How To Conduct Product Demand Analysis

Markets move fast, competitors launch, and channels change. Consumer behavior? That’s a whole different beast. There’s a need to track demand signals in real time, and in today’s competitive market, guesses get expensive.

Your teams don’t need to wait for last quarter’s sales report. They should assess demand at the source: what buyers are searching, clicking, and buying right now. That means fewer bets on products no one wants and more investment in the offers already gaining traction.

When done right, demand analysis links product, marketing, and growth strategies in one unified motion. It shapes pricing, refines messaging, and even influences logistics.

Because when you know what people want (and how urgently they want it), you start leading with faster decisions, leaner launches, and bigger wins.

What is product demand?

It’s a measure of how many people are actively looking for (or already buying) a specific product at a given time and price point. It’s about intent and not just about popularity.

In B2C, it might show up as a spike in monthly searches for “plant-based protein bars”. In B2B, it could be a run of demo requests for CRM platforms aimed at mid-sized teams. Different sectors, same signal: people are looking and ready to act.

Think of product and demand as two halves of the same equation. The product delivers value. Demand tells you how much that value resonates. Analysts track it by looking at volume (searches, clicks, purchases) and velocity (is it rising, stalling, or dropping?).

Here’s a quick product demand example: A trail-running shoe brand sees “wide-fit trail runners” searches jump 40% year over year. At the same time, conversions for their standard line are flatlining. That’s a signal. A real one. They launch a wide-fit range and capture a niche before it gets crowded, instead of waiting for competitors to catch on.

Why conduct a product demand analysis?

Going with your gut is how product teams end up launching a solution to a problem nobody’s trying to solve.

Instead, a structured demand analysis gives you the answers before you commit to big budgets or lock in timelines.

Is the category growing or shrinking? Is there a white-space opportunity? Who’s already dominating the conversation?

For launches, new product demand forecasting shows whether there’s enough interest to justify R&D, and what kind of ramp-up your supply chain needs. No more guessing factory output or hoping for viral lift.

Already in-market? Forecasting product demand helps you track whether interest is flatlining, seasonal, or ready for a well-timed refresh.

It also helps you stay sharp operationally. Search peaks tell supply teams when to position stock closer to customers. Marketing can ride the demand curve: cutting spend when it dips and doubling down when intent spikes.

Most importantly, good demand analysis reduces launch risk. When you pair search signals with market research and competitor benchmarks, you get clarity on where others are over-indexed and where unmet demand still lingers.

This often results in faster product-market fit, fewer stock nightmares, and a better shot at hitting your margin targets.

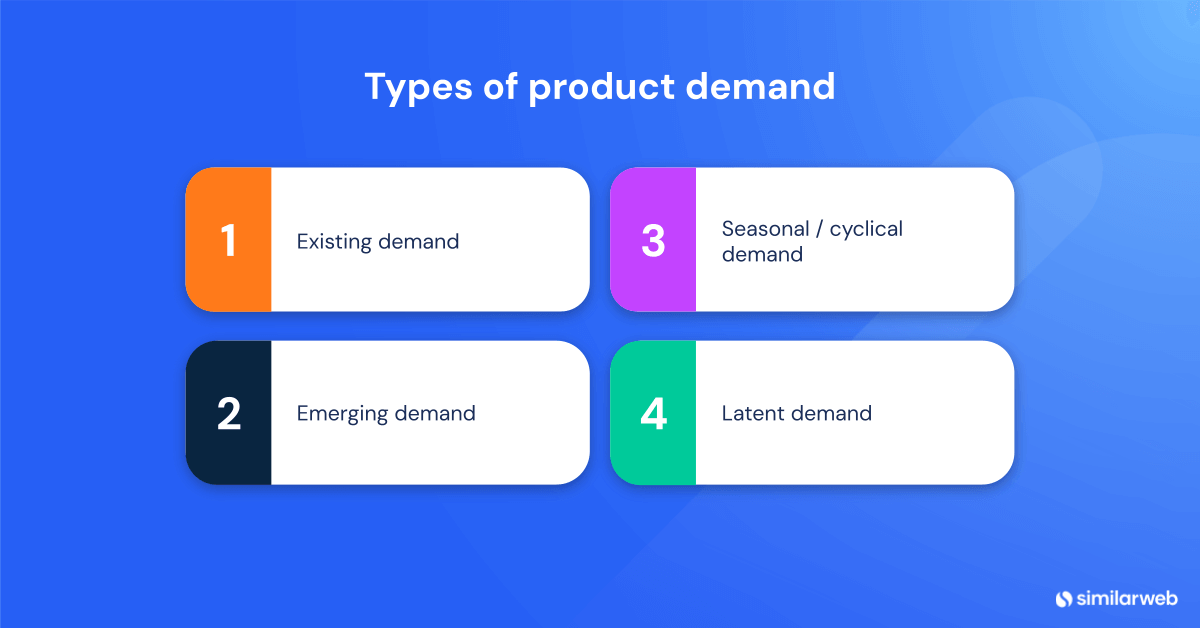

What are the types of product demand?

