If you’re looking for up-to-date data, try Similarweb now.

Introduction

New and exciting trends are emerging in the oral care industry. Products for teeth-whitening and at-home aligners are just a few of the many dental hygiene products growing in popularity.

The electric toothbrush industry in the US is also offering innovative value propositions to an otherwise stagnant industry, tapping into an important consumer demographic – millennials.

A report by Hello Products revealed that 3 out of 10 millennials brush their teeth only once a day. The American Dental Association found that millennials experience more dental problems and are more afraid to visit the dentist than any other age group.

As millennial dental issues grow, brands are racing to reach this audience, developing beautifully designed products with easy online purchase points. As a result, the oral care industry is seeing rapid growth across the digital space. One brand in particular, Quip, is quickly differentiating itself from other industry players through a strong digital strategy that resonates with its target audience.

Key takeaways: Quip is the brand to watch in the electric toothbrush space

Website traffic

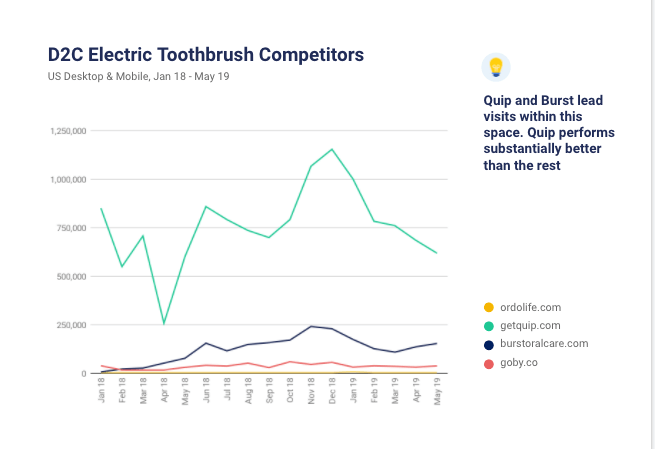

When analyzing website traffic & allocating for pure play visits across brands, Quip gets the majority of traffic within the disruptive D2C market. It has also positioned itself as a threat in the larger electric toothbrush market space.

Brand awareness

Brand awareness serves as the main driver of website visits to getquip.com. During the period of January – May 2019, 37% of traffic to the site was direct and 27% of traffic was generated by organic search.

Cross Comparison

Newcomer Quip is tackling consumer doubt through an extremely strong affiliate marketing program, driven by testimonials, videos, and more. All brands have some percentage of consumers comparing their brand with Quip.

On-site conversion

Quip site conversion has grown 180% between February 2018 and May 2019. This is especially impressive when considering most of Quip’s customers are first-time buyers.

Amazon conversion

Quip launched its presence on Amazon in October 2018. It remains to be seen if Quip will seek to utilize Amazon in a larger capacity.

Competitive landscape

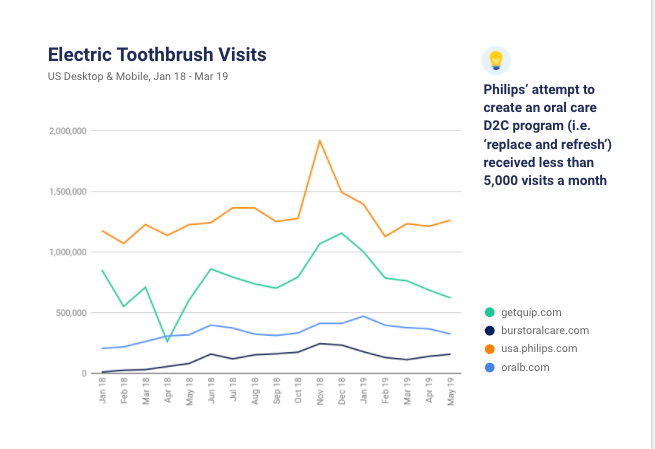

Electric toothbrush visits are growing YoY

Quip’s average monthly visits grew 30% YoY (measured January – May), generating 620K visits in May 2019.

YoY competitive analysis reveals usa.philips.com is still the website to beat, averaging just under 1.3 million visits each month. However, further analysis of usa.philips.com shows that only around 14% of visits go to electronic toothbrush pages, with the remainder going to other Philips products.

Burst is the newest player of the group. Having launched their website in October 2017, burstoralcare.com saw a 265% YoY increase in average monthly visits (measured January – May). Though it only reached 155k visits in May 2019, its dramatic growth makes it a brand to watch out for.

