The Difference Between Qualitative and Quantitative Research

Research isn’t optional if you’re in business—it’s the backbone of every smart decision. But how you gather data matters.

- Qualitative research digs deep into consumer behavior, uncovering motivations, emotions, and the “why” behind decisions.

- Quantitative research turns behavior into measurable data, making trends and patterns crystal clear.

Used together, these methods fuel data-driven strategies that actually work. Similarweb takes it further, integrating both research types into one insights powerhouse. This means businesses get the full picture—what’s happening, why it’s happening, and what to do next.

Qualitative research

At its core, qualitative research is about depth, not numbers. It’s the art of getting into consumers’ minds to decode their decisions.

How do companies do this?

Here are some of the key methods:

- Customer feedback – Nothing beats direct consumer insights. Reviews, complaints, and suggestions reveal what customers love—and what’s driving them away. Understanding these reactions helps brands refine product offerings, adjust messaging, and improve overall customer satisfaction.

- Personal interviews – A conversation can reveal goldmine-level insights that raw data simply can’t. Whether face-to-face or virtual, these deep dives expose pain points, expectations, and emotional triggers. They also allow companies to explore unfiltered opinions, leading to more authentic and valuable insights.

- Focus groups – What happens when you gather a group of consumers and ask them to share thoughts on your product? Patterns emerge. Common opinions. Shared frustrations. Unexpected trends. This real-world input guides product development and marketing strategies while uncovering opportunities competitors might have missed.

- Observational research – What people do tells you more than what they say. Watching how consumers interact with a product or service in real-world settings reveals behaviors they might not verbalize, helping companies understand subconscious influences on purchasing decisions.

Here’s an example of it in motion

A new fitness brand wants to launch a protein shake. So, it interviews gym-goers, who reveal that taste and texture are the biggest deal-breakers.

Without this insight, the brand might have focused on the wrong features. By also observing consumer habits at smoothie bars and fitness centers, the company can fine-tune its offering to match real-world preferences.

Qualitative research is robust. But it becomes unstoppable when combined with real-time behavioral data from Similarweb. Businesses don’t just guess what customers want—they measure it, analyze patterns, and see it in action with data-driven precision.

What are customers searching for?

Knowing what users are actively searching for is essential for shaping a winning strategy.

