Similarweb vs. ChatGPT for Market Research: What Works, When, and Why

I hate to write “let’s face it”, but let’s face it: ChatGPT and other in-chat AI tools changed the way professionals ask questions, write copy, and ideate products. Many tasks that were previously performed with various tools are now done directly in ChatGPT to collect data and get answers.

To put it simply: If you are trying to choose between Similarweb and ChatGPT for market research, you are actually choosing between two different engines with very different goals:

- ChatGPT: A generative system that synthesizes text and can optionally retrieve information from connected sources. It is excellent for brainstorming, summarizing, and shaping early hypotheses.

- Similarweb: A measurement platform that quantifies how people actually behave across the open web, mobile apps, and marketplaces. It is built as a data engine that collects and synthesizes billions of digital signals.

Market research needs accuracy, timeliness, and context.

This article compares ChatGPT’s answer synthesis with Similarweb’s market signals to determine which is better for the market research process.

Which tool can help you quantify demand, track share, and spot channel shifts early, then turn those findings into action?

Let’s compare Similarweb and ChatGPT (Model 5.1, Thinking) in data freshness, scale, metrics, and practical use cases. You will see where ChatGPT speeds up ideation and synthesis, and where Similarweb delivers auditable, decision-grade evidence for market researchers.

TL;DR

- Use ChatGPT for brainstorming hypotheses, summarizing long texts, drafting surveys, or assembling a first pass on competitor lists. With connectors, it can pull documents from your systems, but output quality depends on the sources you attach and how you prompt.

- Use Similarweb when you need measurable market signals: traffic share, channel mix, keyword demand, referral partners, app usage, on-site search on retailers, and conversion benchmarks. These are observed behaviors, not self-reports, with defined methodologies and historical context.

- Data freshness and scale: Similarweb’s products provide up to 37 months of history in enterprise tiers across Web, Sales, and Shopper Intelligence. That means trend analysis, seasonality, and time-based benchmarking. ChatGPT does not have access to a native market metrics database.

- Similarweb and ChatGPT work very well together, especially with APIs. You don’t have to choose between the two, you only need to know each one’s strengths and weaknesses.

What is ChatGPT?

ChatGPT is a conversational AI from OpenAI that generates and refines text, answers questions, and summarizes content in a chat interface. The core experience is a dialogue where you ask for tasks or explanations and iterate in natural language.

ChatGPT is best at helping with planning research, drafting surveys, synthesizing long documents, and turning notes into clear narratives. It can connect to third-party apps through “connectors.” With the right plan and permissions, you can let it search files from tools like Google Drive or SharePoint and return citations to the originals inside the chat.

Output quality depends on what you connect and how you prompt, which is why teams often pair ChatGPT’s drafting and synthesis with a measurement platform when they need verified market metrics.

What is ChatGPT good at?

- Exploration and synthesis: It can quickly generate draft market landscapes, question sets for interviews, or summaries of long PDFs you upload.

- Reasoning over your files and tools: Connectors let ChatGPT pull from services like Google Drive or SharePoint, then reason over that content in a single view. Your output quality is only as good as the inputs you provide.

- Limitations: ChatGPT can make mistakes or misinterpret source material when it lacks explicit citations or structured data. Treat it as a writing and reasoning assistant, not a measurement instrument.

What is Similarweb?

Similarweb is a digital intelligence platform that measures how people discover, research, and buy across the open web, generative AI engines, mobile apps, and online marketplaces. It turns those signals into market intelligence you can use for competitive benchmarking, demand analysis, and go-to-market planning.

Product families include Gen-AI Intelligence and Web Intelligence for websites and search, App Intelligence for mobile usage and rankings, Shopper Intelligence for marketplace behavior, such as on-site search and conversion, and Sales Intelligence for B2B company research and technographics.

Teams use these modules to quantify traffic share, channel mix, keyword demand, ad activity, product performance on retailers, and more.

What is Similarweb good at?

- Quantifying digital behavior at scale:

- AI brand visibility

- Web visits

- User engagement

- Marketing channel share

- Keyword demand

- PPC spend estimates

- App usage

- Marketplace on-site search

- Retailer conversions

- Cross-shopping IQ

- and more…

- Benchmarks and competitive context: Track your position by industry, segment, and geography. Compare yourself against direct and emerging competitors.

- Repeatable time-series analysis: Track trends by country and device, and compare competitors side by side.

- Purpose-built modules:

- Web Intelligence for market research, SEO, PPC, competitive analysis, market sizing, and demand.

- Generative AI Intelligence: for generative engine optimization and AI brand visibility, sentiment analysis, citation analysis, and prompt analysis.

- Shopper Intelligence for Amazon and marketplaces: category share, product views vs. purchases, on-site search, basket behavior.

- Sales Intelligence for B2B prospecting, technographics, and intent, integrated with CRM workflows.

- Advisory Services & Data Labs for bespoke datasets, brand health, consumer journeys, and surveys that bridge the say-do gap.

- Custom dashboards and data connections: You can set custom dashboards or export to your own dashboards, then document the methods behind each metric. That’s critical when you need auditable numbers at a large scale.

Side-by-side: Similarweb vs. ChatGPT for market research

| Dimension | ChatGPT | Similarweb |

| What it is | A generative system that writes, summarizes, and reasons over text and data you provide or connect. | A measurement platform that quantifies digital behavior across web, apps, and marketplaces. |

| Primary use | Brainstorming, summarizing long docs, drafting surveys, synthesizing notes, and first-pass competitor lists. | Market sizing, share tracking, channel mix, keyword research, Gen-AI tracking, competitor analysis, PPC analysis, affiliate discovery, on-site search, conversion, and app usage. |

| Data foundation | Model knowledge plus optional connectors to your sources. Quality depends on what you attach. | Direct measurement and modeled estimates from multiple digital signals, with clear methodology. |

| Data freshness | Varies by connector and browsing setup. | Continuously refreshed datasets, with product pages highlighting frequent updates and recent feature releases. |

| Time series | Not a built-in metrics warehouse. | Rich time series for traffic, keyword trends, SEO, PPC, ads, app rankings, and marketplace behavior. |

| Verification | Requires external validation or citations. | Defined metric calculations and repeatable methods you can document and export. |

| Search & SEO | Draft content, structure briefs, and summarize SERP research from sources you provide. | Measure keyword volumes, AI traffic, AI visibility and prompts, keyword gaps, site audit, backlink analytics, rank by device and geo, SERP features, and landing pages. |

| Paid search | Can outline tests or forecast structures from inputs. | See competitor keywords, ad creatives, PPC spend estimates, landing pages, and geography views. |

| Affiliate & referral | Can list ideas based on text sources. | Finds competitor affiliates, quantifies referral traffic, and reveals partner gaps. |

| Marketplace insights | No native marketplace panel. | On-site search, product views vs. purchases, and conversion on retailers like Amazon, Walmart, and Target. |

| App intelligence | No native app metrics. | App rankings, installs, usage, and audience interests with market-level benchmarking. |

| B2B sales research | Draft outreach and summarize account notes. | Company lists, intent, technographics, and CRM-ready exports. |

| Integrations & reporting | Exports text, depending on your stack. | Datahub dashboards, Looker Studio connector, data feeds, APIs for reproducible charts. |

| Best used for | Hypothesis generation, writing, synthesis, and decision support with human review. | Data-driven decision-making, web traffic analysis, competitive benchmarking, and ongoing market monitoring. |

| Limitations | May misinterpret sources or hallucinate without strong grounding. | Requires access to the platform or datasets, and understanding of metrics to interpret results. |

The metrics that matter in market intelligence

1) Market positioning and share

- Total visits, unique visitors, engagement, loyalty, device split, and channel mix. These give a reliable baseline and let you track gains in share by category.

