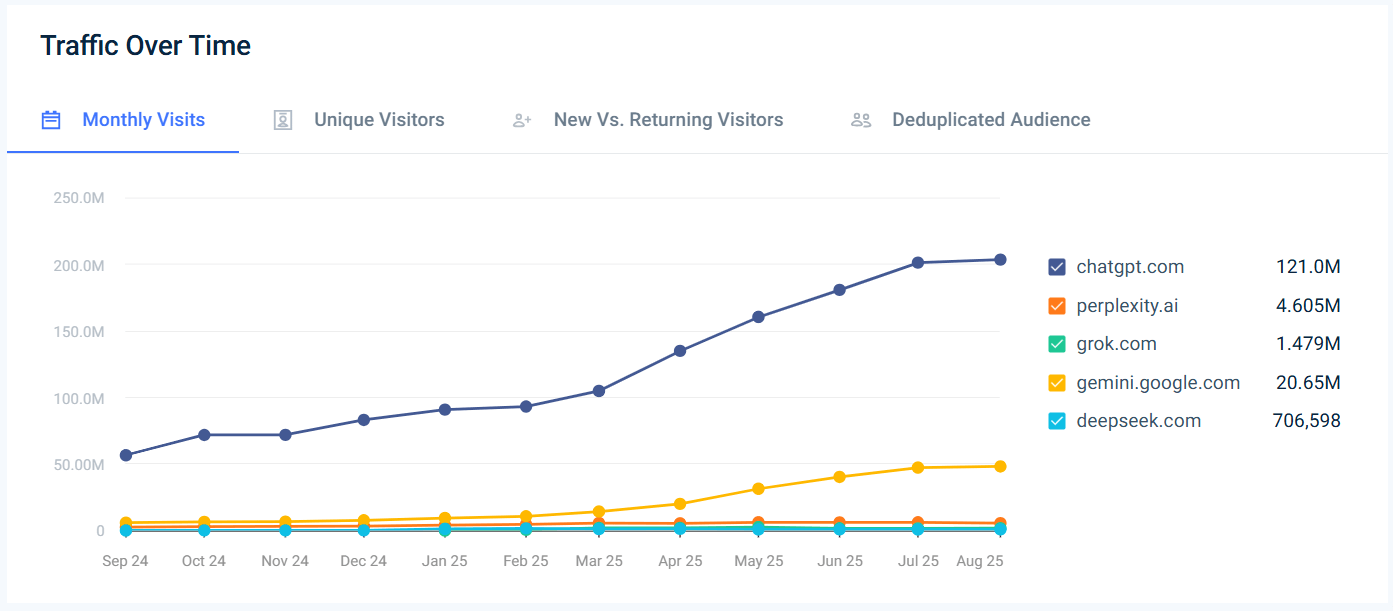

The most visited AI tools websites: 12-month trend

Let’s start with web usage. Website traffic over time gives a great view of each AI tool’s growth trend and can help estimate metrics like visibility and potential traffic from them in the future. Here are the top 5 AI tools websites’ traffic in the last 12 months:

Aside from ChatGPT.com reaching 5.84B visits in August, it has also reached almost 100% growth compared to September 2024. In terms of traffic share, Similarweb data for August 2025, shows that ChatGPT is getting 69% of the total traffic to AI tools. This is while all other AI tools’ sites are still under 1 billion visits a month.

DeepSeek has declined over 8% MoM, dropping over 30 million visits in August and losing a total of 300 million monthly visits (-50% of its monthly traffic) since February 2025. Smaller players like Quark, Doubao, and Replit are visible but still very far behind.

