This white paper was written in 2018. Now you can access the full report here for free.

If you want to see the latest data, try Similarweb now.

User acquisition in fashion is becoming more and more difficult as brands’ own sites compete for traffic with third-party retailers. The competition is particularly difficult as traditional digital strategies are not enough – brands don’t just compete on the shared stage of search engines and affiliate links, but also behind walled gardens like Amazon’s on-site search.

Understanding how audiences arrive at your site or a competitor’s site is not enough. It is crucial to understand how your brand performs on third-party sites in absolute and relative terms. Using Similarweb’s Shopper Intelligence platform we took a deep dive into how brands like Nike and Adidas stay ahead of the game.

This whitepaper looks at desktop and mobile traffic for adidas.com and nike.com, from the US, covering the period from January 1, 2017 to June 30, 2018. The insights also cover incoming traffic to Nike subsidiary converse.com. In addition to considering traffic from search engines into the owned sites, the whitepaper also looks at on-site search at amazon.com and the overlap for visits to more than one of these sites within a single session.

Key takeaways:

1) Fashion brands are trying to strike a balance between selling their goods through owned properties where they can control the experience and maximize profit and selling through third-party retail giants like Amazon.

2) Traditional metrics from search engines and affiliate links only tell part of the story with a huge volume of branded search now taking place on-site at Amazon and other retailers.

3) Consumers shop around to varying degrees. Curating the availability of different products on different platforms enables brands to own the experiences they want and maintain a strong connection with third-party partners.

Nike and Adidas – digital performance

Nike.com and adidas.com are among the top Sports Apparel sites, and rank highly in the overall Shopping category ranking as well.