- Use it when: You need a quarterly board update on digital performance, an investor readout, or competitive benchmarking across the whole funnel.

2) Marketing channel breakdown and paid strategy

- PPC share of spend, branded vs. non-branded mix, affiliates, display, social creatives. This turns “we think they increased paid” into “they shifted budget into non-brand search and affiliates last month.”

- Use it when: You want to balance paid vs. organic acquisition and police agency performance.

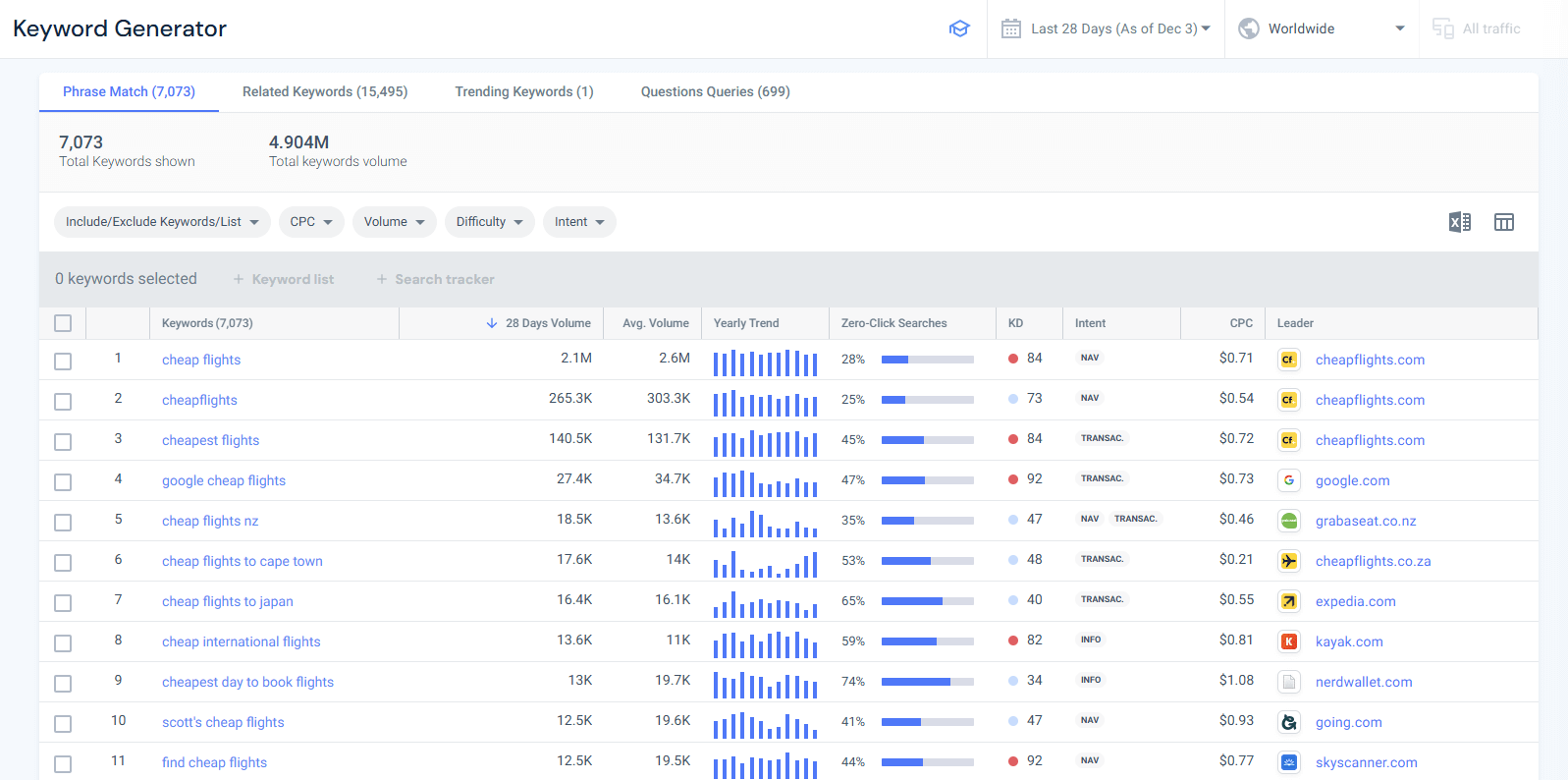

3) Search and keyword demand

- Keyword research with volumes, landing pages, and rank tracking, plus localized views by geo. You can move from a generic “SEO opportunity” to targeted clusters with measurable upside.

- Use it when: You need a content roadmap rooted in actual demand, including non-brand discovery terms.

4) Marketplace intelligence

- On-site search volume and clicks on retailers, product views, purchases, and conversion. Understand what shoppers type, which SKUs convert, and which attributes correlate with purchase.

- Use it when: You are deciding promotions, assortment, or retail media spend.

5) App usage and adoption

- Monthly active users, penetration, sessions per user, session duration, and app rankings. Quantify engagement and cross-over with web audiences.

6) AI and Gen-AI visibility

- GPT Brand Health and the AI Brand Visibility tools track prompts and answers mentioning your brand in chatbots, filling a blind spot that standard social listening misses.

Examples for market research with ChatGPT vs. Similarweb

Let’s check what the data means in practice: Below are examples of market research steps, and how they play out in Similarweb and ChatGPT. See for yourself which tool helps you turn signals into action.

Example A: Traffic share dips 0.4 points in your category

Typical prompt

- “Why did our category share drop by 0.4 points last month, and what should we do about it?”

ChatGPT

- What you get: A narrative hypothesis. It may suggest seasonality, competitor campaigns, or pricing changes. If you attach reports, it will summarize them and propose tests.

Does anyone see any concrete data?

- Limits:

- No native market share time series.

- Numbers depend on what you connect or paste.

- Cannot directly quantify competitor non-brand PPC or affiliate growth in the last 30 days.

- Usefulness: Good for brainstorming causes and drafting an action list you can later verify.

Similarweb

Open the Market analysis tool, set the country and time window, add your site and 3–5 competitors, then scan the share trend to confirm the dip.

