ATO Vehicle Logbook のアプリ分析 2月15日

ATO Vehicle Logbook

- JOhn Lyons

- Apple App ストア

- 有料

- トラベル

ATO Vehicle Log book is fully compliant with Australian Tax Office requirements where the logbook method is used to claim the percentage business use of a vehicle.

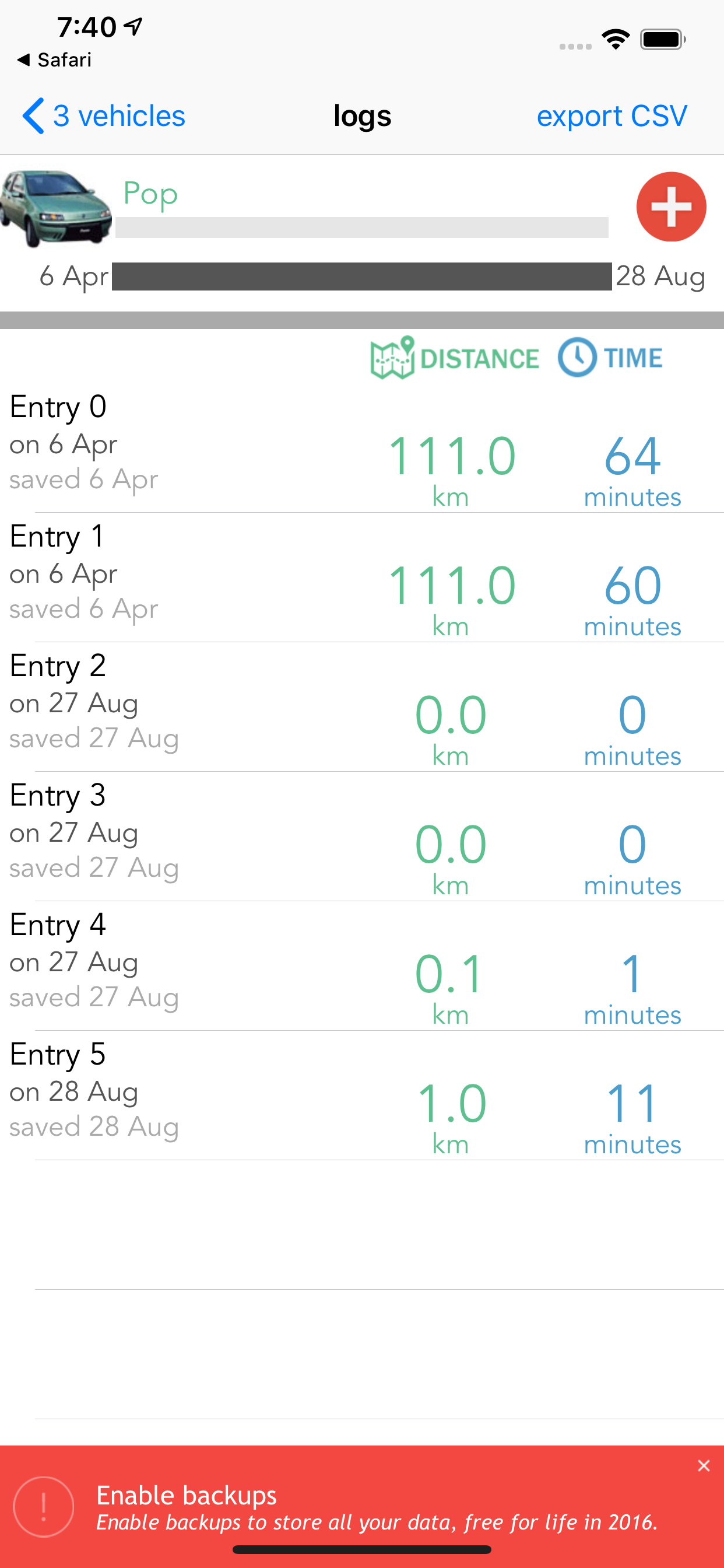

-multiple vehicles.

-choose icon to represent vehicle.

-multiple logbook periods.

-calculates & reports your % business use.

-editing of existing trip records.

-publishes CSV files.

-record journey reasons and description, and optional time

Send your log directly to your employer, accountant or tax agent. You do not need to perform any additional calculations or spreadsheet manipulations. And can easily be pasted into an Excel spreadsheet

You can claim the cost of this app in your tax return. It is a legitimate expense and is fully tax deductible.

The ATO requires a logbook be kept for a continuous 12 week period. As long as this period is representative of the normal business use of the vehicle it remains valid for five years ( for further information refer to the ATO website ).

This app is also suitable for use in other countries where car logbooks are kept for tax purposes e.g. New Zealand, UK (Company Vehicles benefits-in-kind), Canada, South Africa, Ireland, Netherlands, France, Canada etc.

The application can also be used by employees who use their own vehicle for work related travel and need to submit KM reimbursement claims to their employers.

ストアランキング

ストアランキングは、GoogleとAppleが設定した複数のパラメータに基づいています。

業界別 ウェブサイトカテゴリーで

米国--

トラベルで

米国--

アカウントを作成して平均月間ダウンロード数を見るお問い合わせはこちら

ATO Vehicle Logbook時間の経過に伴う ランキングの統計

Similarwebの使用ランクとATO Vehicle Logbook向けApple App ストアランク

ランキング

ご利用可能なデータがありません

トップ競合他社と代替アプリ

同じストアから同じユーザーによって使用される可能性が高いアプリ。

2月 15, 2026