Growth drivers

Direct, organic and paid search

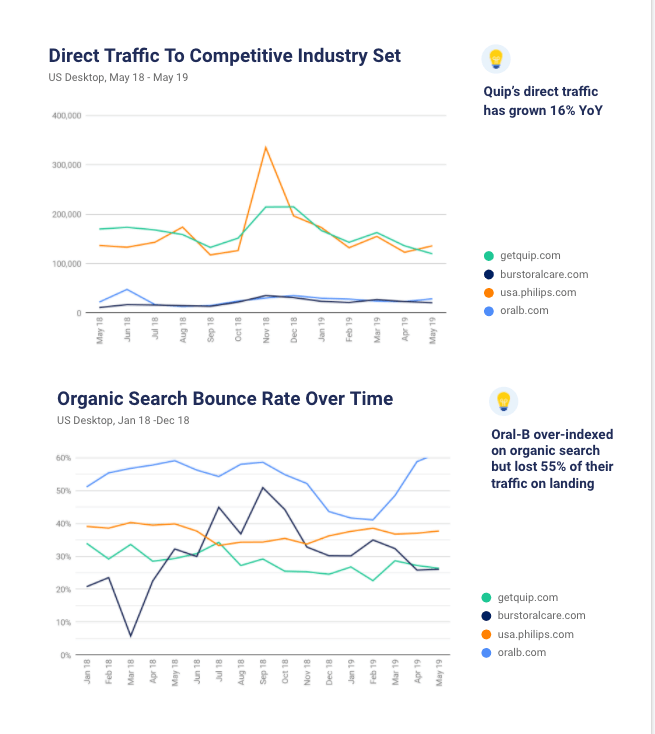

Brand awareness serves as the main driver of website visits to Quip.

Direct traffic has grown 16% YoY (January – May averages), demonstrating continued growth around the brand amongst key audiences. Further, Quip gains the same amount of direct traffic as usa.philips.com, indicating the strength of their position in the market.

Organic search is driven by branded keywords and has been an exponential driver of growth. Average organic search visits have increased by 37% YoY for the time period of January – May. Organic search engagement works in Quip’s favor. The brand excels in organic search engagement with a bounce rate of only 26%.

Paid search went up by 32% YoY (January – May averages) and accounts for 9.6% of desktop traffic to Quip. It remains to be seen if Quip will lower its reliance on paid search in the second half of the year, as brand awareness increases.

Cross comparison

Cross comparison

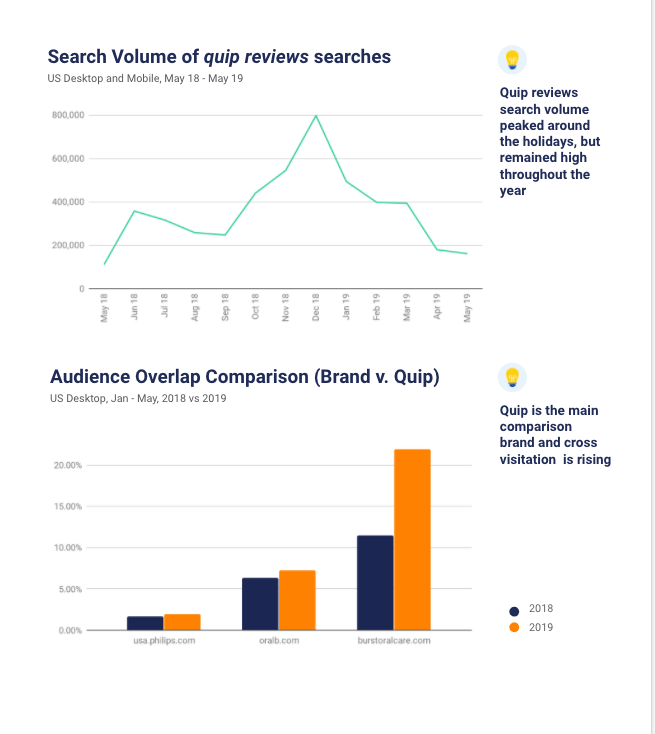

Dominating the space

Quip has positioned itself as the competitor to beat, drawing on affiliate marketing to do so. Cleverly identifying that consumers will compare electric toothbrush brands before purchasing, Quip has flooded search results with reviews in videos, testimonials, and other affiliate content promoting their brand. In the last year, there has been an average of 383k quip reviews related searches per month.