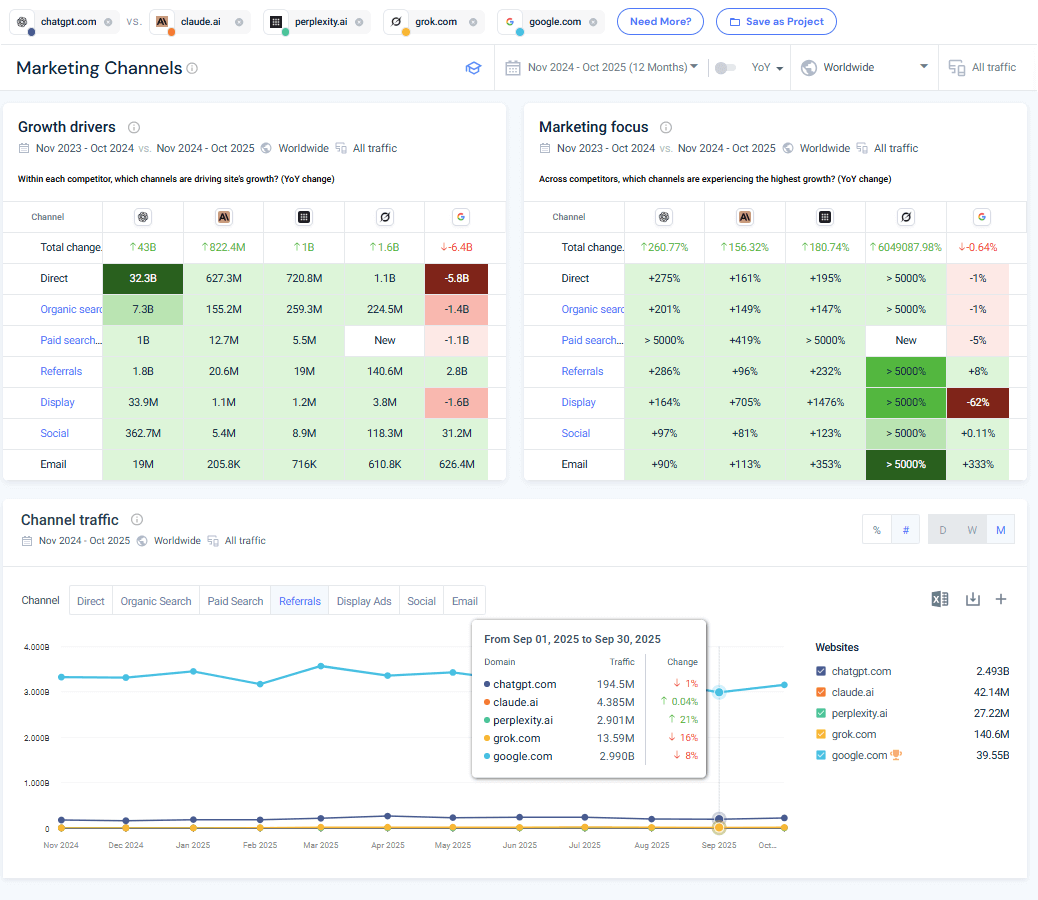

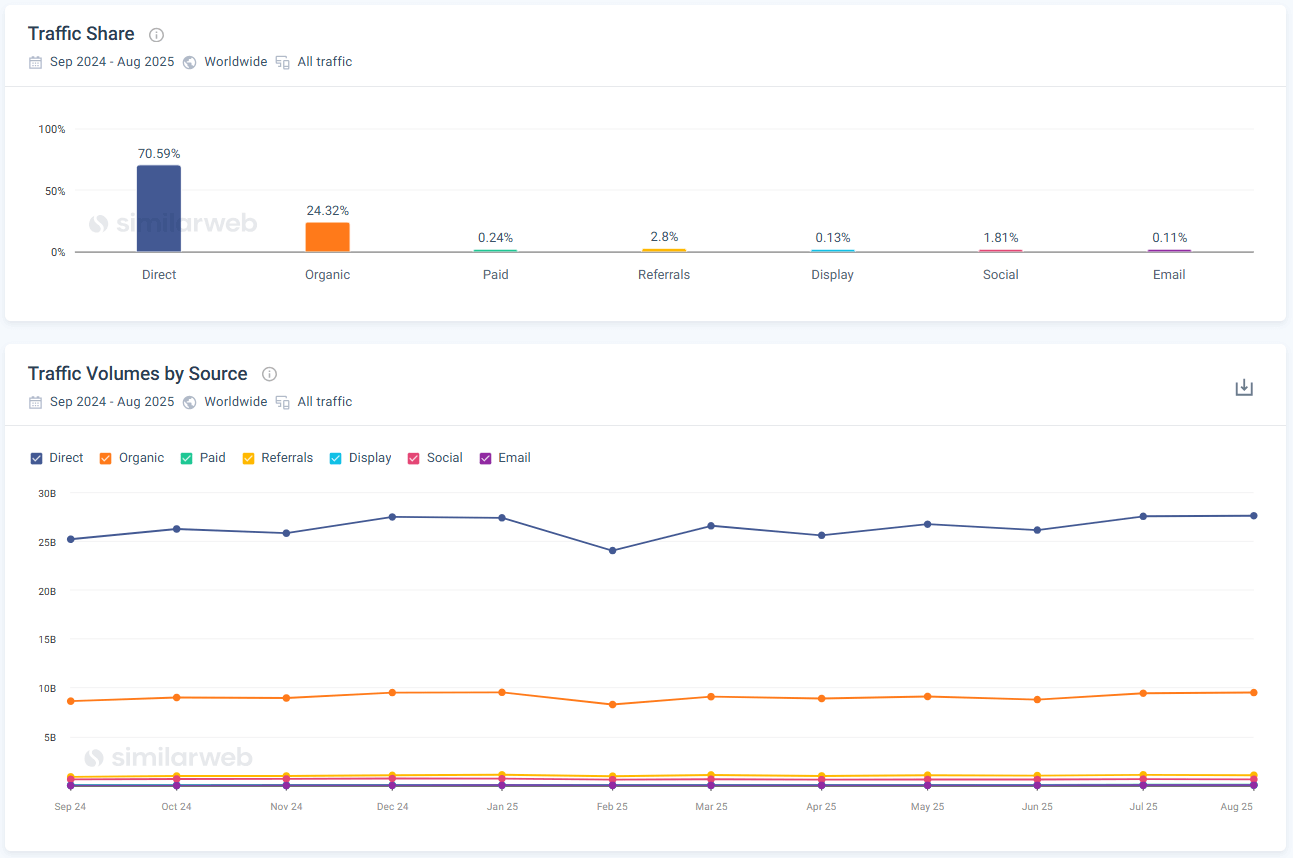

Jump to Marketing Channels to see which source moved. If the search channels look different, open Paid Search for non-brand terms and Search Ads to view creatives and landing pages. Here’s an example of the marketing channels breakdown for ChatGPT vs. Google and other competitors over the past 12 months:

If partners moved, open Referrals to spot rising affiliates.

- What you get: Measured signals.

- Market Overview shows share and MoM or YoY change.

- Marketing Channels identifies where the mix shifted.

- Paid Search and Search Ads show competitor non-brand growth, ad creatives, and landing pages.

- Referrals highlight new or expanding affiliates.

- Decision impact: You can tie the 0.4-point dip to concrete drivers (for example: non-brand search down 6 percent, affiliate referrals at rivals up 9 percent) and size the fix by subcategory, geo, and device.

Example B: On Amazon, new products’ sales stall despite strong clicks

Typical prompt

- “Our new line gets clicks, but conversions lag category median. What is happening and how do we fix it?”

ChatGPT

- What you get: Suggestions based on PDP best practices, reviews of language, and common retail media tactics. If you provide your product pages and ad copy, it will edit or rewrite them.

- Limits:

- No direct view of on-site search terms, product views vs. purchases, or SKU conversion unless you upload proprietary reports.

- No benchmark against category medians from live marketplace behavior.

- Usefulness: Helpful for copy iteration and A/B test ideas once you know which attributes need work.

Similarweb

In Shopper Intelligence, set the retailer and country. Check On-site Search to see the exact terms shoppers use.

