Effective Market Research for New Product Development

Ever wonder why so many new products flop? The harsh reality is that 95% of 30,000 new products launched each year never make it according to a recent report by Harvard Business School.

And here’s the kicker—failure rates haven’t budged much over time.

Why is that?

Because companies just go ahead without solid market research. They assume they know what customers want, throw money into development, and hope for the best. Bad move.

Market research is your blueprint for success—a way to anticipate demand, understand your audience, and eliminate guesswork. Without it, you’re flying blind.

Many businesses struggle with this because they lack access to reliable, up-to-date data. That’s where Similarweb comes in—giving you real-time insights into market trends, consumer behavior, and what your competitors are up to so you can make smarter, data-backed decisions with confidence – before you even think about launching.

But before we go into the how, let’s start with the basics.

What is market research for new product development?

Think of market research as the foundation of every successful product. It’s about making sense of data to spot trends, uncover consumer needs, and fine-tune your product before it hits the market.

Why does this matter for your business?

Because knowing your customer is everything. Companies that use research to guide product development don’t just create better products—they create products people actually want.

Here’s what market research does for you:

- 🤔 Eliminates uncertainty: You’re not guessing; you’re working with real data

- 🕳️ Finds market gaps: Spots unmet needs before your competitors do

- 👓 Improves visibility: The right research helps position your brand where it matters

If you get this right, you’re not just launching a product—you’re setting the stage for long-term success.

A strong market research strategy focuses on three core objectives:

Identify demand

You can’t sell what people don’t want. It’s that simple.

Understanding consumer behavior means going into what customers care about, what they search for, and what drives their purchases. Identifying these patterns helps you predict demand, uncover opportunities, and make smarter business decisions.

1. Analyze purchasing habits

Are there seasonal spikes? Recurring trends? A travel brand might notice a surge in searches for “carry-on luggage” before the holiday season, signaling the perfect time to launch a targeted promotion.

2. Track search trends

What are people actively looking for? If searches for “eco-friendly shampoo” are rising, it’s a sign consumers are leaning toward sustainable beauty products.

3. Spot market gaps

Where are customers underserved? If there’s a high search volume for “affordable ergonomic chairs” but few options available, there’s a clear opportunity to fill the gap.

Once you’ve identified demand, the next step is understanding the competitive landscape. Because knowing what customers want is only half the battle—you also need to know who else is competing for their attention.

Assess competition

Your competitors have already done some of the work—now use it to your advantage.

Studying who’s winning (and who’s struggling) in your space gives you a strategic competitive advantage.

- What are their best-selling products? → Why do customers love them?

- Where do they fall short? → Negative reviews are gold mines of insight.

- What’s their pricing strategy? → Can you offer better value?

The best companies outshine competitors by delivering greater value, smarter positioning, and standout features.

A great example is Slack vs. traditional workplace communication tools.

Instead of just keeping up with email and chat platforms, Slack outshined competitors by redefining workplace communication.

It offered greater value through seamless integrations with productivity tools, smarter positioning as the modern alternative to cluttered email threads, and standout features like searchable message history, channels, and automation. This approach helped Slack become the go-to platform for team collaboration.

Define target audiences

Not every product is for everyone—and that’s a good thing.

Zeroing in on your ideal customer helps you create products that truly resonate, making them far more likely to buy.

- Who is your audience? → Demographics, interests, spending habits.

- What problems do they face? → And how does your product solve them?

- How do they make purchasing decisions? → Emotional triggers, social proof, brand loyalty.

A clear target audience leads to better marketing, better messaging, and better sales.

A strong example is Notion’s rise as a productivity tool.

Initially, Notion tried to market itself as an all-in-one tool for everyone, but growth accelerated when it focused on a clear target audience: startups, product teams, and knowledge workers. By tailoring its marketing and messaging around flexible workspaces, collaboration, and simplicity, Notion resonated deeply with these users. This clarity also improved sales, as businesses saw it as a must-have tool rather than just another note-taking app. As a result, Notion built a loyal user base and expanded strategically into enterprise markets.