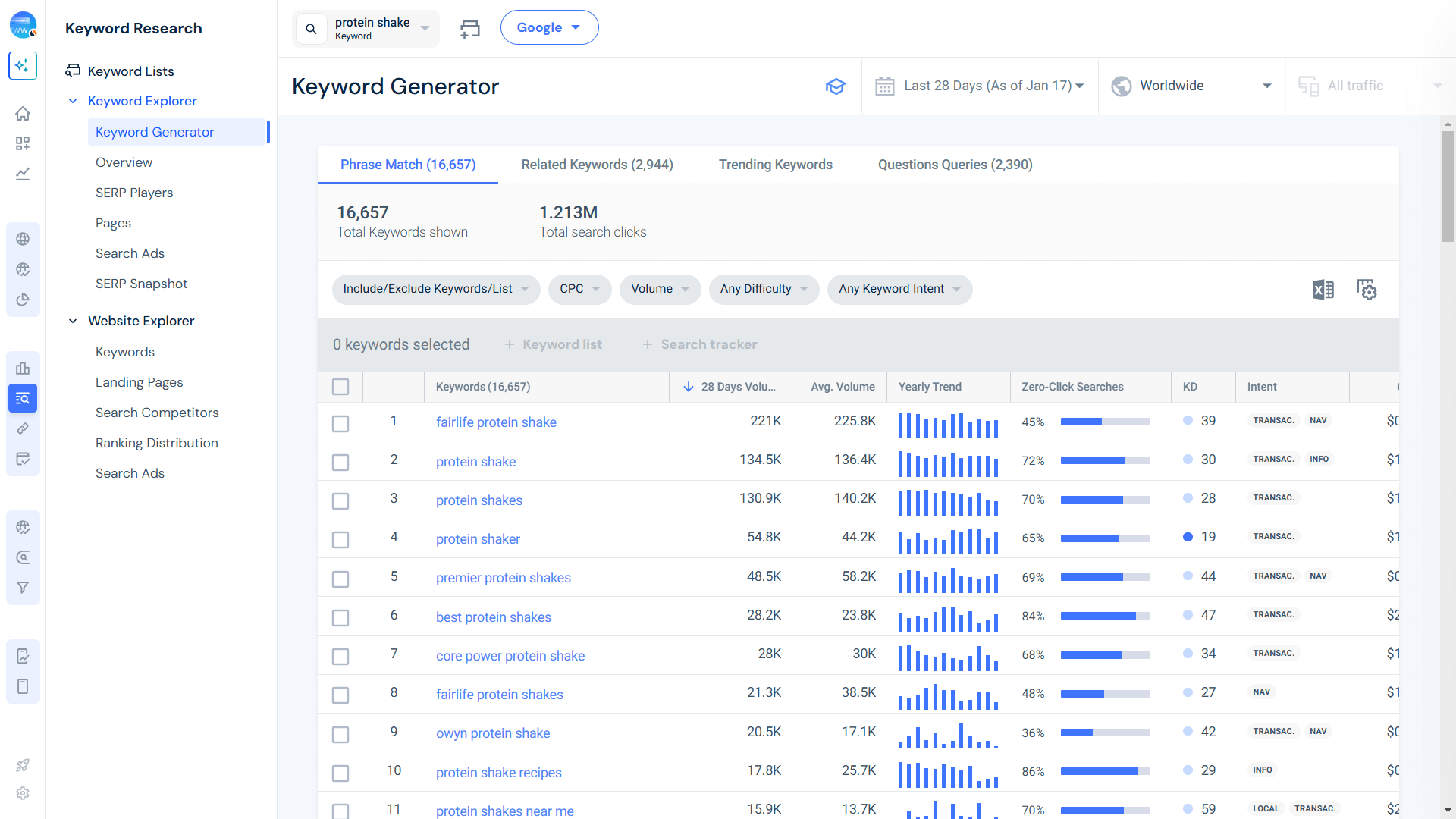

Similarweb’s Keyword Generator uncovers the top search terms that matter most to your audience.

For instance, we analyzed the keyword “protein shake,” which revealed the exact phrases customers use when searching for this product.

How do customers interact with competitor sites?