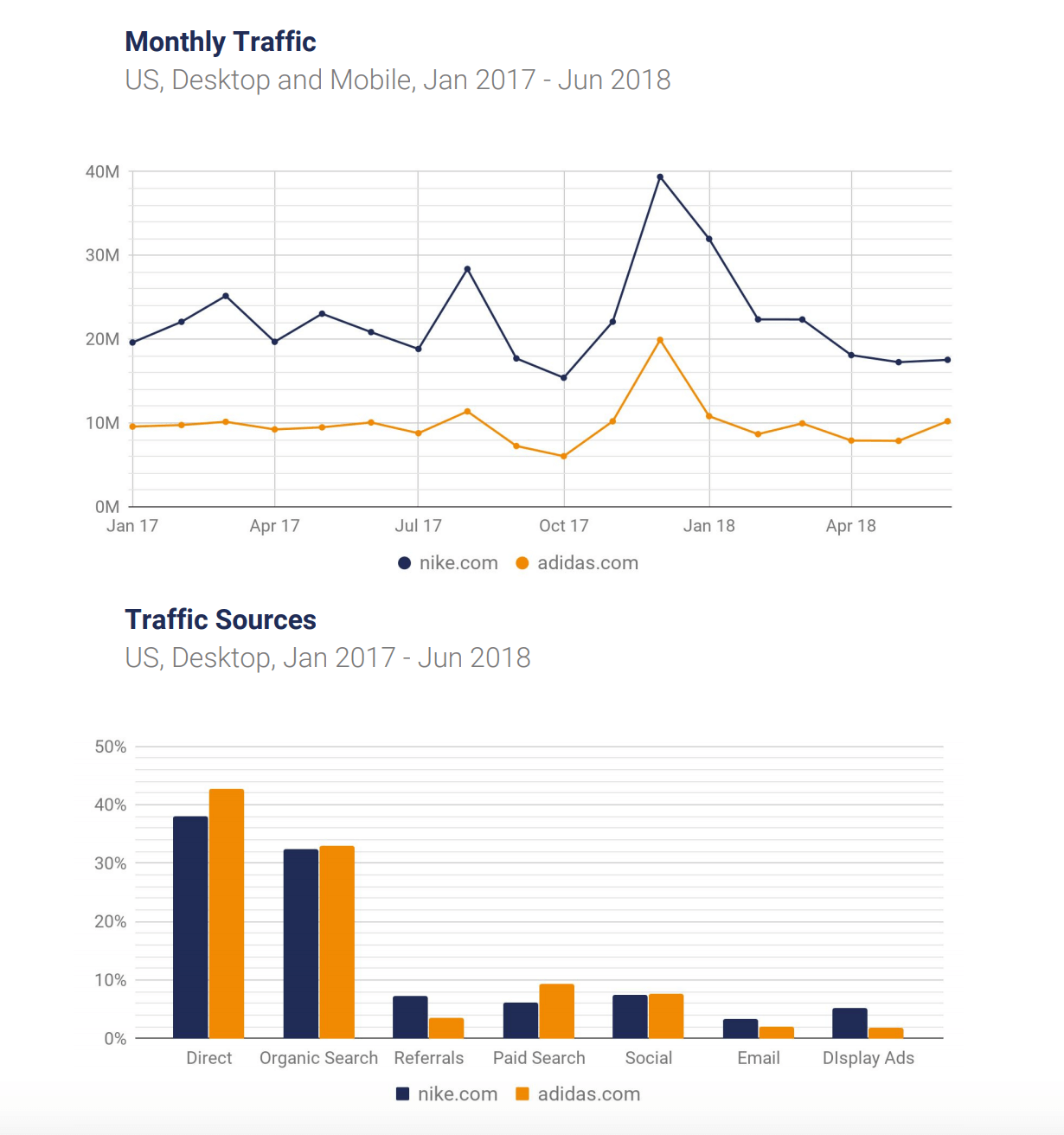

While each of the sites receives significant monthly traffic – 23M and 10M visits on average – traffic growth has been slow, despite the huge brand recognition they enjoy.

Both sites employ a similar digital strategy, focused on brand, resulting in direct traffic making up around 40% of total site traffic. A further 80% of search traffic to each site, both paid and organic, is branded. This strategy is about Nike and Adidas defending their brand and claiming the attention of their most loyal fans. In this way, they retain many of the visitors who are actively seeking the brand, but it may open up doors for third-party retailers to gain traffic against the brands’ names.

Search: tracking branded keywords

Branded traffic to nike.com and adidas.com includes keywords that reference the name of the company or one of its key product lines, such as Air Jordan or Converse for Nike or Yeezy for Adidas.

