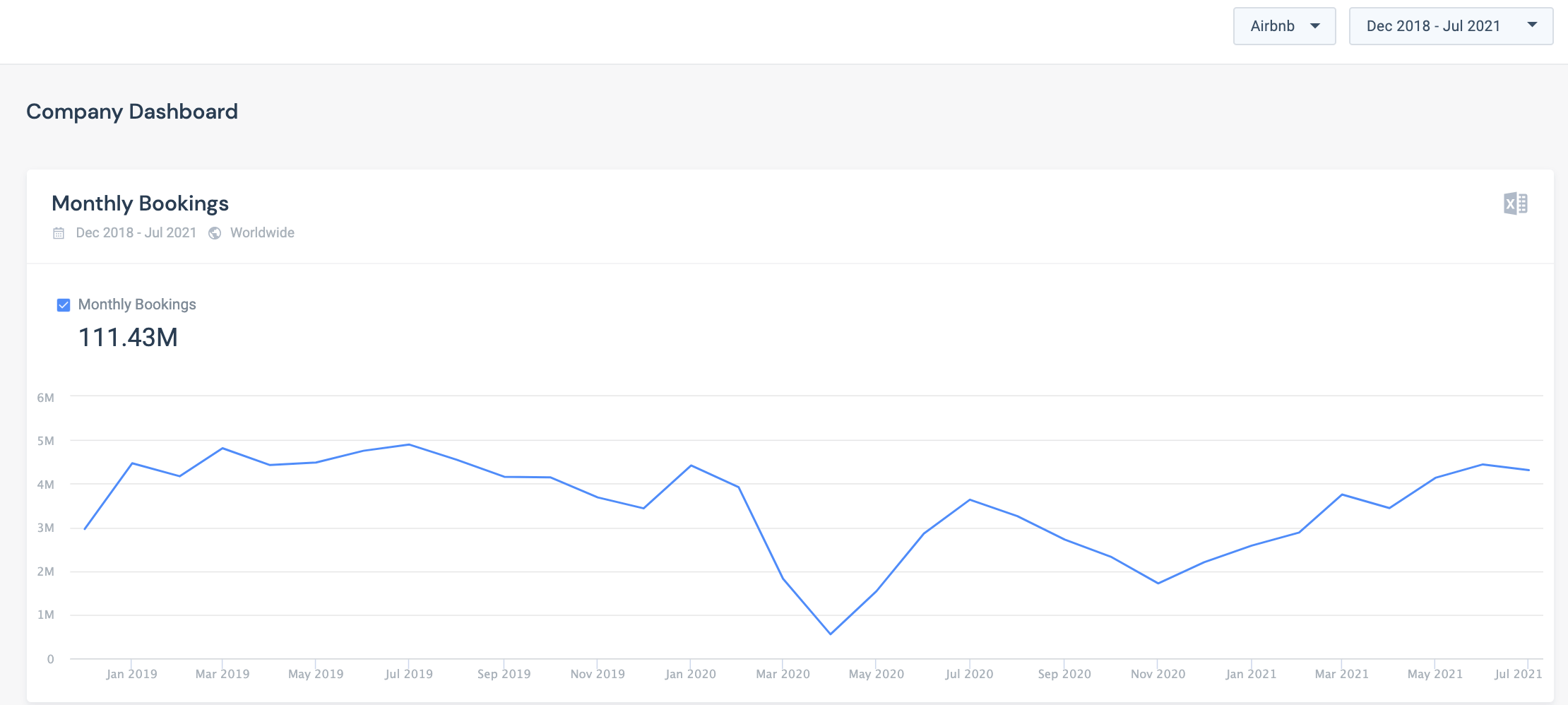

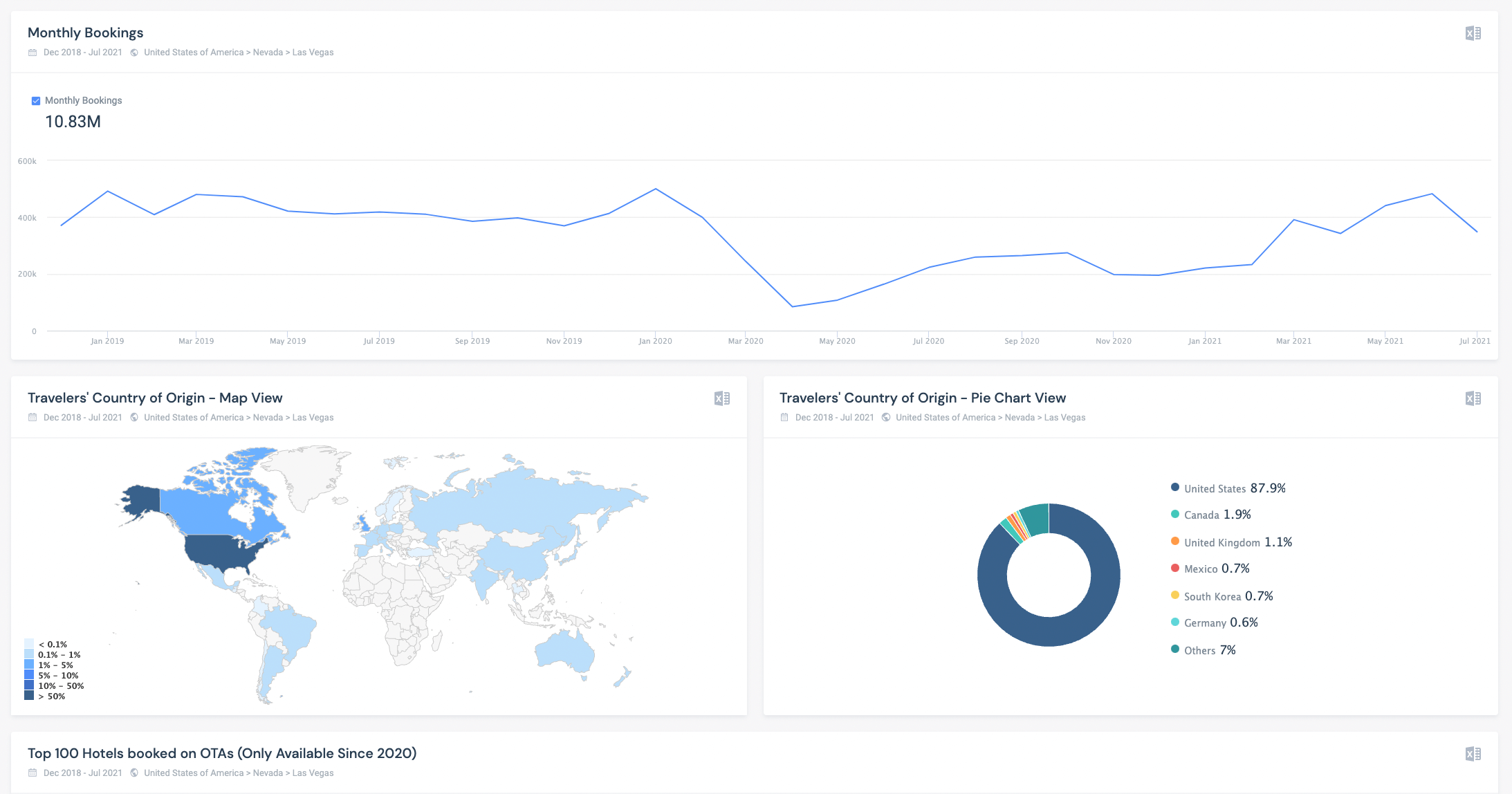

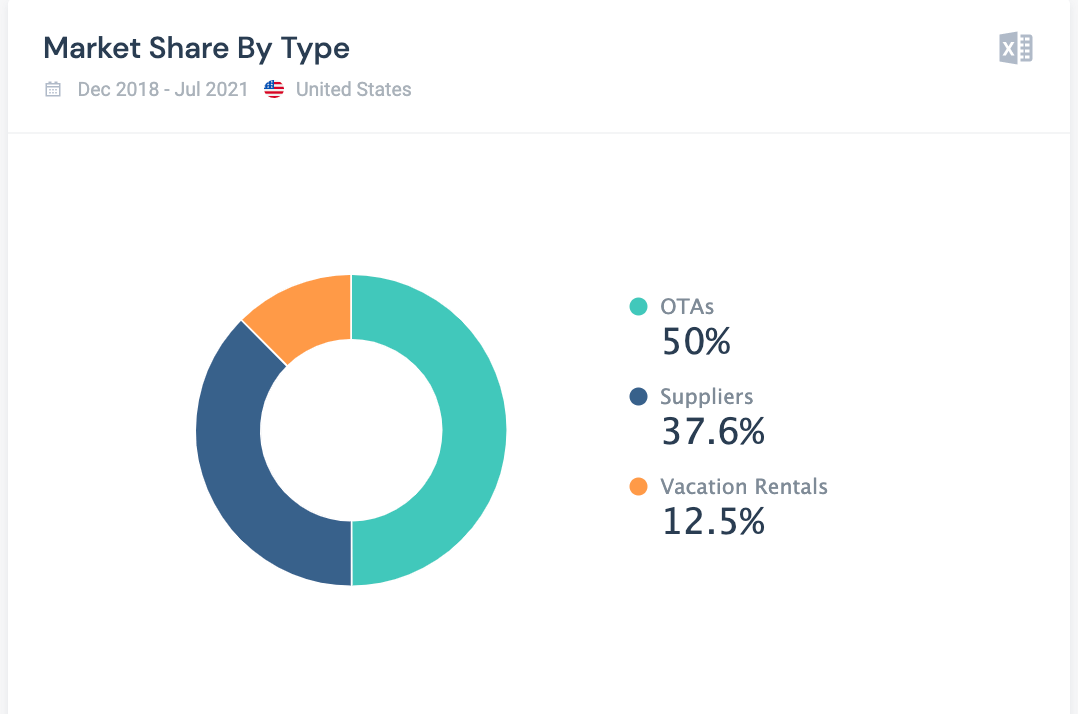

Borders closed. Flights disrupted. Fears growing. Variants spreading. For nearly two years, the travel industry has been tested on a truly unparalleled scale.

How can you navigate this ever-changing landscape and still come out on top? Real-time data is the key. Get onboard with insights to stay ahead of the industry’s swift evolution.