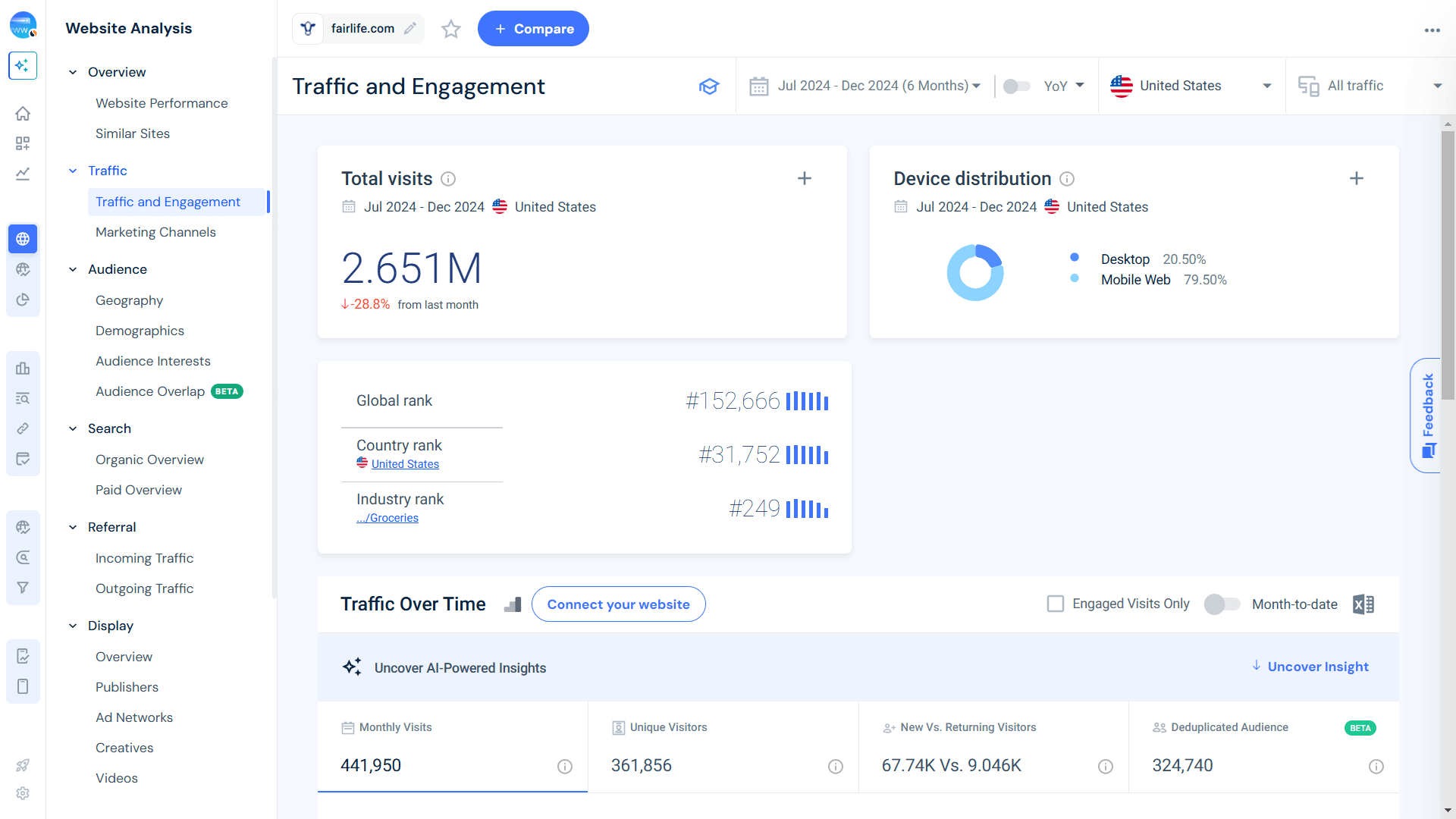

Beyond searches, it’s also important to know how customers interact with your competitors.

Similarweb provides traffic and engagement data, which helps businesses see where customers are going, how long they stay, and what content keeps them hooked. The example below shows the massive amount of traffic going to fairlife.com, the brand ranking #1 for “protein shake”.

Which trends are driving engagement?