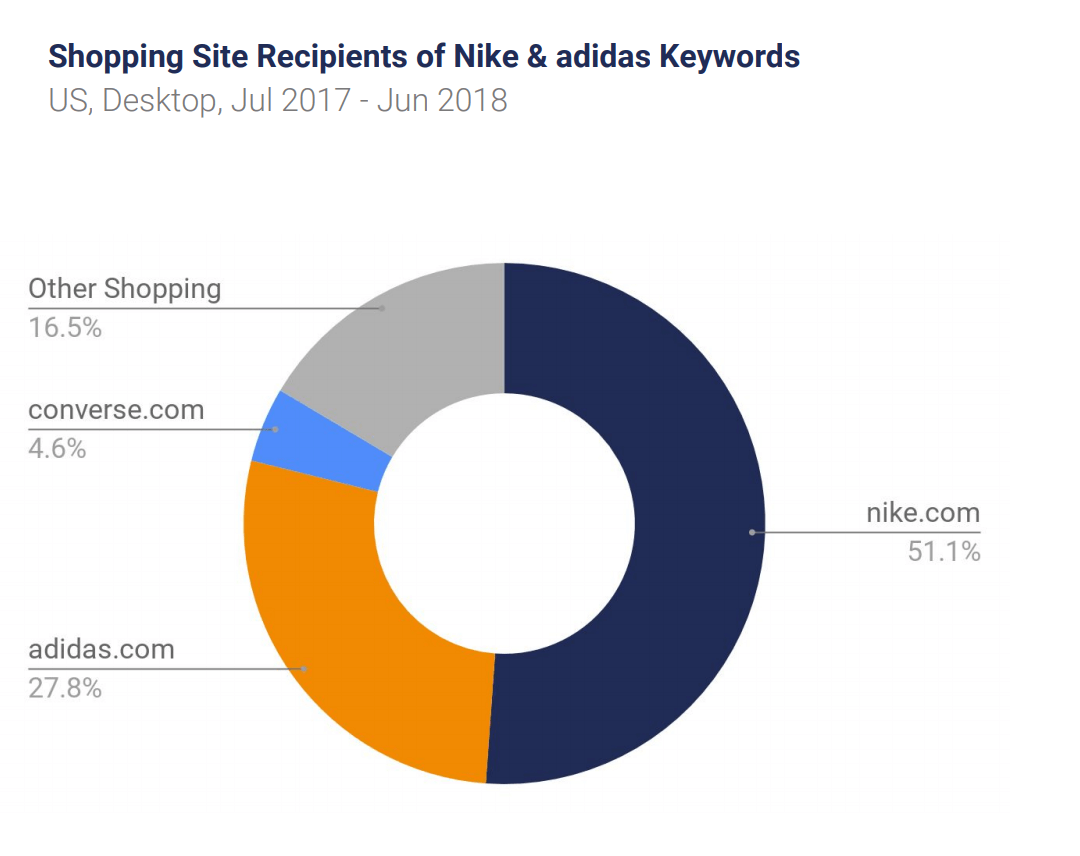

Looking at all traffic from the top 100 branded keywords shows that 83.5% of the organic search traffic goes to nike.com, adidas.com, or converse.com. This suggests that search leeching to third-party sellers is not a major source of traffic loss for either company.

The third-party retailer getting the next highest proportion of this branded traffic is sneaker marketplace flightclub.com (2.9%), followed by footlocker.com (2.1%) and finishline.com (1.3%). Amazon.com only ranks 19th on the list – receiving 0.4% of the organic search traffic for Nike and Adidas-branded keywords.

