This white paper was written in 2019. Now you can access the full report here for free.

Methodology

All data for this white paper is based on traffic from the U.S. unless otherwise noted.

The analysis covers the period from July 1, 2017, to July 31, 2019.

All app data applies to Android apps only.

Introduction

Paying money to buy people’s old clothing and footwear, something that used to be associated only with charity stores, is a phenomenon that is really taking off. In fact, both Macy’s and JC Penney talked about partnerships with thredUP, a fashion resale website, in their most recent quarterly conference calls.

According to Forbes, the fashion resale market accounted for $28bn in 2018, compared to the fast fashion market which accounted for $35bn. However, within ten years the fashion resale market is predicted to almost triple and overtake fast fashion, reaching $64bn whilst the fast fashion market is expected to rise to $44bn.

In this whitepaper, we explore the data behind this growing market, specifically in comparison to the traditional fashion retail market.

Key Takeaways

- Market concentration: Visits to the top five fashion resale sites account for over 75% of all traffic to the top 15 fashion resale sites, whilst the top five fashion retail sites receive under 55% of website traffic to the top 15 fashion retail sites. Of the top five fashion resale sites poshmark.com receives the most amount of traffic and stockx.com experienced the highest YOY growth, 42%, in Q2 2019.

- Fashion retail vs fashion resale: YOY growth in traffic to the top 15 fashion resale sites is higher than for the fashion retail sites (18% vs -5% in Q2 2019) and daily active users (DAUs) for the top five fashion resale apps is higher than for the top five fashion retail apps.

- The fashion resale market: Of the top five fashion resale sites poshmark.com receives the most amount of traffic and poshmark app stats indicate both the highest install penetration and the highest level of user engagement. Visitors to stockx.com are the least engaged of the top five fashion resale sites – spending a relatively low amount of time on the site and visiting the fewest pages per visit of the group.

The data

Top 15 fashion retail sites vs the top 15 fashion resale sites

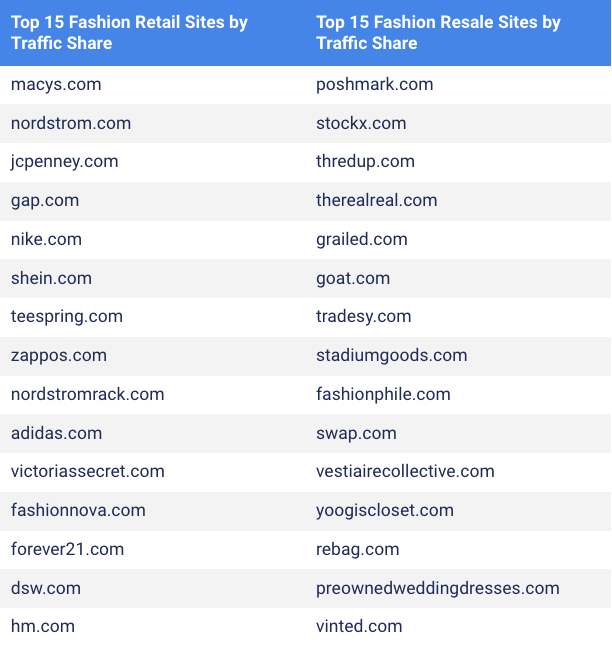

This paper compares traffic and engagement of online activity to the top 15 fashion retail and top 15 fashion resale sites and apps according to online traffic share.

Fashion Resale vs Fashion

Traffic to fashion retail sites is significantly higher than traffic to fashion resale sites

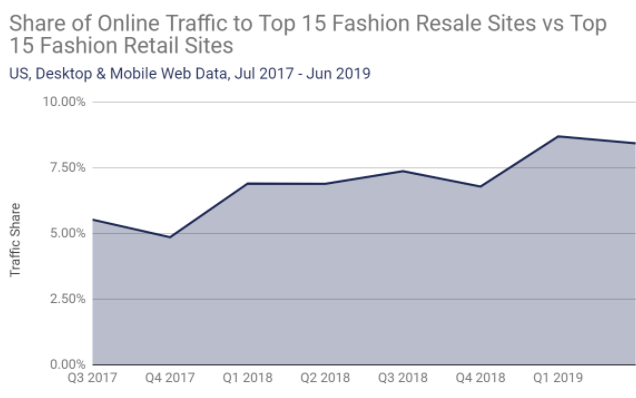

We compared the amount of online traffic to the top 15 fashion retail sites against the top 15 fashion resale sites and found that traffic to the top 15 fashion retail sites accounts for the vast majority of the traffic.