Market research questions for new product development

Creating a game-changing product is about asking the right questions. To build something that truly stands out, you need to dig deep, uncover hidden opportunities, and anticipate potential roadblocks before they derail your plans.

Smart market research lays the foundation for success. It gives you the information you need to design, position, and launch a product that not only meets demand but dominates the competition.

So, what questions should you be asking?

Target audience

You can’t sell to “everyone.” Your ideal customer has specific needs, preferences, and pain points—and it’s your job to find out what they are.

Ask yourself:

- Who exactly is this product for? (Think demographics, income, lifestyle, habits, etc.)

- What problems do they need to solve?

- What features or benefits would make them choose your product over what they’re using now?

Nail this down, and you’ll be designing something your audience actually wants, not just something you think they do.

Market demand

A brilliant idea is worthless if no one wants to buy it. That’s where market demand comes in.

Look at trends and research on customer behavior. Check whether demand is rising, stable, or shrinking.

Here are some of the primary indicators:

- Search volume for related keywords

- Industry reports showing growth in your target category

- Customer complaints or gaps in current solutions that signal an unmet need

If the data points to strong and growing demand – you’re on the right track.

Competitive landscape

Competition is a given. But are they meeting customer needs?

Find out who the leaders are in your space, what they’re doing well (and where they fall short), and how your product can be different—or better.

Maybe you offer a premium version. Maybe you make it more affordable. Maybe you focus on a niche they’re ignoring.

Whatever the angle, knowing your competitive edge is non-negotiable.

Pricing strategy

Price too high, and you’ll scare off buyers.

Price too low, and you’ll kill your margins.

So where’s the balance?

Your pricing should reflect customer affordability while keeping profits healthy, be competitive (but not necessarily the cheapest), and align with perceived value—higher-priced products need a clear why.

Look at competitor pricing. Run market research surveys and test price elasticity. Getting this right could make all the difference.