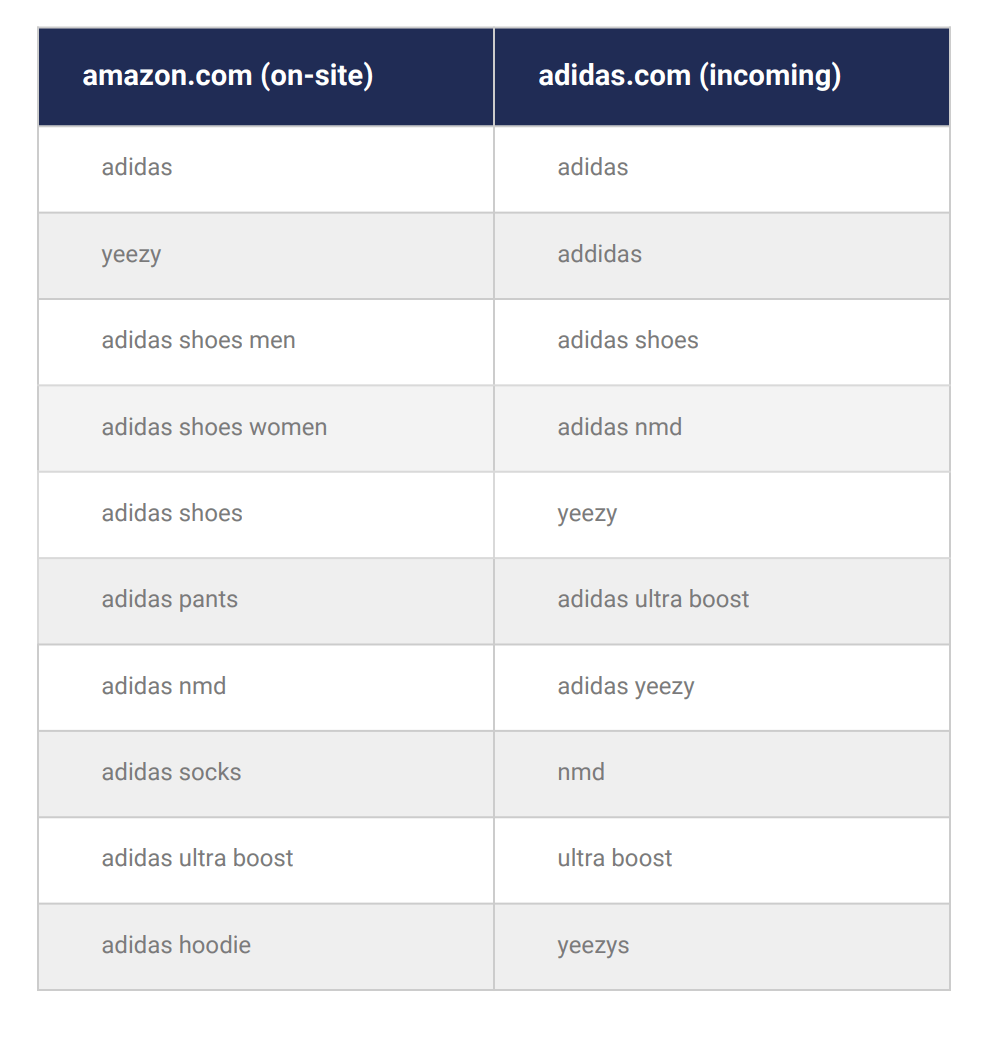

When search starts on amazon

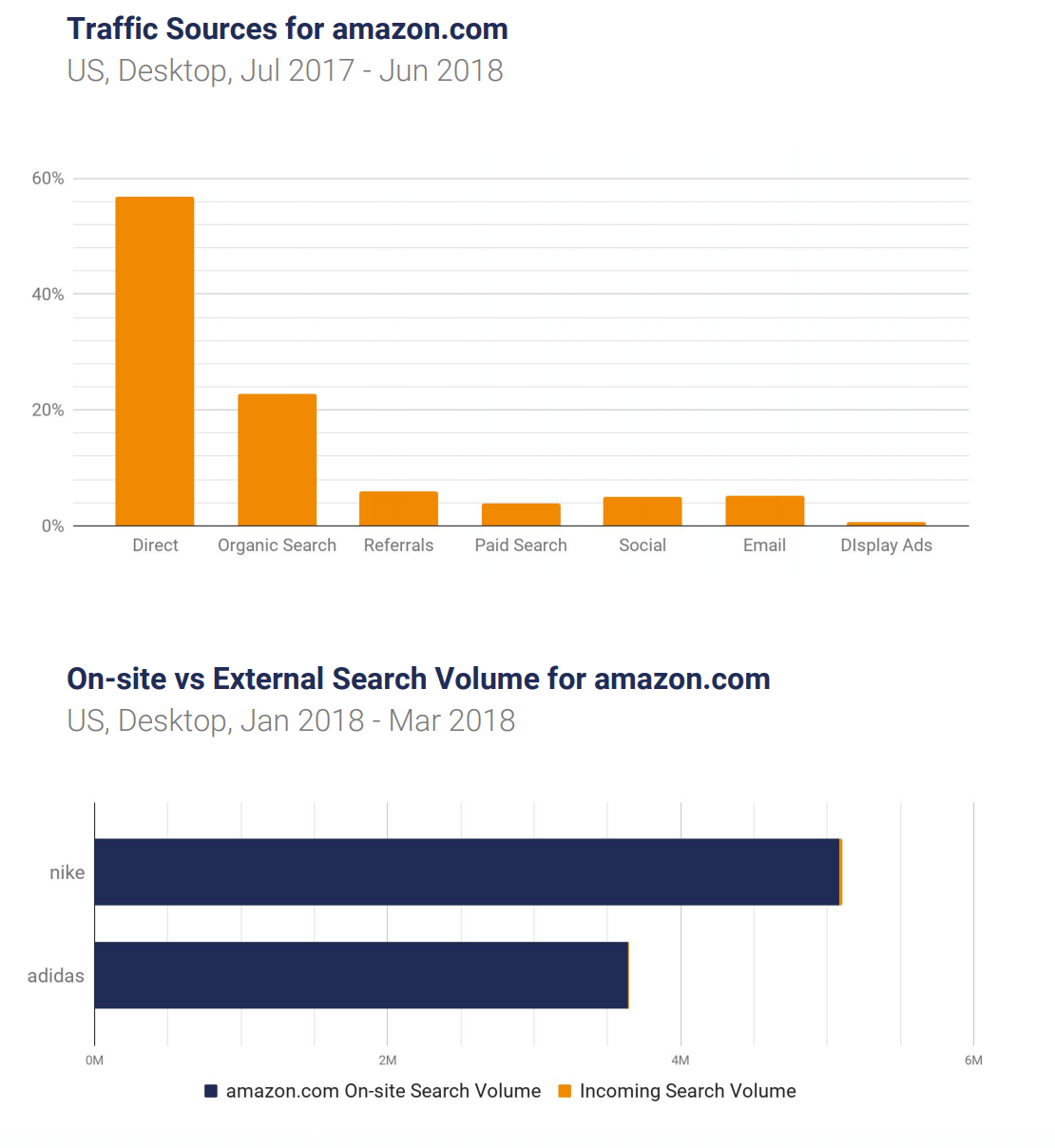

Amazon.com isn’t only where search ends. For many, it’s where search starts. Direct traffic accounts for 57% of traffic to amazon.com. An additional 27% comes from search of which 79% is branded.

So, while less than 50K visits came into amazon.com from searches involving the keywords Adidas or Nike, on-site there were as many as 4.5M searches for Adidas and 6.8M searches for Nike.

That works out as 280-450X more searches for branded products on amazon.com than on google.com.

Where do branded shoe searches convert?

While amazon.com enjoys an extremely high conversion rate–8.4% of amazon.com’s desktop visits end in a purchase–it may not be fair to compare the giant to smaller, specialty retailers.

At nike.com visits have a conversion rate of 3.1%. At adidas.com the rate is 2.4%. Amazon’s entire clothing category, which represents 2.6% of amazon.com, has a conversion rate of 14.2% far above the rate for general goods.

However, a more apples-for-apples comparison looks at conversions following an on-site search for Adidas or Nike products. The on-site conversion rate for Adidas searches is 4.1% and for Nike searches it is 4.3%. In each instance, this is higher than the rate of conversion for visits to the company’s owned site.

Do consumers shop around?

Customers of Nike and Adidas products convert on the companies’ owned sites and at third-party sites like amazon.com. It is important to understand how much these sites compete against one another for the same purchase and whether different types of consumers will buy branded products on different platforms.