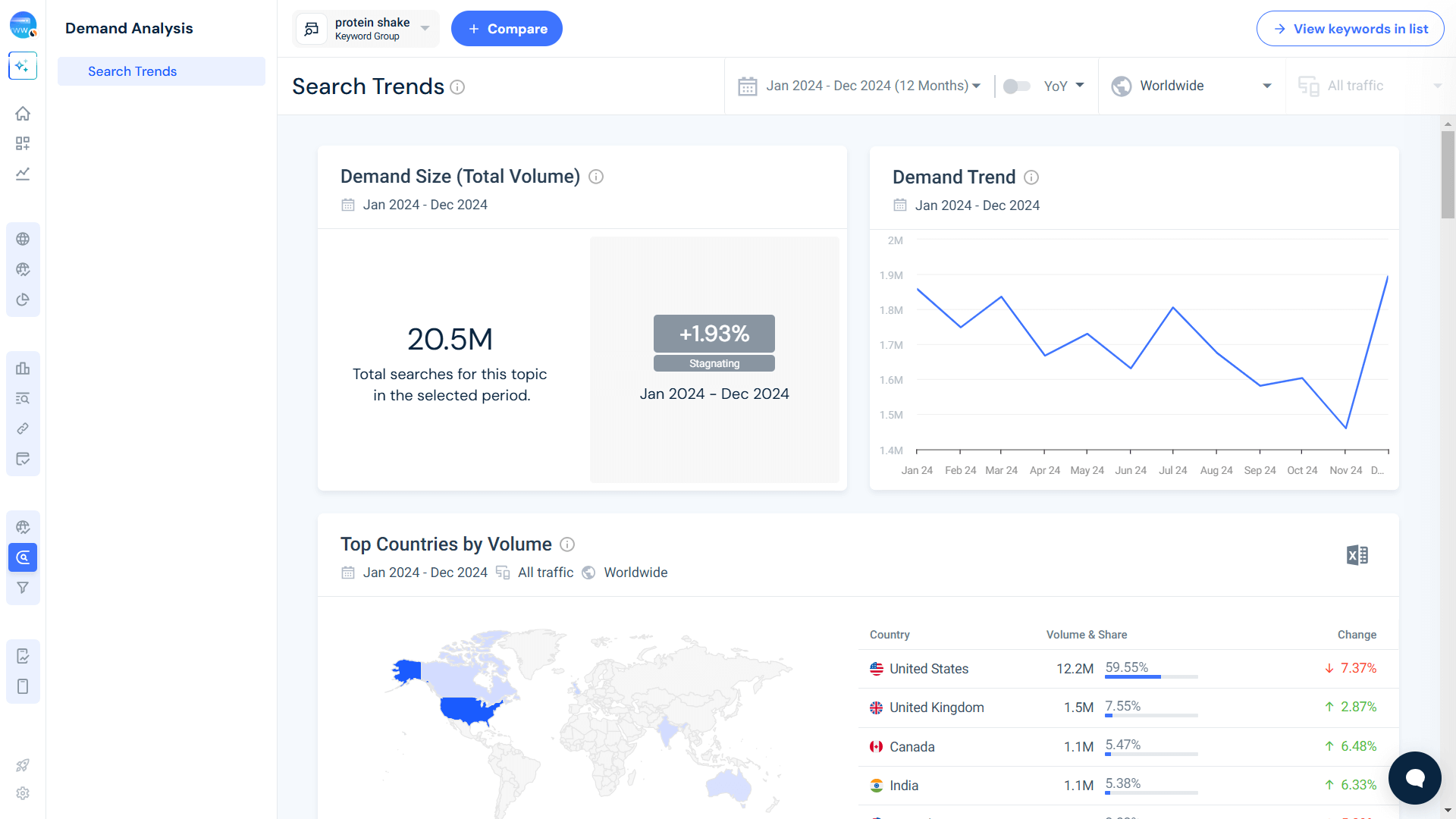

Spotting rising trends before they peak is important to anyone who wants to get a competitive edge. With Similarweb’s Demand Analysis tool, businesses can generate a list of high-demand keywords related to their market.

Look at the phrase “protein shake.” Here are some of the most relevant keywords and phrases included in the analysis:

- protein shakes

- protein shake

- premier protein shakes

- protein shaker

- core power protein shake

- protein shake before or after workout

- protein shake recipes

- best protein shakes

- protein shaker bottle

Using this tool, you’ll be able to see the demand trend for these keywords. This will allow your business to track interest levels and adjust your strategies accordingly.