Every product falls into one of four demand buckets. Knowing which one you’re in defines everything, from how you talk about the product to how fast you move.

1. Existing demand

These are your steady performers. Coffee pods, project management tools, markets with reliable volume and known players.

The game here is about squeezing out share through clever bundles, loyalty offers, and micro-segment targeting. Think incremental wins, not breakout growth.

2. Emerging demand

New categories, new problems, new buzzwords. Think AI meeting summarizers or zero-alcohol spirits.

These categories are heating up fast. Catching them early lets you fine-tune your offer, build backlinks before SEO gets competitive, and lock in partners before everyone else joins the party.

Use trend tracking weekly. It’ll show you when the hype turns into something real.

3. Seasonal or cyclical demand

Holiday spikes, budgeting tools in January, and gardening kits in spring. These follow a pattern.

Use historical sales and search behavior to map out demand windows at the SKU level. Plan production and promo accordingly. No guessing and no waste.

4. Latent demand

People have a need, but no obvious product. Think: pre-iPad, when consumers wanted lightweight ways to browse and stream but didn’t know what to ask for.

You’ll spot latent demand through workaround keywords, forum gripes, and recurring friction points.

Creating demand here means education, piloting MVPs, and crystal-clear messaging that reframes abstract needs into actual solutions.

How to conduct product demand analysis with Similarweb

If you want to know what your customers are actually searching for before your competitors do, this is how you do it.

Below is a practical step-by-step guide using Similarweb’s Demand Analysis tool, part of Similaweb’s Web Intelligence Solution. From building your keyword list to spotting trends, validating niches, and connecting it all back to product and marketing strategy, here’s how to make it actionable.

Build a keyword list that actually reflects demand

Product demand analysis isn’t just about raw numbers – it’s about turning real-time signals into smarter decisions. With Demand Analysis, you can evaluate what consumers are actively searching for, how interest is shifting across time, and where demand is heating up geographically.

Let’s walk through a real-world example: the growing interest in mushroom coffee, a functional beverage blending mushrooms like lion’s mane or chaga with coffee, positioned as a healthier, adaptogenic alternative to traditional caffeine options.

Step 1: Track demand over time

Using the Search Trends dashboard, we analyzed worldwide searches for “mushroom coffee” from April 2024 to March 2025 and compared them to the same period a year earlier.

We see:

- YoY growth: +44.17%

- Total search volume: 8.8M (up from 6.1M)

- In March 2025 alone, searches spiked to 800.7K, a +27.98% increase month-over-month.

This is a classic case of emerging demand gaining mainstream traction. The early signals from the previous year are now translating into accelerating interest, suggesting the category is moving from niche to early majority.

Step 2: Analyze geographic opportunity

Looking at Top Countries by Volume, the United States still leads in search interest, but other markets are showing remarkable growth:

This geographic view can inform market entry strategies, retail distribution planning, or international campaign rollouts. For example, an ecommerce brand might prioritize local fulfillment in India or Australia based on this momentum.

Step 3: Dive into keyword intent

The Keyword Trends and Summary dashboards help dissect what users are actually searching and how their intent is evolving.

You’ll notice:

A branded search surge for “Ryze” and “Rise”, both mushroom coffee brands, indicates product-led awareness and potentially successful campaigns.

Intent-rich searches around health benefits (“is mushroom coffee good for you,” “mushroom coffee benefits”) are up significantly, signaling curiosity and education gaps you can fill through content or advertising.

Step 4: Spot timing windows

Looking at the monthly keyword trendlines, you’ll see that interest in “mushroom coffee” builds in early spring (May peaks) and recovers again post-holiday (February–March).

This insight helps with campaign planning: You can align product launches, influencer partnerships, or seasonal promotions with moments of heightened demand.

Strategic takeaway

This kind of granular demand data helps teams move with confidence:

- Product teams can validate feature sets based on keyword search intent.

- Marketing teams can create benefit-driven messaging backed by actual search language.

- Ops teams can plan inventory around spikes instead of guessing.

