Casualwear Boom in the Gulf: How UAE and KSA Consumers Are Shaping Fashion Trends

In today’s competitive fashion landscape, staying ahead requires more than just trendspotting. Data-driven market analysis helps brands understand evolving consumer preferences, optimize their digital strategies, and outperform competitors.

In this article, we’ll break down the latest insights into the casual clothing markets in the United Arab Emirates (UAE) and the Kingdom of Saudi Arabia (KSA), using data from Similarweb’s market intelligence.

Whether you’re a global brand or a local retailer, these insights will help you navigate shifts in consumer behavior and online shopping trends.

Now before we jump into the data…

Why focus on the UAE and KSA?

Middle Eastern markets are often analyzed through the lens of luxury fashion, given the region’s global reputation for high-end retail. But this report takes a different approach. By focusing on casualwear in the UAE and KSA, we spotlight what’s happening in the mid-market segment, offering a more complete picture of what the average consumer is searching for, buying, and engaging with online. For brands looking to expand, these insights are essential for understanding untapped opportunities beyond the luxury tier.

Market movements: Who’s gaining ground?

The casual clothing space in the Gulf is undergoing major shifts, with consumer preferences evolving rapidly and reshaping the competitive landscape.

Let’s take a closer look at the movements in the region’s two largest markets: UAE and KSA.

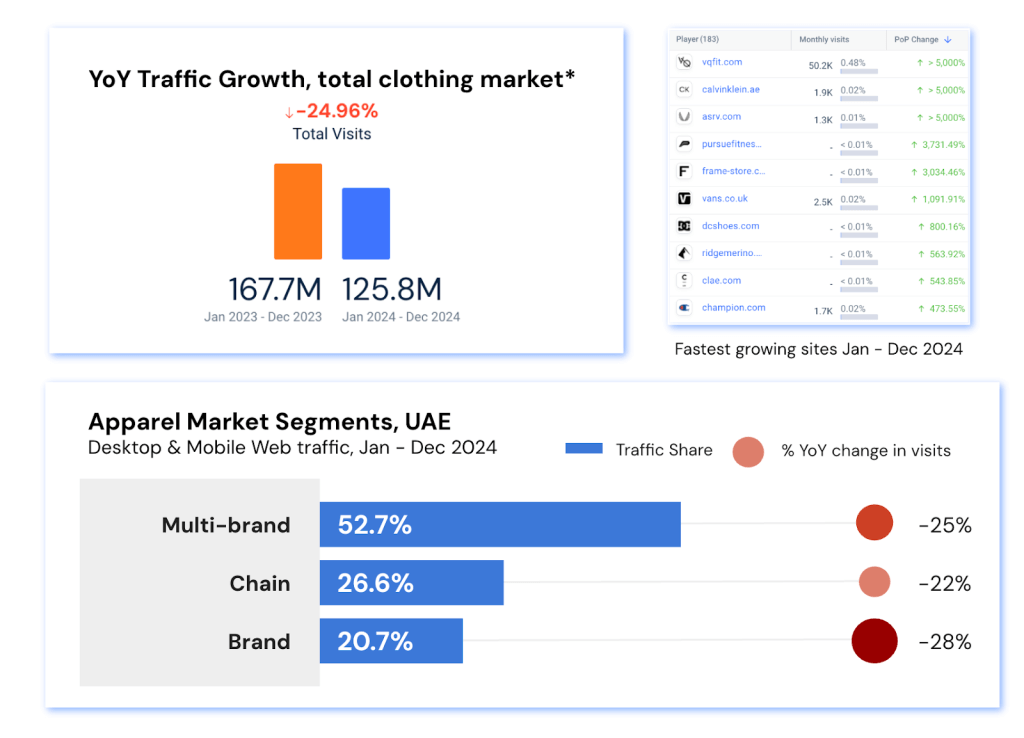

The UAE market: A shift in shopping preferences

The UAE casual clothing market saw significant shifts in 2024. Multi-brand retailers dominate the space, accounting for over 50% of total traffic, but their share has been declining, with traffic dropping 25% year-over-year (YoY). The biggest players in this segment, Namshi, BrandsforLess, and Centrepoint, collectively lost market share.