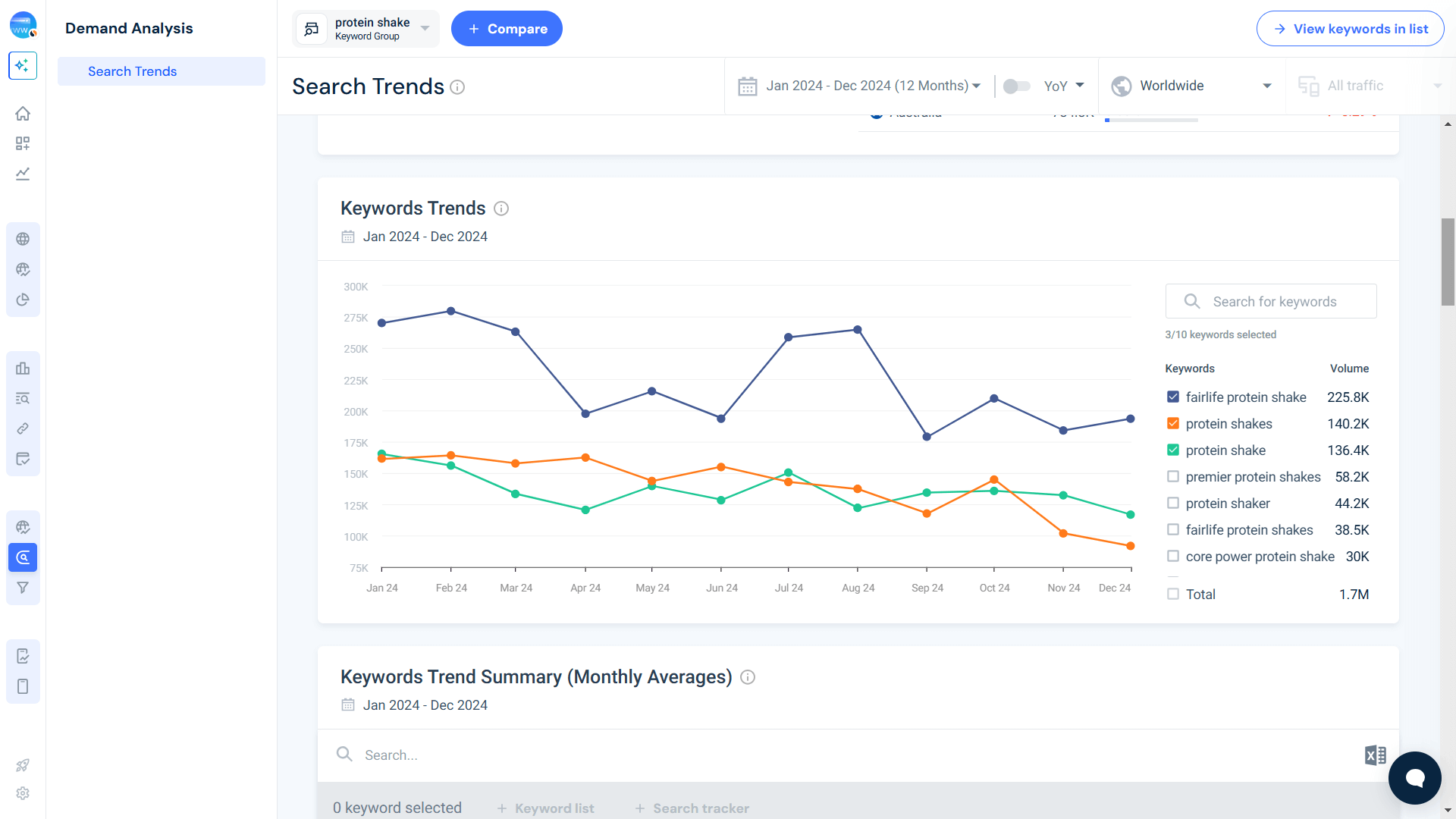

Keyword trends in action

Want to see how these keywords evolve over time? The Search Trends feature tracks search interest shifts to help your business stay ahead of demand fluctuations.

Quantitative research

While qualitative research provides context, quantitative research delivers precision.

Numbers don’t lie—they tell exactly how consumers behave.

- Web traffic stats – How many people visit a site? Where are they coming from? Is traffic increasing or declining?

- Conversion rates – How many visitors actually take action—buying, subscribing, or signing up?

- Surveys & structured data collection – Large-scale surveys collect hard numbers on preferences, trends, and market demand.

- Sales performance metrics – Revenue, growth trends, and category share help businesses understand their market position.

- User engagement data – Metrics like session duration and page views provide insight into how customers interact with content.

Example: quantitative and qualitative research in ecommerce

An ecommerce site sees a 30% drop in traffic. Qualitative research uncovers frustration with the checkout process through a survey or a pop-up. Quantitative research confirms a rise in cart abandonment. Together, these insights shape a solution: improving checkout UX, streamlining payment options, and optimizing mobile responsiveness.

Similarweb provides access to real-time traffic estimates, market share analysis, and performance benchmarks. Businesses can measure success, spot growth opportunities, and make data-backed decisions with confidence.