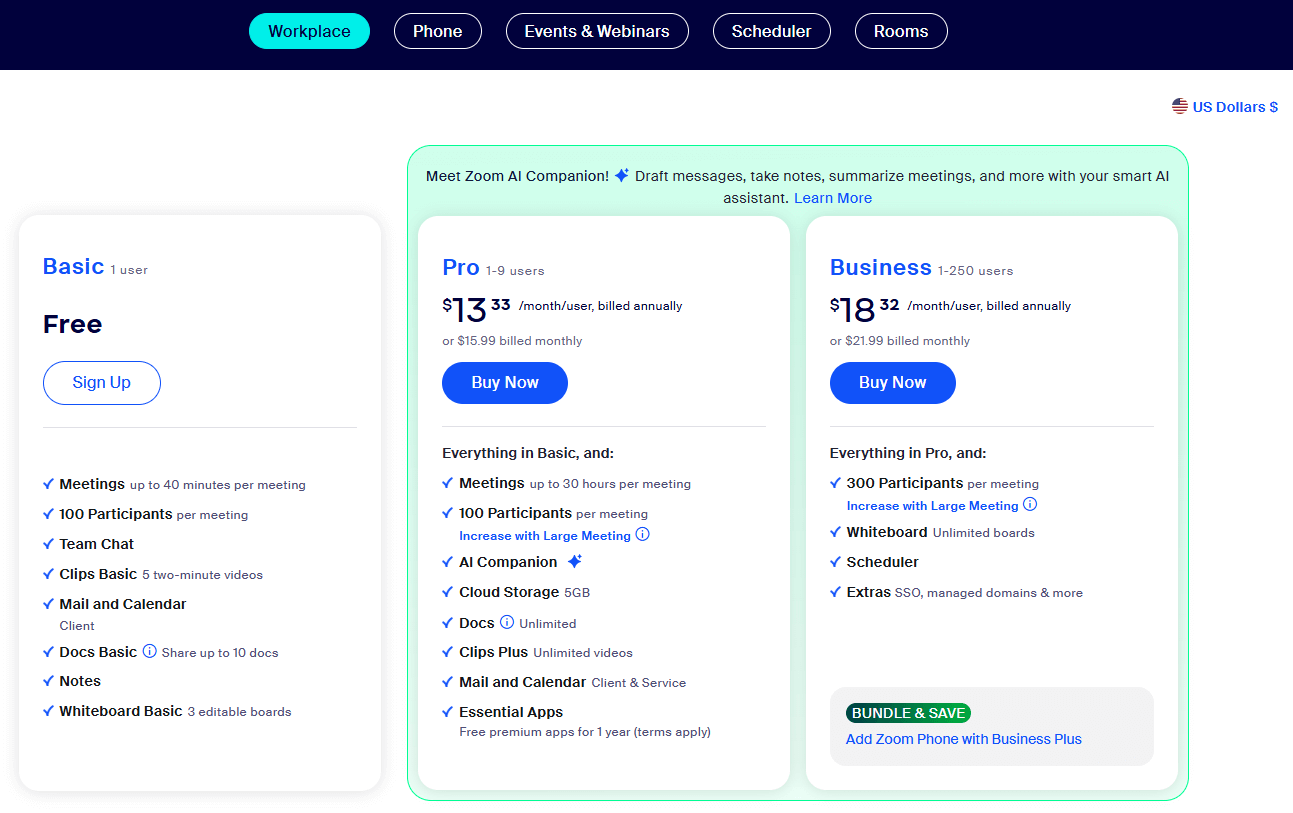

A great example is Zoom’s pricing evolution.

Zoom didn’t just guess its pricing—it analyzed competitors like Webex and Skype, conducted market research, and tested price elasticity to refine its strategy. By offering a free tier with a 40-minute meeting limit, Zoom attracted a massive user base and encouraged upgrades to paid plans. This model proved especially effective during the pandemic, as businesses and schools needed reliable video conferencing.

By continuously adjusting its pricing structure based on usage data and competitive trends, Zoom became the dominant player in the video conferencing space.

Marketing channels

A great product with bad marketing is like a billboard in the middle of the desert. You need to be where your customers are already hanging out.

Ask yourself:

- Do they spend time on social media? If so, which platforms?

- Are they searching Google for solutions? Is the search traffic branded or not?

- Would influencer marketing, paid ads, or email campaigns work better?

Focusing on the right marketing channels could move you one step closer to making sure that every marketing dollar goes where it counts.

Potential barriers

Even the best plans hit roadblocks. A good team should be able to anticipate them in advance.

Consider manufacturing or supply chain delays, shifting regulations in your industry, and customer skepticism or adoption resistance.

Identifying potential pitfalls early gives you time to put solutions in place—so you don’t get blindsided later.

Want to see how data-backed decisions can shape your next product launch? Explore Similarweb’s platform for real-time competitive intelligence.

The steps of market research for new product development

Market research for new product development isn’t just a box to check—it’s the backbone of creating products that actually sell.

Each step in the process serves a purpose: to remove uncertainty, minimize risks, and make sure that your product fits market demand. Let’s break it down.

1. Understanding the market landscape

Detailed market research is your starting point—it’s how you figure out whether a product idea has legs or if it’s going to flop. This means diving into trends, consumer behavior, and demand shifts before you even think about launching.

And here’s where Similarweb steps in. With tools that give you industry stats, website traffic data, and audience demographics, you get a clear view of market trends and shifting consumer expectations.

Instead of guessing, you’ll have real data to identify trends, anticipate demand, and strategically position your product in a way that makes sense.

2. Identifying and validating target customers

Knowing who your audience is – and what they really want – is non-negotiable. That’s why the best companies don’t assume; they ask.

Customer research techniques like interviews, focus groups, and surveys help you create a product that solves real problems rather than just throwing features at the wall and hoping they stick.

If you perform quality research, you get precise profiling.

You’ll know:

- What motivates their buying decisions

- What problems they’re trying to solve

- How to position your product so it resonates

When you truly understand your customers, everything – from product design to marketing – gets sharper, more targeted, and, ultimately, more successful.

Define your ideal customer profile using audience insights. Focus on what influences their choices and tailor your product accordingly.