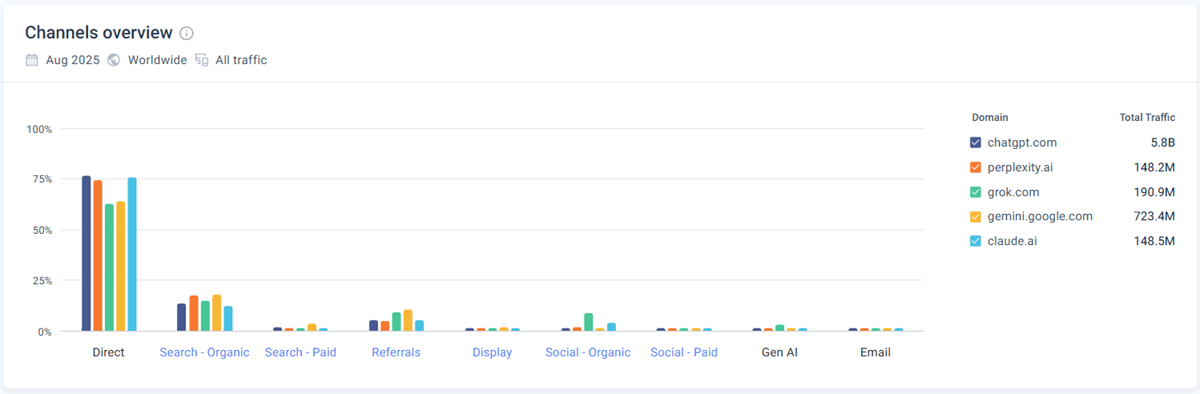

Traffic sources to the top AI tools

The chart below shows each AI tool’s traffic sources split in August 2025. It’s easy to see how all AI tools rely heavily on direct traffic (65%-70%), while organic search and other mediums are less prominent, with an average of 20% traffic share.

Grok and Gemini are the only ones who seem to benefit nicely from referral traffic, but let’s face it: They are the only ones that can utilize it in a large mass, thanks to Google search and X.com. The other AI tools do not enjoy the benefit of having huge organizations backing them up, at least not at that scale.