However, the top 15 fashion resale sites are slowly gaining traffic share. In Q3 2017 traffic to the top 15 fashion resale sites accounted for 5.5% of traffic to the top 15 fashion retail and resale sites combined, and in Q2 2019 this accounted for 8.4%.

Retail Market Concentration

The fashion resale market is highly concentrated

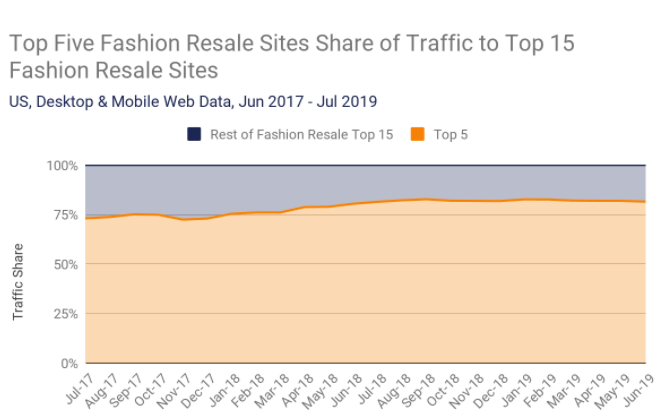

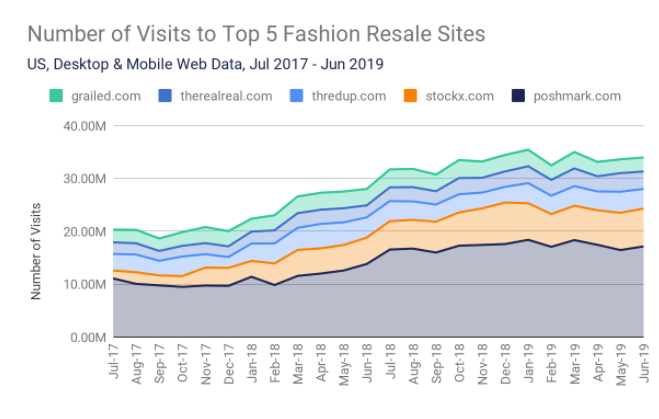

The top five fashion resale sites by traffic share in the U.S. (poshmark.com, stockx.com, thredup.com, threalreal.com, and grailed.com) account for over 75% of traffic to the top 15 fashion resale sites.

In contrast, the top five fashion retail sites by traffic share in the U.S. (macys.com, nordstrom.com, jcpenney.com, gap.com, nike.com) account for less than 55% of the traffic of the top 15 fashion retail sites.

The Growth of Fashion Resale

YOY growth in traffic to fashion resale sites is higher than for fashion retail sites

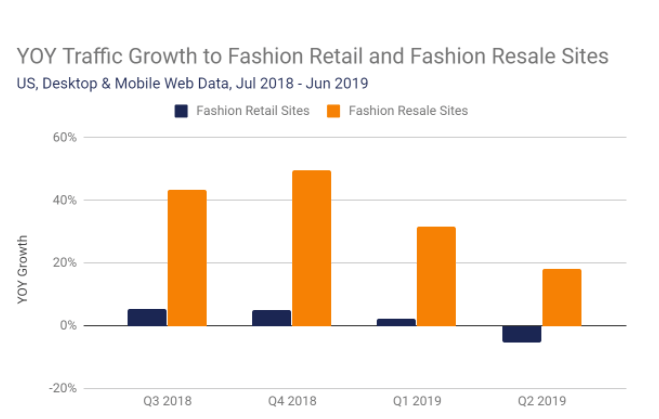

YOY’s growth in traffic to both the top 15 fashion retail and top 15 fashion resale sites in the U.S. has been declining since Q4 2018.