3. Evaluating competitors

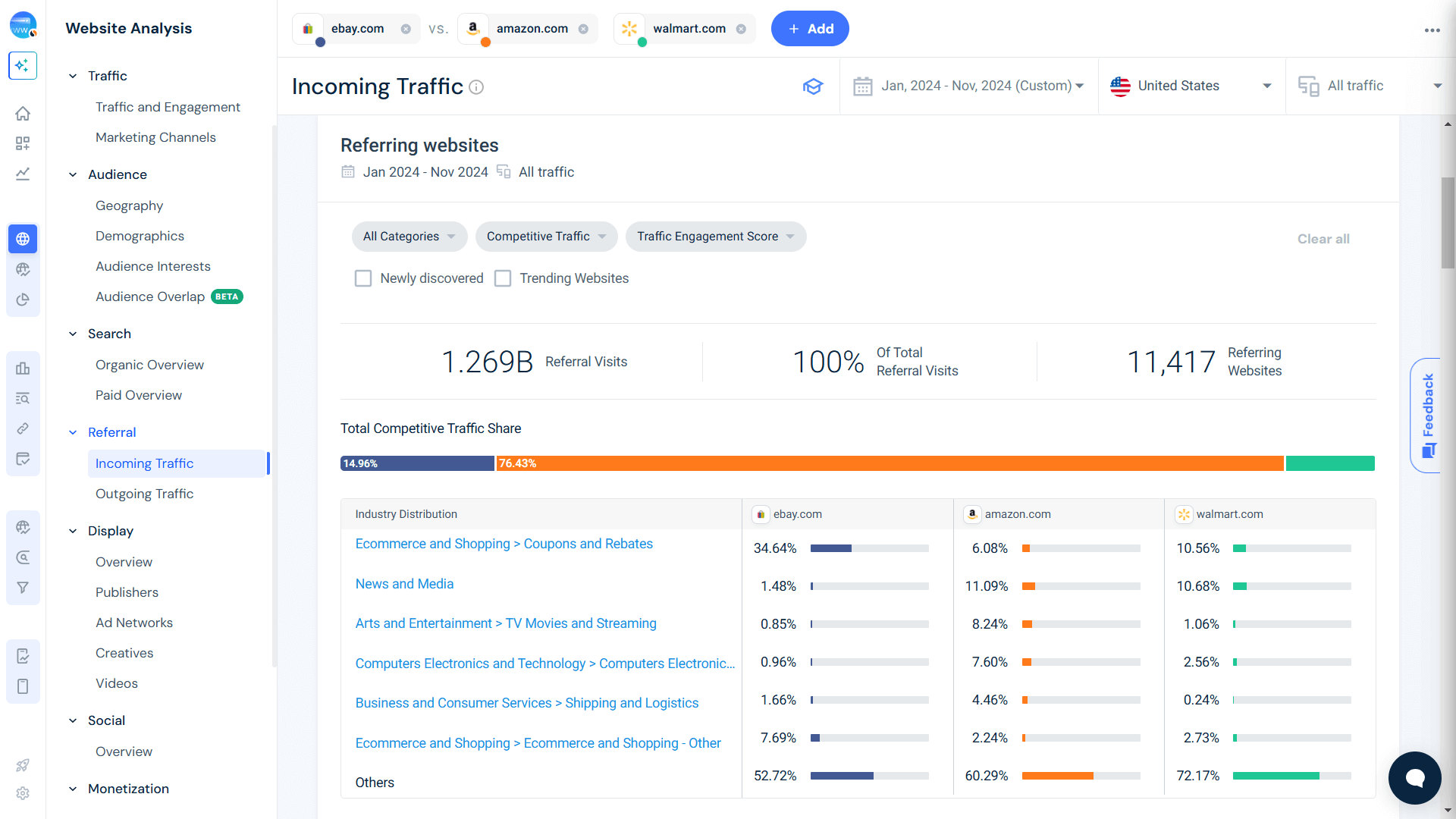

Your rivals are your greatest source of competitive intelligence – but only if you have the right tools to analyze them. With Similarweb, you can instantly see where their traffic comes from, how their customers engage, and where they’re leaving opportunities on the table.