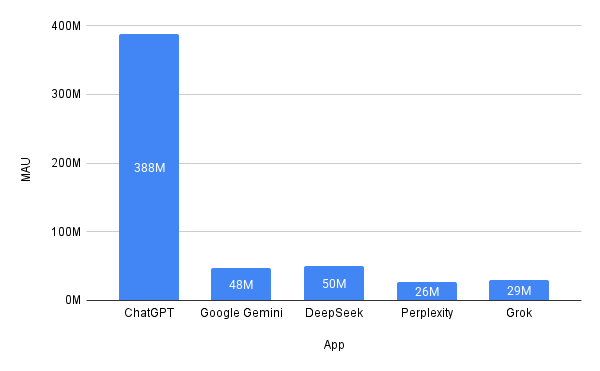

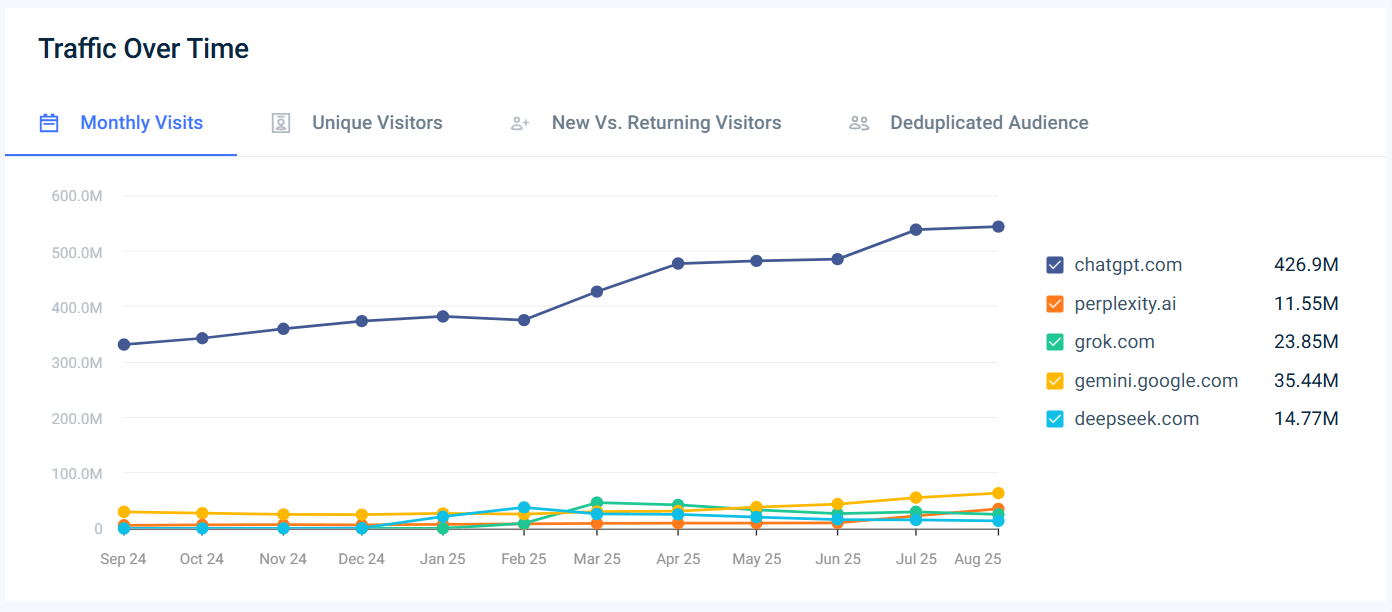

The most used AI tools: MAU breakdown

Now, let’s inspect the August AI tools’ App usage data: The following chart shows the global MAU of each leading app:

App Usage Comparison: ChatGPT leads with 388M MAUs, adding 10M monthly active users MoM. Gemini grew 10% MoM, but is low on daily stickiness. Deepseek has been declining since May 2025, losing a total of 10M monthly active users in the last 3 months.

With so many users choosing one app month after month (after month), I wonder if there will ever be any need for “Perplexity optimization” on general queries rather than specific niches that Perplexity serves the most. For now, I don’t see any reason to make assistant-specific adjustments.

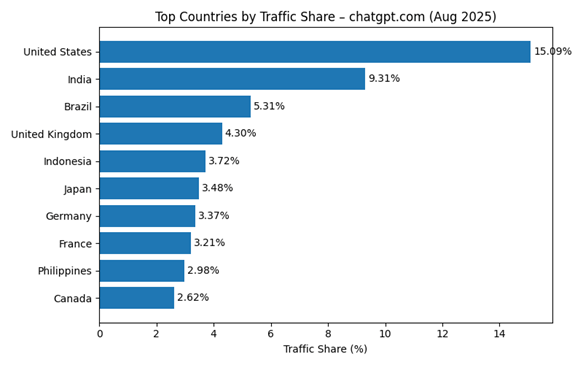

Top AI Tools by country: Which countries use AI the most?

With ChatGPT as the leader of AI tools, I want to see a breakdown of its usage by country. That can help me plan and prioritize my optimization efforts for the different markets better.

ChatGPT’s monthly traffic continues to grow in all regions, with most leading countries also growing in traffic share. When looking at MoM data, I can see that only Indonesia, Germany, and Canada show decreased usage, while most other countries continue expanding:

For SEO purposes, and to answer the question I asked myself at the beginning of the paragraph, it seems that English-speaking markets are the best route to invest in, but finding solutions to assist the markets in Asia with their language-specific issues can help build and expand brand visibility in AI and drive traffic from ChatGPT to your website.

Now it’s time to take a deeper look into each country’s performance. Is your main market in the US? The UK? China? Do you know where your audience goes to get answers?

Top AI tools in the U.S. by web and app engagement

The U.S. remains the biggest market for generative AI. In August 2025, 15.09% of chatgpt.com’s incoming traffic originated from the United States. It’s no surprise that in the US as well, ChatGPT’s traffic share is much larger than its competitors:

Usage spikes correspond to new OpenAI releases and the back‑to‑school season, meaning that many American businesses and consumers rely on AI every day, not just for work but also for their day-to-day tasks:

- Customer support automation: retailers and SaaS companies use ChatGPT and Gemini bots on websites and mobile apps, dramatically reducing wait times.

- Content marketing: marketing agencies use ChatGPT and Perplexity to draft blogs, social posts, and product descriptions, then refine output with human editors.

- Coding assistance: software engineers leverage ChatGPT’s Code Interpreter and Replit’s AI‑powered IDE to debug code, generate unit tests, and learn new languages.