One benefit of these affiliate marketing efforts is that consumers viewing other brands within the marketspace will cross-compare with Quip. In fact, Quip is the only brand in the marketspace that draws cross-comparison from a percentage of all their competitors’ customers. Further YoY analysis (measured from January through May) reveals Quip is further strengthening the brand’s cross-comparison affinity.

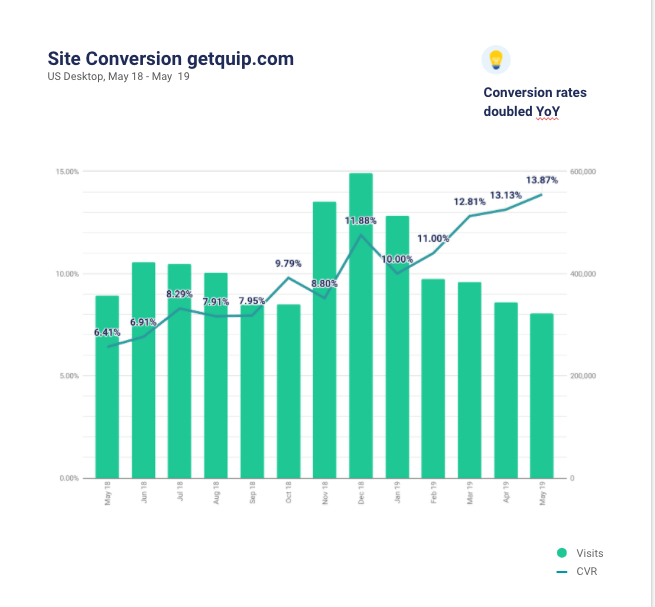

Conversion is on the rise

Quip site conversion has grown 116% between May 2018 (6.4%) and May 2019 (just under 14%), indicating the brand is building consumer trust as a reliable product. This metric is especially interesting considering the majority of visits to getquip.com are not returning buyers but first-time customers.

Quip’s conversion efficiency stems from brand-focused channels, including direct & organic search. However, it is Quip’s overall sales funnel efficiency—from well-branded, offline marketing to polished user experiences, supported by engaging content into the sale—that will continue to drive consumer purchases.

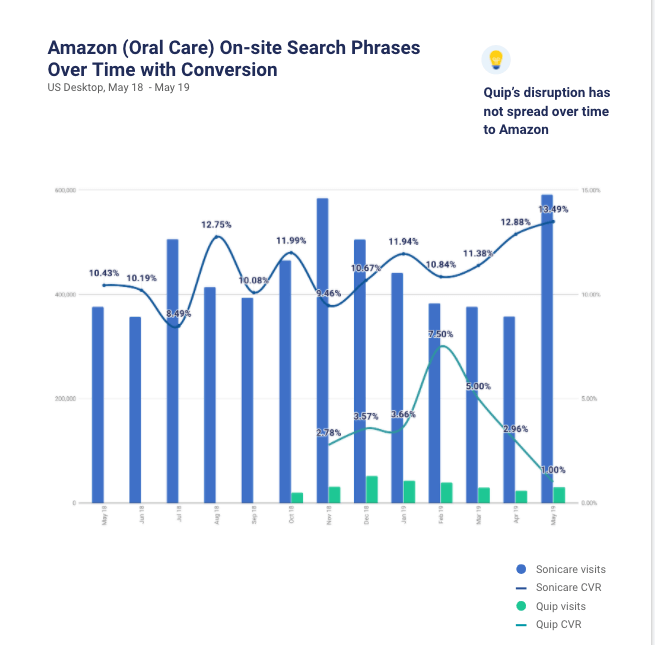

Amazon Spotlight: A winning channel?

Quip launched its presence on Amazon in October 2018. However, it failed to create a dent in the marketplace. Over the last eight months, on-site searches for Quip averaged just 34k per month – a fraction next to its competitors. Further, Quip converted at an average of 4% on the platform, which is well under the industry conversion average for electric toothbrushes at 11.54%

Meanwhile, on-site searches for Philips Sonicare averaged 445k per month. Philips was left largely unaffected by the disruptor on Amazon with both on-site search for the Sonicare and conversion on Amazon remaining stable.

It remains to be seen if Quip will successfully leverage Amazon to drive additional sales. Increased Amazon sales means a lack of control over Quip’s D2C market play, including gathering data, customer relationships and brand control.

Knowing your market means knowing your competitors. Similarweb offers breadth and depth of digital market Intelligence.

To arrange a live demo with a Similarweb Consultant contact us.

Cross comparison

Cross comparison