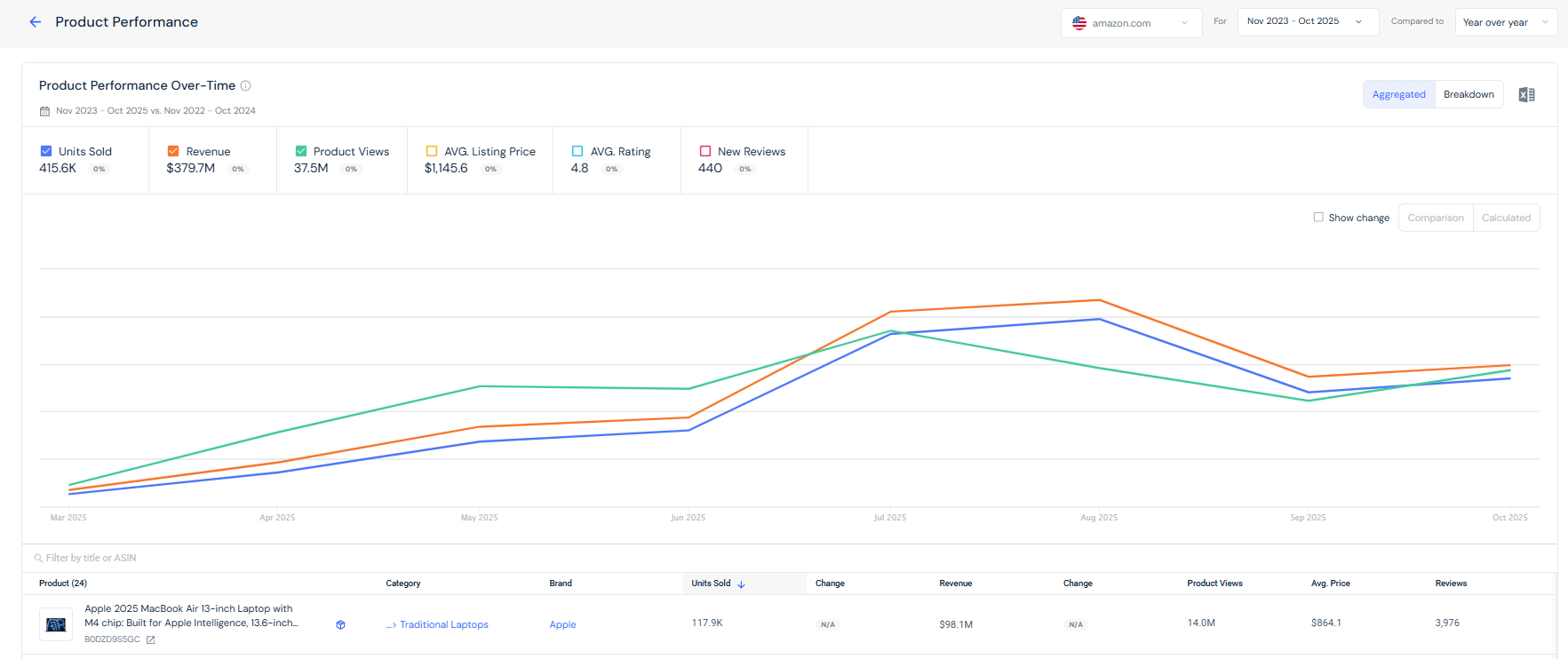

Here’s the view for “MacBook Air”:

Then go to Product Performance for views vs. purchases at the SKU level, and Conversion Overview to benchmark against the category median.

Use the terms you found to optimize your PDP and retail media targeting.

- What you get: Retailer behavior data.

- The On-site Search tool exposes the exact queries gaining traction.

- Product Performance shows views, purchases, and conversions by SKU or attribute.

- Conversion Overview benchmarks you vs. the category median.

- Decision impact: Optimize PDP content and retail media targeting around the top converting query language. Track the lift at SKU and attribute level over the next 4 to 8 weeks.

Example C: AI Overviews start appearing for your category queries

Typical prompt

- “AI Overviews now appear for ‘best budget e-bike’. How do we adapt?”

ChatGPT

- What you get: A clear summary of what AI Overviews tend to surface, suggested page structures, and schema tips. It can draft concise answer blocks for your pages.

I’ll save you the full answer, but there was no data there:

- Limits: Does not monitor when and where AI Overviews appear at scale, nor how often your brand is cited across assistants.

- Usefulness: Strong for content drafting and checklists.

Similarweb

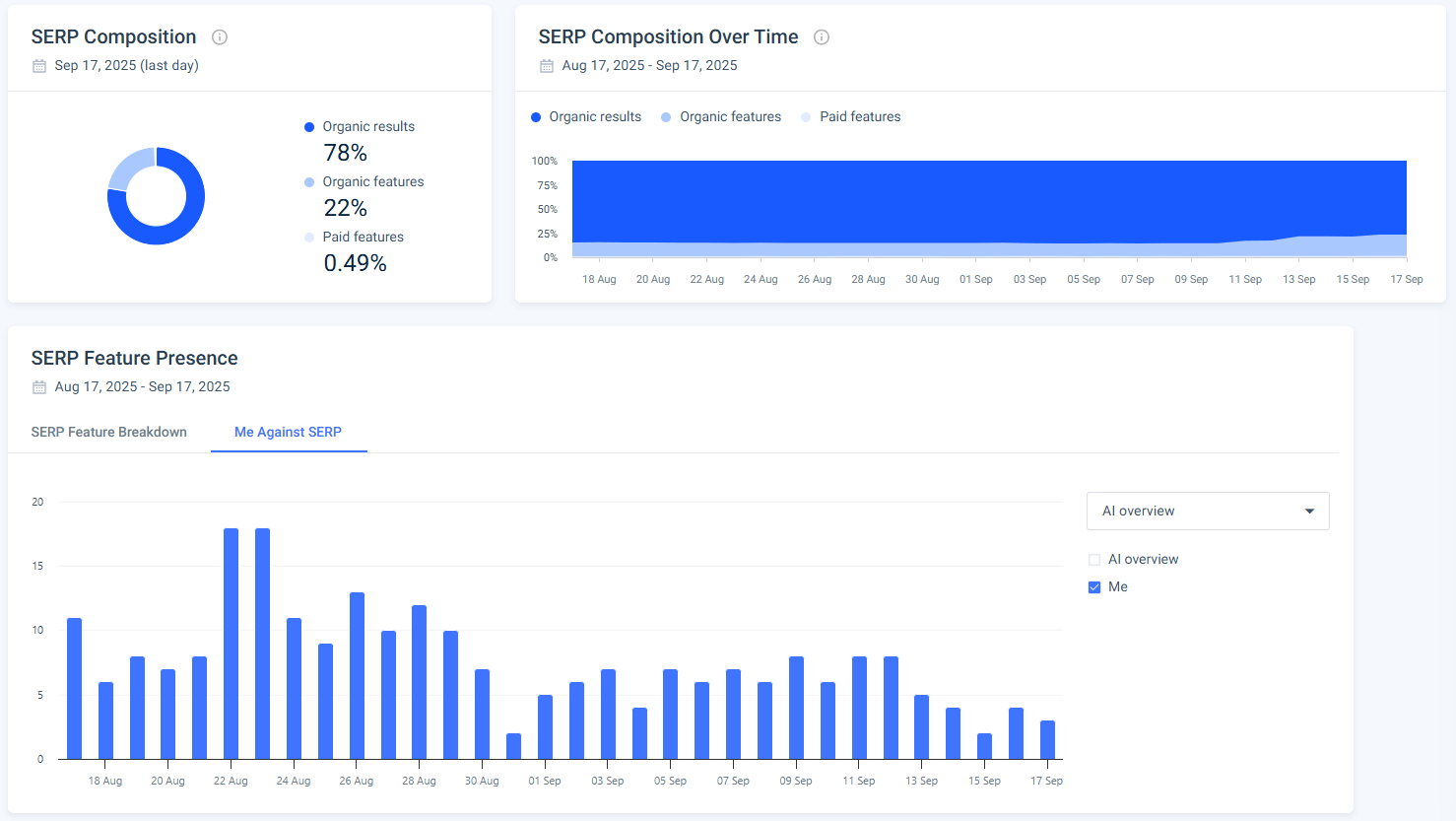

Start with the Keyword Research tool to size search demand and see click distribution. Then track your priority queries in the Rank Tracker by device and country.