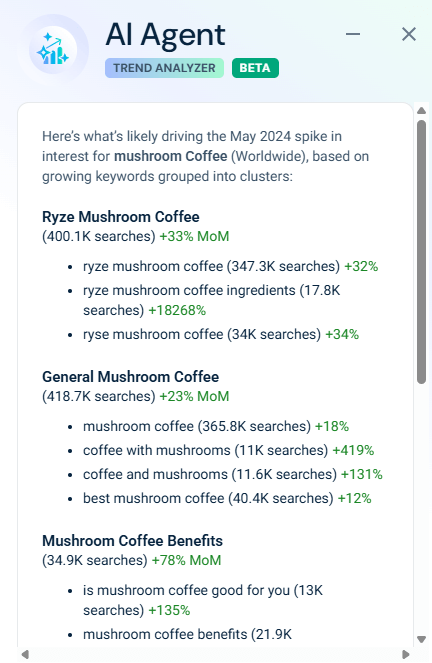

Spot what’s driving demand with Similarweb’s AI Trend Analyzer

Search volume surges are powerful signals, but understanding why they’re happening is what powers action. That’s where Similarweb’s AI Trend Analyzer comes in.

This new feature uses AI to detect spikes in consumer demand and connect them to real-world trends, products, and brand movements. You no longer have to manually sift through data to answer “What just happened?” The AI Agent does it for you, instantly surfacing the who, what, and why behind the numbers.

Let’s look again at the mushroom coffee trend.

Example: The May 2024 spike

In May 2024, search volume for “mushroom coffee” jumped to 1 million searches, up 27% month-over-month – a clear spike in interest.

The AI Trend Analyzer automatically flagged this inflection point and broke it down into three insight clusters:

- Branded Demand: Searches for “ryze mushroom coffee” and “ryse mushroom coffee” surged, suggesting targeted marketing or product-led buzz. One sub-keyword – “ryze mushroom coffee ingredients”, exploded with a +18,268% MoM increase.

- Category Growth: General searches like “coffee with mushrooms” and “best mushroom coffee” also rose significantly, indicating broader consumer curiosity and category expansion.

- Benefit-Driven Intent: Health-related queries like “is mushroom coffee good for you” were up 135%, showing that wellness claims were fueling interest.

Why this matters

In addition to keyword breakdowns, the AI Trend Analyzer also contextualizes demand surges using public data and news sources. Check out how it linked the spike for mushroom coffee:

- Increased awareness around cognitive and immune health benefits

- Expanded distribution of functional beverages

- Strategic marketing by leading brands in the space

This means you can go from raw search data to strategic next steps, whether that’s launching health-focused messaging, preparing seasonal campaigns, or adjusting inventory to match demand peaks.

Tips for monitoring demand over time

Spikes are fun. But winning long term? That’s about patterns.

Treat tools like demand analysis as a living system and not a quarterly task. One good snapshot gives you direction. But watching the changes, week after week, is what keeps your strategy sharp. Demand changes subtly: a new keyword breaks out, an old one slips quietly into irrelevance. The brands that win are the ones that see it early and act fast.

Track the trend, not the peak

Build a simple dashboard. Start with search volume, click-through share, and conversion rates. Chart it weekly or monthly, whichever your team can keep up with. What you’re looking for is shape and not just growth.

Is this a spike from a one-off event, or something longer-term? Is the curve flattening, bending, or breaking? That’s your cue to modify spend, update messaging, or rethink your roadmap.

Design for change, not control

Drop the 12-month marketing plans. Instead, work in rolling 6- to 8-week sprints. Keep budgets fluid so you can double down on fast movers or pause campaigns that start to slip.

For product teams, maintain a backlog of bundle ideas or quick-win features you can pull forward when demand signals flare.

This is how fast companies operate. Restock before competitors know shelves are empty. Publish content before the keyword hits the mainstream. Pause spending before the ROI vanishes. And over time, your strategy starts being predictive, built on live demand, not old reports.

From uncertainty to advantage: what accurate demand data delivers

Great decisions start long before sales data hits the dashboard.

Real-time demand insights guide everything: product tweaks, launch timing, even budget allocation. With Similarweb’s Demand Analysis, you swap guesswork for proof, shorten your feedback loops, and inch closer to real product-market fit with every sprint.

Whether you’re testing a brand-new idea or scaling a proven bestseller, anchoring strategy to search behavior means fewer misses, faster learning, and better bets.

FAQs

How does product demand analysis help with supply chain planning?

It shows you when to act. By syncing keyword demand spikes with your production timelines, you can decide whether to ramp up output, delay restocks, or push inventory. That means fewer stock-outs, lower storage costs, and more budget freed up for growth levers like marketing or product dev.

Can product demand analysis highlight the markets my competitors are missing?

Absolutely. Dig into long-tail keywords with steady growth. These often point to micro-niches no one’s watching yet. Get in early, and your brand becomes the go-to before bigger players even notice what’s happening.

How often should I check demand data?

Use both weekly and monthly views. Weekly gives you fast signals from trends, influencer hits, or campaigns. Monthly smooths out the noise and shows what’s really moving. Together, they give you speed and perspective.

Track your digital metrics and grow market share

Contact us to set up a call with a market research specialist