Nevertheless, YOY’s growth of traffic to the top 15 fashion resale sites is noticeably higher than for the top 15 fashion retail sites. In Q2 2019 YOY growth in traffic to the top 15 fashion resale sites was 18%, compared to -5% for the top 15 fashion retail sites.

Fashion Resale Also Experiencing Growth in Apps

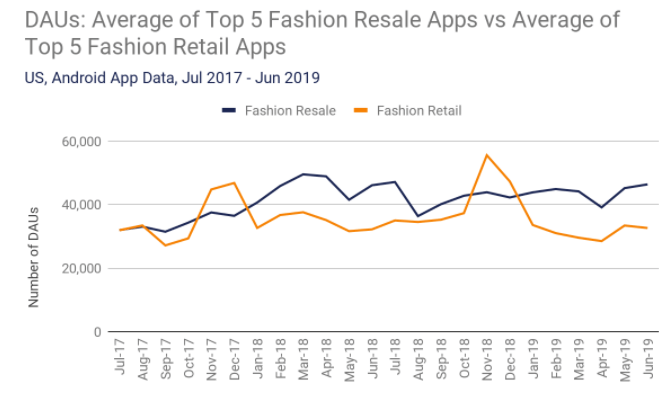

Fashion resale apps attract more engagement than fashion retail apps

In addition, the average number of daily active users (DAUs) for the top five fashion resale apps in the U.S. is higher than the average DAUs for the top five fashion retail apps.

Growth in DAUs for the top five fashion resale apps is also higher than for the top five fashion retail apps. Growth for the top five fashion resale apps between Q3 2017 and Q2 2019 was 35% compared to 2% for the top five fashion retail apps.

Which Fashion Resale Site is Receiving the most Traffic?

Poshmark.com receives the highest amount of traffic

Of the top five fashion resale sites in the U.S. poshmark.com receives the most monthly traffic, with over 17 million visits in June 2019.

In Q2 2019 stockx.com, a fashion reseller focused on sneakers, experienced 42% YOY growth in traffic. This was the highest growth compared to the other top 5 sites.

Poshmark’s app has the highest install penetration but the lowest YOY growth

The Top Five Fashion Resale Apps

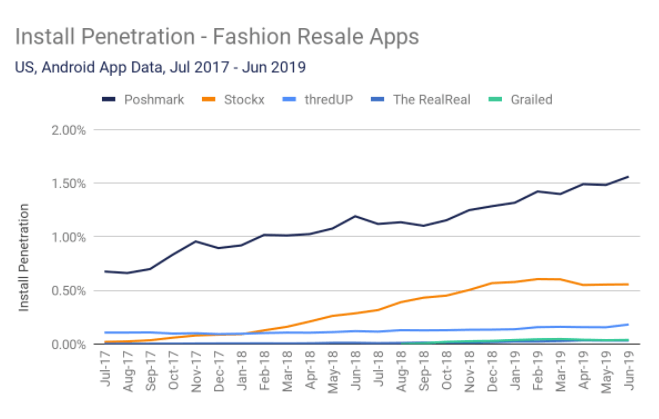

Poshmark’s app has the highest install penetration but the lowest YOY growth

As with its site’s monthly visits, Poshmark’s app is installed on the highest percentage of Android devices (install penetration) in the U.S. compared to the rest of the top five players in the fashion resale industry.

However, YOY’s growth in install penetration for the Poshmark app in Q2 2019 was 38%, the lowest growth compared to the set (apart from Grailed which we do not have YOY data as it only launched its Android app in September 2018).

Despite having the lowest install penetration compared to the group RealReal’s app had the highest YOY growth in Q2 2019, 221%.

Are Visitors to Fashion Resale Sites Engaged?

