You’ve hit your search limit

Start your free trial to keep exploring full traffic and performance insights.

Get Started- Pagina principale

- Analisi dell'app gratuita

- Debt To Income Calculator

Debt To Income Calculator analisi dell'app per 7 gennaio

Debt To Income Calculator

- Rukshan Marapana

- App Store di Apple

- A pagamento

- Finanza

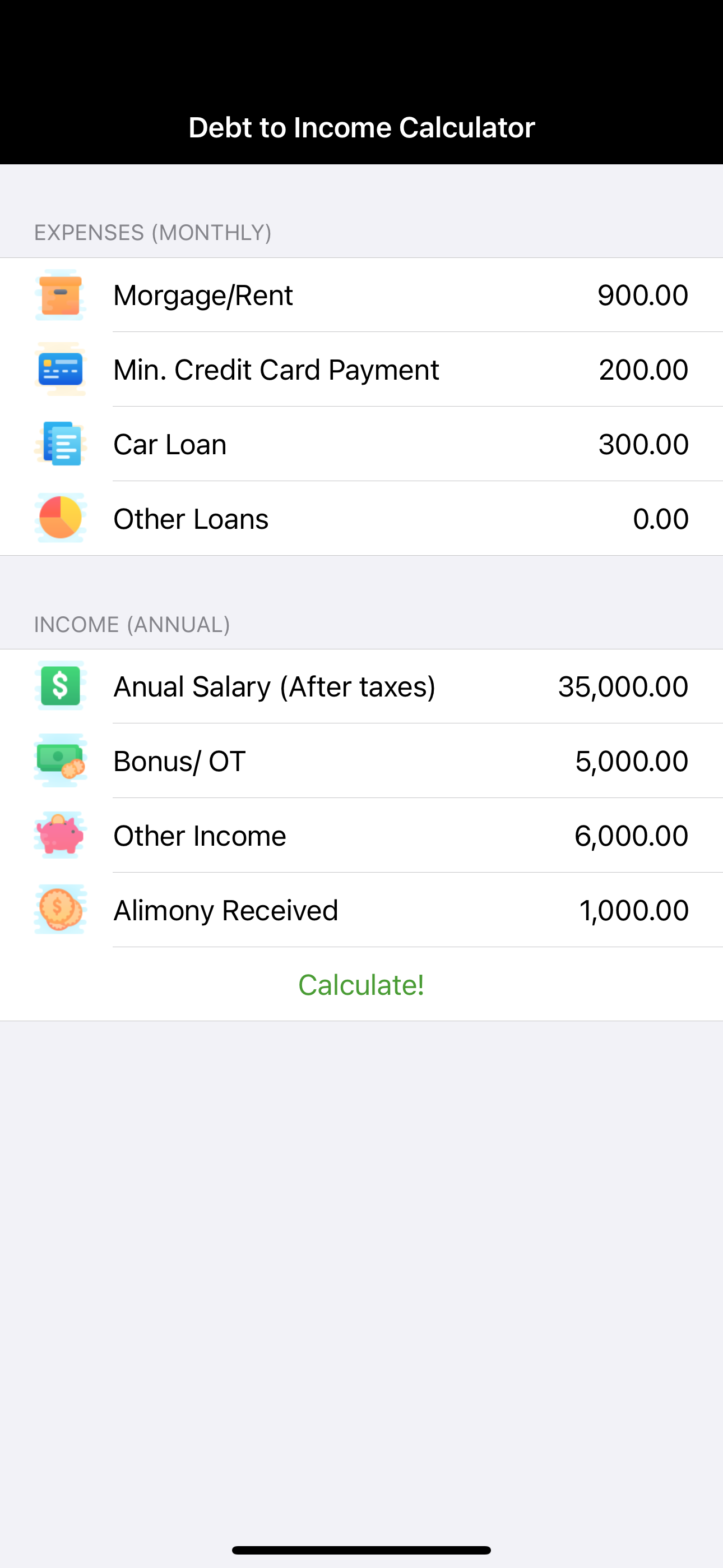

This app was designed to aid you to determine how much debt you could afford compared to your existing income. This app will tell you the ratio between your current income and debt.

What is a debt-to-income ratio?

Debt to income ratio (DTI) is the amount of your total monthly bills divided by how much money you make a month. It allows lenders to determine the likelihood that you would be able to repay a loan.

For instance, if you pay $2,000 a month for a mortgage, $300 a month for an auto loan and $700 a month for the rest of your bills, you have a total monthly debt of $3,000.

If your gross monthly income is $7,000, you divide that into the debt ($3,000 / 7,000) and your debt-to-income ratio is 42.8%.

Most lenders would like your debt-to-income ratio to be under 35%. However, you can receive a qualified mortgage with as high as a 43% debt-to-income ratio.

According to the Federal Reserve Board, the household debt service payments and financial obligations as a percentage of disposable personal income was 10.1% in the first quarter of 2017. That is down from the high of 18.1 in December of 2009.

The ratio is best figured on a monthly basis. For example, if your monthly take-home pay is $2,000 and you pay $400 per month in debt payment for loans and credit cards, your debt-to-income ratio is 20 percent ($400 divided by $2,000 = .20).

Put another way, the ratio is a percent of your income that is pre-promised to debt payments. If your ratio is 40%, that means you have pre-promised 40% of your future income to pay debts.

Why Debt-To-Income Ratio % Matters

While there is no law establishing a definitive debt-to-income ratio that requires lenders to make a loan, there are some accepted standards, especially as it regard federal home loans.

For example, if you qualify for a VA loan, the department of Veteran Affairs guidelines suggest a 41% debt-to-income ratio. FHA loans will allow for a ratio of 43%. It is possible to get a VA or FHA loan with a higher ratio, but only when there compensating factors.

The ratio needed for conventional loans varies, depending on the lending institution. Most banks rely on the 43% figure for debt-to-income, but it could be as high as 50%, depending on factors like income and credit card debt. Larger lenders, with large assets, are more likely to accept consumers with a high income-to-debt ratio, but only if they have a personal relationship with the customer or believe there is enough income to cover all debts.

Remember, evidence shows that the higher the ratio, the more likely the borrower is going to have problems paying.

Classifica degli store

La classifica del store si basa su diversi parametri stabiliti da Google e Apple.

Tutte le categorie in

Stati Uniti--

Finanza in

Stati Uniti#67

Crea un account per visualizzare il numero mensile medio di downloadContattaci

Debt To Income CalculatorStatistiche di ranking nel tempo

Classifica di Utilizzo di Similarweb e Classifica App Store di Apple per Debt To Income Calculator

Classifica degli store

Rank

Debt To Income Calculator Classifica per paese

Paesi in cui Debt To Income Calculator ha la posizione più alta nelle sue categorie principali

Nessun dato da visualizzare

Principali concorrenti e app alternative

App con un'alta probabilità di essere utilizzate dagli stessi utenti, provenienti dallo stesso store.

Debt 2 Income Calculator

Heng Jia Liang

Loan Calculator Professional

AppRebel, Inc.

Mortgage Calculator: Payment

Phan Nhat Đang

Loan Calculator - Loan2Me

Jeffrey Williams

gennaio 7, 2026