Market leaders regularly research rivals. That means learning about their website traffic sources (where are they getting customers from?), performance metrics (what’s working for them and what’s not?), and gaps in their strategy (where are they failing to meet demand?).

With Similarweb’s Competitor Analysis tools, you can benchmark yourself against top competitors and find the market and audience gaps they’re missing out on.

This information is gold because it lets you differentiate, whether that’s pricing, features, or positioning. Instead of playing catch-up, you’ll be setting the pace.

Run a competitive analysis using Similarweb’s platform. Identify the key weaknesses in your top competitors’ strategies and find ways to capitalize on them.

4. Concept testing and feedback collection

Good products don’t happen by accident. They’re tested, refined, and improved before ever hitting the shelves. Before committing to full-scale production, you need validation – real feedback from potential buyers.

You can use customer surveys to gauge initial reactions or do consumer behavior tracking to monitor buying intent. You can also make use of product feedback tools to identify dealbreakers early. But how do you do this at scale?

You need to know:

- If your product fits the market

- Whether demand is high enough to justify investment

- What tweaks to make before launch

By testing early, you reduce risk, improve product fit, and avoid expensive missteps down the line.

Types of data to leverage in market research

Whether you’re refining a product, entering a new market, or optimizing your strategy, tapping into multiple data sources can result in higher accuracy and greater success.

Here are three examples of the types of data that can fuel effective market research:

Keyword trends

Ever wonder what’s on your customers’ minds? Recognizing customer search patterns reveals what people want—and when they want it.

By tracking keyword trends, businesses can identify emerging demands before competitors catch on and refine product positioning to match search intent. This can also pinpoint seasonal spikes so marketing efforts can be adjusted accordingly.

Referral traffic and conversion funnels

Want to know how your competitors are capturing traffic—and how you can do it better? Referral traffic and conversion funnel analysis give businesses an inside look at:

- Where do potential buyers come from → Search engines, social media, partnerships?

- What’s driving conversions → Ads, blog content, discounts—what’s working?

- Where drop-offs happen → Identify weak points in the buying journey and optimize.

With these insights, you can fine-tune your strategy, redirect traffic, and capture market share.