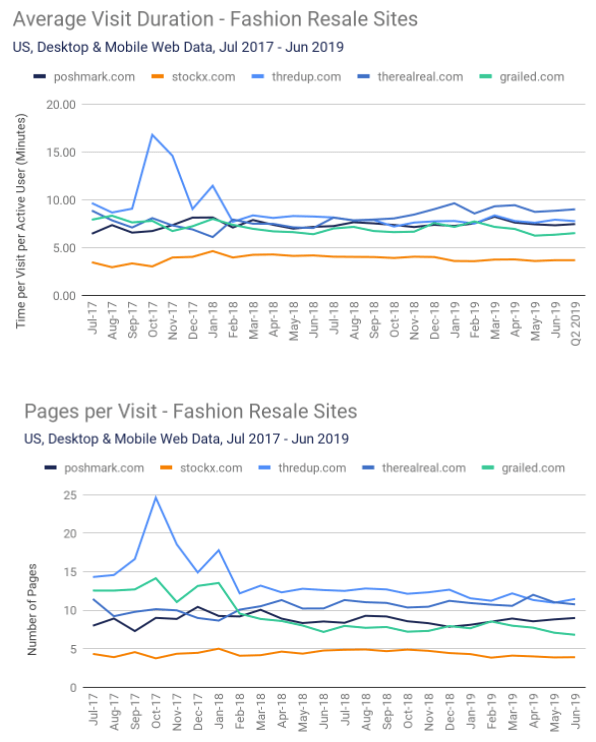

Visitors to stockx.com are the least engaged

The average visit duration is between five and ten minutes for four out of the top five fashion resale sites in the U.S. In Q2 2019 visitors spent the most amount of time on therealreal.com (an average of 9 minutes) and the least amount of time on stockx.com (an average of just over 3.5 minutes).

In addition, visitors to thredup.com and therealreal.com visited the most pages per visit in Q2 2019, indicating that visitors to those sites are more engaged than visitors to the other three sites.

Visitors to stockx.com appear to be the least engaged – spending both the least amount of time on the site and visiting the least amount of pages per visit.

Which Fashion Resale App Has the Most Engaged Users?

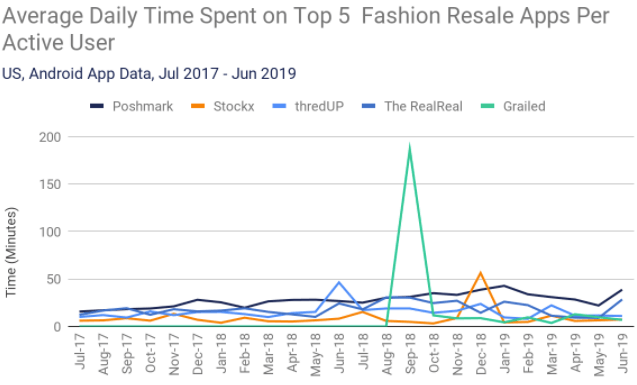

Users spend the most amount of time on Poshmark’s app

Aside from a peak in the daily time spent per user on the Grailed app in September 2018 when the app launched, users are spending the most amount of time on Poshmark’s app. In June 2019 this was on average just under 40 minutes per day per active user.

In Q2 2019 Poshmark’s Android app experienced 7.6% YOY growth in the average amount of time per active user on the app and was the only app of the top five fashion resale apps to experience positive growth. Stockx, thredUP, and The RealReal all experienced a YOY decrease in average daily time per user on their Android apps. YOY engagement data for Grailed’s Android app is not available as this was only launched in September 2018.

Conclusion

Fashion retail sites receive a significantly higher share of the traffic to fashion sites but traffic to fashion resale sites is growing at a faster rate. However, the fashion resale industry is very concentrated – with the top 5 sites accounting for over 75% of traffic to the top 15 fashion resale sites.

Poshmark.com receives the highest amount of traffic, and its app has the highest install penetration and level of user engagement compared to the other top five fashion resale apps.

Visitors to thredup.com and therealreal.com are very engaged – visiting over 11 pages per visit in Q2 2019 but engagement on their apps was low and decreasing YOY.

To arrange a live demo with a Similarweb Consultant, Contact Us