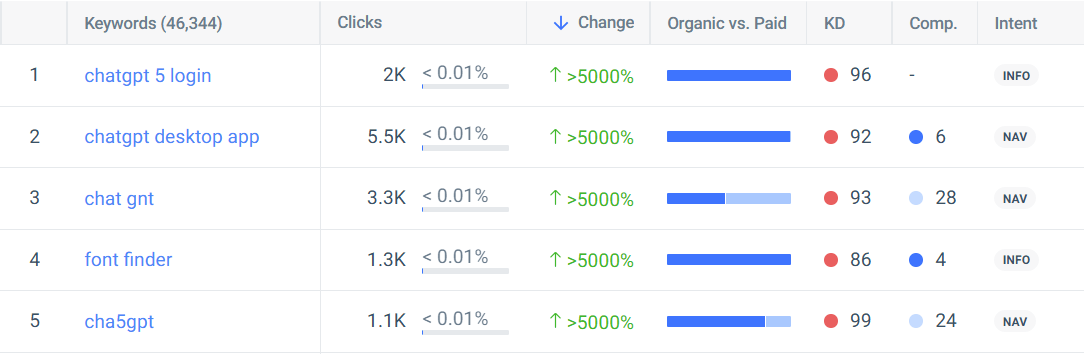

U.S. Search & Channel Trends

Much like in the global arena, organic search drives almost 19% of ChatGPT.com’s USA traffic in Aug 2025, while direct visits dominate at 74%. Paid search contributed about 2.4%.

Trending search queries revolve around “ChatGPT desktop app,” “GPT‑5 Login,” and “how to use ChatGPT for writing,” indicating persistent curiosity about new features and advanced AI capabilities.

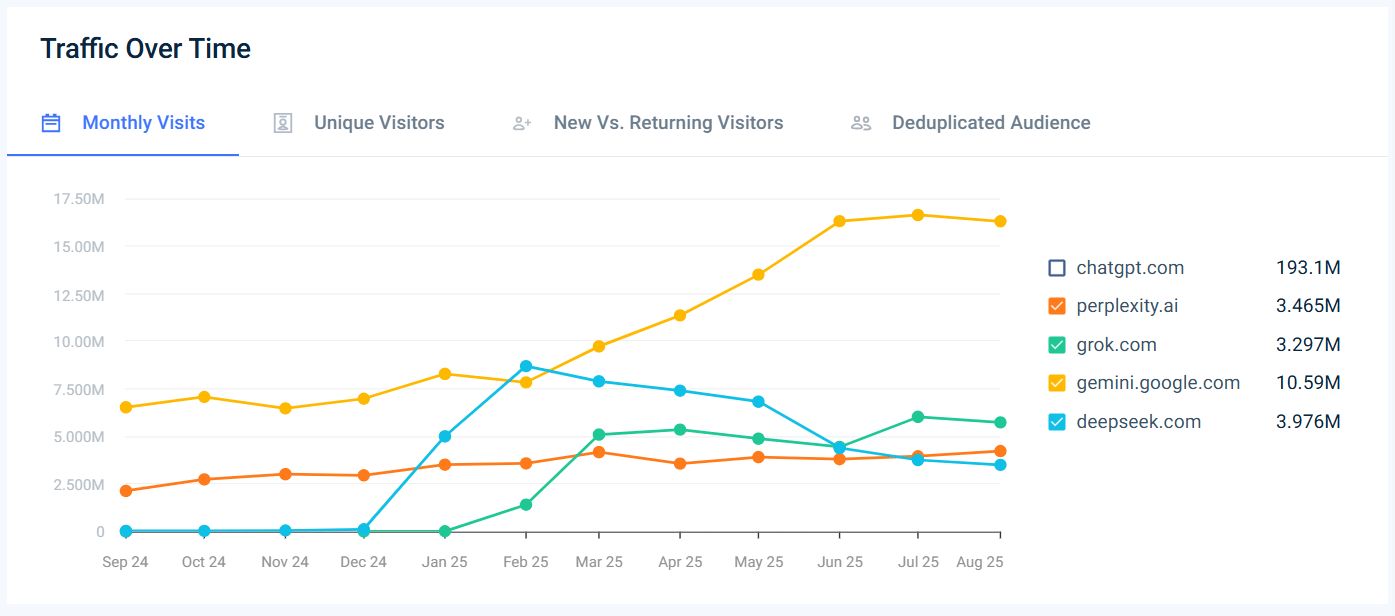

Which AI tools are the most used in Europe?