Meanwhile, chain stores like Shein, Max, and Splash gained traction, increasing their share to 27% despite an overall traffic drop of 22%. Direct-to-consumer (D2C) brand sites struggled the most, with larger brands seeing sharp declines. However, smaller niche brands emerged as strong performers, indicating an appetite for fresh, trend-driven offerings.

The KSA market: Shein’s dominance and the rise of D2C

KSA presents a different landscape. Shein dominates the market, capturing 30% of all industry traffic. Multi-brand sites, on the other hand, have faced a steep 36% decline, with major players like Namshi, Centrepoint, and Max Fashion seeing traffic drops of over 30%.

Interestingly, D2C brand sites performed better in KSA than in UAE, with total traffic declining by only 5%. Eight of the ten fastest-growing sites in the country were brand sites, indicating a growing preference for direct brand engagement among Saudi shoppers.

The competitive landscape: Sportswear and streetwear take the lead

Style meets comfort as Gulf consumers gravitate toward brands that blend athletic utility with street appeal. This shift is redefining the competitive landscape across both markets.

Who’s winning in the UAE?

Athleisure brands dominate the UAE casual clothing space, with Adidas and Nike leading in overall traffic. However, their growth has stagnated, suggesting market saturation. The brands that saw the highest audience growth included:

- New Balance (+92%) and Asics (+84%): Sneaker brands with strong streetwear appeal

- Crocs (+149%) and Steve Madden (+67%): Footwear brands embracing comfort and versatility

- Squatwolf (+26%) and Vqfit (+5,000%): Premium gym wear brands tapping into performance and lifestyle fashion

Meanwhile, traditional denim brands struggled, with searches and traffic for brands like Lee (-2%), Diesel (-23%), and Wrangler (-83%) shrinking in favor of relaxed-fit streetwear.

The KSA market: Late adoption, fast growth

KSA appears to be following UAE’s trends but at a delayed pace. While Adidas saw stagnant growth in the UAE, it grew significantly, by over 5000%(!), in KSA in 2024. Other brands experiencing strong growth include:

- Onitsuka Tiger (+868%) and Reebok (+672%): Sneakers leading the charge

- The Giving Movement (+483%) and Lululemon (+118%): Activewear brands carving out a niche

- Wrangler (+611%): A rare denim brand seeing growth in KSA

Digital traffic insights: Where are consumers searching?

Understanding where your audience is browsing can offer a major competitive edge, regardless of which market you’re operating in.

Let’s explore how Gulf consumers are discovering their favorite casual brands online.