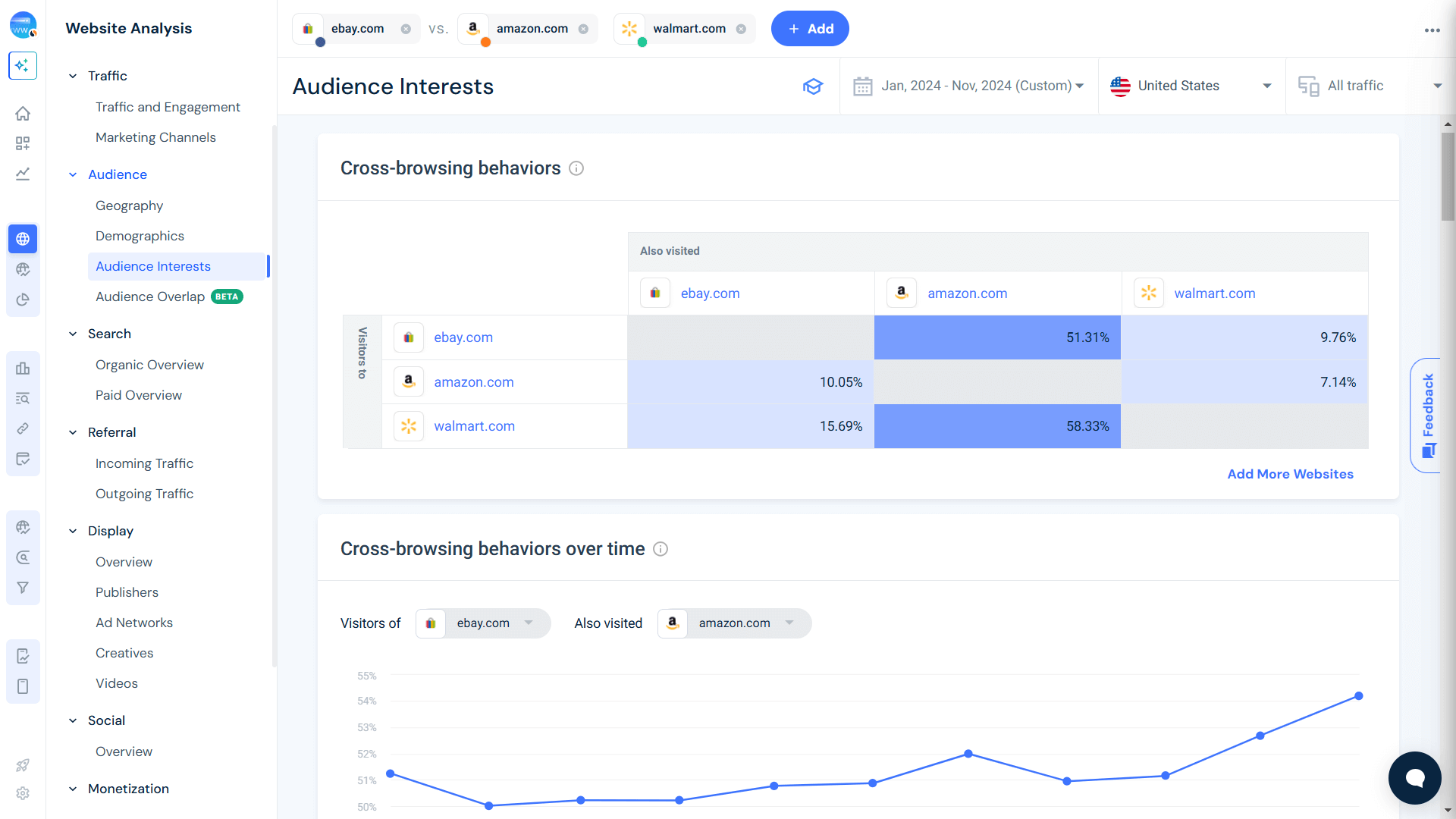

Audience segmentation

Not all customers are the same—and treating them as such is a mistake. Audience segmentation helps brands break down their target market into meaningful groups so that marketing efforts hit the right people at the right time.

This data allows businesses to tailor messaging to different audience segments based on interests, behaviors, and demographics.

Product positioning can also be refined to attract the most valuable customers. It also optimizes ad spend by focusing on high-converting customer groups.

Think of these datasets as the building blocks of a strong market research strategy. They provide a deeper learning of customer behavior, market demand, and competitive positioning—all necessary for making smarter, evidence-based decisions that drive growth.

Using Similarweb for new product market research

Launching a new product is high risk, high reward – and success depends on knowing who your customers are, what they want, and how the competition is moving.

Let’s take a look at a direct-to-consumer (D2C) fitness brand looking to develop an eco-friendly activewear line. Their success hinges on knowing market demand, competitive positioning, and audience profiling – all important for making their launch a hit.

So, how does Similarweb help brands conduct full-scale market research before a product launch?