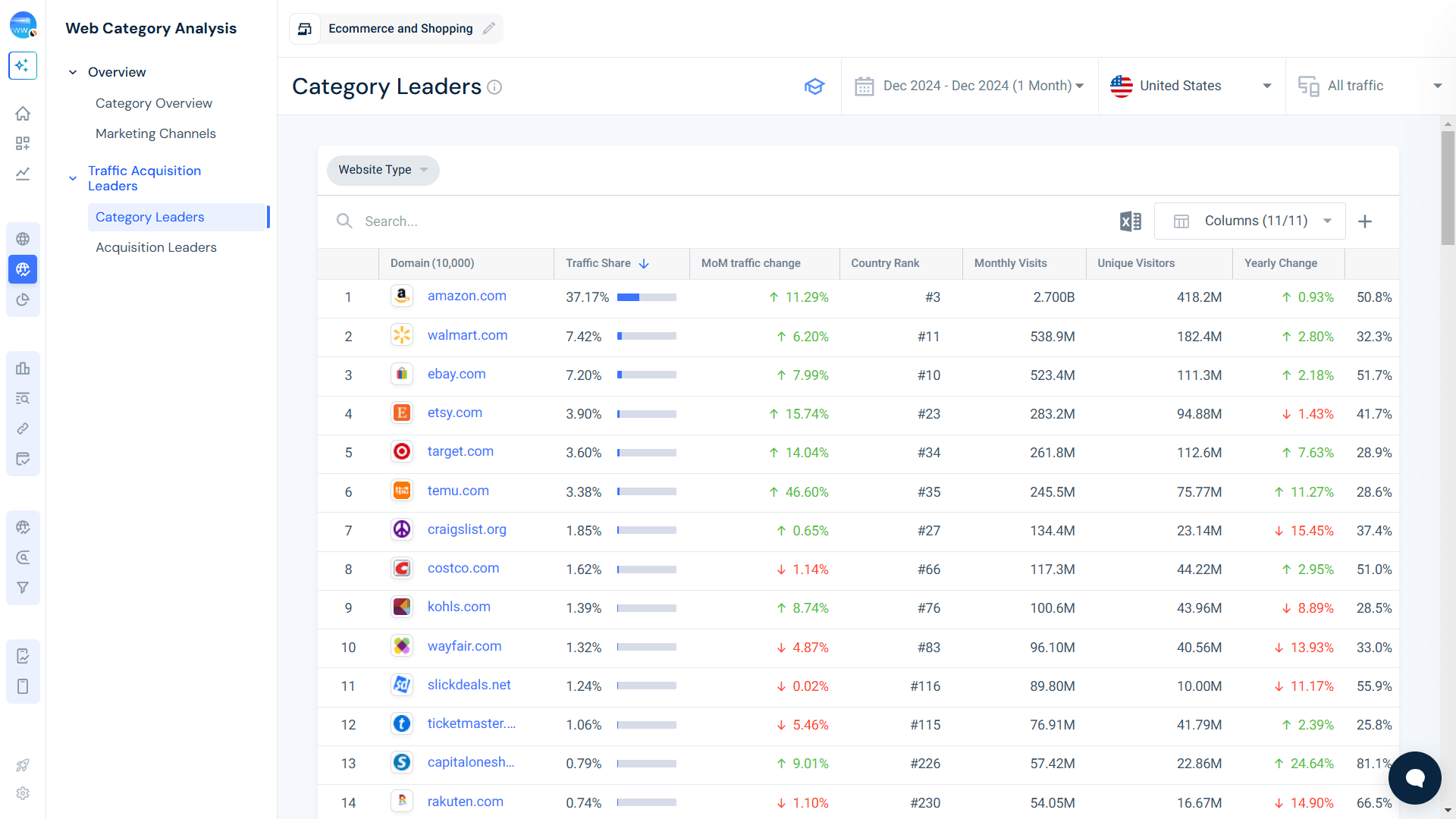

What brands are gaining traction?

To get a clear picture of market movements, use Similarweb’s Web Category Analysis. In the example below, we analyzed the Ecommerce and Shopping category to track industry leaders and identify the brands seeing the biggest Month-over-Month (MoM) traffic changes and Yearly growth trends.

Spotting these rising players can help refine competitive strategies and uncover potential partnership or differentiation opportunities.