For each keyword you track, you will be able to see the SERP features it appears for, including AI Overviews:

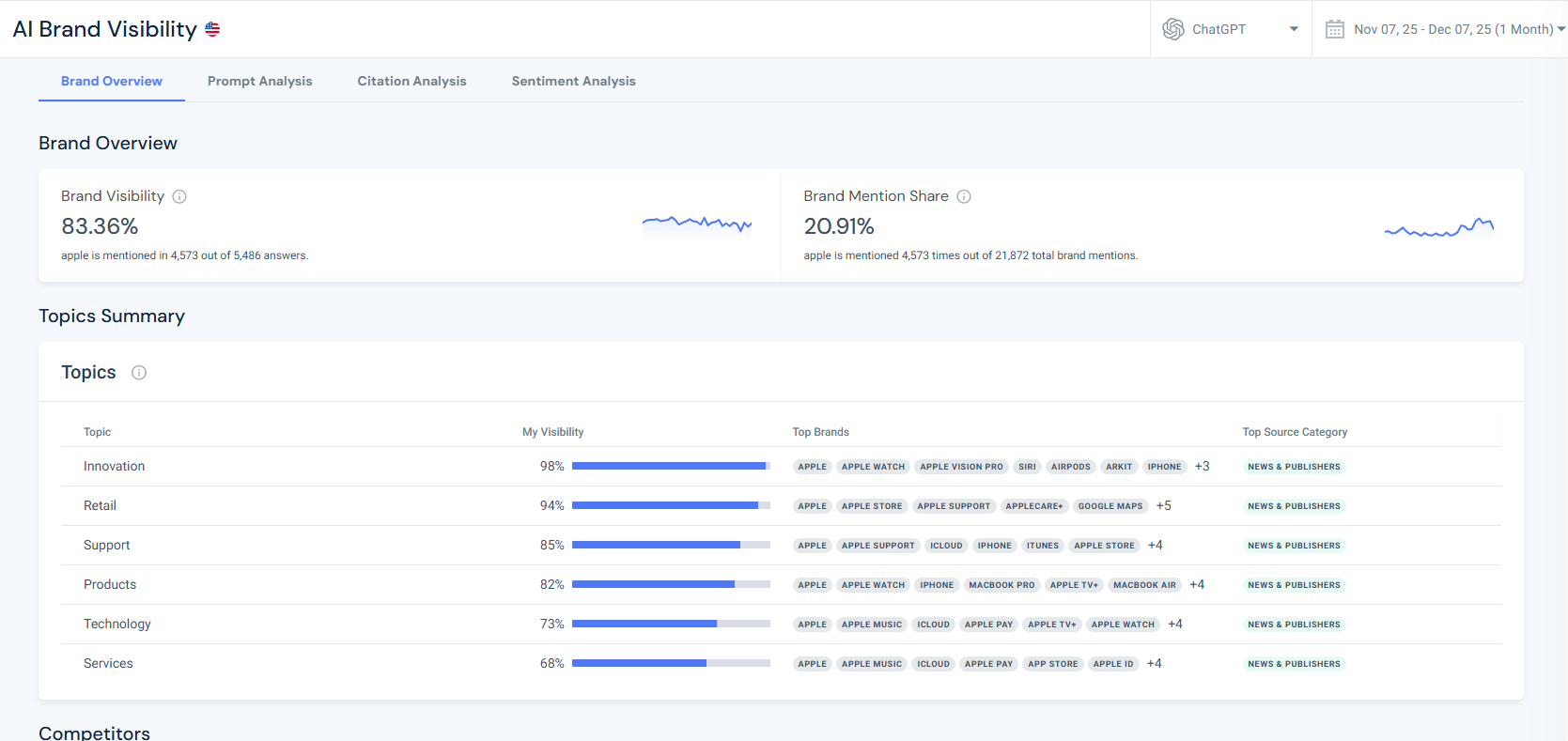

Use AI Brand Visibility or Brand Health to monitor brand mentions inside AI chatbot answers.

Prioritize topics where demand is sustainable and mentions rise after you publish.

- What you get: Measurement and monitoring.

- Keyword Research to size demand and detect shifts that correlate with the AI Overview rollout.

- Rank Tracker for device and geo positions for the affected queries.

- AI Brand Visibility and AI traffic tracker to track brand mentions inside generative answers.

- Decision impact: You can prioritize topics with durable demand, measure SERP and AI Overview exposure by country and device, and monitor whether brand mentions improve after content changes.

DIY: How to do market research in Similarweb vs. ChatGPT

1) Market positioning and share

Ask ChatGPT: “Who leads our category and how has share changed?”

- Likely output: A summary citing news, analyst notes, or docs you attach. It will describe leaders and possible trends.

- Risk: No consistent visit or share time series. Uses potentially outdated sources.