Europe shows diverse adoption patterns:

- The United Kingdom (4.30% share) and Germany (3.37%) remain the largest European audiences for chatgpt.com. These users primarily access ChatGPT via desktop browsers, aligning with heavy use in academic research and translation services. Gemini has shown impressive growth rates in the UK in the past 12 months, but had some setbacks during August 2025.

The graph below shows traffic to the top AI tools in the past 12 months, excluding ChatGPT, for better visibility into the other tools.

- France (3.21%) shows strong month‑over‑month growth (+5.87%), fueled by interest in AI‑generated content and language learning.

- Privacy concerns and compliance with GDPR push some users toward privacy‑focused tools like Claude. Anthropic positions Claude as a safer alternative, which may explain the site’s rapid traffic growth (+18.64% MoM).

Popular European AI use cases

- University resources: British and German universities integrate Perplexity and ChatGPT into digital libraries to generate reading summaries and research outlines.

- Creative agencies: French advertising firms use Gemini’s image generation features alongside ChatGPT to brainstorm campaigns.

- Regulated industries: European banks experiment with Claude for internal document drafting, attracted by its privacy protections.

Trends in AI tools usage in Asian markets

India is fully adopting AI tools

India (9.31% share) and Brazil (5.31%) remain among ChatGPT’s fastest‑growing user bases. India has high adoption rates also for Gemini and Perplexity in the past 3 months, indicating that they are up to date with new abilities and tools, and are happy to use different AI tools for different goals.

Local growth drivers include:

- Education and training: Students in India and Brazil rely on ChatGPT and Gemini for tutoring and language practice.

- Entrepreneurship & marketing: Small businesses use AI to draft legal contracts, marketing materials, and customer responses in local languages.

Top AI tools in Japan, Indonesia, and the Philippines

Japan (3.48%), Indonesia (3.72%), and the Philippines (2.98%) all show significant engagement. Japanese users value ChatGPT’s translation and code‑analysis features, while Southeast Asian users often access the tools via mobile due to limited desktop penetration.

AI tool usage in China: Led by domestic Quark and Doubao

China continues to restrict foreign AI access, making domestic platforms dominant:

- Quark (88.14 M visits) and Doubao (74.29 M visits) remain key players, offering search and chat services tailored to Chinese regulations.

- Kimi (about 27,000 visits) serves a niche group but continues to iterate. Moonshot AI’s partnership with schools could fuel growth if restrictions ease.

- Users circumventing restrictions sometimes access ChatGPT via VPNs, but local adoption remains limited.

Reasons for Chinese popularity:

- Regulatory Barriers: The Great Firewall restricts access to foreign services like ChatGPT, prompting users to adopt domestic alternatives.

- Cultural Localization: Quark and Doubao integrate Mandarin‑language content and local cultural nuances, making them more relevant to Chinese users.

- Research Focus: Chinese tech giants heavily invest in AI research, especially video and image generation, giving their tools an edge in multimedia applications.

Examples of AI usage in different regions

- U.S. retailer: A major American chain integrated ChatGPT.com into its customer‑service workflow. After training the model on product FAQs, support resolution times fell by 40%, and customer satisfaction scores improved.

- UK university: Professors at a British university use Perplexity to summarize journal articles and generate reading lists, citing improved student comprehension.

- Indian ed‑tech startup: A Bangalore‑based platform combines Gemini with ChatGPT to offer bilingual tutoring apps, helping rural students study in English and Hindi.

- Brazilian entrepreneur: A small café owner in São Paulo uses ChatGPT to craft daily specials and social posts in Portuguese, boosting social‑media engagement.

- Chinese students: Unable to access ChatGPT directly, Beijing University students rely on Quark and Doubao for research and summarization; built‑in translation features accommodate English sources.