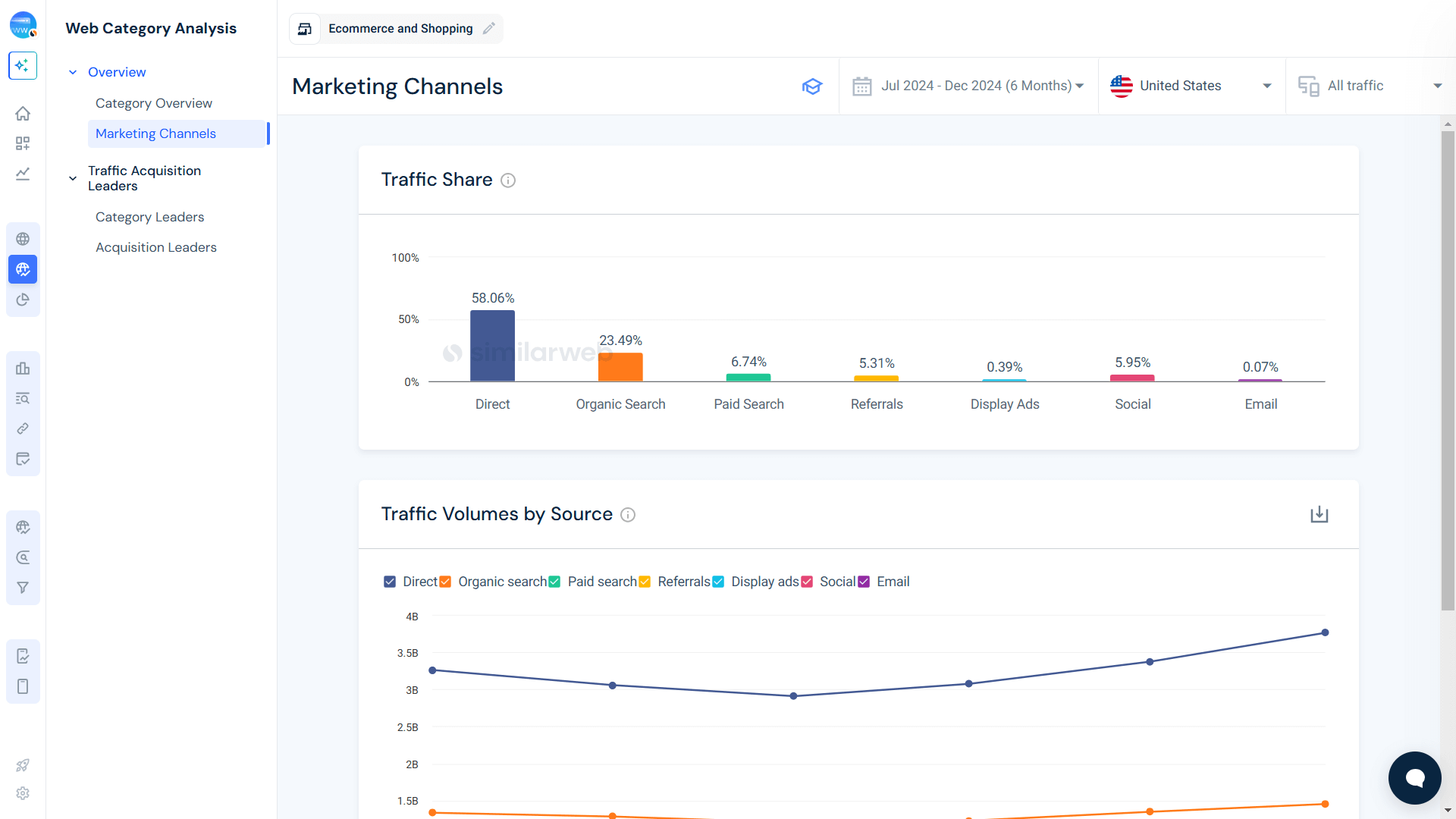

What marketing channels are driving the most engagement?

Learning where traffic is coming from is important to optimizing marketing strategies. Below, we showcase the leading marketing channels for the industry to reveal which platforms—whether organic search, paid advertising, social media, or direct traffic—are delivering the highest interaction.

Knowing where customers are most active will allow brands to allocate resources efficiently and increase conversions.

Use Similarweb’s traffic and conversion data to identify performance trends, monitor rising competitors, and adjust your marketing strategy.

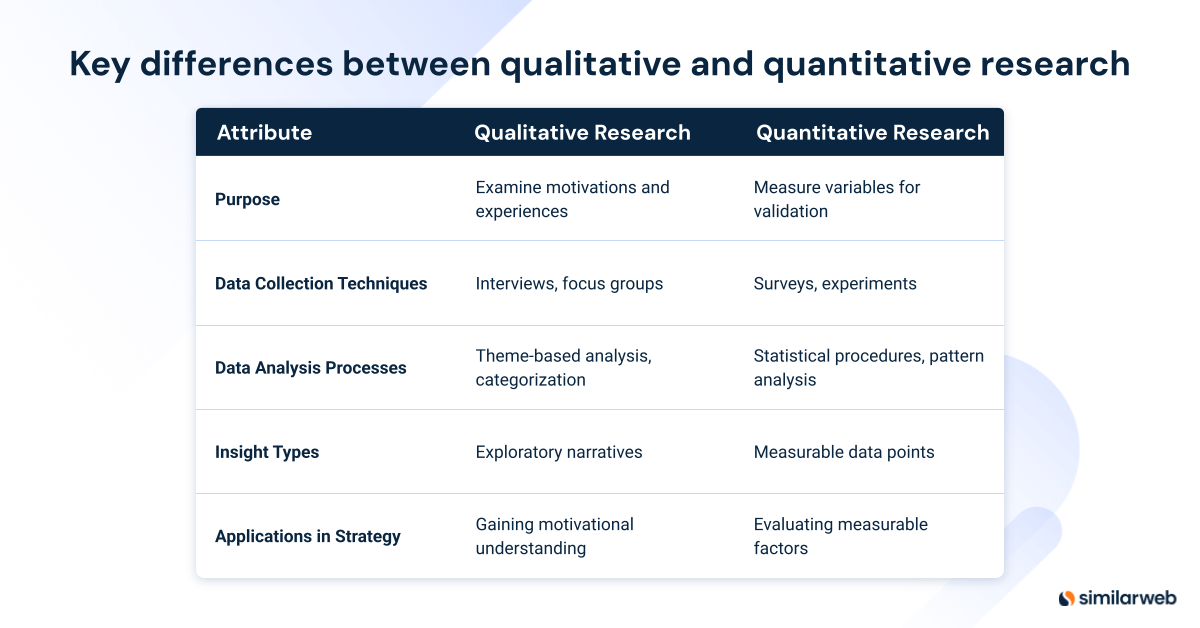

Key differences between qualitative and quantitative research

For businesses looking to refine their market research approach, understanding the core differences between qualitative and quantitative research is essential. Each method serves a distinct purpose, and when combined, they provide a full-spectrum view of consumer behavior.

- Qualitative research dives deep into motivations, emotions, and personal experiences. It focuses on the why behind decisions, offering insights through interviews, focus groups, and direct feedback.

- Quantitative research deals with hard numbers. It answers how many, how much, and how often, giving businesses clear, measurable data to guide decision-making.

Example: A retailer sees a drop in sales. Qualitative research uncovers that customers feel the in-store experience is outdated and lacks personalization. It reveals a decline in foot traffic and a drop in repeat purchases.