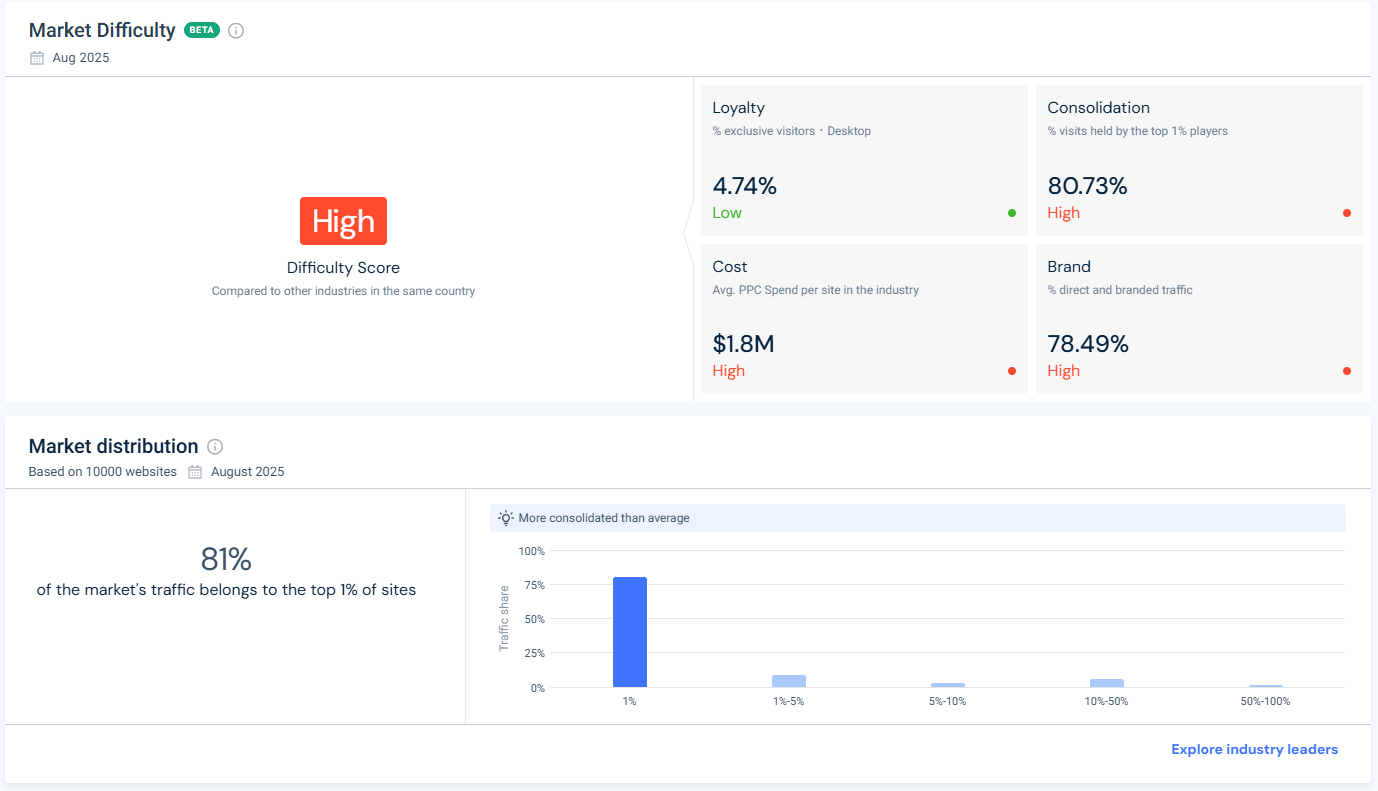

Do in Similarweb: Home → Market Overview

- Output: Total visits, market difficulty, market distribution, visit share, engagement, device split, loyalty, and change over time by country.

- Why it matters: Quarterly or board-level readouts require numbers you can export and reproduce.

2) Marketing channel breakdown and paid strategy

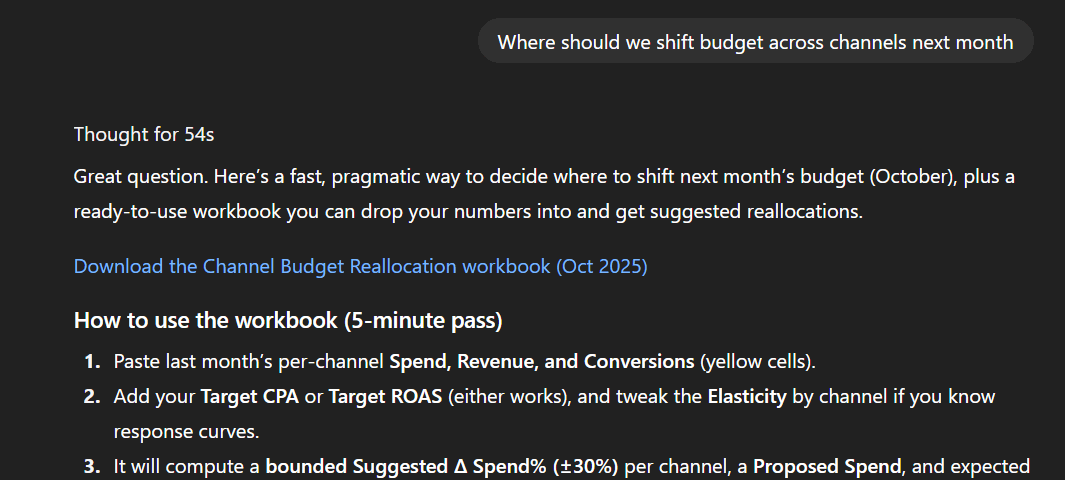

Ask ChatGPT: “Where should we shift budget across channels next month?”

- Likely output: A test plan based on general principles or any performance data you provide.

Nice, right? Think again. - Risk: No direct measurement of competitor channel mix or spend. Assumptions may be off.

Do in Similarweb: Marketing Channels, then Paid Search, Search Ads, Referrals

- Output: Channel shares by domain, branded vs. non-brand traffic split, paid keyword lists, creatives, landing pages, and affiliate partners.

- Why it matters: You can see which rivals increased non-brand and which affiliates are worth recruiting.

3) Search and keyword demand

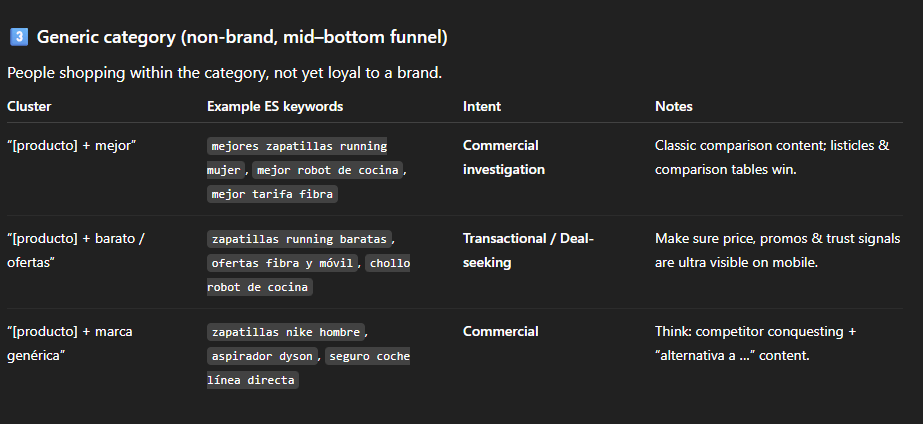

Ask ChatGPT: “Give me keyword clusters and search intent for Spain on mobile.”

- Likely output: Well-organized clusters and sample intents. If you paste exports from a tool, it will cluster and brief them.

- Risk: No built-in volumes, click distribution, or landing page mapping unless you supply them.

Do in Similarweb: Keyword Research and Rank Tracker

- Output: Volumes, click distribution between organic and paid, device and geo splits, SERP features, your and competitors’ landing pages, and tracked ranks over time.

- Why it matters: It lets you quantify upside and timeline, not just brainstorm topics.

4) Marketplace intelligence

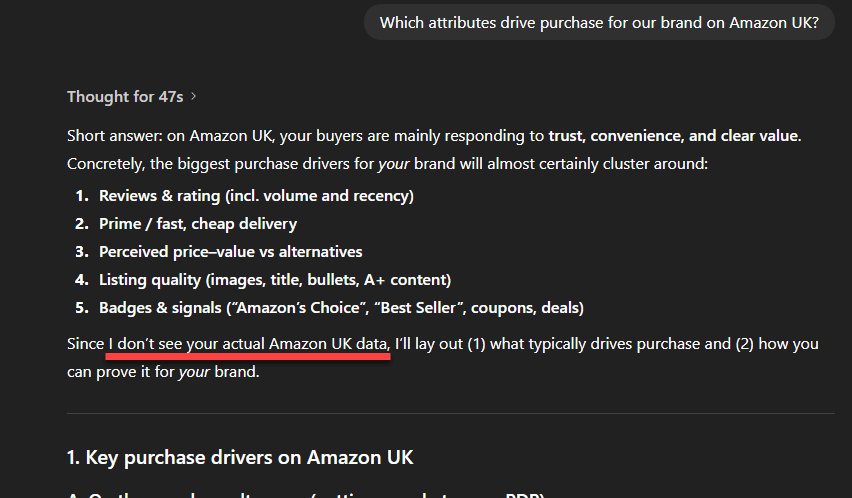

Ask ChatGPT: “Which attributes drive purchase for our brand on Amazon UK?”

- Likely output: Attribute hypotheses from reviews and best practices.

- Risk: No live on-site search, view-to-purchase funnels, or conversion medians by category.

Do in Similarweb: Shopper Intelligence → Search, Products, Conversion

- Output: On-site search terms and click paths, product views vs. purchases, conversion by SKU and attribute, category benchmarks.