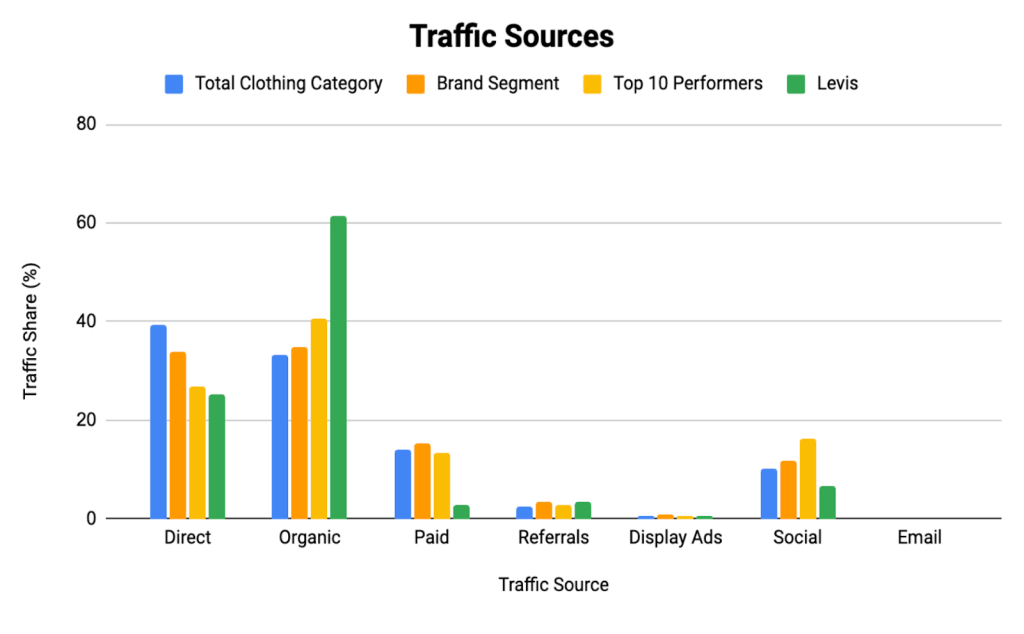

UAE: Organic and direct drive traffic

Direct traffic accounts for 40% of visits to UAE clothing sites, followed by organic search (33%). However, brands experiencing growth have a strong social media presence, with social traffic contributing 16% of their visits.

Levi’s, for example, relies on organic search for over 60% of its traffic but could benefit from stronger paid and social campaigns to enhance visibility beyond branded search.

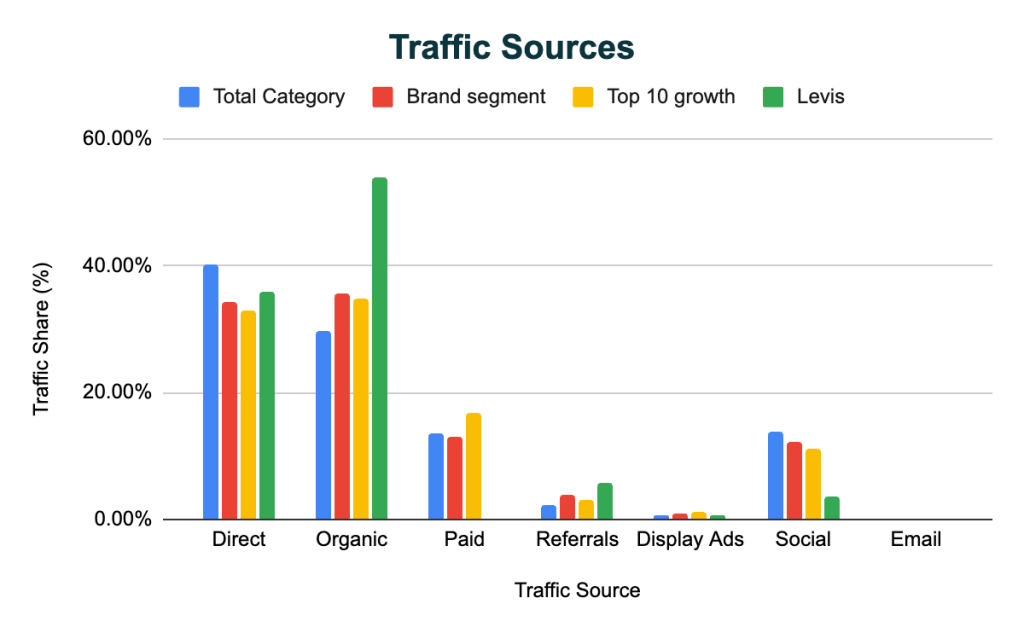

KSA: The power of localization and paid ads

In the KSA, in contrast to the UAE, paid search and social media play a bigger role, each accounting for 13-14% of traffic. Top-performing brands invest more in paid search (17%) and display ads (1.2%). Levi’s, which depends heavily on organic traffic (90%), risks falling behind in this highly competitive market without a stronger paid and social strategy.

What exactly are consumers searching for?

Search behavior reveals deeper insights into style preferences. From fast fashion to function-first fashion, here’s what Gulf shoppers are looking for.