Businesses don’t just get numbers—they get context. They understand that sales are down but also why customers are leaving. This dual approach ensures more precise and effective strategic planning.

The takeaway: When qualitative and quantitative research work together, businesses gain a sharper competitive edge. Use insights wisely, adapt strategies faster, and stay ahead of market trends.

When to use qualitative vs. quantitative research (or both)

Situations where qualitative research is ideal

For businesses seeking deep insights into market trends, customer perceptions, and emerging pain points, qualitative research is invaluable. It’s especially useful when entering new markets, launching innovative products, or fine-tuning messaging to better resonate with target audiences.

Interviews, focus groups, and open-ended surveys reveal why customers make decisions. Understanding these stories allows businesses to craft compelling marketing messages, improve product design, and create emotional connections with their audience.

Example: interviewing health and beauty customers

A skincare brand discovers through customer interviews that buyers want more eco-friendly packaging. This insight shapes the next product launch, boosting customer satisfaction and loyalty.

Scenarios for quantitative research

Quantitative research excels in situations where measurable data is required—from tracking ROI on marketing campaigns to analyzing market demand and forecasting future trends. Businesses use quantitative research to validate their strategies with hard numbers and adjust tactics accordingly.

Metrics like website traffic, conversion rates, and industry benchmarks provide actionable insights that help companies stay competitive. Without quantitative data, decision-making becomes guesswork rather than strategy.

Example: analyzing a fall in subscriptions

A subscription box service sees a drop in sign-ups. Web analytics reveal that most visitors abandon the checkout page. This leads to optimizing the payment process and increasing conversions.

The complementary nature of these approaches

Great businesses don’t choose between qualitative and quantitative research—they use both. Qualitative research provides the context behind behaviors, while quantitative research confirms the scale of those behaviors.

When used together, these approaches provide a comprehensive strategy. Businesses gain a clearer understanding of not just what’s happening, but why it’s happening and how to fix it.

Example: blending in-store and online experience

A retail chain experiences declining foot traffic. Qualitative insights reveal that customers prefer online shopping for convenience. Quantitative data confirms declining in-store purchases. The solution? A hybrid strategy that improves both in-store and online experiences.

Similarweb: bridging various research insights

Similarweb stands out by seamlessly unifying qualitative insights with quantitative data to provide a complete market view. By merging consumer sentiment, keyword trends, and behavioral analysis with data like traffic metrics and performance benchmarks, businesses gain a multi-dimensional understanding of their market.

This integrated approach helps companies make data-backed decisions while staying attuned to shifting consumer preferences. With real-time analytics and deep market intelligence, Similarweb delivers the tools needed to spot trends, assess competition, and refine growth strategies.

Smarter research = smarter business directions

Great strategies aren’t built on guesswork. Businesses that combine qualitative and quantitative research gain a serious competitive edge. Why? Because they understand not just what’s happening in their market—but why it’s happening.

Want to sharpen your decision-making?

Use Similarweb to merge behavioral insights with digital data, unlocking a complete, actionable view of your industry. Find gaps, identify opportunities, and outsmart the competition.

FAQs

How does integrating qualitative and quantitative research help businesses?

Merging these two methods provides a holistic view of consumer behavior. Qualitative research reveals the motivations behind customer choices, while quantitative research measures how frequently those behaviors occur. When combined, businesses can develop strategies grounded in both narrative insight and measurable data, leading to smarter product development, sharper marketing campaigns, and stronger customer engagement.

What are some challenges in qualitative research?

Qualitative research requires time and expertise. Collecting and analyzing open-ended feedback, interviews, and focus groups demands careful interpretation. It’s subjective and labor-intensive—but its depth makes it indispensable for brands that want to understand their customers beyond just numbers.

How is quantitative research limited compared to qualitative research?

Quantitative research provides hard numbers, but it lacks context. It can tell you that, for example, sales have dropped by 15%, but not why customers are leaving. That’s where qualitative insights fill the gap—giving businesses the story behind the stats so they can take meaningful action.

How do businesses determine the right research method?

It depends on the goal. If a business wants to understand customer emotions, motivations, or pain points, qualitative research is best. If the objective is to track trends, measure performance, or validate assumptions with data, quantitative research is the way to go. The winning formula? Using both.

Why is data reliability important in research strategies?

Decisions should be based on accurate, up-to-date insights—not guesswork. Reliable data ensures that businesses stay ahead of market trends, avoid costly mistakes, and optimize strategies based on real consumer behavior rather than assumptions.

Track your digital metrics and grow market share

Contact us to set up a call with a market research specialist