Here you can see the top-selling products for the “MacBook Air” search and the top-selling pages to beat:

- Why it matters: Targets PDP rewrites, media, and assortment changes with evidence.

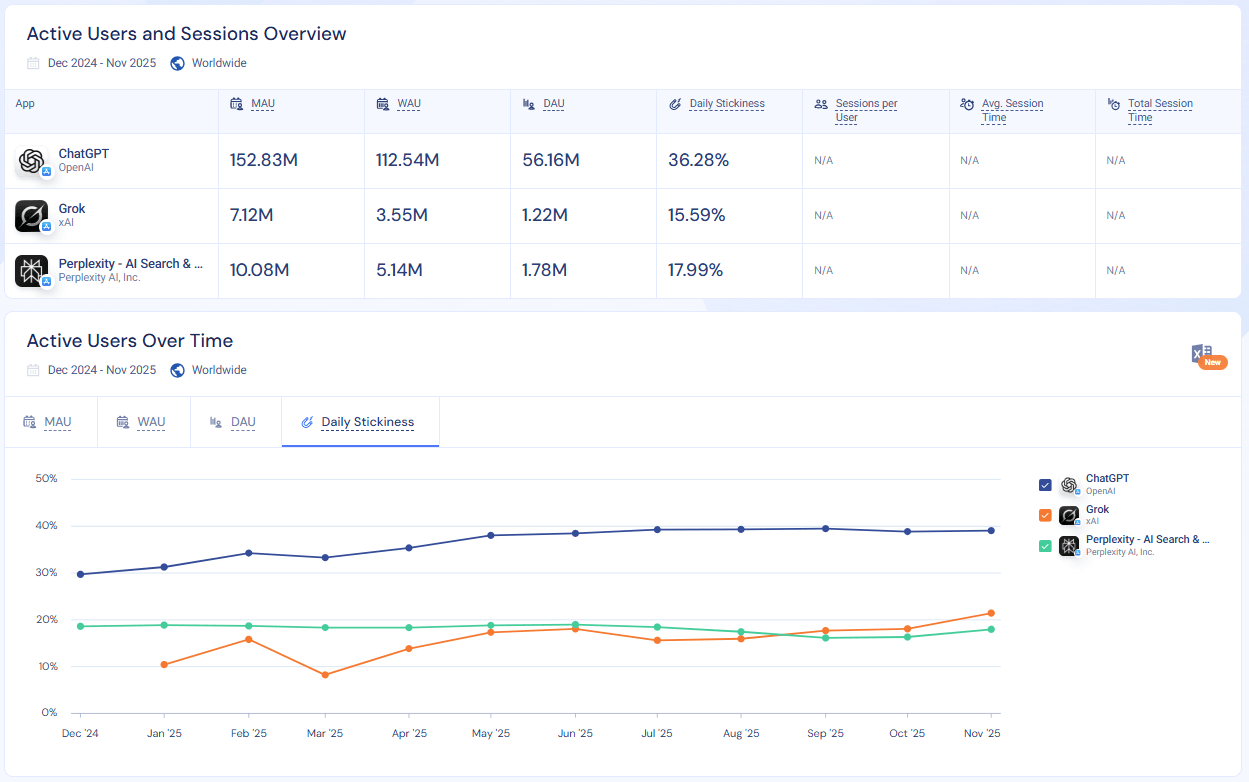

5) App usage and adoption

Ask ChatGPT: “Is our app gaining traction vs. Competitor X in Germany?”

- Likely output: A narrative based on store reviews, release notes, or articles you share.

- Risk: No MAU, sessions per user, or penetration metrics.

Do in Similarweb: App Intelligence → App Analysis

- Output: Installs, MAU, sessions per user, session duration, rankings, category trends.

For example, here’s ChatGPT’s app daily stickiness vs. Grok and Perplexity:

- Why it matters: It lets you quantify engagement changes and cross-over with web audiences.

6) AI and Gen-AI visibility

Ask ChatGPT: “How often does our brand show up in assistant answers?”

- Likely output: It can check within the current chat and produce examples.

- Risk: No monitoring across AI chatbots, topics, and time.

Do in Similarweb: AI Brand Visibility and AI Brand Health

- Output: Mentions and share of voice across prompts and assistants, tracked over time.

Here’s Apple’s brand visibility and brand mentions share by topic in the past month:

- Why it matters: Quantifies a new surface of discovery that standard listening misses.

Similarweb vs. ChatGPT market research: Value matrix

| Market research task | What ChatGPT typically returns | Open risks | What Similarweb returns | Decisions you can make |

| Explain a 0.4pt share dip | Narrative causes, generic tests | No measured mix or competitor spend | Share trend, channel mix, non-brand vs. brand, creatives, affiliates | Rebalance budget, recruit partners, defend plan with numbers |

| Fix Amazon conversion gap | PDP best practices, copy rewrites | No on-site search or SKU conversion | On-site queries, views vs. purchases, conversion vs. median | Update PDP attributes and retail media to match demand |

| Respond to AI Overviews | Page structure and schema tips | No scaled monitoring by query and geo | Demand trends, ranks, and AI brand mentions | Prioritize topics, measure exposure, track brand gains |

| Build a quarterly market view | Summary of sources you attach | Stale or incomplete inputs | Visits, traffic share, engagement by geo and device | Clear story for leadership with reproducible metrics |

| Plan non-brand SEO content | Clusters and intents | No built-in volume or click split | Volumes, click distribution, landing pages, tracked ranks | Content roadmap with expected impact by market |

| Benchmark your app vs. peers | Review-based narrative | No MAU or session metrics | Installs, MAU, sessions per user, rankings | Product roadmap and growth KPIs tied to usage |

Objectively: where ChatGPT fits

ChatGPT is an excellent assistant for research workflows:

- Create a research plan with hypotheses and interview prompts.

- Summarize the attached PDFs and transcripts, and ask it to highlight any contradictions or risks.

- Create a first pass competitor list, then validate it with Similarweb’s market data before you present.

- Generate survey questions, then run a behavioral survey through Similarweb Advisory Services if you need targeting based on observed behavior rather than self-reported panels.

Just remember: ChatGPT output must be verified before it becomes a part of your plan. Do not claim market share, demand, or conversion changes without measurement.