UAE: Fast fashion and sneaker culture dominate

In the UAE, consumer searches reflect a strong interest in fast fashion and sneaker culture. Shein-related queries alone made up 20% of search-driven traffic. Other top searches included:

- Running shoes (+22%) and football boots (+209%): Highlighting the rise of sports-inspired fashion

- Jeans (+239%) and baggy jeans (+220%): Suggesting a move toward relaxed-fit denim styles

- Hoodies (+66%) and puffer jackets (+153%): Demonstrating demand for casual, weather-appropriate pieces

Many searches also included geographic terms like ‘UAE’ and ‘Dubai,’ showing strong interest in local retail offerings.

KSA: Gendered searches and localized trends

In Saudi Arabia, search trends indicate distinct preferences for menswear and womenswear, with gender-specific searches far more prevalent than in the UAE:

- Menswear searches were 25% higher than in the UAE, with significant interest in items like men’s thermal clothing (+274%) and Max black winter jackets (+176%)

- Womenswear searches were 700% higher, with top searches for off-shoulder dresses (+101%) and leather skirt midi (+236%)

- Shein-related queries accounted for 20% of total search traffic, reinforcing its dominance

Localized Arabic-language searches were also common, emphasizing the importance of region-specific SEO strategies.

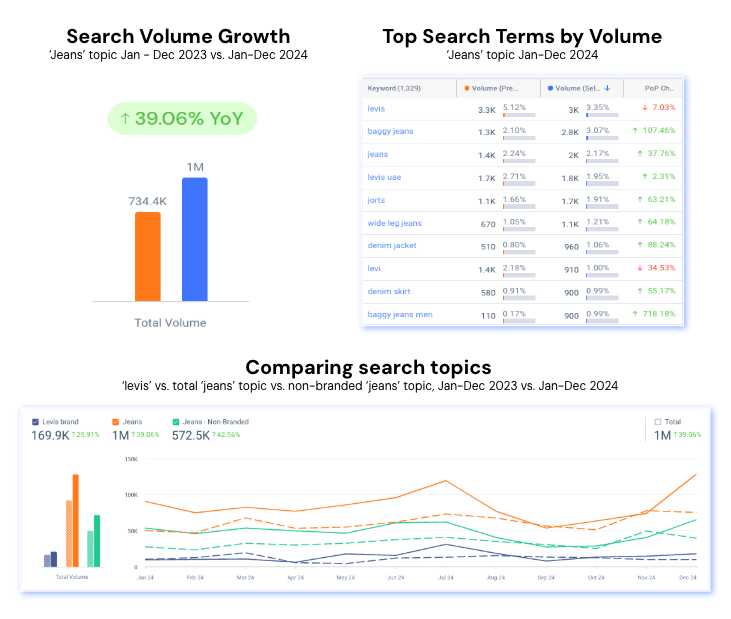

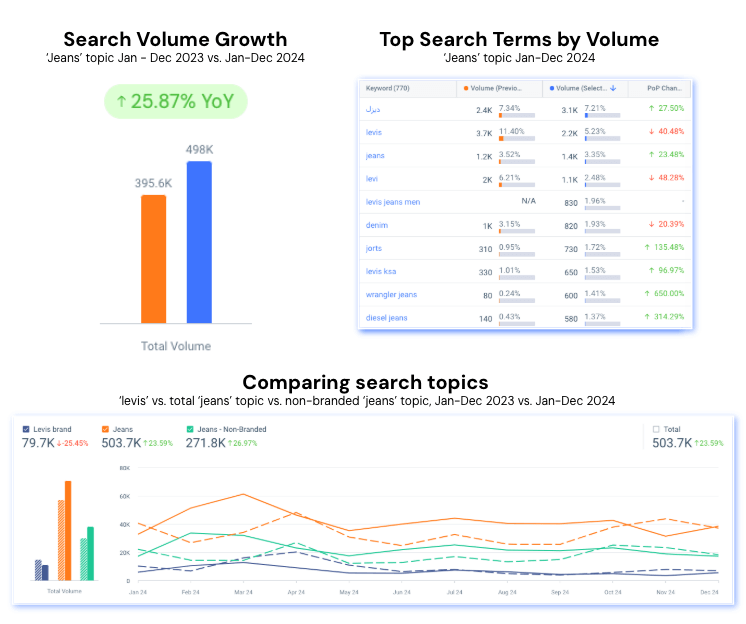

Share of search: Jeans-related trends in 2024

Denim is making a comeback across the Gulf – but not in the way you might expect. A focus on comfort, fit, and new silhouettes is reshaping the jeans market.

UAE: Rising interest in relaxed denim

Interest in jeans surged nearly 40% in the UAE in 2024, reflecting a shift in consumer fashion preferences. While Levi’s remains the most searched brand in the jeans category, non-branded jeans searches such as ‘baggy jeans’ (+107%) and ‘wide-leg jeans’ (+64%) are growing even faster at 43% YoY.

This shift signals a growing preference for relaxed-fit styles over traditional skinny jeans. Levi’s brand-specific search volume increased 26%, indicating strong brand recognition, but it still competes with a rising demand for non-branded denim terms.

KSA: A developing denim market

Saudi Arabia also saw an increase in jeans-related searches but at a lower rate of 26%. Unlike in the UAE, Levi’s searches declined 26%, while competitors like Wrangler and Diesel gained traction in branded search volume.

Non-branded jeans searches now account for more than 50% of all jeans-related queries in KSA, with growing interest in baggy, cargo, and colorful denim styles such as ‘green jeans’ (+1800%). The denim market in KSA is still developing, but consumer preferences are diversifying.