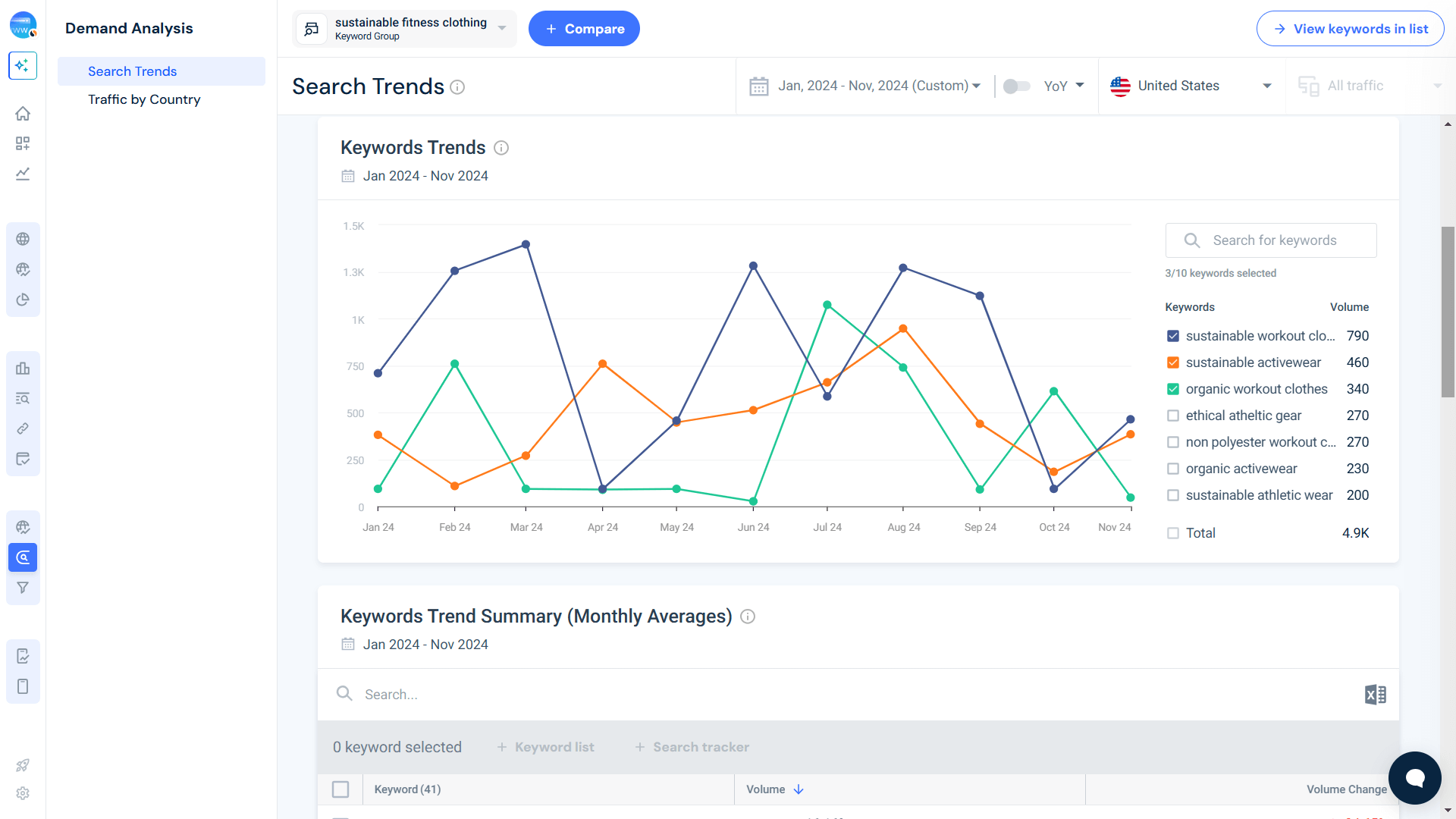

Step 1: Analyzing market trends with Similarweb

Before investing in design, manufacturing, and marketing, a brand needs to confirm whether there’s real demand for sustainable fitness wear. Using Similarweb’s Demand Analysis, they uncover clear growth signals in search behavior.

Keyword searches like “eco-friendly gym wear” and “sustainable fitness clothing” are on the rise, while steady search volume growth signals increasing interest in sustainable options. It also shows that traffic to competitor sites with eco-friendly offerings is spiking.

This data proves the demand is there. The brand now knows that eco-conscious consumers are actively looking for products like theirs so they can shape marketing strategies and product features around what matters most to their audience.

Step 2: Benchmarking against competitors

Winning in a competitive market means knowing who you’re up against and what’s working for them.

With Similarweb’s Competitive Analysis, brands can assess their top competitors who are already selling sustainable fitness wear. Here’s what they discover:

Traffic sources

Competitors pull massive traffic from social media and referrals, and a brand must invest in these channels to stay competitive.

Audience insights

Competitor audience data shows a heavy lean toward Millennials and Gen Z. These buyers prioritize sustainability, health, and fitness. With this intel, the brand can refine its content and outreach to better connect with these consumers.