How to use Similarweb and ChatGPT together

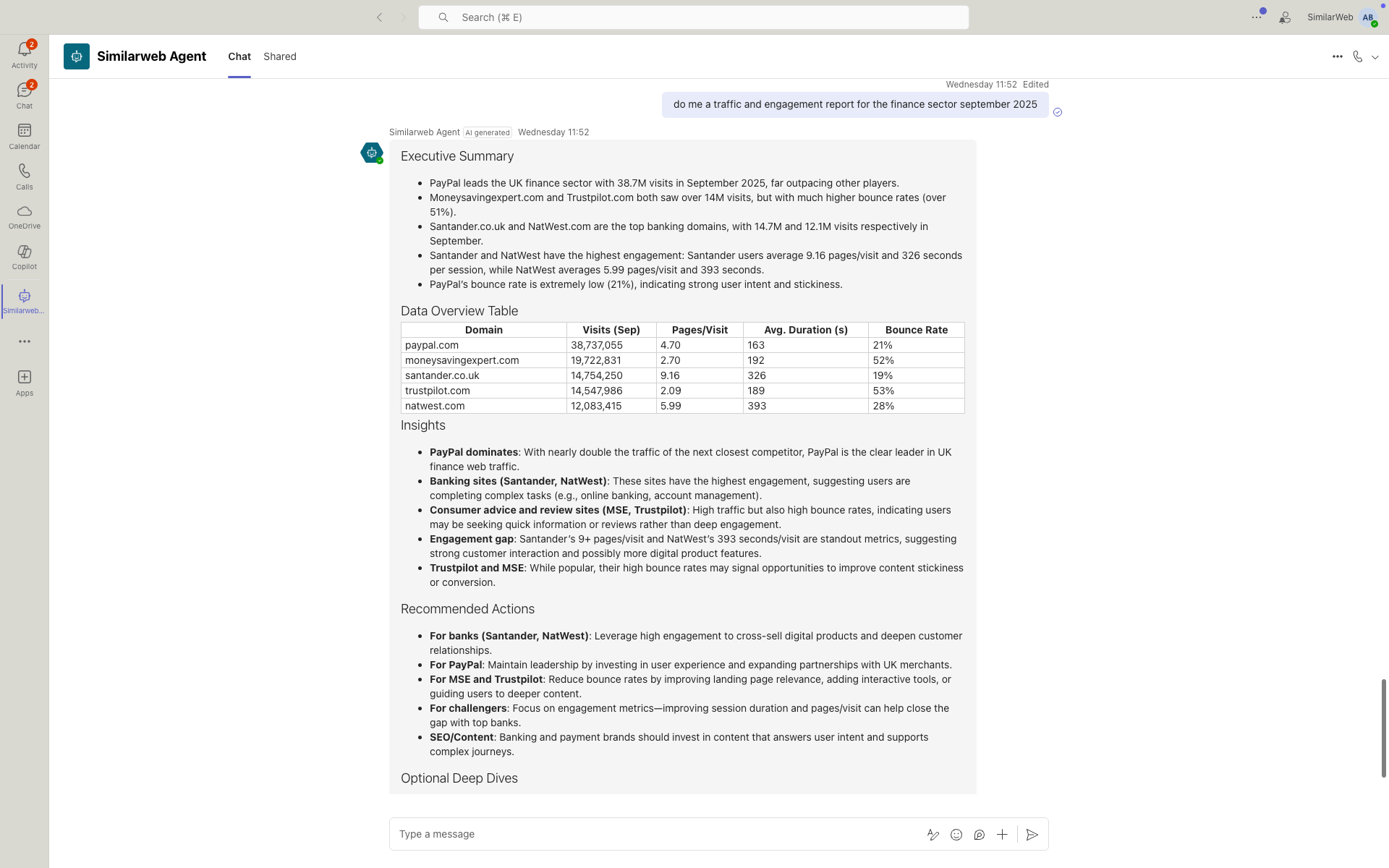

Here’s a quick example of how to use ChatGPT and Similarweb together for market research to enrich insights and data:

- Flow: Generate hypotheses and drafts in ChatGPT. Validate and size with Similarweb.

- Evidence loop: When Similarweb confirms a shift, feed the charts back to ChatGPT to produce a crisp executive summary, a QA checklist, and test plans.

- Governance: Treat all numbers as “Similarweb-sourced.” Treat text and plans as “ChatGPT-assisted.” This keeps roles clear for stakeholders.

Pro tip: If you have Enterprise Similarweb access (or free user seats in your account), you can use ChatGPT’s agent mode to extract the data you need. All you have to do is assign it a user email address, and you can use it to log in to the platform and do all the heavy lifting data extractions.

Bring Similarweb data directly into your AI with MCP

If you want AI systems to move from “good guesses” to decision-grade intelligence, Similarweb’s MCP Server is the missing layer.

MCP connects Similarweb’s web, app, search, and marketplace data directly into LLMs and AI agents, giving them live, structured market signals instead of relying only on static files or model knowledge. With MCP, AI agents understand what data is available, how it’s structured, and how to retrieve it in real time, which makes them more autonomous, adaptive, and reliable for market research tasks.

In practice, this means you can ask questions in plain English (“Track our non-brand share in Germany over the past three months”) and your AI agent will return structured market data pulled from Similarweb APIs and datasets.

Teams are already using MCP to build competitive intelligence agents that monitor category share and detect channel shifts, SEO and content strategy agents that identify keyword gaps and top-performing landing pages, and market research agents that benchmark performance, surface emerging trends, and assemble full intelligence reports.

MCP turns Similarweb into a native data layer for your AI stack, powering workflows that stay current, verifiable, and tightly aligned with real-world digital behavior.

Actionable takeaways

- If your question needs a number, start in Similarweb. Traffic share, PPC share, search volumes, on-site search, conversion, retention, loyalty, and app usage are measurable.

- Use ChatGPT for the blank page problem. Draft ideas and frameworks, but verify insights with Similarweb before taking action.

- Invest in repeatable reporting. Create one high-level, consistent deck that executives can reuse. Then add deep dives as needed.

- Plan for long and short horizons.

- Quick wins: rebalance PPC to rising non-brand clusters and fix PDP content for top on-site search terms.

- Strategic horizon: expand into growth subcategories, refine retention cohorts, and build content moats around durable demand.

Conclusion

ChatGPT and Similarweb complement each other, but they are not interchangeable.

- ChatGPT helps you think: ideate, outline, and synthesize across the content you provide.

- Similarweb helps you know: quantify market size, share, demand, and conversion with repeatable metrics and historical data.

When the question demands a number you would defend in a meeting, Similarweb is the right starting point. When you need to move quickly from a blank page to a structured plan, ChatGPT can help you get there faster, as long as you verify with measured data.

Bottom line:

- ChatGPT accelerates thinking and presentation.

- Similarweb is built for measurement, so it validates, quantifies, and tracks what changed, where, and by how much.

- Use both, but do not skip the measurement step when you need a number you can defend.

FAQ

Is ChatGPT good for market research?

Yes. Use it for ideation, summarization, drafting surveys, and turning notes into first-pass narratives, especially when it can reference your own documents. It does not include native market metrics, so validate numbers with a measurement platform.

What does Similarweb measure that ChatGPT doesn’t?

Observed digital behavior at scale: traffic share, channel mix, keyword volumes and click distribution, paid search terms and creatives, referral and affiliate traffic, marketplace on-site search and conversion, and app usage. These are tracked over time by country and device.

When should I use both together?

Use ChatGPT to draft hypotheses and plans, then use Similarweb to validate, size, and monitor changes. Treat numbers as Similarweb-sourced and plans as ChatGPT-assisted so stakeholders know which parts are measured vs. generated.

Which metrics matter most for market sizing and benchmarking?

Total visits, visit share, engagement and loyalty, device split, keyword volumes and click distribution, non-brand vs. brand mix, paid share by channel, and marketplace conversion. Review at least 12 months of history to account for seasonality.

How do I track the impact of AI Overviews and other answer engines?

Monitor demand with keyword research, track ranks by device and country, and measure brand mentions in assistants with the AI brand visibility tool. Use these signals to prioritize topics and to verify if exposure improves after content updates.

How fresh is the data, and how much history can I analyze?

Data is refreshed on a regular cadence and supplied as a time series. Enterprise tiers include a multi-year history, which enables seasonality analysis and before-and-after comparisons for campaigns and launches.

How do you ensure data quality and privacy?

Signals are cleaned, de-duplicated, normalized, and modeled using repeatable methods. Automated and manual checks remove bots and spam, map domains and apps to entities, and validate outputs against benchmarks where available. Data is aggregated and privacy-safe.

Track your digital metrics and grow market share

Contact us to set up a call with a market research specialist