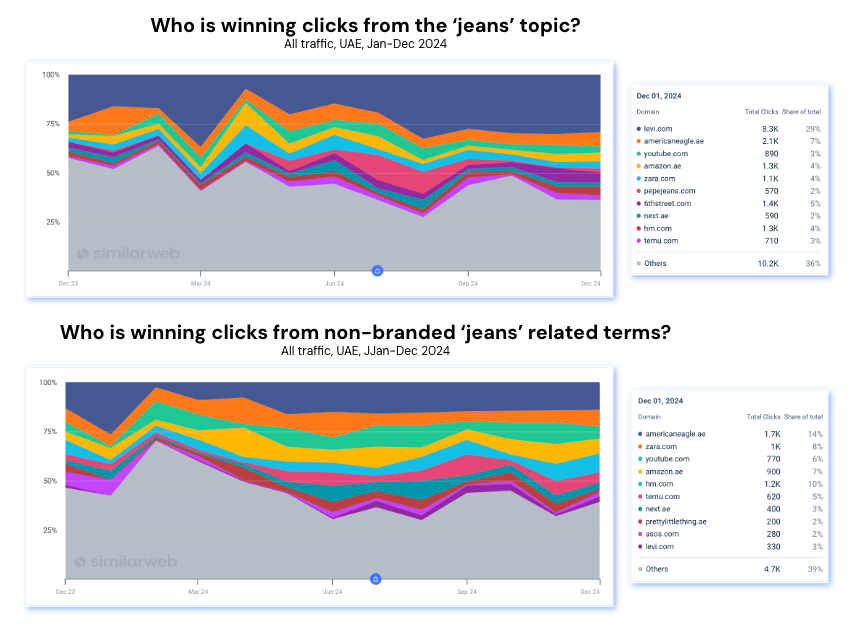

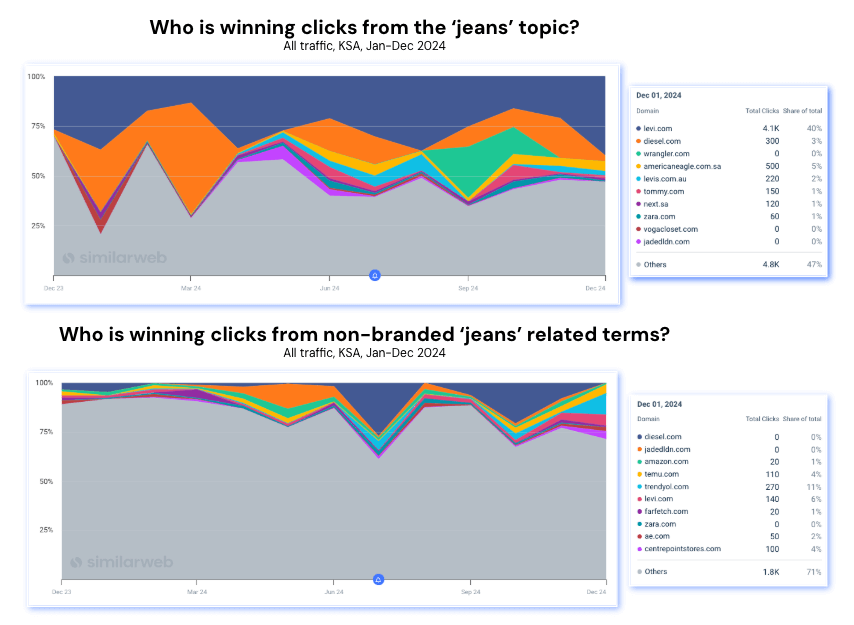

Share of voice

Search visibility and click share are key indicators of brand strength. Here’s how major denim players stack up in the Gulf’s evolving fashion scene.

UAE: Levi’s leads but faces competition

Levi’s holds the largest share of clicks for jeans-related searches in the UAE, capturing nearly one-third of all clicks in 2024. However, it is losing out on non-branded jeans searches, where it holds only 3% of total click share. American Eagle dominates in this category, with Zara, Amazon, and H&M also capturing significant traffic.

To maintain its leadership position, Levi’s must strengthen its organic and paid search strategies for high-performing non-branded denim terms.

KSA: Growing competition in the jeans segment

In KSA, Levi’s retains a 40% share of clicks for jeans-related searches. However, since April 2024, American Eagle, Wrangler, and Tommy Hilfiger have gained traction, steadily increasing their share.

Interestingly, Levi’s Australian domain is cannibalizing traffic from KSA searches, suggesting an issue with local domain targeting. Additionally, Diesel, Amazon, Temu, and Trendyol have consistently targeted non-branded jeans searches, posing a competitive threat. As branded search interest declines, Levi’s must shift its focus toward non-branded search optimization to retain its market presence.

Key takeaways for fashion brands expanding into Gulf markets

These insights highlight actionable opportunities for fashion brands looking to break into or grow within the Gulf markets.

1. Adapt to market-specific trends

- UAE shoppers are moving away from multi-brand sites in favor of chain stores and niche brands

- KSA shoppers prefer direct brand engagement, and localized search terms are critical

2. Diversify marketing strategies

- UAE brands should enhance their social presence to capture more organic traffic

- KSA brands should invest in paid search and localized content to compete effectively

3. Tap into consumer search behavior

- With denim searches up 40% in UAE and 26% in KSA, brands should optimize their keyword strategy

- Capture non-branded searches (e.g., ‘baggy jeans,’ ‘football boots’) to win new customers

Discover where to grow next – with Similarweb

The fashion industry in UAE and KSA is evolving, and brands must act fast to stay relevant. Understanding consumer behavior, optimizing search visibility, and diversifying marketing channels are essential for success.

With Similarweb’s Web Intelligence suite, you can:

- Analyze market trends in real-time

- Track competitor performance to refine your strategy

- Discover high-impact keywords to boost your search traffic

Ready to expand your market reach? Try Similarweb today and turn insights into action.

Image by Mircea Iancu on Pixabay

The #1 tool for digital marketing success

Give it a try or talk to our marketing team — don’t worry, it’s free!