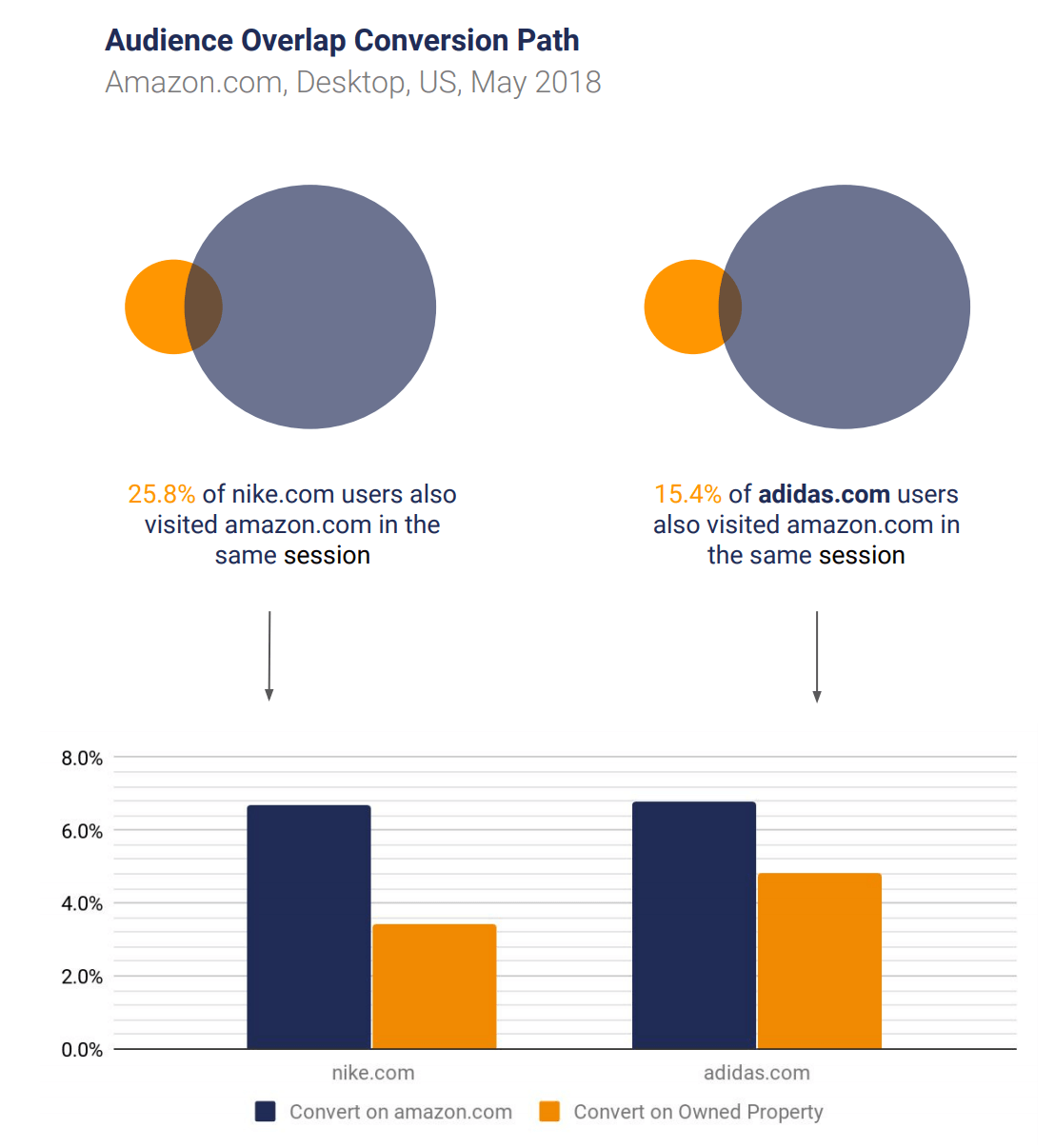

The lower proportion of crossover traffic between amazon.com and adidas.com suggests that Adidas is able to retain, and potentially convert, visitors to their own site, more than Nike. This may be due to a variation in the range of products and the value of promotions on their owned property vs a third-party retailer.

Crossover sessions for both Nike and Adidas convert on amazon.com 7% of the time. At nike.com the same conversion rate is 3.4% and 4.8% at adidas.com. Factoring in the lower overlap rate, suggests that Adidas is better at converting brand sales on its own platform.

The Adidas advantage

In the past couple of years, Adidas has made significant strides in the digital space – focusing all of its marketing efforts online, and it is paying off.

Though traffic to the site is lower than to nike.com, adidas.com manages to keep people on the site, and maintain a higher conversion rate for consumers who also shop around at Amazon.

A key part of this success has been the careful curation of their product line with event releases of new items, particularly Kanye West’s Yeezy brand, available exclusively at adidas.com. This way all the industry buzz drives traffic to the owned property while reflected brand awareness maintains traffic for other Adidas products at third-party retailers.

Similarweb: the industry standard

Similarweb: the industry standard

Similarweb is the standard for understanding the digital world. With the largest international online panel consisting of hundreds of millions of devices, Similarweb provides granular insights about any website or app across industries. Global brands such as Google, eBay, and Adidas rely on Similarweb to understand, track and grow their digital market share.

Knowing your market means knowing your competitors. Similarweb offers breadth and depth of digital market intelligence.

Similarweb: the industry standard

Similarweb: the industry standard