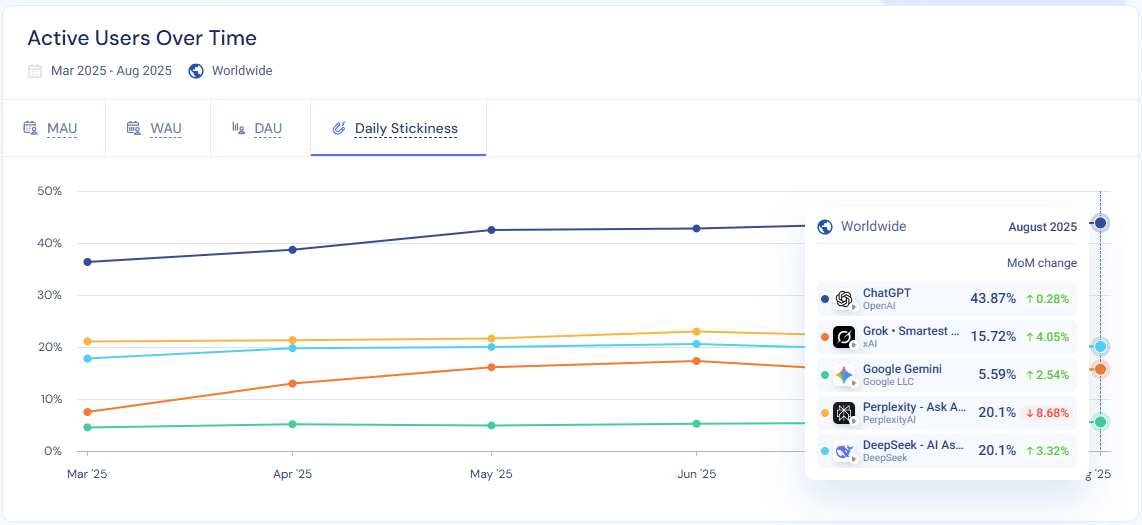

Comparative analysis of AI tools engagement metrics

Daily stickiness: ChatGPT maintains the highest user loyalty (43.87% of app users return daily). Perplexity and DeepSeek show moderate stickiness (~20%), while Gemini lags at 5.59%, suggesting many install but rarely return.

Device distribution: ChatGPT.com’s audience shifted slightly toward mobile in August, but desktop still accounts for 68.08% of visits. Gemini, DeepSeek, and Perplexity are even more desktop‑heavy (>70% of traffic), reflecting use in professional and academic settings.

AI Product developments that affected usage trends

ChatGPT: OpenAI launched GPT‑4.5 Turbo in early August, offering faster responses and better handling of complex tasks. The update caused a spike in both downloads and visits. The company also expanded its voice‑chat feature to more markets, contributing to mobile engagement.

Google Gemini: Google rolled out Gemini Ultra, an enterprise tier integrated with Workspace, enabling document summarization and data analysis within Gmail and Drive. Despite the new feature, app stickiness remained low, hinting at a gap between curiosity and daily utility.

DeepSeek: DeepSeek partnered with hardware manufacturers in China to preinstall its assistant on new laptops, helping boost desktop traffic but not necessarily app adoption. The site’s negative month‑over‑month growth suggests users may be sampling alternatives.

Perplexity: Perplexity continued its rapid iteration, launching Perplexity Pro with citation support and multimodal queries. The service’s high growth in downloads (+47.34% MoM) and strong stickiness reflect user satisfaction with its ability to provide sources for answers.

Claude: Anthropic’s Claude 3 models gained traction among enterprise users due to strict safety policies and privacy controls. The absence of a consumer‑facing app limits mass adoption, but rising web traffic (+18.64%) shows corporate curiosity.

Conclusion

August 2025 data confirm yet again that ChatGPT.com is far ahead of its competitors, both in web visits and app engagement. A surge to 5.846 billion visits shows that this is one website migration that didn’t have a negative effect on the new domain’s traffic and growth. If anything, it highlights ChatGPT’s centrality in the new AI ecosystem.

Competition is fierce: Google Gemini, DeepSeek, and Perplexity each attract hundreds of millions of visits and continue to innovate. It’s important to keep an eye on them as well and study their growth patterns and trends, and be ready for any upcoming change in this race.

Key takeaways:

- ChatGPT’s dominance is unquestionable: it leads in visits, app MAUs, and engagement, thanks to continuous improvements and wide accessibility. Research, test, and measure as much as you can, and make sure to stay up to date with its new abilities and product developments.