By studying the competition, the brand can sharpen its strategy to increase user interest, brand awareness, and market penetration.

Step 3: Refining the target audience

You can’t sell to everyone. But you can sell to the right people.

Using Similarweb’s audience interests and demographics data, this brand can build a data-backed customer profile:

- Targeting 25-40-year-olds interested in fitness, health, and sustainability

- These consumers frequently visit health blogs, sustainability websites, and fitness marketplaces

With this refined audience profile, the brand adjusts its product positioning, ad targeting, and messaging to increase relevance and user activity.

Step 4: Validating the product idea

The brand isn’t going into full-scale production just yet. Before committing, they assess search intent data and category performance to confirm viability—and it pays off.

Untapped opportunities emerge, particularly in Southeast Asia, where interest in sustainable activewear is booming.

By validating demand first, the brand verifies that its strategy is built on solid data so that the risks are reduced and the chances of market success are higher.

The outcome

Armed with Similarweb’s actionable data and insights, this brand can launch its sustainable activewear line with a clear understanding of market demand, competitive pricing based on real-world information, and a fine-tuned marketing plan targeting the right audience.

The result? A successful launch proves that evidence-based research is the difference between guessing and winning.

Common pitfalls in market research (and how to avoid them)

Even with solid research, businesses can fall into common traps. Here’s what to watch for:

- 👵 Using outdated data → Market trends shift fast. Ensure you’re analyzing real-time insights rather than relying on last year’s reports

- 🔢 Focusing only on numbers → Quantitative data is critical, but don’t overlook qualitative insights from surveys, reviews, and social listening

- 🕵️♀️ Copying instead of innovating → Learning from competitors is smart, but true success comes from differentiation.

Pro Tip: Use Similarweb’s competitor benchmarking to identify gaps—not just imitate what’s already out there.

Leverage Similarweb’s actionable insights to innovate – faster and better

Bringing a new product to market without research is like running a race blindfolded.

With Similarweb data and insights, brands gain the visibility, insights, and strategic direction needed to minimize risk, seize opportunities, and launch smarter.

Don’t leave your next product launch to chance. See how Similarweb can supercharge your next product launch with real-time market intelligence.

FAQs

What are the initial steps for conducting market research?

Start with a clear game plan. Define your objectives and what you need to uncover. Pinpoint the key questions that will shape your strategy. Next, choose the right data collection methods: surveys, focus groups, customer interviews – each has its strengths, so pick what fits best. Once you’ve gathered data, analyze it to refine product features, target the right audiences, and craft marketing strategies that actually drive results.

What types of questions should be included in market research?

Your questions should dive deep into consumer behavior, preferences, and buying habits. What do customers want from a product? How much are they willing to pay? What pain points are they looking to solve? You’re not just collecting data—you’re gathering insights to shape your strategy. Competitive intelligence is just as crucial: What are your rivals doing well? Where are they falling short? The right questions ensure you’re making informed decisions, not guesses.

Why is competitor analysis beneficial for product development?

Your competitors have already tested the market—so learn from them. A strong competitor analysis reveals what they’re doing right, where they’re struggling, and how market trends are shifting. Spotting their strengths and weaknesses helps you uncover gaps they’ve missed, allowing you to position your product more effectively. This isn’t about copying—it’s about standing out. The more you understand the competitive landscape, the better you can create products that customers actually want (and will pay for).

How do surveys contribute to market research efforts?

Surveys are your direct line to customers. They reveal what your audience wants, what frustrates them, and what drives their purchasing decisions. Whether you’re collecting quantitative data to identify trends or qualitative feedback to refine messaging, surveys provide real-world insights that guide product development, pricing, and marketing. Used strategically, they help ensure you’re building something people truly need.

How does market validation help in product launches?

Market validation is your insurance against flops. Before committing resources, you need proof that people actually want what you’re building. Gathering feedback, running tests, and making real-world tweaks reduce risk and boost your chances of success. The result? A product that’s not just innovative – but one that customers are eager to buy.

Track your digital metrics and grow market share

Contact us to set up a call with a market research specialist