- Regional dynamics matter: the U.S. and India drive usage, while Europe shows cautious but growing adoption. Investing your efforts there may not bear fruit in one day, but it has great potential for the future.

- Engagement vs. reach: high download numbers don’t guarantee daily use. Gemini’s low stickiness highlights the need for compelling features and better onboarding.

- Emerging trends: Pro tiers (Gemini Ultra, Perplexity Pro) and safer models (Claude 3) show the market moving toward professional and enterprise applications, growing potential reach for B2B brands that invest in GEO and AI visibility.

SEOs should remember these insights when selecting which AI tools to optimize for, and how. Tailoring our GEO strategies to usage trends, regional preferences, and product updates is becoming more and more important in the process of preparing for future opportunities.

How can you make sure your strategy keeps up with AI tools growth?

On top of our Web Intelligence and App Intelligence data, which provide you with the full picture on the AI tools market, Similarweb also offers a range of Gen-AI tools and AI-powered features that can help you improve your AI performance.

You can use them to monitor your brands’ AI visibility, track your competitors’ AI traffic (and your own), and optimize for Google AI Overviews (that’s what I do).

Not enough? Our AI agents will help you analyze trends, optimize your strategy, automate your workflows, and get the most out of Gen-AI traffic.

FAQ

What is the most popular AI tool in August 2025?

ChatGPT is the most popular AI tool in 2025, with 388M monthly active app users and 5.84B visits to the ChatGPT website in August.

Which AI tools are the fastest growing in August 2025 (website and app)?

Based on month‑over‑month growth, Claude.ai saw the biggest jump in August 2025, with traffic up 18.64%. Google’s AI Studio also grew 12.53%, and Perplexity’s visits rose 5.42%. In contrast, DeepSeek’s traffic fell nearly 9 %, continuing a decline that has cut its visits by more than half since early 2025.

Which AI tool has the highest daily user engagement (“stickiness”)?

ChatGPT leads by a wide margin: 43.87% of its app users return daily. Perplexity and DeepSeek show moderate stickiness (~20%), while Google Gemini’s is only 5.59%. High stickiness suggests users rely on ChatGPT for routine tasks, whereas lower figures indicate more exploratory or one‑off usage.

How does ChatGPT’s usage compare with Google Gemini’s?

Although Gemini has more downloads than ChatGPT, its user base is smaller and less loyal. ChatGPT had 5.846 billion visits and 388.02M MAUs, whereas Gemini had 723.3 million visits and 47.56M MAUs. ChatGPT’s daily stickiness (43.87%) dwarfs Gemini’s 5.59%, indicating that many Gemini installs are never used or used only once

What are the top countries using ChatGPT?

The United States contributed the largest share of traffic to chatgpt.com in August 2025, at 15.09%, followed by India (9.31%), Brazil (5.31%), the United Kingdom (4.30%), and Indonesia (3.72%).

Are there free AI chatbots available for businesses?

Yes. According to a SaaS‑marketplace guide, many AI chat tools offer free plans: ChatGPT can be used as a basic chatbot at no cost, xAI’s Grok is free on X (Twitter), and Google’s Bard (based on Gemini) is free in some regions. Dedicated platforms like Tidio and Chatbase also provide free tiers, though advanced features require paid plans

How much do AI tools cost?

Prices vary widely. ChatGPT offers a free tier, while ChatGPT Plus costs about $20 per month. Other generative tools have similar models: Runway offers free credits and paid plans, Tidio has a free tier, and corporate chatbots like Copilot cost around $30 per user per month. Pay‑as‑you‑go models like DeepSeek and Perplexity charge per usage, often by the token.

Which AI tool should marketers and SEOs focus on?

For research and content creation, ChatGPT remains the most versatile choice, thanks to its high adoption, wide‑ranging capabilities, and continuously improving features. SEOs should also watch Perplexity, which excels at providing research‑backed answers and is growing rapidly, and Claude, which prioritizes safety and privacy (a key consideration for regulated industries).

Track Gen-AI And Organic KPI's On The #1 SEO Platform

Give it a try or talk to our marketing team - it’s free!